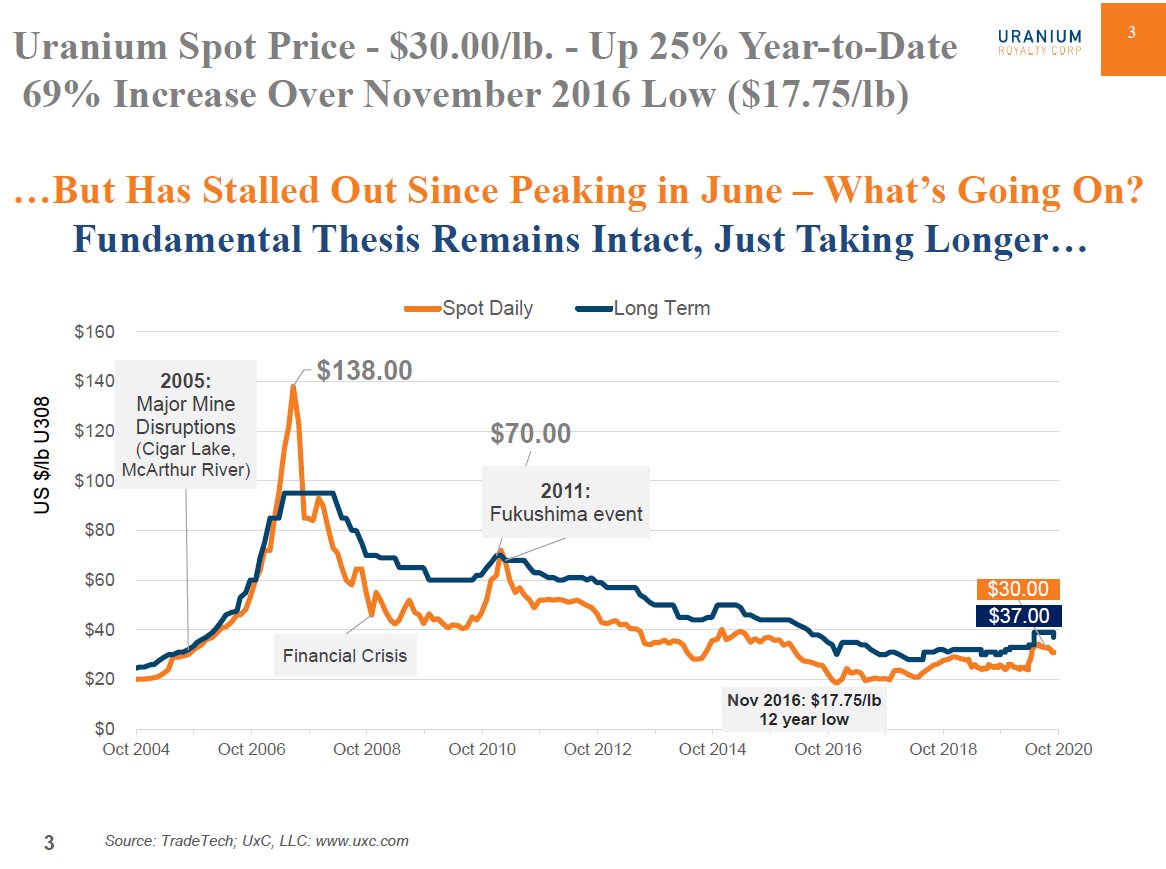

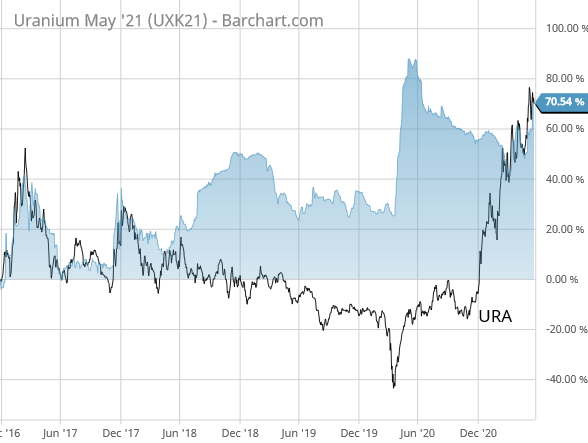

Q: Are #Uranium #stocks overvalued vs Spot #U3O8 price?🤔 A: No. Global X ETF $URA used to track lock-step with Spot U but decoupled in 2018 after $URA changed from 100% to 50% U stocks.⤵️ Now, $URA has recovered to match the >70% rise in Spot U since November 2016 bottom⤴️ .../2

2) You see.. in early 2018 Global X #Uranium ETF $URA held >US$400M AUM 100% in U #stocks, but changed its Index to just 50% U stocks.😡 $URA then dumped >$200M worth of U stocks into tiny U sector,⤵️ decoupling $URA from tracking U Spot price.🔀 Investors exited U space🐻 .../3

3) But, in August 2020 Global X #Uranium ETF $URA increased its weighting of U #stocks from 50% to 75%, buying large volumes of U stocks🚛 which pushed up share prices↗️ and produced a Bullish market signal.🐂🛒 Investment firms began piling back into $URA & U stocks again⤴️.../4

4) Surging #Uranium #stocks, #COVID19 closures of U mines that pushed #U3O8 Spot higher,↗️ new #ESG investment into U sector on rising demand for #CarbonFree #nuclear,💰 have now pushed ETF $URA back up to recouple & track again with Spot U that's UP >70% since Nov 2016 bottom.⤴️

• • •

Missing some Tweet in this thread? You can try to

force a refresh