Aston Villa’s 2019/20 financial results covered the season following promotion, when they retained their Premier League status by finishing 17th and also reached the Carabao Cup final. Second season after Nassef Sawiris and Wes Edens acquired the club. Some thoughts follow #AVFC

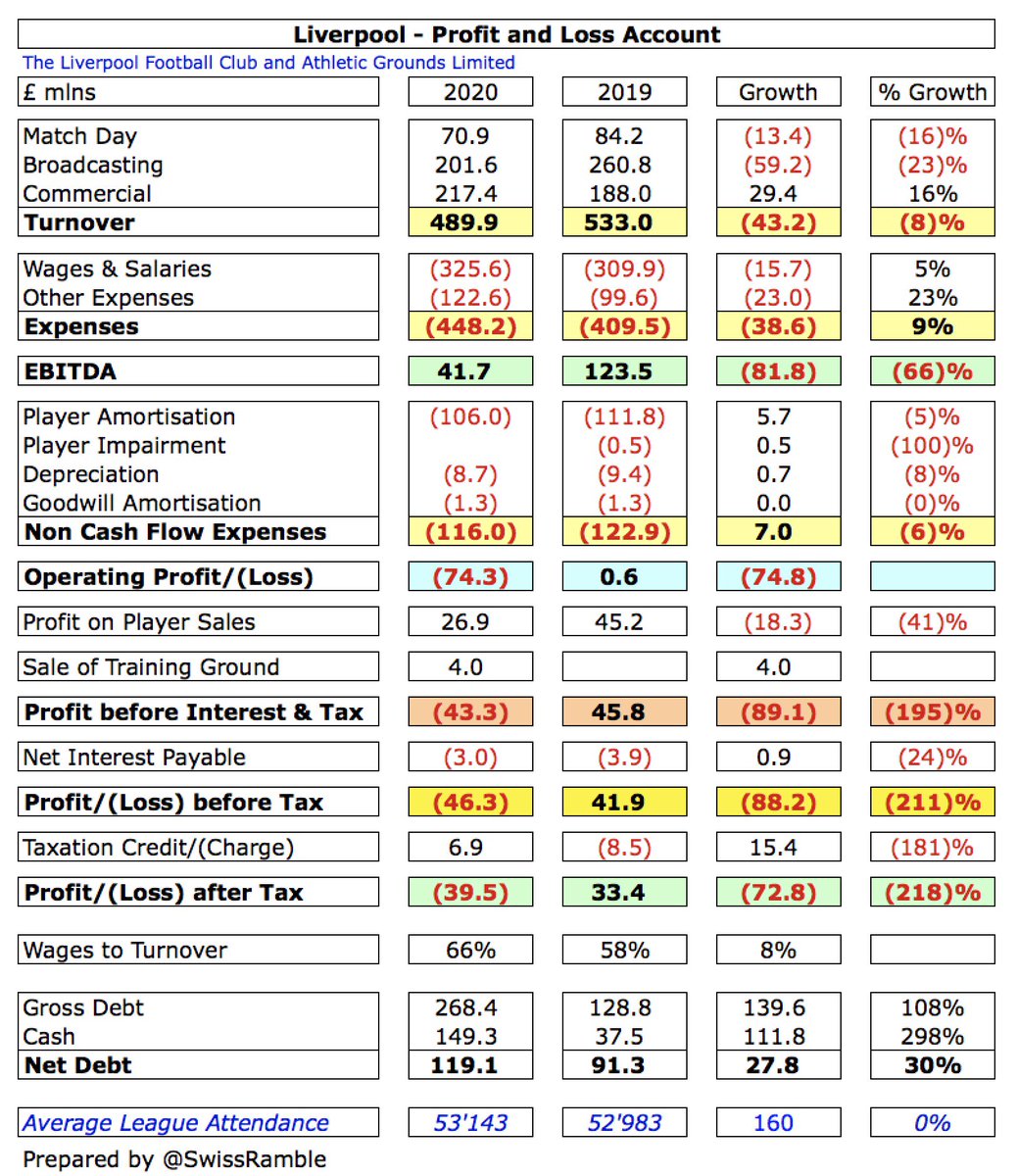

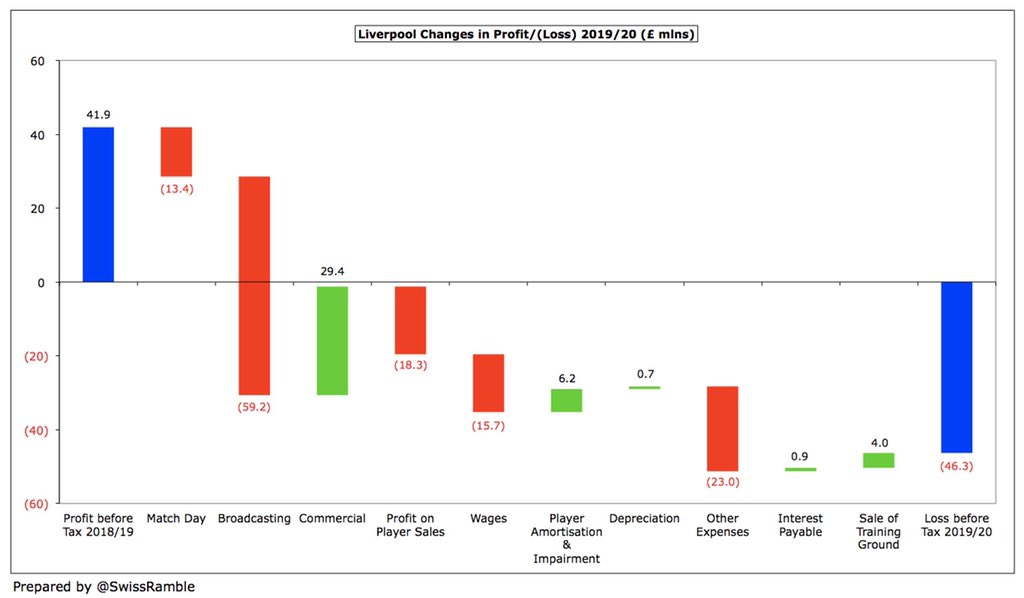

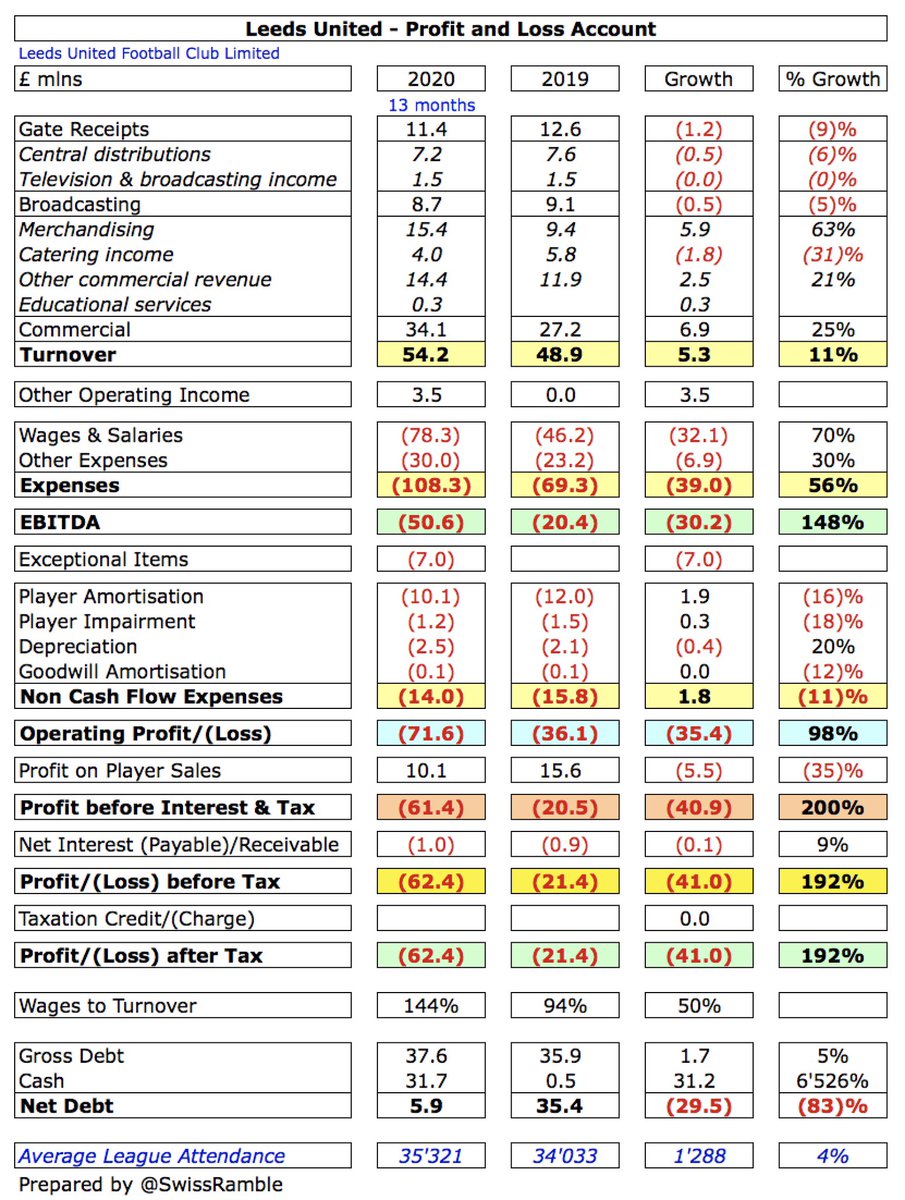

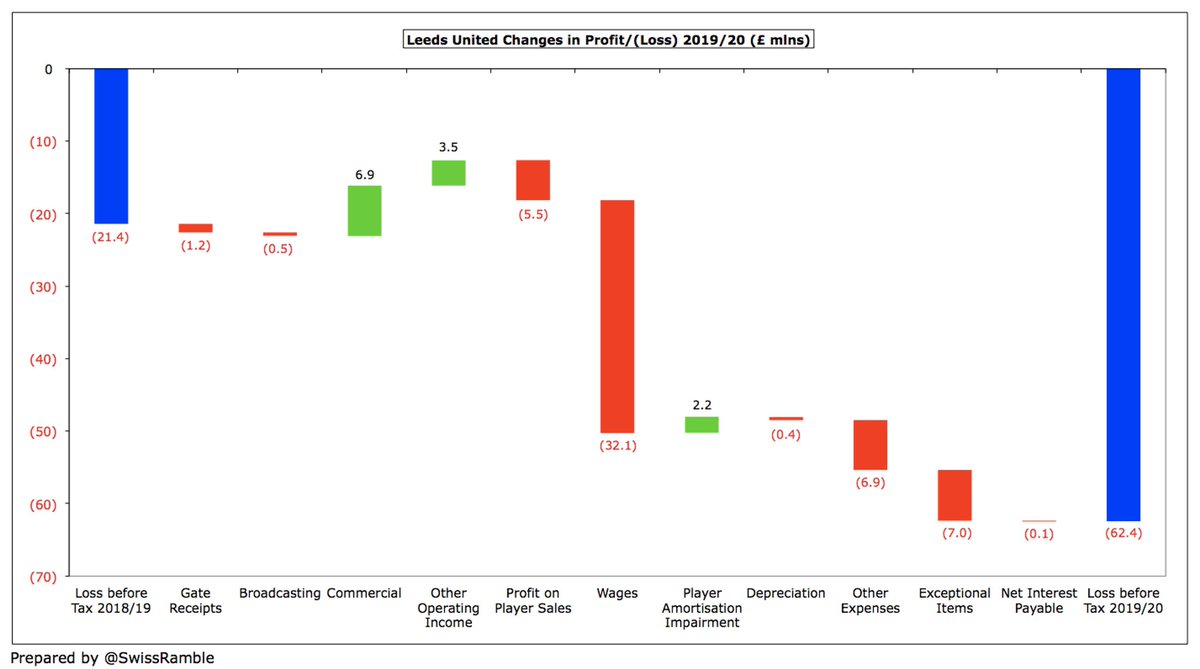

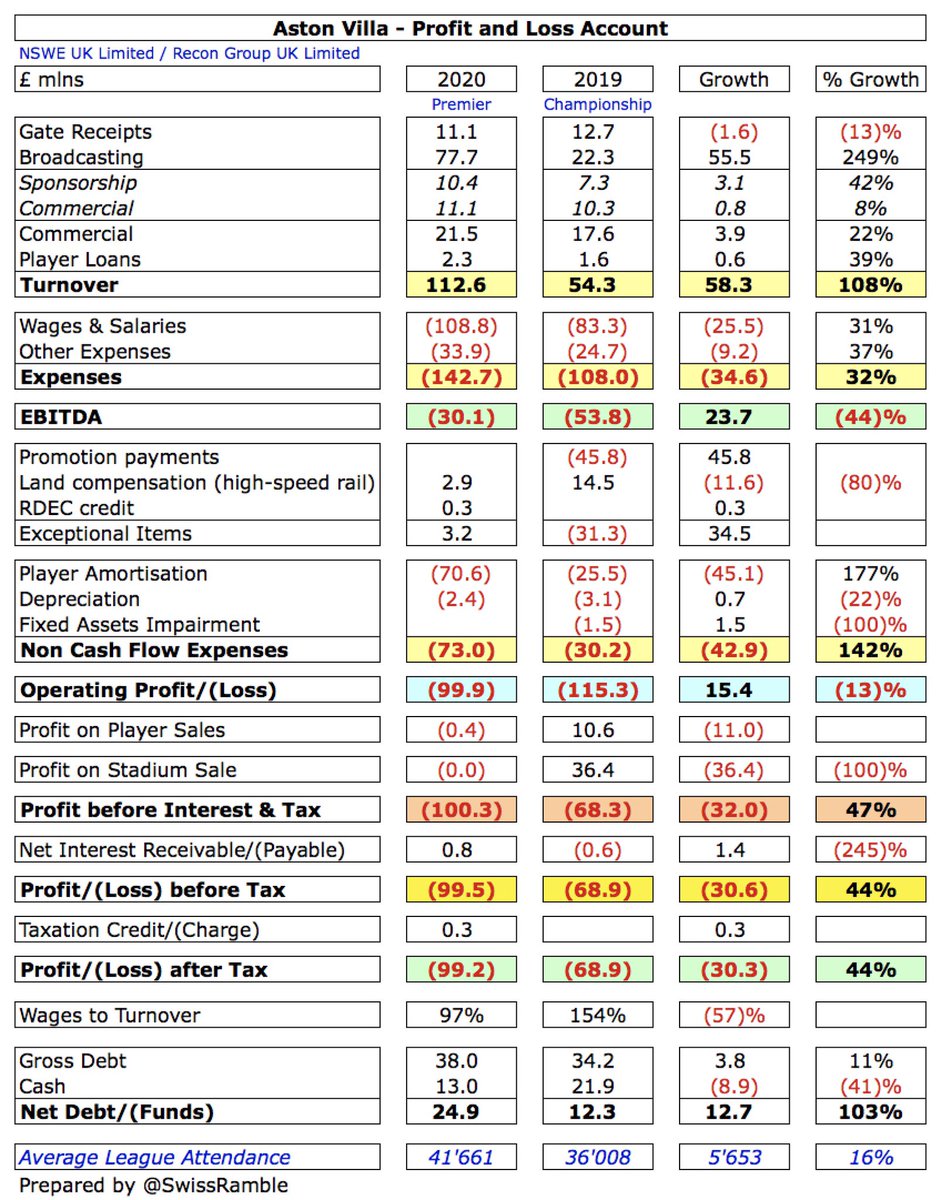

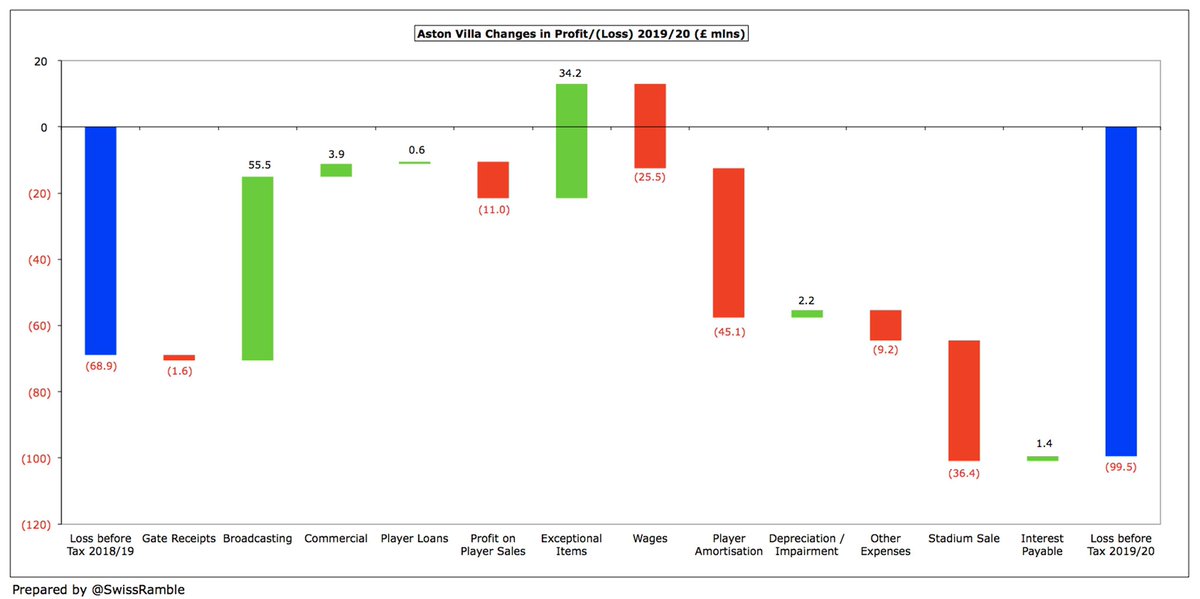

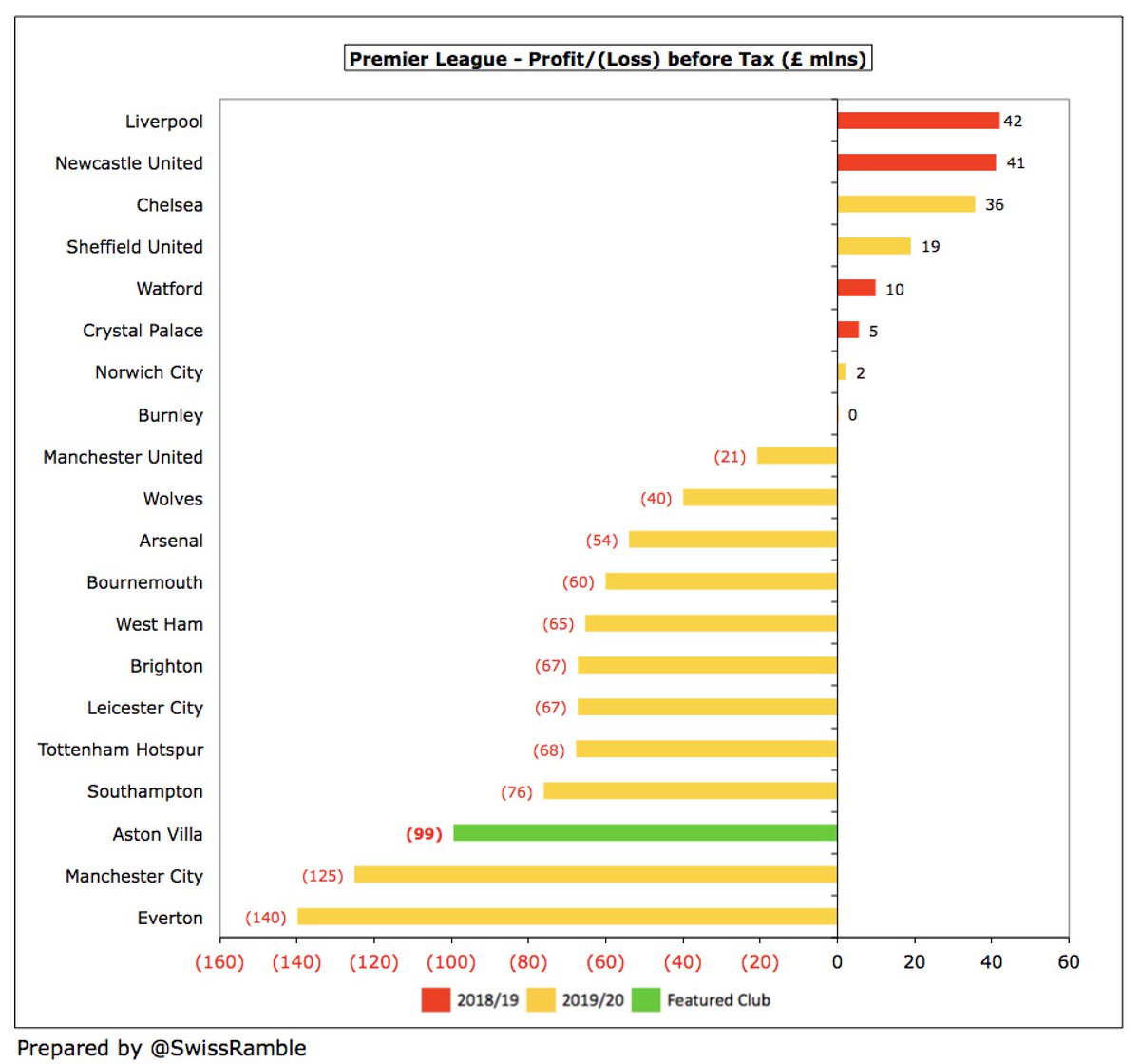

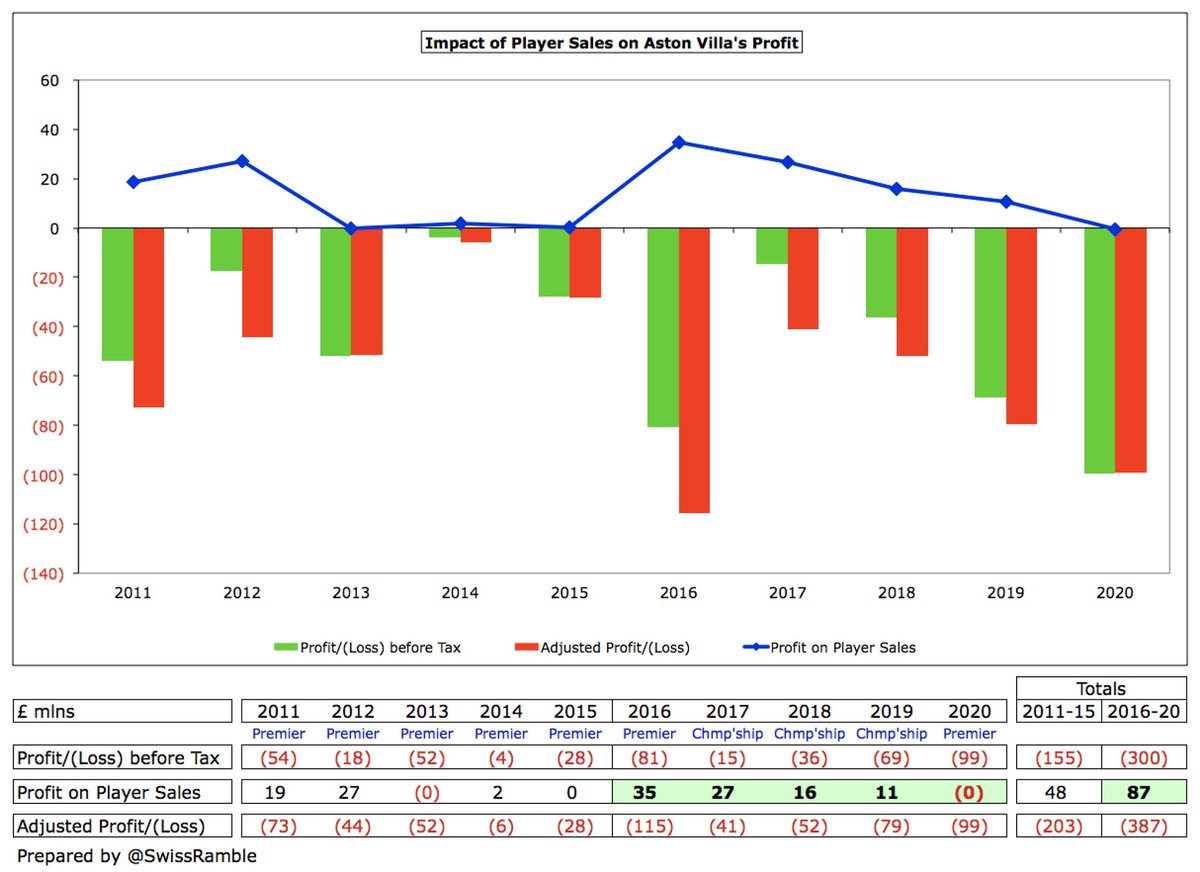

Despite promotion #AVFC loss widened from £69m to £99m. Revenue more than doubled from £54m to £113m, though profit on player sales fell £11m to a small negative result, while investment in the squad to compete in the Premier League increased expenses by £76m (55%).

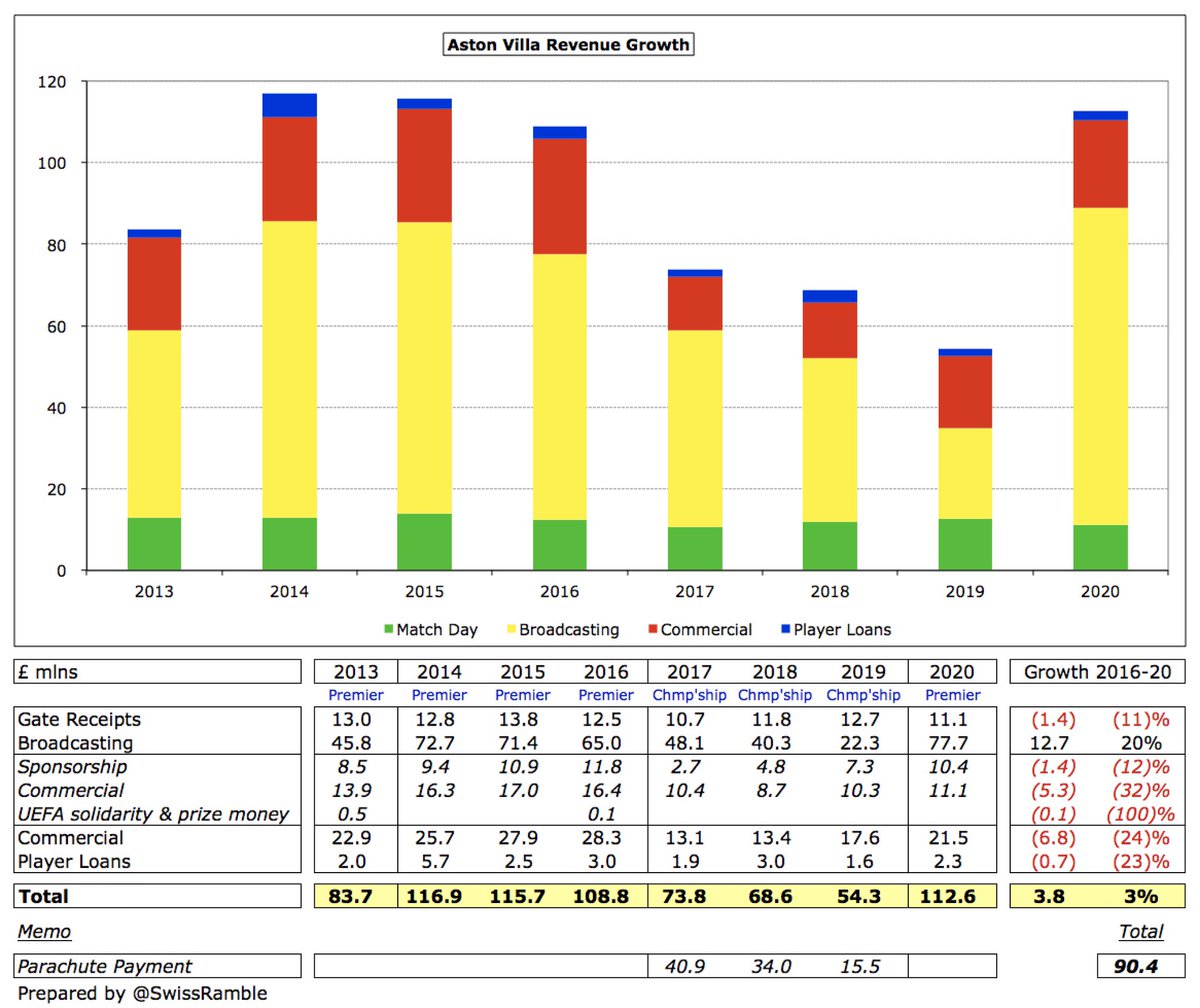

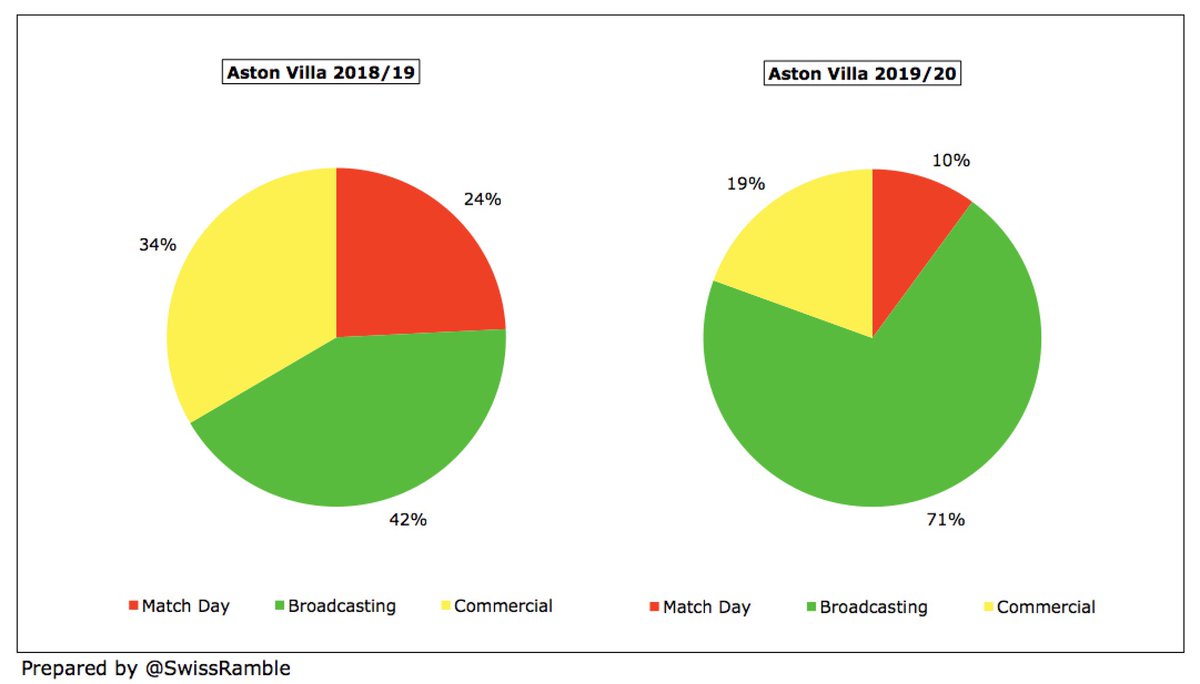

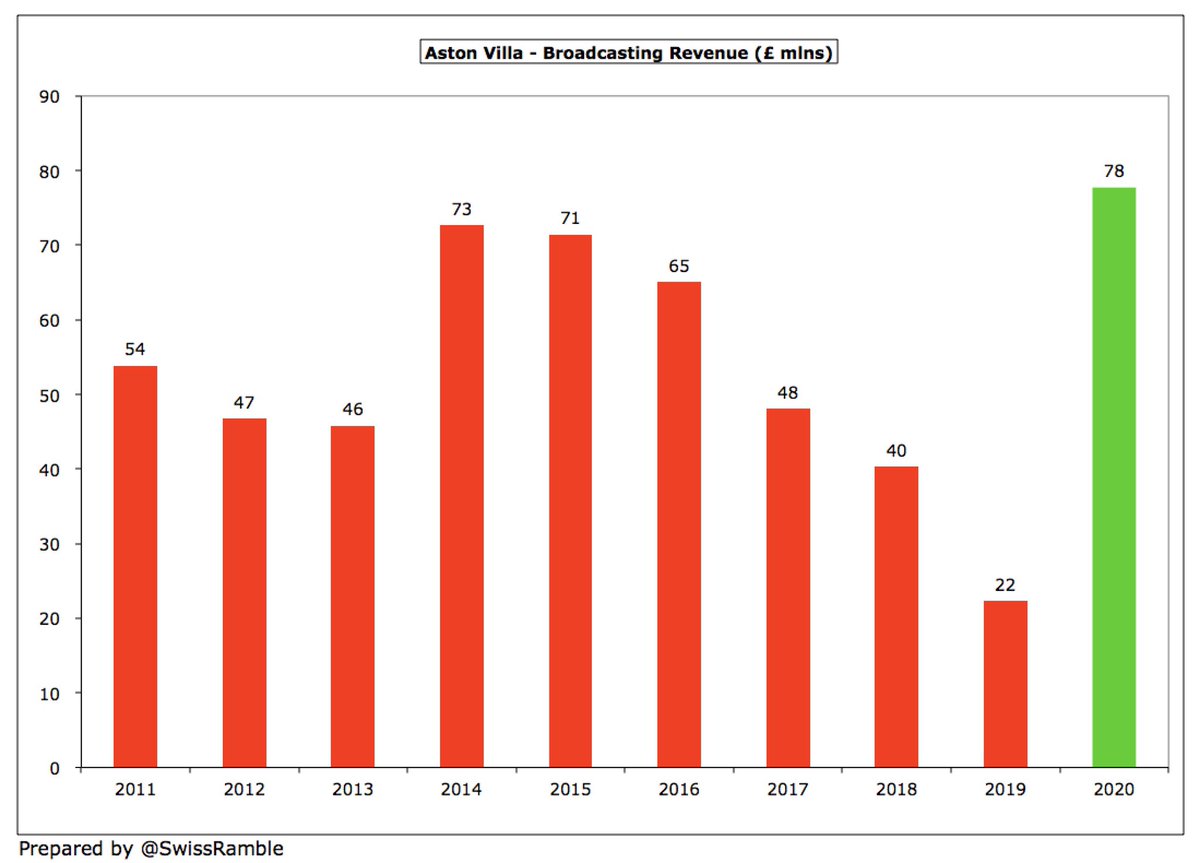

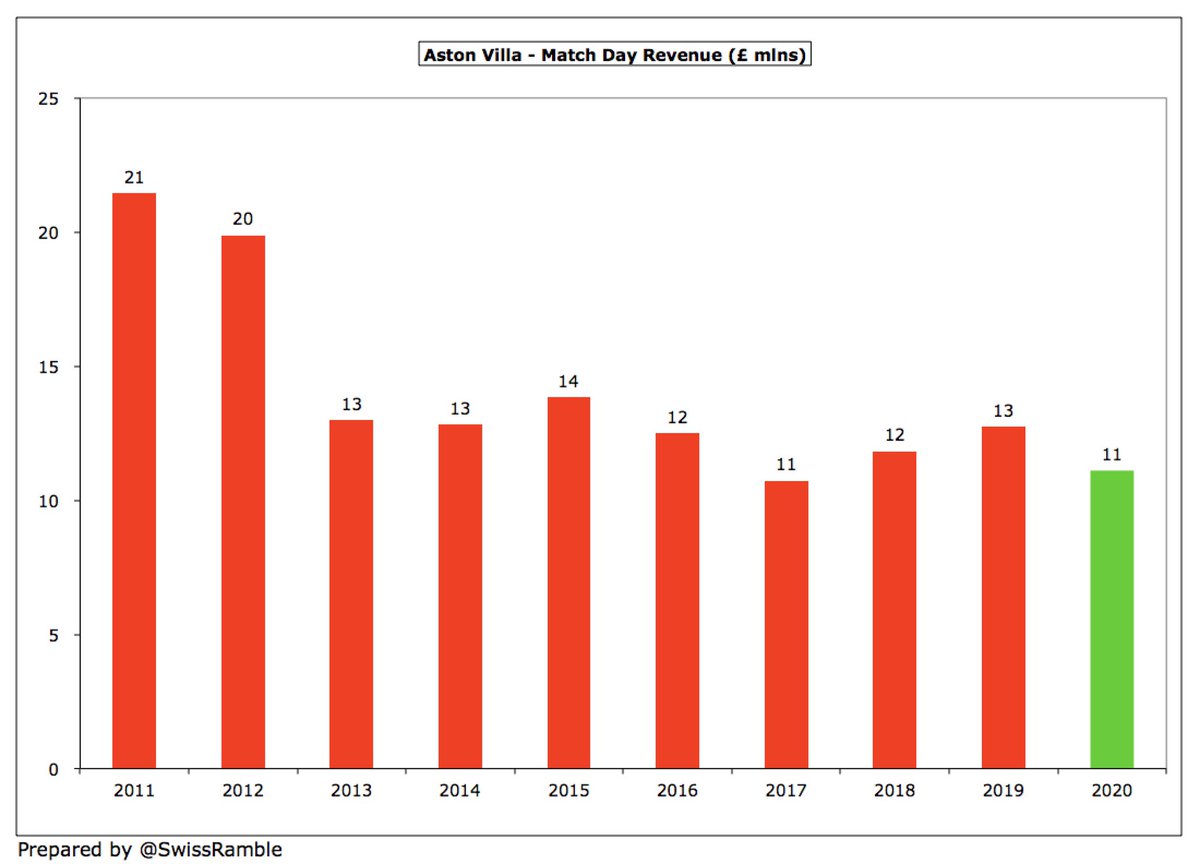

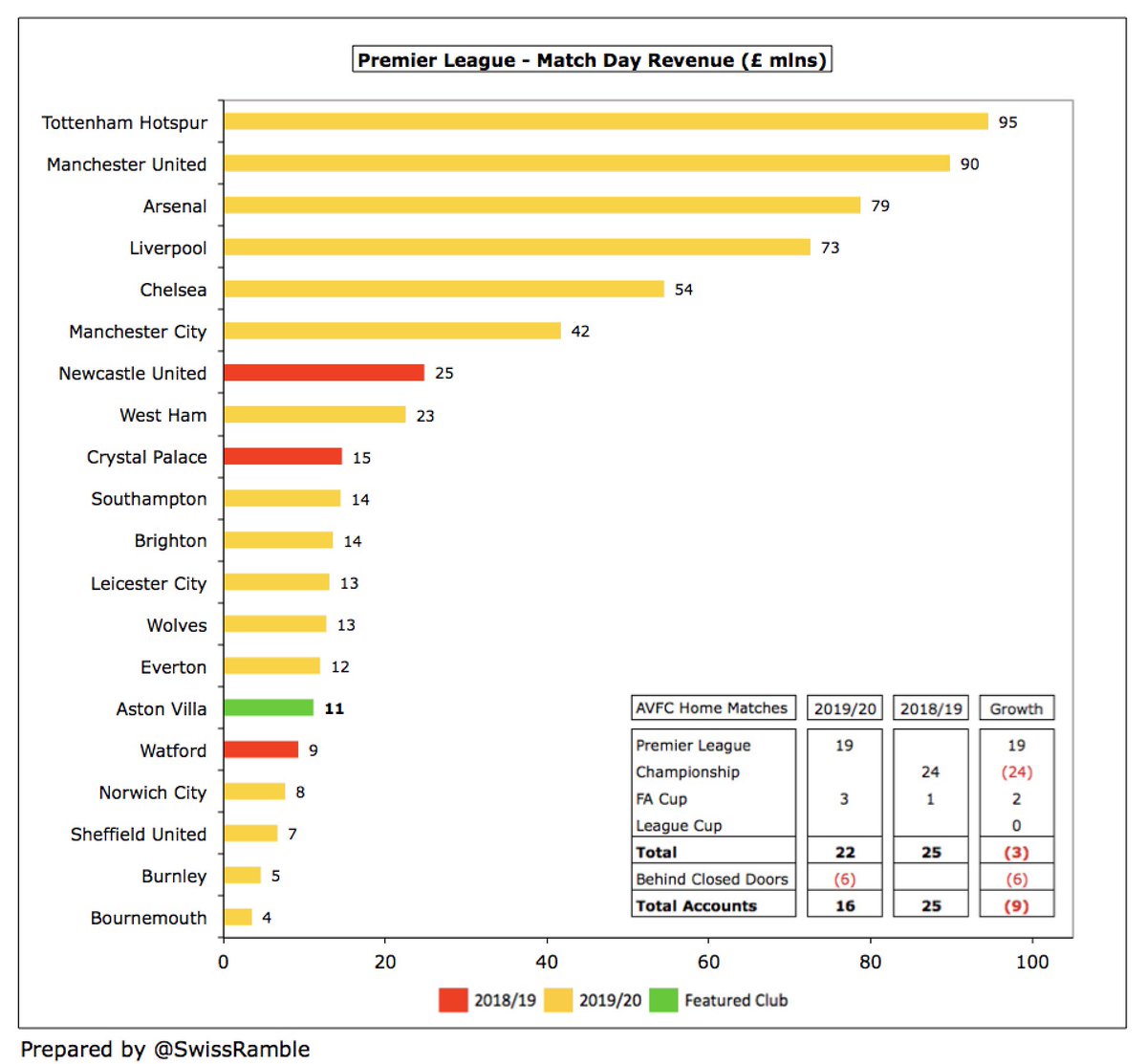

Main driver of the #AVFC £58m revenue increase was broadcasting, up £56m from £22m to £78m, due to the much more lucrative Premier League TV deal, though commercial also rose £4m to £21m, while player loans were up £1m to £2m. However, gate receipts were down £2m (13%) to £11m.

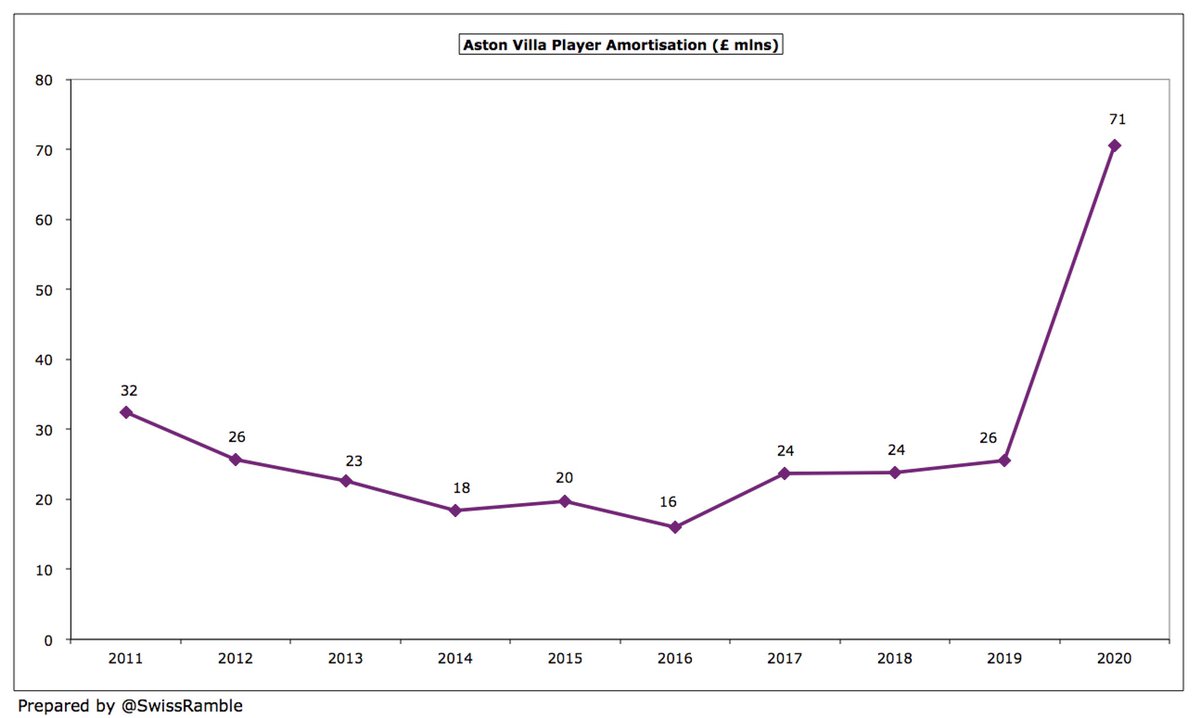

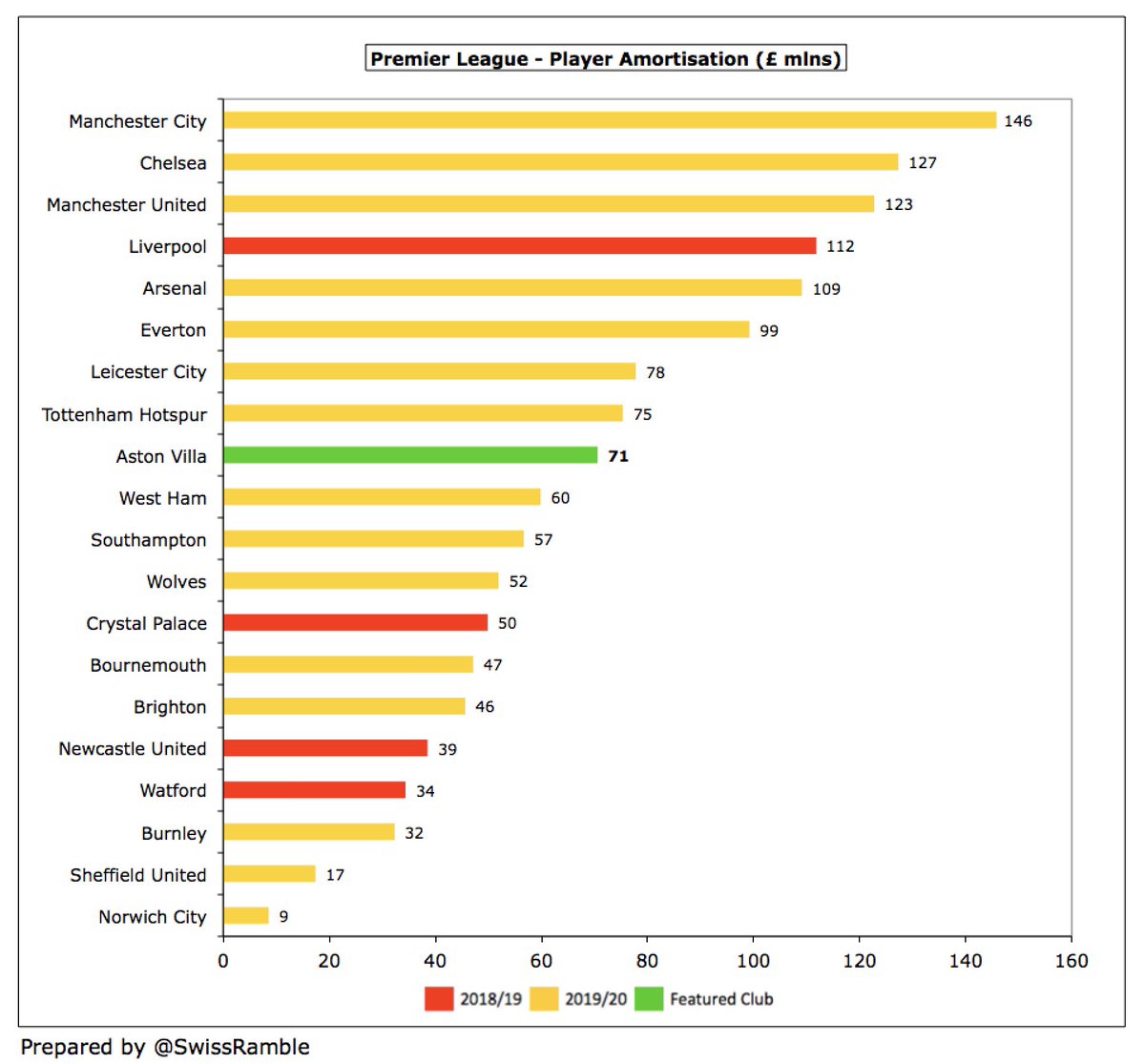

Investment in rebuilding the #AVFC first-team squad resulted in big cost growth: wage bill rose £26m (31%) from £83m to £109m, while player amortisation shot up £45m, almost tripling from £26m to £71m. Other expenses increased £9m (37%) to £34m.

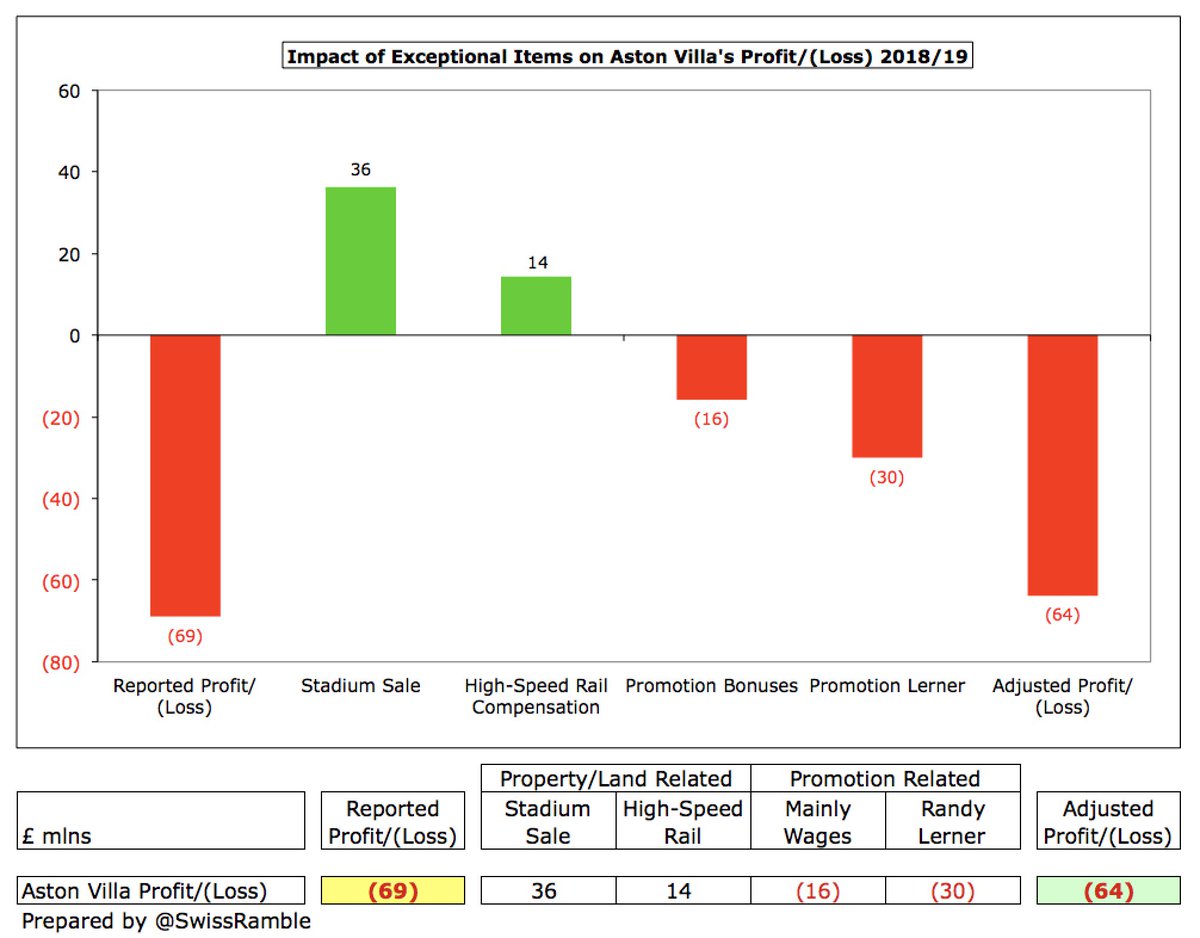

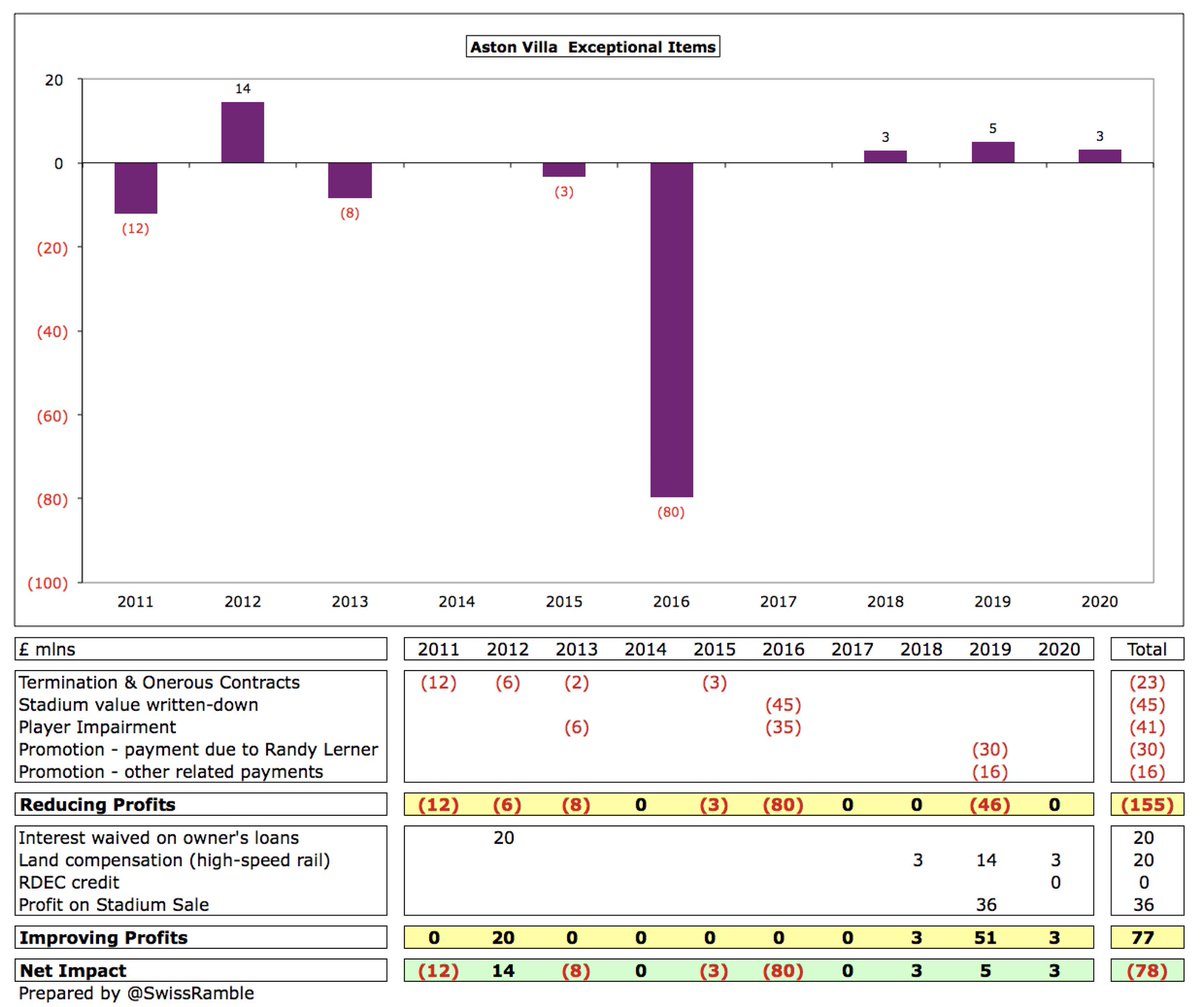

Worth noting that #AVFC prior year accounts included many exceptional items that more or less offset each other. Accounting gains were made by £36m profit from the stadium sale £36m and £14m HS2 land compensation, but on the other hand there were £46m promotion payments.

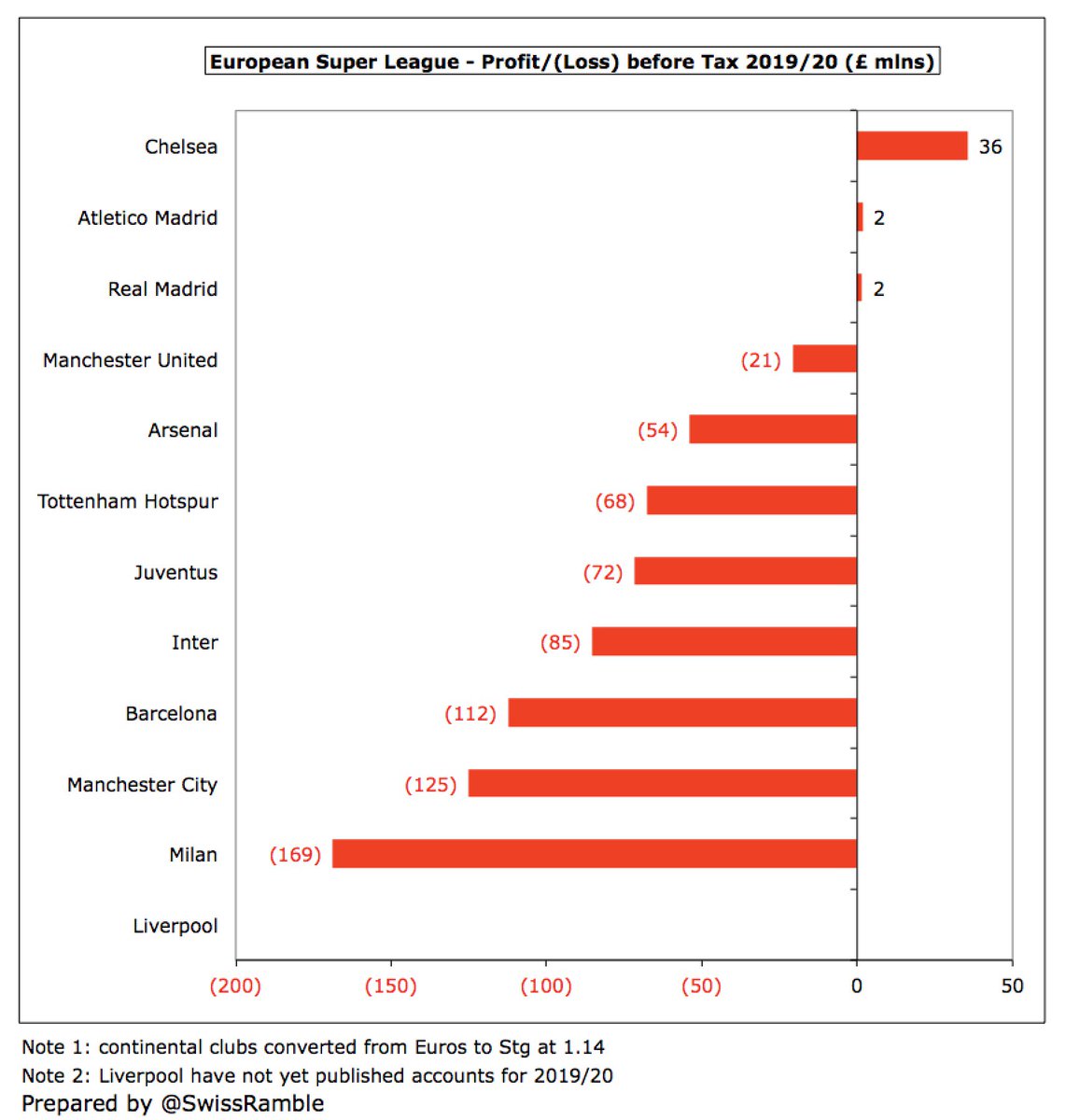

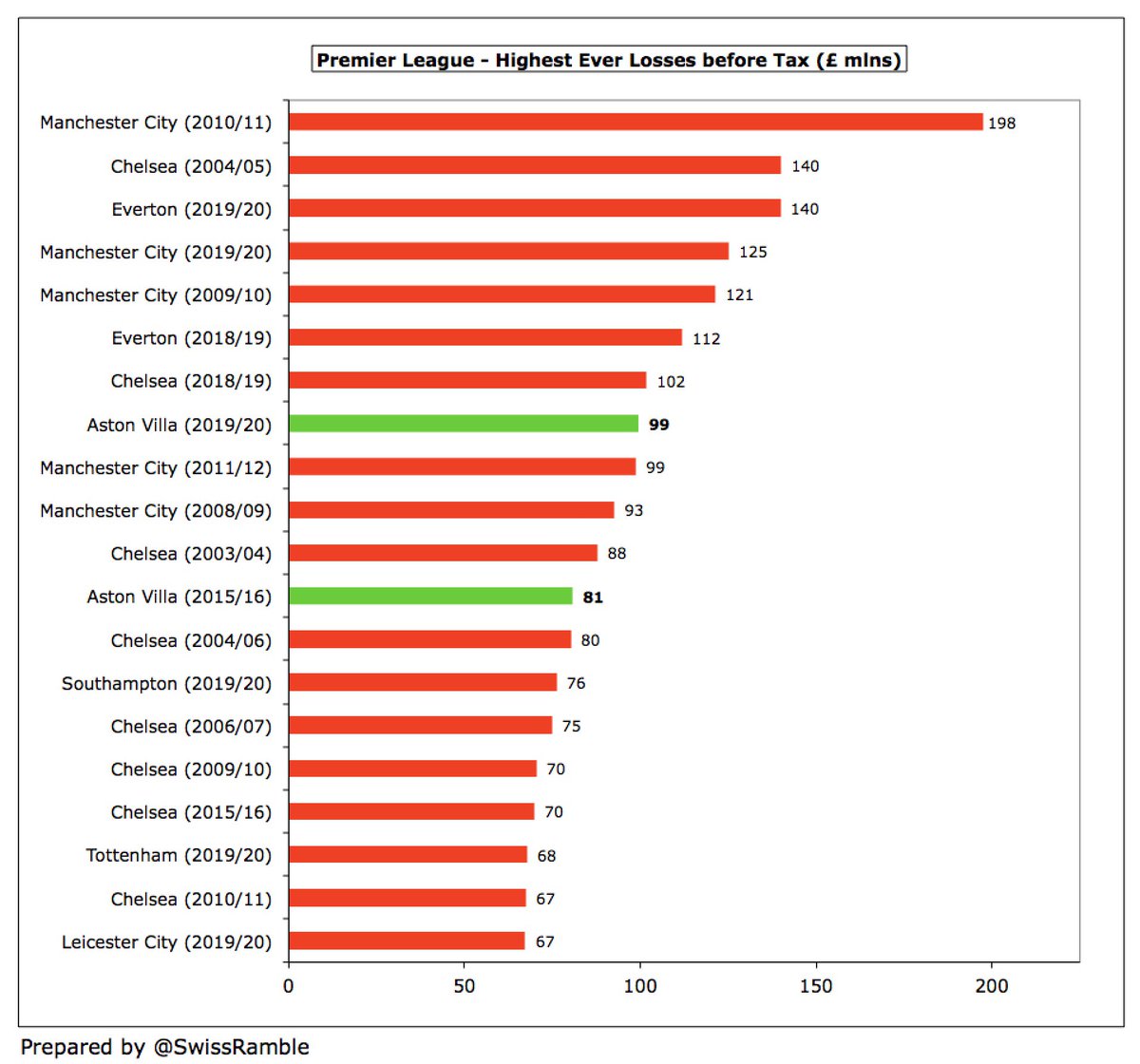

#AVFC £99m loss is obviously not great, but everyone has been adversely impacted by COVID with half the clubs to date in the Premier League 2019/20 posting losses above £50m. That said, only #EFC £140m and #MCFC £125m have reported larger losses than Villa.

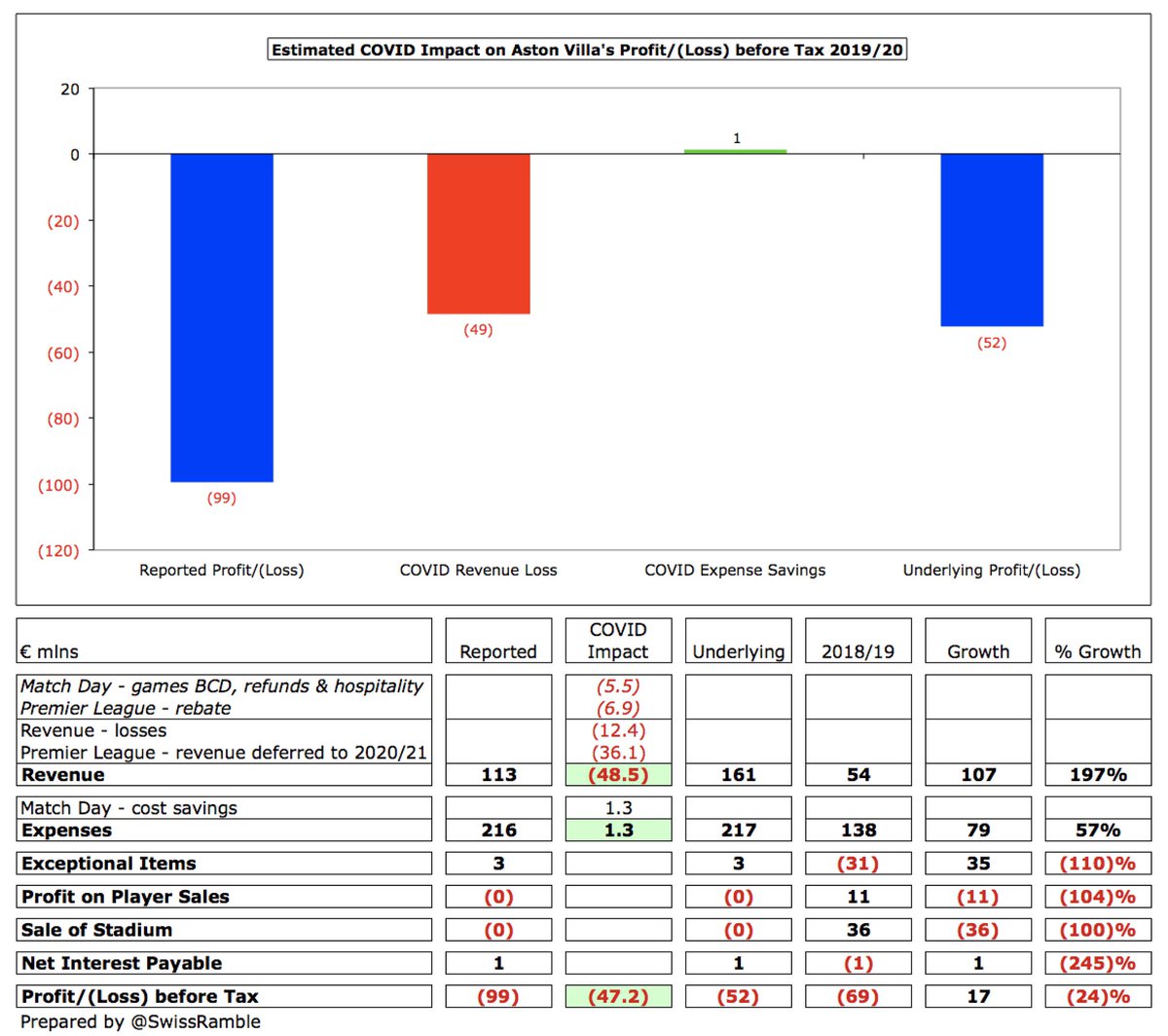

Clearly, #AVFC figures have been significantly hit by the pandemic, which has resulted in money lost from a rebate to broadcasters and games played behind closed doors, while revenue for games played after 30th June accounting close has been deferred to 2020/21 accounts.

In fact, COVID resulted in £48m reduction to #AVFC revenue, split between £12m lost (match day £5.5m, TV rebates £6.9m) and £36m broadcasting deferred to 2020/21. Along with £1.5m cost savings, net impact is £47m, but club would still have posted £52m loss.

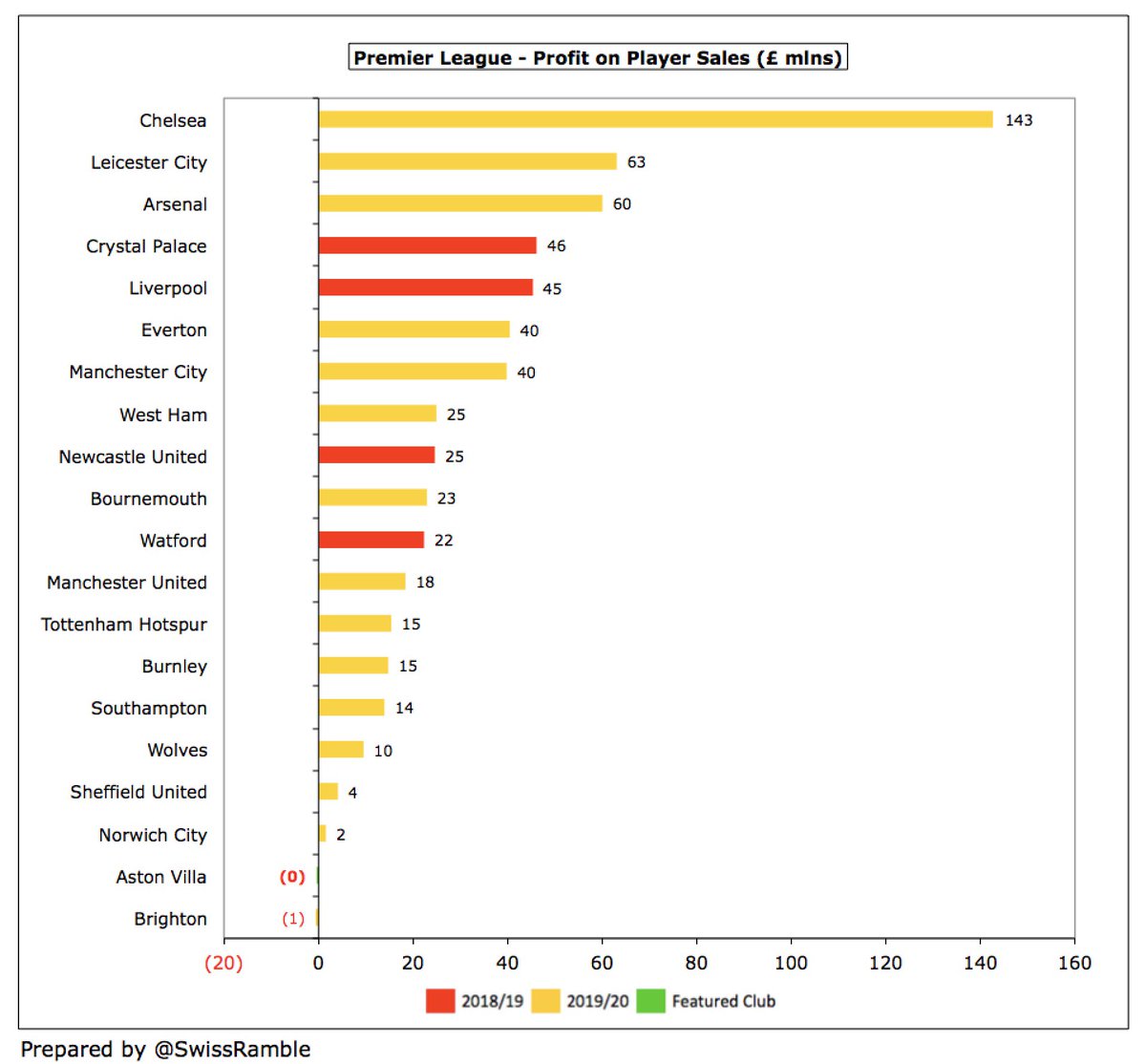

#AVFC made a small £0.4m loss from player sales, down from prior year’s £11m, as many players were released for nothing. Unsurprisingly, this is one of the worst player trading performances in the Premier League, way below the likes of #CFC £143m, #LCFC £63m and #AFC £60m.

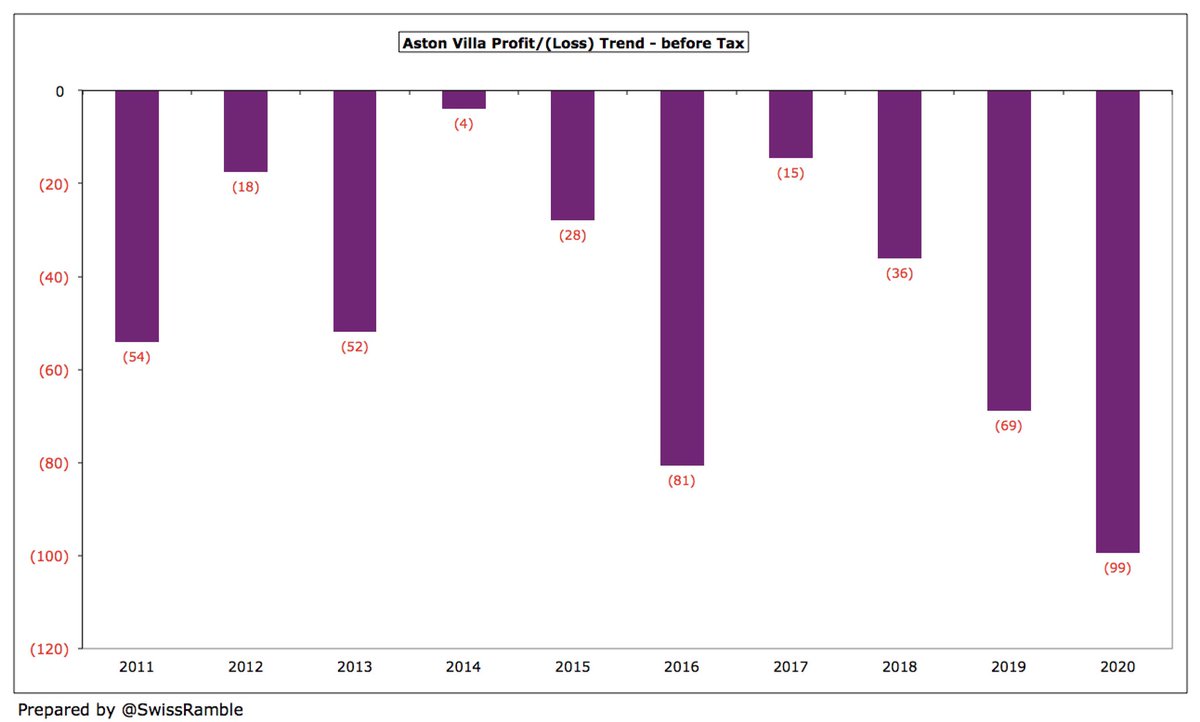

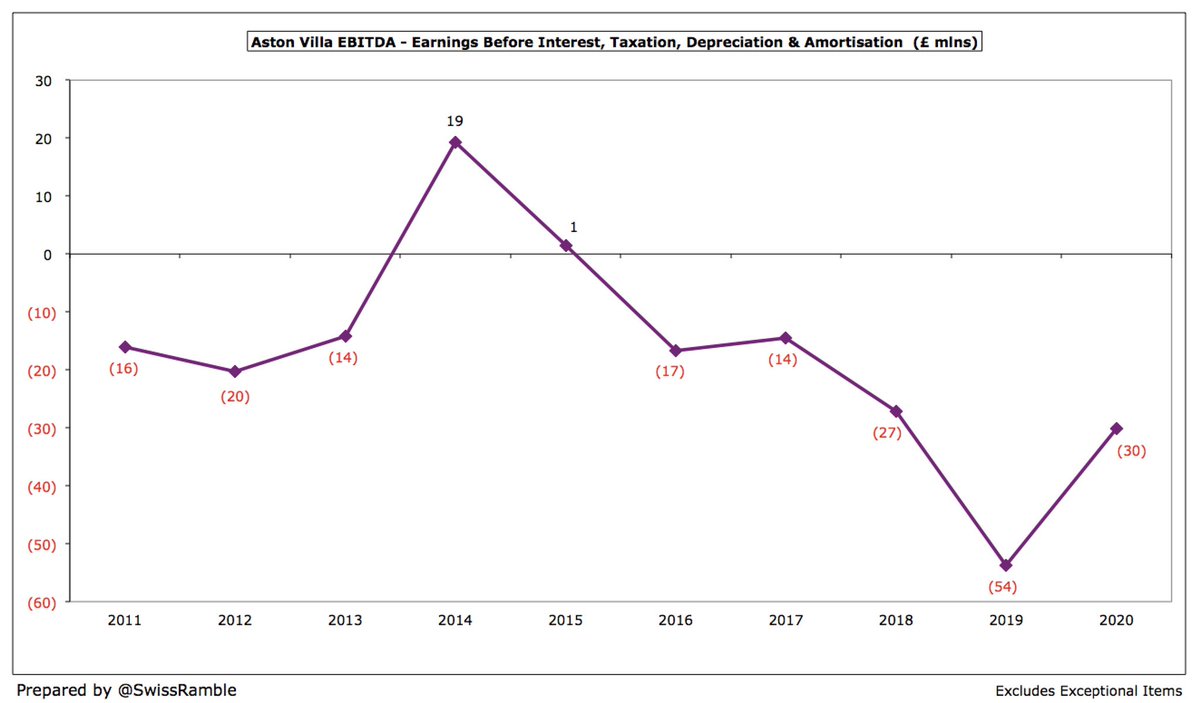

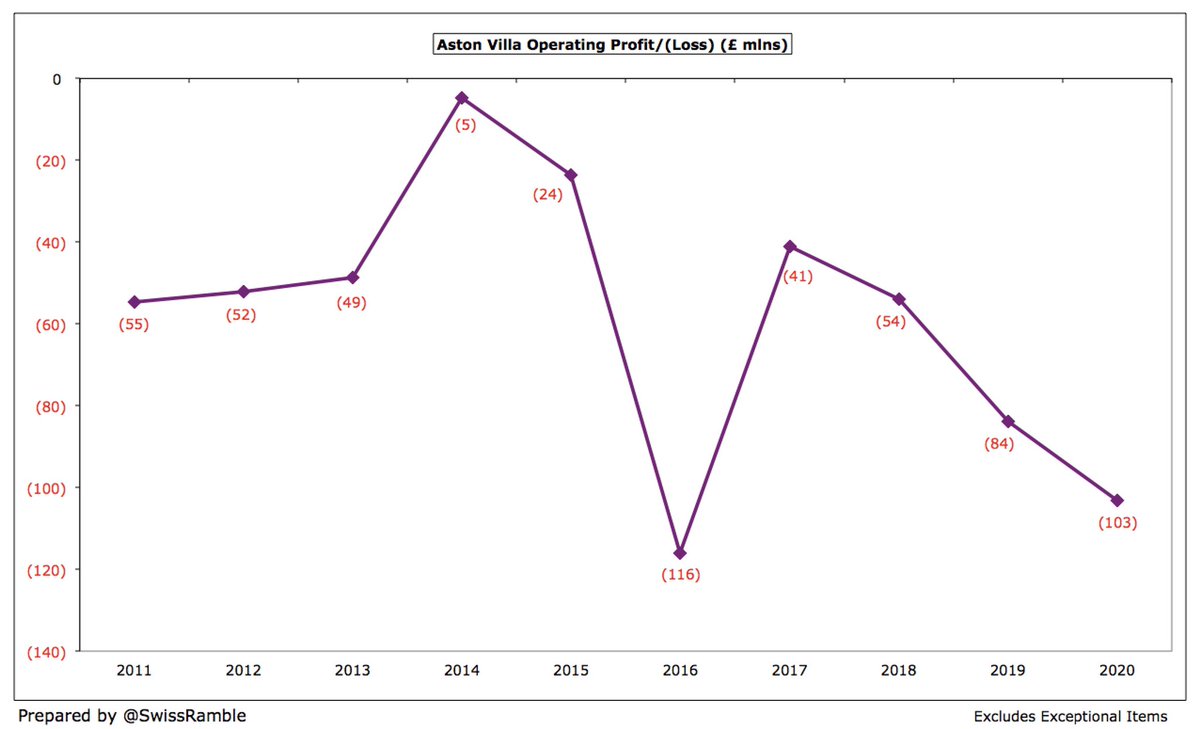

The large loss was nothing new for #AVFC, as they have consistently lost money, posting total losses of £455m in the last decade, including £119k in the 3 years spent in the Championship. In fact, the £99m loss in 2019/20 is actually 8th highest ever in Premier League.

#AVFC only had £3m exceptional items in 2020: high-speed rail compensation £2.9m and RDEC credit £0.3m. Prior year included £36m stadium sale profit and £14m HS2 compensation, but £45m promotion payments: £15m bonuses and £30m to former owner, Randy Lerner, after Xia defaulted.

Until the blip in 2020, #AVFC had been generating more from player sales. They still earned £87m from this activity in the last 5 years, compared to £48m in the preceding 5-year period. That said, profit has declined each year since 2016 and 2021 is also likely to be low.

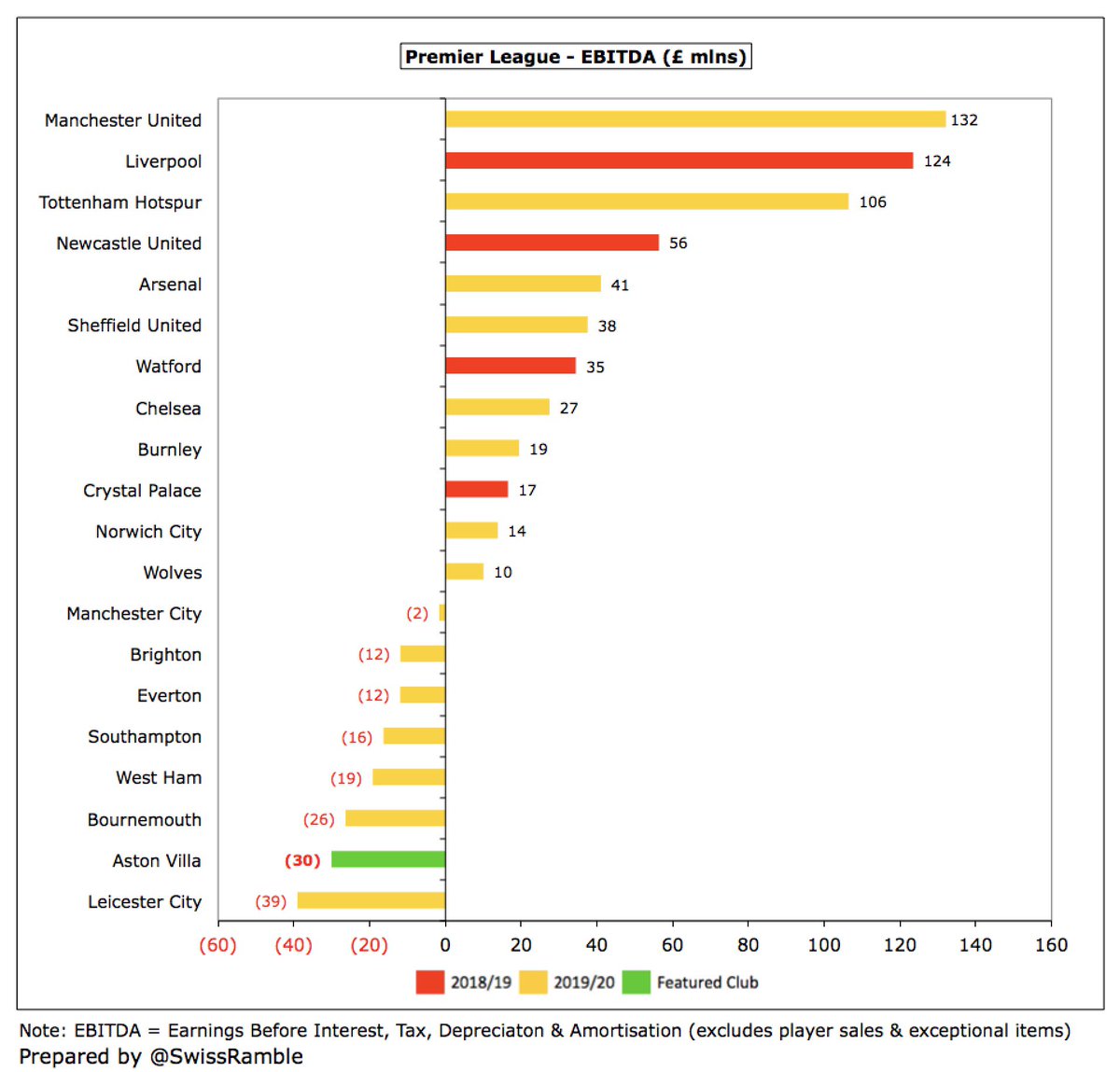

#AVFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £(54)m to £(30)m, but this was still one of the worst performances in the Premier League, only surpassed by #LCFC £(39)m.

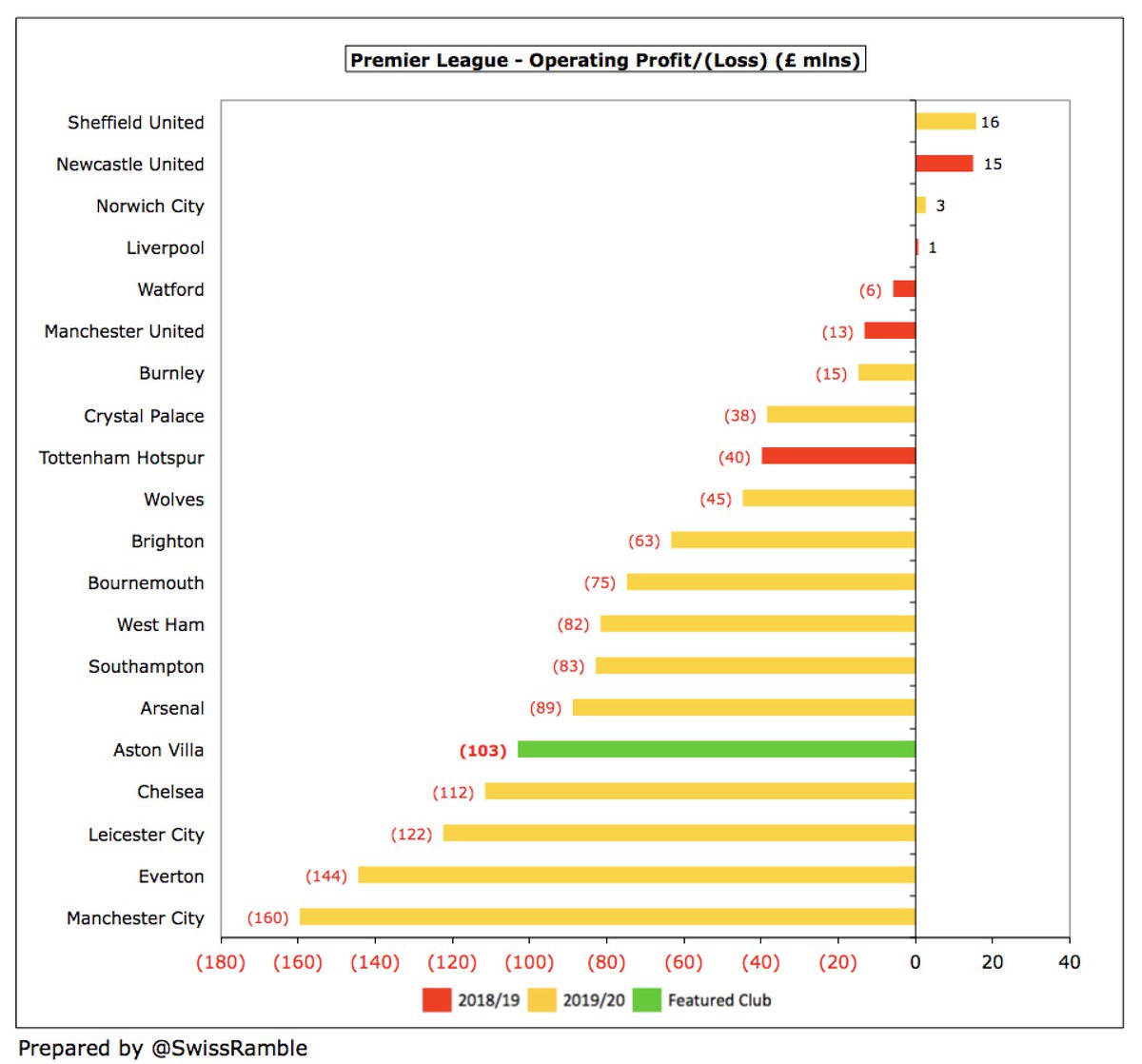

#AVFC operating loss (i.e. excluding player sales and interest) widened from £84m to £103m, the third year in a row it has deteriorated. Only four clubs in the Premier League reported a worse result than Villa: #MCFC £160m, #EFC £144m, #LCFC £122m and #CFC £112m.

Despite the adverse impact of the pandemic, #AVFC £113m revenue is still £4m (3%) higher than the last time they were in the top flight in 2016, mainly due to higher broadcasting (71% of total revenue). Without COVID, Villa would have reported £161m revenue, a club record.

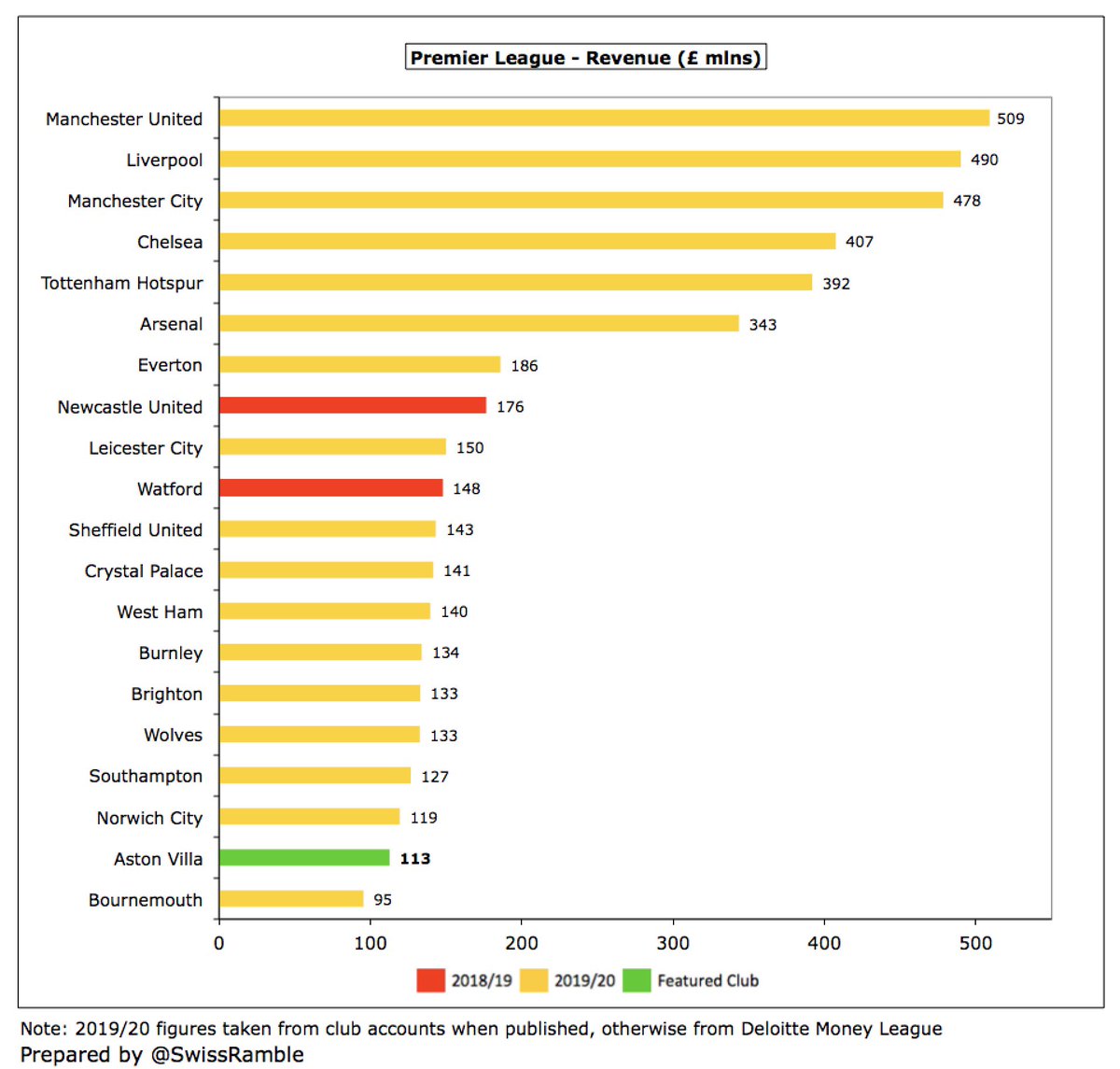

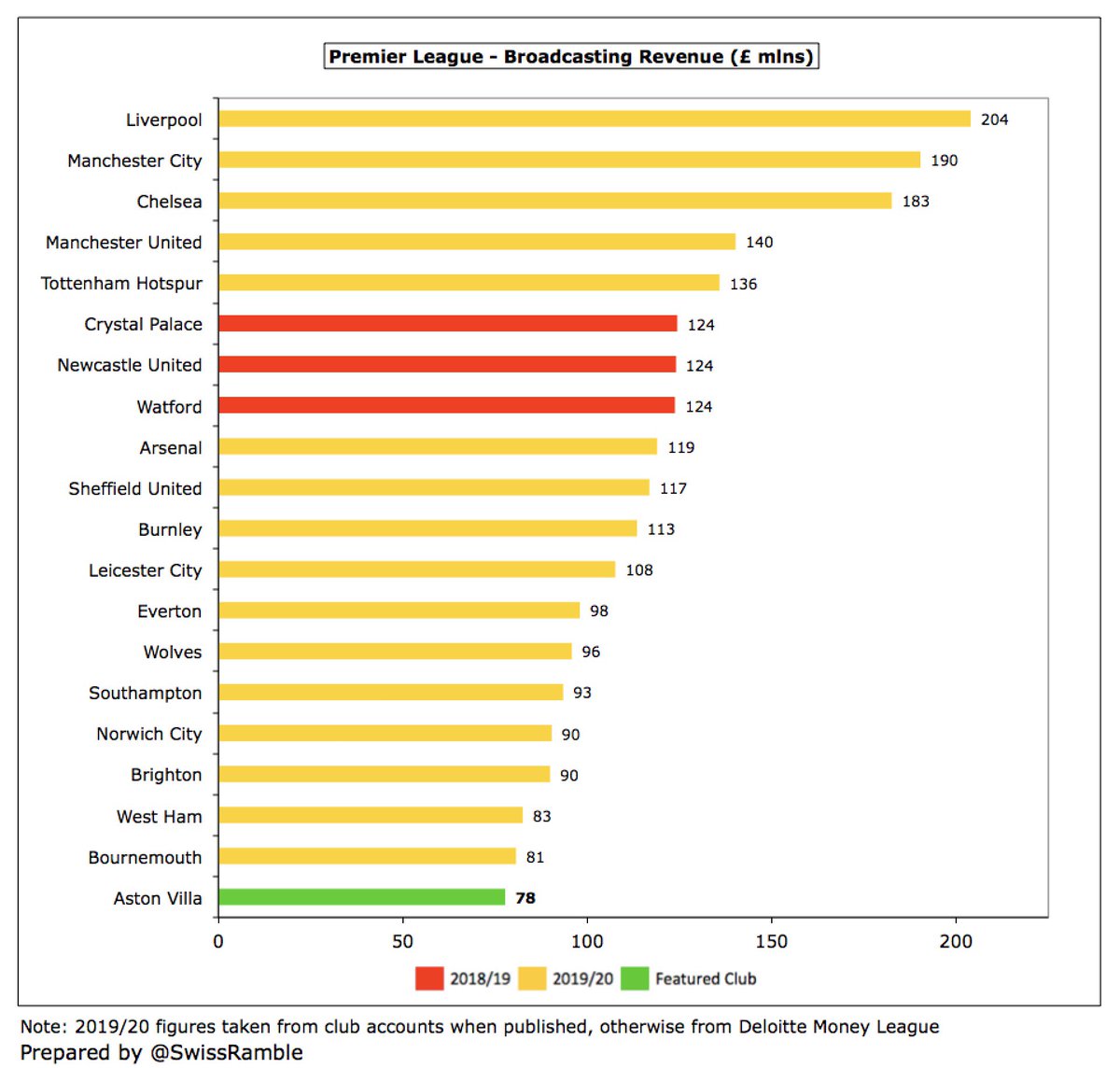

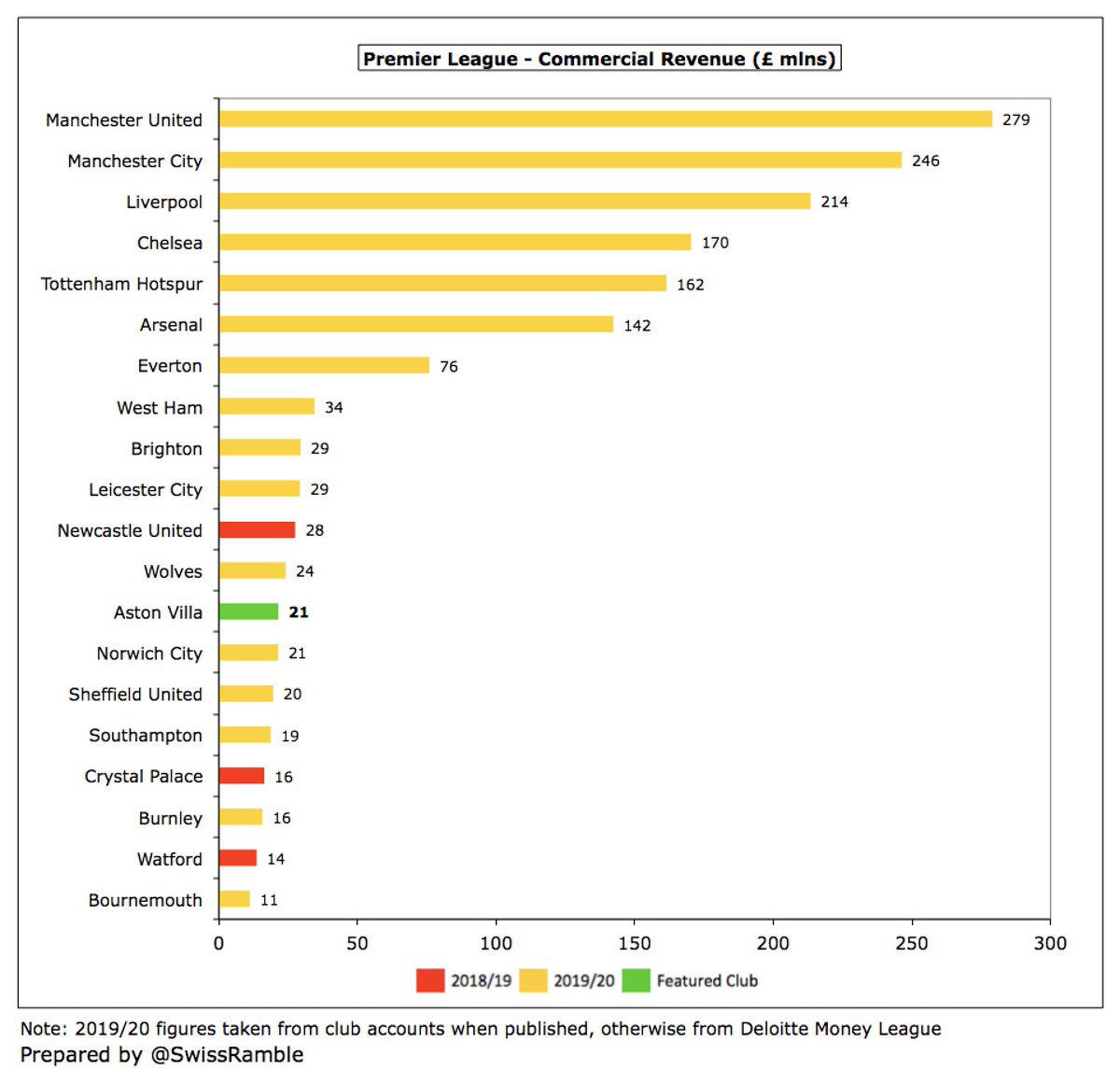

Even after the growth due to promotion, #AVFC £113m revenue was the second lowest in the Premier League, only ahead of Bournemouth £95m. To place that into perspective, it’s less than a quarter of the top three clubs: #MUFC £509m, #LFC £490m and #MCFC £478m.

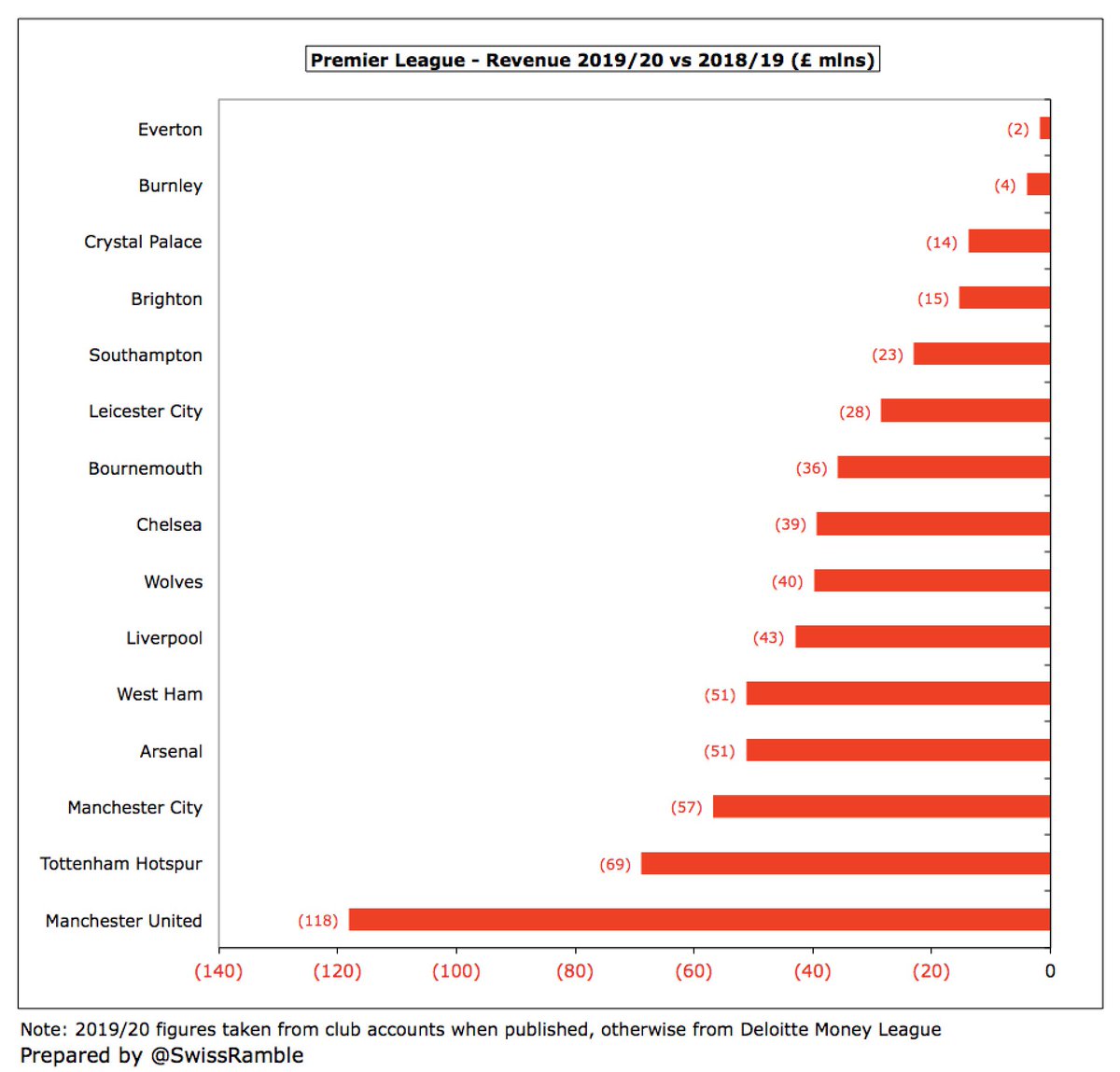

However, #AVFC have been more impacted by COVID-19 than many others, as their accounts close relatively early on 31st May, so more revenue has been deferred to the 2020/21 accounts than those clubs whose accounts close on 30th June or 31st July.

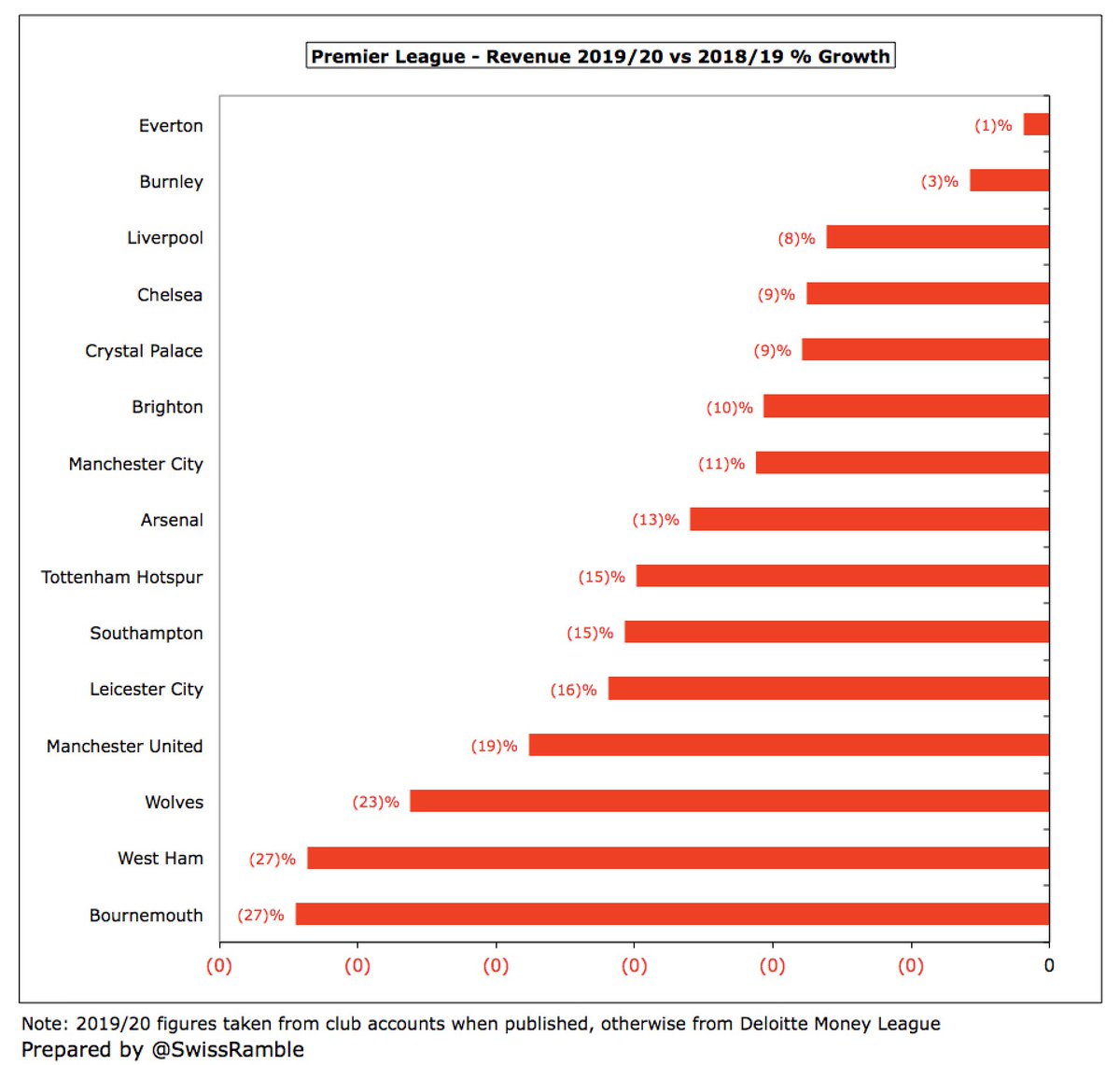

On the other hand, most Premier League clubs’ revenue is significantly down in 2019/20, due to COVID-19 impact, averaging decreases of £39m (13%). #EFC small 1% decrease is due to once-off £30m for stadium naming rights option.

Following promotion #AVFC broadcasting income rose £56m from £22m to £78m. This was the lowest in the Premier League, but was significantly impacted by £36m revenue from 10 games slipping to 2020/21 accounts and £7m rebate to broadcasters.

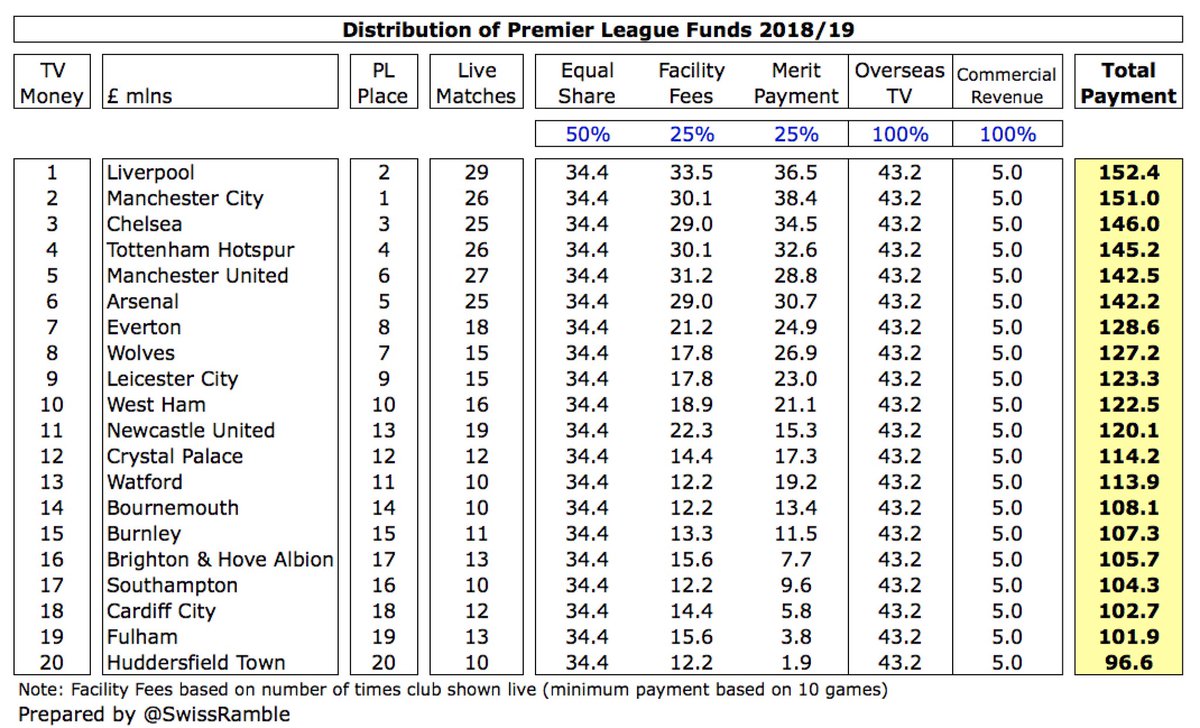

Much of Premier League TV deal is distributed equally, but part based on league position (merit payments, growth in overseas rights) and number of times team is shown live (facility fees). From 2019/20 each league place worth around £3m, so #AVFC improvement from 17th will help.

#AVFC gate receipts fell £1.6m (13%) from £12.7m to £11.1m, as they played 3 fewer home games and 6 behind closed doors due to COVID. Firmly in the bottom half of the Premier League, just 12% of #THFC £95m after the Londoners’ move to their new stadium.

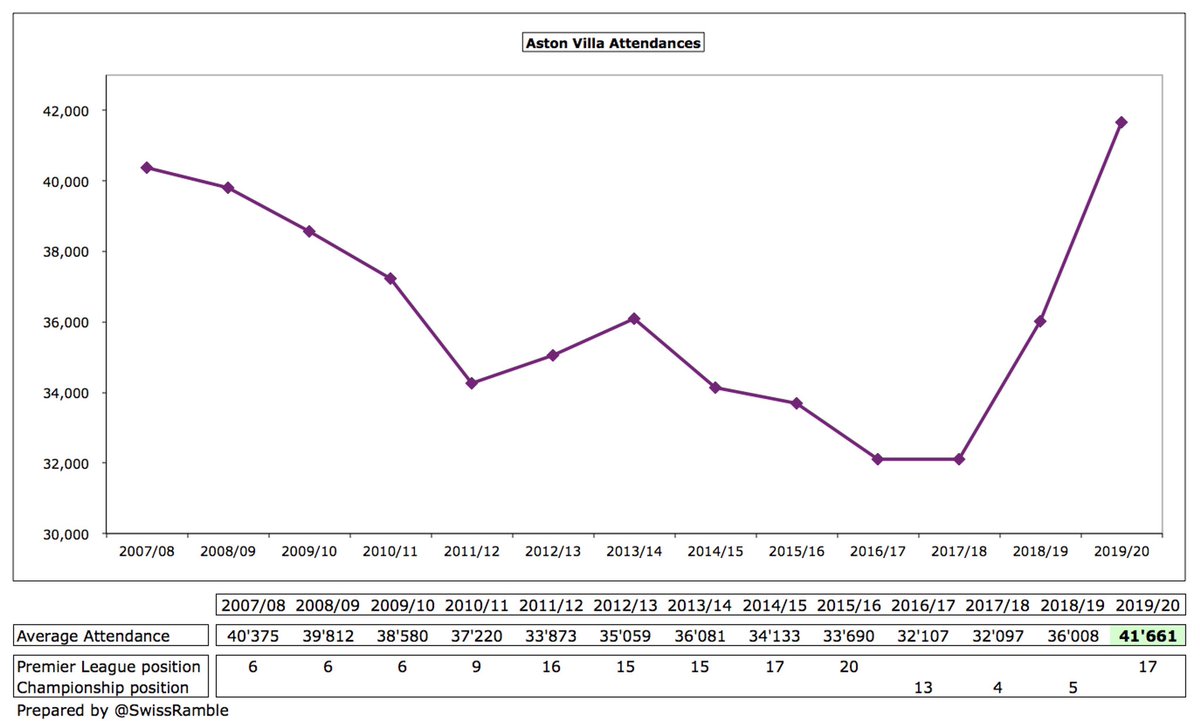

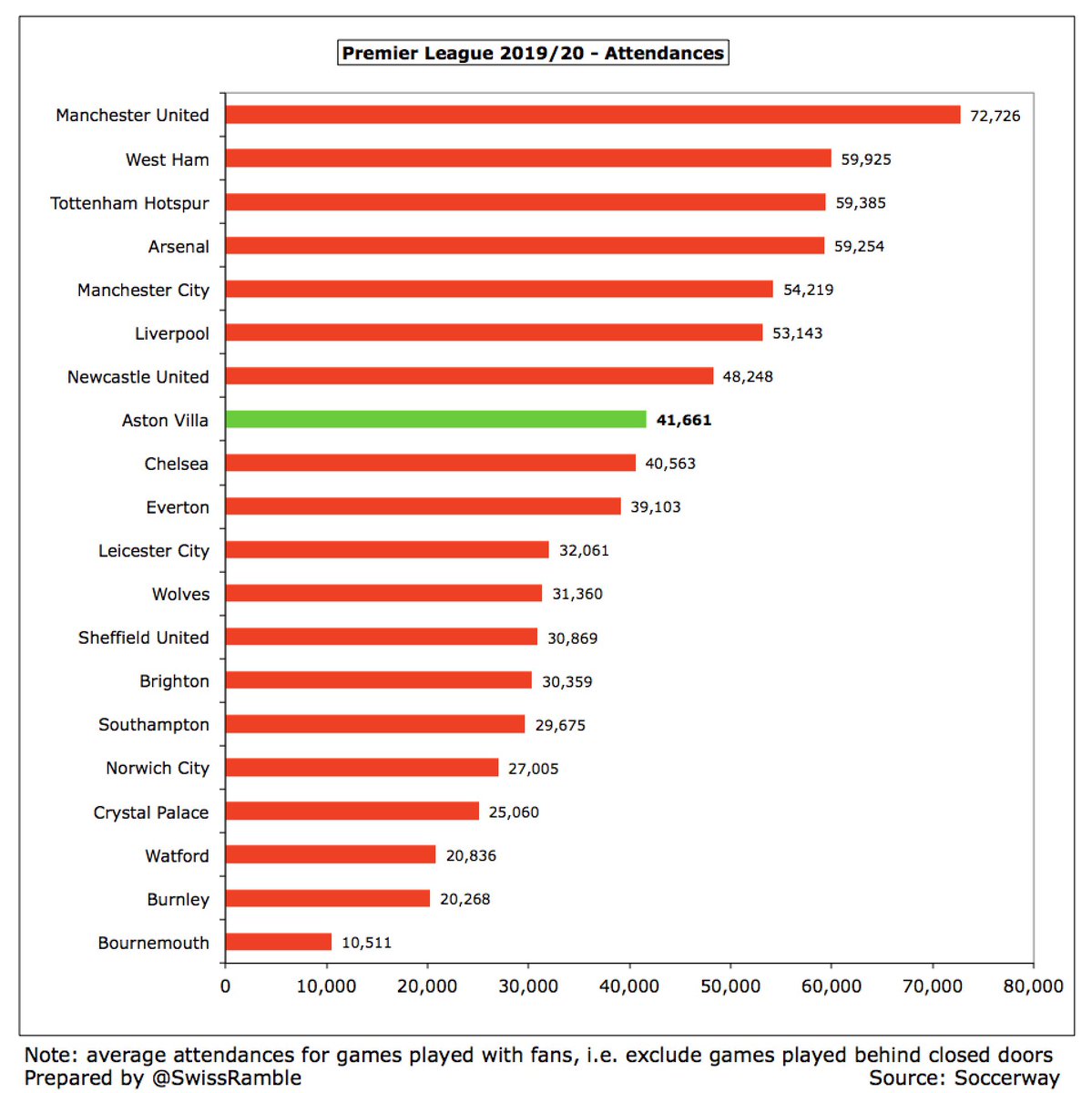

#AVFC average attendance increased 16% from 36,008 to an impressive 41,661 (for games played with fans), which was 8th highest in the Premier League. Season ticket sales were capped at all-time high of 30,000, while prices were frozen for the second year in a row.

The #AVFC board strategy includes a long-term plan to improve the Villa Park stadium, aiming to increase capacity (there is a substantial waiting list for season tickets) and modernise commercial facilities (to help boost revenue).

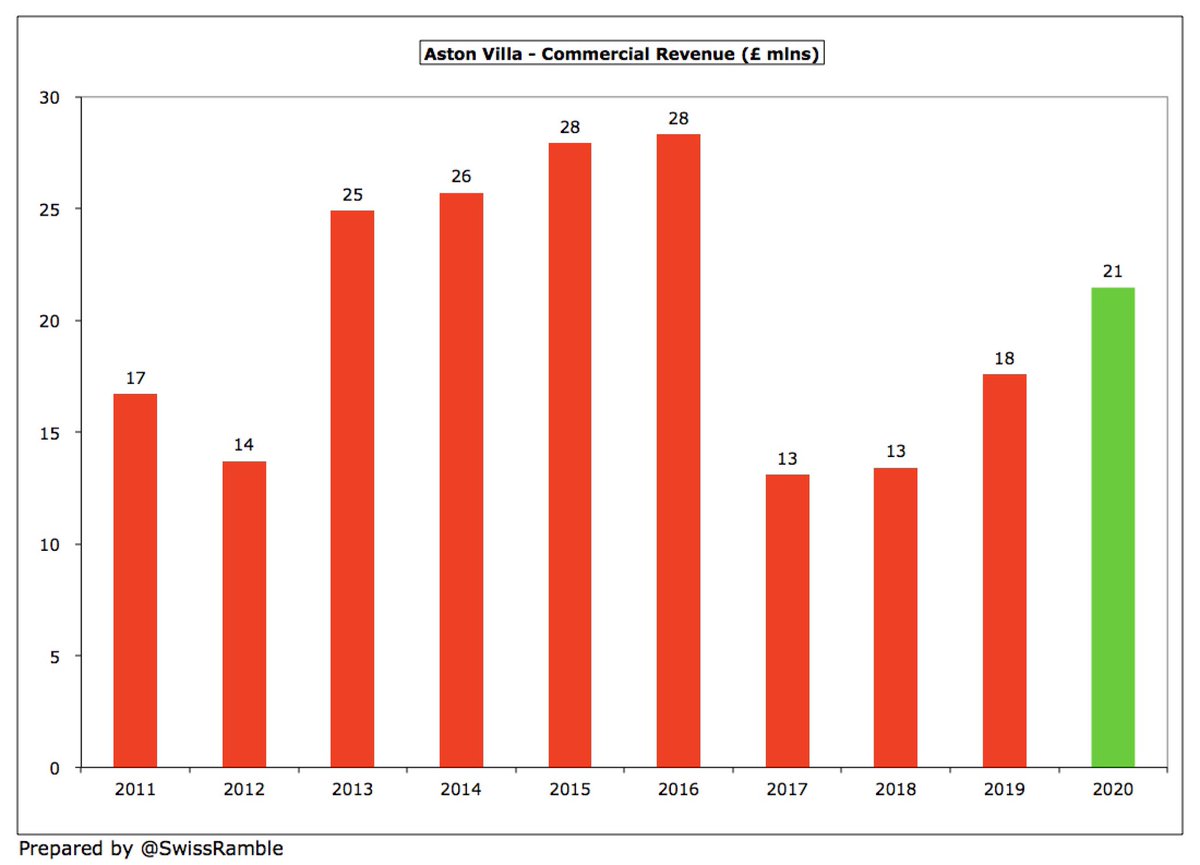

#AVFC commercial income rose £3.9m (22%) to £21.5m, mainly due to sponsorship (up £3.1m to £10.4m), but still in bottom half of the Premier League. This revenue stream has grown three years in a row, but still a fair bit lower than the club’s £28m peak in 2016.

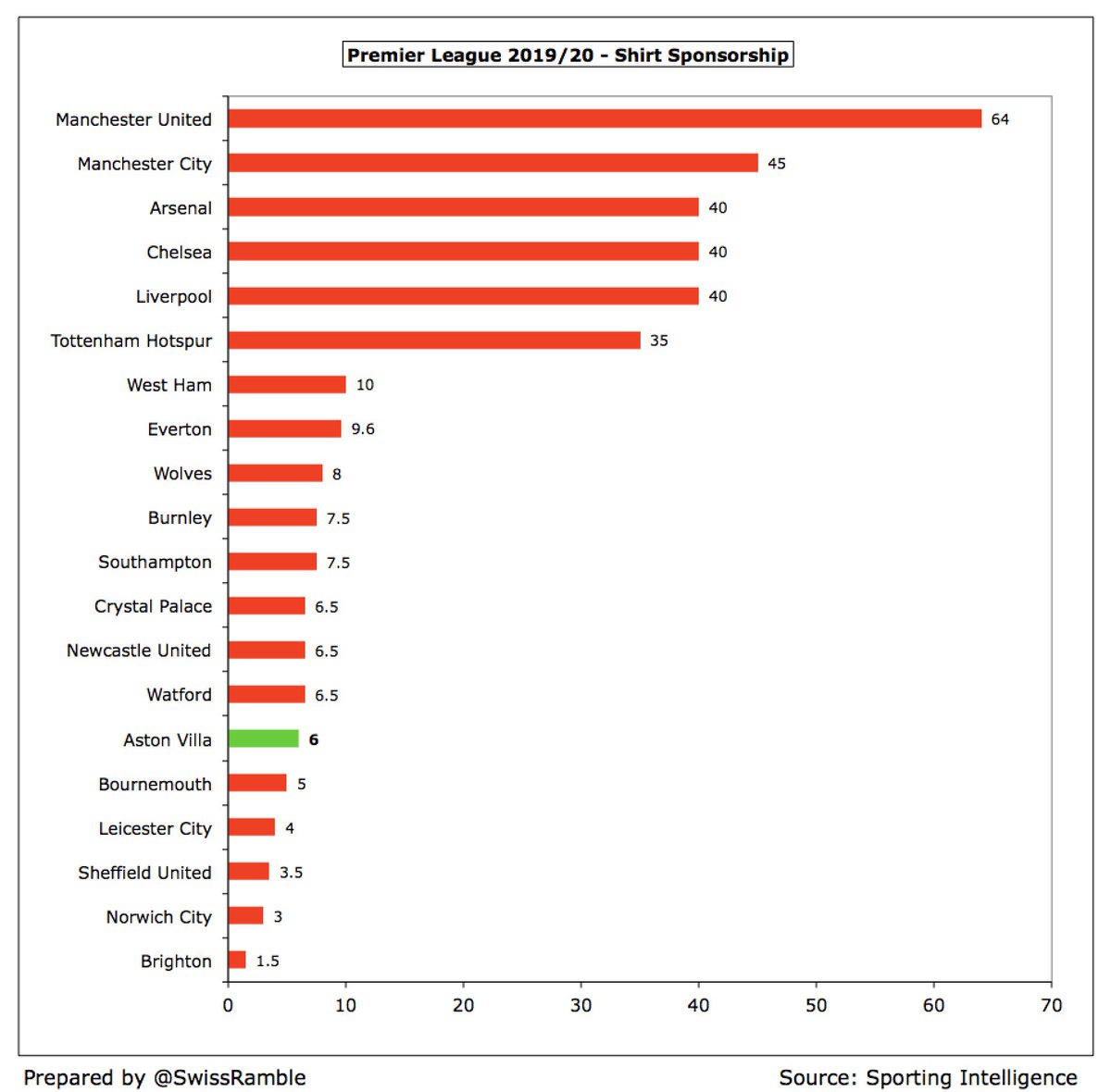

Following promotion #AVFC signed two “record-breaking” deals: shirt sponsor W88 replaced 32Red for £6m; while Kappa has a 3-year kit supplier deal. From this season, car retailer Cazoo has succeeded W88 in a 2-year deal for a similar amount. LT is the club’s new sleeve sponsor.

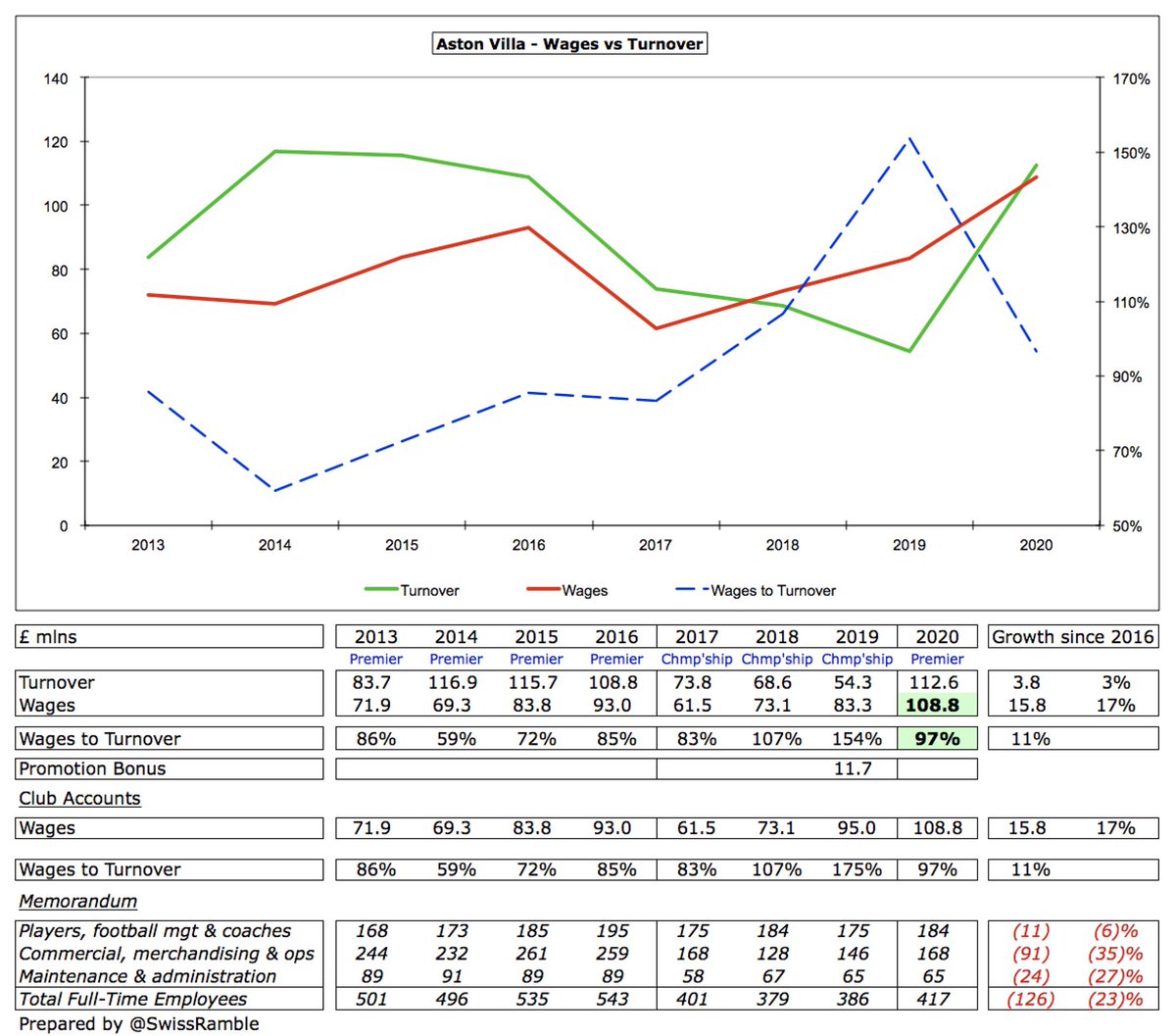

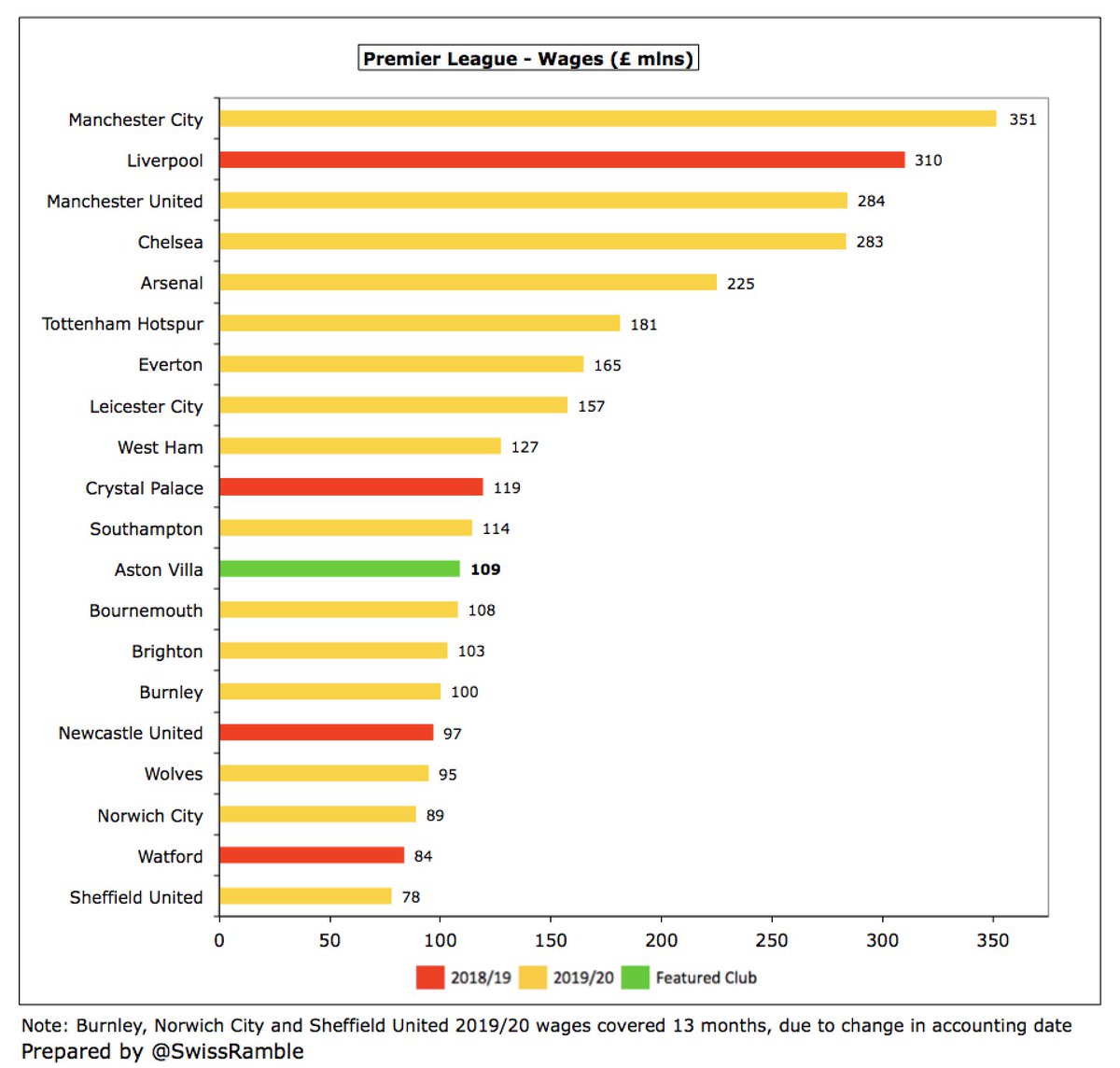

#AVFC wage bill rose £26m (31%) from £83m to £109m, as club invested in the first-team squad. Note that prior year comparative excludes £12m of promotion-related payments, which gives the £95m reported in the club’s accounts. Wages up £16m (17%) from 2016 for a new club record.

Following the increase, #AVFC wage bill of £109m was 12th highest in the Premier League, so arguably the club under-performed by finishing 17th. It is not known whether figure includes bonuses for retention of Premier League status (may have been deferred to 2020/21 accounts).

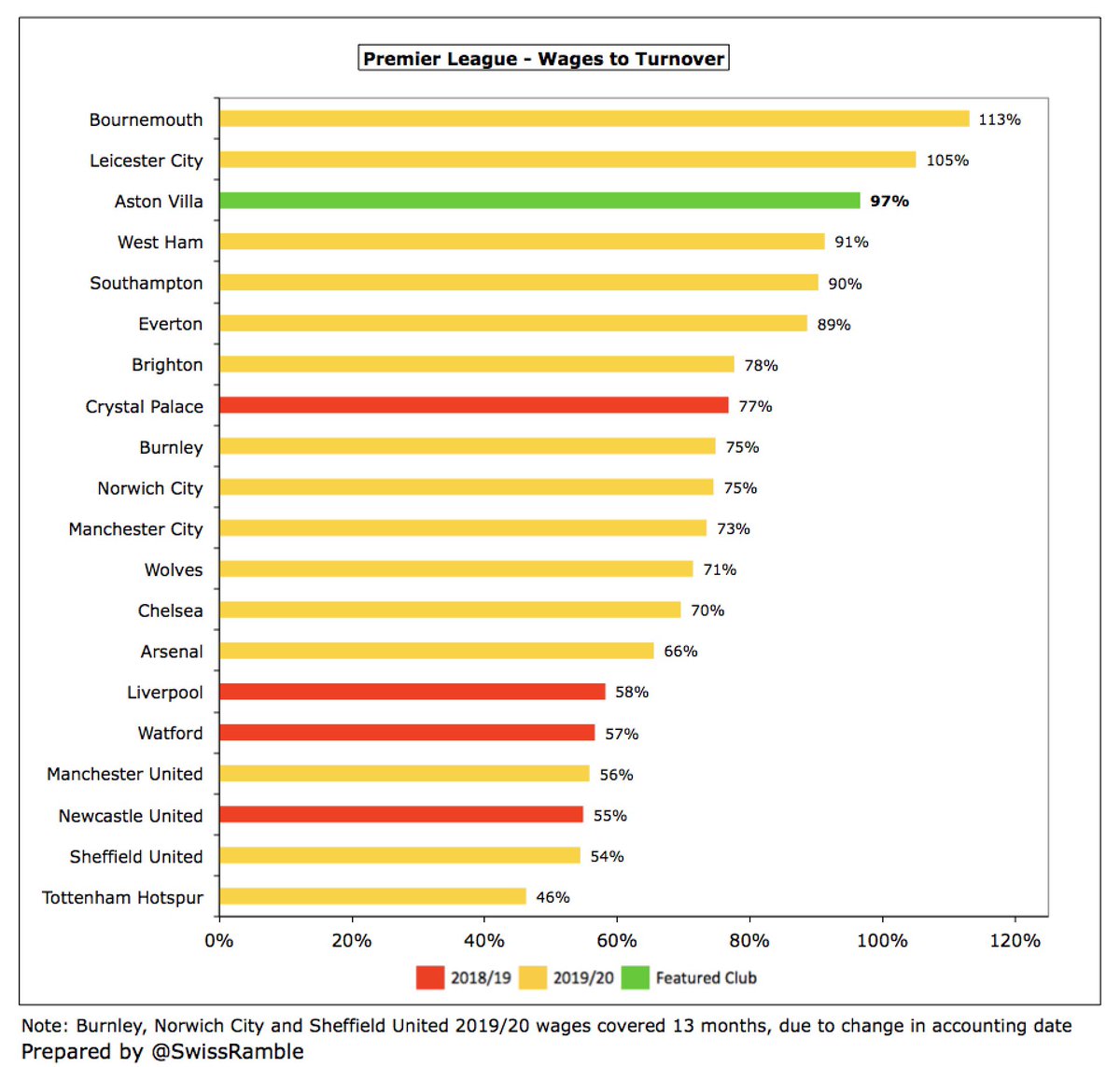

After promotion, #AVFC wages to turnover ratio improved from 154% to 97%, though this was still the third highest (worst) in the Premier League, only better than #AFCB 113% and #LCFC £105%. However, would be a respectable 68% after adjusting for COVID impact on revenue.

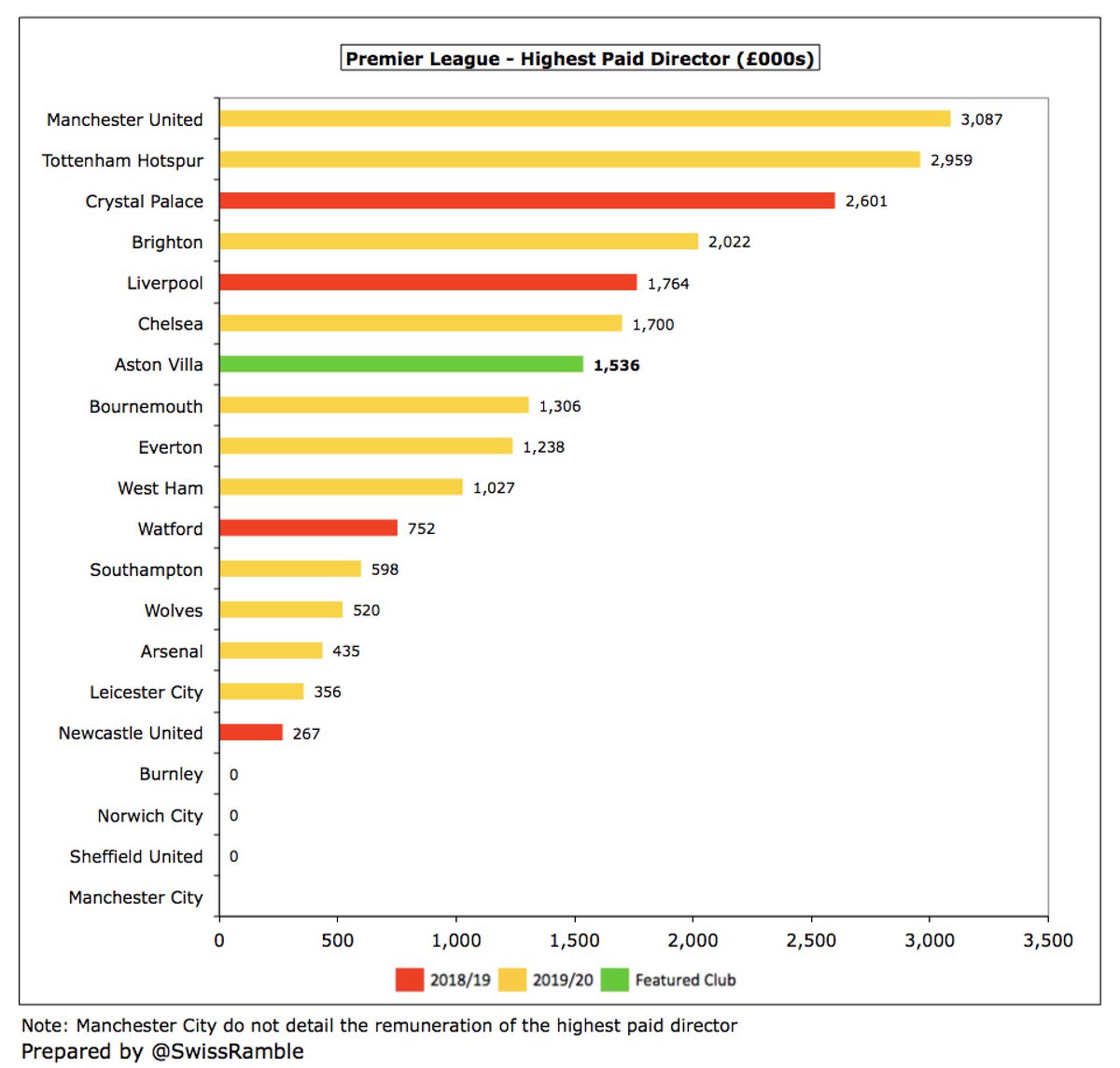

#AVFC directors remuneration surged from £439k to £1.5m, presumably for chief executive Christian Purslow, the self-proclaimed “Fernando Torres of Finance”. That said, only around half of Ed Woodward at #MUFC and Daniel Levy at #THFC, who both trousered around £3m.

#AVFC player amortisation, the annual charge to expense transfer fees over a player’s contract, shot up £45m (177%) from £26m to £71m, 9th highest in the Premier League. The size of the increase is difficult to explain, notwithstanding the significant investment in the squad.

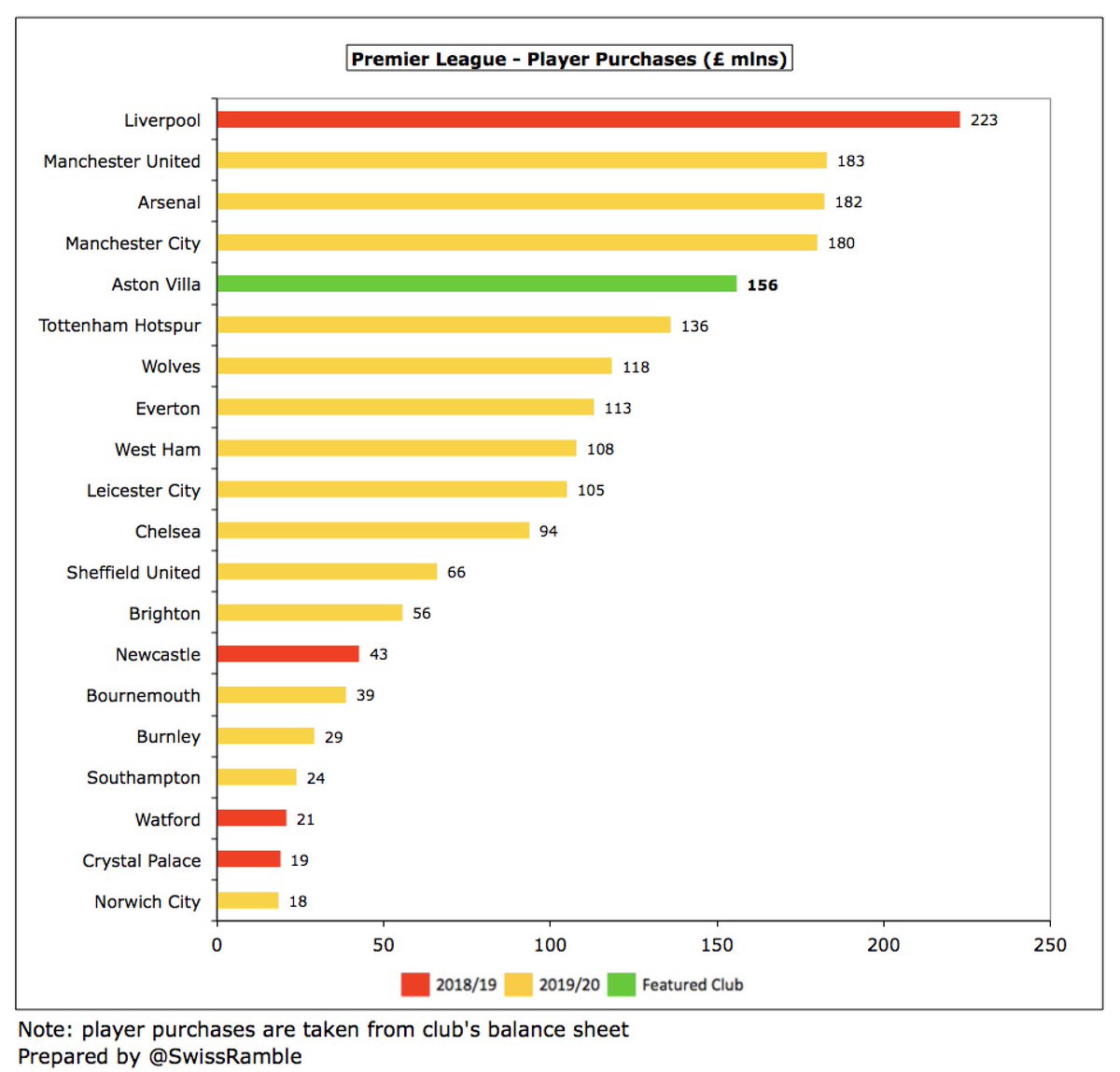

#AVFC splashed out £156m on player purchases, including Wesley, Mings, Luiz, Targett, Konsa, Nakamba, Samatta, Trezeguet, El Ghazi, Heaton, Engels, Jota and Hause. Only below 3 clubs to date in the 2019/20 Premier League (#MUFC £183m, #AFC £182m and #MCFC £180m).

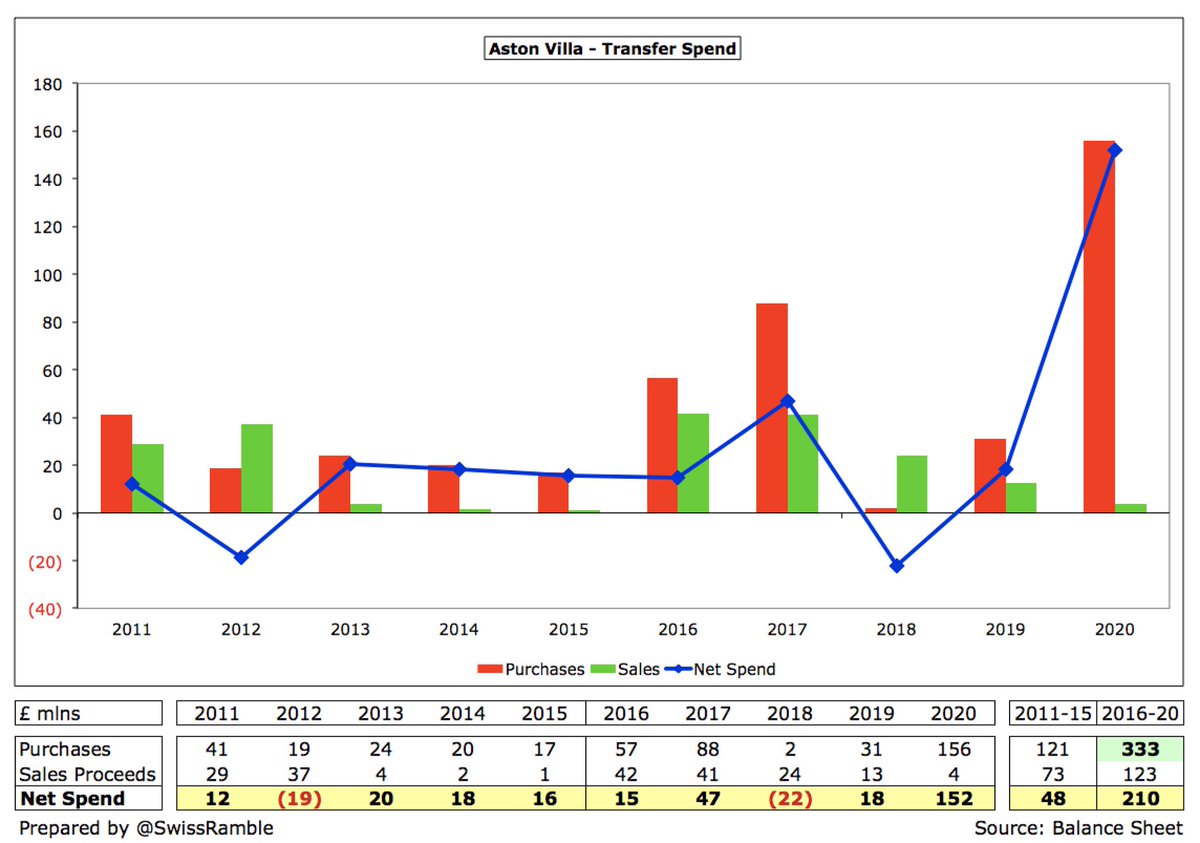

#AVFC have really ramped up player investment, spending £333m in the last 5 years, compared to only £121m in the preceding 5-year period. Accounts note £109m spent since year-end, mainly Watkins, Traoré, Martinez, Sanson and Cash, which means £265m since promotion.

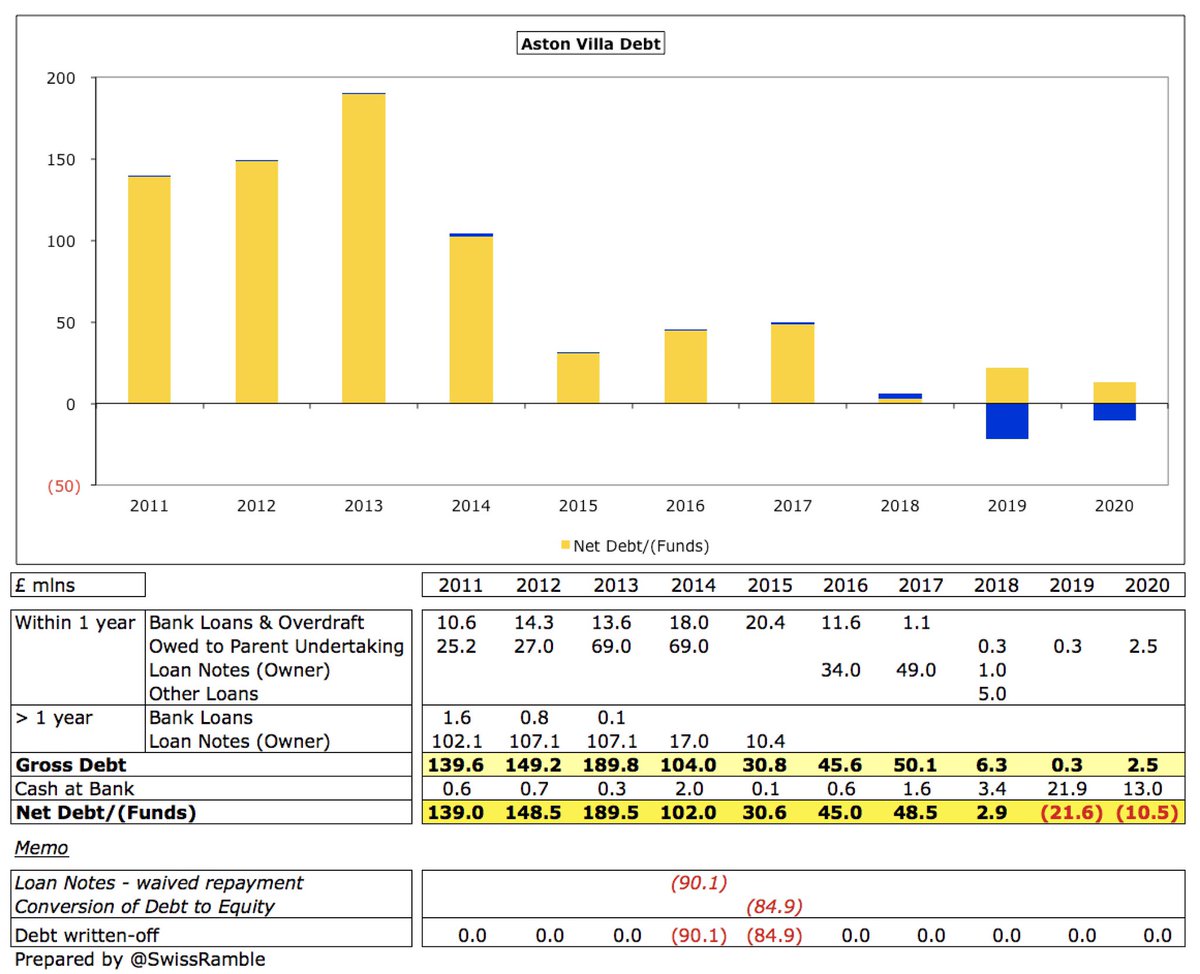

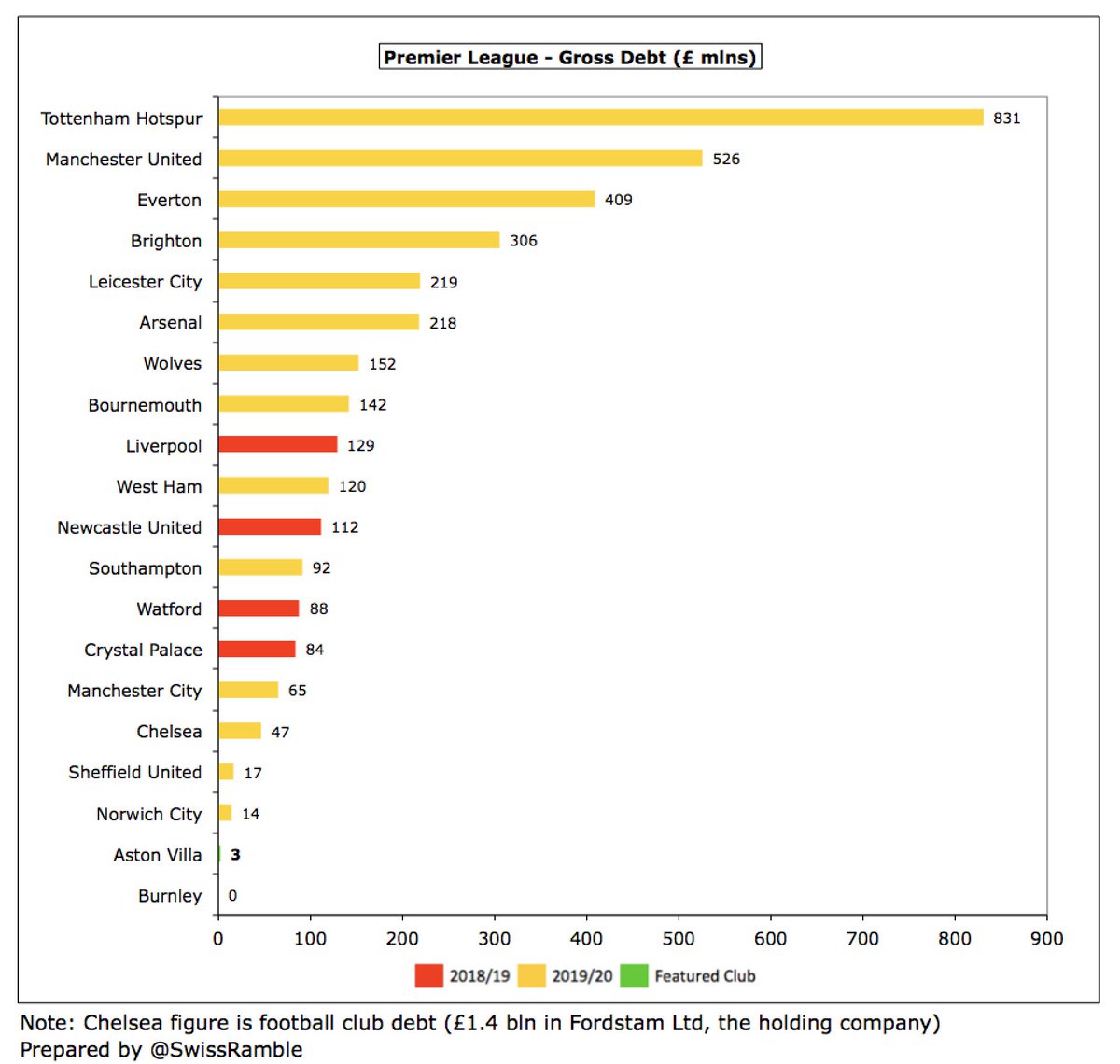

#AVFC are effectively debt-free. Slashed from £50m 3 years ago to just £2.5m, all owed to group undertakings, as the new owners have repaid old loans. In fact, debt has significantly reduced from the £190m high in 2013 following £90m loan waiver and £85m conversion into equity.

#AVFC tiny debt is in stark contrast to many clubs in the Premier League, e.g. six owe more than £200m: #THFC £831m, #MUFC £526m, #EFC £409m, #BHAFC £306m, #LCFC £219m and #AFC £218m (most of these are for stadium/training ground development).

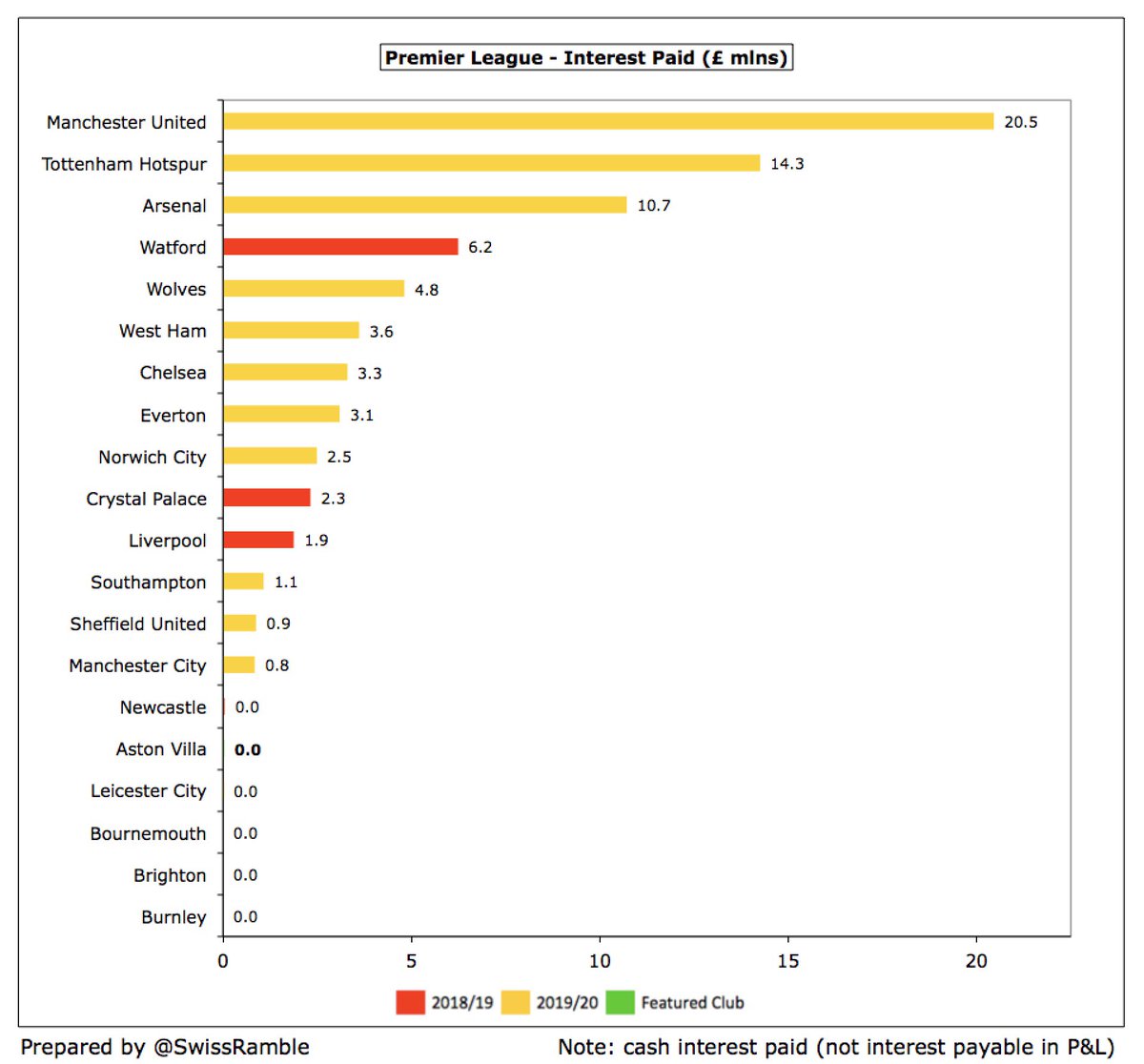

Consequently, #AVFC paid no interest in 2019/20, which gives them a competitive advantage against many of their rivals who do have to pay interest on their loans. As an example, the highest payments were #MUFC £20m, #THFC £14m and #AFC £11m.

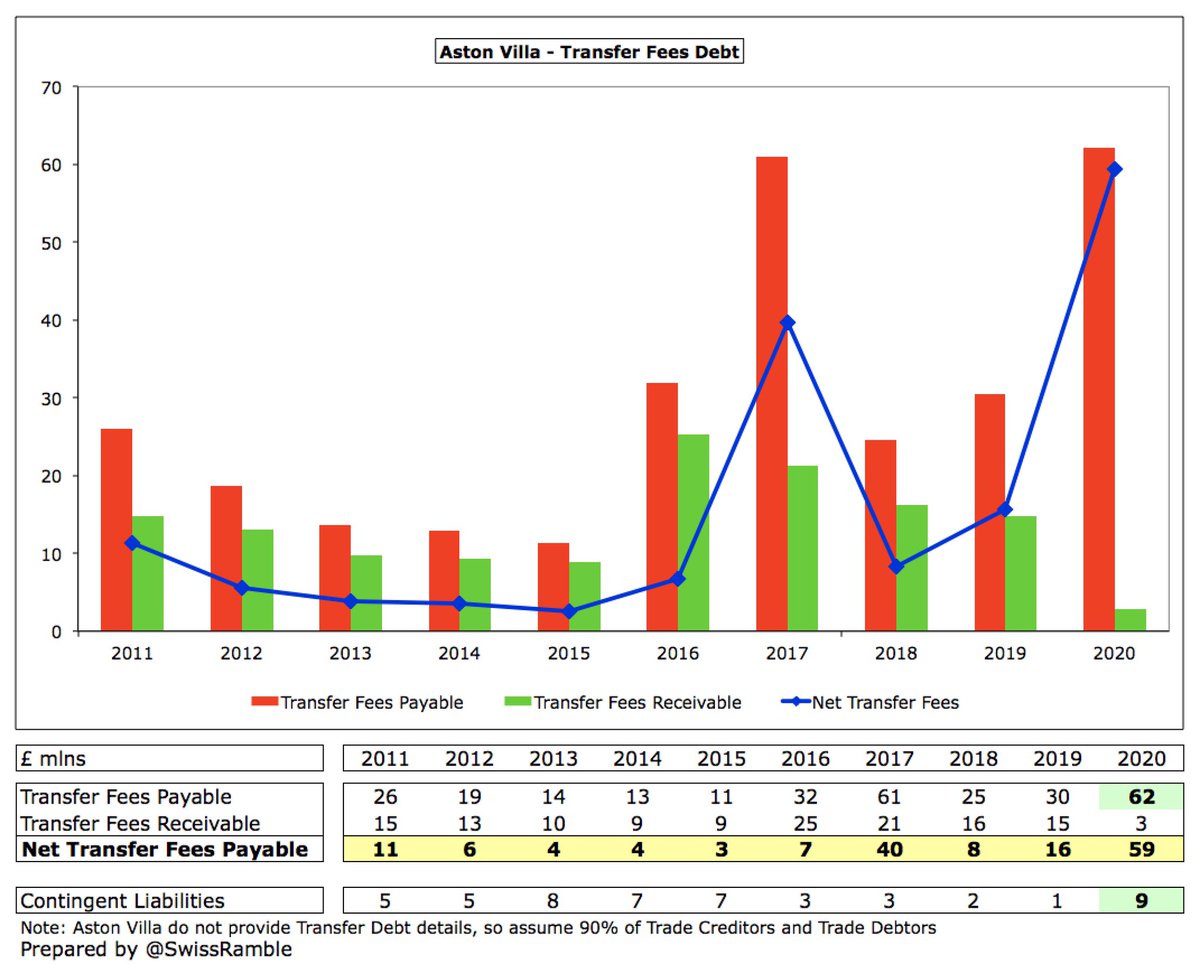

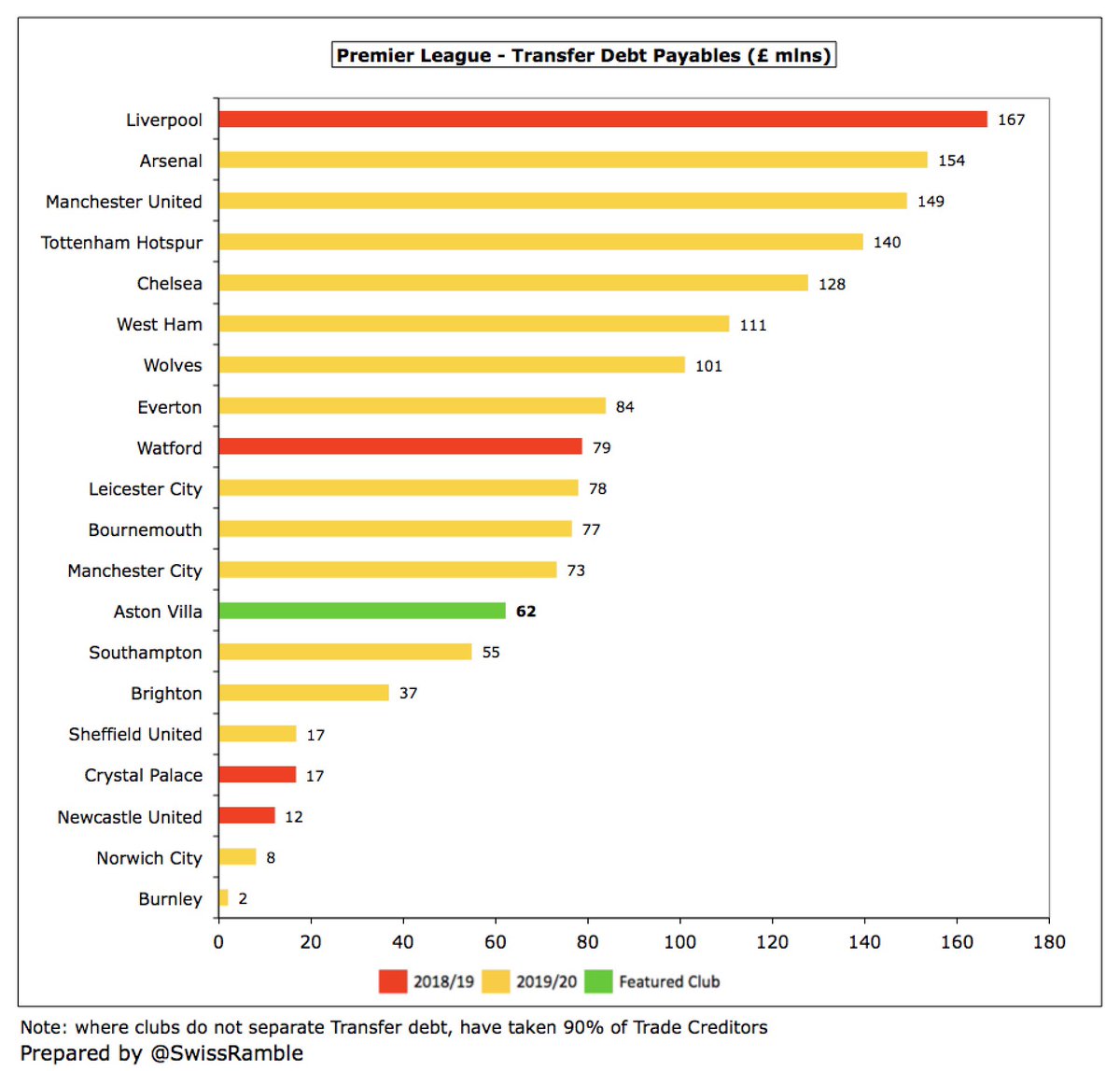

#AVFC don’t separately report transfer debt, but assuming 90% of Trade Creditors, this has grown from £30m to £62m, but still on the low side for Premier League, e.g. #AFC £154m, implying that much of transfer spend is paid upfront. Also have £9m contingent liabilities.

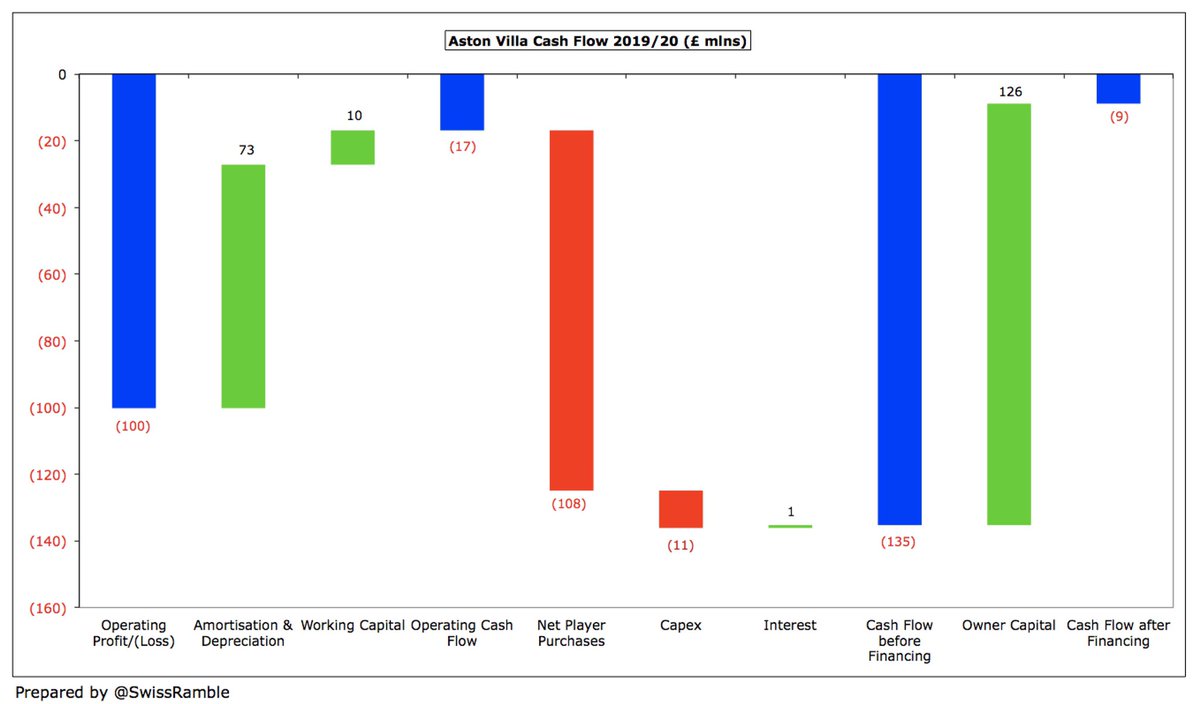

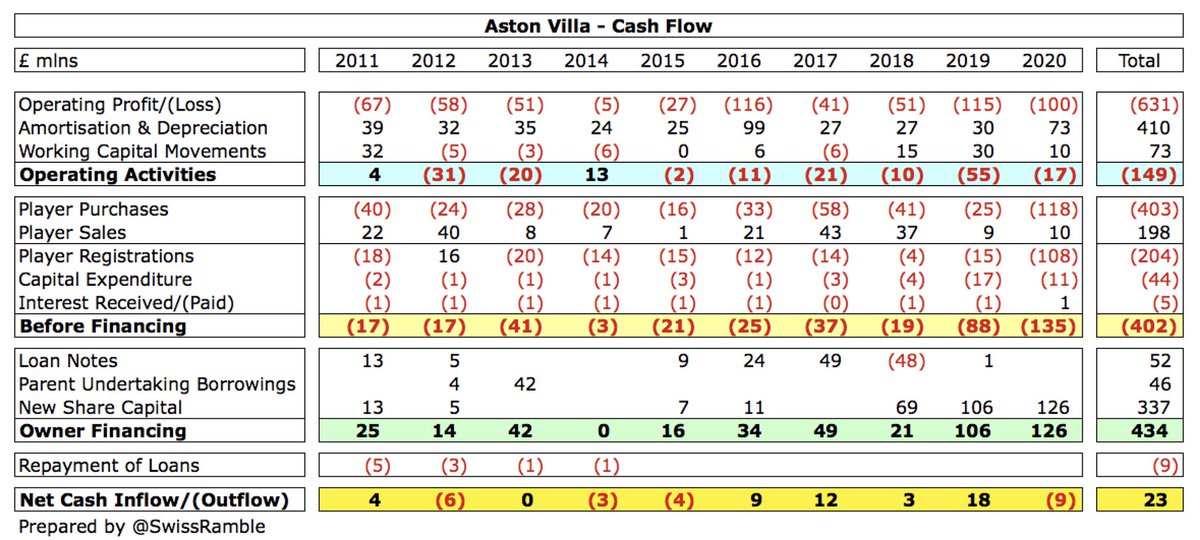

#AVFC £100m operating loss improved to £17m negative cash flow by £73m amortisation/depreciation and £10m working capital movements. Then spent £108m net (purchases £118m, sales £10m) and £11m on training ground. Largely funded by £126m capital from owners, but £9m cash outflow.

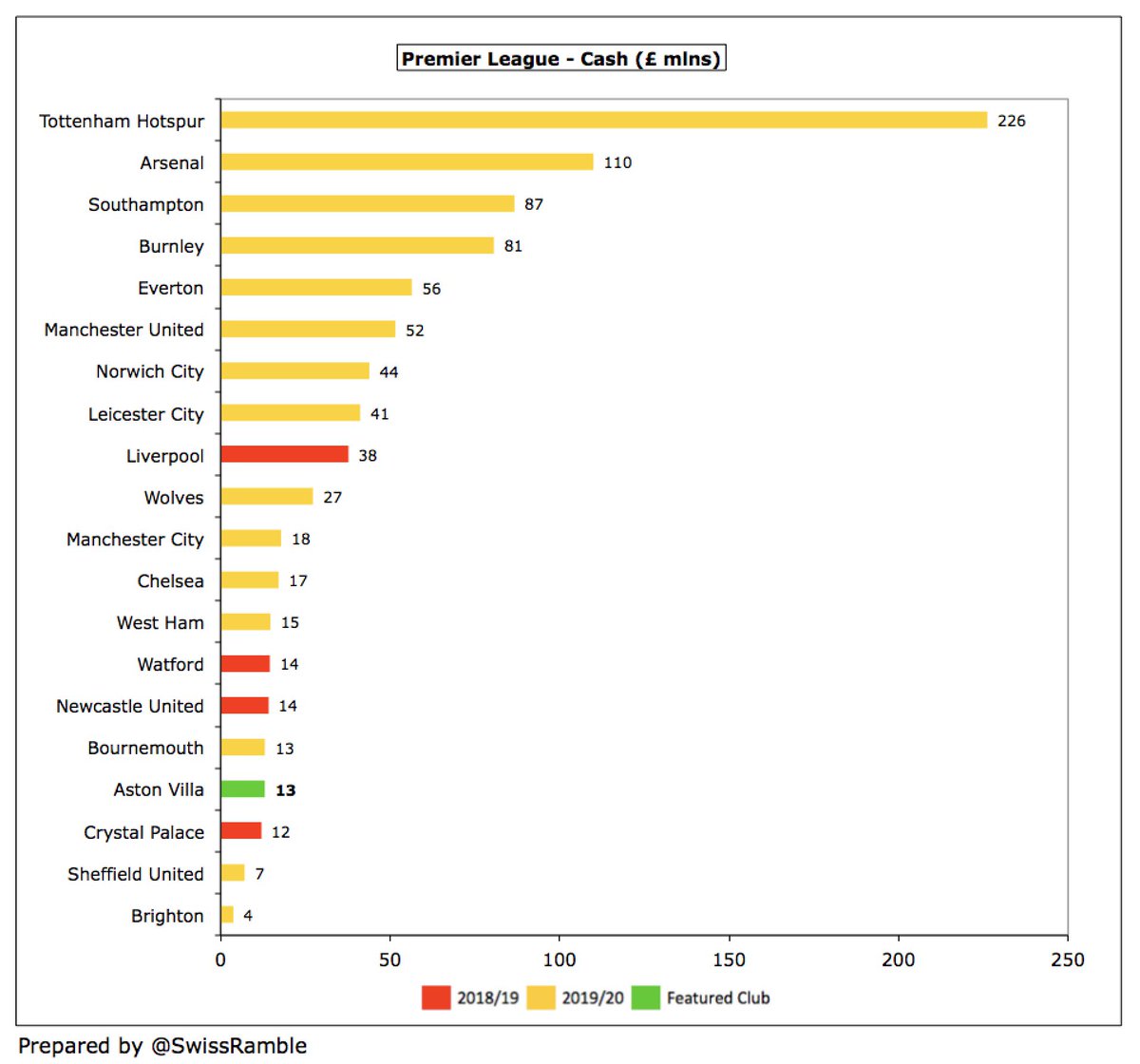

As a result, #AVFC cash balance fell from £22m to £13m. This is one of the lowest in the Premier League, which is not a great buffer during the current challenging environment, but NSWE have confirmed their support for at least 12 months.

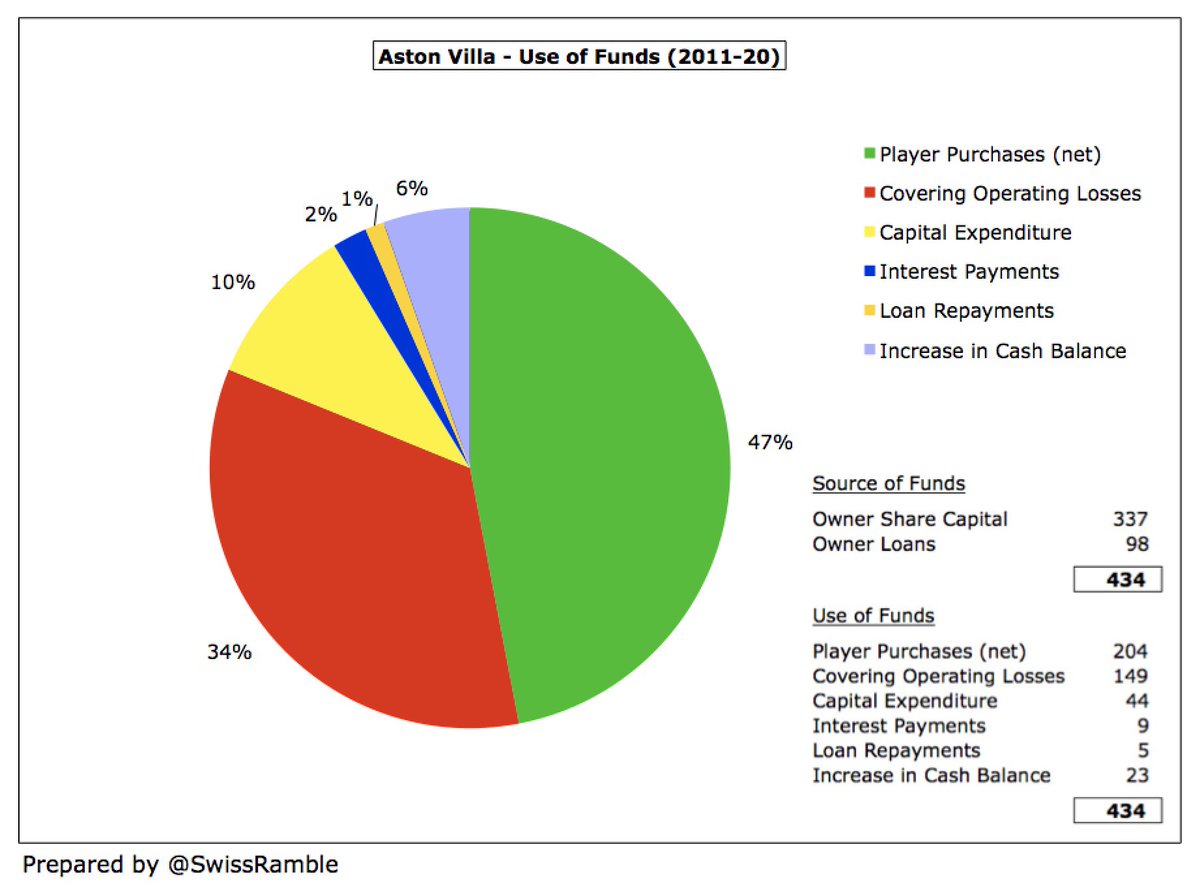

In the last 10 years #AVFC owners (old and new) have provided £434m of funding (share capital £337m plus loans £98m). This has largely been spent on players (net) £204m, covering operating losses £149m and infrastructure investment £44m.

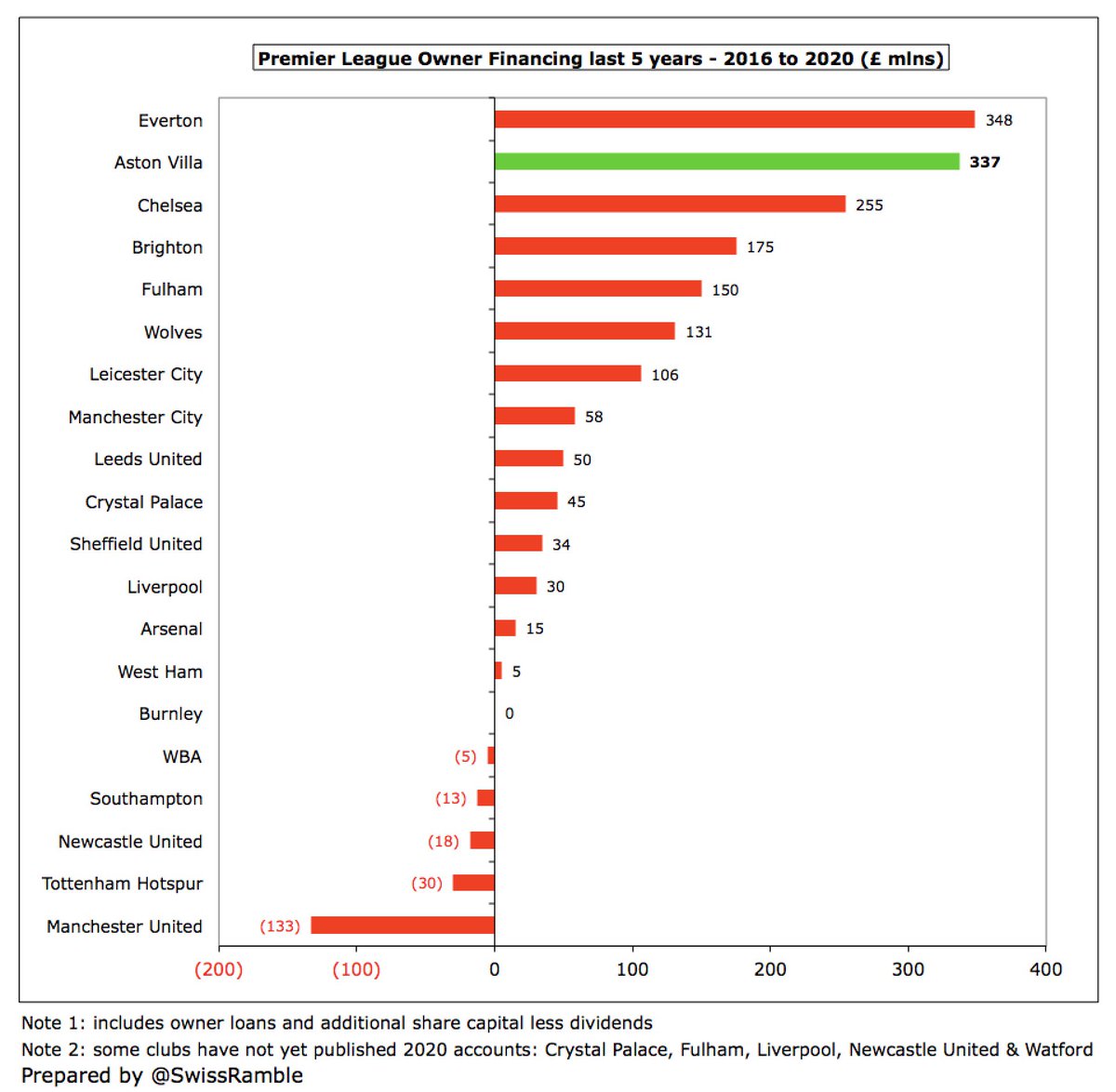

There is little doubt that Sawiris and Edens have “put their money where their mouth is”, as the owners have injected £302m capital since their arrival. In fact, #AVFC owner financing of £337m in the last 5 years is the 2nd highest of Premier League clubs, only behind #EFC £348m.

When the owners bought #AVFC, they said, “we’re here to bring the club back to its original glory.” There’s a long way to go to meet that target, given Villa are European Cup winners, but they have made a promising start, while still providing considerable financial support.

• • •

Missing some Tweet in this thread? You can try to

force a refresh