WHO REVIEWED & HELPED WRITE THE HINMAN SPEECH?

Who was on the 63 emails that included a draft of the speech?

Where is Hinman’s public calendar?

Who purchased large quantities of #Ether between December 2017 to June 13, 2018?

$10k in #ETH ICO = a net worth more @GaryGensler👇

Who was on the 63 emails that included a draft of the speech?

Where is Hinman’s public calendar?

Who purchased large quantities of #Ether between December 2017 to June 13, 2018?

$10k in #ETH ICO = a net worth more @GaryGensler👇

https://twitter.com/twobitidiot/status/1435241885430386693

@ethereumJoseph received 9.5% of #ETH as a co-founder.

Everyone knows @VitalikButerin and Lubin held an ICO through crowdfunding which was without a doubt an unregistered securities offering.

Where was @SECGov?

Where is outrage from those that attack @Ripple & #XRP?

Everyone knows @VitalikButerin and Lubin held an ICO through crowdfunding which was without a doubt an unregistered securities offering.

Where was @SECGov?

Where is outrage from those that attack @Ripple & #XRP?

https://twitter.com/cryptolawus/status/1436113873455796228

One River bet $1 billion on #BTC and #Ether in October 2020. Two months later on his last day at the @SECGov, Clayton directs the enforcement action against @Ripple and #XRP. Twelve weeks later, Clayton joins One River.

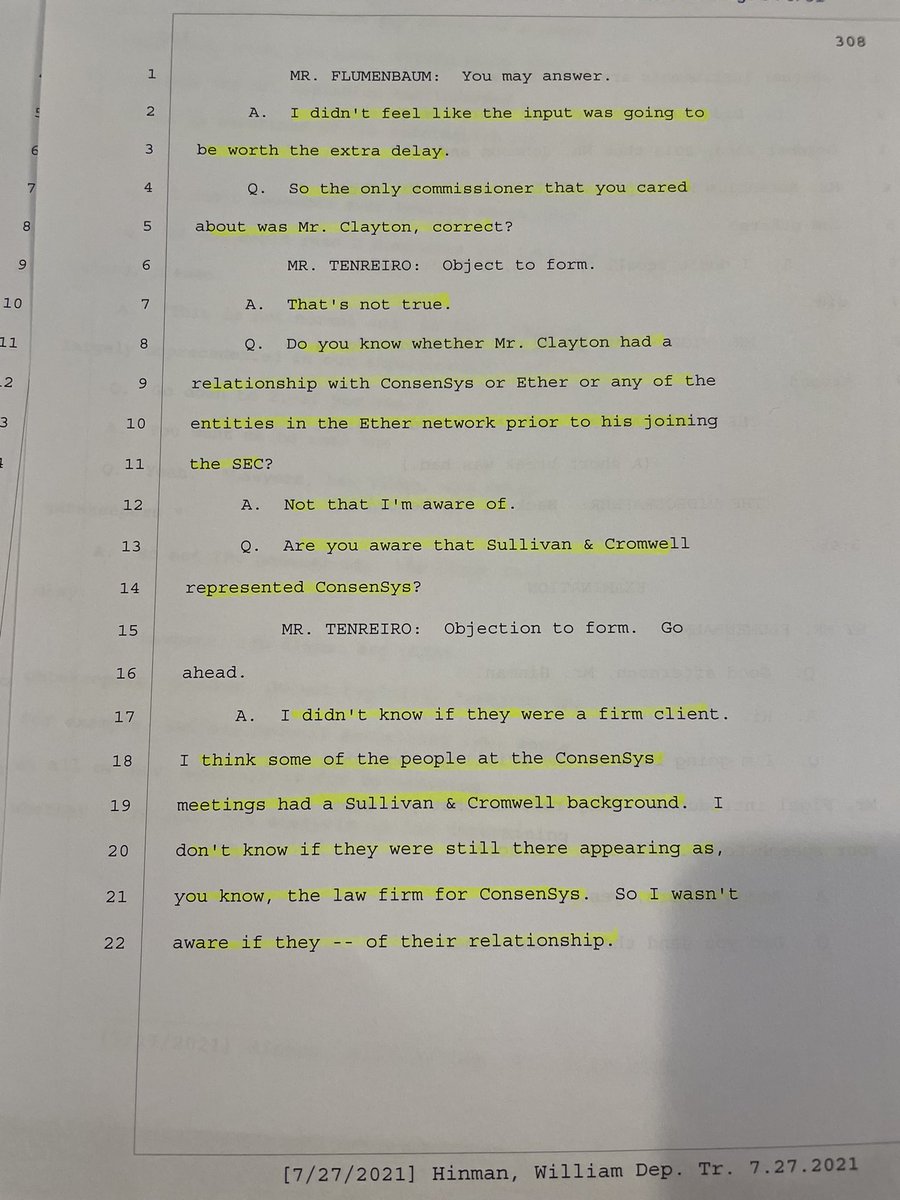

Clayton’s law firm represented Lubin and #Consensys.

Clayton’s law firm represented Lubin and #Consensys.

Hinman’s law firm was on the Board of the #EtherAlliance. Hinman’s firm represented clients heavily involved with the @ethereum foundation.

Hinman collected over $15 million from his law firm (the one on the Board of the #EtherAlliance) while working at the #SEC.

Hinman collected over $15 million from his law firm (the one on the Board of the #EtherAlliance) while working at the #SEC.

We know for a fact that Hinman, as Director of Corporation Finance, had a meeting with Joe Lubin and representatives from #Consensys on December 13, 2017.

This meeting with the co-founder of @ethereum took place while the SEC was aggressively investigating and prosecuting ICOs.

This meeting with the co-founder of @ethereum took place while the SEC was aggressively investigating and prosecuting ICOs.

#KIK, #EOS, #Telegram, and dozens of others were being investigated or prosecuted during the time period of the Lubin & Hinman meeting.

Maybe this meeting was about #Ether’s ICO? Nope!

Was @Ripple @bgarlinghouse or @chrislarsensf being investigated yet? Nope!

Maybe this meeting was about #Ether’s ICO? Nope!

Was @Ripple @bgarlinghouse or @chrislarsensf being investigated yet? Nope!

Before the lawsuit against #Ripple & #XRP, Joe Lubin repeatedly claimed that #XRP was not a competitor to #Ether.

Despite #Ether getting a pass from Hinman and the SEC in June 2018, #XRP was still battling #Ether for the number 2 spot in late 2018👇

coindesk.com/markets/2018/1…

Despite #Ether getting a pass from Hinman and the SEC in June 2018, #XRP was still battling #Ether for the number 2 spot in late 2018👇

coindesk.com/markets/2018/1…

Despite #XRP’s significant market cap and notoriety, investigating #Ripple wasn’t even a thought despite the SEC’s aggressive stance against ICOs and fraud within the digital asset space.

So why didn’t the SEC pursue #Ripple in 2017 with all the other unregistered securities?

So why didn’t the SEC pursue #Ripple in 2017 with all the other unregistered securities?

In addition to #XRP being the #2 or the #3 crypto asset, prior to 2015 FinCEN and the SEC agreed to meet regularly and share information about companies.

Ripple entered into a settlement agreement with FinCEN in 2015 agreeing to register all future XRP sales “only” with FinCEN.

Ripple entered into a settlement agreement with FinCEN in 2015 agreeing to register all future XRP sales “only” with FinCEN.

The point is the SEC was well aware of Ripple and #XRP by 2017.

Let’s return to the Lubin and @ConsenSys meeting in December 2017. If not about #Ether’s crowdfunded ICO, what was it about?

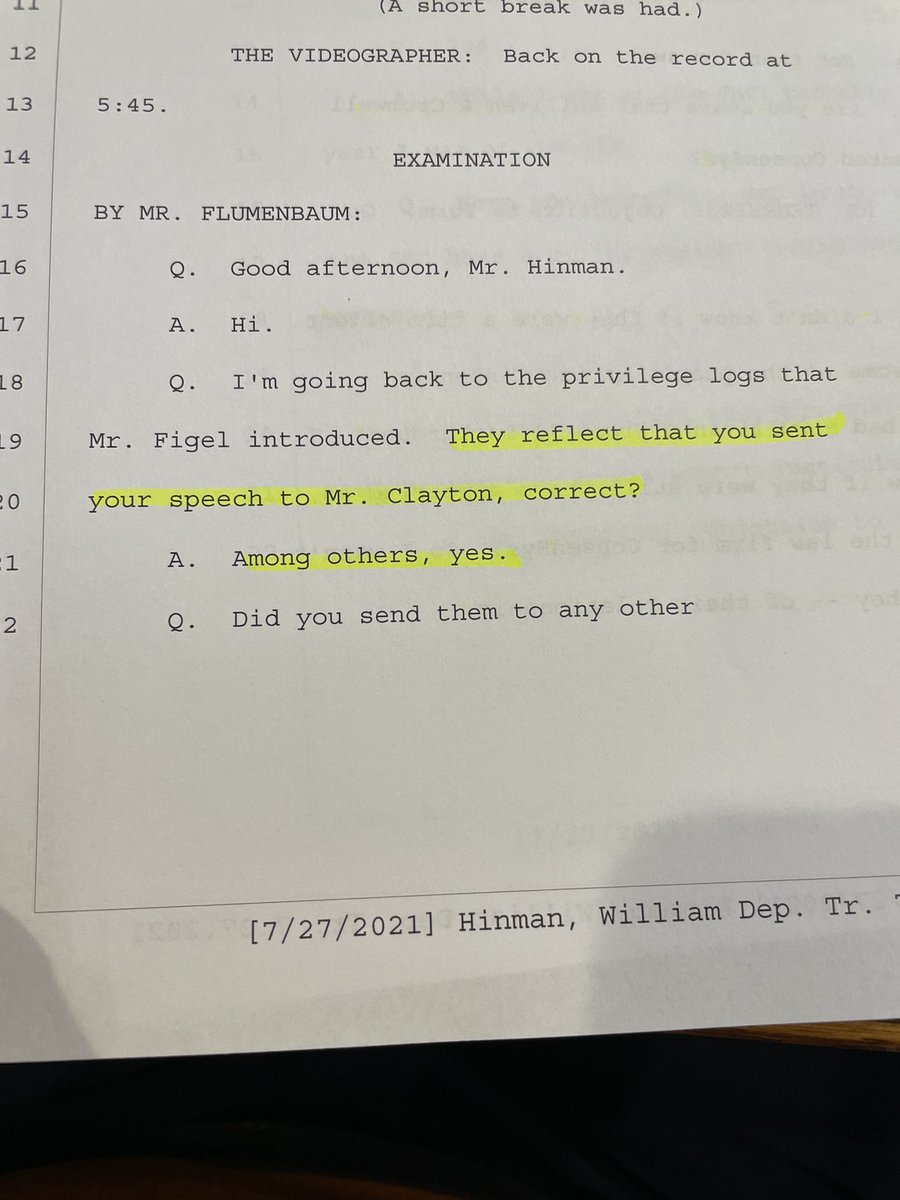

In his deposition, Hinman claimed he was unsure who represented Lubin and #Consensys.🤔

Let’s return to the Lubin and @ConsenSys meeting in December 2017. If not about #Ether’s crowdfunded ICO, what was it about?

In his deposition, Hinman claimed he was unsure who represented Lubin and #Consensys.🤔

That’s right, Hinman testified he was unsure whether his boss and close friend, Jay Clayton’s law firm represented Lubin and #Consensys. 🤥

Six months after this initial meeting with Lubin and #Consensys, on June 14, 2018, Hinman stated #Ether was NO LONGER a security.

Six months after this initial meeting with Lubin and #Consensys, on June 14, 2018, Hinman stated #Ether was NO LONGER a security.

He ignored the #ETH ICO because it can’t be described as anything other than an unregistered securities offering.

In his speech. Hinman says “putting aside the fundraising…” 👇

Why would Hinman put aside the fundraising?

Regardless, we can all agree this is one HUGE “aside”.

In his speech. Hinman says “putting aside the fundraising…” 👇

Why would Hinman put aside the fundraising?

Regardless, we can all agree this is one HUGE “aside”.

Why give such a HUGE advantage to #ETH in the race for the number 2 spot behind #Bitcoin?

The above facts demonstrate HUGE conflicts of interests.

You don’t have to be a conspiracy theorist to seriously question the integrity of the process during the Clayton and Hinman era.

The above facts demonstrate HUGE conflicts of interests.

You don’t have to be a conspiracy theorist to seriously question the integrity of the process during the Clayton and Hinman era.

Why does @ethereumJoseph single out #XRP and state with such conviction that the other tokens will not get the same clarity that #BTC and #Ether received?👇

How does Lubin know with such certainty that the SEC won’t comment further regarding other decentralized networks? 👇

How does Lubin know with such certainty that the SEC won’t comment further regarding other decentralized networks? 👇

https://twitter.com/digitalassetbuy/status/1434967377091903490

Lubin and @novogratz were roommates and close friends. Why is Novogratz so confident that he can bet “diamonds to donuts” that #ETH won’t be declared a security just 9 days before the speech👇

Novogratz with great conviction guaranteed the SEC wouldn’t declare #ETH a security👇

Novogratz with great conviction guaranteed the SEC wouldn’t declare #ETH a security👇

https://twitter.com/digitalassetbuy/status/1435217171215486980

@HesterPeirce is a a Commissioner of the SEC and has less confidence or knowledge regarding anything the SEC will or will not do.

The SEC usually never gives clear and decisive market opinions yet these two gentlemen seemed to know exactly what the SEC would do or not do. 🤔

The SEC usually never gives clear and decisive market opinions yet these two gentlemen seemed to know exactly what the SEC would do or not do. 🤔

How could Lubin predict so accurately the SEC would refuse to comment on any other tokens? Why was #XRP singled out? Lubin literally gloats that compared to #ETH & #BTC other tokens will be “spectacularly” disadvantaged because of regulatory uncertainty?

How did Novogratz know?

How did Novogratz know?

https://twitter.com/digitalassetbuy/status/1435243322759581696

Mike’s a very smart guy, but he wouldn’t be that confident unless he was assured by someone who had personal knowledge of what Hinman was going to say about #ETH in that speech.

In the clip below the General Counsel of Consensys Mr. Corva discusses an alliance with regulators.

In the clip below the General Counsel of Consensys Mr. Corva discusses an alliance with regulators.

https://twitter.com/digitalassetbuy/status/1436034898469470209

We know Corva met with Hinman the day before the above clip.

Just how many times did Lubin or others from #Ether or @ConsenSys meet or talk with the SEC between December 13, 2017 and June 14, 2018?

Who reviewed, edited or helped write the Hinman speech before June 14, 2018?

Just how many times did Lubin or others from #Ether or @ConsenSys meet or talk with the SEC between December 13, 2017 and June 14, 2018?

Who reviewed, edited or helped write the Hinman speech before June 14, 2018?

Who’s on the 63 emails regarding the speech?

Who made any large purchases of #ETH leading up to the speech?

If anyone did make large purchases of #ETH leading up to the speech, do they have any connection to Lubin and Consensys or Hinman and Clayton or their law firms?

Who made any large purchases of #ETH leading up to the speech?

If anyone did make large purchases of #ETH leading up to the speech, do they have any connection to Lubin and Consensys or Hinman and Clayton or their law firms?

Which SEC employees owned #ETH on June 13, 2018?

Where’s Hinman’s calendar 📆 and dates of SEC meetings?

We need an investigative journalist to start asking these fair questions: @MyStephanomics @eisingerj @trish_regan @RebeccaJarvis @gmorgenson @LizClaman @EricLiptonNYT

Where’s Hinman’s calendar 📆 and dates of SEC meetings?

We need an investigative journalist to start asking these fair questions: @MyStephanomics @eisingerj @trish_regan @RebeccaJarvis @gmorgenson @LizClaman @EricLiptonNYT

Joe Lubin was 💯 on 🎯 when he said other tokens would be spectacularly disadvantaged compared to #BTC and #ETH.

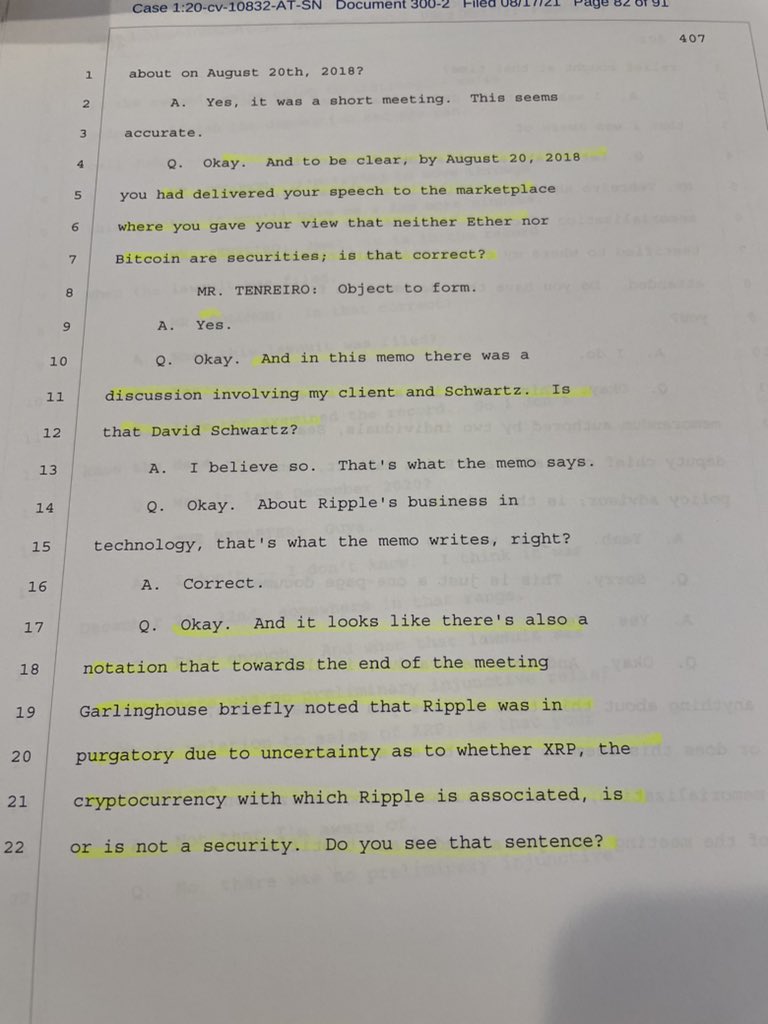

@bgarlinghouse and @JoelKatz met with Hinman and Clayton on August 20, 2018 - 9 weeks after the speech.

This is how @Ripple’s CEO described this disadvantage:👇

@bgarlinghouse and @JoelKatz met with Hinman and Clayton on August 20, 2018 - 9 weeks after the speech.

This is how @Ripple’s CEO described this disadvantage:👇

9 weeks after the speech Garlinghouse tells Clayton and Hinman that #Ripple is living in “purgatory” because the SEC didn’t provide the same clarity for #XRP that it did #ETH.

In response, neither Clayton nor Hinman told #Ripple’s CEO that they believed #XRP was a security.

In response, neither Clayton nor Hinman told #Ripple’s CEO that they believed #XRP was a security.

The origination of #ETH fits the Howey definition of an investment contract much easier than #XRP ever could.

Anyone that does a cursory review of the facts above (and there is so much more), will come to only one conclusion: the lawsuit against #Ripple and #XRP was a hit job.

Anyone that does a cursory review of the facts above (and there is so much more), will come to only one conclusion: the lawsuit against #Ripple and #XRP was a hit job.

In a clip above, @novogratz himself predicted the SEC would pick a token or promoters and try and take them out as an example.

You don’t have to be a fan of #Ripple or #XRP to acknowledge the injustice, the selective enforcement, and deep conflicts of interests or corruption.

You don’t have to be a fan of #Ripple or #XRP to acknowledge the injustice, the selective enforcement, and deep conflicts of interests or corruption.

• • •

Missing some Tweet in this thread? You can try to

force a refresh