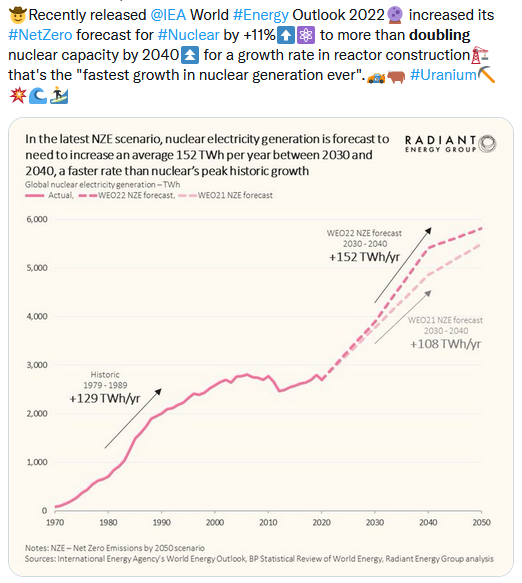

1) The #investing opportunity in #Uranium⛏️💰 emerges from an accelerating #Nuclear Renaissance🏎️⚛️🏗️ creating unprecedented demand for #U3O8🛒 that was already in a deep multi-year structural supply deficit⏬ that can only be repaired by far higher #U3O8 prices.✖️2⃣⏫🐂🧵.../2👇

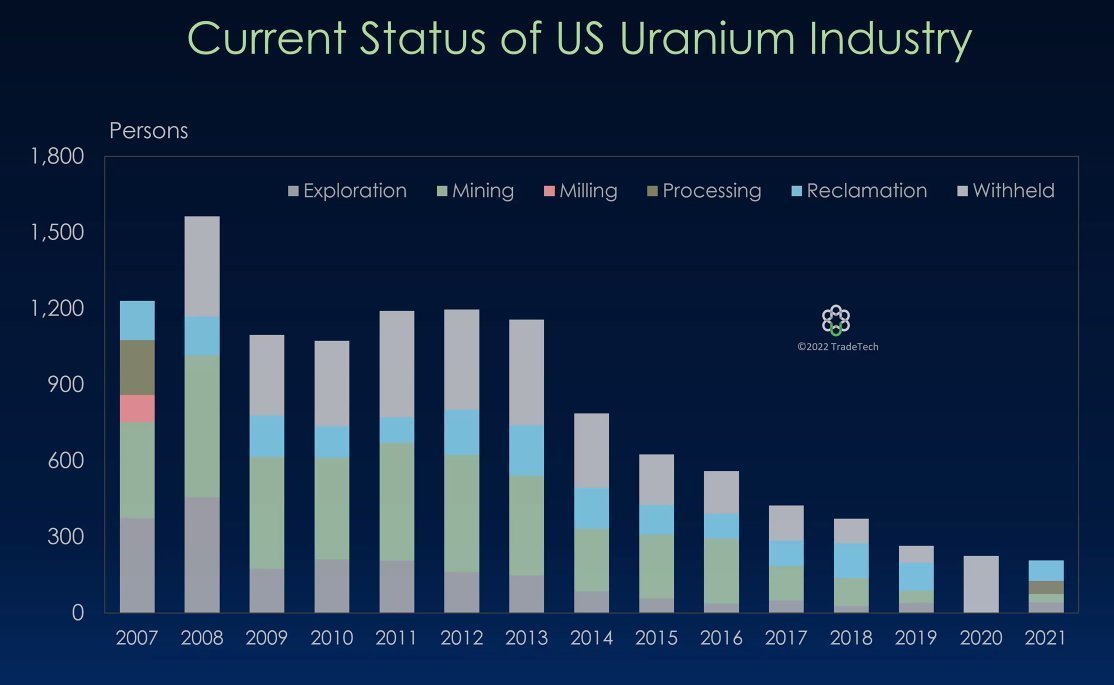

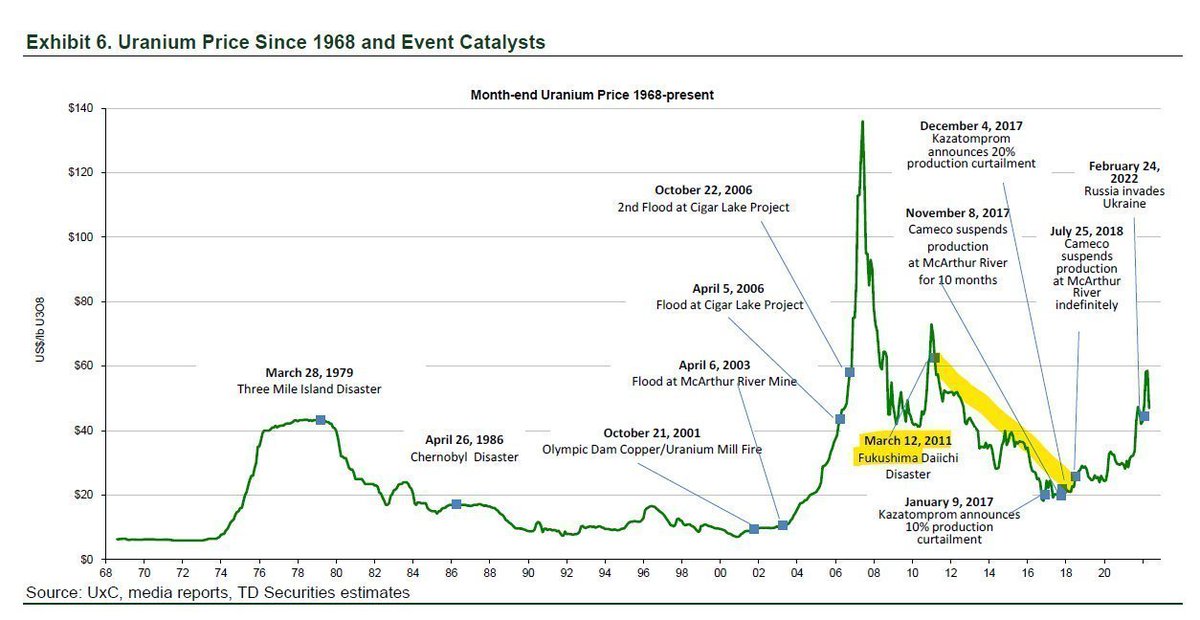

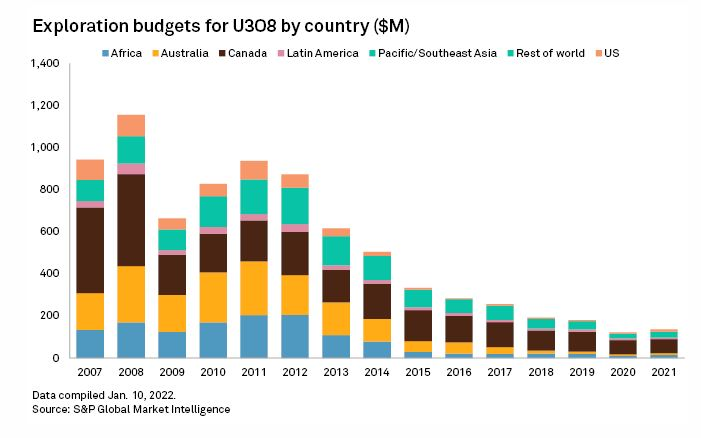

2)The #Uranium #mining #stocks #investing thesis in a nutshell🥜 is that after Fukushima the #U3O8 price sank, new mine projects were cancelled, many mines closed, investment dropped💰⤵️ as investors mistakenly thought '#Nuclear #energy is dying'🪦 but they were wrong!✖️😯../3👇

3) #Nuclear #energy has recovered over the past decade⚛️🏗️⤴️ so that #Uranium demand today is back where it was before Fukushima & surging higher.🌞 A #Nuclear revival has been underway for years📈 now kicked into high gear🏎️ by an #EnergyCrisis & #NetZero targets.🎯⚡️⏫ .../4👇

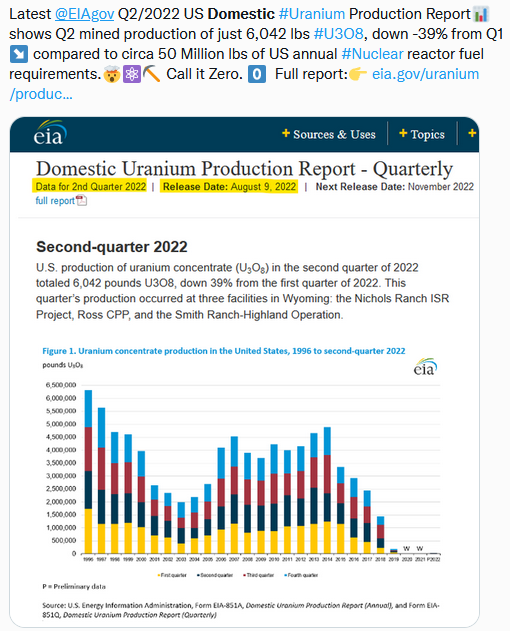

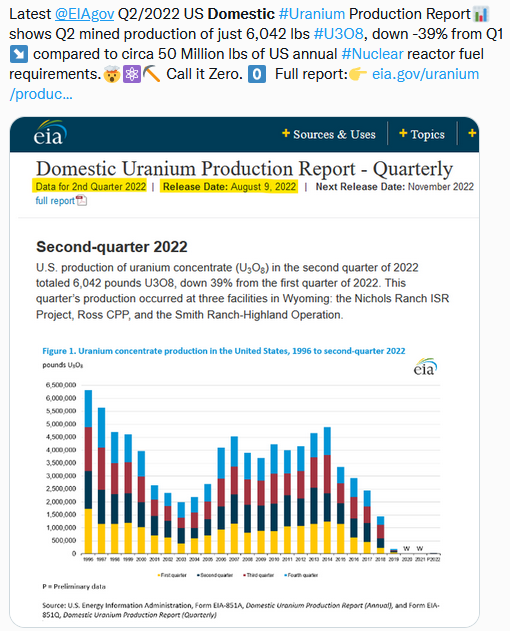

4) Rising #Nuclear fuel demand🌞⚛️🏗️⤴️ as #Uranium production declined⛏️⤵️ has led to a massive mined U supply deficit⏬ estimated by industry consultants at ~65 Million lbs #U3O8 in 2022, partially offset by ~20M lbs of 'Secondary Supply' from other non-mined sources🛒 .../5👇

5) But bringing idled & new large #Uranium mines into production requires far higher #U3O8 prices than today's ~$48/lb⚠️ as inflation pushes costs higher💰 so $90+/lb is needed to bring enough new mines online to fix the deficit🏭⬆️⛏️ as operating mines are in decline↘️🗜️.../6👇

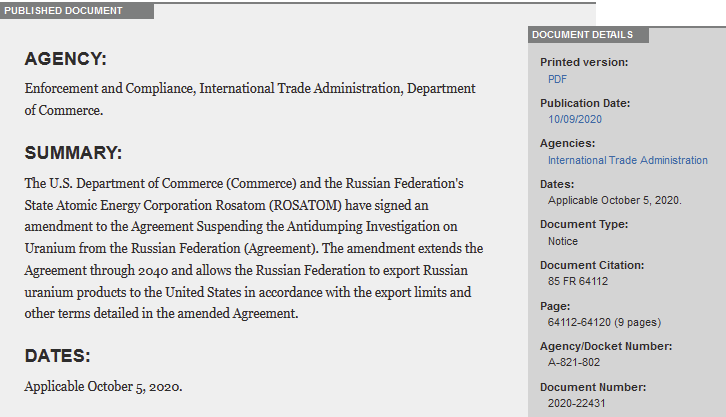

6) #Russia's war on #Ukraine🪖 has sparked an #EnergyCrisis⚡️😟 disrupting already depressed #Uranium supply💥⛏️⤵️ in midst of a global #Nuclear resurgence.🌞⚛️🏗️⤴️ A pivot away from Russian U supply🇷🇺⛔️ is creating new shock-waves.🌊 More detailed🧵here:👇

https://twitter.com/quakes99/status/1561232244865265664?s=20&t=JcII8Ly42jF4q8O_H5xEKw

• • •

Missing some Tweet in this thread? You can try to

force a refresh