TIME TO ENTER & NOT EXIT FROM EQUITY at this juncture

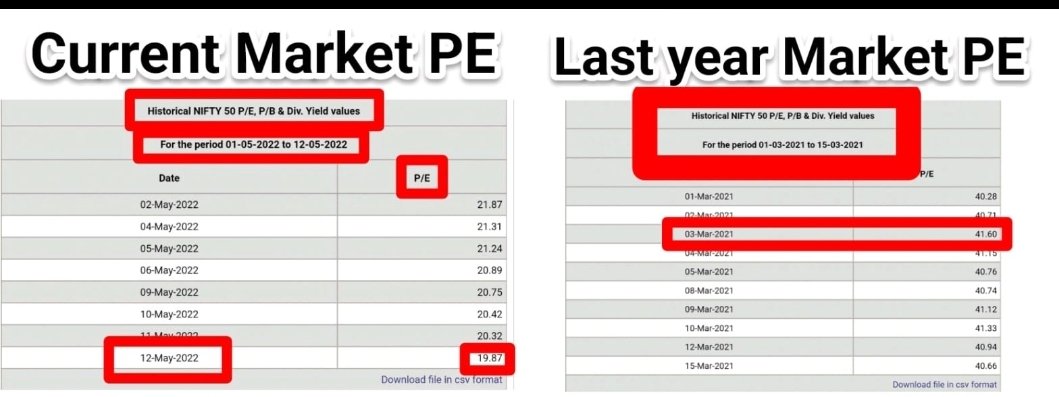

After yesterday's correction, NIFTY PE & PB have gone down for our Algo to show one can invest 60% in Equity. In such a scenario, we would recommend out of ₹100, ₹60 can now be invested in Equity and balance 40% in Liquid.

After yesterday's correction, NIFTY PE & PB have gone down for our Algo to show one can invest 60% in Equity. In such a scenario, we would recommend out of ₹100, ₹60 can now be invested in Equity and balance 40% in Liquid.

We then do value STP of 3X over next few months till markets remain in Yellow Zone. If markets collapse to Green Zone, balance amount in liquid can be deployed in Equity immediately.

What is 3X?

60 lacs/60 mths = 1 lac is 1X

3X in this case is 3 lacs

What is 3X?

60 lacs/60 mths = 1 lac is 1X

3X in this case is 3 lacs

But please remember, that after 60% investment in Equity if markets correct, for some time that portion will show negative returns for a short while. That should not perturb us as these investments would have been done at reasonable valuation Zone.

Hence very soon when markets start rising, this strategy will help us deliver very decent returns over longer period of time.

Intention is to invest at right Valuations rather than at any valuations.

Intention is to invest at right Valuations rather than at any valuations.

If markets recoup yesterday's losses, you may invest 50:50 in favour of Equity and follow rest of the strategy

Remember, impact of actual #QT is still not visible in this market

Even post markets going in Green in Nov 08, it still went down by further 40% by Mar 09. Don't panic

Remember, impact of actual #QT is still not visible in this market

Even post markets going in Green in Nov 08, it still went down by further 40% by Mar 09. Don't panic

This is not the time to be conservative. Such levels of markets come very infrequently.

Remember March 2020 collapse lasted less than a month before bouncing back.

Remember March 2020 collapse lasted less than a month before bouncing back.

Post your investments, markets may remain listless or sideways, that can be expected due to huge bull run it has experienced for quite some time now;especially US markets

One can relax only when one has invested at right Valuations.Otherwise you will always remain on tenterhooks

One can relax only when one has invested at right Valuations.Otherwise you will always remain on tenterhooks

• • •

Missing some Tweet in this thread? You can try to

force a refresh