Question 4 U @brandon_munro et al re knock-on effects on WNA #Uranium demand figures from overfeeding by enrichers: WNA quotes U demand at 62,496tU (162.5M lbs #U3O8) per 393,744MW #Nuclear capacity = ~413K lbs/1000MW. AFAI can tell, this figure accounts for a SWU surplus...

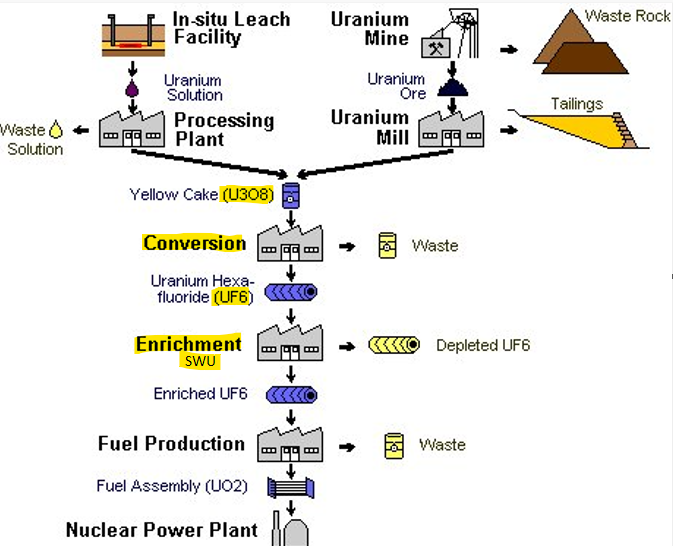

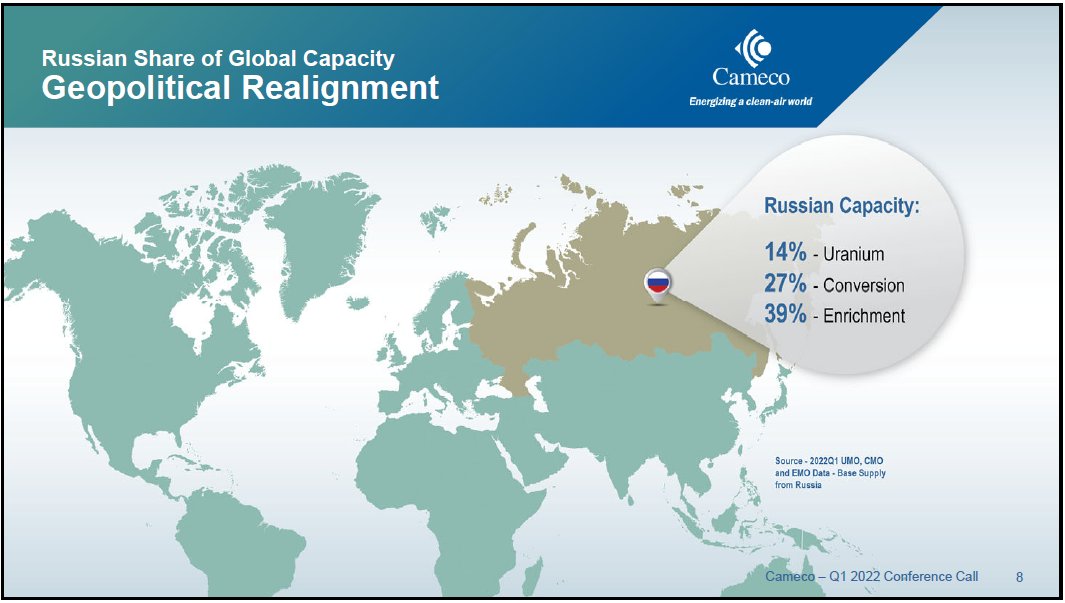

2) which has led to underfeeding which reduced amount of #Uranium (UF6 & mined #U3O8) required to enrich #Nuclear fuel to achieve the necessary fuel load for each reactor, circa 15% below that which would be needed if there was no SWU surplus. Is that correct?🤔 in other words...

3) without underfeeding, #Uranium(#U3O8) demand per 1000MW of #Nuclear rises by circa 15% to 475K lbs.⬆️ As enrichers move to overfeeding by say 15%, will WNA then raise their U requirements to 546K lbs/1000MW for western reactors not supplied by Russia?🤔 As well, SWU deficit...

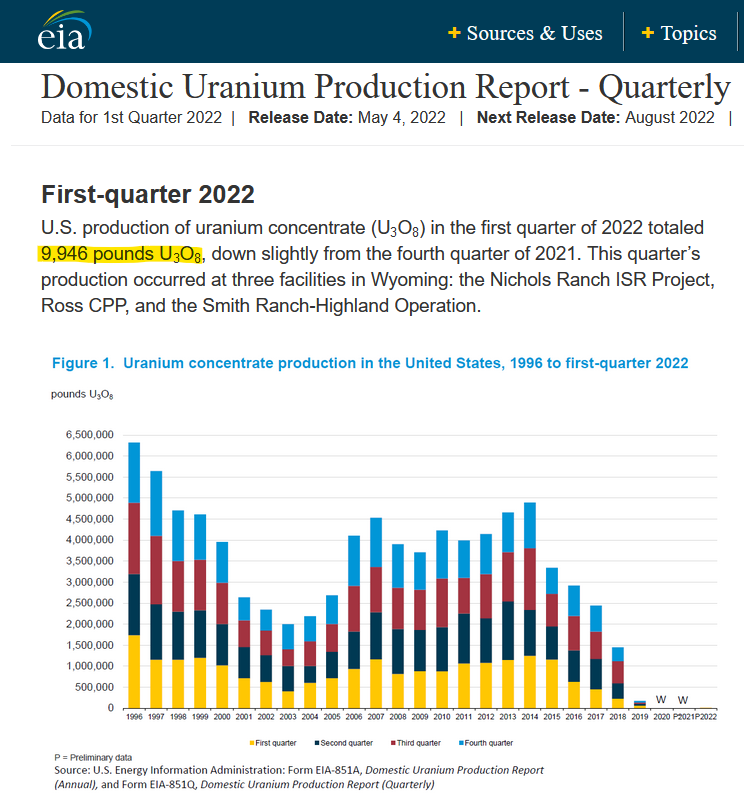

4) means #uranium inventories held by US & EU #Nuclear utilities no longer represent 2-3 years of forward demand. In US, EIA shows 84.6M lbs #U3O8 equivalent out of 141.7M lbs of inventory (60%) is not yet enriched, so move to overfeeding reduces forward time cushion?✂️ Thoughts?

• • •

Missing some Tweet in this thread? You can try to

force a refresh