Consider the following:

Clayton and Hinman worked closely together before the @SECGov. Clayton brings Hinman on board to join him and the #SEC.

Joe Lubin @ethereumJoseph is co-founder of #Ether and founder of #Consensys.

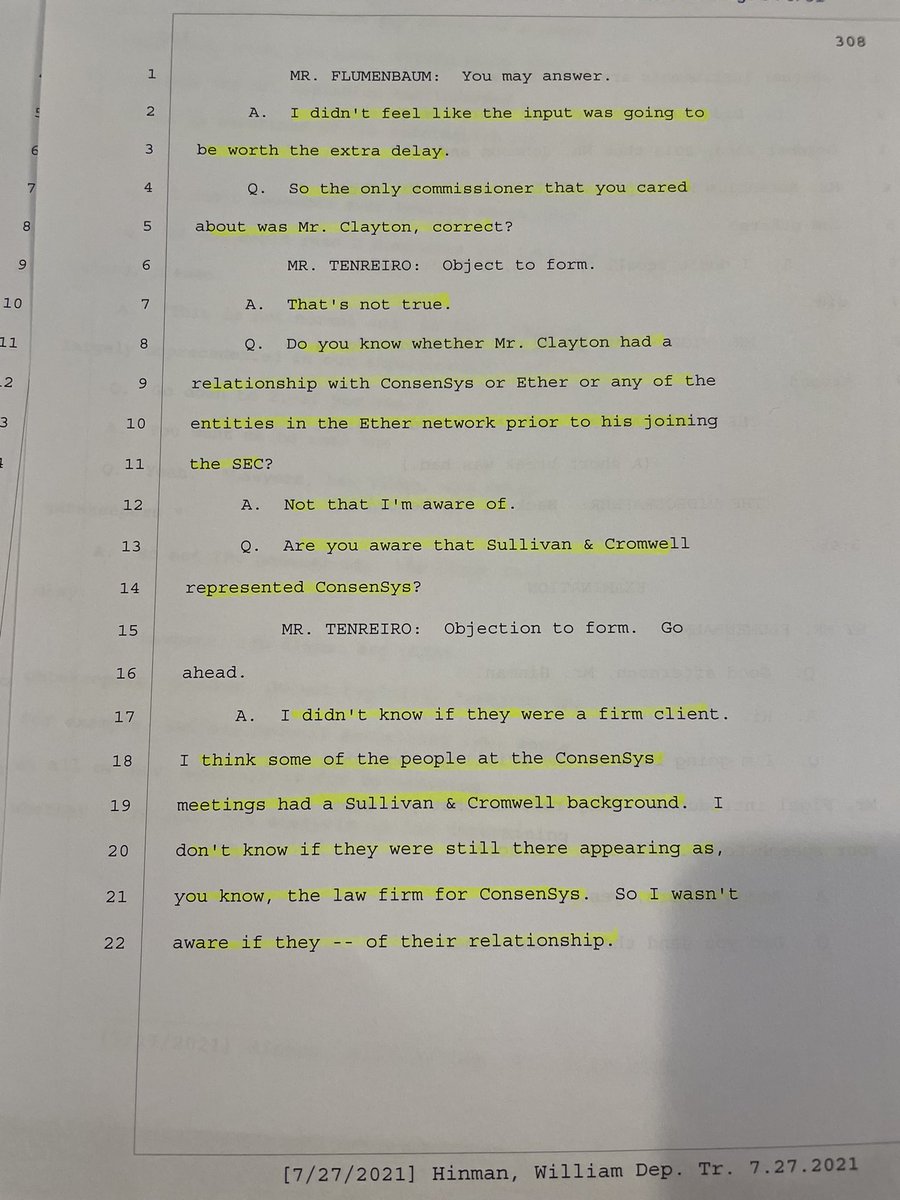

Clayton’s law firm represented Lubin and #Consensys.

Clayton and Hinman worked closely together before the @SECGov. Clayton brings Hinman on board to join him and the #SEC.

Joe Lubin @ethereumJoseph is co-founder of #Ether and founder of #Consensys.

Clayton’s law firm represented Lubin and #Consensys.

Hinman’s law firm was on the Board of the #EtherAlliance and represented clients involved with the #Ethereum Foundation.

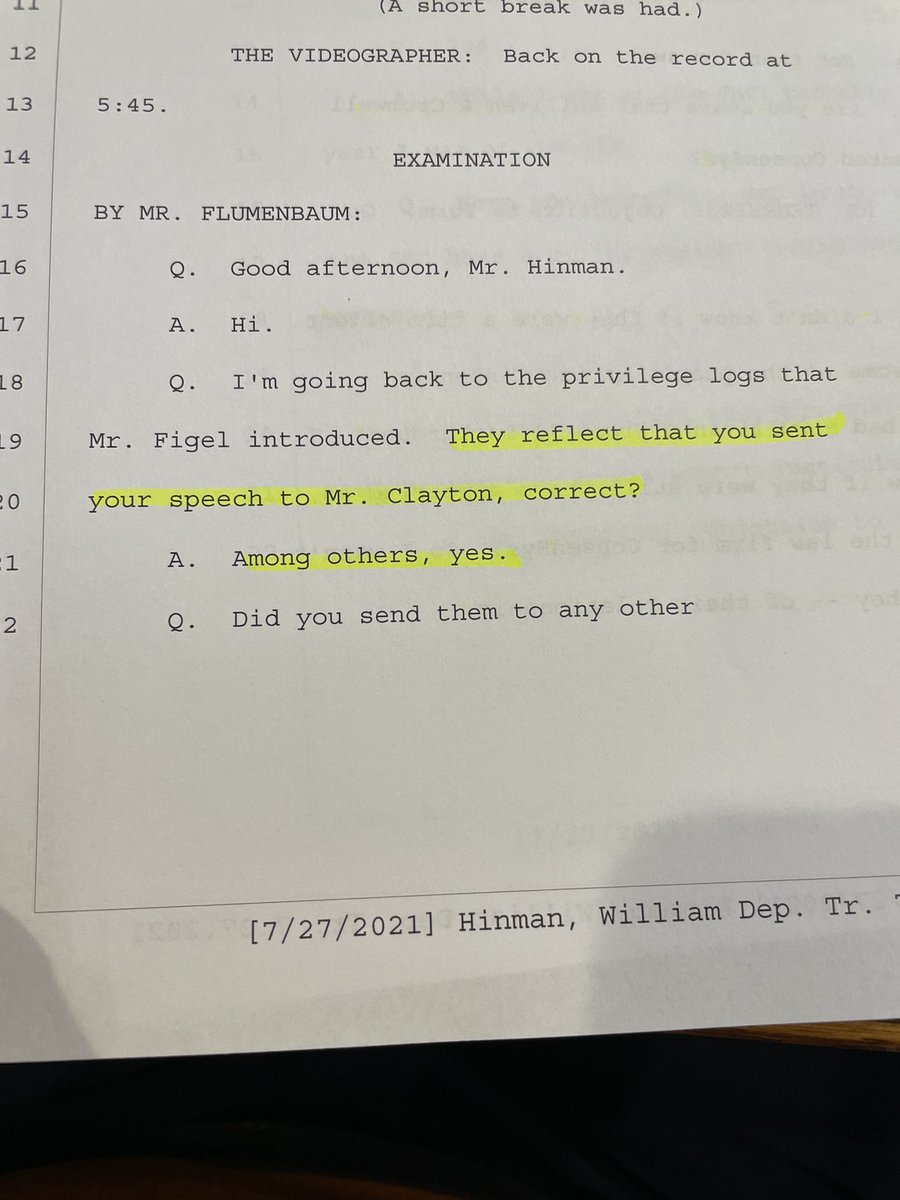

Hinman met with Lubin and Consensys prior to his June 14, 2018 #BTC and #Ether are not securities speech.

Lubin was part of the Hinman speech conference.

Hinman met with Lubin and Consensys prior to his June 14, 2018 #BTC and #Ether are not securities speech.

Lubin was part of the Hinman speech conference.

In October 2020 One River makes a $1 billion bet on #BTC & #Ether.

2 months later on his last day at the SEC Clayton directed the filing of the enforcement action against @Ripple @bgarlinghouse & @chrislarsensf asserting the ridiculous claim that even Today’s #XRP is a security

2 months later on his last day at the SEC Clayton directed the filing of the enforcement action against @Ripple @bgarlinghouse & @chrislarsensf asserting the ridiculous claim that even Today’s #XRP is a security

https://twitter.com/RuleXRP/status/1433910967050674179

Less than 12 weeks after leaving the SEC, Clayton joins One River.

While #BTC and #Ether are declared commodities and given clarity, @Ripple and #XRP are buried in litigation.

With all this in mind watch @digitalassetbuy’s clip below. #XRPHolders can’t watch without disgust.

While #BTC and #Ether are declared commodities and given clarity, @Ripple and #XRP are buried in litigation.

With all this in mind watch @digitalassetbuy’s clip below. #XRPHolders can’t watch without disgust.

https://twitter.com/digitalassetbuy/status/1433733454802399233

DAI asks 4 critical questions:

1) who helped write the Hinman speech?

2) who was in the 63 emails regarding the speech?

3) where is Hinman’s public calendar?

4) where is the Hinman’s 2018 TechGC video?

Lubin proclaims how other projects are “spectacularly” disadvantaged.

1) who helped write the Hinman speech?

2) who was in the 63 emails regarding the speech?

3) where is Hinman’s public calendar?

4) where is the Hinman’s 2018 TechGC video?

Lubin proclaims how other projects are “spectacularly” disadvantaged.

#BTC and #Ether have a HUGE advantage because the other projects must now deal with the @SECGov. He argues how the other tokens are basically securities.

When you consider the pass that #Ether was given by Clayton, Hinman and the SEC, you would think he would have more grace.👇

When you consider the pass that #Ether was given by Clayton, Hinman and the SEC, you would think he would have more grace.👇

https://twitter.com/iso_xrp/status/1433922189397422080

You simply cannot overstate the significance and advantage that the Hinman Speech provided to #Ether and #BTC

I’ve said for months it makes no legal or common sense to claim today’s #XRP itself is a security and that there must be an ulterior motive behind the #Ripple lawsuit.🤔

I’ve said for months it makes no legal or common sense to claim today’s #XRP itself is a security and that there must be an ulterior motive behind the #Ripple lawsuit.🤔

https://twitter.com/rulexrp/status/1433911382064476165

• • •

Missing some Tweet in this thread? You can try to

force a refresh