🚨IMPORTANT PSA: Gonna start writing again!🚨

Not articles though... Starting work on my books!

TITLE DROPS AND INFO BELOW! 👇

It's time.

#Wallstreetsilver #silversqueeze #Silverbacks #Fintwit @WallStreetSilv @Galactic_Trader @PalisadesRadio @goldsilver_pros @TheEarlyStage

Not articles though... Starting work on my books!

TITLE DROPS AND INFO BELOW! 👇

It's time.

#Wallstreetsilver #silversqueeze #Silverbacks #Fintwit @WallStreetSilv @Galactic_Trader @PalisadesRadio @goldsilver_pros @TheEarlyStage

So, twitter activity will drop down to a more palpable level. I know i've been tweeting/retweeting alot :D Alot's been going on though.

However i think this is a good time for me to start work on the books, because something in me tells me it's important to finish them this year

However i think this is a good time for me to start work on the books, because something in me tells me it's important to finish them this year

I wanna write 3 of them before years end (releasing all at once) so i'd better get started :D

Besides there's not that much left for me to do in the markets at the moment.

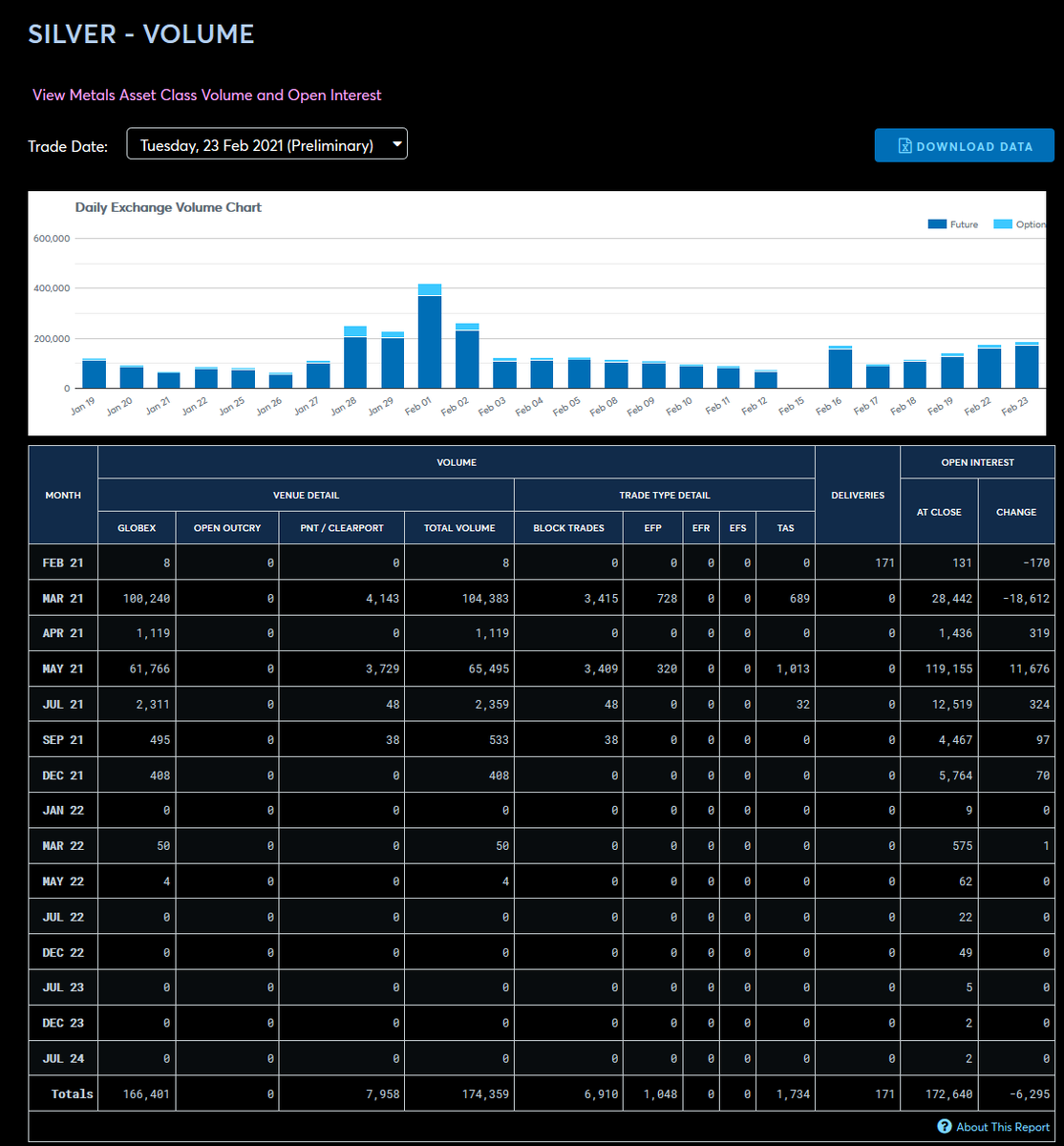

SLV wouldn't have changed the prospectus if Comex could supply. The silversqueeze has gone widespread.

Besides there's not that much left for me to do in the markets at the moment.

SLV wouldn't have changed the prospectus if Comex could supply. The silversqueeze has gone widespread.

Think i've put forward enough to show the entire goddamn stablecoin space is a conspiracy.

But with the recent USDC attestation they're either gonna make the Coinbase IPO or the market will collapse by something i won't see.

Either way i'm pretty goddamn sick of it right now xD

But with the recent USDC attestation they're either gonna make the Coinbase IPO or the market will collapse by something i won't see.

Either way i'm pretty goddamn sick of it right now xD

The Canada stuff's been a hit, and with the bondmarket collapse there's little doubt about my predictions there either.

However - Even i can't say what central banks will or won't do to stop this collapse.

The difference with last year is that they are *already* in the market.

However - Even i can't say what central banks will or won't do to stop this collapse.

The difference with last year is that they are *already* in the market.

What i DO know is that *something* will ALWAYS drop at this point.

Either yields and the dollar go up, or yields and the dollar go down. YCC kills the dollar because the same thing still happens if the 10y doesn't move at all.

And then there's the dying CMBS market.

Either yields and the dollar go up, or yields and the dollar go down. YCC kills the dollar because the same thing still happens if the 10y doesn't move at all.

And then there's the dying CMBS market.

The effects of stimulus will also become clear over the space of the next month once checks are sent out. Expect FAR more volatility, in everything. Up and down.

In any case; Pretty much everything is on borrowed time now, and predicting collapse is... Too easy at this point :D

In any case; Pretty much everything is on borrowed time now, and predicting collapse is... Too easy at this point :D

Not like i'll be going away; But activity will come in bursts. Rather then being glued to my feed.

I'll also continue to stream (aiming for 2 a week) and do interviews if anybody wants to have me on!

Finally though i feel like i can rely on others to carry the fight forward :D

I'll also continue to stream (aiming for 2 a week) and do interviews if anybody wants to have me on!

Finally though i feel like i can rely on others to carry the fight forward :D

SO! WITHOUT FURTHER ADO!

I'll be writing a trilogy of books. And my aim will be nothing less but to finally take economics out of the realm of theory (and bullshit), create a modern Wealth of Nations, and finally introduce 3 Definitions of Economics, as there are Laws of Nature.

I'll be writing a trilogy of books. And my aim will be nothing less but to finally take economics out of the realm of theory (and bullshit), create a modern Wealth of Nations, and finally introduce 3 Definitions of Economics, as there are Laws of Nature.

The first book will be titled...

"The Definition of Money."

I'll be using my ability to both think high level and reduce complex concepts down to its core to finally define Money as universally as possible, applicable in all historical situations; Past, Present AND Future.

"The Definition of Money."

I'll be using my ability to both think high level and reduce complex concepts down to its core to finally define Money as universally as possible, applicable in all historical situations; Past, Present AND Future.

The second book will be...

"The Definition of Value."

In that book i'll be looking at the most elusive of animals to ever be hunted: Intrinsic Value. I shall define it as well, as it is required to understand Intrinsic Value fully if one is to understand Money.

"The Definition of Value."

In that book i'll be looking at the most elusive of animals to ever be hunted: Intrinsic Value. I shall define it as well, as it is required to understand Intrinsic Value fully if one is to understand Money.

And finally, the pièce de résistance; Something original to truly push Economics into the 21st century. Book no. 3:

"Ethereal Value and the Crypto Future."

I've often said that i'm not against crypto, just first generation tech and the fact the coins themselves are worthless.

"Ethereal Value and the Crypto Future."

I've often said that i'm not against crypto, just first generation tech and the fact the coins themselves are worthless.

With my understanding of value, i've fixed that shortcoming. In fact - I already fixed it back in 2019, by finding a beast none of you even realized you were looking for; Ethereal Value.

In short: Ethereal Value is the unquantifiable value of services that carry subjective value

In short: Ethereal Value is the unquantifiable value of services that carry subjective value

A short example: The price difference between a haircut, and a "good looking" haircut. It describes the unquantifiable value of "what a fool will pay for it", or in other words, the subjective value some people ascribe to a $200 designer haircut, while others would never pay that

No good is produced, haircuts are a service. Nor is there any intrinsic value difference between a good looking haircut, and a haircut. Who's to say what "good looking" is? There is value in producing these haircuts - But only because there is demand for them *beyond pragmatism.*

Location also shifts behavior and with it Ethereal value; There's little value in a designer hairdresser on a forward military base.

The reason for me to define Ethereal Value is to solve a problem i ran across defining Intrinsic Value:

Digital media *has no Intrinsic Value.*

The reason for me to define Ethereal Value is to solve a problem i ran across defining Intrinsic Value:

Digital media *has no Intrinsic Value.*

Every single definition i have doesn't fit something we can copy infinitely and perfectly with next to no cost. Nothing in Intrinsic value describes the value correctly of a direct Ctrl+C/Ctrl+V copy.

It breaks every single law we thought we had. For Intrinsic value.

It breaks every single law we thought we had. For Intrinsic value.

Therefore, we need to go deeper to define it. And Intrinsic value can be said to be an Ethereal Value; a Human Value:

"When we all die; The Cats aren't going to hoard gold."

All trade is human. All concepts of intrinsic value ARE human. What we value is produced *by our minds*.

"When we all die; The Cats aren't going to hoard gold."

All trade is human. All concepts of intrinsic value ARE human. What we value is produced *by our minds*.

We can value HORRIBLE things! We can value reporting Jews to be sent to deathcamps very highly!

Just not all of us (very few these days thankfully). Which is what makes finding Ethereal value such a goddamn bitch.

It's not consistent in the least.

...However....

Just not all of us (very few these days thankfully). Which is what makes finding Ethereal value such a goddamn bitch.

It's not consistent in the least.

...However....

I've actually done it.

I've *actually found* a >QUANTIFIABLE, DIGITISEABLE, UNIVERSAL UTILITY (meaning same utility to all humans, like gold) ETHEREAL VALUE!<

I've talked to @PalisadesRadio, @goldsilver_pros and @TheEarlyStage about it. They know this is something trailblazing.

I've *actually found* a >QUANTIFIABLE, DIGITISEABLE, UNIVERSAL UTILITY (meaning same utility to all humans, like gold) ETHEREAL VALUE!<

I've talked to @PalisadesRadio, @goldsilver_pros and @TheEarlyStage about it. They know this is something trailblazing.

And - I've managed to build it into a crypto currency.

WELL i'm no programmer. Originally, my idea was to find funding and hire someone. I designed it as far back as late 2019.

But after 2020/2021, seeing everything... Society just needs me to go full Satoshi Nakamoto on this.

WELL i'm no programmer. Originally, my idea was to find funding and hire someone. I designed it as far back as late 2019.

But after 2020/2021, seeing everything... Society just needs me to go full Satoshi Nakamoto on this.

THE BOOKS WON'T BE FREE THOUGH good lord no i'm only going to be able to pull this trick once!

And i give away too much for free already. One of my streams can put newsletters out of business.

I wanna keep it accessible though. Something like $15 per book or $40 for the box set

And i give away too much for free already. One of my streams can put newsletters out of business.

I wanna keep it accessible though. Something like $15 per book or $40 for the box set

And maybe $10 for the digital versions, we'll see. Regardless, i aim to spread this info far and wide, so the world may finally move into the age of enlightenment when it comes to finance.

I am planning nothing less but to make gold obsolete, by offering something superior.

I am planning nothing less but to make gold obsolete, by offering something superior.

TRULY superior. FULLY justified by the LAWS of Money, Intrinsic Value AND subjective Ethereal Value - valuations even gold can't match: Gold can fall out of favor.

>This has never and won't ever.<

Naturally; You'll have to wait until the books for the reveal :D

>This has never and won't ever.<

Naturally; You'll have to wait until the books for the reveal :D

One thing's for sure. My attitude towards this is the same as Eminem's towards Rap. I don't want a footnote in history.

I want my name on the fucking book.

Release TBD!

@BullionStar @MacleodFinance @WallStreetSilv @Ben__Rickert @natefishpa @wmiddelkoop @GoldSwitzerland #fintwit

I want my name on the fucking book.

Release TBD!

@BullionStar @MacleodFinance @WallStreetSilv @Ben__Rickert @natefishpa @wmiddelkoop @GoldSwitzerland #fintwit

• • •

Missing some Tweet in this thread? You can try to

force a refresh