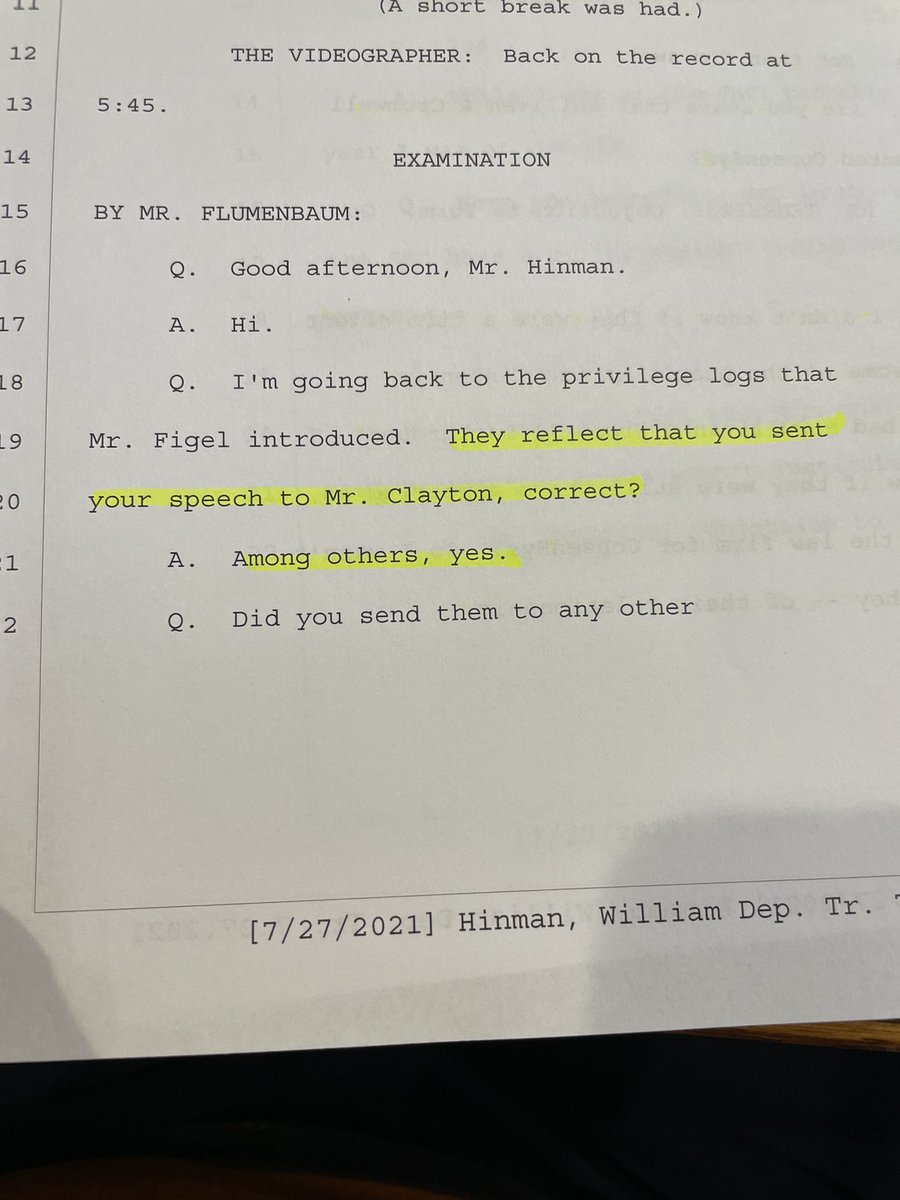

In the Hinman deposition it is mentioned that attorney Brian Rabbit was present at a meeting between Hinman & Clayton and @bgarlinghouse and @JoelKatz.

Attorney Rabbit was Senior Policy Advisor to Chairman Clayton at the time. Meet Brian Rabbit 👇

jonesday.com/en/lawyers/r/b…

Attorney Rabbit was Senior Policy Advisor to Chairman Clayton at the time. Meet Brian Rabbit 👇

jonesday.com/en/lawyers/r/b…

Attorney Rabbit was at this meeting wherein Brad Garlinghouse informs Clayton that @Ripple was living in “purgatory” because of the lack of clarity regarding whether #XRP is or is not a security. Of course, Clayton never responded back to Garlinghouse that #XRP is a security.

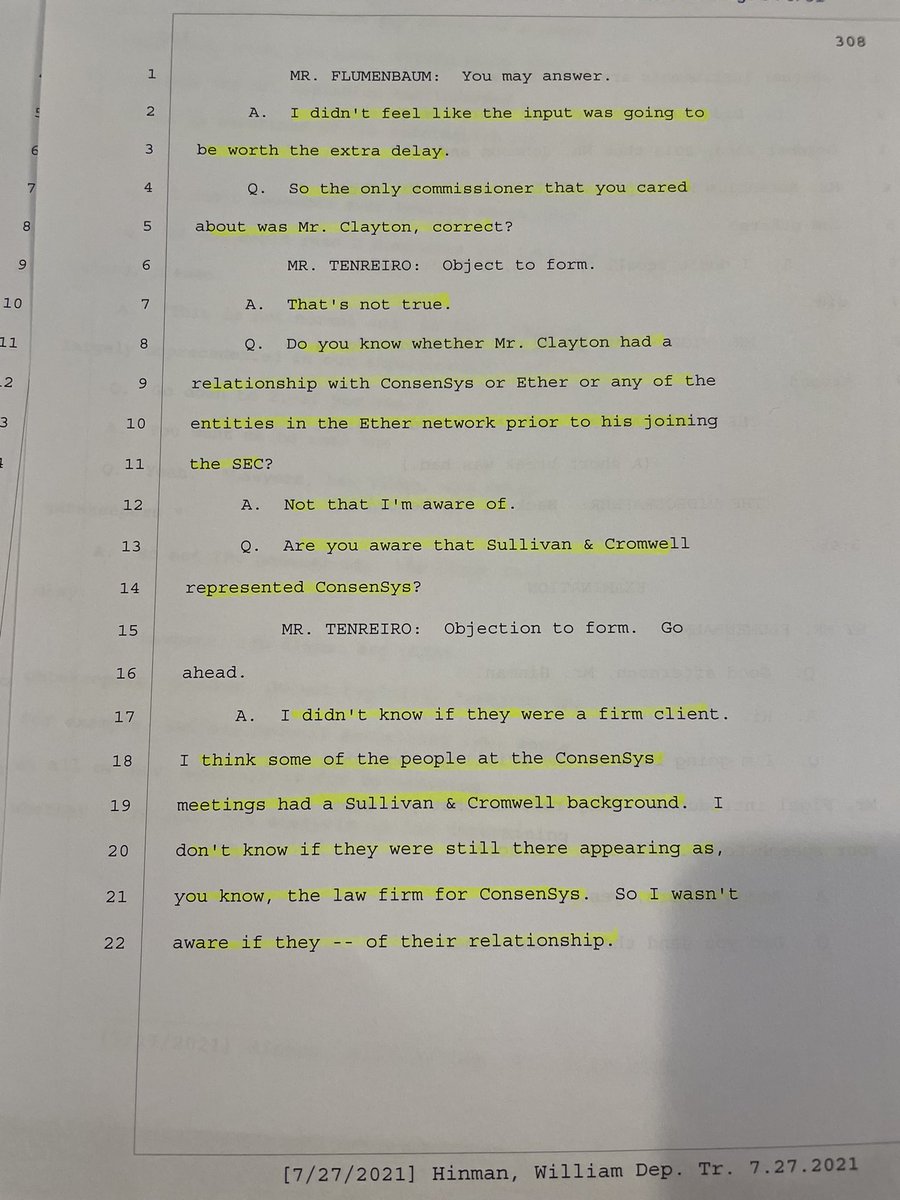

The only thing more ridiculous than the @SECGov claiming today’s #XRP is a security is the @SECGov’s argument that the Hinman speech was only his personal opinion and not meant to be guidance by the #SEC.

@digitalassetbuy found Brian Jackson discussing the Hinman speech.

@digitalassetbuy found Brian Jackson discussing the Hinman speech.

I thought I would look up this Brian Rabbit since he was a Senior Advisor to Clayton and met with @JoelKatz and @bgarlinghouse.

What does Attorney Rabbit say about how the @SECGov provides guidance to market participants:

Through speeches!

Yet, the SEC claims otherwise.🤥

What does Attorney Rabbit say about how the @SECGov provides guidance to market participants:

Through speeches!

Yet, the SEC claims otherwise.🤥

• • •

Missing some Tweet in this thread? You can try to

force a refresh