Alright. I promised something shocking, and i'll deliver:

NEW #BUBBLE DETECTED!

I'm not sure how to call this one since it's part of the Options/Stockmarket bubble, but what isn't at this point.

So for this one, ima go with:

"The Counter-Party Risk Bubble"

I think it's big.

NEW #BUBBLE DETECTED!

I'm not sure how to call this one since it's part of the Options/Stockmarket bubble, but what isn't at this point.

So for this one, ima go with:

"The Counter-Party Risk Bubble"

I think it's big.

https://twitter.com/DesoGames/status/1364929632072523777

Rather then just tell you (since that usually doesn't work) lemme just talk you through my line of thinking:

It started when i replied to this post:

My comment was that a bloomberg terminal is expensive, but spending rent money on options is no problemo.

It started when i replied to this post:

https://twitter.com/jameshenryand/status/1364941163841601539

My comment was that a bloomberg terminal is expensive, but spending rent money on options is no problemo.

But that made me think...

Hang on. I've seen news posts before about how options volume has exploded, even exceeded normal share trading. People are ACTUALLY doing it, i'm not just being facetious here.

Now i don't use options myself, but i *have* looked into them.

Hang on. I've seen news posts before about how options volume has exploded, even exceeded normal share trading. People are ACTUALLY doing it, i'm not just being facetious here.

Now i don't use options myself, but i *have* looked into them.

The reason i don't use them myself is because i consider them unethical according to my strict standards.

Because they don't *mitigate* risk. They Transfer it.

By that i mean, if i buy silver AND gold, i'm hedging silver's volatility with gold's price stability.

Because they don't *mitigate* risk. They Transfer it.

By that i mean, if i buy silver AND gold, i'm hedging silver's volatility with gold's price stability.

(see i understand hedging too).

At the same time, i'm hedging silver's performance with silver's lack-of-performance-relative-to-gold. I'm giving up a bit of THEORETICAL gains for safety. THAT's hedging.

If you buy an option to hedge, *somebody has to >write< that option*.

At the same time, i'm hedging silver's performance with silver's lack-of-performance-relative-to-gold. I'm giving up a bit of THEORETICAL gains for safety. THAT's hedging.

If you buy an option to hedge, *somebody has to >write< that option*.

Meaning if you buy an option to buy $TSLA at $100, somebody else sells you the right to do so.

Meaning, if you *excercise* that option;

>That person HAS to give you a TSLA share!<

They are contractually obligated to do so. Usually this goes unnoticed because of the brokerages.

Meaning, if you *excercise* that option;

>That person HAS to give you a TSLA share!<

They are contractually obligated to do so. Usually this goes unnoticed because of the brokerages.

They'll just cash settle everything on the back end by bunching trades up together, especially if there's no transactional fees. If they don't settle internally.

So that leads to the question... Who actually writes these options? Because that's something i didn't know.

So that leads to the question... Who actually writes these options? Because that's something i didn't know.

Oh sure i know in the case of big banks it's other big banks and hedgefunds...

...But who's selling to the retail crowd?

I figured Citadel, or there'd be protections atleast. I had read about selling puts and calls myself and decided to stay the fuck away from that danger.

...But who's selling to the retail crowd?

I figured Citadel, or there'd be protections atleast. I had read about selling puts and calls myself and decided to stay the fuck away from that danger.

But one doesn't assume. So i simply asked google,

"Who writes robin hood options"

The first post was a hit, and is a good read in itself on what it means to sell an option!

...But i'm a gamer. I'm used to glitching systems, and some stuff... triggers me. Hard.

Like this does:

"Who writes robin hood options"

The first post was a hit, and is a good read in itself on what it means to sell an option!

...But i'm a gamer. I'm used to glitching systems, and some stuff... triggers me. Hard.

Like this does:

Oh dear oh fuck oh god oh no.

Cash is the protection?

I can feel this... i can smell this... i can *taste* it.

I had to ask.

Hey Google;

Cash is the protection?

I can feel this... i can smell this... i can *taste* it.

I had to ask.

Hey Google;

Oh you think the the little subtext does it for me? Nah i have to click on stuff when i'm excited.

And then i read the replies. I've underlined the sentences i focus on, so you get the same experience, from top to bottom:

And then i read the replies. I've underlined the sentences i focus on, so you get the same experience, from top to bottom:

Yep... yep yep yep.

That's exactly what i was afraid of.

The lesson i learned back in 2008:

Counter. Party. Risk.

Lehman Brothers was such a problem because other banks had loans to Lehman on their balance sheets as assets, rather then liabilities.

That's exactly what i was afraid of.

The lesson i learned back in 2008:

Counter. Party. Risk.

Lehman Brothers was such a problem because other banks had loans to Lehman on their balance sheets as assets, rather then liabilities.

When the assets weren't there, banks relying on that credit had to call in other credit lines, which made it impossible for THOSE banks to lend, so THEY called in credit lines etc etc etc.

And this... This is exactly the same structure.

And this... This is exactly the same structure.

Only this time, DIRECTLY connected to the stock market, rather then being indirectly connected via the banks (which in turn fell because of the housing market).

You starting to get the picture?

And if there's one thing i know about humans....

You starting to get the picture?

And if there's one thing i know about humans....

Y'all motherfuckers not nearly as unique as y'all think.

If Retail is doing this, then it's being done systematically all throughout the system.

Robin Hood hasn't innovated anything except for bringing hedge fund financial WMD's to a bunch of monkeys, and then hide the risks.

If Retail is doing this, then it's being done systematically all throughout the system.

Robin Hood hasn't innovated anything except for bringing hedge fund financial WMD's to a bunch of monkeys, and then hide the risks.

That's it.

"Margin-Collateral-Backed Options" are 2008's NINJA loans of 2021.

The moment i read that, my mind IMMEDIATELY flashed back to this moment from one of my favorite movies. Guess which people i think are basically Vlad (RH's CEO):

"Margin-Collateral-Backed Options" are 2008's NINJA loans of 2021.

The moment i read that, my mind IMMEDIATELY flashed back to this moment from one of my favorite movies. Guess which people i think are basically Vlad (RH's CEO):

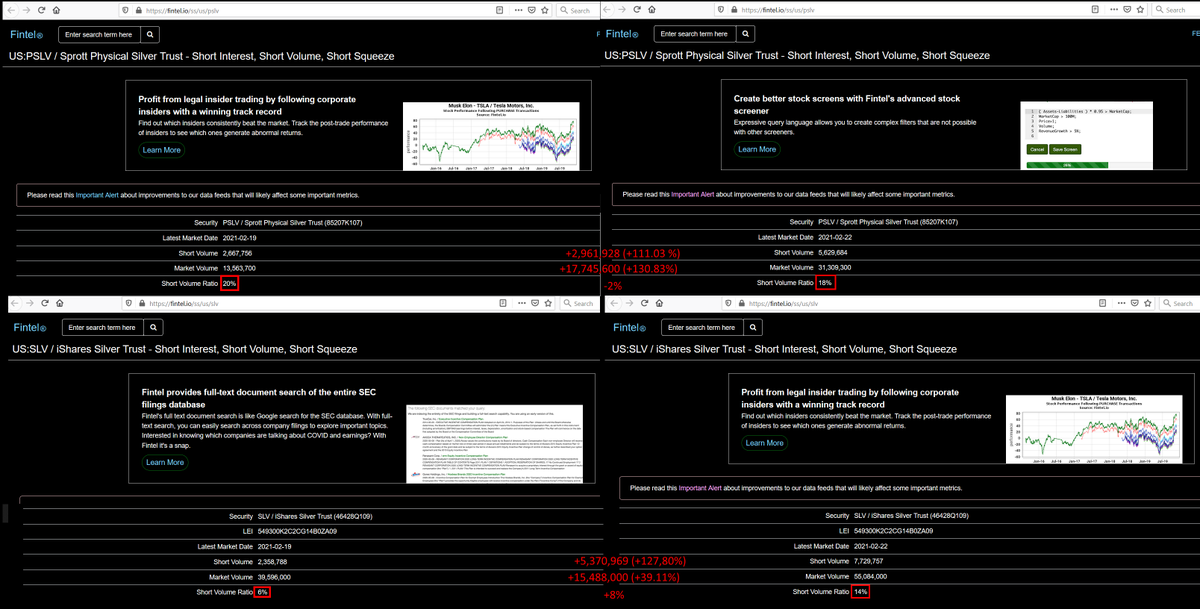

There are a MASS of people out there who've *sold* calls and puts >on margin and they don't even know<

If the market goes either which way too steeply, in say a March 2020 replay, that 80% options go worthless is going to shift dramatically.

ESPECIALLY on puts.

If the market goes either which way too steeply, in say a March 2020 replay, that 80% options go worthless is going to shift dramatically.

ESPECIALLY on puts.

But a steep rise isn't much better. It'll blow up the calls, ALSO bought on margin.

Remember that Robin Hood suddenly had to raise Billions? Twice? To satisfy margin requirements?

Remember that the Investment Brokers guy said "The entire system nearly collapsed"?

Remember that Robin Hood suddenly had to raise Billions? Twice? To satisfy margin requirements?

Remember that the Investment Brokers guy said "The entire system nearly collapsed"?

What are the chances THIS is the reason?

What if Wallstreetbets damn near popped the counter party risk bubble?

Because when you think about it, Melvin Capital blowing up fine... But why did RH *itself* almost bite the dust BEFORE WSB got cut off from the spice?

What if Wallstreetbets damn near popped the counter party risk bubble?

Because when you think about it, Melvin Capital blowing up fine... But why did RH *itself* almost bite the dust BEFORE WSB got cut off from the spice?

Think about it.

If shares bought on margin, are ALSO collateral for call options...

...That's a >double sale<. TWO people hold TITLE claims:

1. Collateral for Margin.

2. Collateral for Calls.

>TO A SHARE!!!!!<

THAT'S THE THING! Don't focus on the cash cost or the margin.

If shares bought on margin, are ALSO collateral for call options...

...That's a >double sale<. TWO people hold TITLE claims:

1. Collateral for Margin.

2. Collateral for Calls.

>TO A SHARE!!!!!<

THAT'S THE THING! Don't focus on the cash cost or the margin.

The point is 2 people have a collateral calls on those shares: 1. The person who bought the call, and 2....

Robin Hood. Because THEY provide the margin.

But again. Systemic behavior.

Is that margin cash that RH owns?

No. it's far too much. So who LENDS them that?

Citadel.

Robin Hood. Because THEY provide the margin.

But again. Systemic behavior.

Is that margin cash that RH owns?

No. it's far too much. So who LENDS them that?

Citadel.

So follow the chain here:

1. Market dips.

2. Puts go ITM unexpectedly.

3. Collateral calls.

4. Puts can't afford shares.

5. Puts take losses, ITM puts take losses.

6. RH's OWN collateral evaporates.

7. RH goes broke

8. Citadel has to >write down< the margin loans.

1. Market dips.

2. Puts go ITM unexpectedly.

3. Collateral calls.

4. Puts can't afford shares.

5. Puts take losses, ITM puts take losses.

6. RH's OWN collateral evaporates.

7. RH goes broke

8. Citadel has to >write down< the margin loans.

9. Citadel is as overleveraged as the banks in 2008 were, because OF COURSE THEY ARE THE ENTIRE FUCKING SYSTEM'S CHOKING ON LEVERAGE!

10. Citadel has to sell to make collateral calls.

11. EVERY TIME YOU READ "COLLATERAL CALL", READ: SELLING ASSETS INTO THE OPEN MARKET!

10. Citadel has to sell to make collateral calls.

11. EVERY TIME YOU READ "COLLATERAL CALL", READ: SELLING ASSETS INTO THE OPEN MARKET!

12. Selling begets selling begets selling.

13. More puts go ITM.

14. More collateral calls.

15. More non-existant collateral.

16. Etc.

The investment brokers guy wasn't lying. The system REALLY damn near died.

Not froze. DIED. The entire financial system.

...Again.

13. More puts go ITM.

14. More collateral calls.

15. More non-existant collateral.

16. Etc.

The investment brokers guy wasn't lying. The system REALLY damn near died.

Not froze. DIED. The entire financial system.

...Again.

If you think i brought shock; Like and retweet ^_^

#WSS #wallstreetsilver #Silver #Silversqueeze #PSLV $PSLV #PSLVChallenge #Silverbacks #fintwit @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @michaeljburry @goldsilver_pros @GoldTelegraph_ @Ben__Rickert @ttmygh

#WSS #wallstreetsilver #Silver #Silversqueeze #PSLV $PSLV #PSLVChallenge #Silverbacks #fintwit @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @michaeljburry @goldsilver_pros @GoldTelegraph_ @Ben__Rickert @ttmygh

• • •

Missing some Tweet in this thread? You can try to

force a refresh