1. A thread on three #PBOC 2021 Q2 Macro sentiment surveys from Bankers (Sample 3200), Industrial Companies (5000) and Urban Bank Customers (20,000). Surveys data are considered less informative and need to be heavily discounted, but could be complimentary to other data source.

2. Though data came from two diff. surveys, bankers and entrepreneurs have similar view:

Entrepreneur(Bankers) view on Macroeconomy 23.9%(25.5%) as “Cold”,72.6%(71.8%) “Normal”,3.5(2.7%)% “Hot”. Normal got 50 and HOT got 100. Indexes recovered to pre-Pandemic, Q3 lower than Q2

Entrepreneur(Bankers) view on Macroeconomy 23.9%(25.5%) as “Cold”,72.6%(71.8%) “Normal”,3.5(2.7%)% “Hot”. Normal got 50 and HOT got 100. Indexes recovered to pre-Pandemic, Q3 lower than Q2

3. Product Selling Price (Raw Material Purchasing) Sentiment, 24.4%(47.1%) expect “Increase”,67.6% (49.6%) "Same",8.0%(3.2%) "Decrease”. Expect China PPI/CPI finally converge somewhat as companies raise prices on consumers. Some Q3 pull back from Q2.

4. Domestic(Export) Order, Capital Turnover and Sales Revenue, Business Climate and Profitability Indexes all point to similar pattern of recovered to pre-pandemic levels but not piping hot.

5. PBOC entrepreneur survey started in 1992. Banker Survey started in 2004. Banking Industry Climate/Profitability, and Monetary Policy Sentiment Index all points to lukewarm numbers.

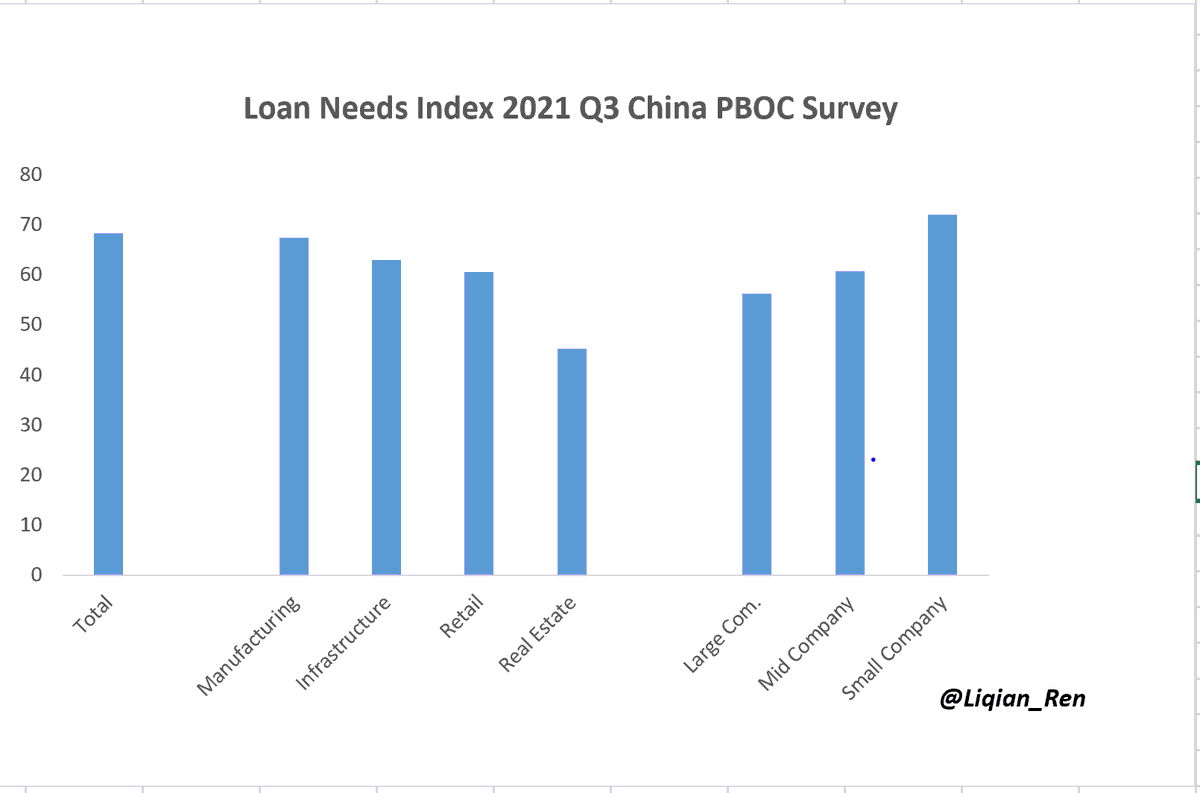

6. The loan needs index has been on an slight upswing for the last 5 years. Website didn't have longer history. More other sources of data are needed to get a better read on what this is indicating and welcome your insights!

7. PBOC Urban Savers Quarterly Survey started in 1999. Income index has not recovered to pre-pandemic. Employment and Spending all recovered but luke-cool, collaborating other data where Chinese consumption is luke-cool, but not cold.

8. When asked about the top three investment choices: Wealth Management Products (46.1%), Funds (26.5%), Stocks (17.5%) We'll be hearing about some future WMP stories after #Evergrande.

9. When asked next 3 months where more spending: Edu 30.1%, Healthcare 27.5% Travel 19.6% Big Ticket Items 19.5%, Housing 19.2% Entertainment 18.0% Insurance 13.8%。Without more historical data for comparison, hard to interpret.

10. In summary, survey points to strong recovery to pre-pandemic but reached a lukewarm stage. PBOC seemed waiting for Fed to act and not contribute further to market volatility and inflation, whether upside or downside. Credit creation through targeted channels are ongoing.

11. Original reports links in Chinese.

Entrepreneur Survey:

pbc.gov.cn/goutongjiaoliu…

Bankers Survey

pbc.gov.cn/goutongjiaoliu…

Urban Savers Survey

pbc.gov.cn/goutongjiaoliu…

Entrepreneur Survey:

pbc.gov.cn/goutongjiaoliu…

Bankers Survey

pbc.gov.cn/goutongjiaoliu…

Urban Savers Survey

pbc.gov.cn/goutongjiaoliu…

12. On expectation, Loan Needs Index is higher for Small/Mid Companies. And surprisingly, low for Real Estate Sector. Without historical data for comparison and other real estate "action" data to collaborate survey data, these numbers remain to be taken seriously.

@threadreaderapp unroll #China #PBOC #Survey #Loan #Entrepreneur #UrbanSaver #2021Q3 #Growth #ChinaMacro #Sentiment #城镇储户 #银行家 #企业家 #问卷调查

• • •

Missing some Tweet in this thread? You can try to

force a refresh