$SPX

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

Our weekly "NEXT WEEK, The Bear's take, The Bull's take, Our take" is here

For more info read our newsletter

Subscribe for Free

pointblanktrading.substack.com

#SPX $SPY $ES $SPX #ES_F $GAMMA $GEX #GAMMA #GEX $QQQ #QQQ

$DIA $IWM #trading

NEXT WEEK

The Bear's take:

• Rates, dollar, employment ↑

• Geopolitical tensions

• $VIX and $VVIX are above 20DMA and uptrending

• $SPX closed below 200, 100, 50 and 20 DMA

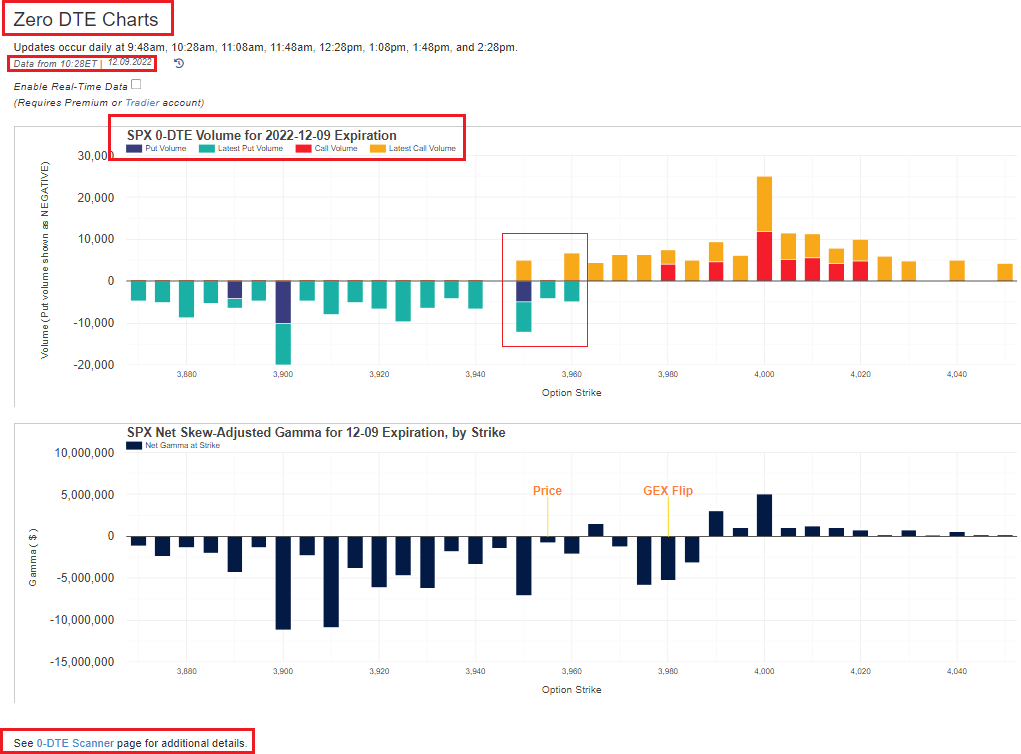

• Negative #Gamma regime

• Leading sectors are breaking down

$ES_F $SPX $SPY #SPX #VIX #trading

The Bear's take:

• Rates, dollar, employment ↑

• Geopolitical tensions

• $VIX and $VVIX are above 20DMA and uptrending

• $SPX closed below 200, 100, 50 and 20 DMA

• Negative #Gamma regime

• Leading sectors are breaking down

$ES_F $SPX $SPY #SPX #VIX #trading

NEXT WEEK

The Bull's take

•Inflation/Commodities/Oil/ $DXY are ↓

•Seasonality favors up movement

•It was all about heavy $GEX & #Quad witching day

•Indices are very near strong support

• $VIX and $VVIX still in donwtrend

• Breadth indicator (#S5TH) is still holding

#SPX

The Bull's take

•Inflation/Commodities/Oil/ $DXY are ↓

•Seasonality favors up movement

•It was all about heavy $GEX & #Quad witching day

•Indices are very near strong support

• $VIX and $VVIX still in donwtrend

• Breadth indicator (#S5TH) is still holding

#SPX

NEXT WEEK

Our take

•Expecting the market to bounce on Monday

•There is serious technical damage on charts, but #Quad #Opex and #Gamma had an important influece on that, expecting #SPX to float

•Market may need to reach stronger support not far away before meaningful bounce

Our take

•Expecting the market to bounce on Monday

•There is serious technical damage on charts, but #Quad #Opex and #Gamma had an important influece on that, expecting #SPX to float

•Market may need to reach stronger support not far away before meaningful bounce

Comments:

Technical damage on charts is ugly. We need more than one up day to fix that

As in 2018 market may go down for a few more days before a significant bounce

In our newsletter we will identify the support levels from which the market should bounce.

unroll @UnrollHelper

Technical damage on charts is ugly. We need more than one up day to fix that

As in 2018 market may go down for a few more days before a significant bounce

In our newsletter we will identify the support levels from which the market should bounce.

unroll @UnrollHelper

• • •

Missing some Tweet in this thread? You can try to

force a refresh