History Repeats, Are we Listening ?

A Thread 🧵on Economic Cycles, Past & Present, What we Know and What we Do Not.

#Economics #Commodities #recession

@SahilKapoor @virtual_kg @avasthiniranjan @nsitharaman @564pankaj @JustPunforfun @riteshmjn @bloombergquint @PauloMacro

A Thread 🧵on Economic Cycles, Past & Present, What we Know and What we Do Not.

#Economics #Commodities #recession

@SahilKapoor @virtual_kg @avasthiniranjan @nsitharaman @564pankaj @JustPunforfun @riteshmjn @bloombergquint @PauloMacro

We are in a cycle of historical oscillation

Economic instability driven by a pathogen, reminiscent 2018; the outbreak of the Spanish Flu.

More than a century later, where do we go from here?

2/n

Economic instability driven by a pathogen, reminiscent 2018; the outbreak of the Spanish Flu.

More than a century later, where do we go from here?

2/n

As a result of the effects of the COVID-19 pandemic, combined with wars and economic shocks, are we at the beginning of a new supercycle of history?

What is an economic cycle, or oscillation ?

Read On....

3/n

What is an economic cycle, or oscillation ?

Read On....

3/n

This consists of a long-term economic cycle, marked by periods of evolution and self-correction brought about by technological innovation, that result in a long period of prosperity — in theory.

4/n

4/n

Research shows that global economy tends to be very cyclical in nature with alternating periods of “boom and bust.”

5/n

5/n

The four stages of an economic cycle are expansion, peak, contraction (also known as recession) and trough, followed by another expansion that marks the beginning of a new cycle.

6/n

6/n

How Long Do these Cycles Last ?

A typical economic cycle lasts about five-and-a-half years, although some are quite short, as little as 18 months, and others can span more than a decade.

7/n

A typical economic cycle lasts about five-and-a-half years, although some are quite short, as little as 18 months, and others can span more than a decade.

7/n

What Economic catalysts can trigger oscillations ? Some examples

1. Industrialisation of the US in the late 19th century

2. Reconstruction of Europe and Japan after the Second World War.

3. The emergence of China as a leading global manufacturer.

8/n

1. Industrialisation of the US in the late 19th century

2. Reconstruction of Europe and Japan after the Second World War.

3. The emergence of China as a leading global manufacturer.

8/n

Geopolitics are currently in disarray, the type of economic cycle the world experienced in 1918 is recurring now, marked by contraction and then a trough, being exacerbated by the emerging bifurcation of the global economy; as Russia is isolated by Western countries.

9/n

9/n

Technology & interconnectivity accelerate effects of super-cycle —-> reduced food security and more volatile economies.

Understanding economic processes may be incomplete, as suggested by non forecasted crash of 2008. (Other than by a few people

, like Dr Mike Burry)

10/n

Understanding economic processes may be incomplete, as suggested by non forecasted crash of 2008. (Other than by a few people

, like Dr Mike Burry)

10/n

Commodity super-cycles are driven by super-cycles in the broader economy and are sustained by rising demand for raw materials, manufactured materials and sources of energy.

11/n

11/n

Commodities sector is especially cyclical, more than the broad economy, because of the lag between supply shortages and the provision of additional production capacity.

Commodities producers are struggling to meet demand which can take years to complete.

12/n

Commodities producers are struggling to meet demand which can take years to complete.

12/n

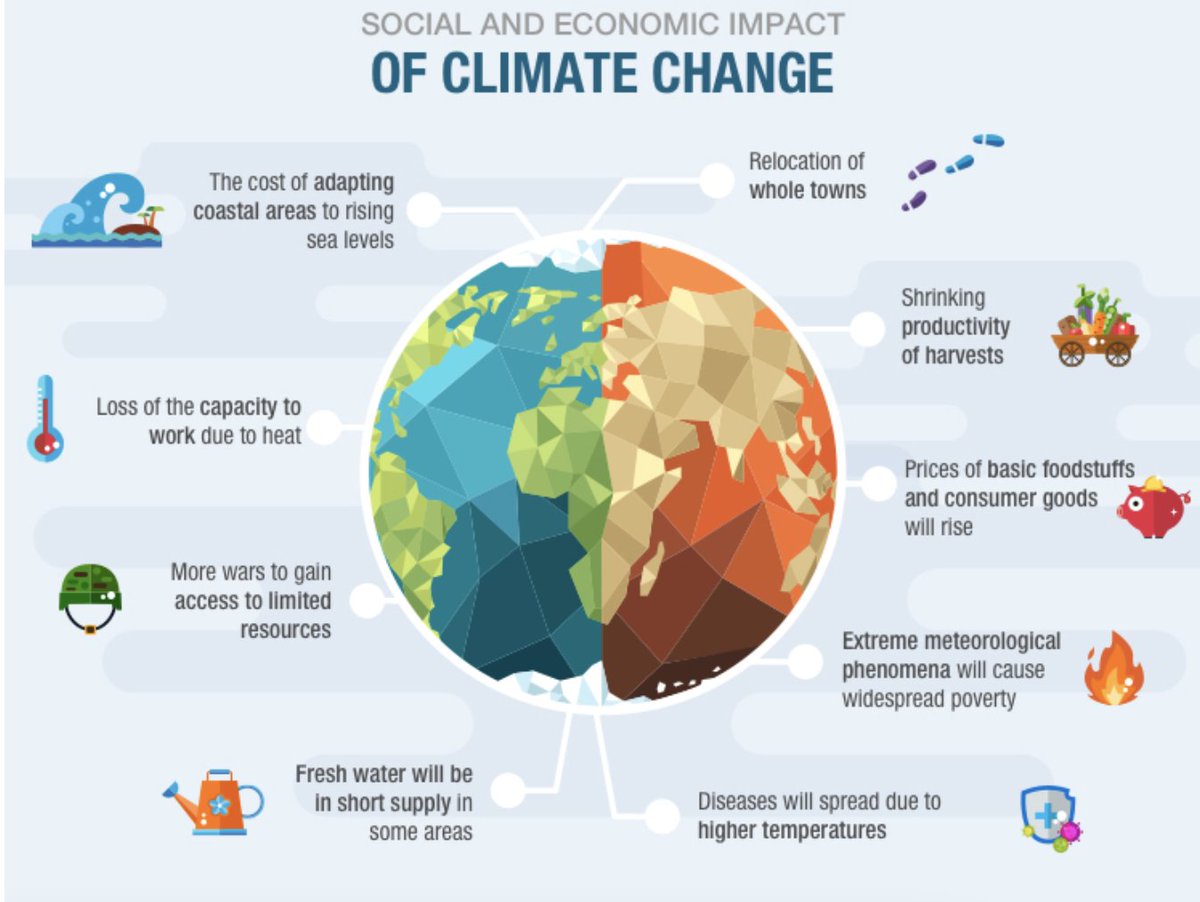

A complication for the currently emerging low point of the cycle is the requirement for proactivity on climate change issues, which everyone is talking of. May it be the Jerome Powell or EM Governments.

(Infographic: @IberdrolaI )

13/n

(Infographic: @IberdrolaI )

13/n

It is important to realise that a sustained transition to low-emission power sources and transportation, along with movement toward digitalisation , could significantly affect the trough of the super-cycle .

14/n

14/n

Broad market transitions can negatively impact commodities such as oil, coal and natural gas, but at the wrong time. The importance of commodities in this cycle is going to shift in terms of potential during the upcoming downturn.

15/n

15/n

Geopolitically, the game is just beginning and nation states will find themselves in various stages of economic decline this year. Heading into 2023 might be a rough ride, with product shortages and, probably, a more complex geopolitical environment.

16/n

16/n

Threat levels are rising not falling.

The current dangerous international environment is accelerating these factors, especially in relation to commodities.

17/n

The current dangerous international environment is accelerating these factors, especially in relation to commodities.

17/n

This situation is not new, an in the making since decades. Climate changes have even talked of since long. This means a larger shock is coming.

For example, the US is forecast to enter a recession in 2023. But other countries are facing shocks now, including China.

18/n

For example, the US is forecast to enter a recession in 2023. But other countries are facing shocks now, including China.

18/n

The balance of the international system is being disrupted. Social media and high-speed global connectivity is increasing the speed of dis balance, elements that did not exist in the early 20th century and are complicating current cycle of oscillation.

End.

RT if u want 2 🙏

End.

RT if u want 2 🙏

• • •

Missing some Tweet in this thread? You can try to

force a refresh