No sooner had a European Super League (ESL) been announced than the plans were shelved, at least for the time being, but what were the factors that drove the 12 breakaway clubs to this deeply unpopular move? As usual, it was all about money, a combination of fear and greed.

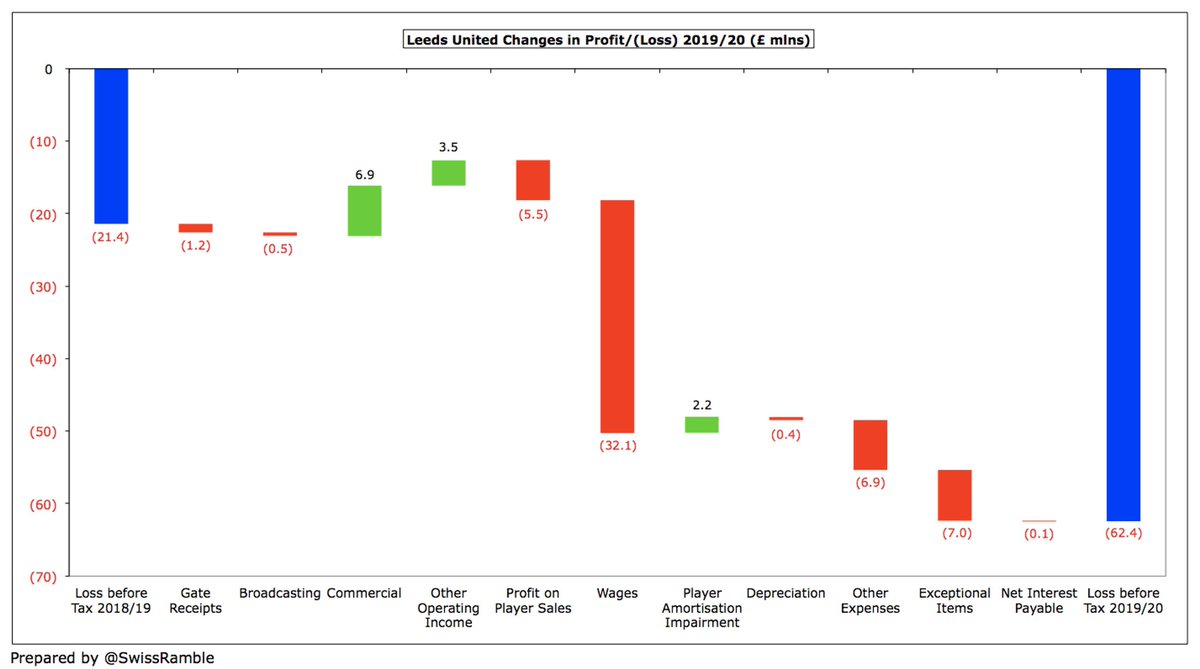

Whether football is broken is debatable, but there is little doubt that many of the 12 Super League clubs are facing serious financial problems. To some extent, this helps explain why the “dirty dozen” would seek more revenue, but does not excuse this horribly ill-conceived plan.

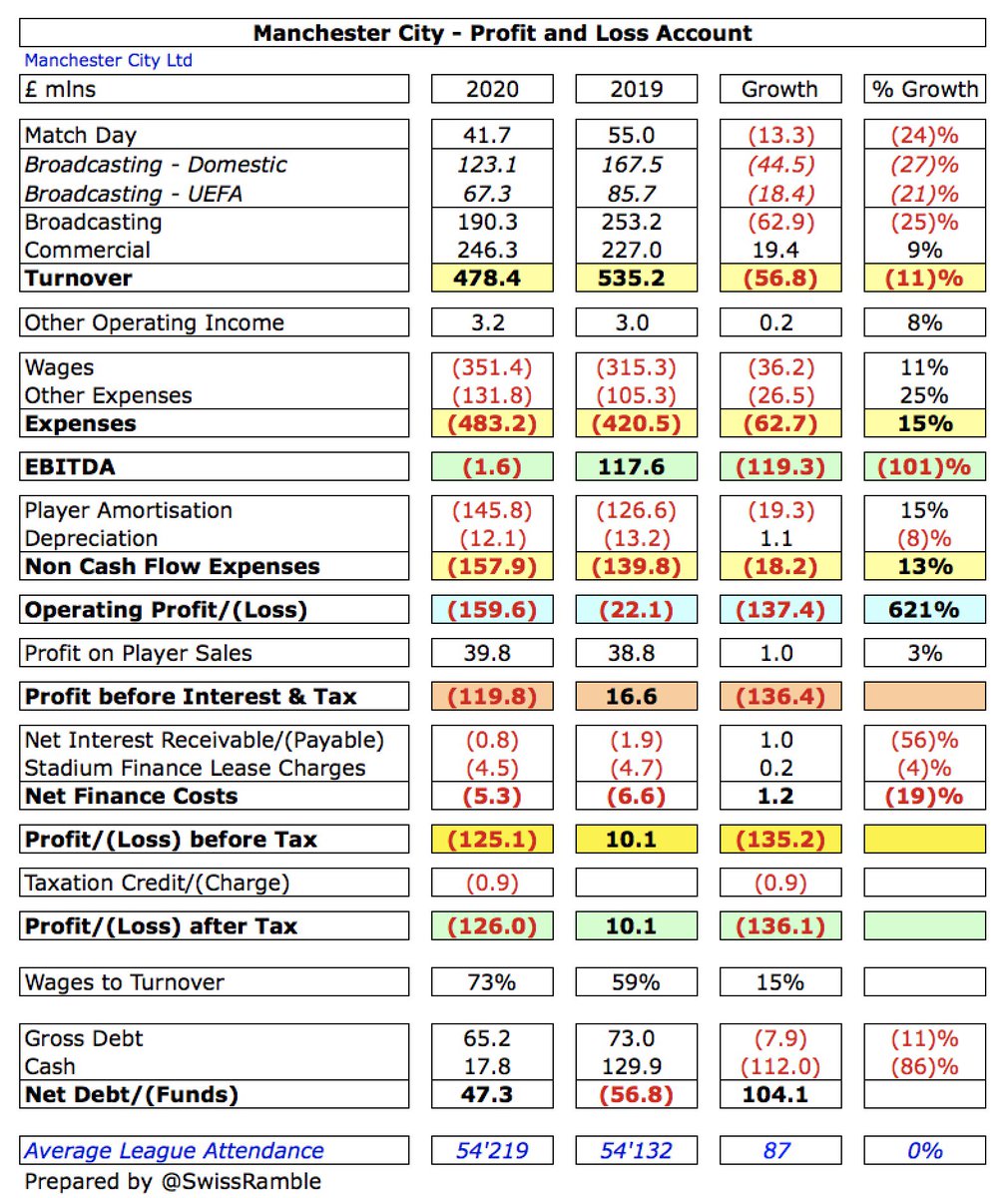

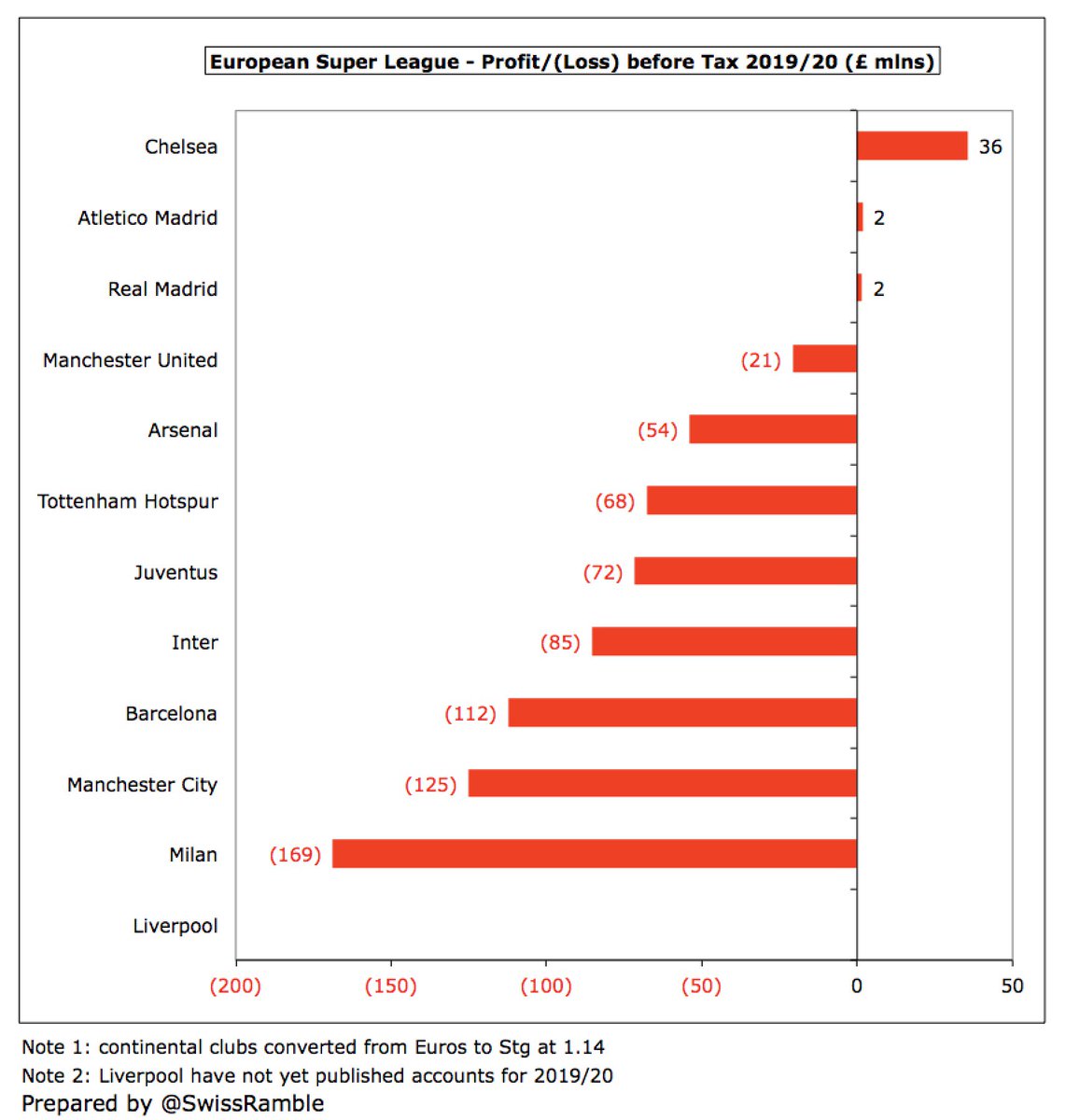

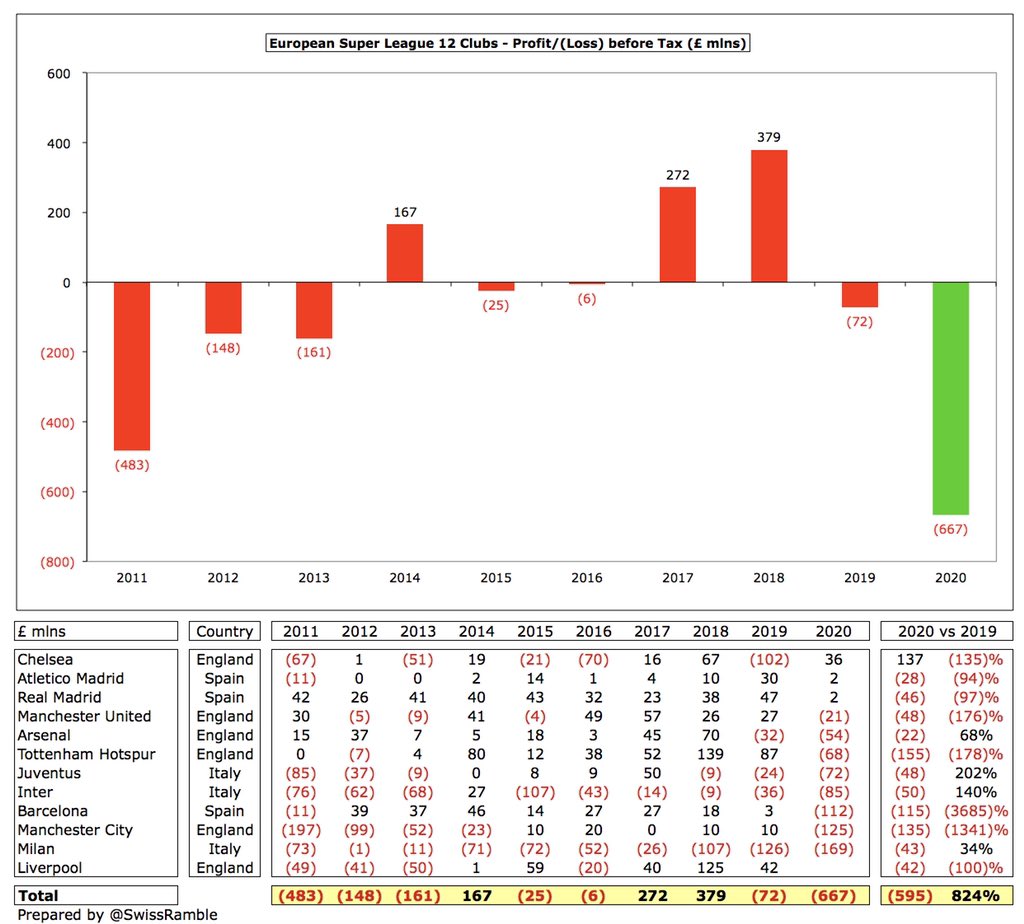

You don’t have to look too far to see the seriousness of the financial predicament with pre-tax losses of the 12 ESL clubs adding up to a worrying £667m, even before #LFC announce their results. Three of them lost more than £100m: #Milan £169m, #MCFC £125m and #FCBarcelona £112m.

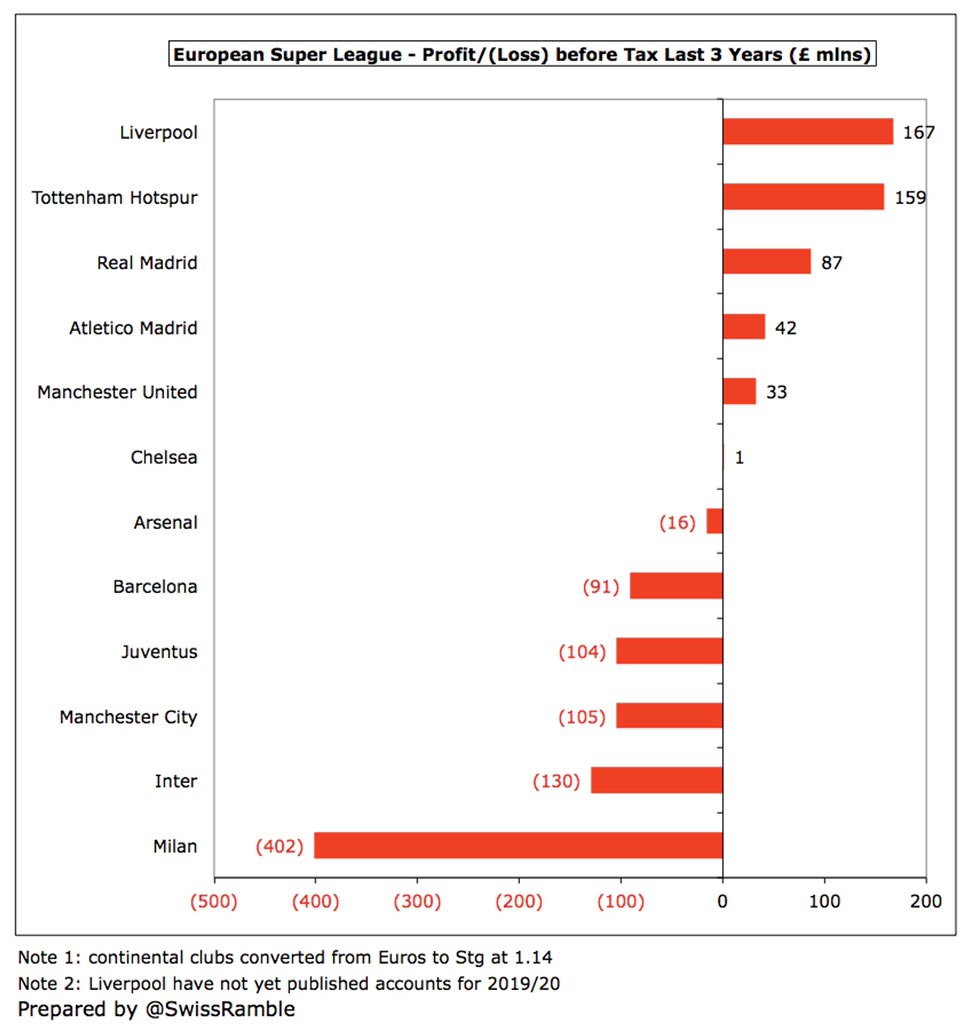

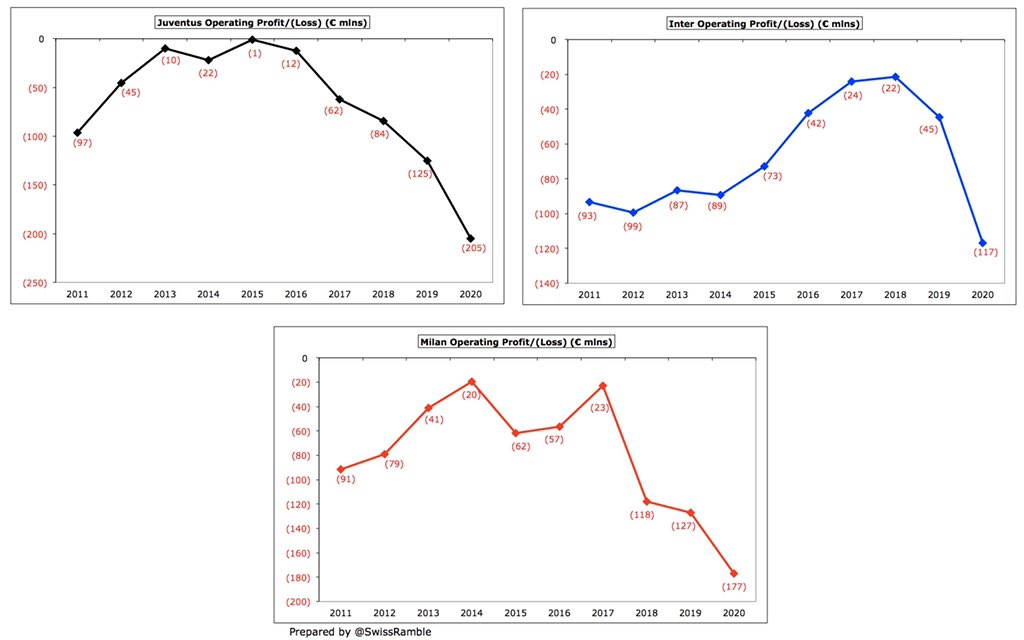

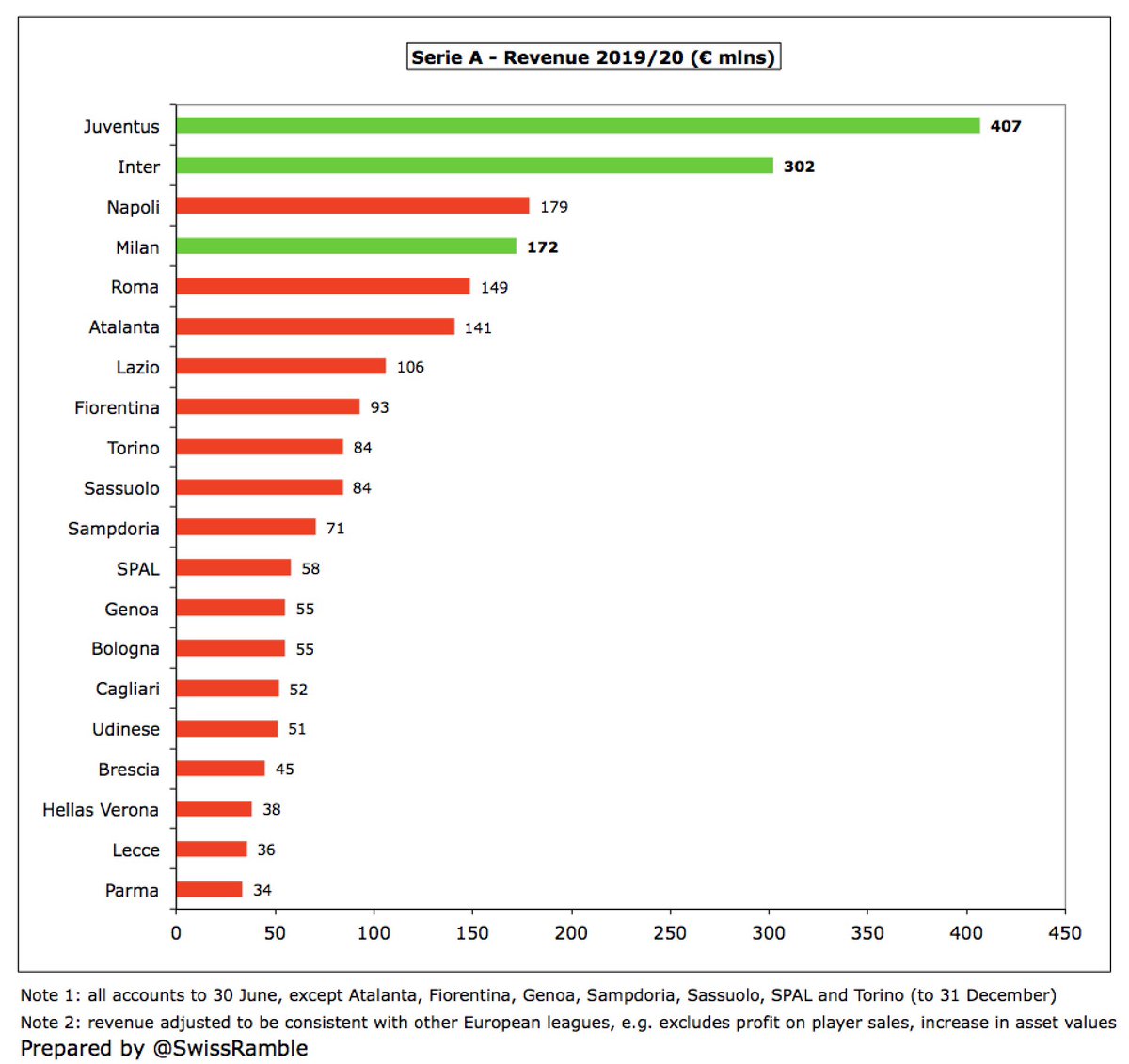

Of course, 2019/20 loss is driven by the impact of the COVID-19 pandemic, but some were already struggling before this struck, particularly the Italian clubs, who have reported hefty deficits, e.g. over the last 3 years #Milan £402m, #Inter £130m and #Juventus £104m.

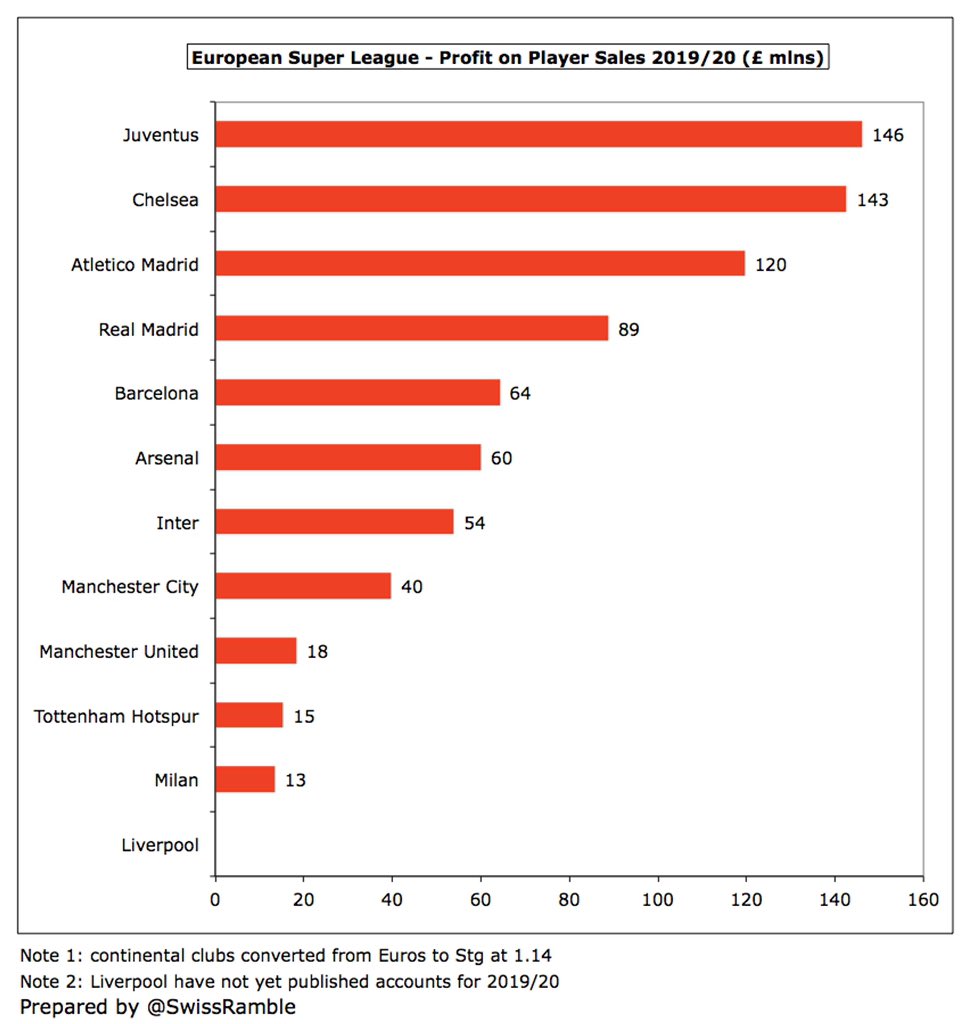

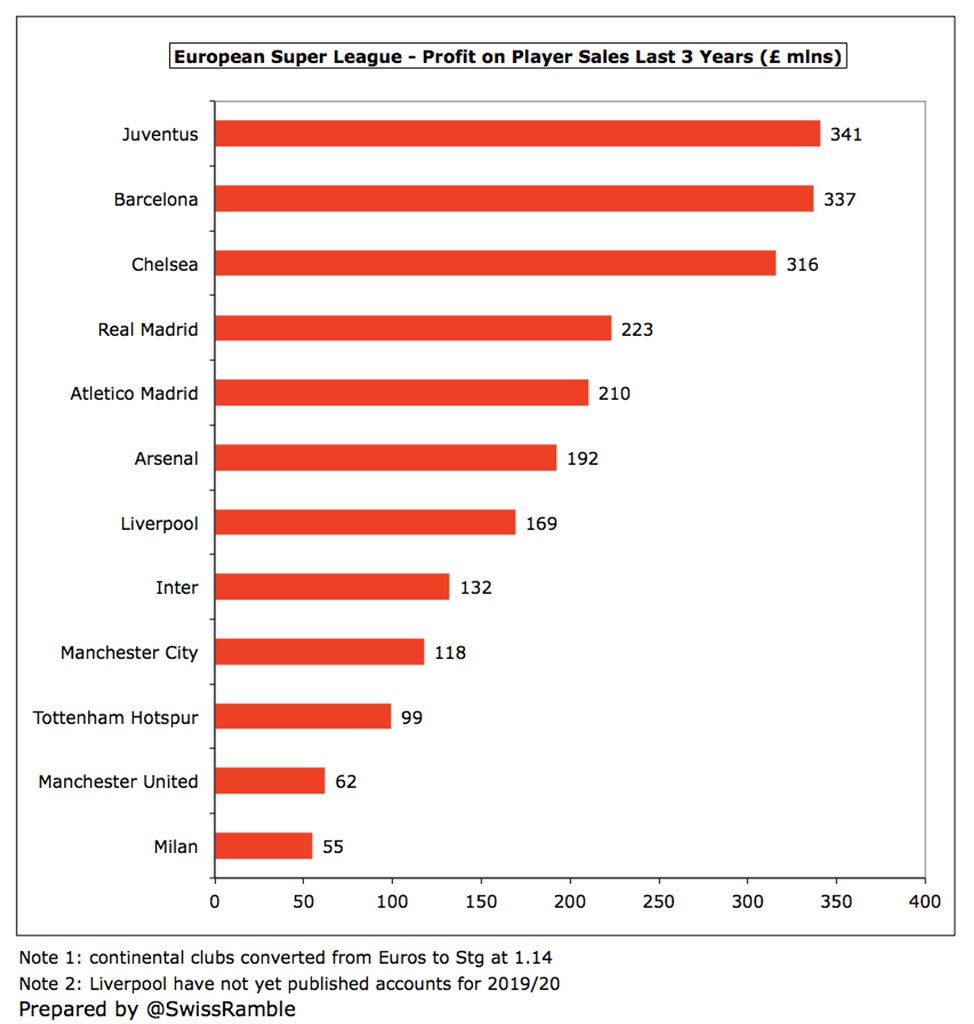

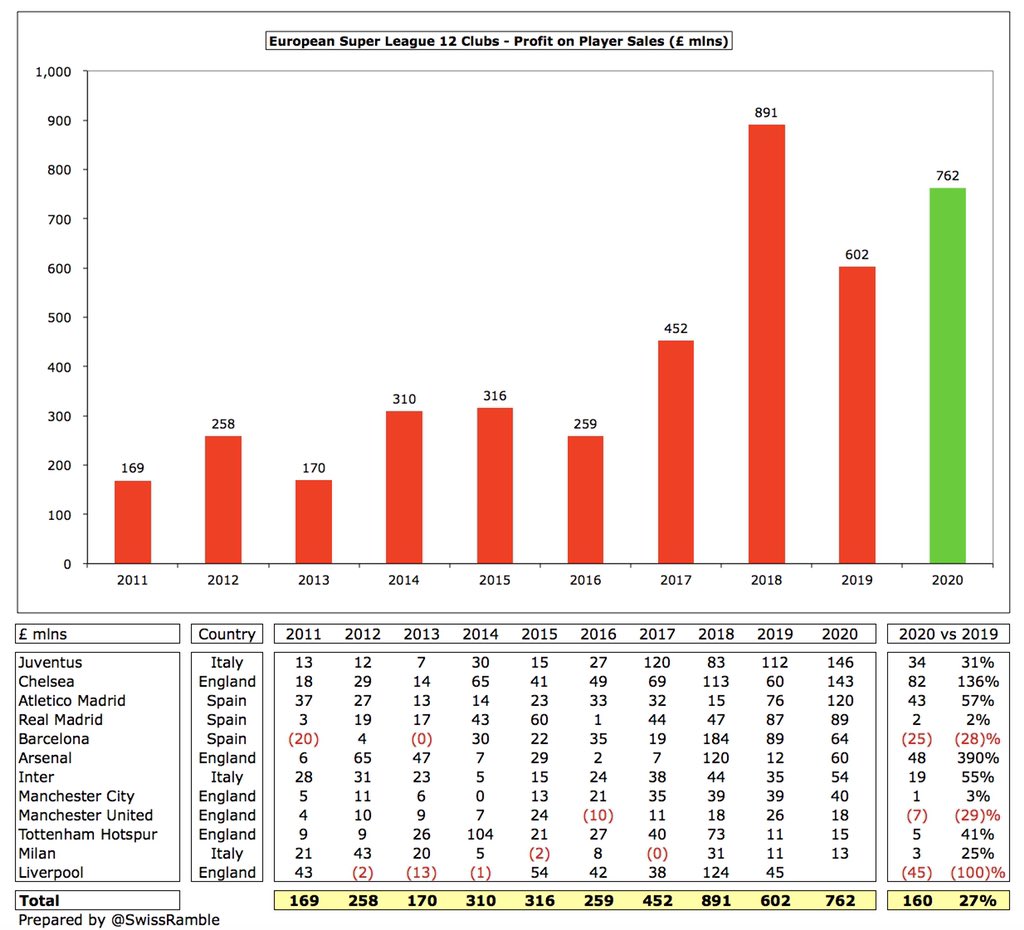

It is also worth noting that these losses would have been even higher without the significant impact of player sales. In last 3 years, 5 clubs have generated profits here above £200m: #Juventus £341m, #FCBarcelona £337m, #CFC £316m, #RealMadrid £223m and #Atleti £210m.

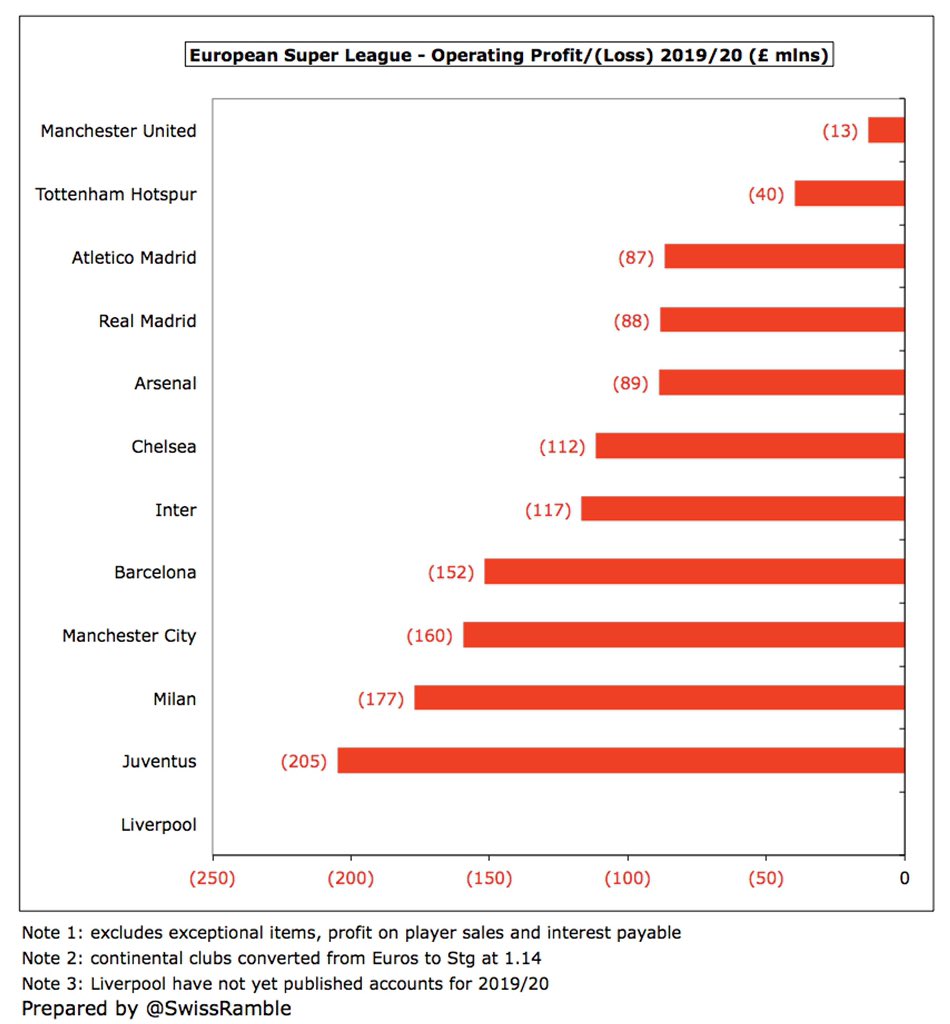

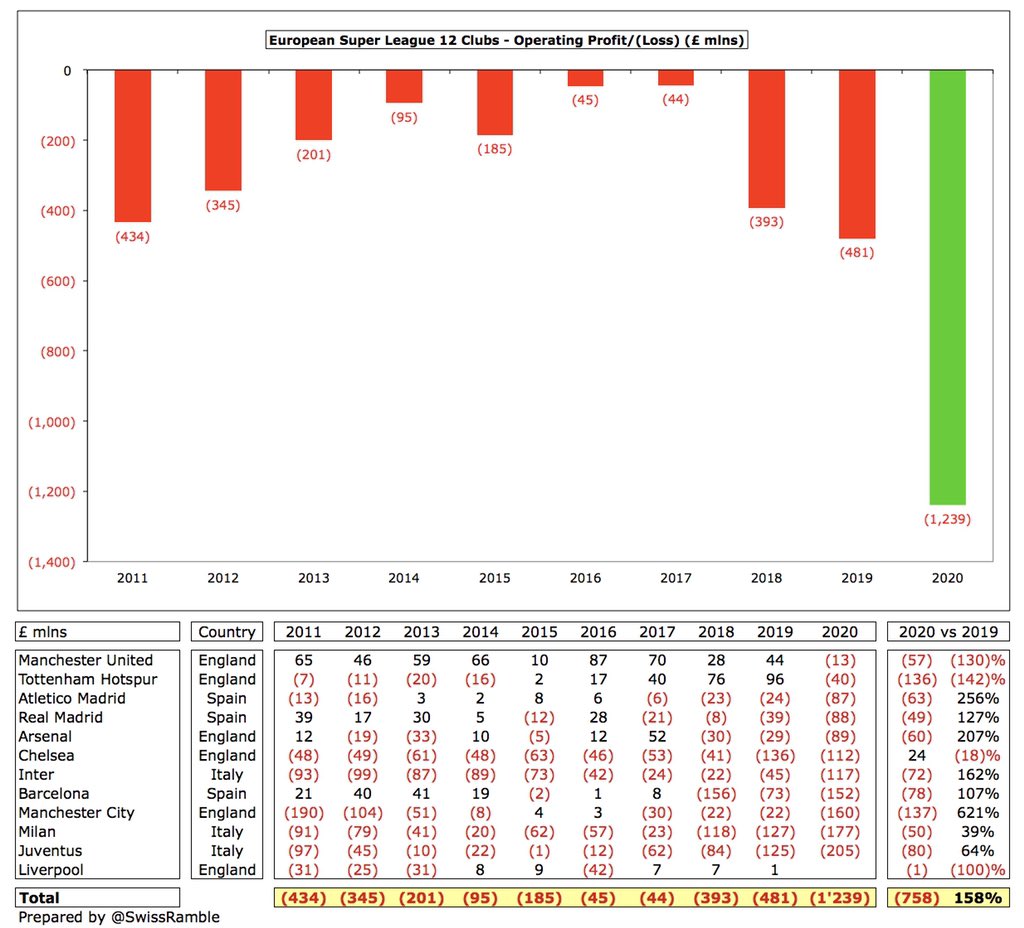

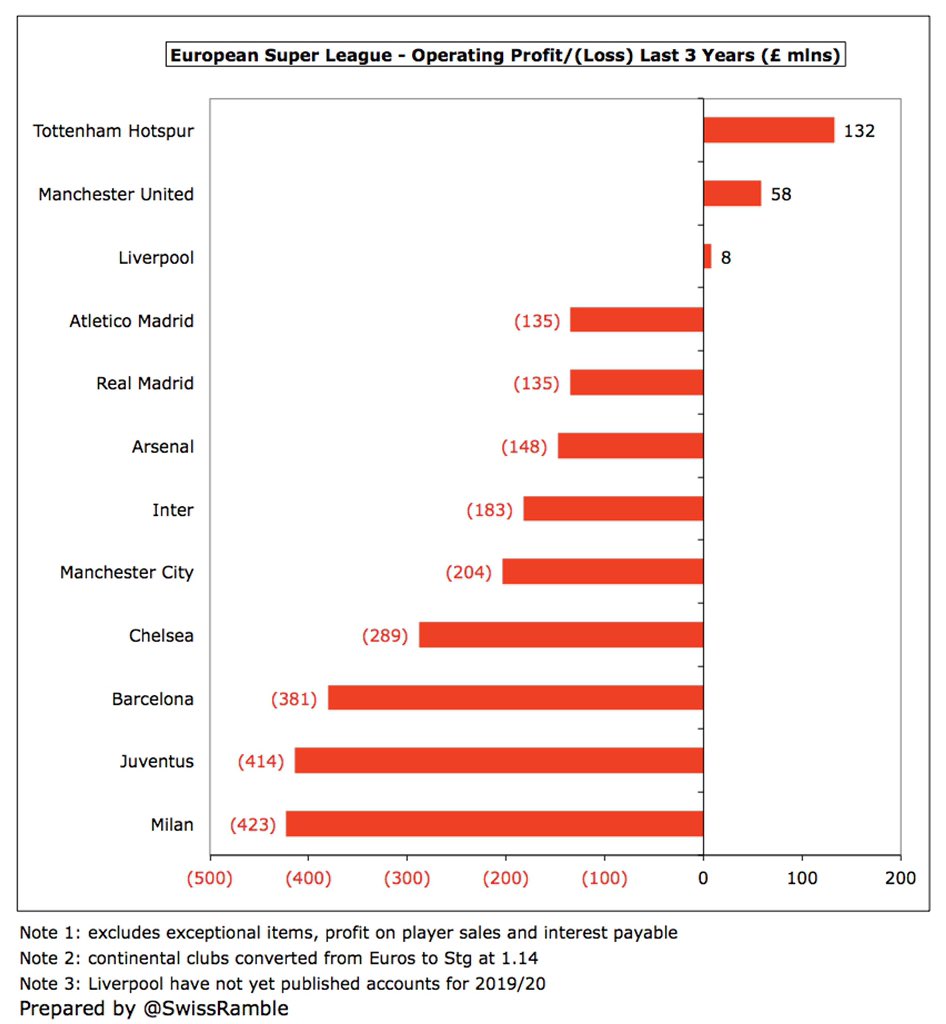

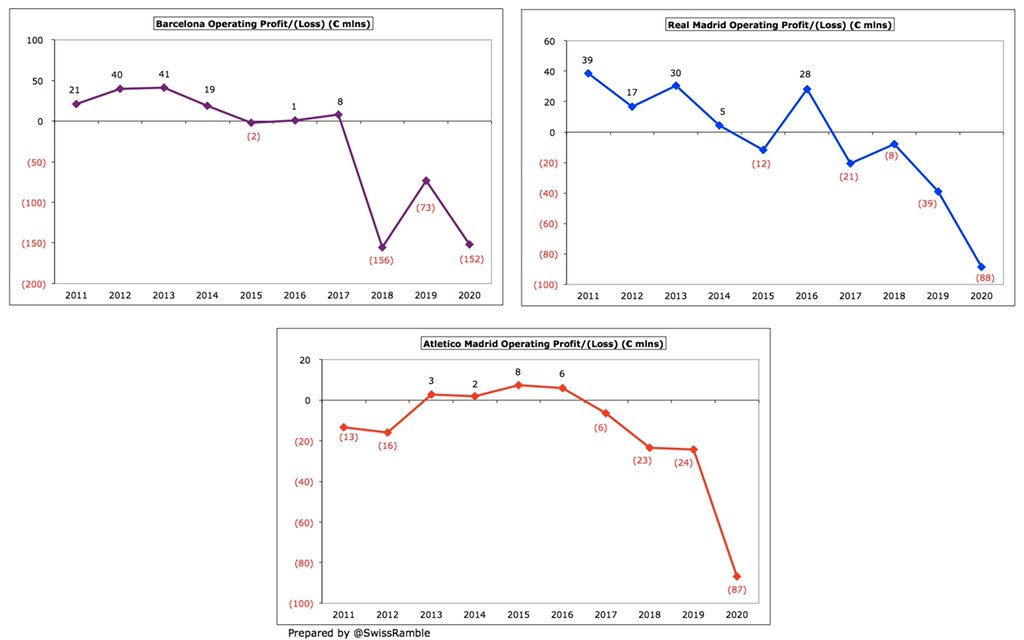

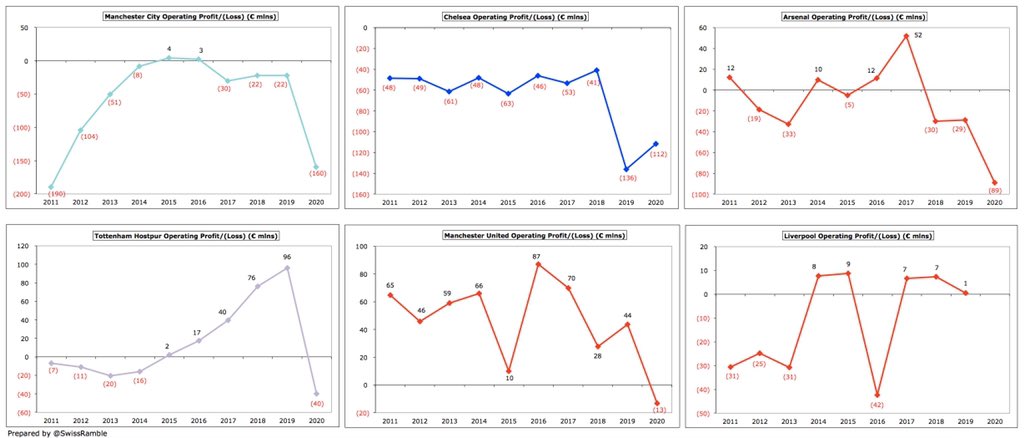

Excluding profits on player sales (and interest payable), operating losses are enormous, amounting to £1.2 bln in 2019/20 (excluding #LFC). Again, the pandemic has bitten here, but clubs have consistently lost money on their recurring business in the past few years.

This is most evident in Italy, where operating losses at #Milan and #Juventus in the past 3 years are more than £400m. It’s a similar story in Spain, especially #FCBarcelona £381m. In general, the English clubs look better, though #AFC decline is concerning.

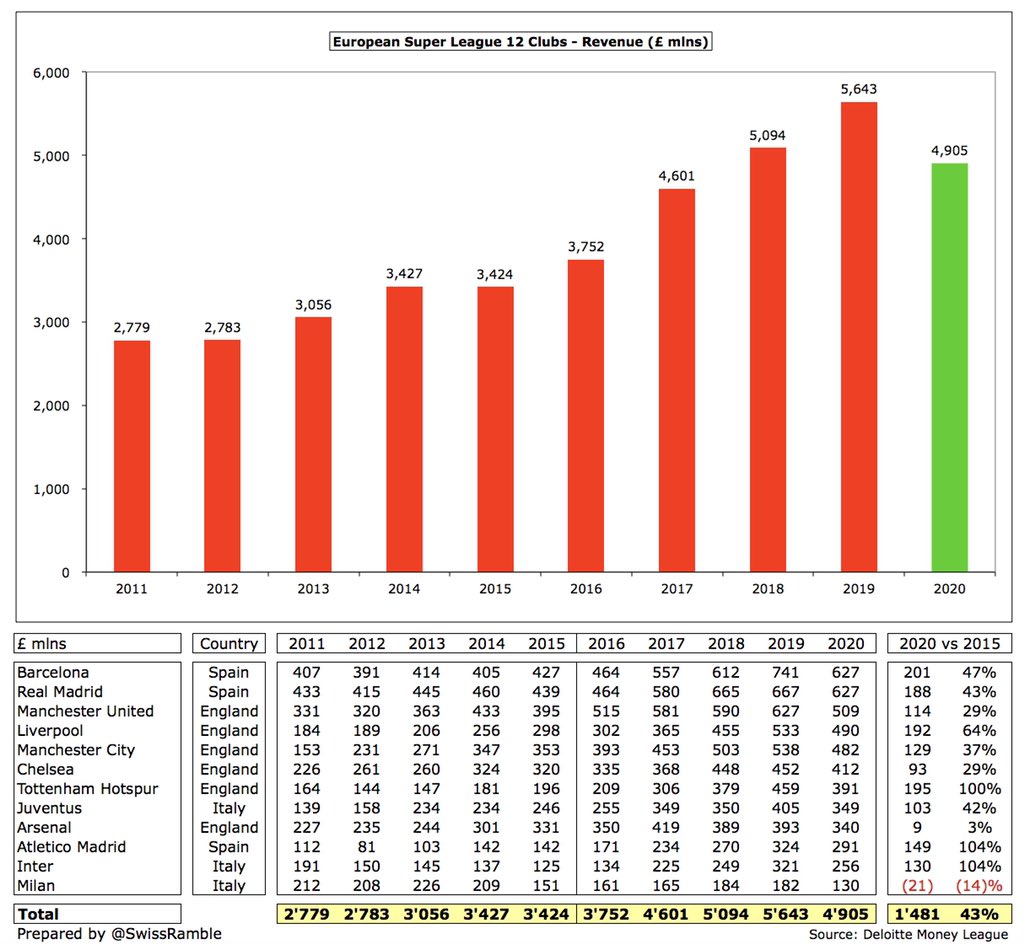

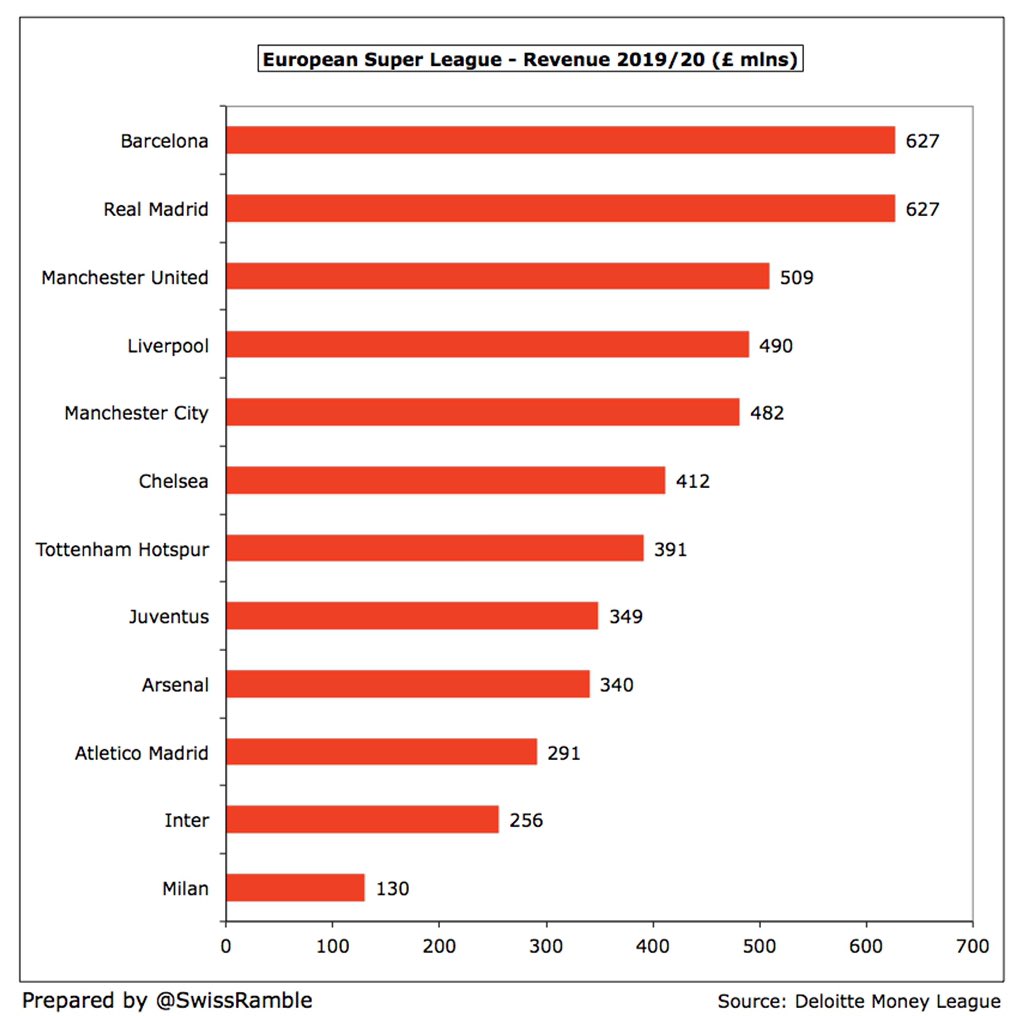

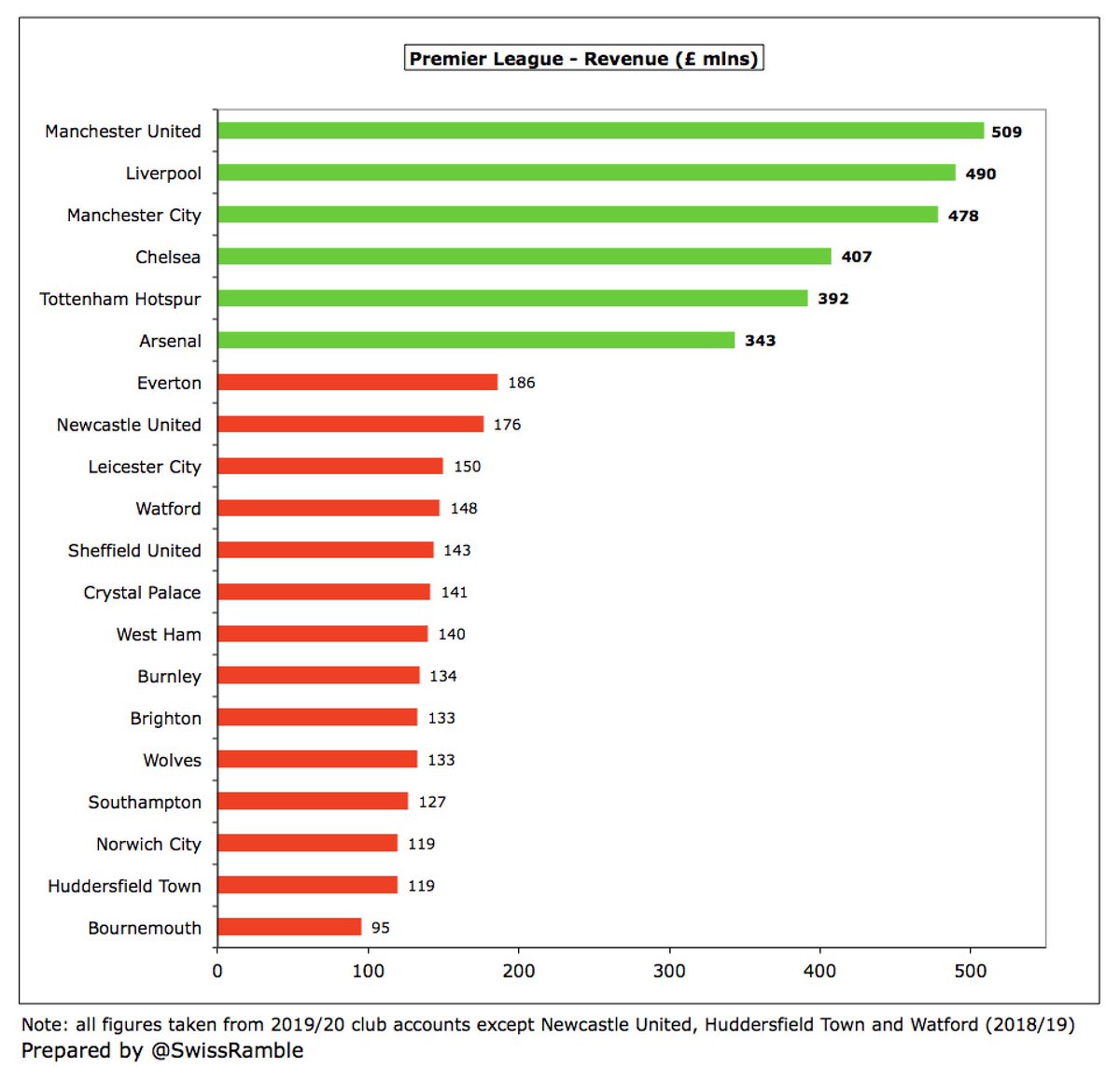

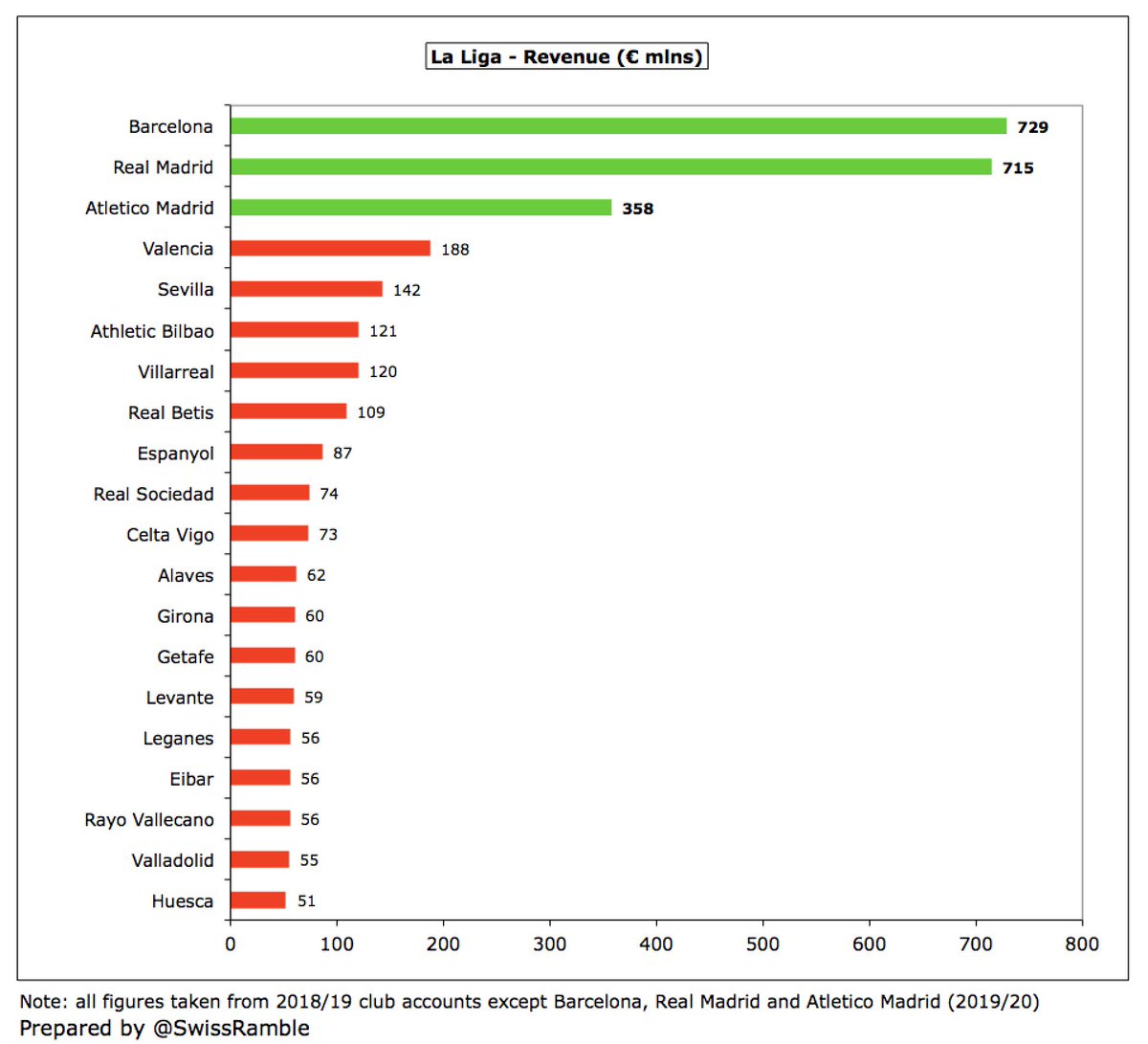

On the face of it, ESL clubs should be doing fine, as revenue has grown steadily, e.g. by £1.5 bln (43%) in 5 years from £3.4 bln to £4.9 bln. Revenue earned by elite clubs is seriously impressive: #FCBarcelona £627m, RealMadrid £627m, ##MUFC £509m, #LFC £490m and #MCFC £482m.

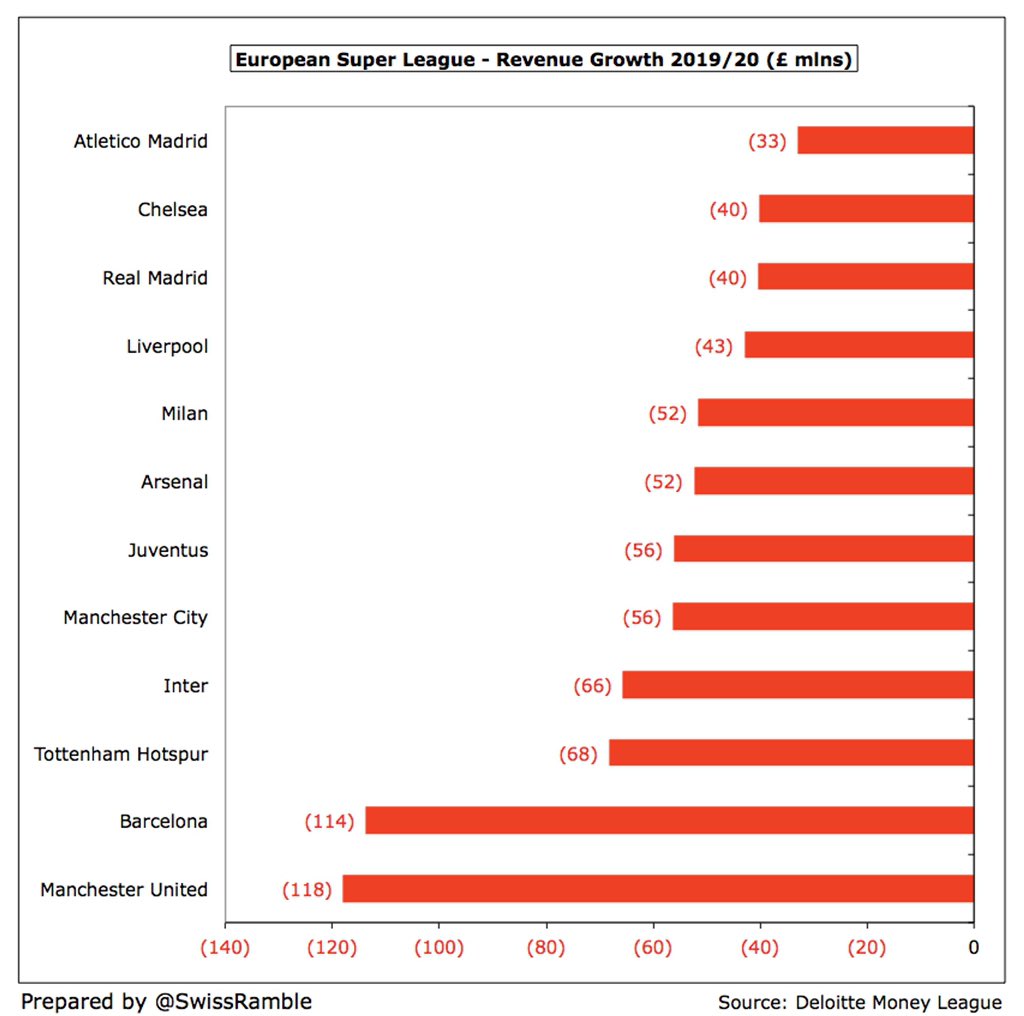

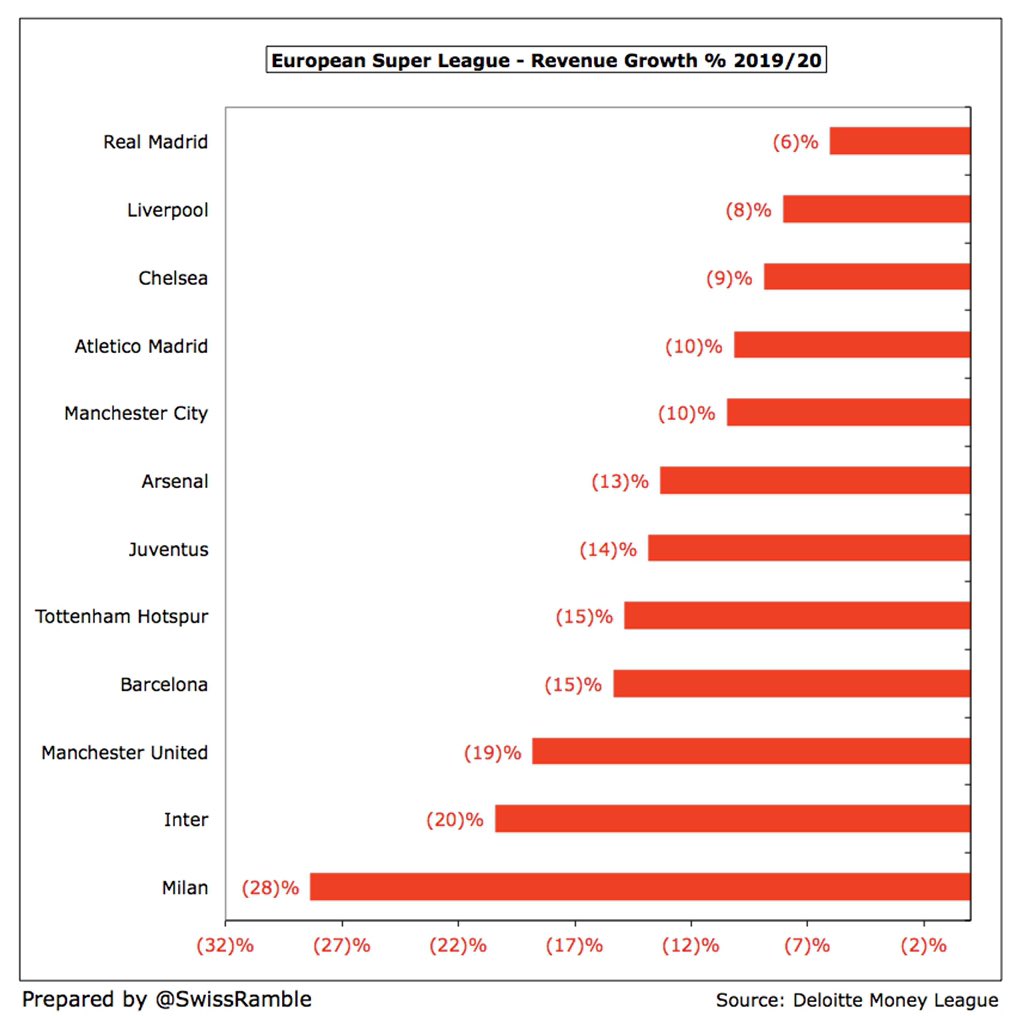

However, there has been a steep fall in revenue in 2019/20, due to the pandemic, with the 12 clubs seeing a £739m (13%) decrease, led by #MUFC £118m, #FCBarcelona £114m and #THFC £68m. The figures will look even worse in 2020/21 after a full season of games without fans.

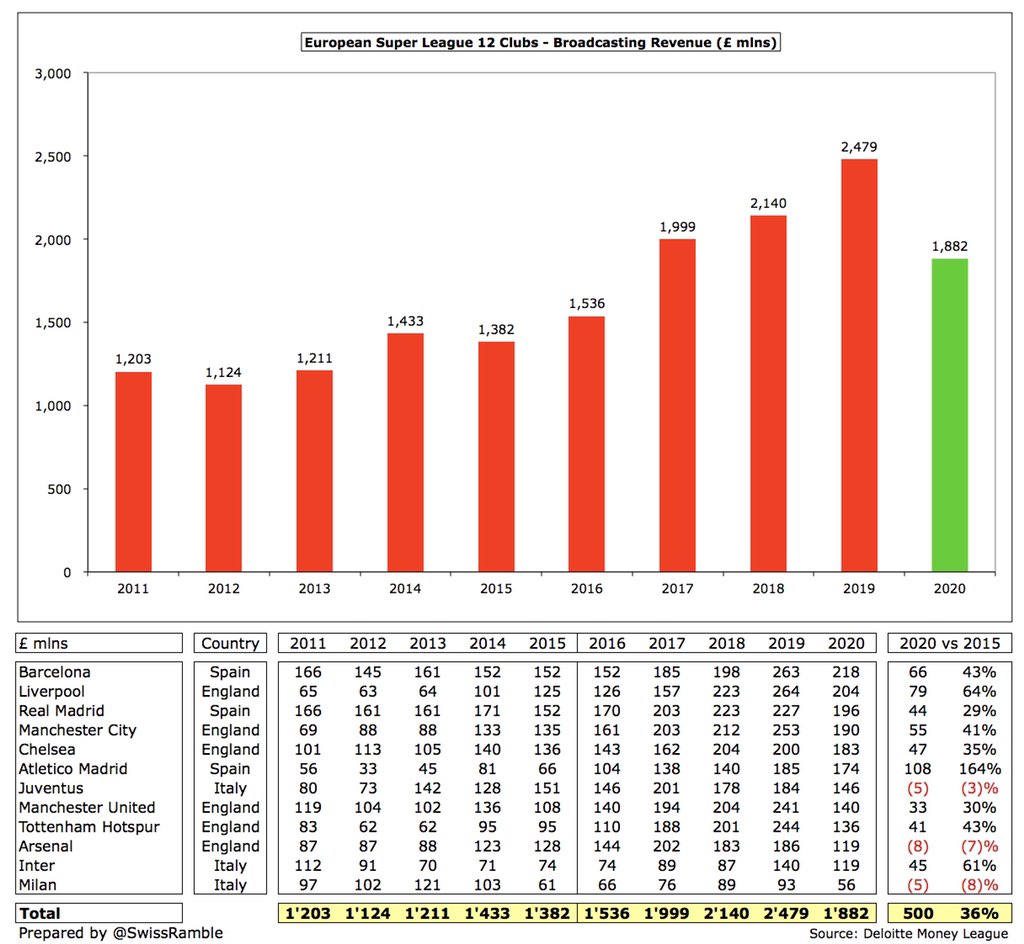

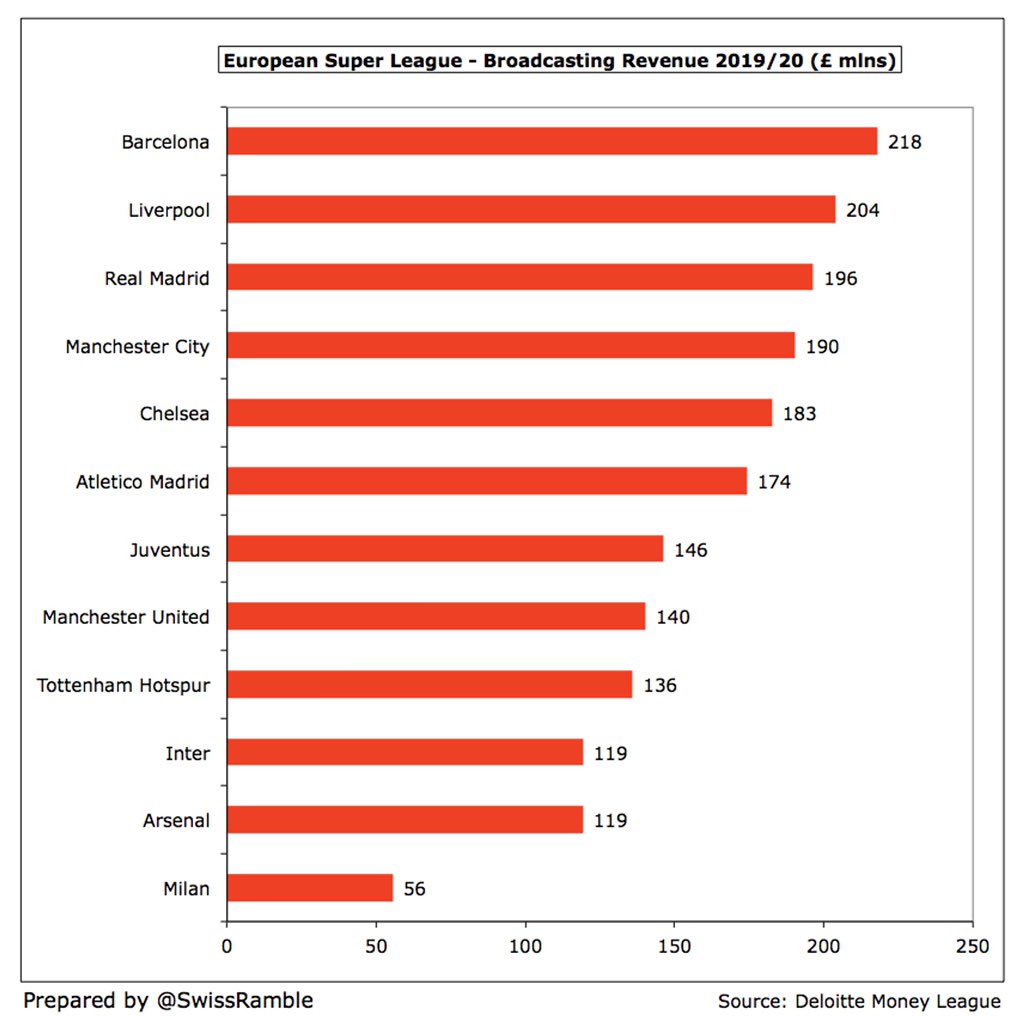

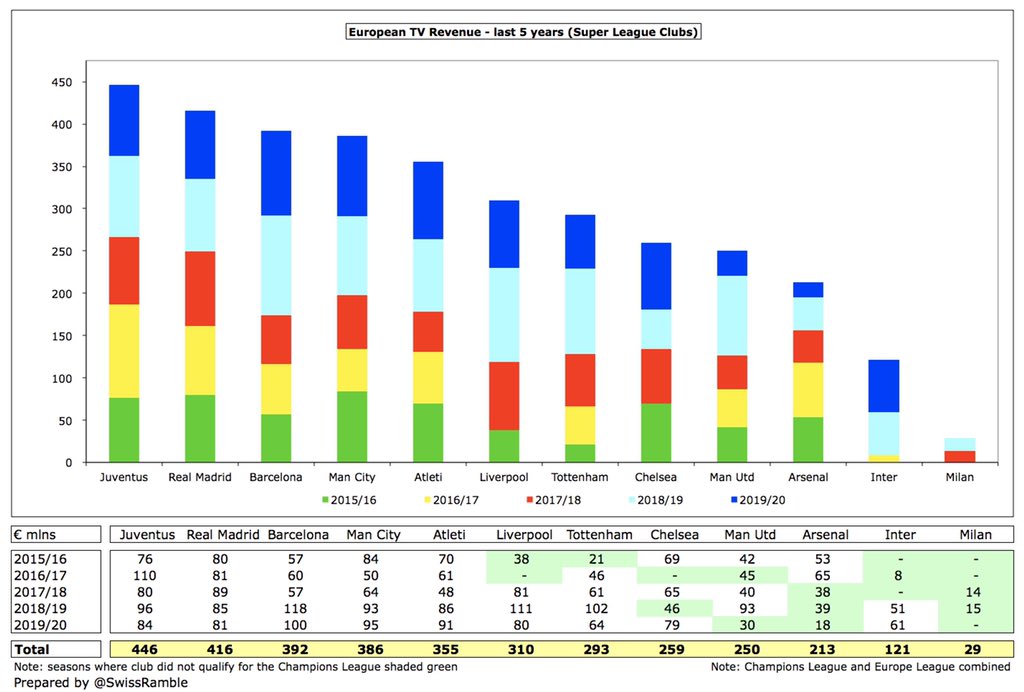

Broadcasting income has driven much of the revenue growth, rising £500m (36%) in last 5 years from £1.4 bln to £1.9 bln, #FCBarcelona £218m earned most, followed by #LFC £204m, #RealMadrid £196m & #MCFC £190m. Importance of European qualification is clear, e.g. #Milan only £56m.

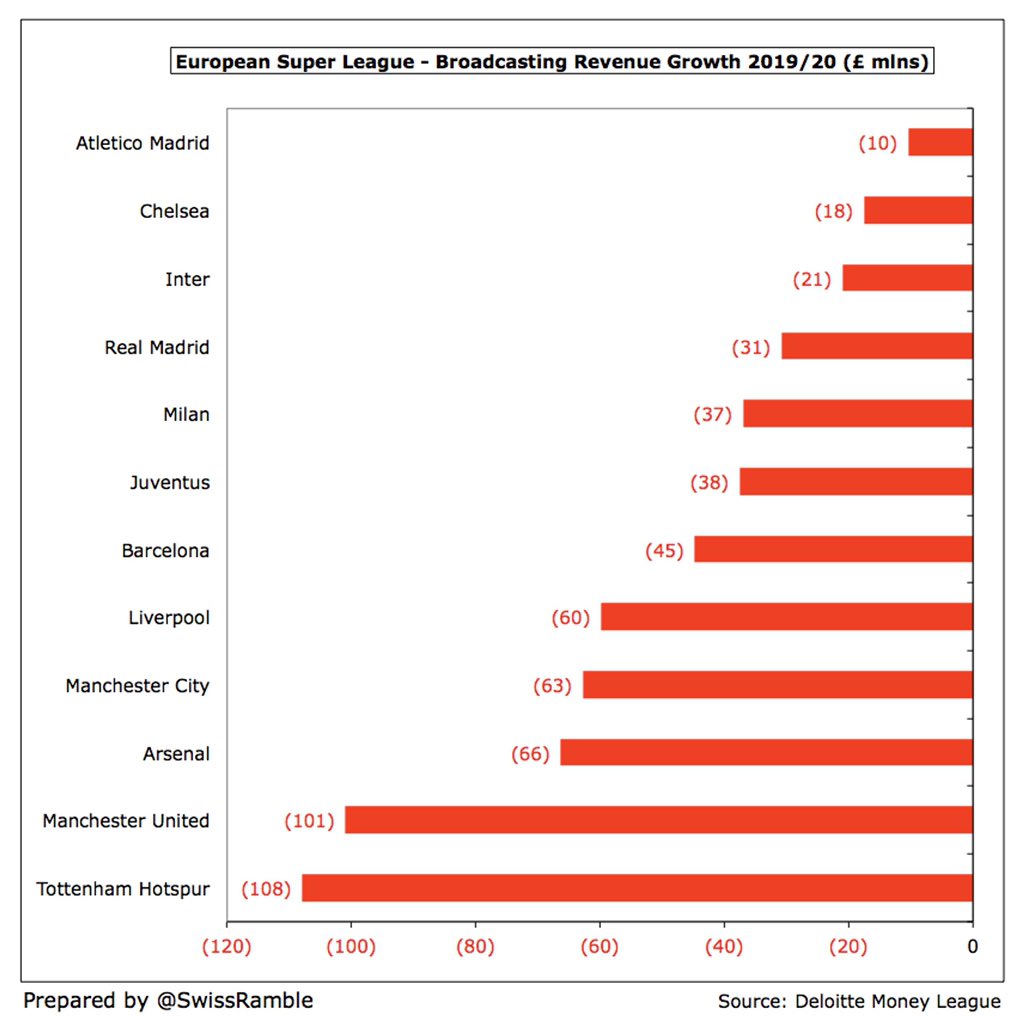

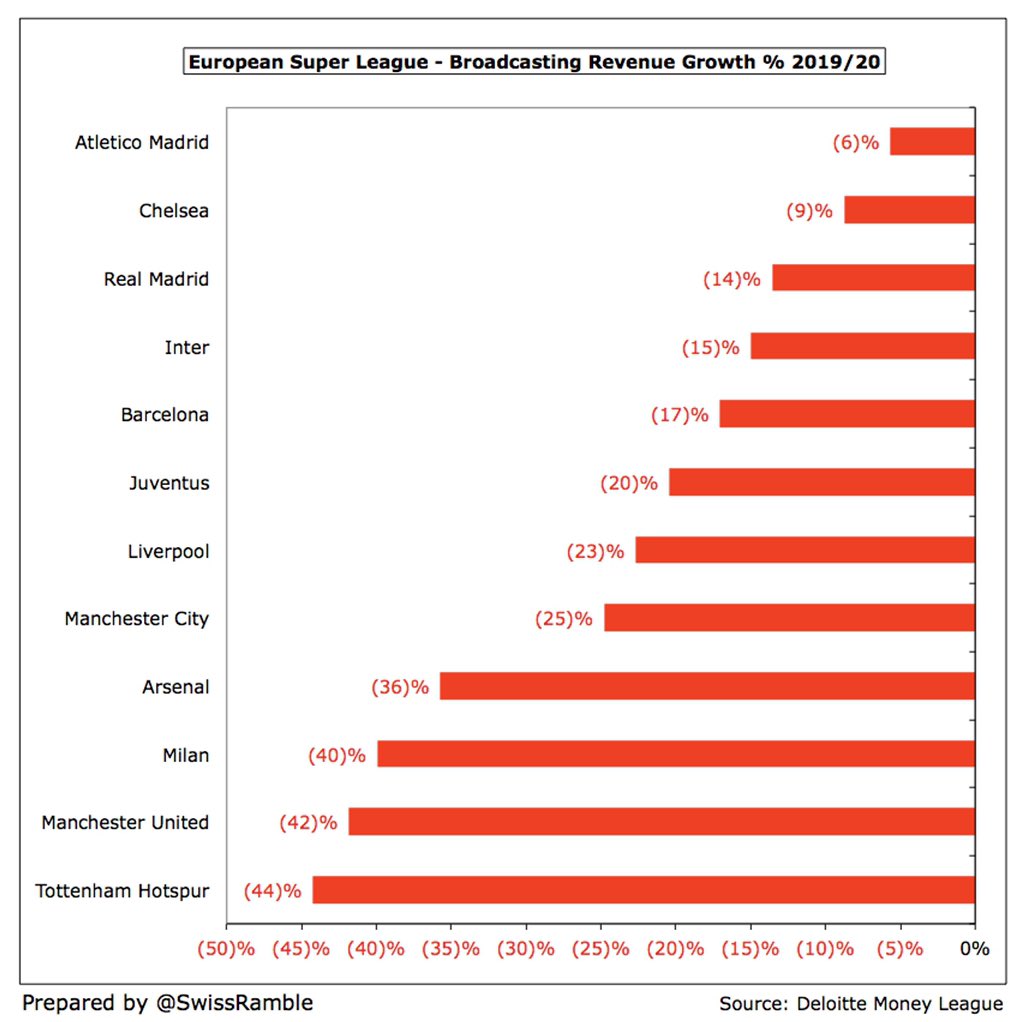

However, TV income was severely impacted in 2019/20, due to a combination of rebates to broadcasters and revenue deferrals to 2020/21 (as season was extended beyond accounting close), leading to £597m (24%) decrease. The English clubs were particularly hard hit.

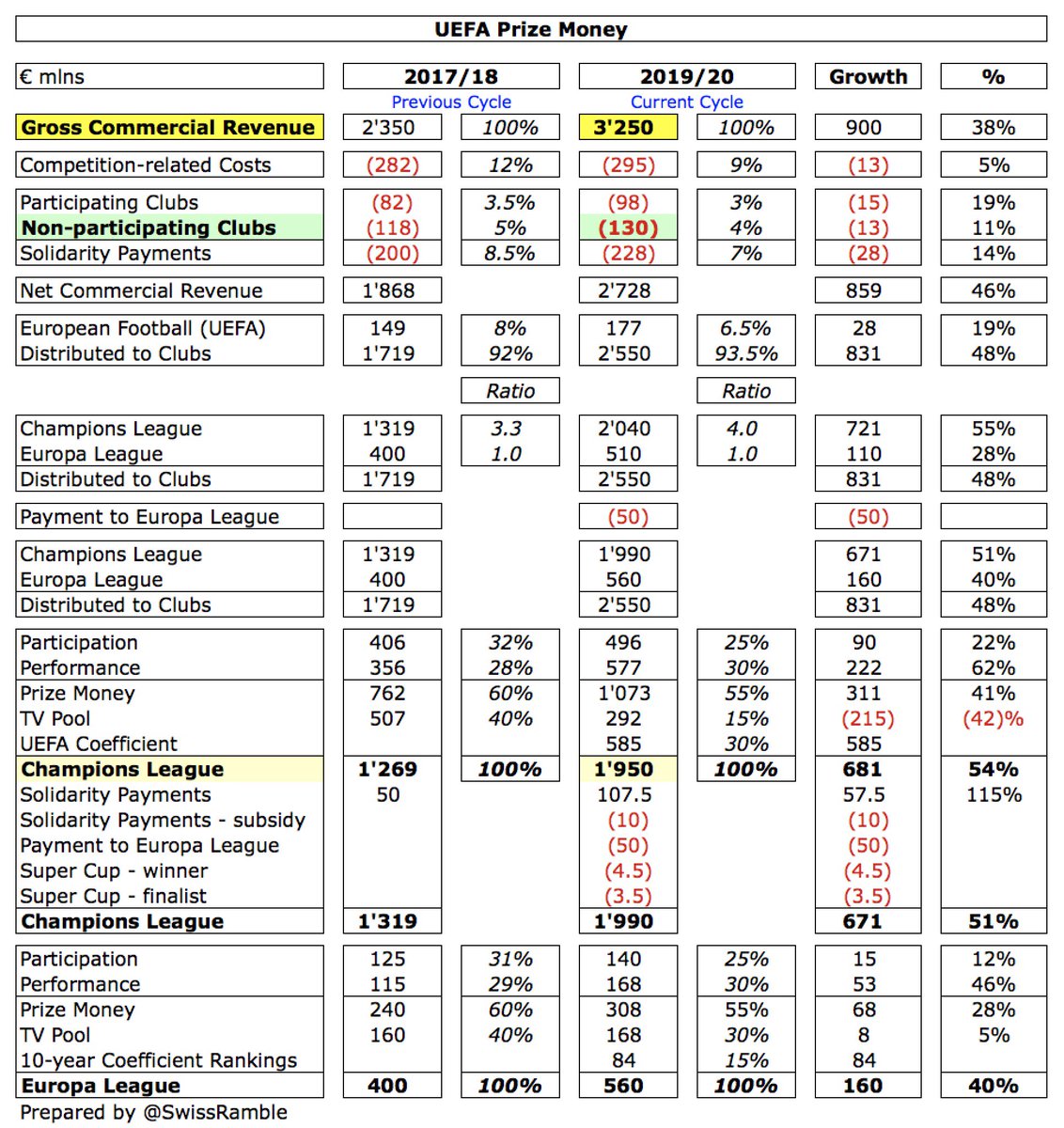

Europe is extremely important to the ESL clubs, especially in Spain and Italy. Highest earnings in last 5 years are #Juventus €446m, #RealMadrid €416m, #FCBarcelona €392m, #MCFC €386m & #Atleti €355m. However, when clubs don’t qualify for Champions league, it really hurts.

This is at the heart of the ESL proposal with its guaranteed places for the 15 “Founder Clubs”. General secretary, Anas Laghari, said there was “real frustration” among owners over the unpredictability of the current “unstable system”, preferring the certainty of a US model.

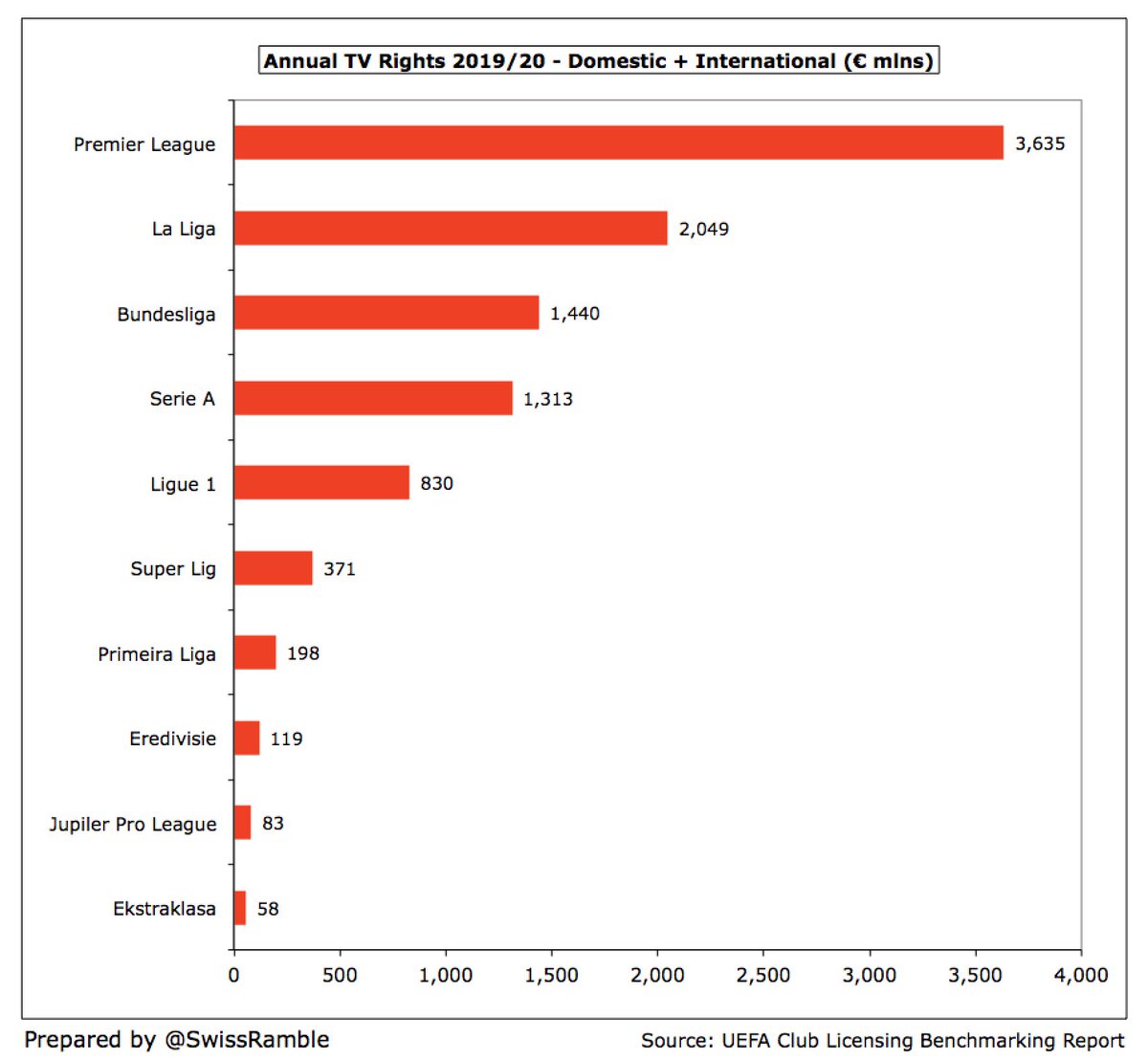

Domestically, the Premier League TV rights deal dwarfs other leagues, worth €3.6 bln a year, well ahead of La Liga €2.0 bln, Bundesliga €1.4 bln, Serie A €1.3 bln & Ligue 1 €0.8 bln. This helps explain why non-English clubs have been more enthusiastic about the Super League.

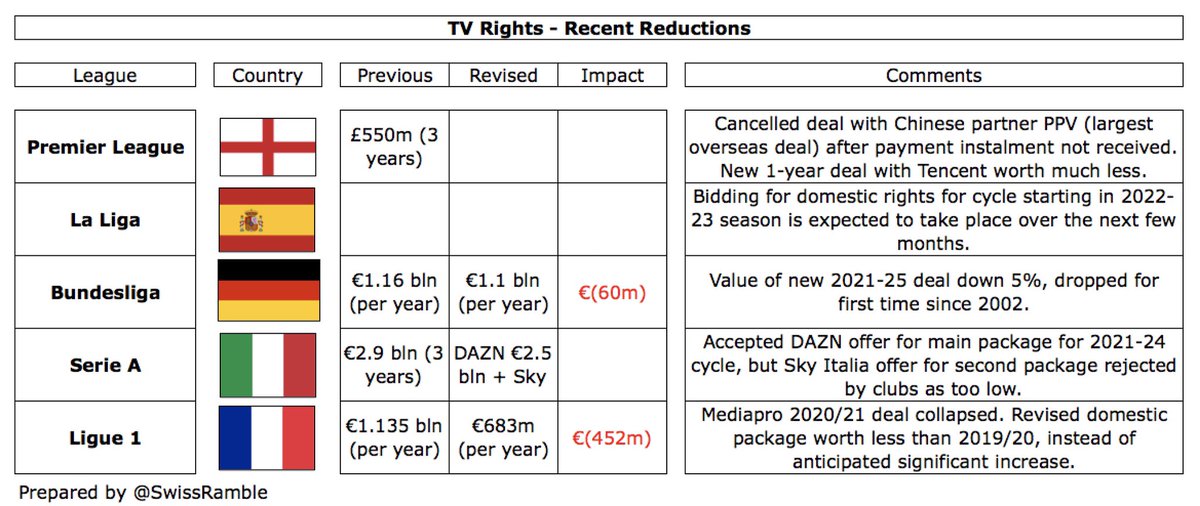

However, TV rights appear to be stagnating. The Premier League had to cancel its lucrative Chinese deal after non-payment, while the huge new Mediapro deal in France collapsed. The new Bundesliga deal is 5% lower than the old one, while Serie A rejected Sky offer as too low.

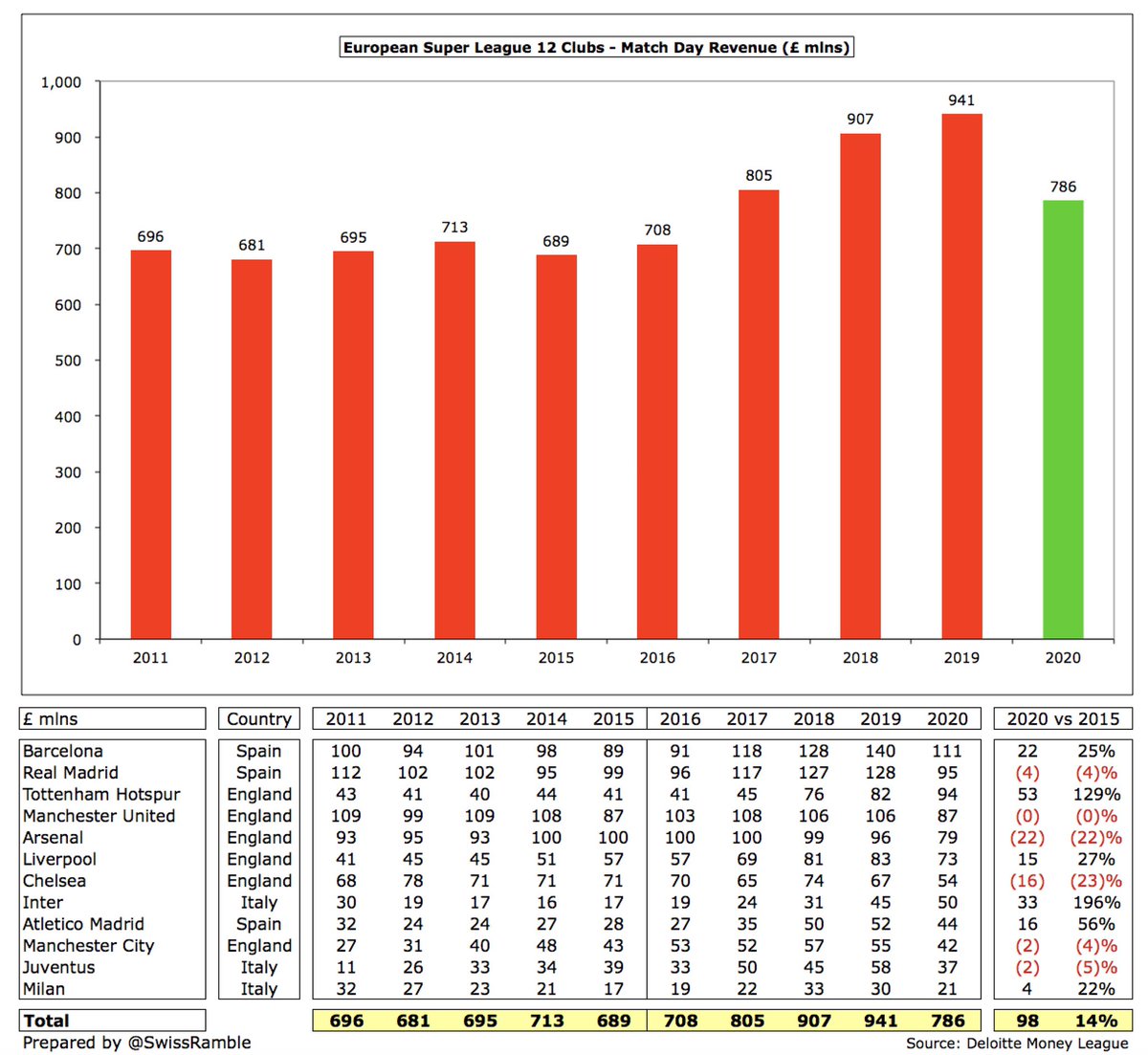

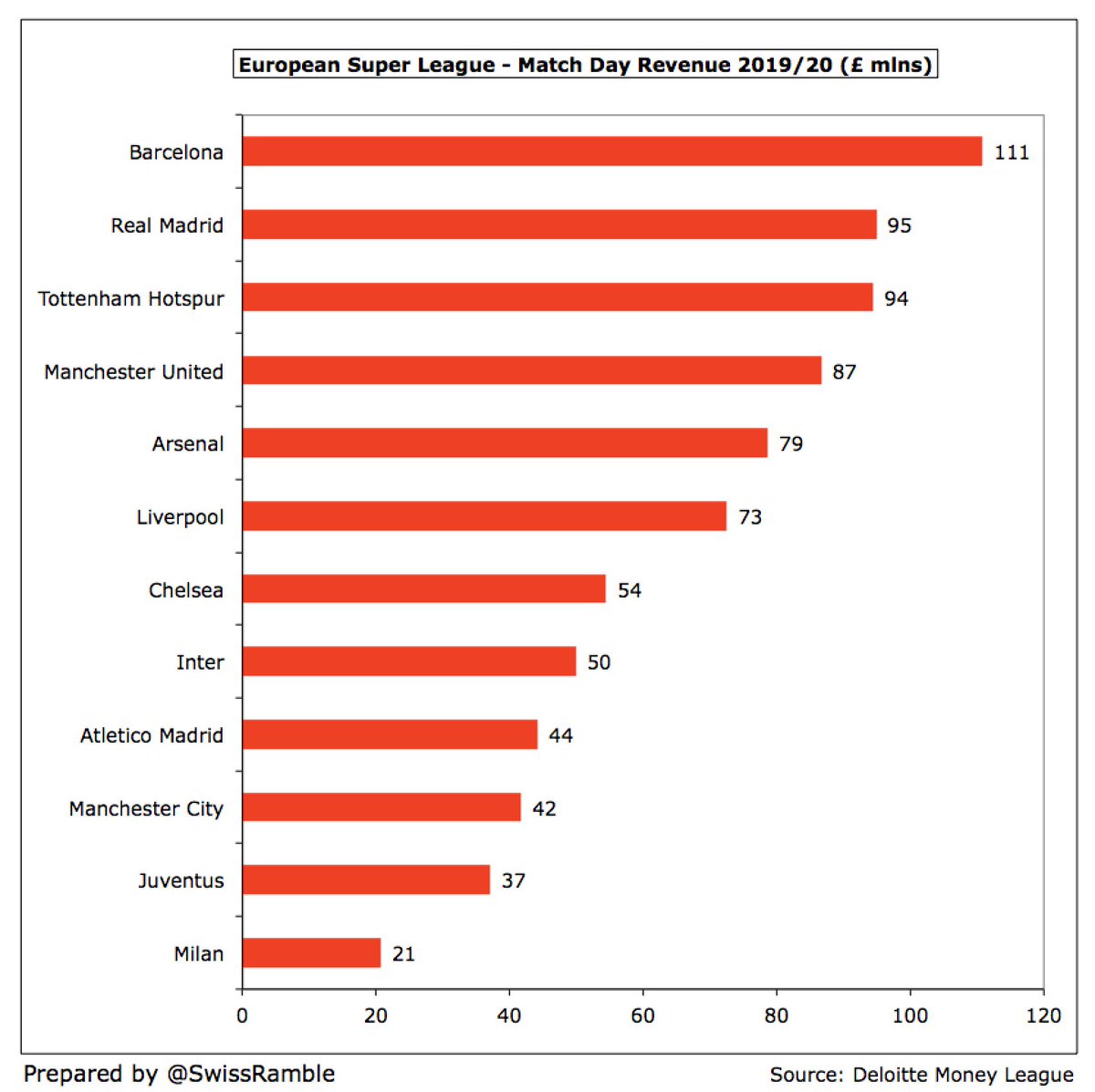

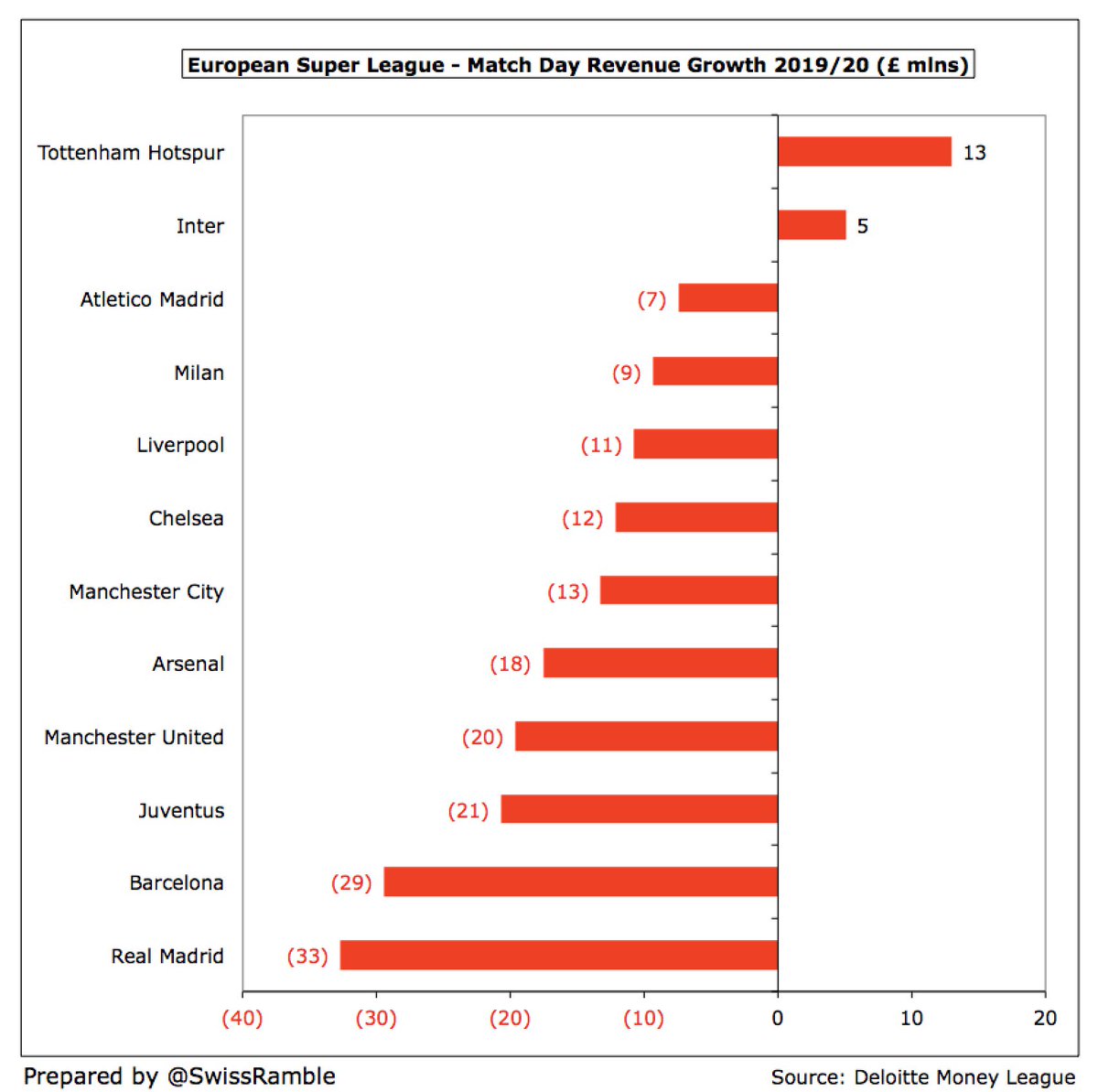

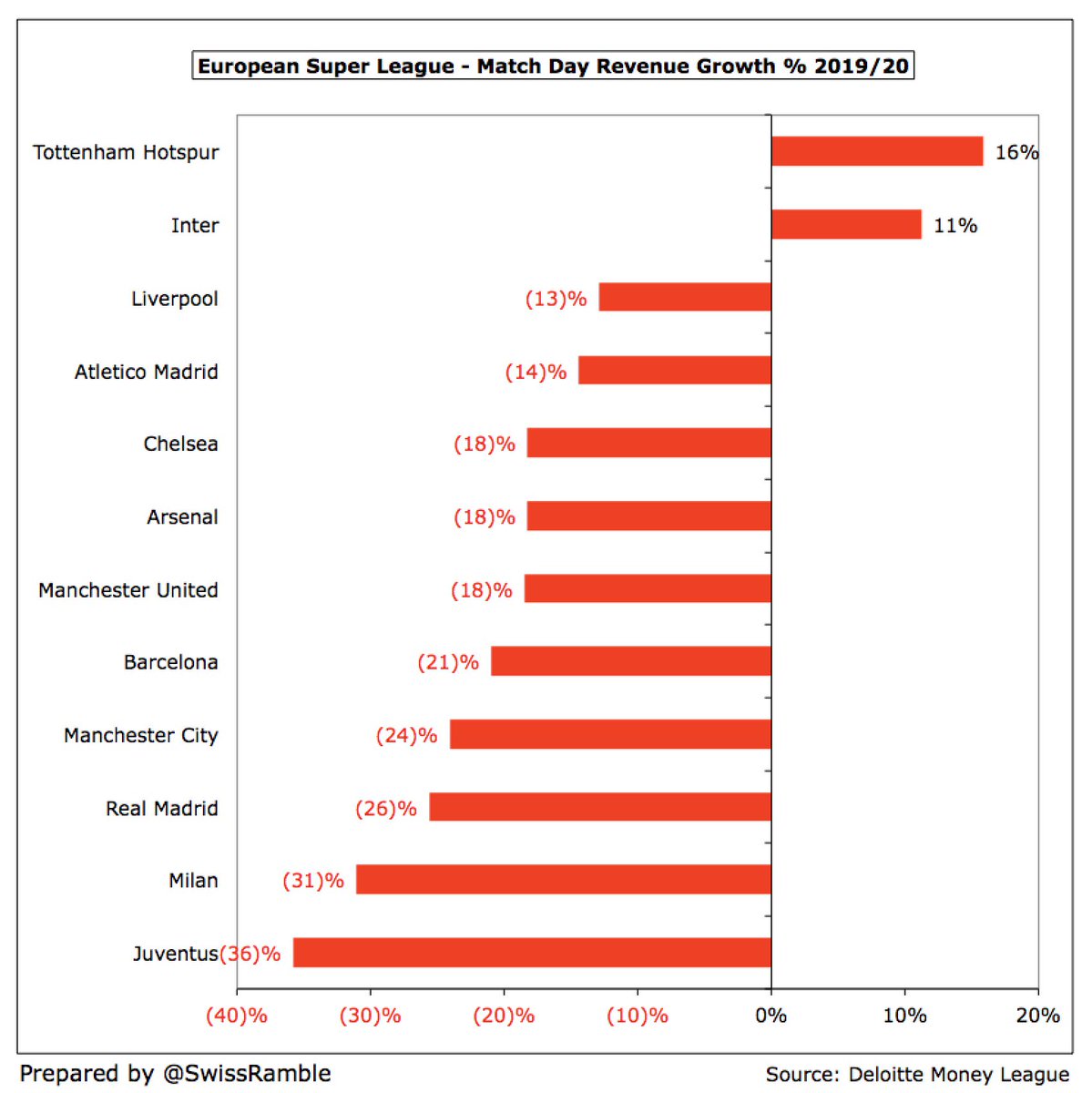

Match day is least important revenue stream, having grown only £98m (14%) in last 5 years, but still worth £786m a year to the 12 clubs, led by #FCBarcelona £111m, #RealMadrid £95m and #THFC £94m. Put another way, this revenue will be lost in 2020/21 (games behind closed doors).

In 2019/20 match day income was already down £155m (16%), as games were played without fans for the last 3 months of the season. The clubs that were most impacted financially were #RealMadrid £33m, #FCBarcelona £29m and #Juventus £21m.

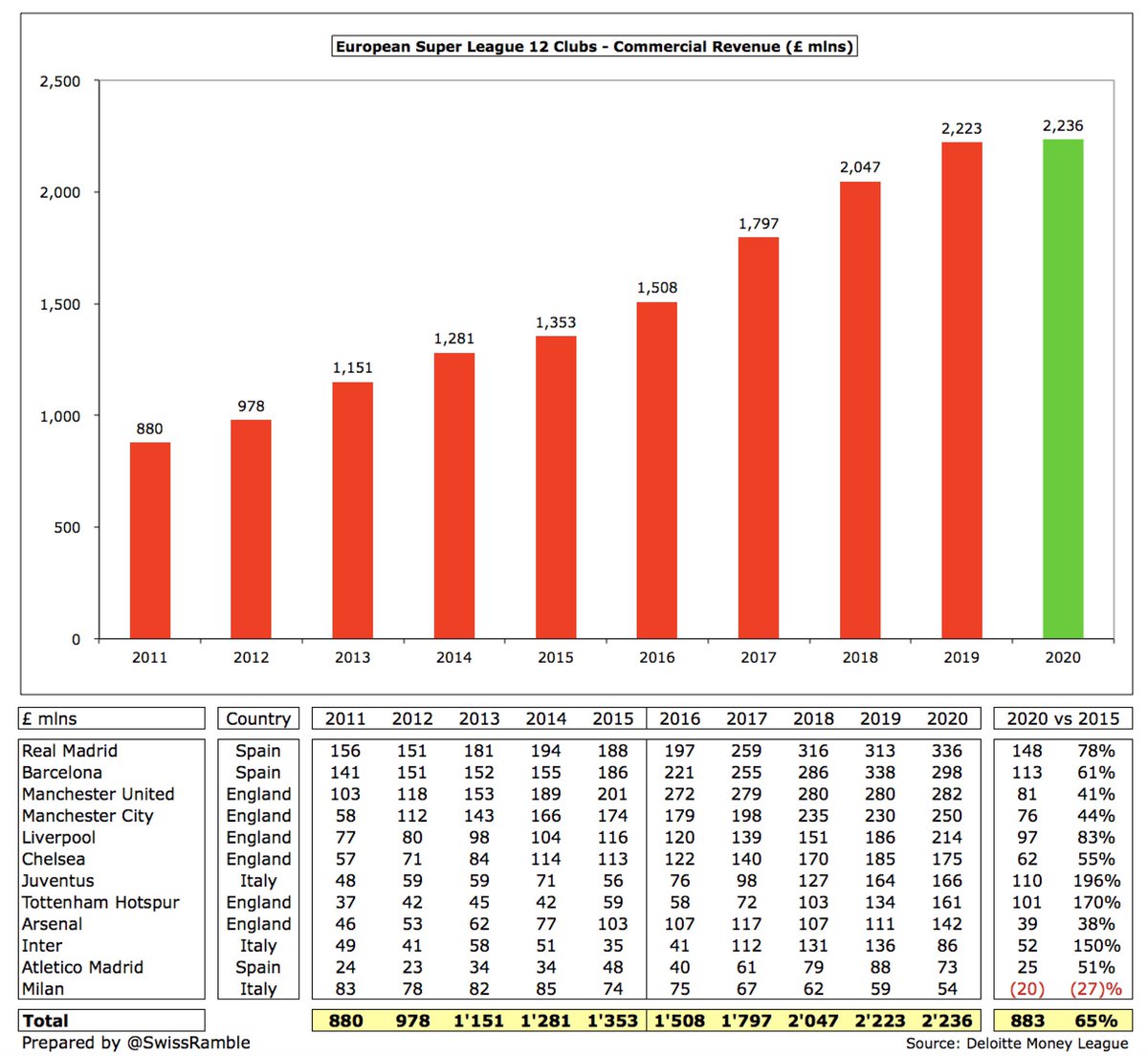

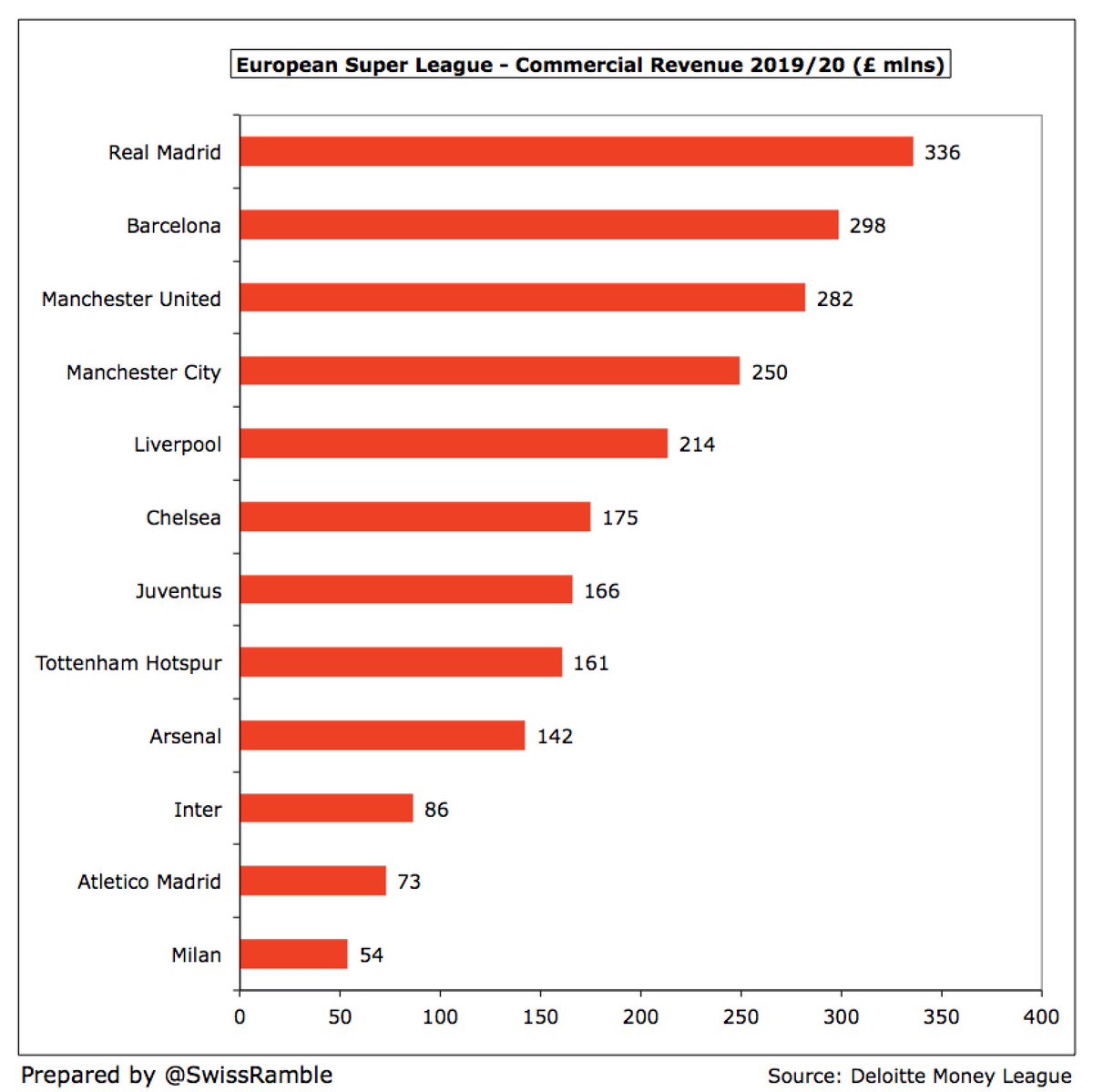

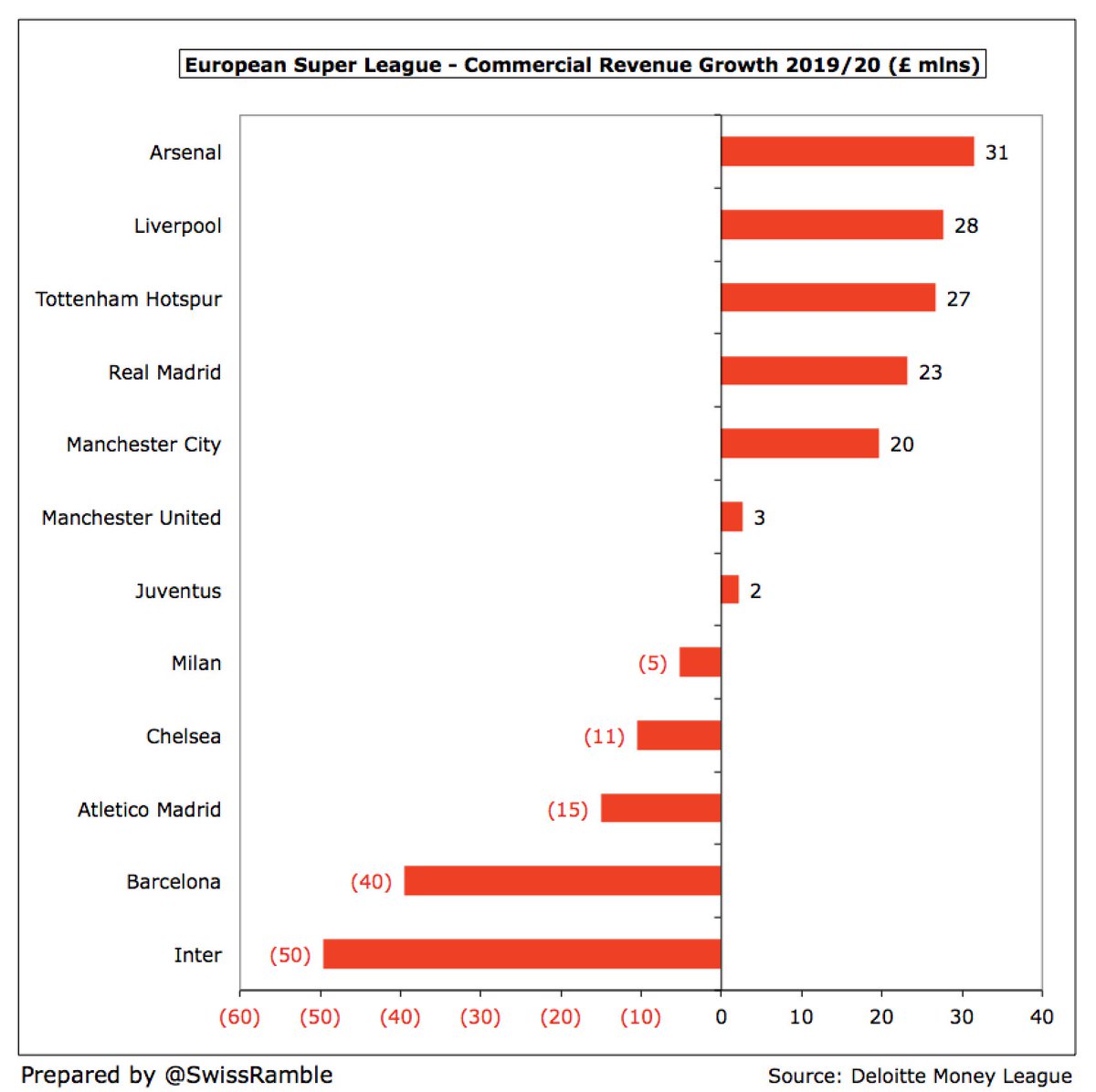

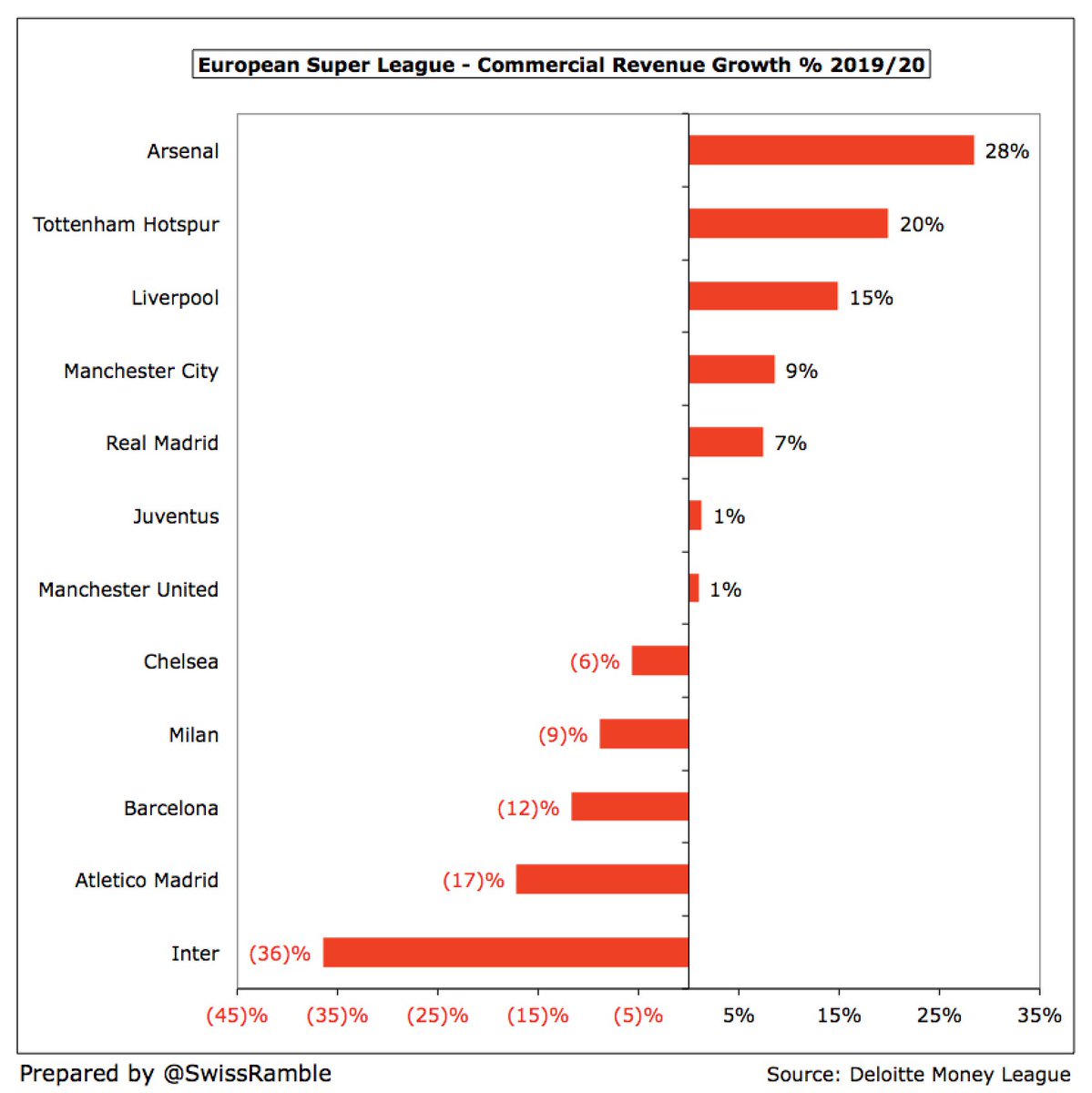

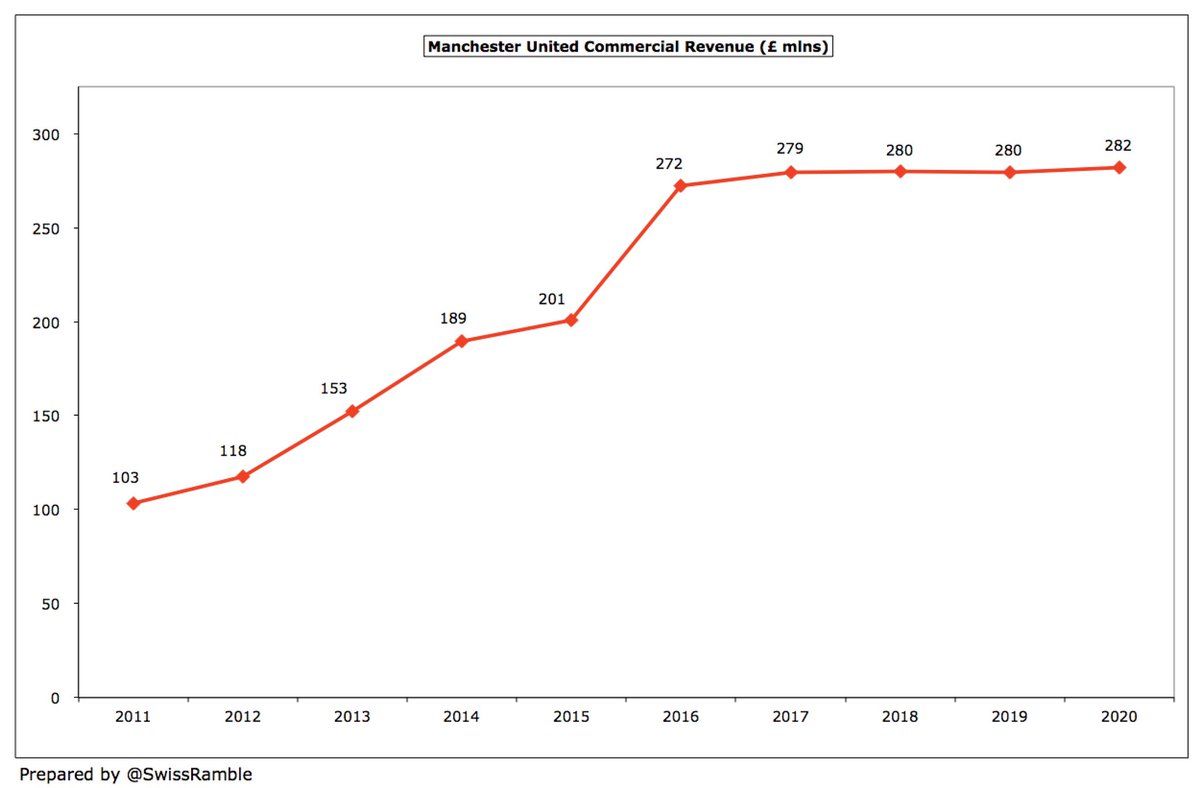

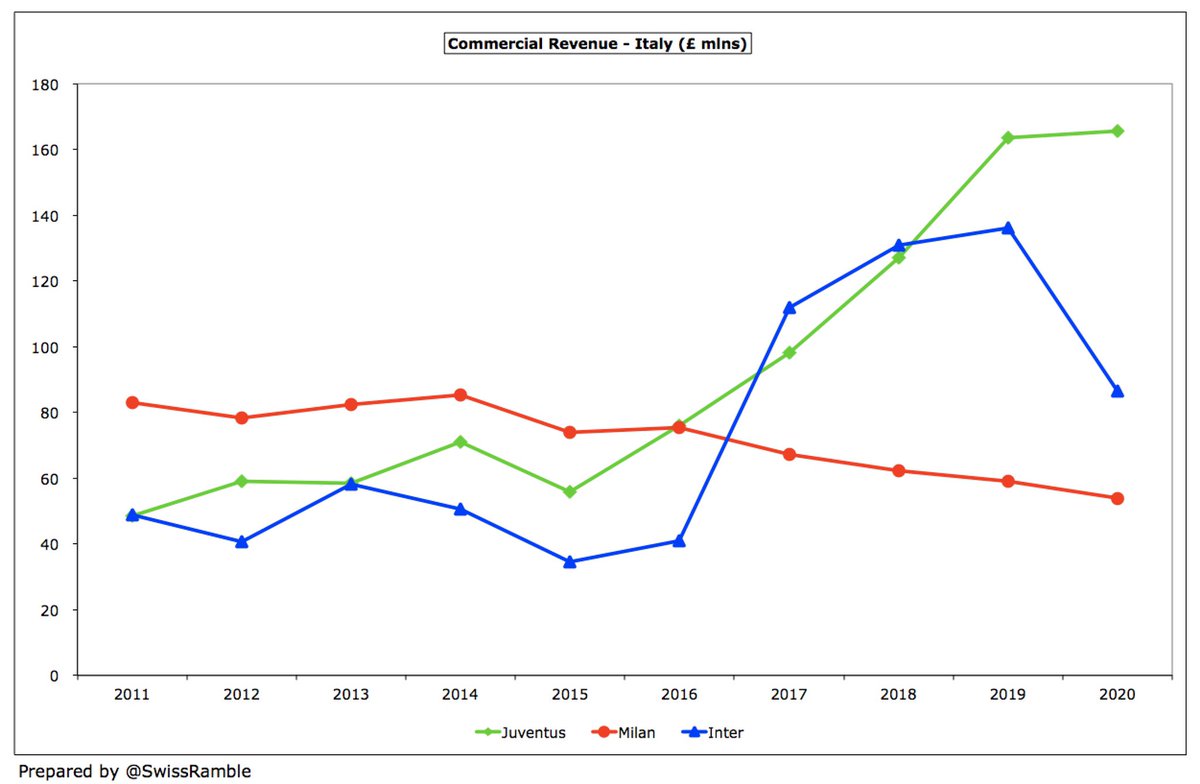

Commercial income has also driven growth, rising £0.9 bln (65%) from £1.3 bln to £2.2 bln. In fact, four of the Super League clubs earn more than a quarter of a billion from this revenue stream: #RealMadrid £336m, #FCBarcelona £298m, #MUFC £282m and #MCFC £250m.

In fact, commercial income held up pretty well in the pandemic with many clubs actually increasing revenue in 2019/20, especially in England #AFC £31m, #LFC £28m and #THFC £27m, mainly due to new sponsorship deals, though new stadium also helped Spurs.

However, this disguises some worrying points about commercial income for some clubs. Zero growth at #MUFC in last 4 years (and TeamViewer deal much less than Chevrolet). #Inter down a third (£50m) in 2019/20 (termination of Chinese sponsorships), and #Milan has steadily declined.

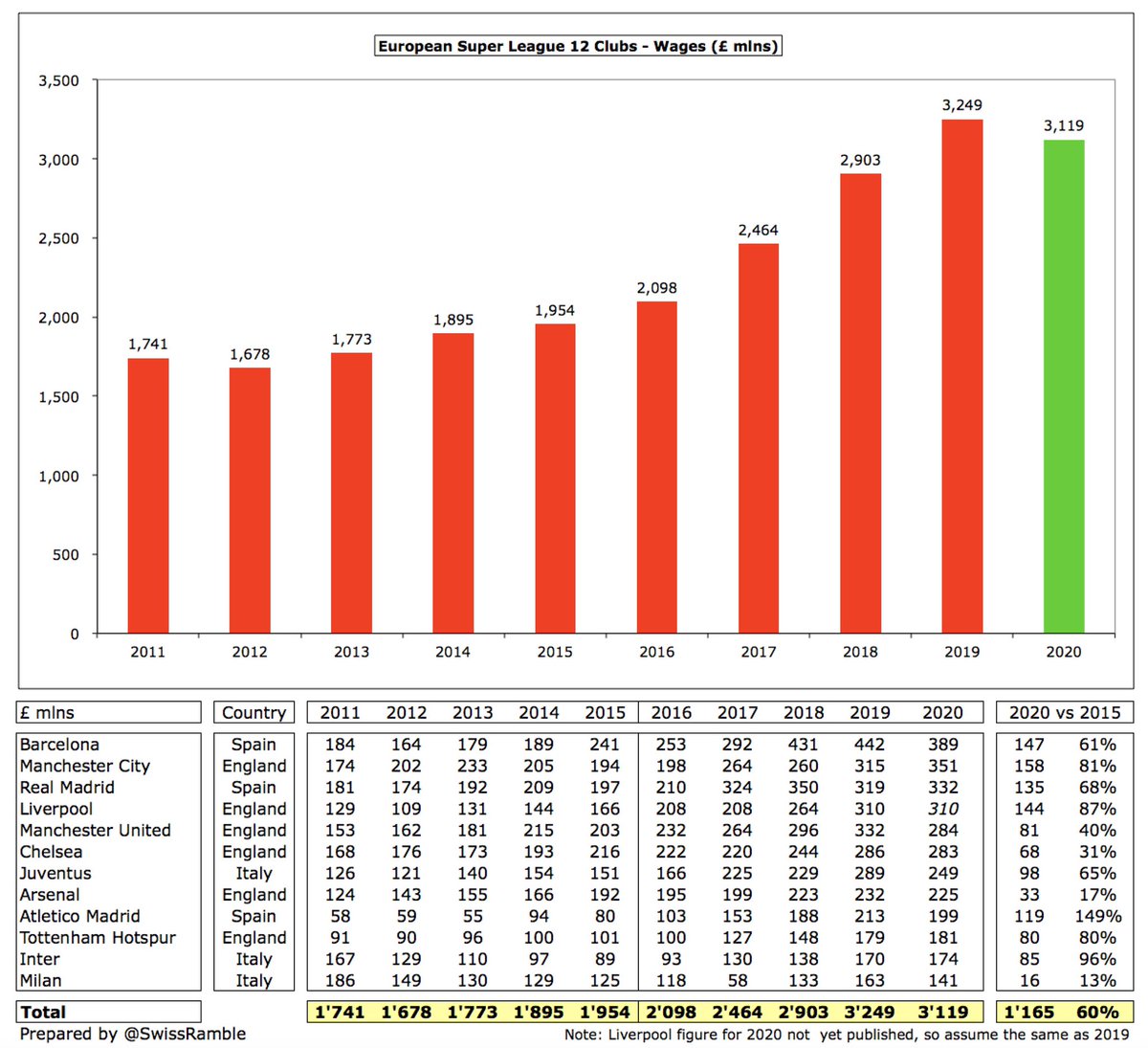

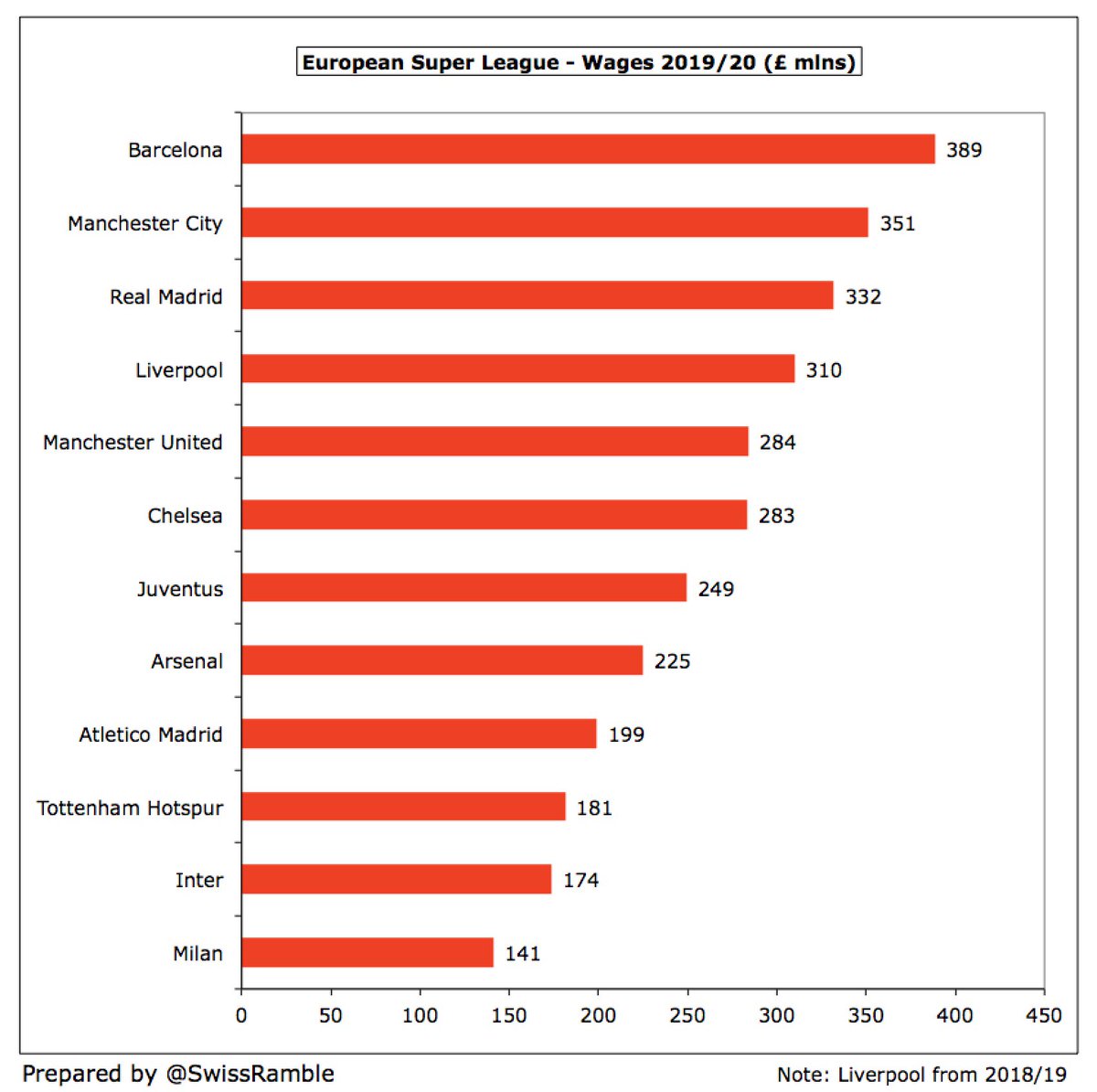

Of course, many of the financial problems are self-inflicted with most of the revenue growth simply going to higher wages, which are up £1.2 bln (60%) in 5 years from £1.9 bln to £3.1 bln. The three highest wage bills are #FCBarcelona £389m, #MCFC £351m and #RealMadrid £332m.

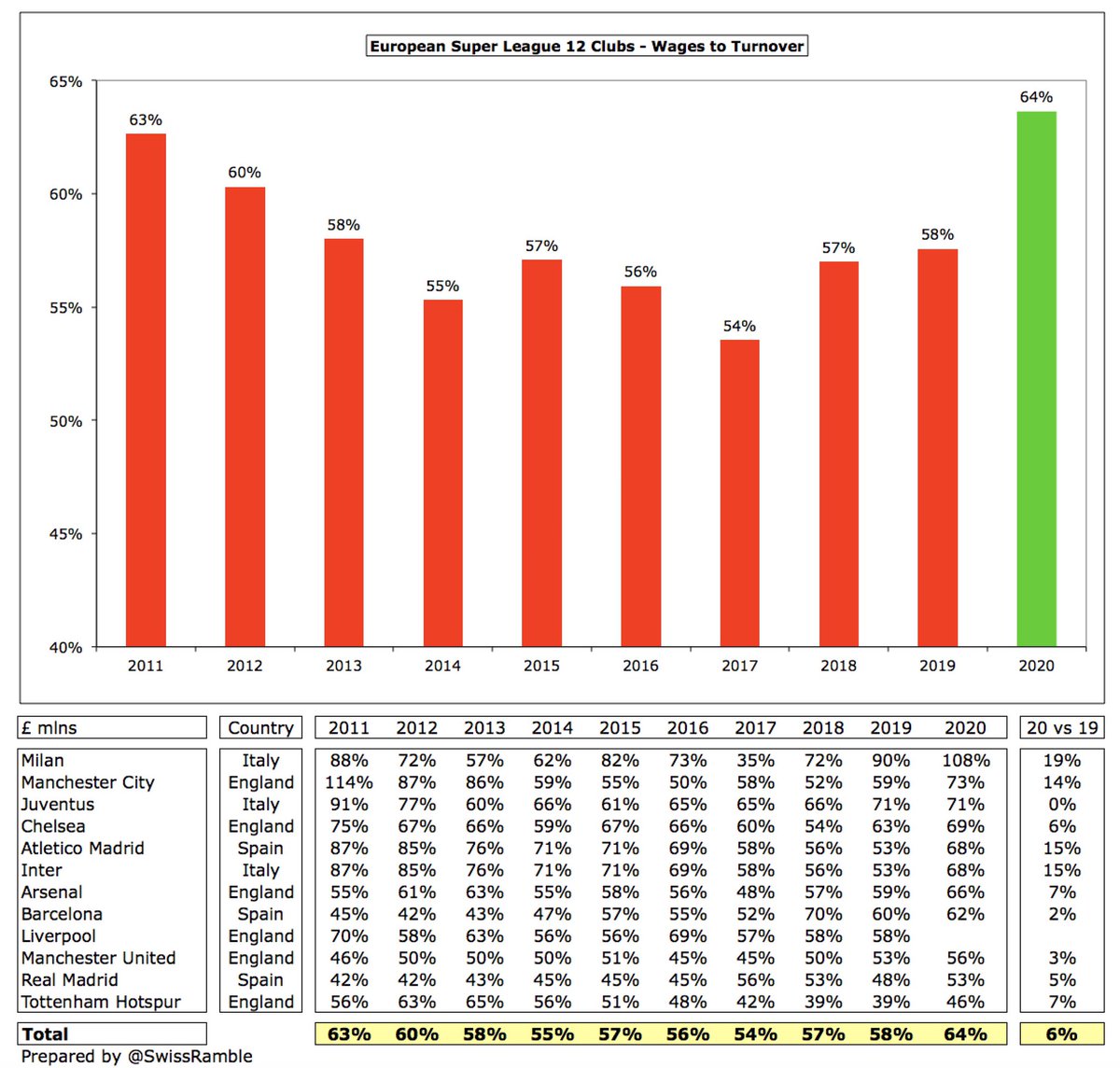

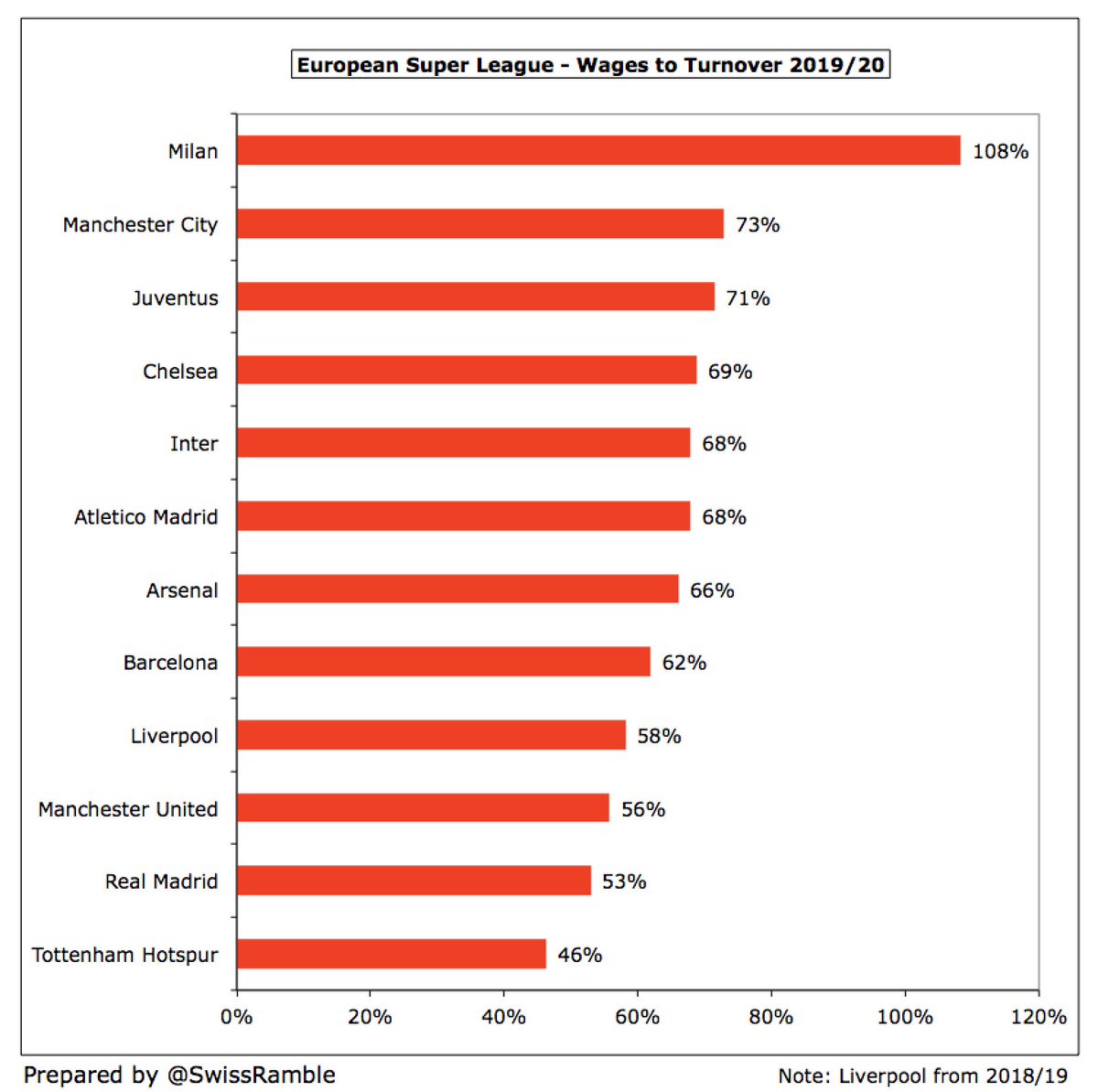

As a result, the wages to turnover ratio has risen to 64% for the Super League clubs. This is not too bad, but there is a wide range among the 12 with #Milan 108% being the worst, followed by #MCFC 73% and #Juventus 71%. #THFC are at the other end of the spectrum with 46%.

This is another key element of the Super League plan with a limit of 55% of revenue for player salaries, transfers and agent fees, i.e. much lower than current 64% for wages alone, thus increasing profitability. Also income tax equalised at 45%, removing a Spanish disadvantage.

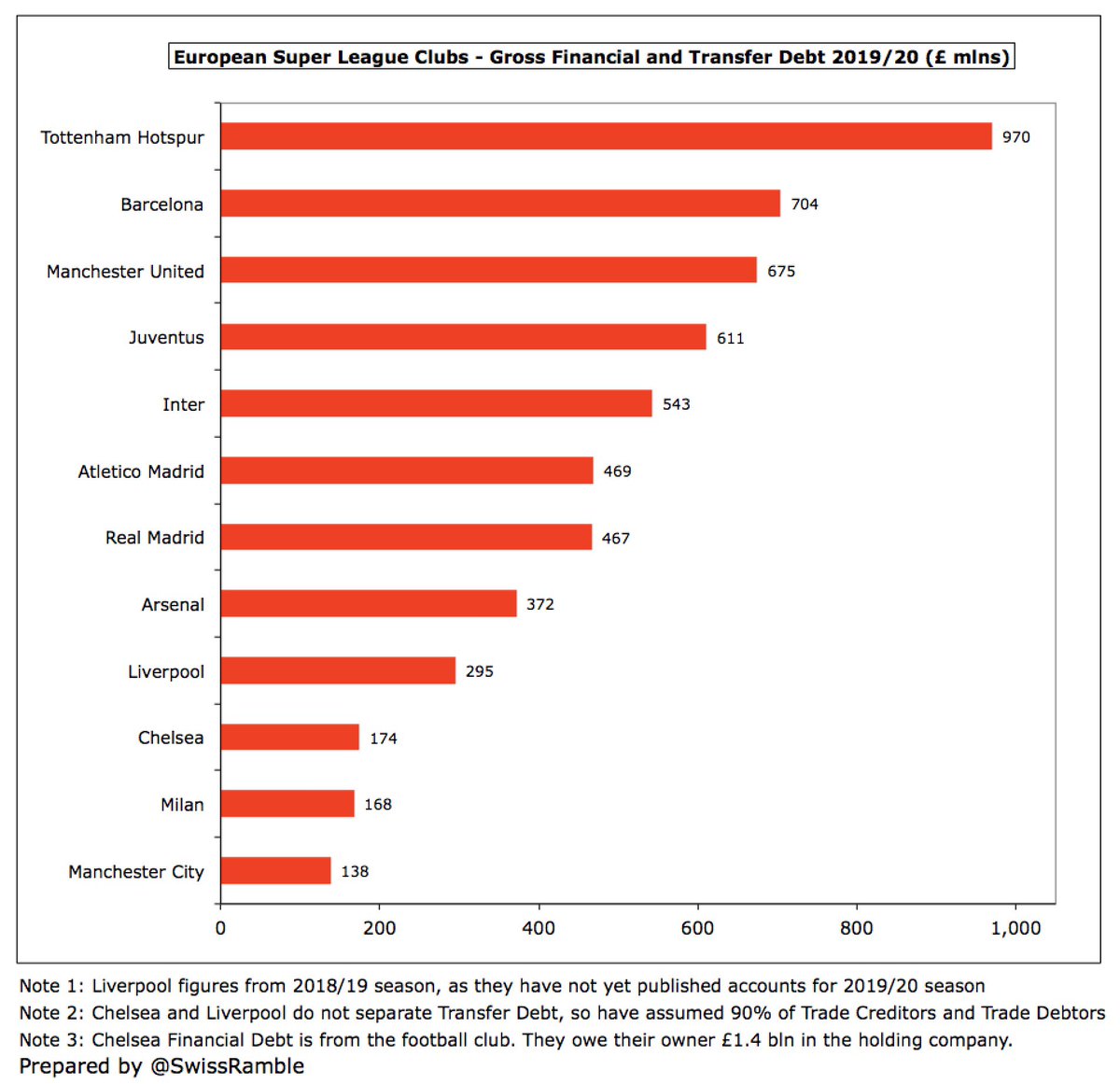

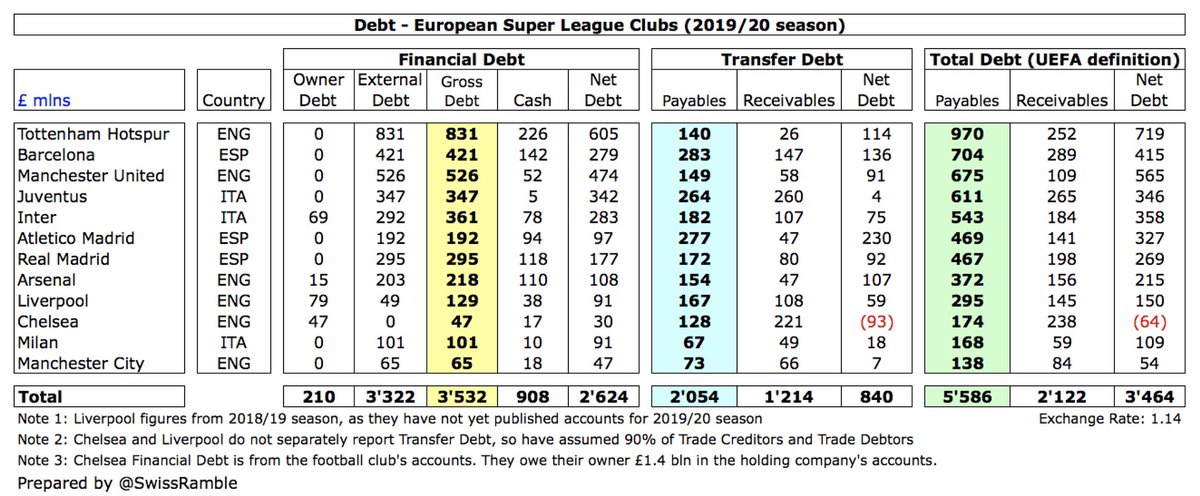

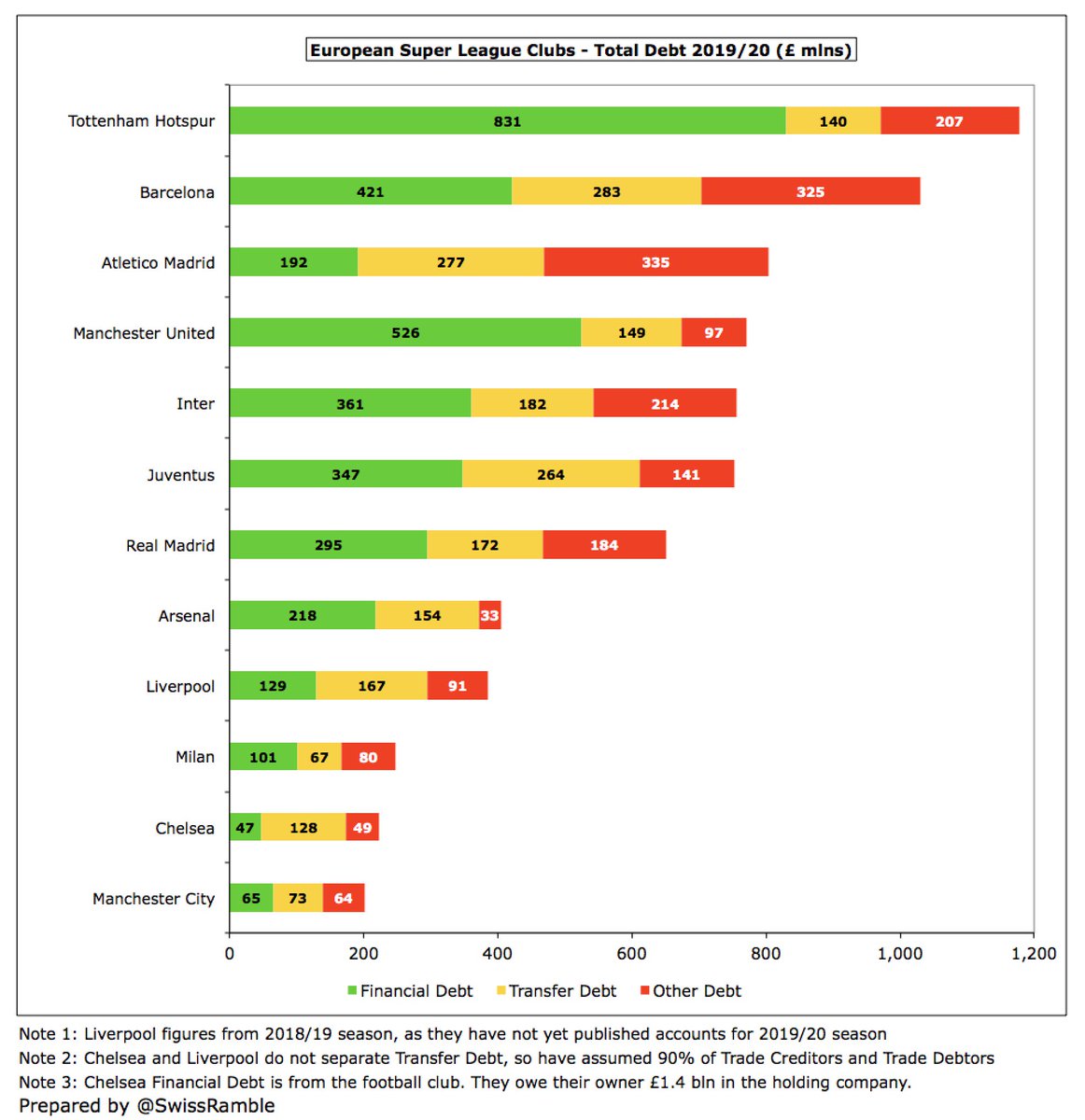

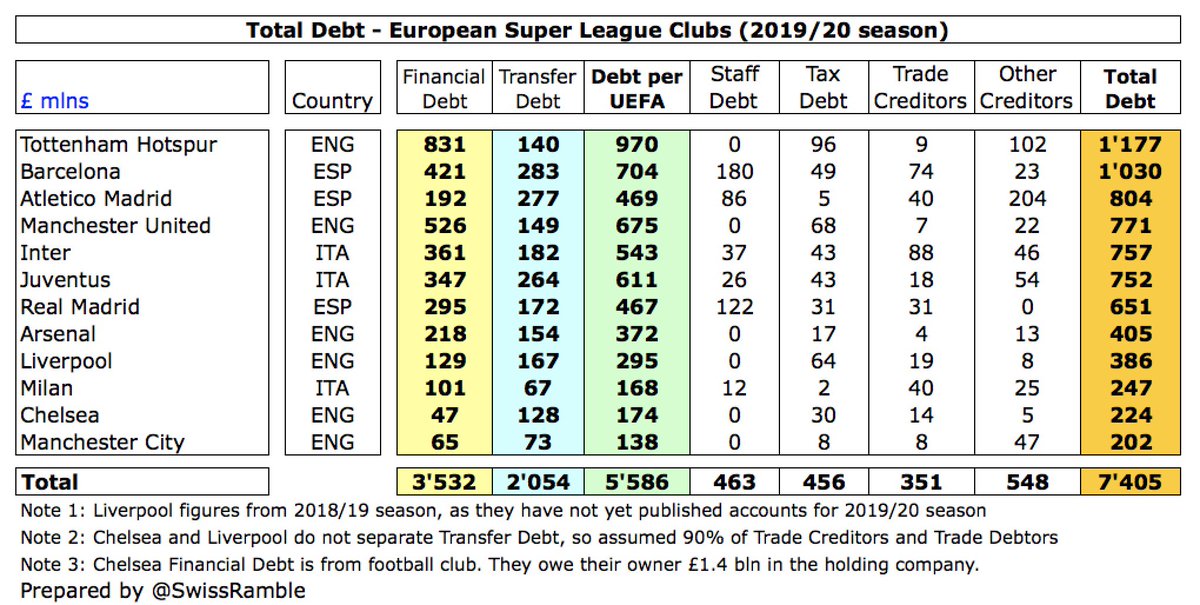

Another major financial issue for the 12 Super League clubs is £5.6 bln of debt, as per UEFA’s definition: financial debt (£3.5 bln) and transfer debt (£2.1 bln). Moreover, almost all of the financial debt has come from banks (£3.3 bln), compared to only £0.2 bln from owners.

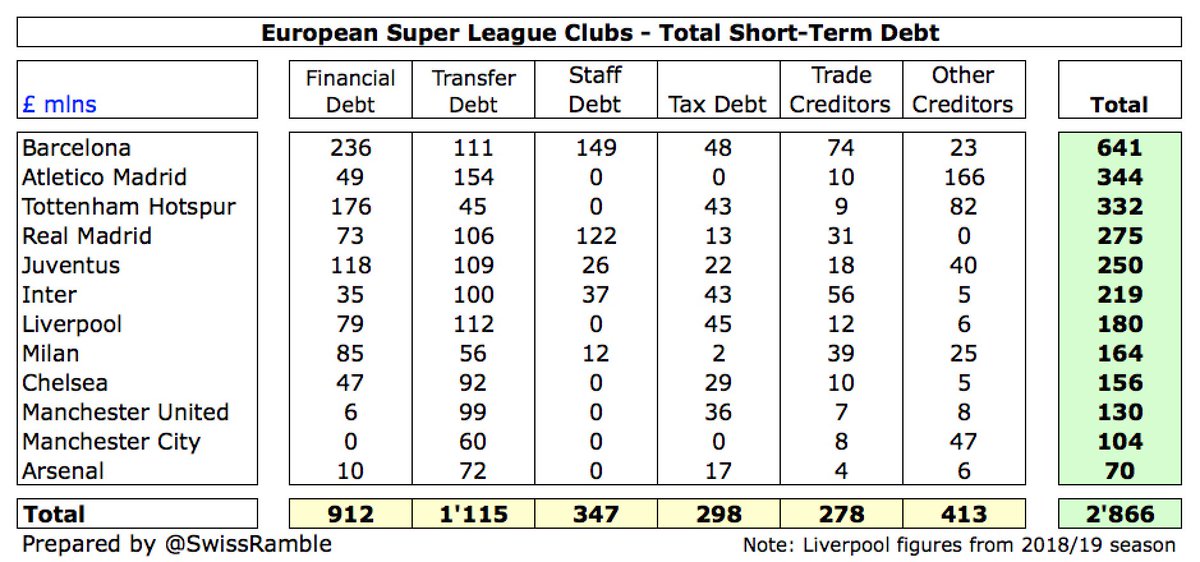

If we include other debt, such as amounts owed to staff, tax authorities, suppliers and other creditors, the total debt is a staggering £7.4 bln. #THFC have £1.2 bln (new stadium), followed by #FCBarcelona £1.0 bln (including £180m salaries), #Atleti £804m and #MUFC £771m.

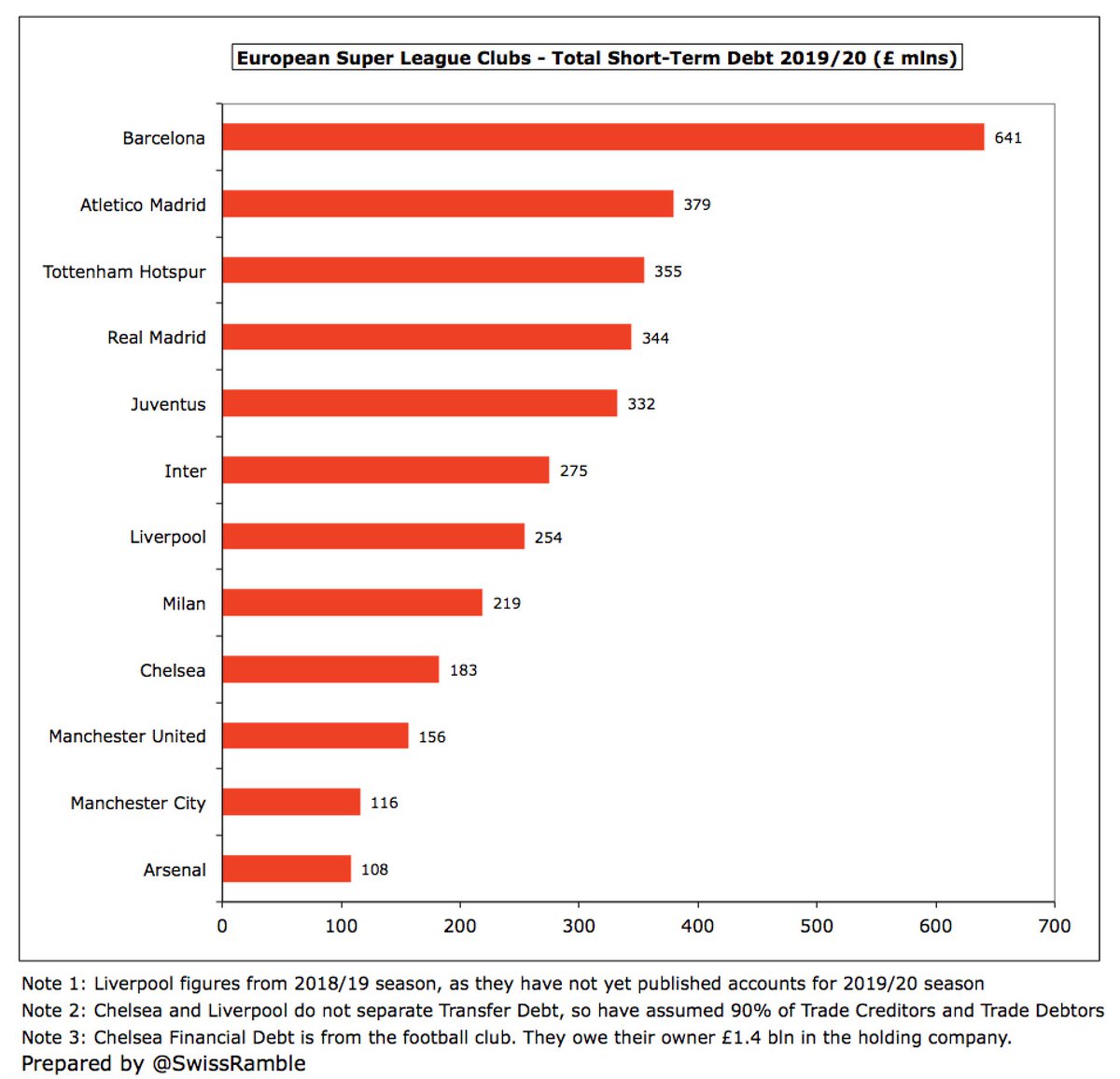

One reason why #FCBarcelona have more problems with debt than English clubs is that so much of it is short-term, i.e. needs to be repaid within the next 12 months: £641m for Barcelona (including £236m bank loans), while for #THFC and #MUFC it is only £332m and £130m respectively.

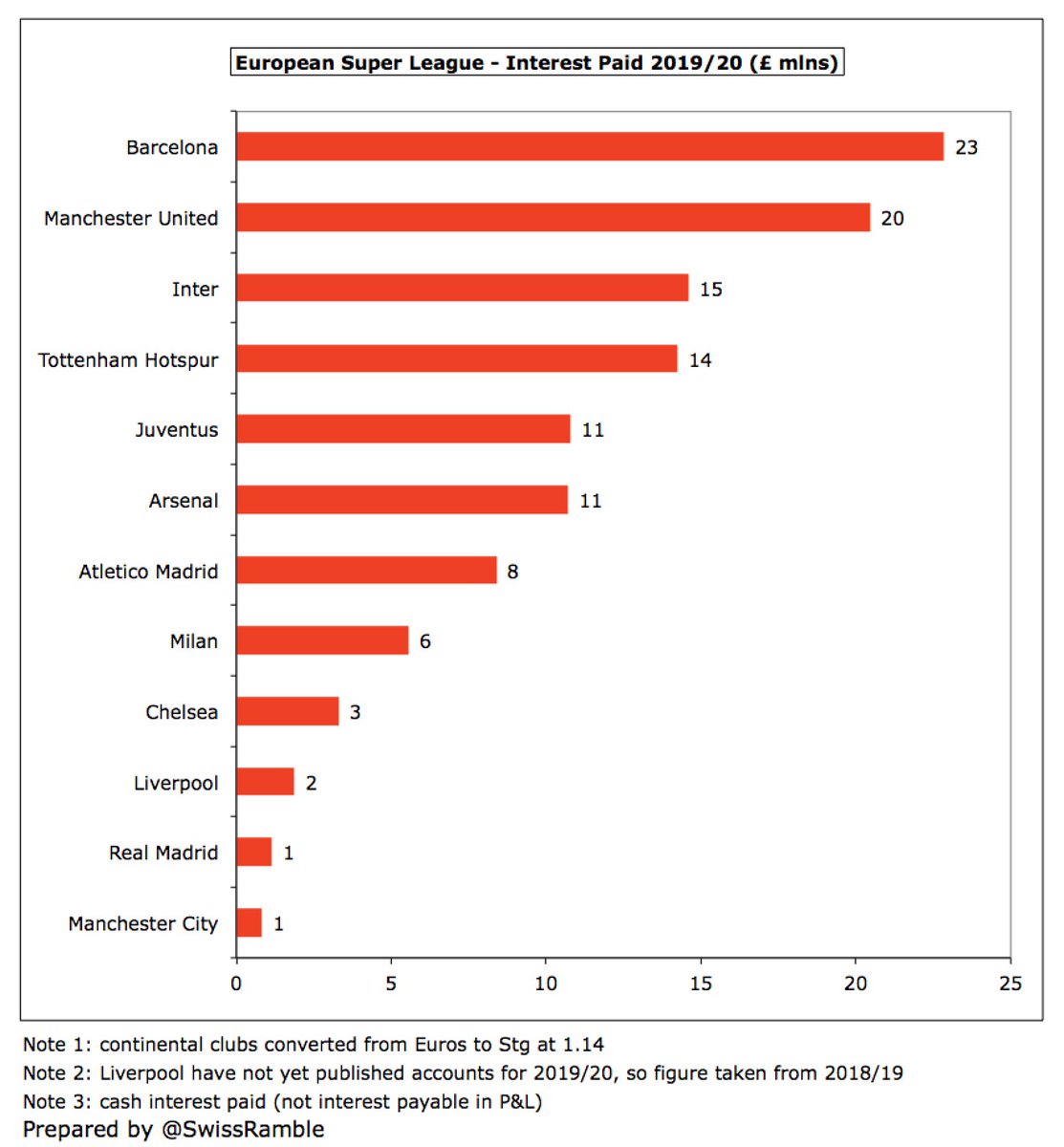

Unless money is provided interest-free by a club’s owner (like #CFC), debt comes at a price. Last year the highest interest payments were at #FCBarcelona £23m, #MUFC £20m, #Inter £15m and #THFC £14m. #RealMadrid will increase with large loans required for stadium redevelopment.

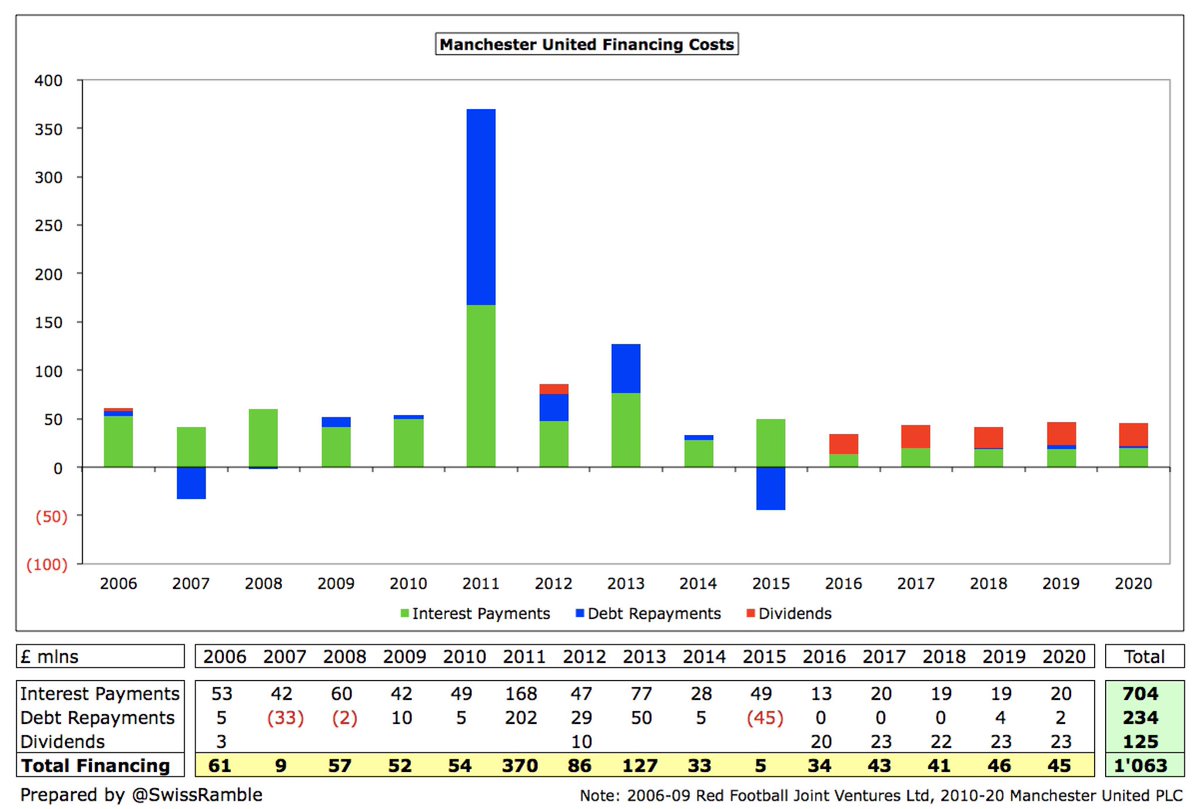

#MUFC fans will be painfully aware that their club has paid huge sums for the privilege of having the Glazers as owners. Since the leveraged buy-out they have spent over £1 bln on financing: £704m interest, £234m debt repayments and £125m dividends. Averaged £42m in last 5 years.

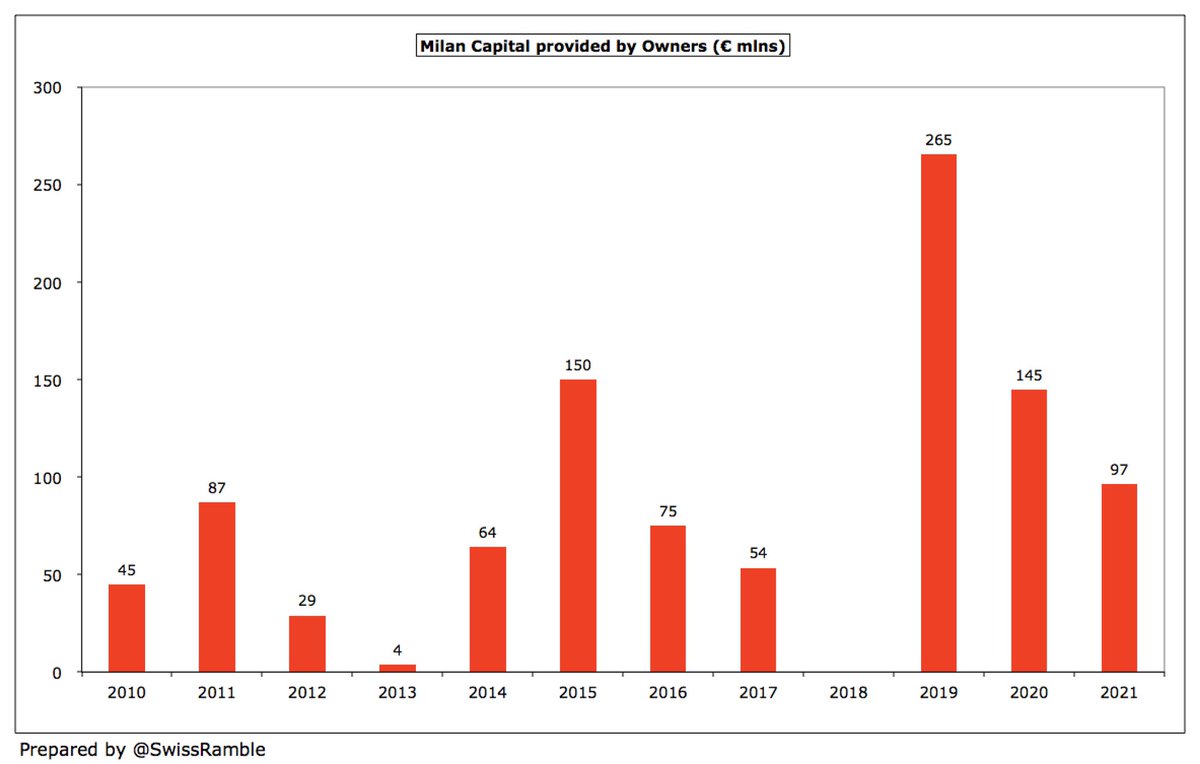

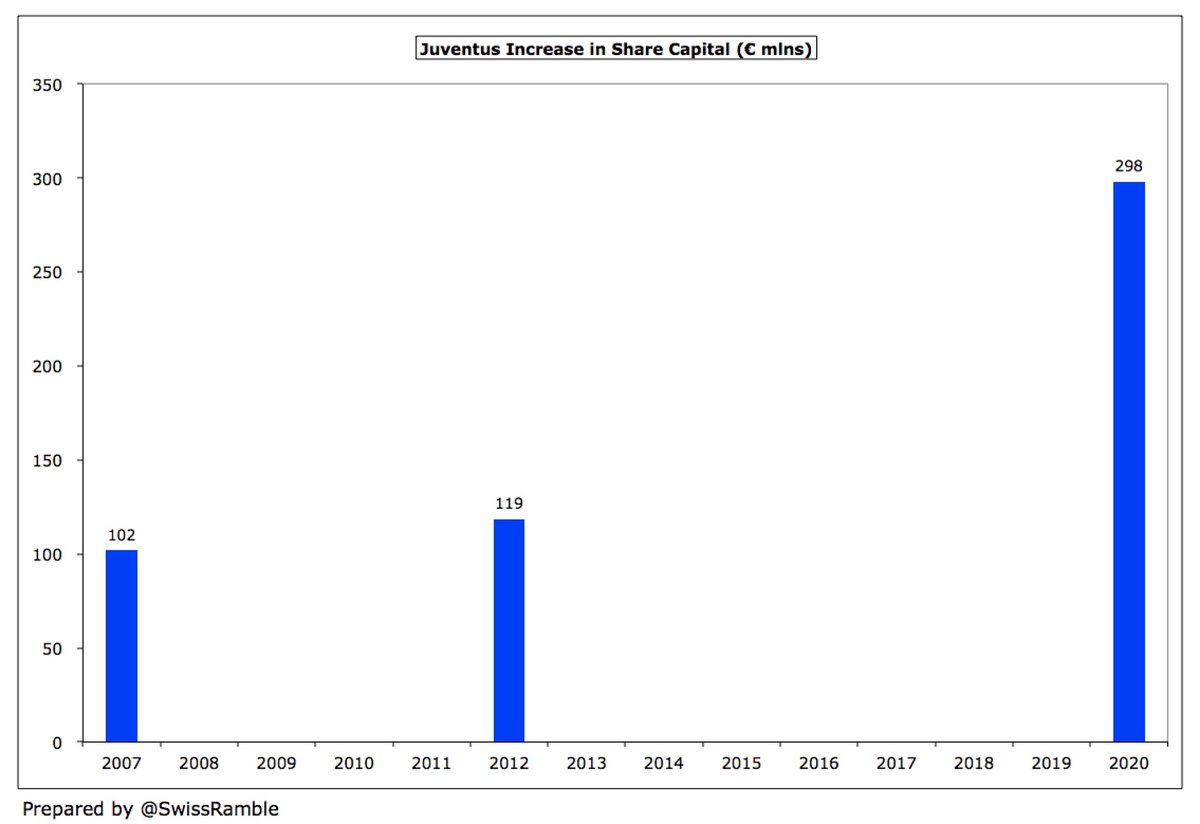

In stark contrast, some clubs have required substantial funding from their owners to cover losses. For example, since 2014 various owners at #Milan have put in around €850m, while #Juventus shareholders have provided over €500m capital since 2007 (including €298m in 2020).

It is clear that Super League clubs face tough financial challenges, but it’s largely their own fault. They have enjoyed substantial advantages over others, but decided to go for even more money, rather than address structural issues, their motto seemingly being “greed is good”.

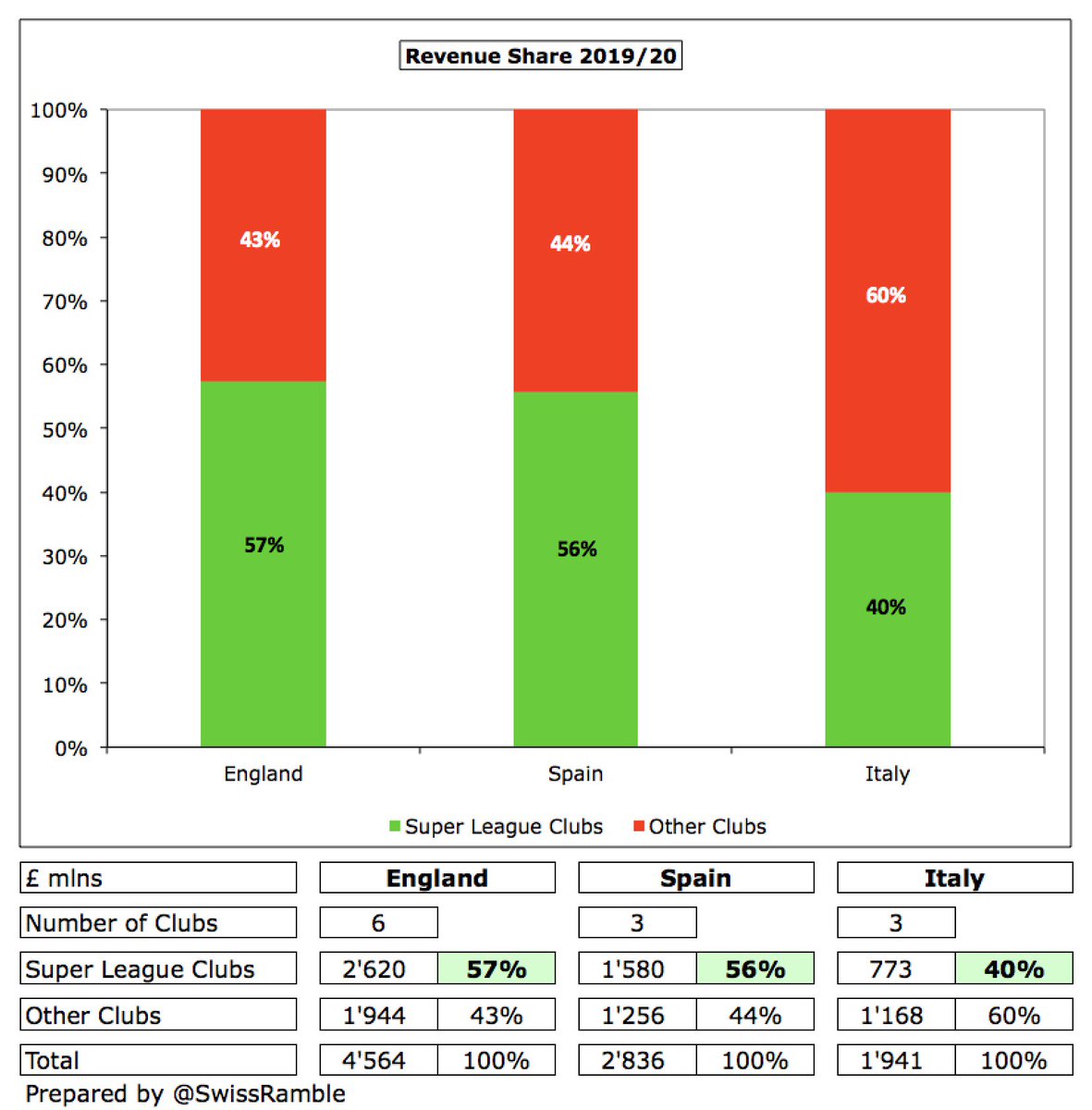

The revenue gap between the 12 Super League clubs and others in their domestic leagues is enormous. For example, lowest ranked of Big Six in England #AFC has almost twice as much as next highest. Same story in Spain for 3rd placed club. Closer in Italy, but #Juventus miles ahead.

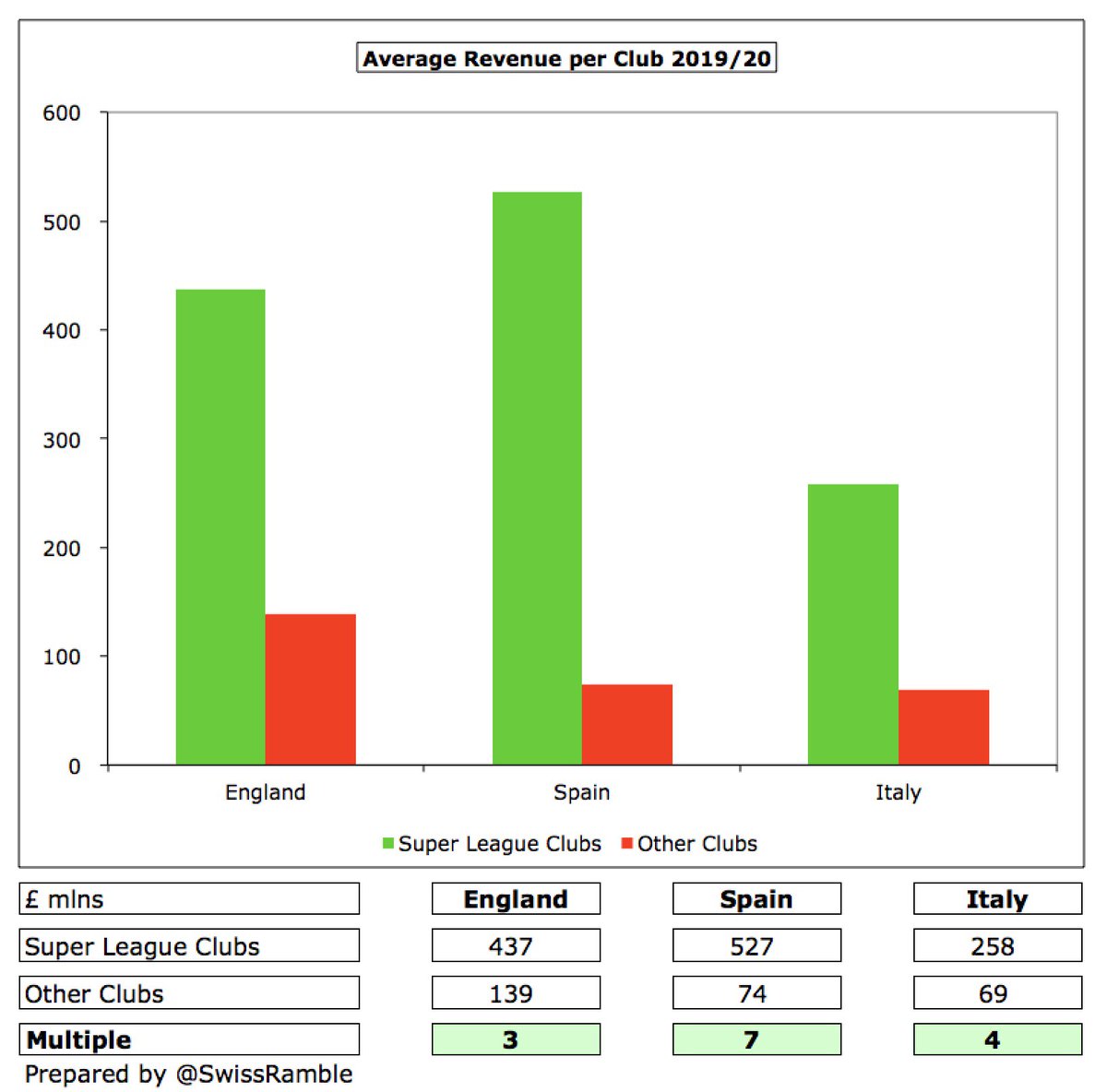

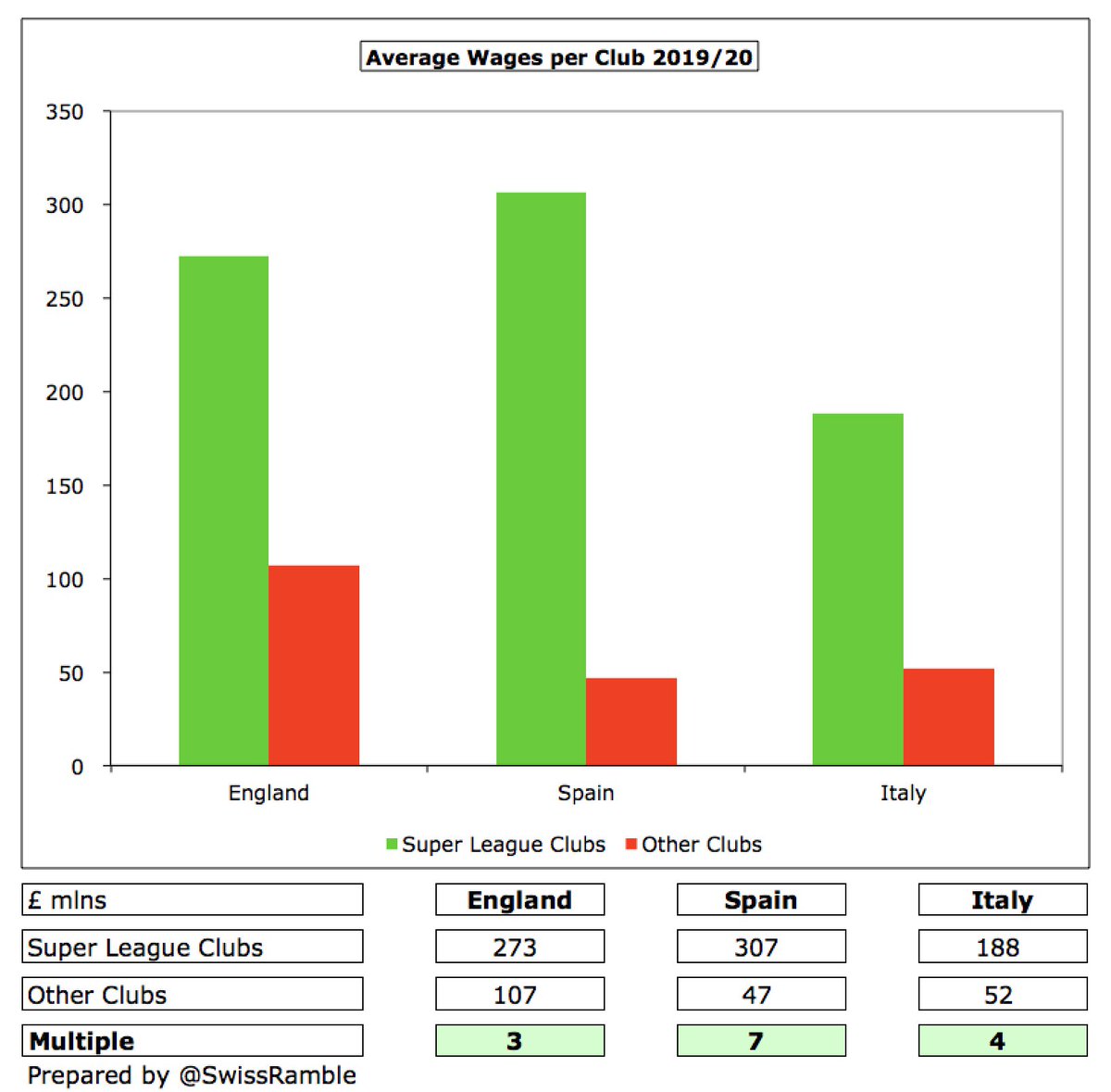

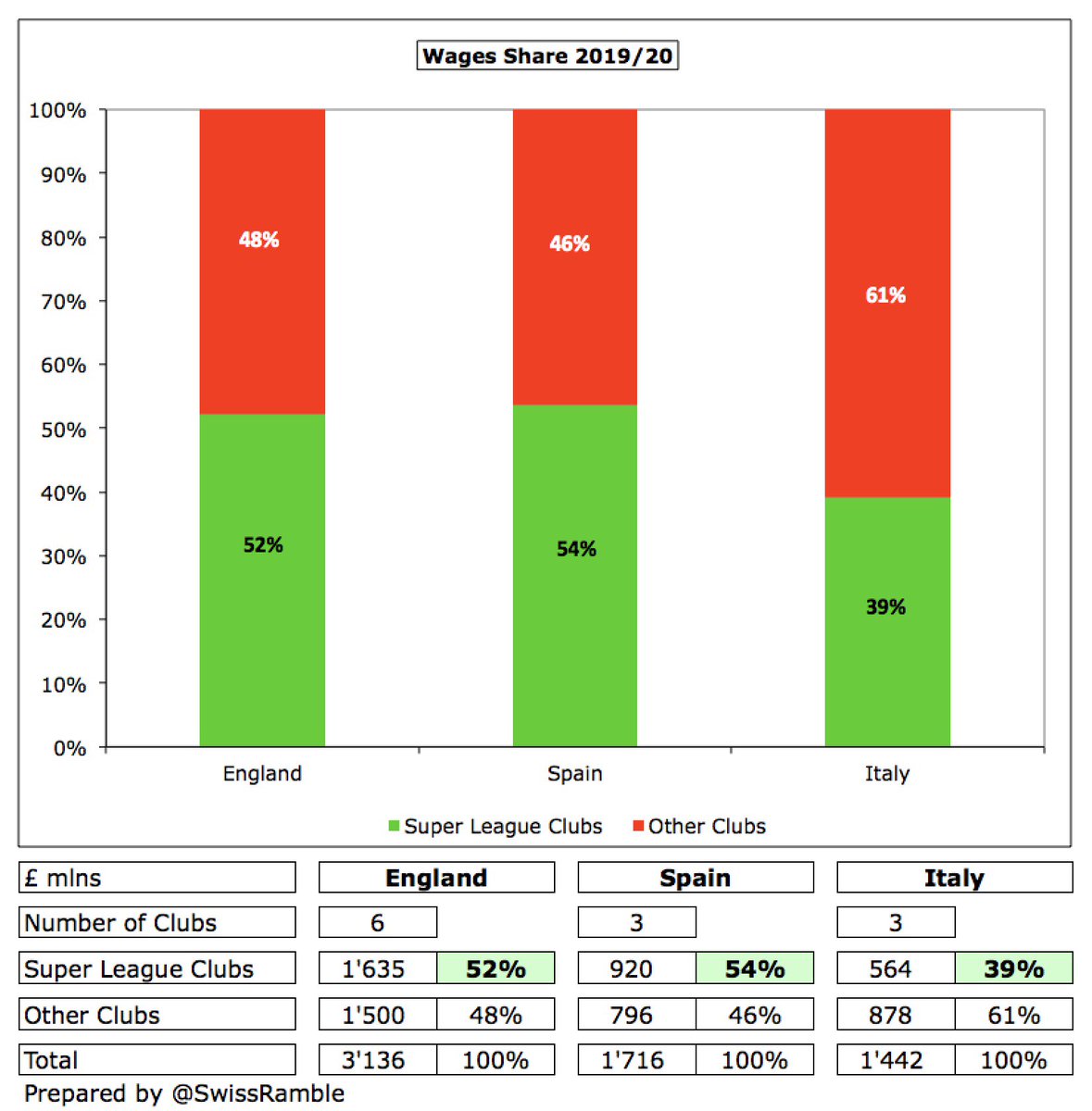

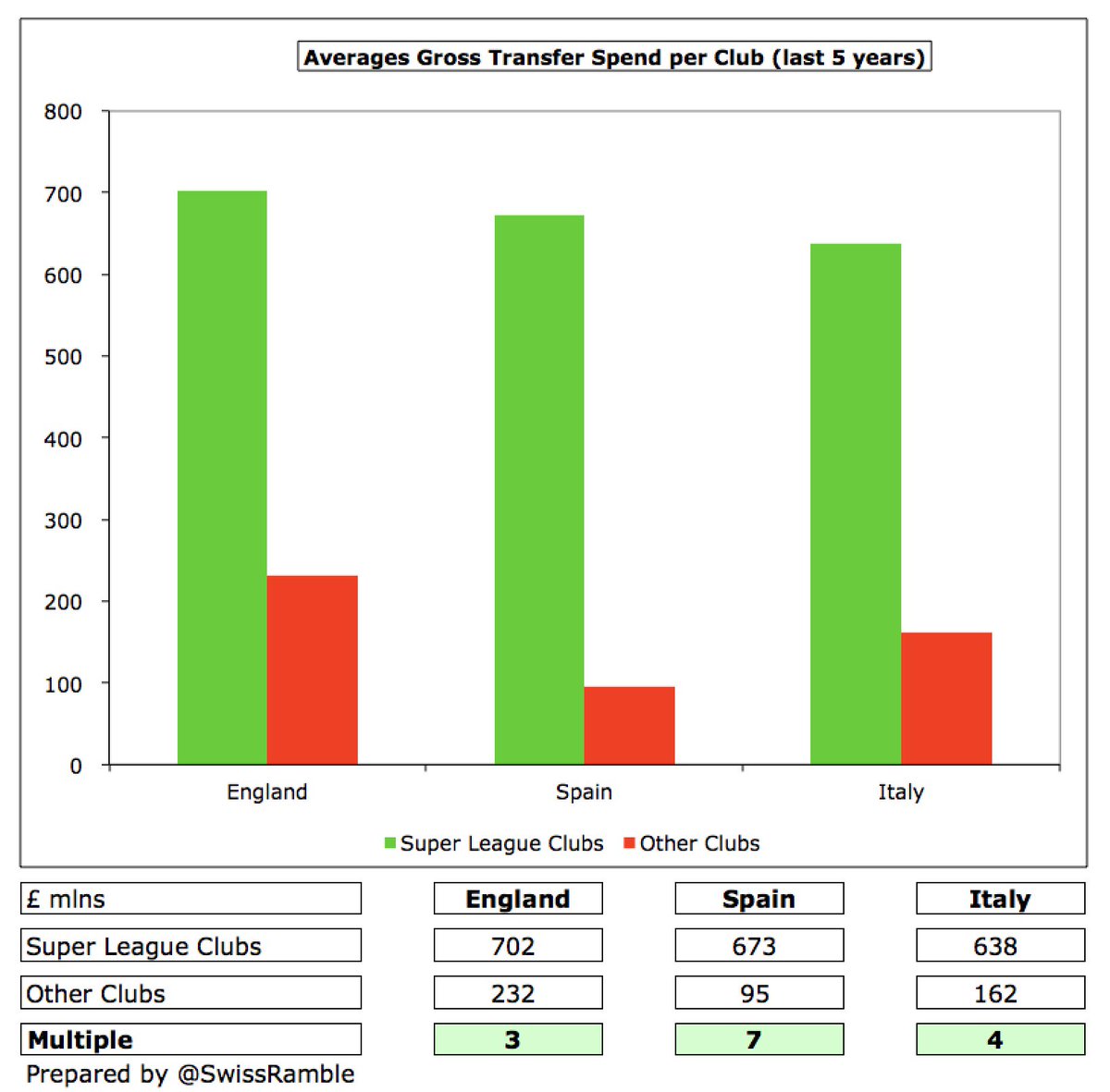

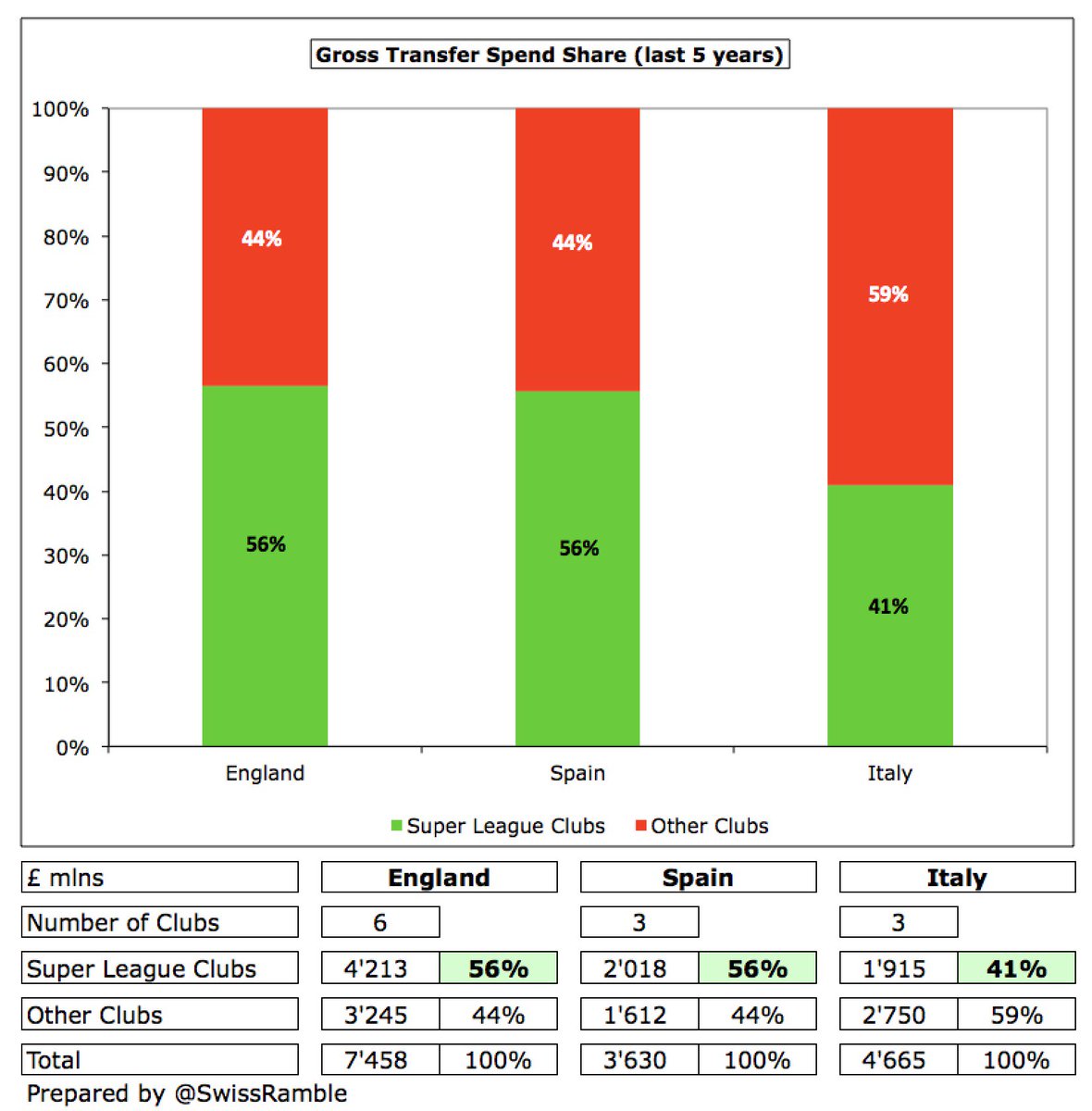

The 6 English ESL clubs have 57% of total Premier League revenue, while the 3 Spanish clubs cover 56% and the 3 Italian clubs 40%. In terms of average revenue, Spanish ESL clubs’ are 7 times as much as others, Italian clubs 4 times and English clubs 3 times.

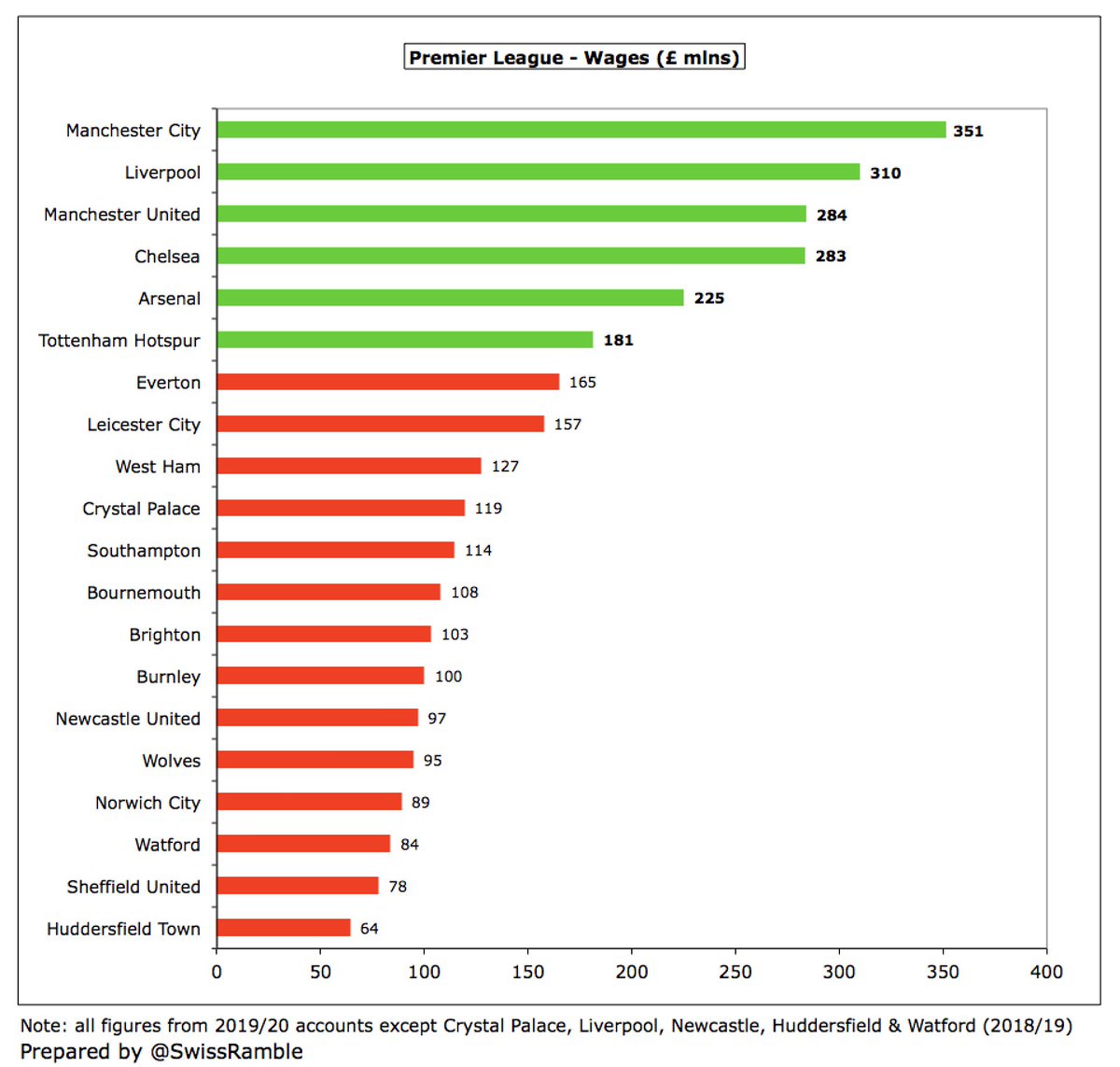

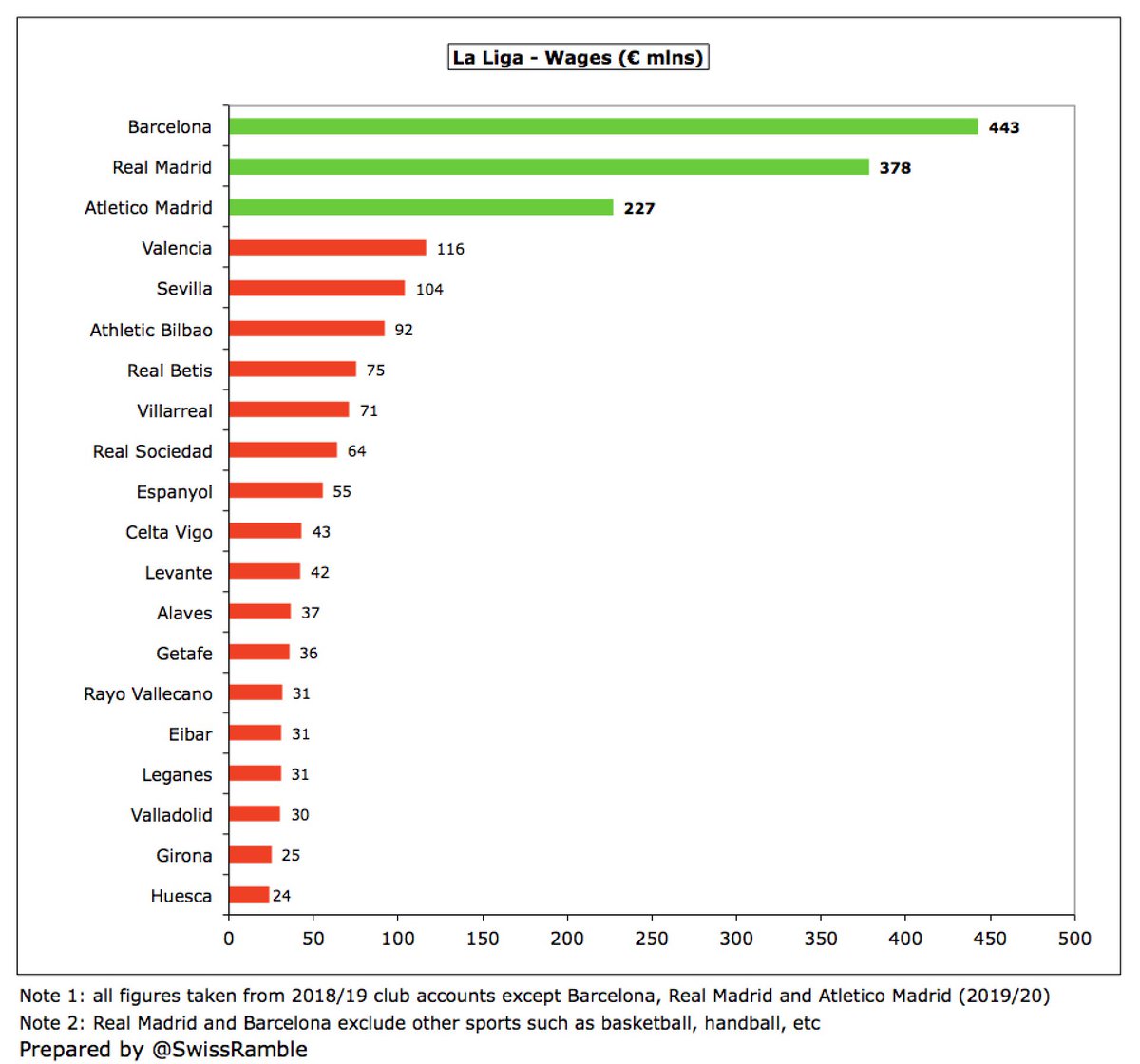

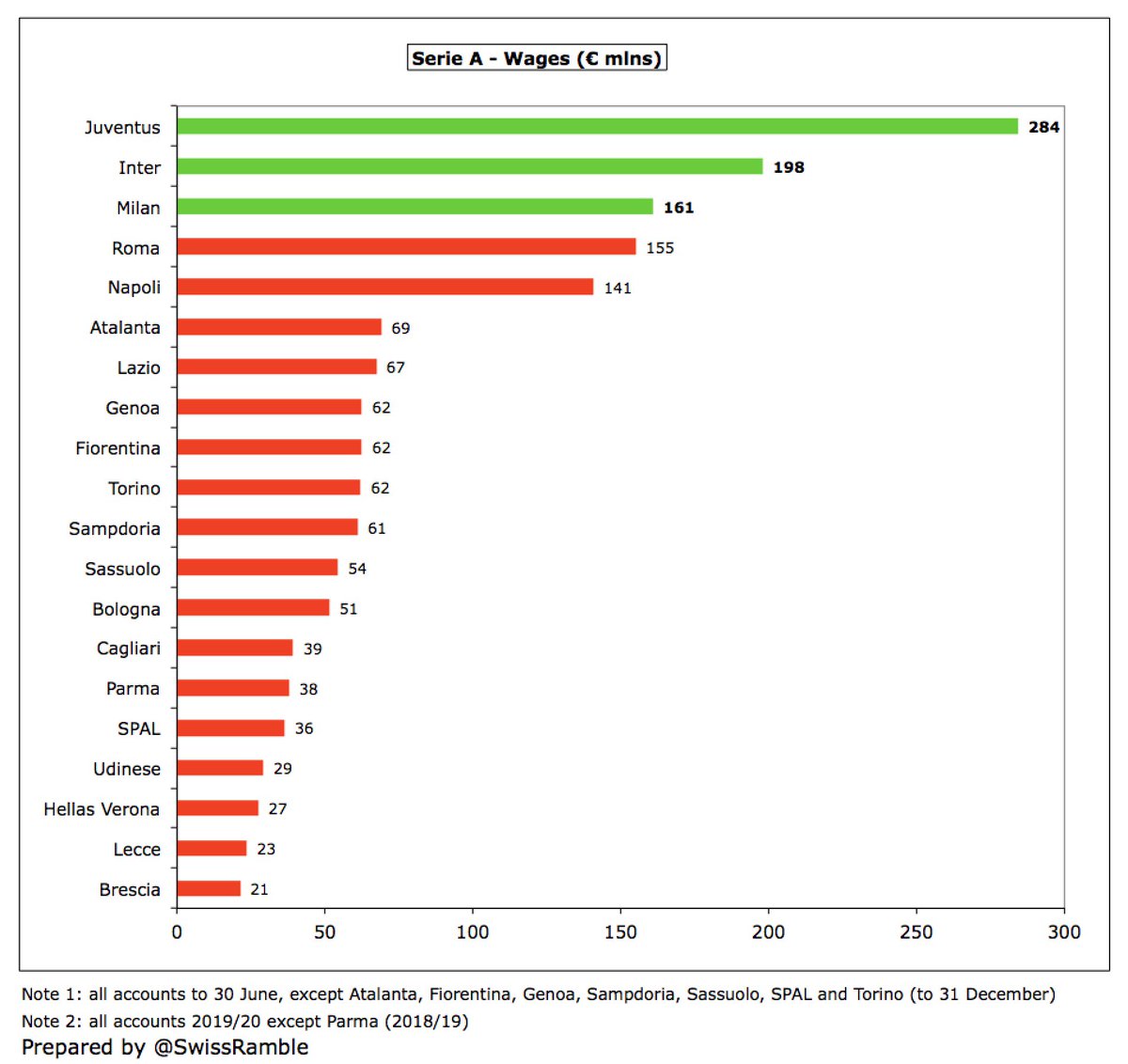

It’s a similar story for wages, perhaps the best single financial indicator of success on the pitch. Unsurprisingly, the 12 Super League clubs fill the top places in their domestic leagues. The gap to other clubs is particularly stark in Spain and Italy (at least for #Juventus).

As a result, Spanish Super League clubs average £307m wages are 7 times as much as £47m of the other 14 clubs in La Liga. In Italy, it’s 4 times as much (£188m vs. £52m), while in England it’s “only” 3 times as much (£273m vs. £107m).

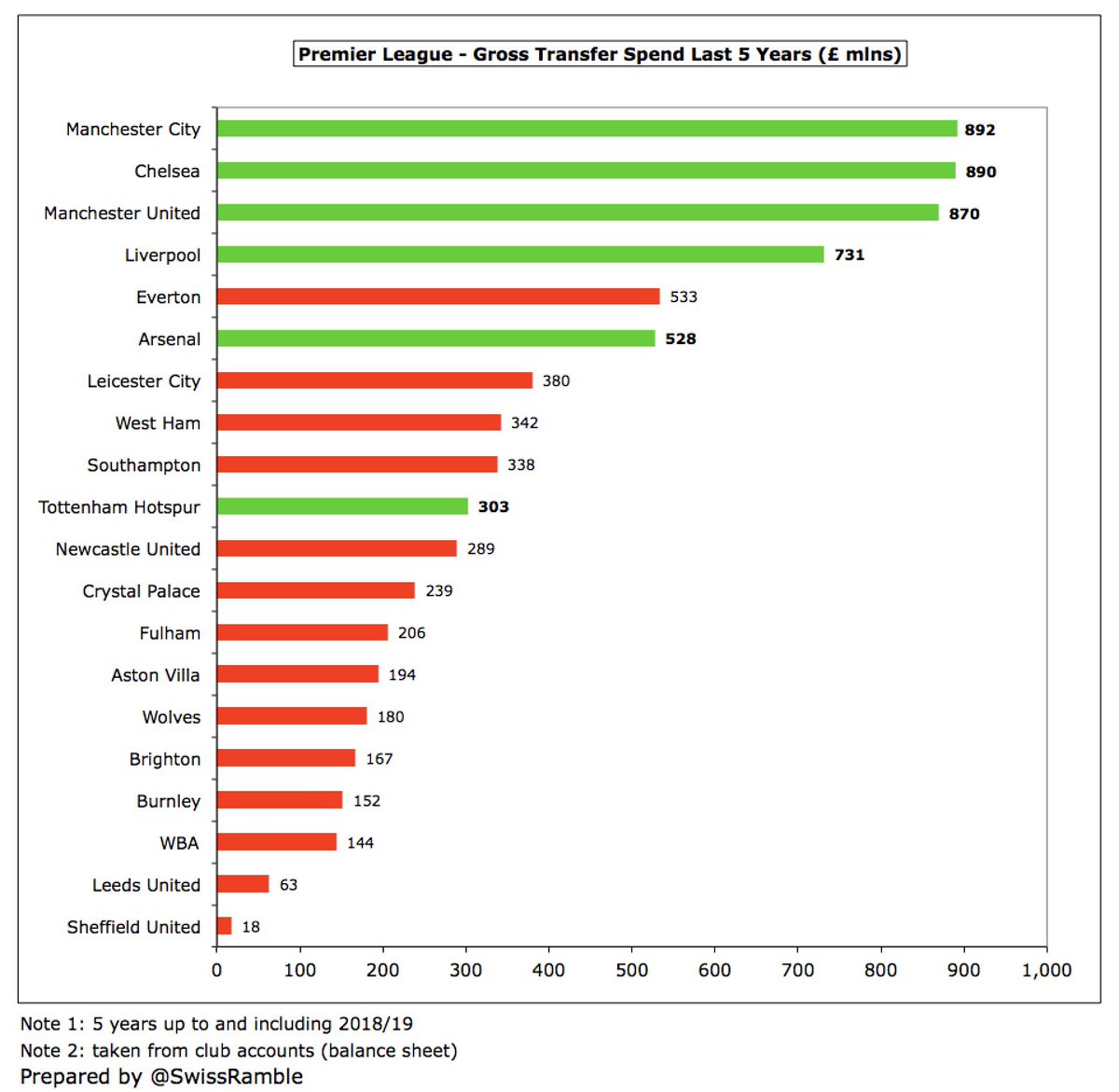

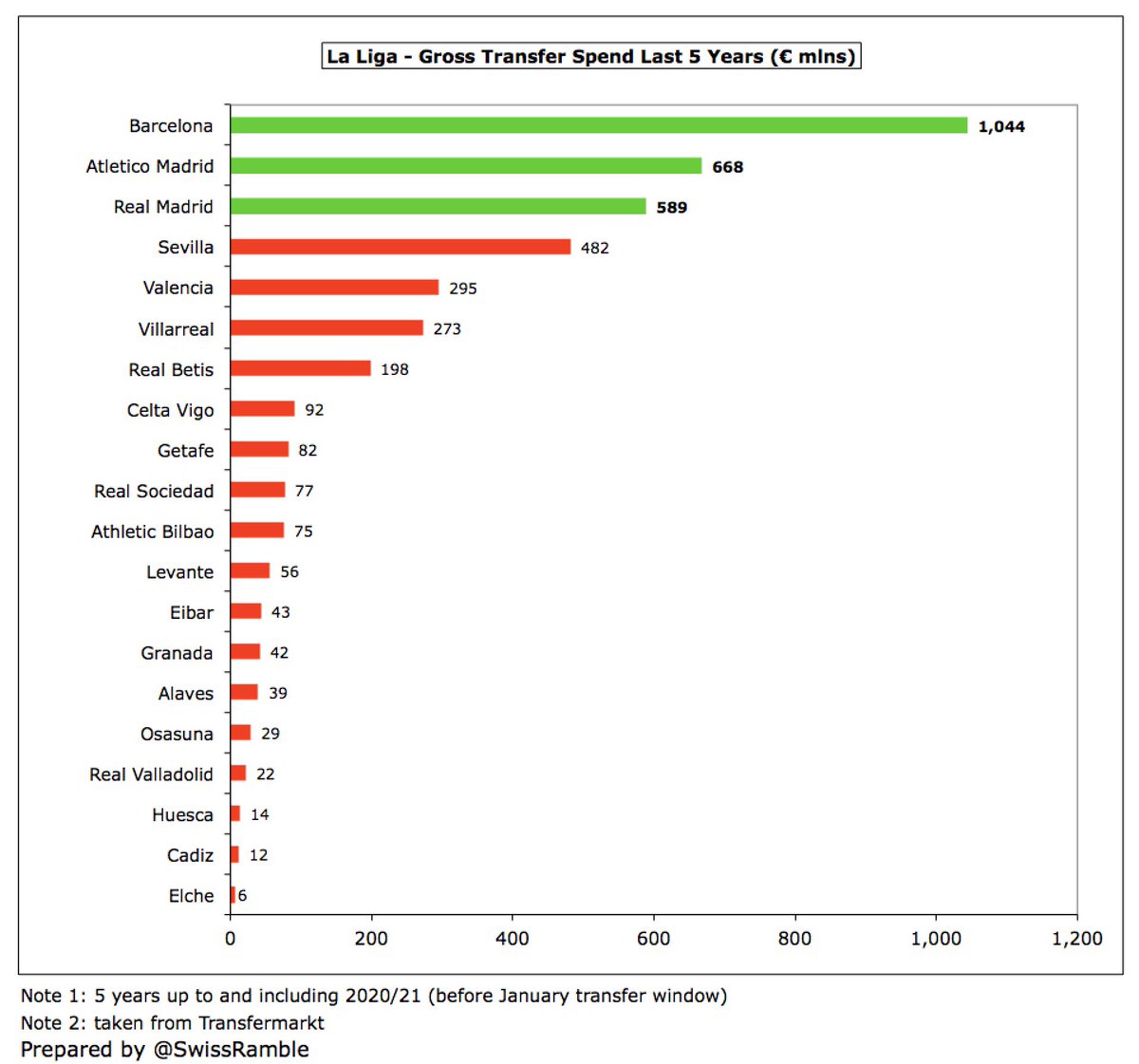

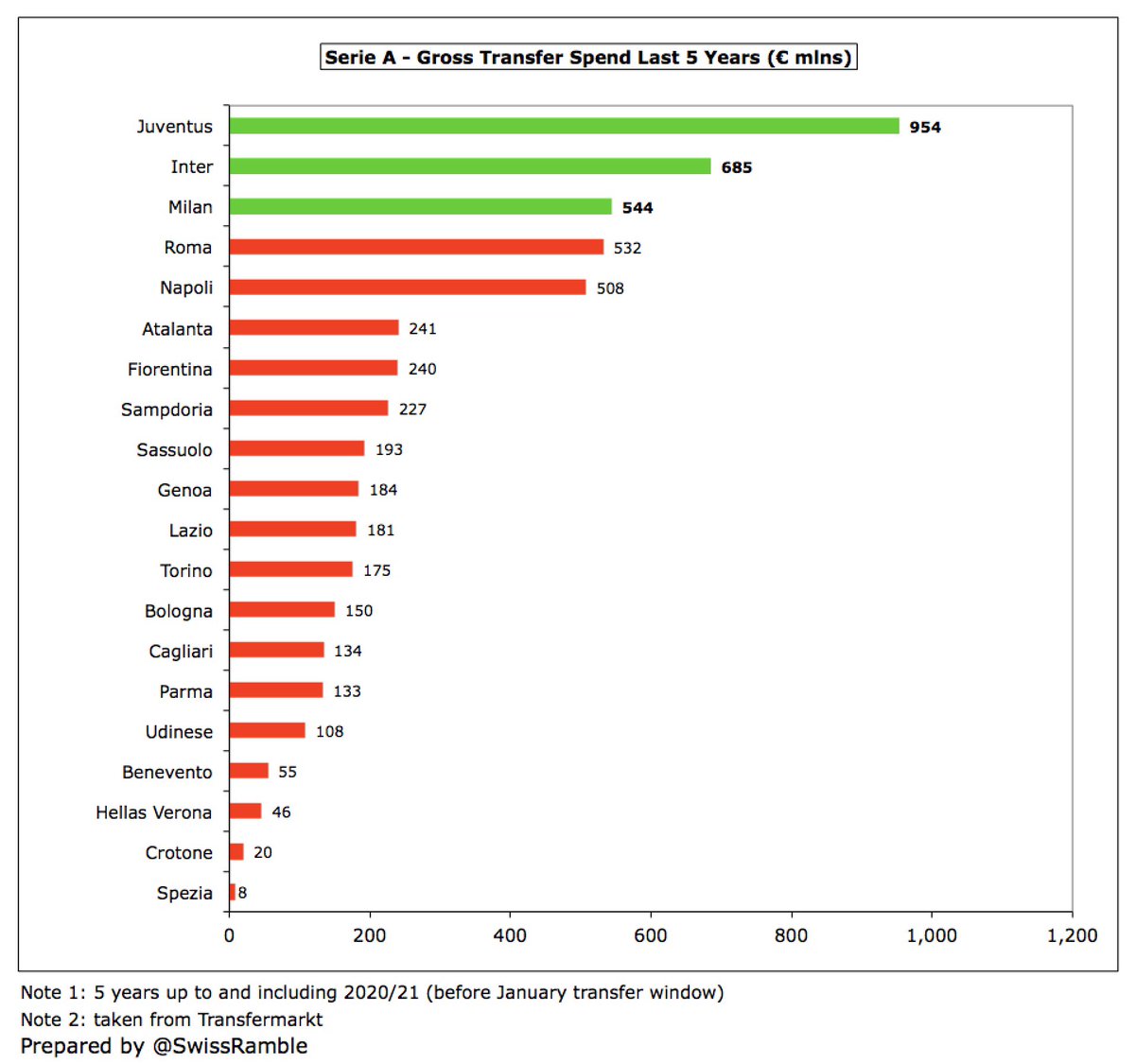

Looking at transfer spend (gross) over 5 years, it’s much the same in Spain and Italy, though #FCBarcelona and #Juventus are well ahead with around £1 bln apiece. There is more variation in England, largely due to relatively low player purchases at #AFC and #THFC.

Nevertheless, the average gross transfer spend comparative is identical to wages: Spain 7 times as much as other clubs domestically (£673m vs. £95m); Italy 4 times as much (£638m vs. £162m); and England 3 times as much (£702m vs. £232m).

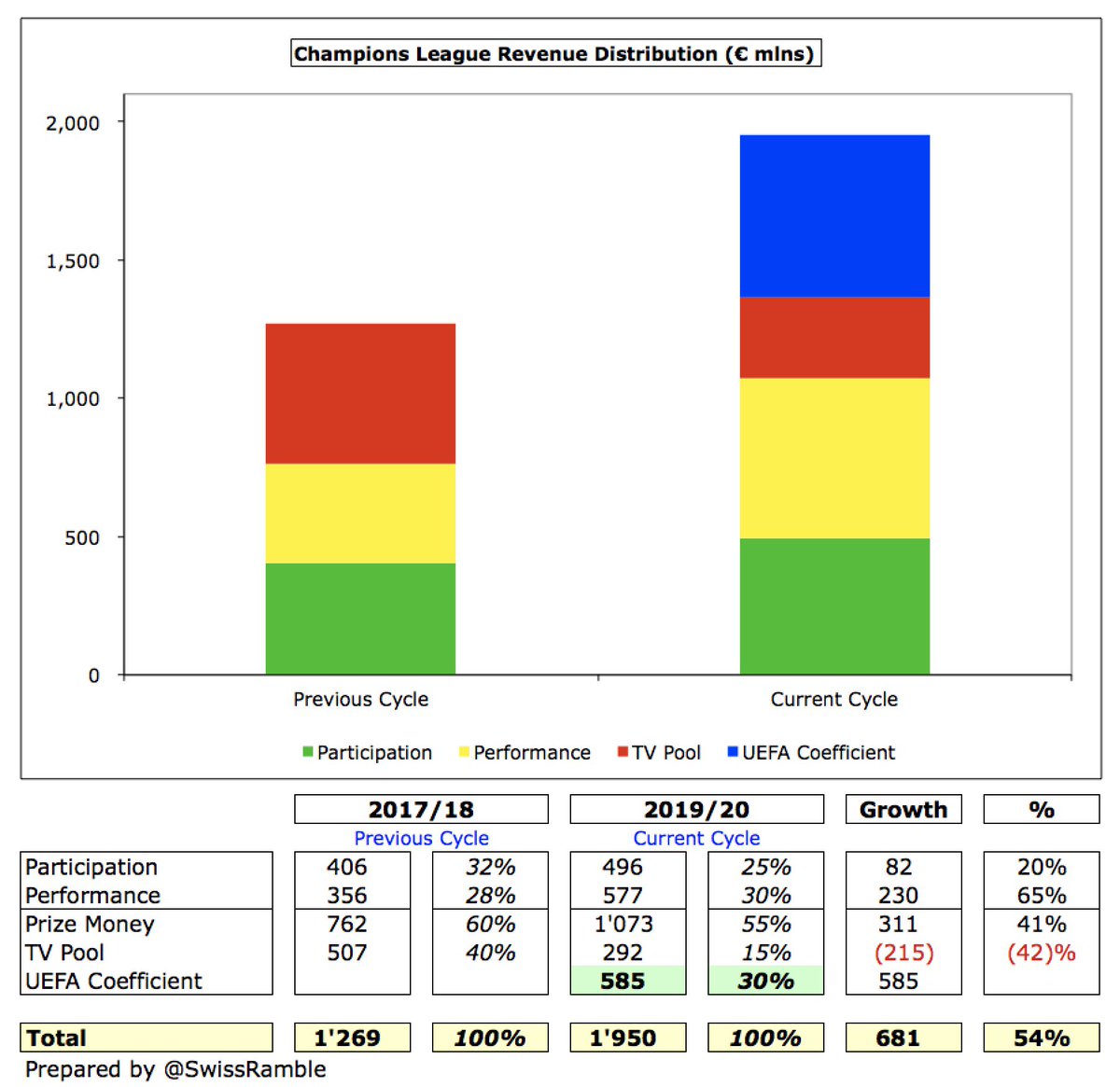

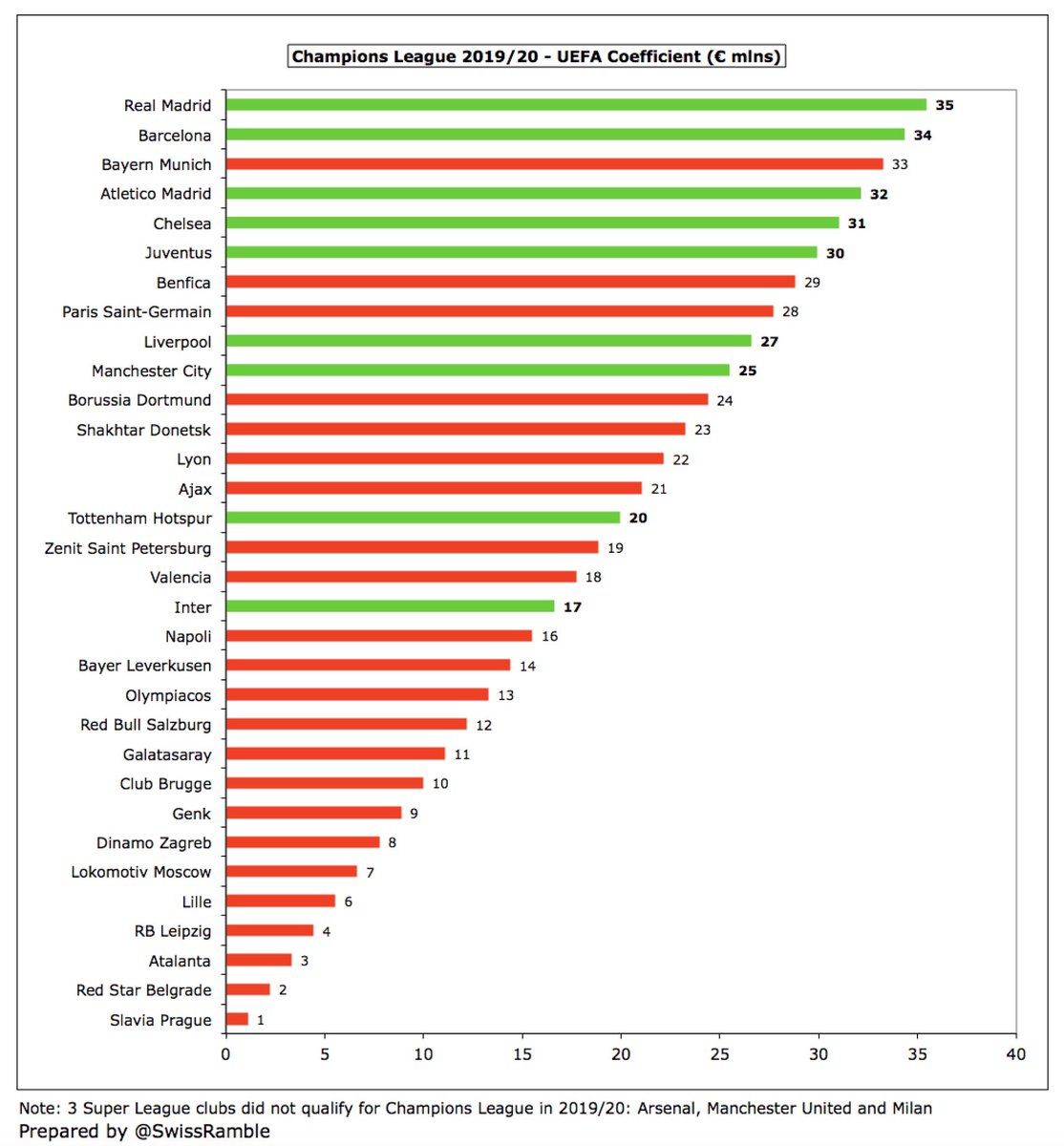

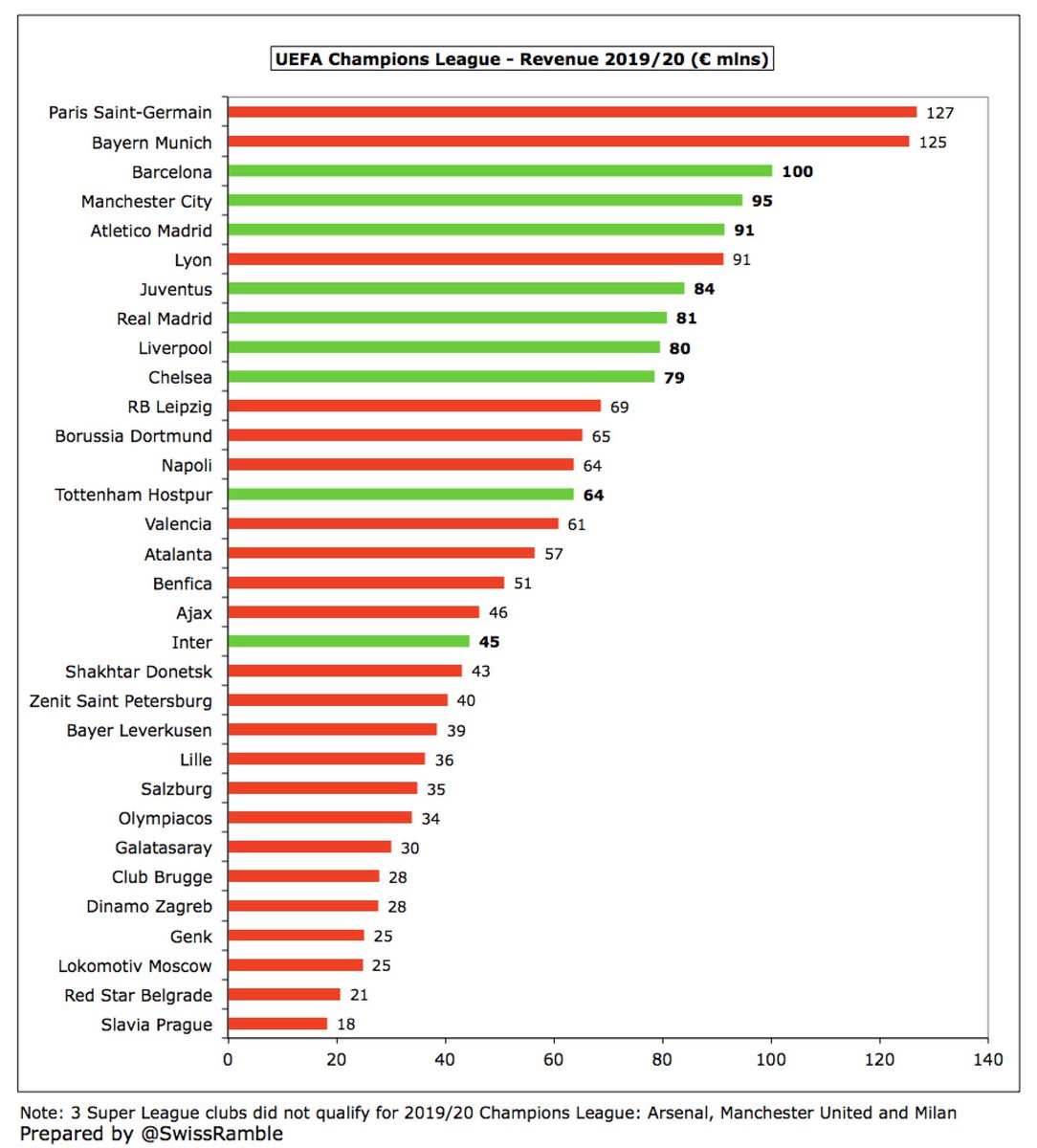

It’s not as if football authorities have not tried to placate Super League clubs in the past. For example, UEFA introduced a coefficient ranking to distribute Champions League revenue that clearly benefits them, e.g. highest earners are #RealMadrid €35m and #FCBarcelona €34m.

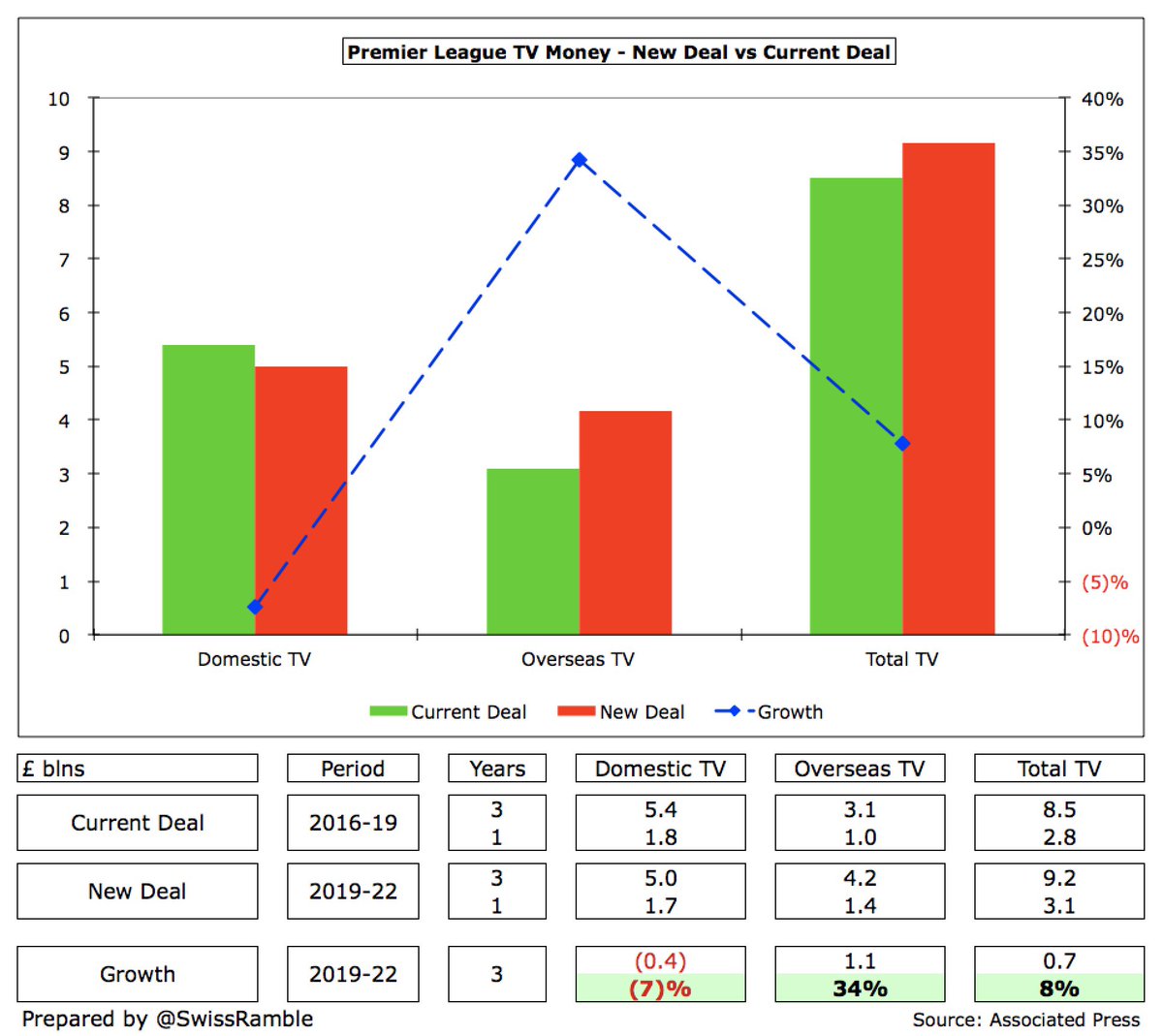

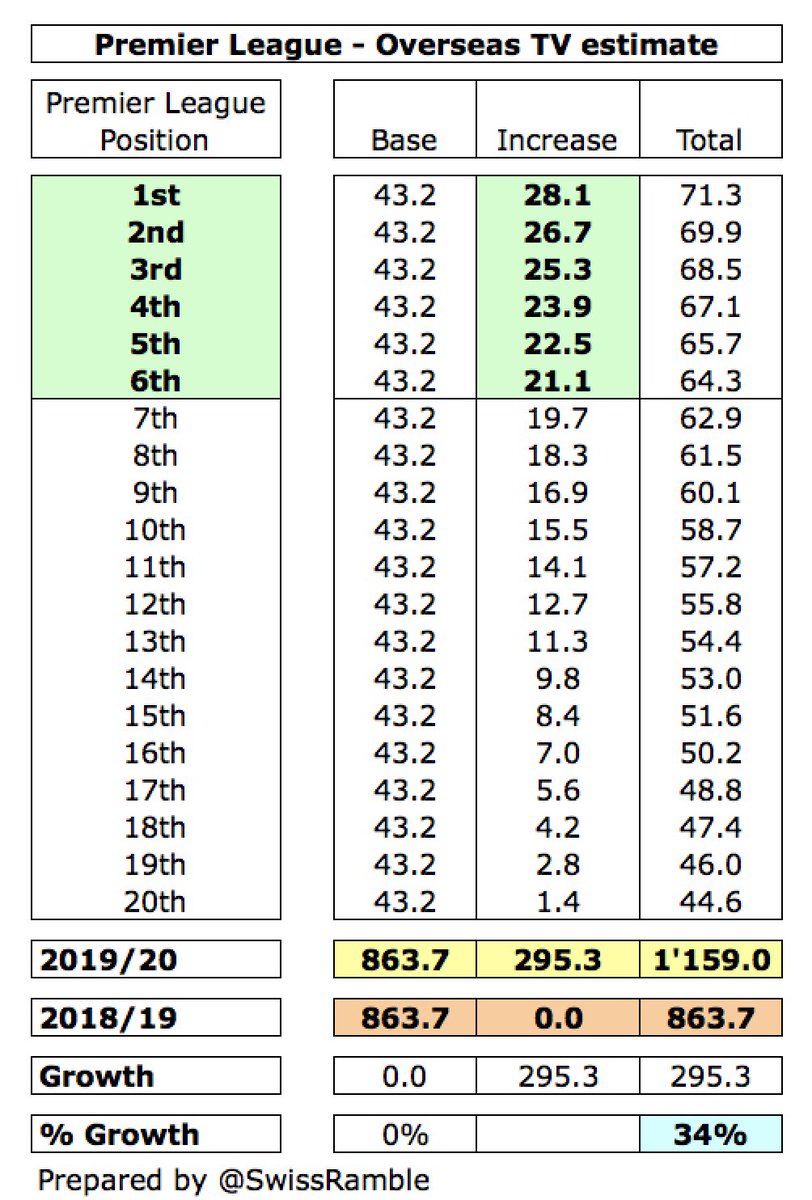

Similarly, latest Premier League deal saw 7% fall in domestic rights, but 34% increase in overseas rights. These were previously distributed equally, but this was changed, so that the increase is distributed based on where clubs finish in the league, benefiting Big Six (usually).

Furthermore the new Champions League format will expand number of clubs from 32 to 36, including 2 places per UEFA coefficient, i.e. a safety net for big clubs. This bloated pig of a competition will greatly expand the amount of games in a blatant attempt to secure more TV money.

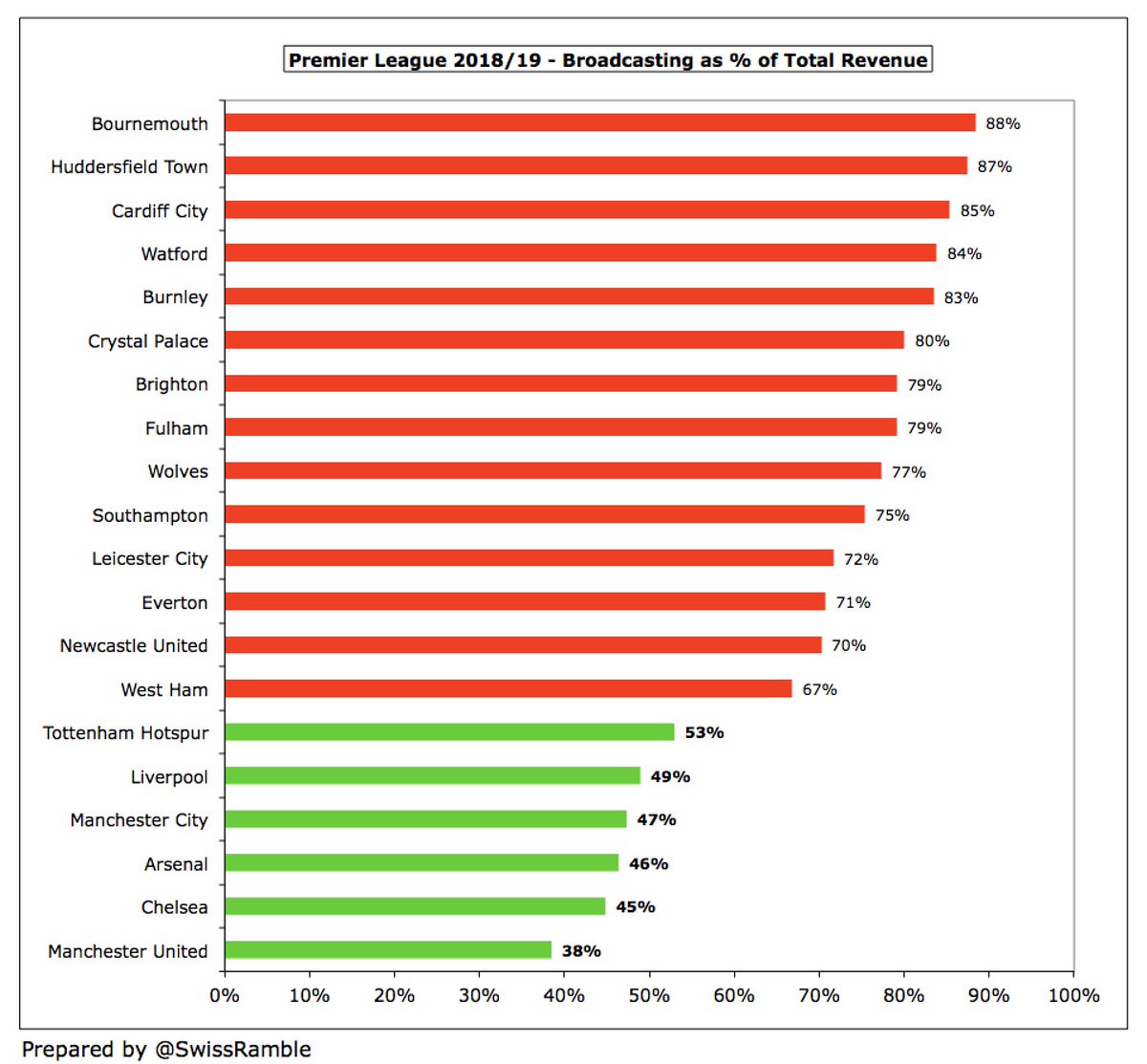

It is little wonder that other clubs reacted so badly, as the Super League could have had a tremendous impact on their revenue, e.g. lower Premier League TV deal if the clubs were expelled. Those clubs outside the Big Six earn between 67% and 88% from broadcasting.

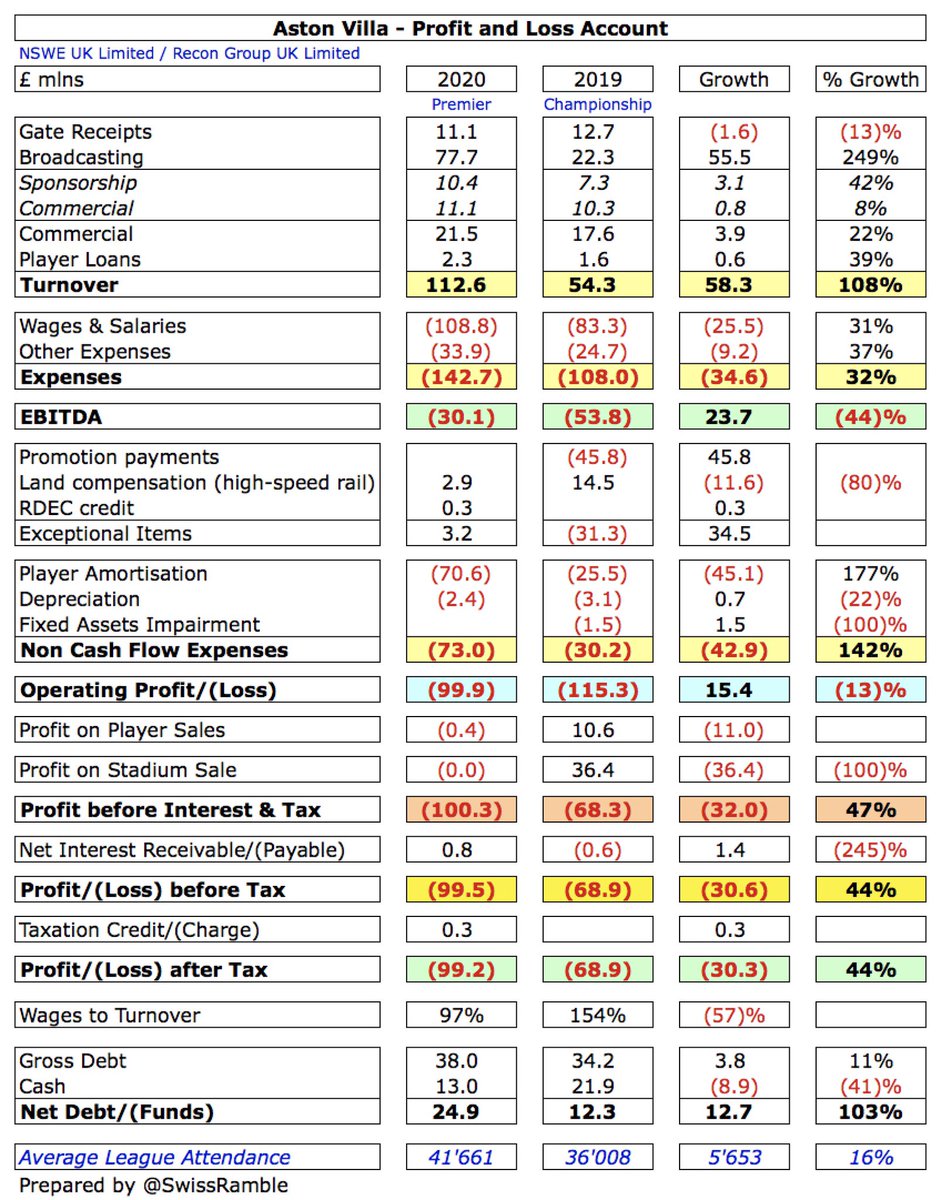

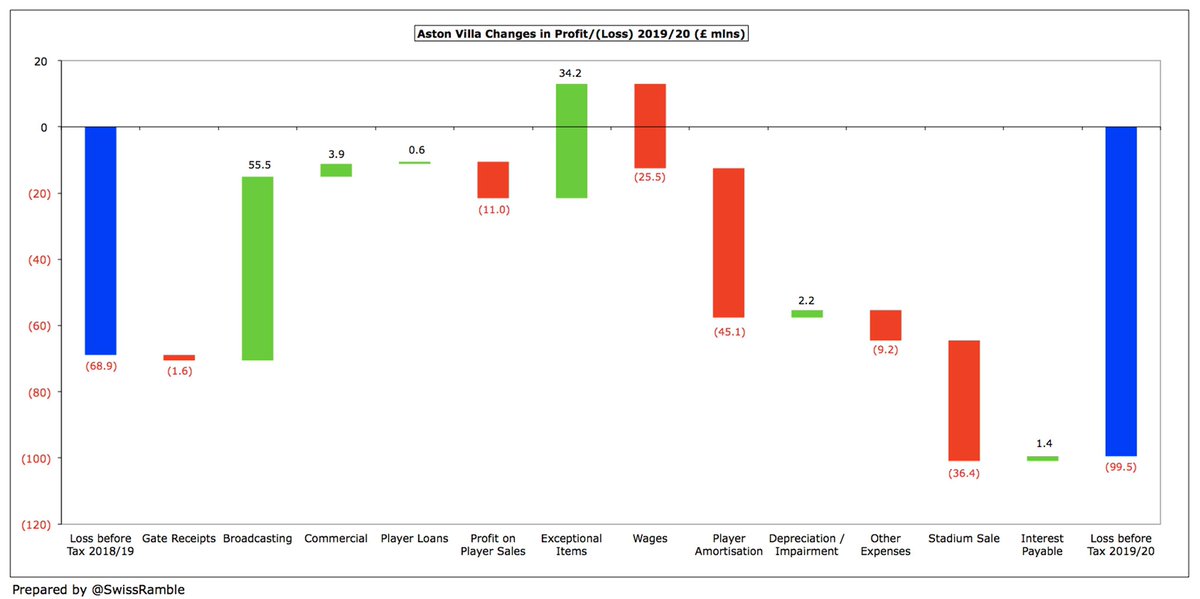

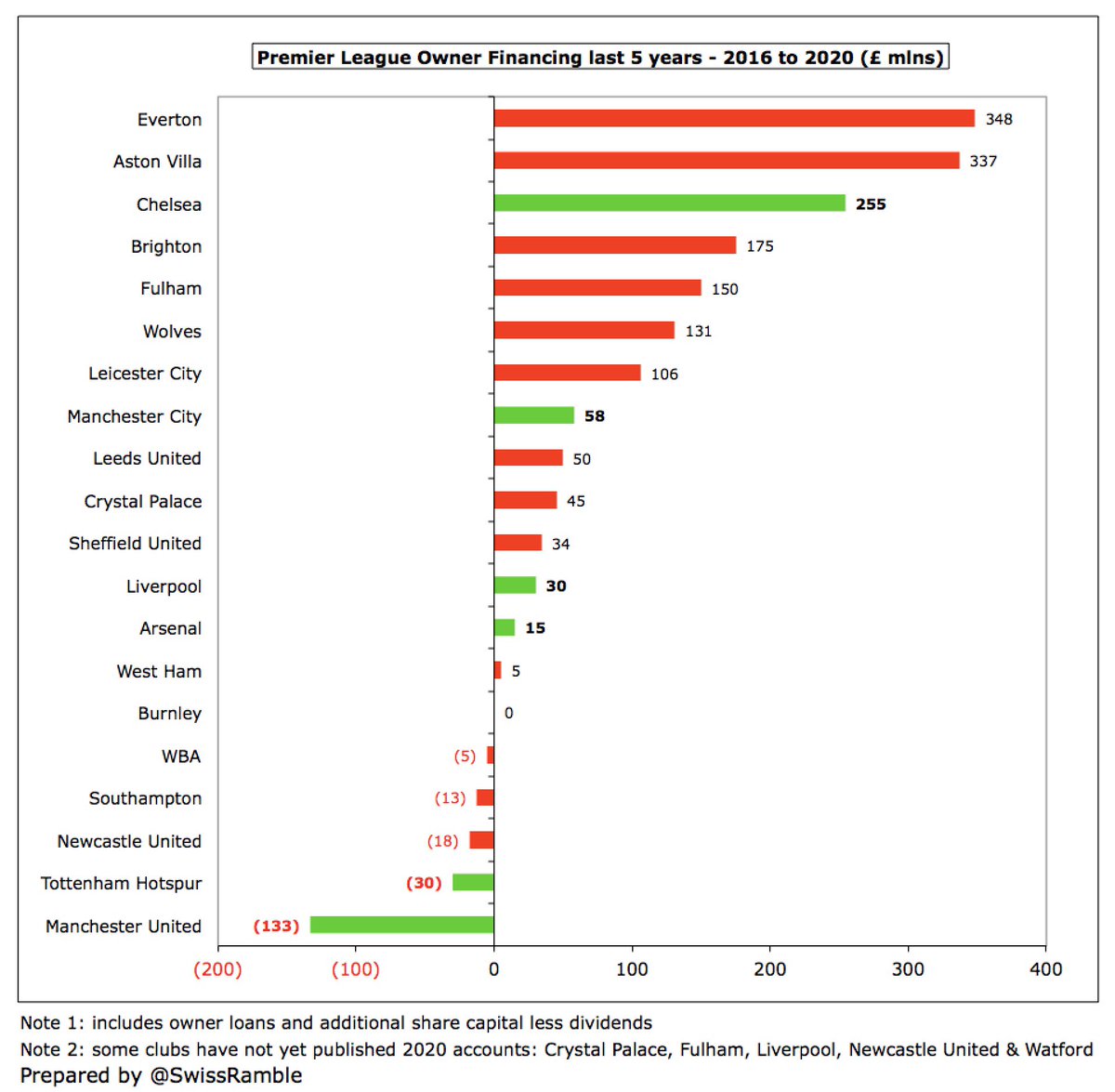

And what about owners that have poured money into Premier League clubs, such as #EFC (£348m in the last 5 years), #AVFC £337m and #BHAFC £175m? The Super League would effectively shut the door in their face. It might also mean that Mike Ashley could not sell #NUFC.

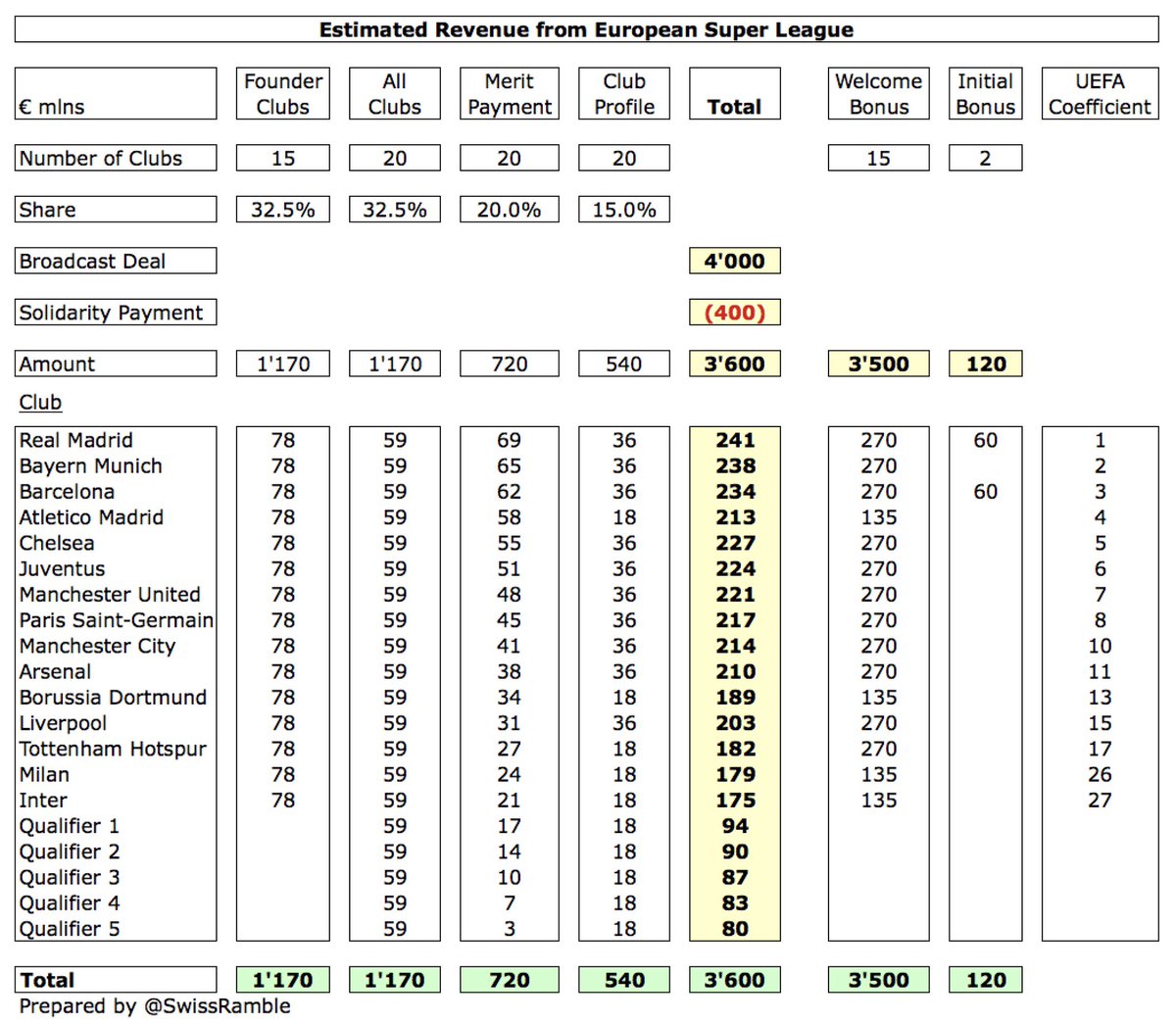

As per media reports, each Super League club would receive a “welcome bonus” of €270m (11 clubs) or €135m (4 clubs) from a €3.5 bln pot funded by JP Morgan to spend on stadiums, training grounds or covering COVID-19 losses. Actually a loan against future revenue to be repaid.

The annual income would be split 4 ways: (a) equal share for 15 Founder Clubs 32.5%; (b) equal share for all 20 clubs 32.5%; (c) merit payment 20%, distributed like Premier League; (d) club profile 15%. In addition, #RealMadrid and #FCBarcelona get €60m in first 2 years.

Assuming revenue of €4 bln (much higher than UEFA €3.25 bln), I have estimated that the 15 Founder clubs would earn between €241m and €175m. The 5 qualifiers would receive €80m-€94m. These numbers are obviously modeled, but it does give some idea of the “size of the prize”.

To place this into perspective, this is almost twice as much as the highest earners in the 2019/20 Champions League: #PSG €127m, #FCBayern €125m, #FCBarcelona €100m and #MCFC €95m. This is not an attempt to justify the Super League, but it does explain the attraction.

The Super League argued that solidarity payments to non-participating clubs would be more than 3 times as much as those under UEFA. These are currently €130m (4% of €3.25 bln), so that implies annual payments of around €400m (in line with stated €10 bln over 23 years).

That all sounds wonderful, but the assumption of a €4 bln broadcasting deal (twice the Champions League money) feels aggressive, especially as the Super League did not have a broadcasting partner lined up. In fact, key players have ruled themselves out (Sky, BT, DAZN and Amazon)

In addition, the clubs would have to repay the JP Morgan €3.5 bln funding, which reportedly would cost €264m a year (2-3% interest rate). There is also the inconvenient fact that the investment bank has since pulled their backing after the overwhelmingly negative response.

Although fans might think that this is a case of “all’s well that ends well”, it would be no surprise if the leading clubs had another go at forming a Super League at some stage. The worry is that next time they might actually put together a coherent plan with much better PR.

• • •

Missing some Tweet in this thread? You can try to

force a refresh