Yknow i gotta comment on this.

@MacleodFinance Help me out here. I'm reading more and more that "hyperinflation is defined as 50% a month" - but that's *new*.

Years ago when i looked it up i found "economists don't agree on where it starts, but the general line is 10% a month".

@MacleodFinance Help me out here. I'm reading more and more that "hyperinflation is defined as 50% a month" - but that's *new*.

Years ago when i looked it up i found "economists don't agree on where it starts, but the general line is 10% a month".

I can't remember *EVER* reading about ANY consensus for the decade i've been studying economy and looking up US financial history and general world economic history.

And i'm sorry, but 50% a month is 600% A YEAR!

I'm pretty sure the common man isn't gonna wait that long.

And i'm sorry, but 50% a month is 600% A YEAR!

I'm pretty sure the common man isn't gonna wait that long.

IMO this is just another warping of the economic language by the establishment.

Hyperinflation *cannot* be defined as having a set boundary, because it's largely *psychological* in nature.

LONG BEFORE you lose 50% of your purchasing power a month are you gonna exit the system!

Hyperinflation *cannot* be defined as having a set boundary, because it's largely *psychological* in nature.

LONG BEFORE you lose 50% of your purchasing power a month are you gonna exit the system!

Modern economists would want you believe that reality is shaped according to their theories, but that's oh so ass backwards.

Theory follows reality. Reality is, hyperinflation is a process that starts LONG BEFORE you even reach 10% a month.

It's already here. Today.

Theory follows reality. Reality is, hyperinflation is a process that starts LONG BEFORE you even reach 10% a month.

It's already here. Today.

The fact that Jerome Powell is relentlessly mocked;

The #PSLVChallenge and #wallstreetsilver;

record low confidence in the political class due to both mismanagement for decades;

THE FACT THAT NONE OF THEIR BULLSHIT THEORIES MAKE ANY SENSE IN REAL LIFE!

It's a crisis of faith.

The #PSLVChallenge and #wallstreetsilver;

record low confidence in the political class due to both mismanagement for decades;

THE FACT THAT NONE OF THEIR BULLSHIT THEORIES MAKE ANY SENSE IN REAL LIFE!

It's a crisis of faith.

Saying hyperinflation starts at 50% a month is the same as defining the start of the recession 9 months down the line.

>reality isn't the point where economists agree<

It's what happens regardless of their opinions.

So let me again define THE PROCESS of hyperinflation:

>reality isn't the point where economists agree<

It's what happens regardless of their opinions.

So let me again define THE PROCESS of hyperinflation:

It is a 3 step process, nice and easy to follow:

1. Impossible-to-stop inflation.

Everything has a beginning, and hyperinflation begins when a currency's end is inevitable through fundamental reasons. For Weimar Germany, those were the war reparations.

1. Impossible-to-stop inflation.

Everything has a beginning, and hyperinflation begins when a currency's end is inevitable through fundamental reasons. For Weimar Germany, those were the war reparations.

Impossible to avoid, impossible to pay. Then it's just a matter of time.

For the #USA, we can *time* step 1:

16th of September, 2019.

The Repo Crisis, or as i like to call it:

"The day the #USA went broke."

To his credit, J-Pow might be reactive, he's one quick lil fucker.

For the #USA, we can *time* step 1:

16th of September, 2019.

The Repo Crisis, or as i like to call it:

"The day the #USA went broke."

To his credit, J-Pow might be reactive, he's one quick lil fucker.

Shot that thing down with a QE-but-not-QE bazooka immediately. Problem is, ya can't fix a hole in the dam with a bazooka.

From that date, and it's VERY important to understand this:

>>QE became *impossible* to EVER turn off!<<

THAT is why it was the start of hyperinflation.

From that date, and it's VERY important to understand this:

>>QE became *impossible* to EVER turn off!<<

THAT is why it was the start of hyperinflation.

Lets run through a hypothetical:

What would've happened if they turned QE off in October?

I think we can all agree, the Repo crisis would've returned.

What about November?

Same thing.

December?

bloomberg.com/opinion/articl…

They printed half a trillion to prevent his prediction.

What would've happened if they turned QE off in October?

I think we can all agree, the Repo crisis would've returned.

What about November?

Same thing.

December?

bloomberg.com/opinion/articl…

They printed half a trillion to prevent his prediction.

By the way, i'd already converted my life savings to #silver, #gold and #cash in a 6:3:1 ratio, the day before that report hit. So i've been on point on every single major event since then.

Those "temporary repo operations" were supposed to last until April 2020.

Those "temporary repo operations" were supposed to last until April 2020.

That's how Ray Dalio said "cash is trash" before the dollar spiked from 99 to 104 and ol' Ray lost alotta money (i called that top too btw)

What the financial space WAS expecting, was another great financial crisis, only worse. And it was timed; When the Fed would withdraw repo.

What the financial space WAS expecting, was another great financial crisis, only worse. And it was timed; When the Fed would withdraw repo.

So in January, what the timeline was a reduction in Repo in April, ignored warnings in May/June, and an inevitable stock market crash in July: Withdraw and crash, or extend the repo operations too long, people start questioning "Temporary", and the crash happens anyway.

Ray wasn't wrong - just complacent. That's why black swans are called black swans.

It's not that they don't exist. Australia's full of em. It's just that everybody's *so used* to the current paradigm, no one looks further.

The info is seen, but ignored. Judged unimportant.

It's not that they don't exist. Australia's full of em. It's just that everybody's *so used* to the current paradigm, no one looks further.

The info is seen, but ignored. Judged unimportant.

Well, we know the virus and the monetary response. Not too long after Repo operations completely vanished because QE is the better deal, and at a trillion *per month*; It eclipsed the $60B QE4: Not QE anyway.

The US has >gone through< the first phase of hyperinflation.

The US has >gone through< the first phase of hyperinflation.

The first phase lasted from 16th of September 2019 to the 9th-11th of November 2020.

This is the "Fundamentals" phase, where inflation can't be stopped, but it's still constrained by supply-demand laws.

I have proof ofcourse. The Fed was always gonna change the measures.

This is the "Fundamentals" phase, where inflation can't be stopped, but it's still constrained by supply-demand laws.

I have proof ofcourse. The Fed was always gonna change the measures.

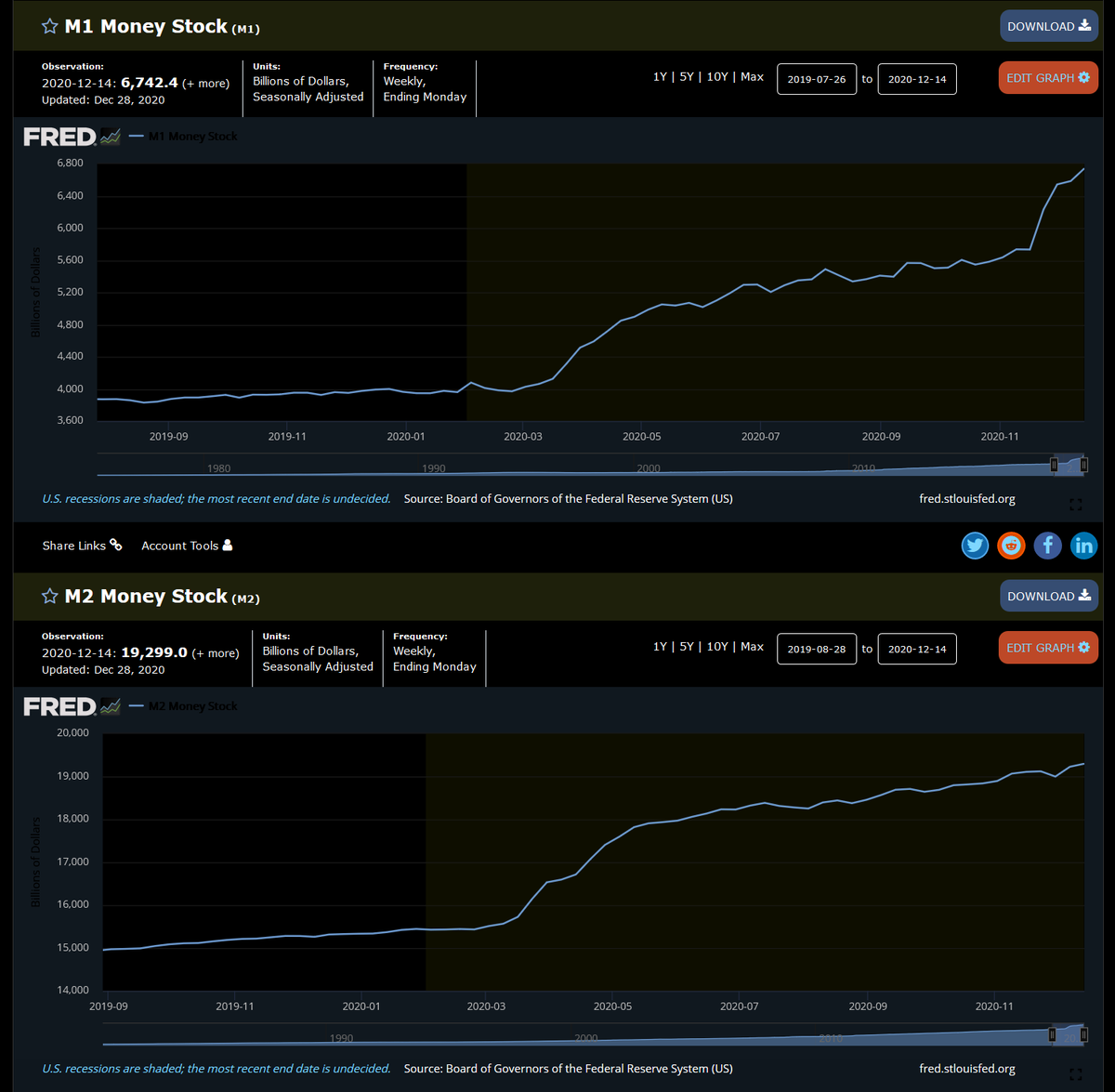

In March, M1 and M2 still went up equally. M1 is circulating currency, while M2 is currency and liquid assets that easily get converted to currency.

It is *NO* coincidence they changed their measure retroactively from May 2020, even on the old chart:

fred.stlouisfed.org/series/M1

It is *NO* coincidence they changed their measure retroactively from May 2020, even on the old chart:

fred.stlouisfed.org/series/M1

ALWAYS TAKE SCREENSHOTS KIDS!

So, now we're in Phase 2 of hyperinflation, since November 2020 until ?.

This is the "Switch" phase, where - AT SOME POINT - inflation flips to hyperinflation, where supply/demand fundamentals flip to Psychological drivers.

#WSB is a symptom.

So, now we're in Phase 2 of hyperinflation, since November 2020 until ?.

This is the "Switch" phase, where - AT SOME POINT - inflation flips to hyperinflation, where supply/demand fundamentals flip to Psychological drivers.

#WSB is a symptom.

One i predicted btw. Added 2 meme's i made on the 13th (quelle surprise) and 23rd of November, eluding to the "Doomsday Demand" i wrote about in my Shadowcontracts article:

desogames.com/shadowcontract…

That they hit $GME first doesn't matter. It's still an excess M1 currency symptom

desogames.com/shadowcontract…

That they hit $GME first doesn't matter. It's still an excess M1 currency symptom

It could very well be that in the future, the "switch moment", where fundamentals flipped to psychology, is defined as "Robin Hood disabling trading GME and other shorted stocks".

The reasons they did that are unimportant.

What *is* important, is that they created a *movement*.

The reasons they did that are unimportant.

What *is* important, is that they created a *movement*.

Demand in the supply/demand equation is *always* psychological, which is why it makes S/D so hard to understand. THINK about the word. People "Demand" things to buy, while supply is "dug out of the ground"

This factor is now focused >beyond turning a profit or even survival.<

This factor is now focused >beyond turning a profit or even survival.<

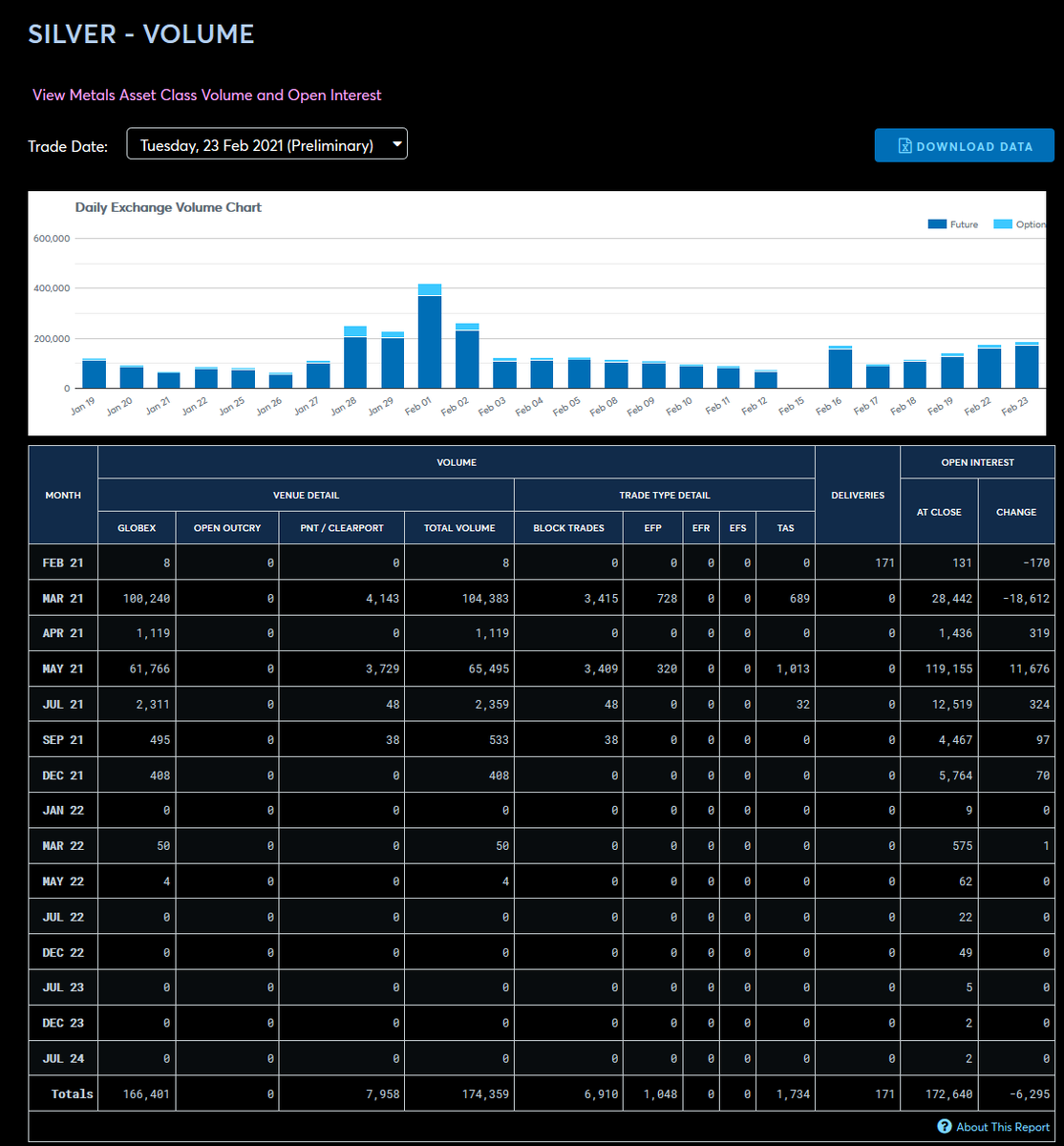

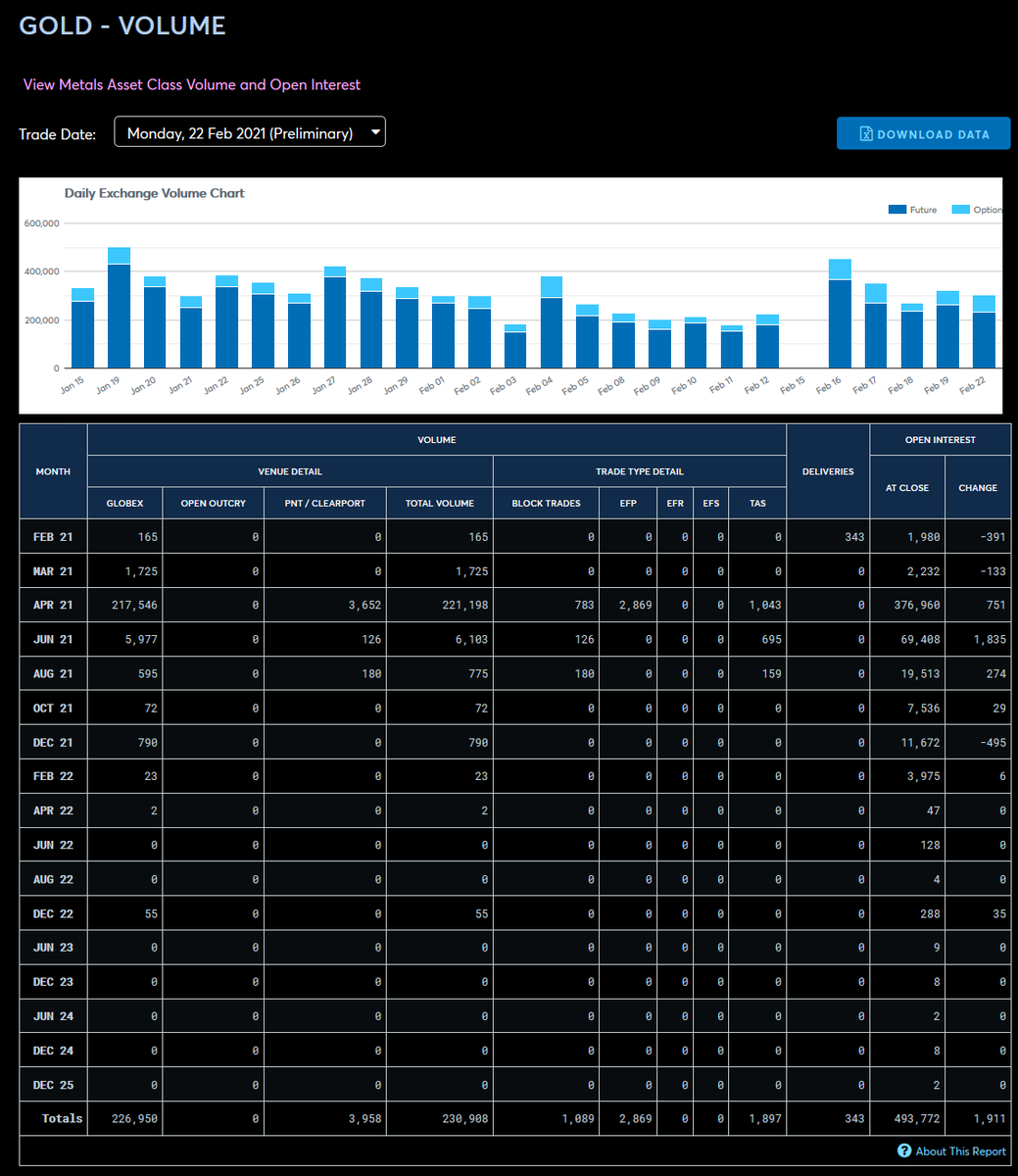

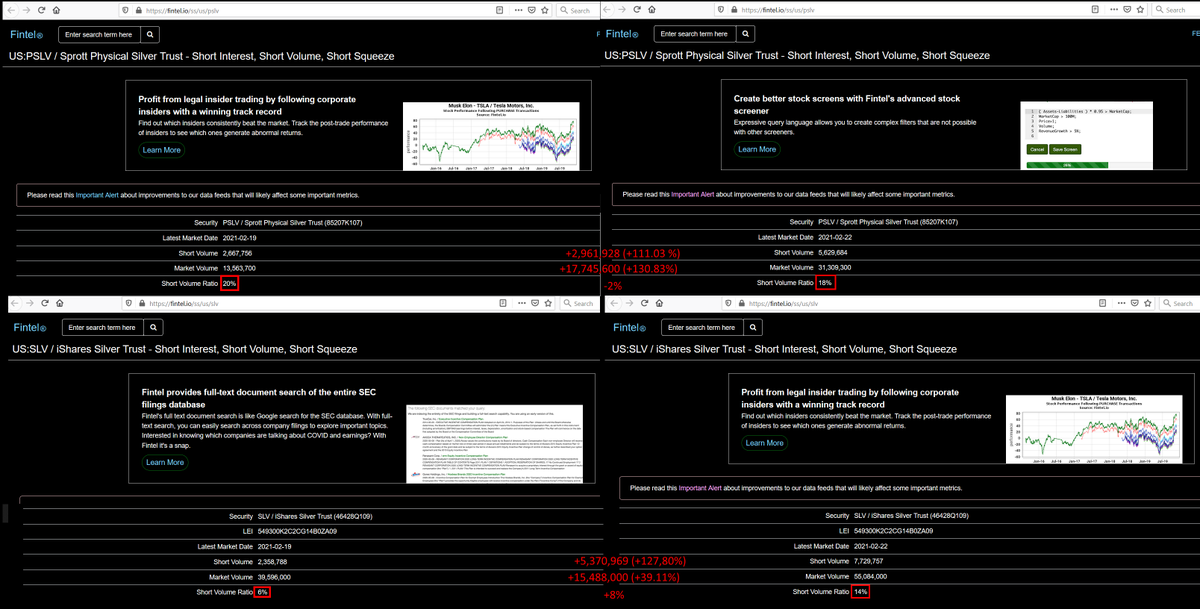

#wallstreetsilver is another symptom, a more severe one.

#WSS might be smaller then #WSB, but infinitely more focused. Tactics are discussed. Strategies considered. New fronts are opened, but >on the same asset; Money. The Silverspace is backing it with experience and intel.

#WSS might be smaller then #WSB, but infinitely more focused. Tactics are discussed. Strategies considered. New fronts are opened, but >on the same asset; Money. The Silverspace is backing it with experience and intel.

Like inflation couldn't be stopped in phase 1, in phase 2 this movement, this "Doomsday Demand" cannot be stopped, and will only grow.

Jerome Powell's remarks yesterday shows that. He's mocked and rates are going up, despite his ultra-dovishness.

Fed's outta ammo. For real.

Jerome Powell's remarks yesterday shows that. He's mocked and rates are going up, despite his ultra-dovishness.

Fed's outta ammo. For real.

Nothing they will do now will work, because every single measure means printing more currency.

While the dollar IS debt, and we're in a *solvency* crisis.

They can do Nothing.

Phase 3 is "Panic". No idea when it starts. Time. A trigger (comex). But the end cannot be stopped.

While the dollar IS debt, and we're in a *solvency* crisis.

They can do Nothing.

Phase 3 is "Panic". No idea when it starts. Time. A trigger (comex). But the end cannot be stopped.

JOIN THE CAUSE! PROTECT YOURSELF!

#Silverbacks #Wallstreetsilver #PSLVChallenge

#WSS #Silver #Silversqueeze $PSLV #PSLV #Silverstimulus #Fintwit @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree

#Silverbacks #Wallstreetsilver #PSLVChallenge

#WSS #Silver #Silversqueeze $PSLV #PSLV #Silverstimulus #Fintwit @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @PalisadesRadio @goldsilver_pros @GoldTelegraph_ @TheLastDegree

YIELD CURVES ADDENDUM!

My order-of-operations remains #Canada > #USA > #EU.

Time to start thinking about shorting currencies!!!!!

I love silver. But the REAL money is in shorting a currency to death.

#WSS #Wallstreetsilver #Silver #silversqueeze #PSLV $PSLV #PSLVChallenge

My order-of-operations remains #Canada > #USA > #EU.

Time to start thinking about shorting currencies!!!!!

I love silver. But the REAL money is in shorting a currency to death.

#WSS #Wallstreetsilver #Silver #silversqueeze #PSLV $PSLV #PSLVChallenge

• • •

Missing some Tweet in this thread? You can try to

force a refresh