This is significant evidence in @SECGov 🆚 @Ripple & and even more significant evidence in #XRPHolders 🆚 @SECGov.

@CRYPTOcounselo2 does a great job summarizing the relevant statements and admissions contained in the video shared. Read the thread.

Some additional thoughts:

@CRYPTOcounselo2 does a great job summarizing the relevant statements and admissions contained in the video shared. Read the thread.

Some additional thoughts:

https://twitter.com/CRYPTOcounselo2/status/1430418405811761155

Amy Starr is likely one of the fact witnesses from the #SEC that #Ripple elected to depose in addition to William Hinman.

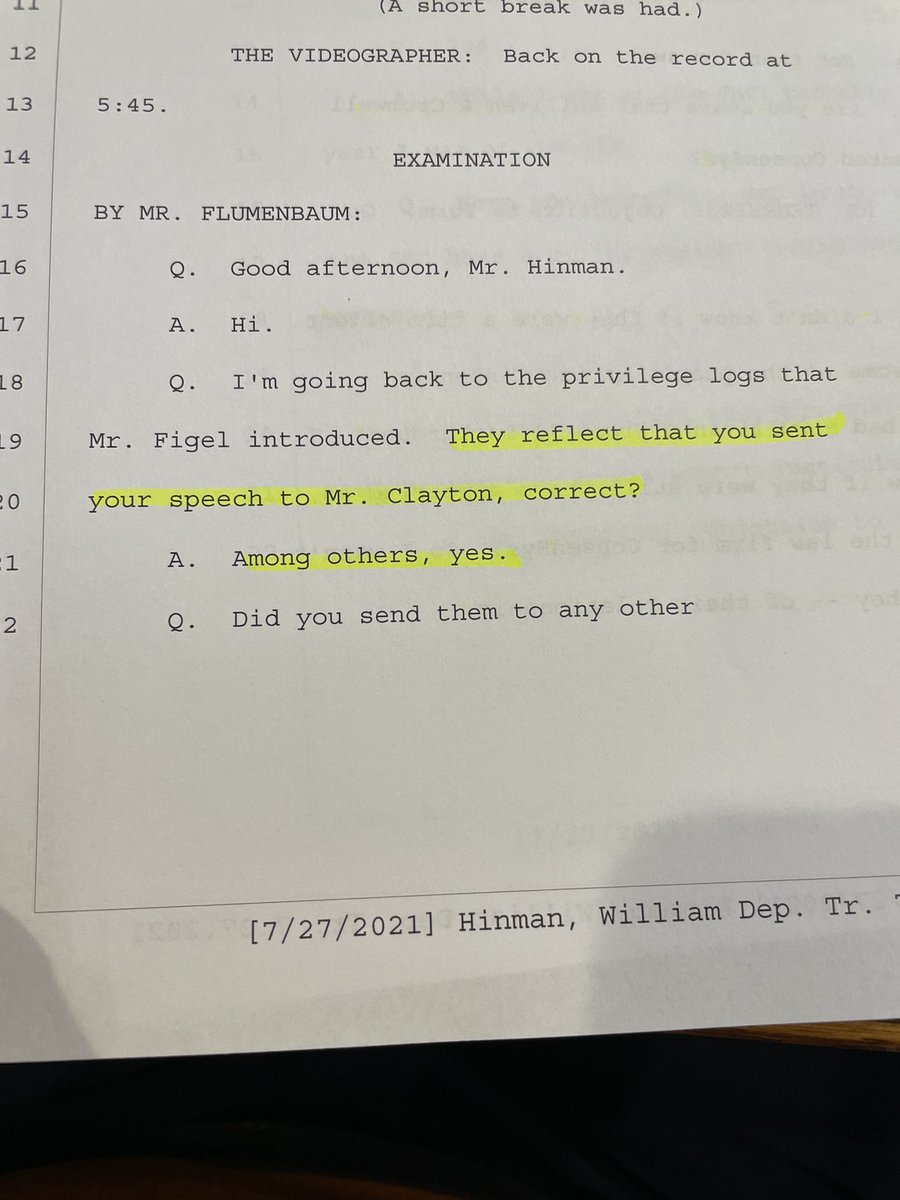

Her name was brought up in the Hinman deposition. See pic 👇

In the Consensus 2019 video Amy states “we have people that really understand the technology.”

Her name was brought up in the Hinman deposition. See pic 👇

In the Consensus 2019 video Amy states “we have people that really understand the technology.”

Amy Starr states that at the #SEC “we developed an expertise” in blockchain technology and that at the #SEC “we participate internationally.”

Why is this all significant? One, #XRP was internationally recognized as a non-security!

Two, the #SEC was an expert and understood

Why is this all significant? One, #XRP was internationally recognized as a non-security!

Two, the #SEC was an expert and understood

blockchain technology so well YET it chose to NOT bring a case against #Ripple or #XRP for 7.5 years even though it aggressively pursued others between 2017-2019.

This makes the decision to file the case on Clayton’s last day even more arbitrary, capricious and suspicious.

This makes the decision to file the case on Clayton’s last day even more arbitrary, capricious and suspicious.

The other HUGE piece of evidence are the statements by @coinbase’s General Counsel of Business Lines & Markets, Dorothy Dewitt.

She made these comments 3 months AFTER #Coinbase listed #XRP.

Most significant is that we know #Coinbase met with the #SEC in early 2019 to

She made these comments 3 months AFTER #Coinbase listed #XRP.

Most significant is that we know #Coinbase met with the #SEC in early 2019 to

specifically discuss #Coinbase’s decision to list #XRP. It is very likely that #Coinbase met with Amy Starr who was a “senior person in the division with oversight of novel securities” and later joined the FinHub unit at the #SEC.

Bottom line: Amy Starr worked for Hinman in the

Bottom line: Amy Starr worked for Hinman in the

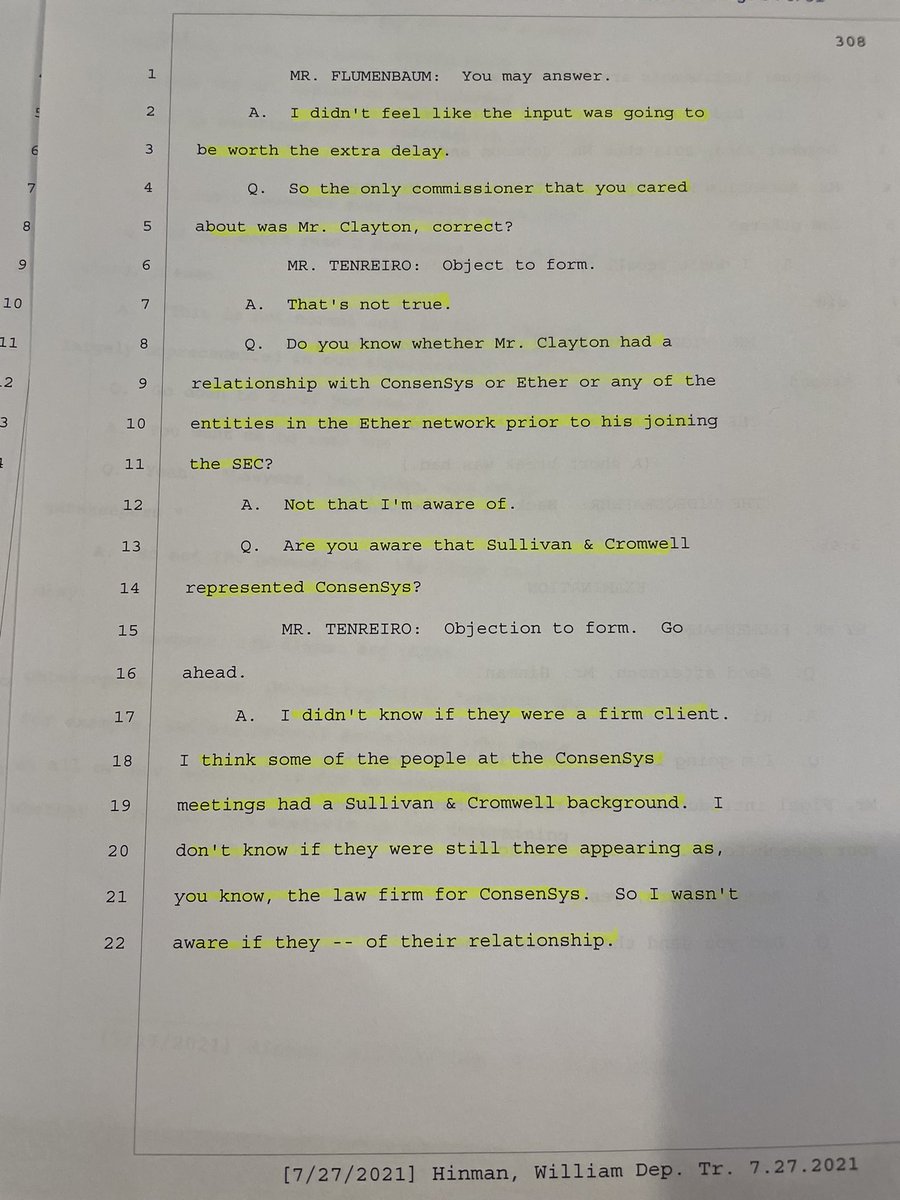

Division of Corporate Finance. She apparently set up the Hinman meeting with Joe Lubin, Co-founder of #Ethereum and founder of Consensys.

Dorothy Dewitt, a General Counsel at #Coinbase, stated that #Coinbase worked closely with the #SEC and that #Coinbase would:

Dorothy Dewitt, a General Counsel at #Coinbase, stated that #Coinbase worked closely with the #SEC and that #Coinbase would:

“analyze each token one by

one to make sure they’re NOT securities BEFORE listing them.”

She said #Coinbase implemented a “robust analysis as possible” which “included an #Howey analysis” and that #Coinbase “felt very confident in its robust analysis.”

She said each token

one to make sure they’re NOT securities BEFORE listing them.”

She said #Coinbase implemented a “robust analysis as possible” which “included an #Howey analysis” and that #Coinbase “felt very confident in its robust analysis.”

She said each token

listing must be “defensible before listing in the U.S.”

She made sure to point out that #Coinbase “rejected tokens” because they failed this robust #Howey securities’ analysis.

Even more significant, she stated that #Coinbase “considered the #SEC’s framework” and “found it

She made sure to point out that #Coinbase “rejected tokens” because they failed this robust #Howey securities’ analysis.

Even more significant, she stated that #Coinbase “considered the #SEC’s framework” and “found it

helpful” when developing #Coinbase’s own framework in determining

whether a token is a security.

She stated #Coinbase’s framework did something the #SEC’s framework didn’t do.

She stated that #Coinbase’s framework has weightings assigned to each individual factor.

whether a token is a security.

She stated #Coinbase’s framework did something the #SEC’s framework didn’t do.

She stated that #Coinbase’s framework has weightings assigned to each individual factor.

She stated that both the #SEC’s framework and the #Coinbase

framework “reinforced Hinman’s view that a token can start out as a security but later not be.”

Bottom line: at this meeting ABOUT #XRP, the #SEC DID NOT disagree with the #Coinbase analysis - which partly relies

framework “reinforced Hinman’s view that a token can start out as a security but later not be.”

Bottom line: at this meeting ABOUT #XRP, the #SEC DID NOT disagree with the #Coinbase analysis - which partly relies

on the #SEC’s analysis - that #XRP IS NOT a security.

Ladies and gentlemen, in the United States 🇺🇸, there is no bigger market participant than @coinbase.

Isn’t it ironic that a HUGE piece of evidence that #Ripple will rely on to establish its Fair Notice Defense - that market

Ladies and gentlemen, in the United States 🇺🇸, there is no bigger market participant than @coinbase.

Isn’t it ironic that a HUGE piece of evidence that #Ripple will rely on to establish its Fair Notice Defense - that market

participants reasonably believed that #XRP is not a security- comes from a market participant that delisted #XRP.

Remember, the Fair Notice Defense is an objective analysis. What did market participants believe?

This is even more critical evidence for #XRPHolders.

Remember, the Fair Notice Defense is an objective analysis. What did market participants believe?

This is even more critical evidence for #XRPHolders.

If #XRPHolders get a chance to be heard in this case, this is some of the evidence I will be presenting on behalf of #XRPHolders to show that regardless of whether #XRP was a security in 2013-2017, it’s insane to say that today’s token itself is a security.

For more on understanding the significance of the Fair Notice defense please see @CryptoLawUS’s recent video.

#xrpwins

#xrpwins

• • •

Missing some Tweet in this thread? You can try to

force a refresh