1) Cantor Fitzgerald reaffirms their Buy Rating with US$32/C$40 Price Target🎯 for Cameco $CCJ $CCO as #Uranium Sentiment Continues to Improve 🤠🐂 with term U prices heading higher⬆️ & offers up their key takeaways🥡 from Q3 Results Conference Call👨💻 #Nuclear #mining #ESG🏄♂️ ...2

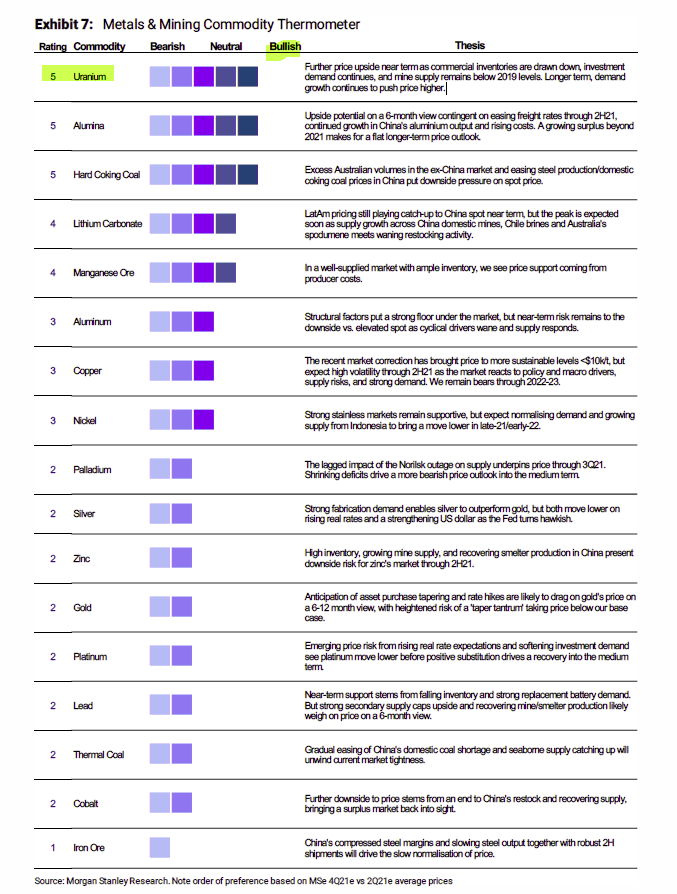

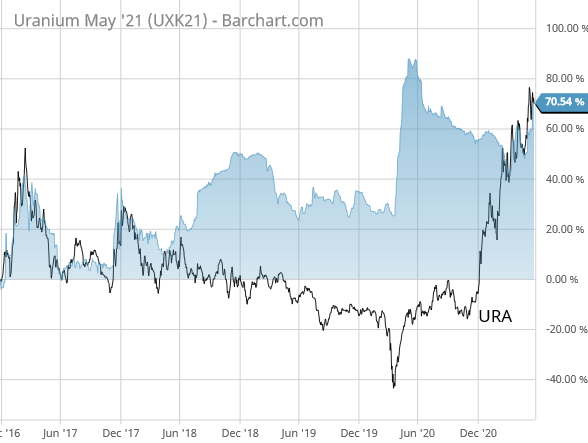

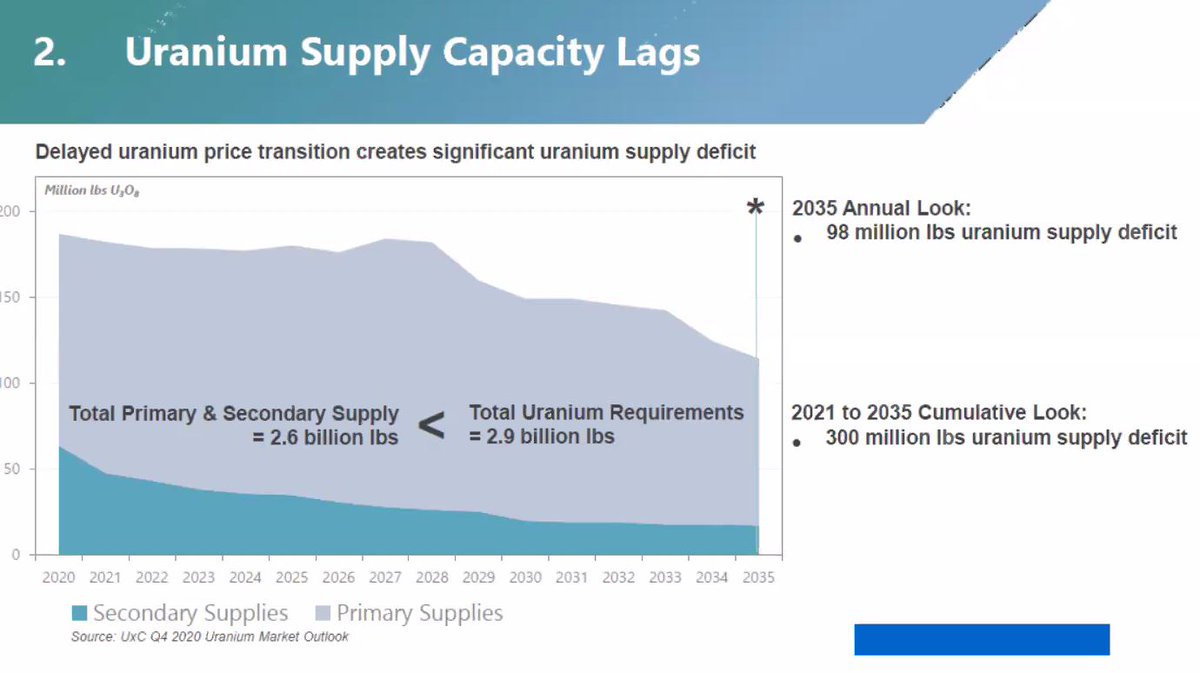

2) "macro setup for #Uranium, and by extension Cameco, is exceptional"😃 as "some urgency" towards long-term contracting returns😟as #SPUT in thin Spot market is killing carry trade⚰️ & Q3 Long-Term #U3O8 price is Up $10 +28%⬆️ but still "early innings" in contracting cycle⚾️...3

3) Cantor provides their view on @Sprott Physical #Uranium Trust as its Spot #U3O8 purchases are "permanently sequestered."🔒 Cameco is not interested in launching its own U fund as Kazatomprom is doing with ANU Energy & world's largest U mine restart is a mid-decade event😲.../4

4) Cantor affirms that "sentiment in the #Uranium sector has turned increasingly positive. The narrative has clearly shifted as it has become abundantly clear that #Nuclear power has a critically important and growing role to play in the energy mix of the future."🌞⚛️🤠🐂 #ESG 🏄♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh