$PSLV $SLV #Shorts volume update! Tags first explanation below!

#Fintwit #Wallstreetsilver #Silver #Silversqueeze #Silverbacks #PSLV #PSLVChallenge #PSLVMarathon @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @PalisadesRadio @GoldTelegraph_ @goldsilver_pros

#Fintwit #Wallstreetsilver #Silver #Silversqueeze #Silverbacks #PSLV #PSLVChallenge #PSLVMarathon @WallStreetSLVR @Galactic_Trader @TeminatorTrader @jameshenryand @PalisadesRadio @GoldTelegraph_ @goldsilver_pros

So there's some confusion between short volume and short interest. I pretty much made the same mistake the first time around, because believe it or not.... there's just a fuckton of data to track at this point.

So, short volume is NOT short interest, but, it does tell us things.

So, short volume is NOT short interest, but, it does tell us things.

Very simply put, "what isn't there cannot be traded".

This goes for us, as we're literally buying silver to take it off the market. Whatever's part of "market volume" doesn't include *my* PSLV shares, because i'm not actively trading them.

So you're looking at buys and sells.

This goes for us, as we're literally buying silver to take it off the market. Whatever's part of "market volume" doesn't include *my* PSLV shares, because i'm not actively trading them.

So you're looking at buys and sells.

Short volume's the same. You're looking at shorts and shorts closing, or in other words, buying back a share. Opening or closing doesn't matter, a trade is a trade for a single number.

So we can't tell short interest from volume. Buuutt....

So we can't tell short interest from volume. Buuutt....

That doesn't mean it tells us nothing. It allows us to guess more accurately. Because, in this case, there is 1 VERY important fact here:

$SLV and $PSLV >>are the same investment vehicle!<<

Meaning, they're both physical silver backed ETFs.

Well, supposed to be.

$SLV and $PSLV >>are the same investment vehicle!<<

Meaning, they're both physical silver backed ETFs.

Well, supposed to be.

Meaning, they should both track the price of silver as close as possible. True, arbitrage is a thing, but as we've seen the MASSIVE differences between price moves in SLV and PSLV - arbitrage is clearly broken.

That or the bots are arbitraging by shorting, in which case LOL.

That or the bots are arbitraging by shorting, in which case LOL.

That's HFT money, and fuck those guys too. Liquidity providers my ass. Vultures. Spreads on penny stocks are HUGE. As are the penny-profits they make on stuff like $AAPL

In any case, SLV and PSLV being physical ETFs, shorting either *should be* the same as shorting Silver itself

In any case, SLV and PSLV being physical ETFs, shorting either *should be* the same as shorting Silver itself

Ergo, they should have a similar percentage of shorts - similar to the shorts on silver itself. After all, the moment one is shorted more then the other, supply goes up, price goes down, and an arbitrage opportunity exists. Guaranteed profits.

This is not the case.

This is not the case.

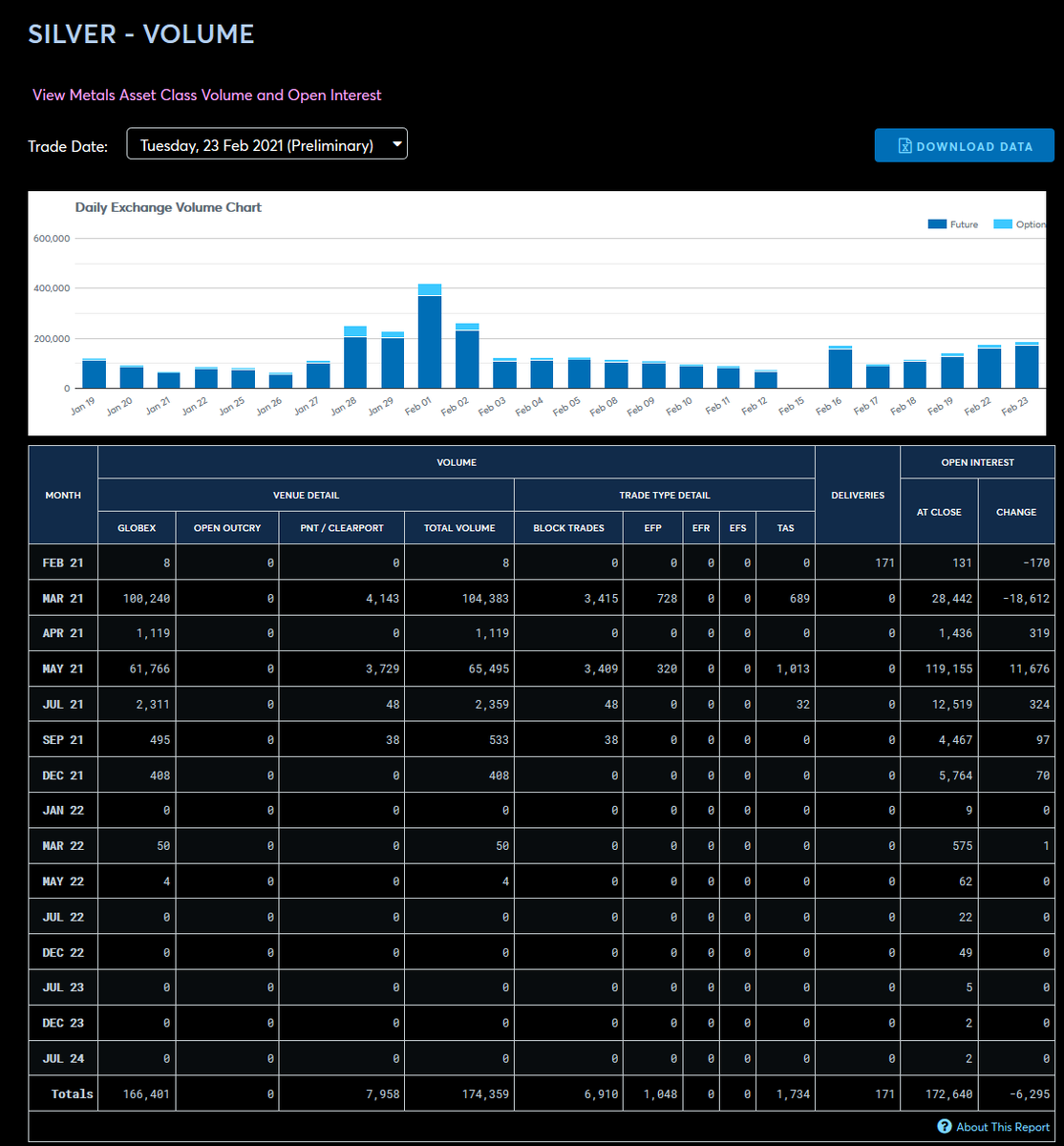

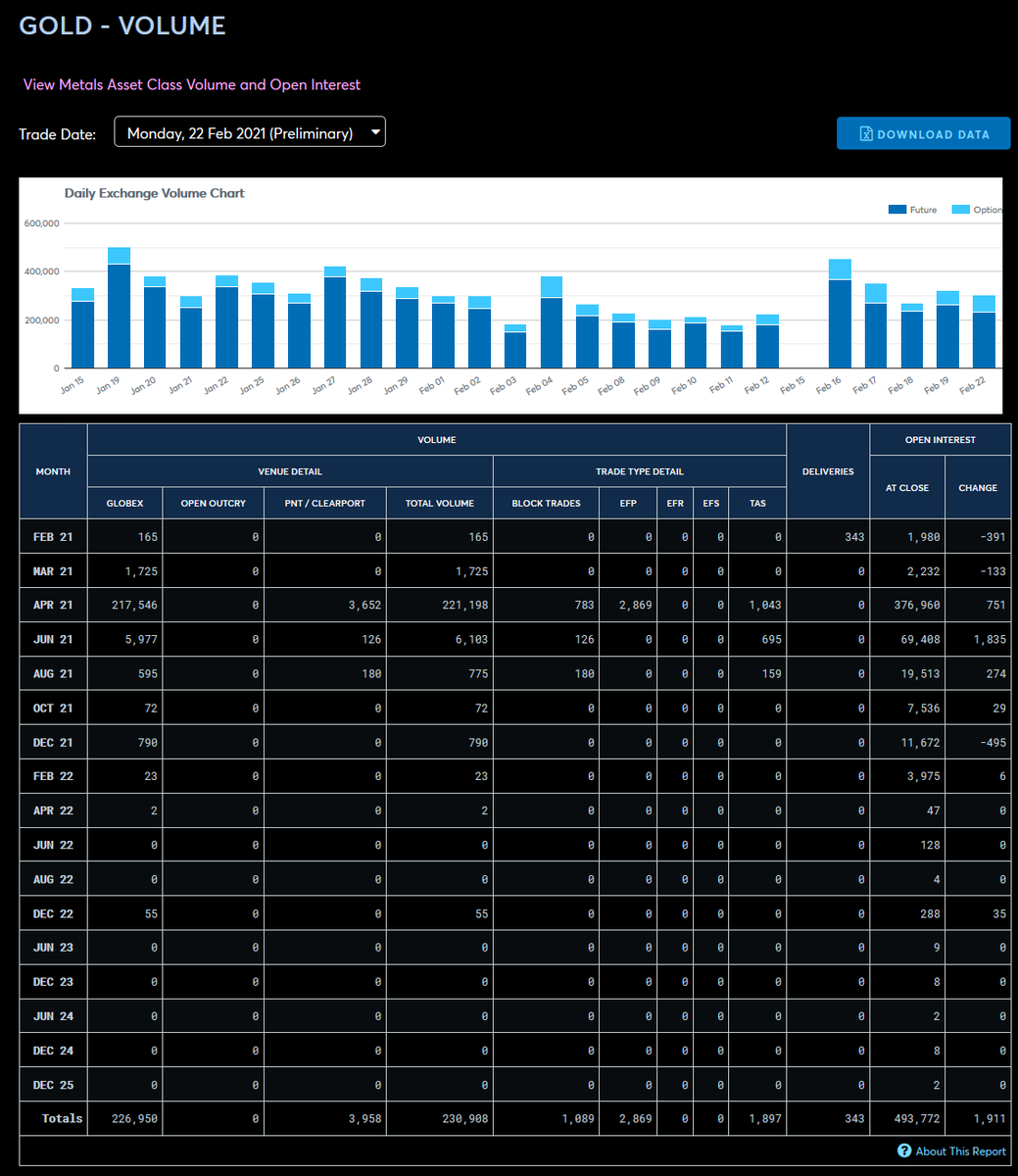

Because SLV is more popular and has a higher trading volume, you'd expect the short trading volume to be higher too.

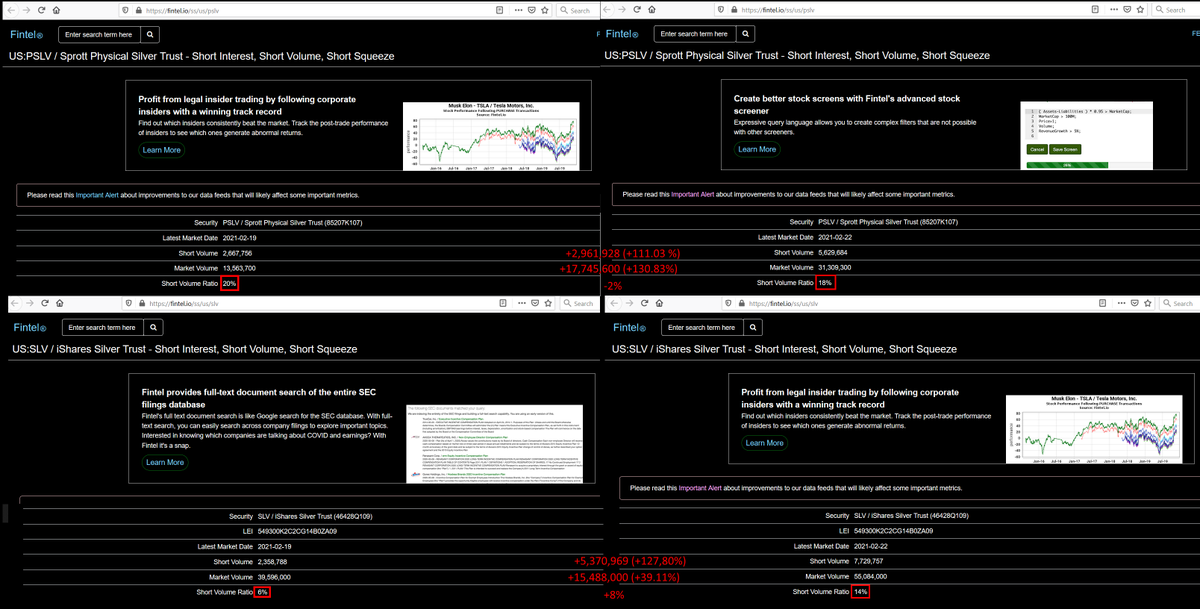

SLV happened to have twice the market volume yesterday, so it should have twice the short volume of PSLV.

This clearly isn't the case. PSLV's volume is higher!

SLV happened to have twice the market volume yesterday, so it should have twice the short volume of PSLV.

This clearly isn't the case. PSLV's volume is higher!

SUBSTANTIALLY higher.

Because of this, the >short volume ratio<, which is the percentage you see, is 22% for PSLV and 9% for SLV.

We might not be able to see if a trade was opened or closed, but we CAN see how much trades were made, and we CAN reason, more shorts = more trades.

Because of this, the >short volume ratio<, which is the percentage you see, is 22% for PSLV and 9% for SLV.

We might not be able to see if a trade was opened or closed, but we CAN see how much trades were made, and we CAN reason, more shorts = more trades.

Now, if those short traders were smart, they just closed everything en masse.

But we HAVE to consider motive here. JPM has downgraded silver. GS gold. Bloomberg is putting out sell articles, while MSM is deathly silent on wallstreet >silver<.

We're getting active pushback.

But we HAVE to consider motive here. JPM has downgraded silver. GS gold. Bloomberg is putting out sell articles, while MSM is deathly silent on wallstreet >silver<.

We're getting active pushback.

Which is a first too for the silverspace, by the way. It's never gotten this far.

We also know they've done worse then naked shorting:

bloomberg.com/news/articles/…

Again; We can play that game too, legally, if you >just let it execute.< Then you overpay and it's "just stupid"

We also know they've done worse then naked shorting:

bloomberg.com/news/articles/…

Again; We can play that game too, legally, if you >just let it execute.< Then you overpay and it's "just stupid"

Jamie Dimon will Never ever think of a tactic of deliberately overpaying even a single cent beyond the cost of doing business.

That's why it's genius. Just be stupid and overpay a few cents a share to drive up the price. Doesn't hurt us individuals.

Does affect a single price.

That's why it's genius. Just be stupid and overpay a few cents a share to drive up the price. Doesn't hurt us individuals.

Does affect a single price.

In any case, the point is, there is a *VERY* high possibility that the discrepancy in short volume between two identical instruments comes from many small short trades, not a few large organic ones.

NO ONE is expecting PSLV to drop with a social media campaign pushing it!!!

NO ONE is expecting PSLV to drop with a social media campaign pushing it!!!

In short.

The most likely and probable explanation for short volume for PSLV exceeding SLV by multiples is because shorts for PSLV greatly exceed SLV, as well as many trades are being made and closed from a select few entities - rather then from a mass of people.

The most likely and probable explanation for short volume for PSLV exceeding SLV by multiples is because shorts for PSLV greatly exceed SLV, as well as many trades are being made and closed from a select few entities - rather then from a mass of people.

Finally there's 1 more piece of data on that website i haven't showed yet, and apparantly, everybody else is too lazy to go look for (i include the link in the screenshot for a reason, yknow).

Guess which one is PSLV.

Guess which one is PSLV.

Oh, don't worry;

*that's a low number*.

SOMEBODY go get a sub there because i'm tapped (and just to verify), but last time i checked it was north of $2, and when i checked *yesterday* with 28% short volume, i remember $2.52.

Logically; the more shorts, the higher the rate.

*that's a low number*.

SOMEBODY go get a sub there because i'm tapped (and just to verify), but last time i checked it was north of $2, and when i checked *yesterday* with 28% short volume, i remember $2.52.

Logically; the more shorts, the higher the rate.

I VERY much wonder if that cost skyrockets tomorrow with our new $500 sell orders tactic. Atleast we'll be able to check effectiveness directly!

Regardless, i'm alot worse with math then you people think, so somebody else will have to figure how to calculate short interest here.

Regardless, i'm alot worse with math then you people think, so somebody else will have to figure how to calculate short interest here.

THE POINT STANDS:

PSLV *IS* GETTING SHORTED TO SUPPRESS THE PRICE!

WE DON'T KNOW BY HOW MUCH, BUT WE DO KNOW BY A FUCKTON! (borrowing costs show as much).

The #Silversqueeze is real gentlemen. They showed their hand.

So lets up the ante.

#PSLVChallenge day 5: #PSLVMarathon.

PSLV *IS* GETTING SHORTED TO SUPPRESS THE PRICE!

WE DON'T KNOW BY HOW MUCH, BUT WE DO KNOW BY A FUCKTON! (borrowing costs show as much).

The #Silversqueeze is real gentlemen. They showed their hand.

So lets up the ante.

#PSLVChallenge day 5: #PSLVMarathon.

• • •

Missing some Tweet in this thread? You can try to

force a refresh