1)On Friday Congress was asked for $1.5 Billion in "emergency" funding for "acquisition and distribution of low-enriched #uranium(LEU) and high-assay LEU(HALEU)"🛒 "to address potential future shortfalls in access to Russian uranium and [#nuclear] fuel services"⚛️⛏️🇷🇺 A 🧵../2👇

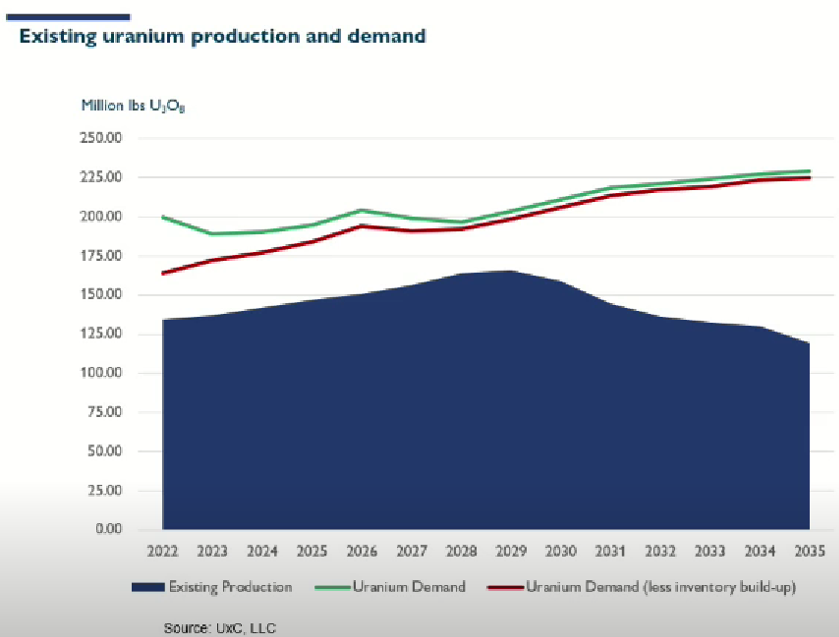

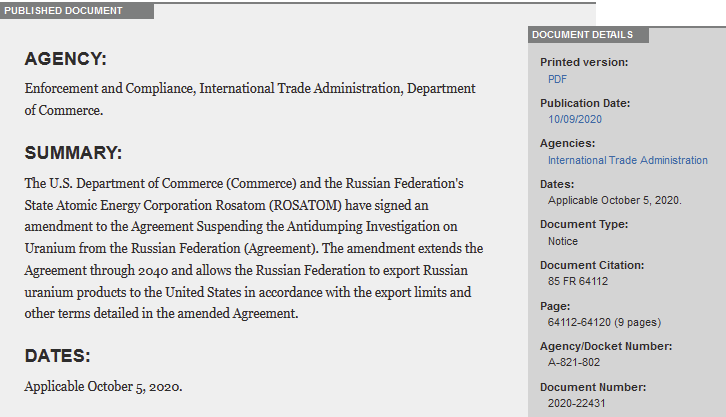

2)US #Nuclear utilities send #Russia hundreds of $Millions per year under a "Russian Suspension Agreement" US government extended in 2020 that allows utilities to purchase & import 20% of their enriched #Uranium reactor fuel from Russia (about 10M lbs/yr #U3O8 equivalent)😯../3👇

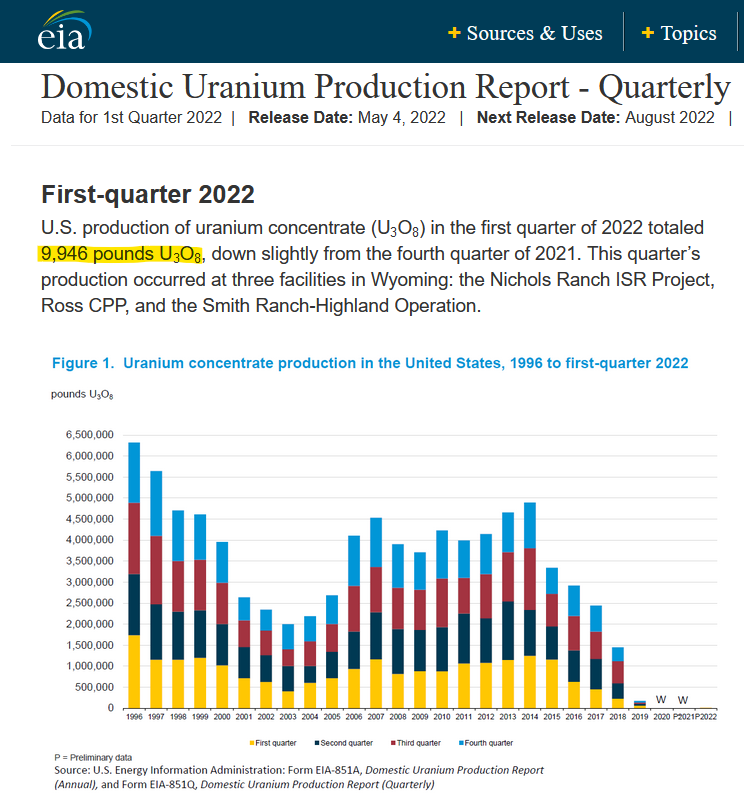

3)US government wants to stop US #Nuclear industry from funding #Russia's war on #Ukraine but haven't yet banned the import of Russian #uranium because it would halt deliveries of 20% of US reactor fuel already in signed contracts, with alternative sources in short supply. ../4👇

4)US department of Energy met with congressional staff & #Nuclear industry reps to develop a strategy whereby DOE would "buy enriched #uranium directly from domestic producers" to replace supply from #Russia. In June, Biden admin lobbied Congress to support $4.3B in funding../5👇

5)Now Biden admin has made a direct ask of Congress to provide "emergency" funds of $1.5B for "acquiring and distributing" enriched #Uranium from non-Russian sources. I think this may signal US is now ready to ban the import of Russian uranium once Congress approves funds../6👇

6)The $1.5B would allow DOE to solicit for enriched #uranium supply contracts with domestic suppliers as per their June proposal, so as to acquire & distribute replacement supply to #Nuclear utilities who have signed contracts for Russian LEU/HALEU blocked by an import ban.../7👇

7) Centrus $LEU is the main conduit thru which enriched #Uranium from #Russia is imported & delivered to US #Nuclear utilities. It may be Centrus who subcontract with Urenco, ConverDyn, Cameco, etc for enrichment, UF6, conversion & #U3O8 feed to fulfill DOE requirements.../8👇

8)Urenco is moving to overfeeding to increase its enriched #Uranium production & can expand if they get more signed contracts. ConverDyn is ramping up in a few months time. Cameco can utilize its full capacity if it gets contracts. $1.5B is stimulus needed to ramp up supply../9👇

9)Bottom line... signs of an imminent US ban on Russian #uranium may now be visible. Even without a ban (or export ban by #Russia) US is moving to end its reliance on Russia by ramping up domestic enrichment, conversion & #U3O8 #mining which is good news for U #stocks, imho.🌊🏄♂️

• • •

Missing some Tweet in this thread? You can try to

force a refresh