U may feel sucker-punched🥊 or prayers answered😇 or got stopped out🤨 by correcting #Uranium #mining #stocks📉 but 1 thing's 4 certain... #U3O8 supply⛏️⏬ vs #Nuclear demand⚛️🏗️↗️ fundamentals are getting stronger every day🏋️♂️ with even better (re)entry prices now.🛒 A🧵4U👇 ../2

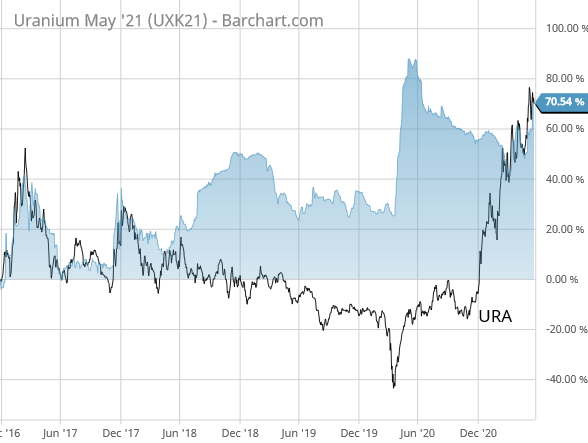

2) If you're new to #Uranium & #mining #stocks in general👼 then U need to understand why this highly cyclical🔃 mined #nuclear reactor fuel⛏️⚛️ is famous for delivering extraordinary life-altering returns😎🍹 when it enters a boom cycle after a decade long bear market🚀.../3

3) #Uranium is a cyclical commodity🔃 that goes through boom & bust cycles based on supply vs demand imbalances⚖️ magnified to extremes by supply security fears😨 as there is no available substitute fuel for #nuclear reactors & production is concentrated in so few countries .../4

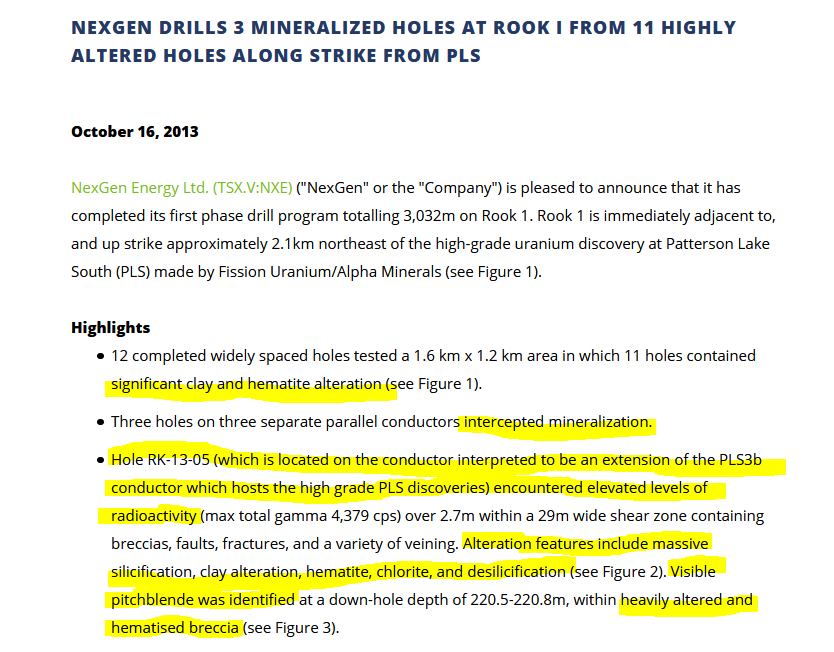

4) Like other commodities #Uranium rises in value when supply is scarce🏜️ which in turn triggers more production to meet demand⛏️ but because it's the most regulated mined metal📚 subject to extremes of environmental scrutiny🧐 bringing new mines online is costly💰 & slow🐌 .../5

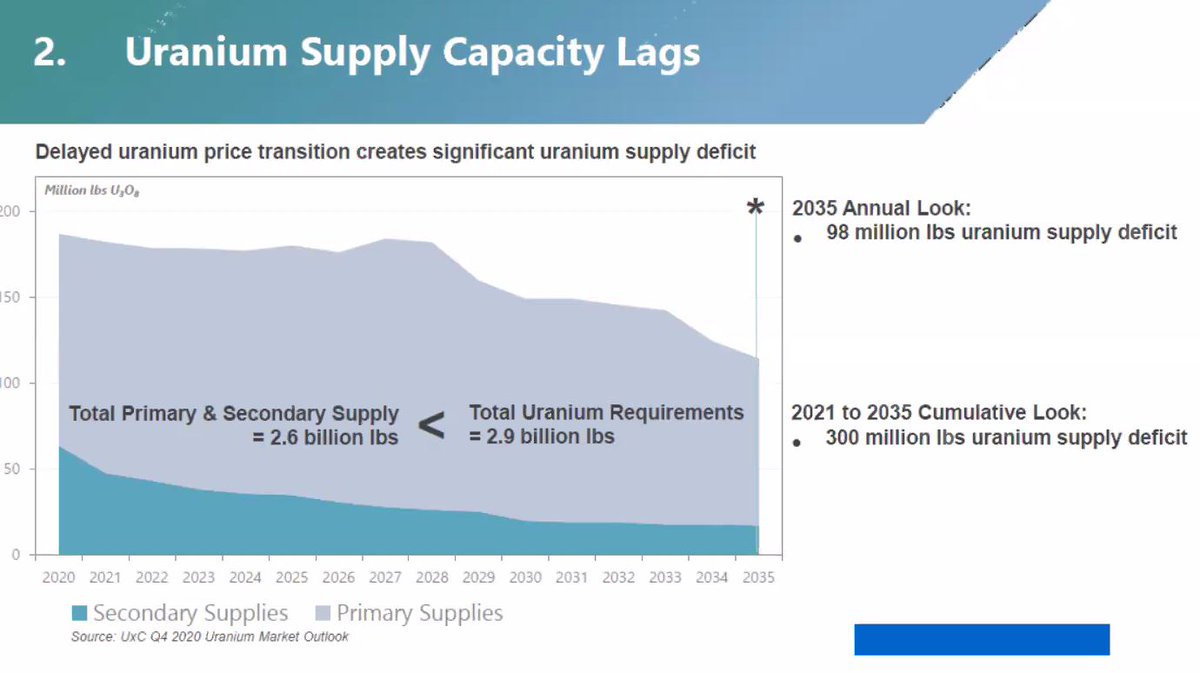

5) Lengthy time delays to get new #Uranium mines built or idled mines restarted🥱 while #nuclear fuel demand keeps growing🏗️⚛️ produces what can become an extreme supply deficit that keeps pushing uranium prices higher & higher as fuel buyers panic that they won't get fuel😱 ../6

6) Today the #Uranium #mining sector is in a significant #U3O8 supply deficit due to 10 years of a low commodity price & under-investment in exploration, development & construction of new mines.🏭⛏️ Today's U price is 1/2 that needed to bring idled and/or new mines online⚠️ .../7

7) #COVID19 pandemic has further deepened the #uranium supply deficit due to lengthy mine closures in #Canada & #Kazakhstan with no chance to make up that lost production.⤵️⛏️ Meanwhile, 2 major U mines just closed⛔️ due to ore depletion & no new mines are being built. 0⃣🏭 .../8

8) Throughout this period of declining mined supply↘️ #Nuclear utilities have been under-buying U, drawing down inventory & relying on other #uranium sources (Secondary Supply) to meet demand instead of signing new supply contracts.✍️ They're now running low & must restock⛽️ ../9

9) What will make this #Uranium boom cycle even more extreme🚀 is new global decarbonization #ESG drive🌞 requiring far more #CarbonFree #nuclear #energy to meet #NetZero emissions goals⚛️🏗️ further supporting & spiking demand higher⤴️ in midst of a sustained U deficit⏬⛏️ .../10

10/ New #uranium mines⛏️ to meet existing #nuclear demand should have been financed, licensed & built yesterday🏭 to increase U supply to rebalance the market.⚖️ A doubling of #U3O8 prices💲💲 and another $5B+ investment💰 is needed to build the required new mines ASAP⌛️🏗️ .../11

11/ But building new #Uranium mines can take many years for this highly regulated commodity.🐌 Even if U prices do double & $10B flows in💵 it still can't speed up permitting & mine construction🦥 once again leading to spiking prices🚀 & life-changing gains 4 U #stocks.🔜💰☘️🌈🤠

• • •

Missing some Tweet in this thread? You can try to

force a refresh