#BOND WATCH!

🚨🚨MEGA ALERT!🚨🚨

#USA 30 YEAR REAL YIELD GONE POSITIVE!

@HustlerHindu reminded me i once said;

"The only thing i fear is US real rates going positive"

We're here.

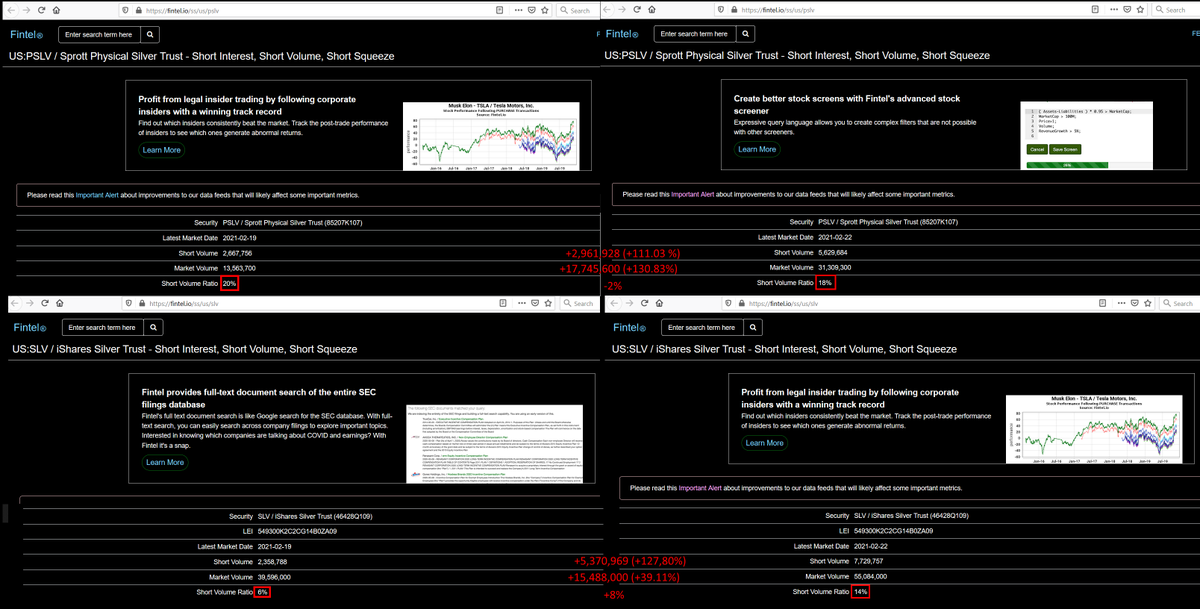

#WallstreetSilver #Silversqueeze $PSLV #PSLVChallenge #fintwit @WallStreetSLVR @Galactic_Trader

🚨🚨MEGA ALERT!🚨🚨

#USA 30 YEAR REAL YIELD GONE POSITIVE!

@HustlerHindu reminded me i once said;

"The only thing i fear is US real rates going positive"

We're here.

#WallstreetSilver #Silversqueeze $PSLV #PSLVChallenge #fintwit @WallStreetSLVR @Galactic_Trader

The reason i said that is simple.

"Once real rates go positive, they won't be able to be stopped."

"When real rates go positive the negative rates/gold correlation will break, as it's not causation"

"Rather going up with yields going down, gold will go up with yields going up"

"Once real rates go positive, they won't be able to be stopped."

"When real rates go positive the negative rates/gold correlation will break, as it's not causation"

"Rather going up with yields going down, gold will go up with yields going up"

We're here.

The bond market collapse is upon us.

BUY SOME FUCKING PRECIOUS METALS!

@PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree @TheEarlyStage @LawrenceLepard @TeminatorTrader @jameshenryand @GlobalProTrader @maartenverheyen @Ben__Rickert @SilverChartist

The bond market collapse is upon us.

BUY SOME FUCKING PRECIOUS METALS!

@PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree @TheEarlyStage @LawrenceLepard @TeminatorTrader @jameshenryand @GlobalProTrader @maartenverheyen @Ben__Rickert @SilverChartist

REMEMBER WHEN I SAID IT WASN'T JUST THE US?!

AND HOW ITALY WAS THE LAST HOLDOUT?!

#WSS #Wallstreetsilver #PSLV $PSLV #PSLVchallenge #Silver #silversqueeze #gold #goldsqueeze #platinum #platinumsqueeze #fintwit

AND HOW ITALY WAS THE LAST HOLDOUT?!

https://twitter.com/DesoGames/status/1361992911538294789

#WSS #Wallstreetsilver #PSLV $PSLV #PSLVchallenge #Silver #silversqueeze #gold #goldsqueeze #platinum #platinumsqueeze #fintwit

• • •

Missing some Tweet in this thread? You can try to

force a refresh