1/21

To find a glimmer of hope in the bear market, you need to follow stablecoin trends.

Following this trend will lead you to Y2K Finance (@y2kfinance)

The Ultimate Guide to Y2K Finance🧵

To find a glimmer of hope in the bear market, you need to follow stablecoin trends.

Following this trend will lead you to Y2K Finance (@y2kfinance)

The Ultimate Guide to Y2K Finance🧵

2/21

Before I dive in, a quick mention to @BanklessHQ since I wouldn't have found @y2kfinance and written this thread without them.

Here's what I'll cover:

- Stablecoin trends

- Overview of Y2K

- Thesis

Before I dive in, a quick mention to @BanklessHQ since I wouldn't have found @y2kfinance and written this thread without them.

Here's what I'll cover:

- Stablecoin trends

- Overview of Y2K

- Thesis

https://twitter.com/BanklessHQ/status/1610425838066929671

3/21

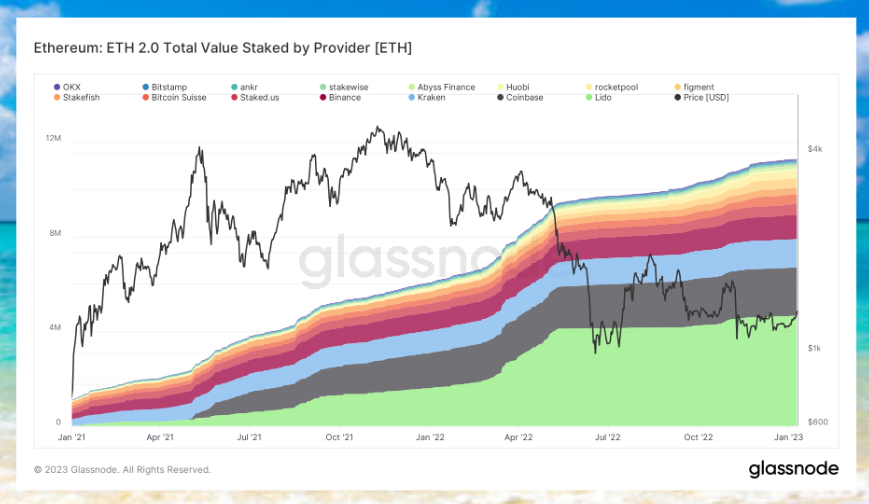

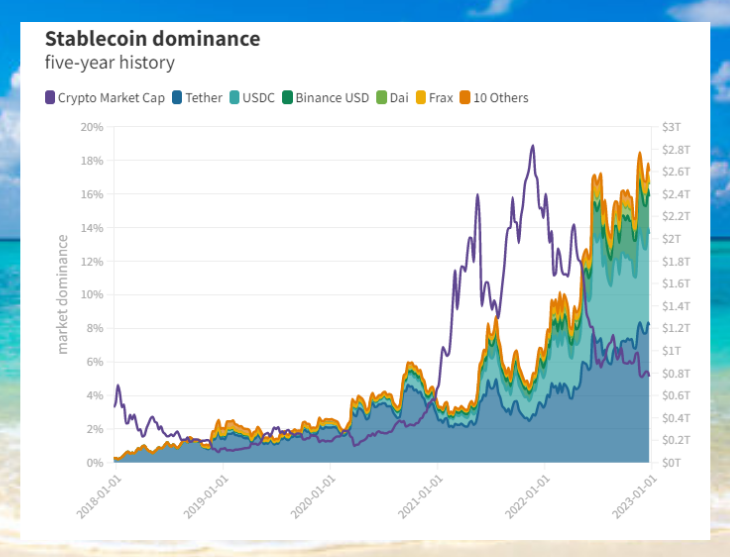

2022 saw a significant rise in stablecoin hodlers

When the total crypto market cap dropped, the stablecoin market cap is bound to drop. But stablecoin dominance paints a different story:

2022 saw a significant rise in stablecoin hodlers

When the total crypto market cap dropped, the stablecoin market cap is bound to drop. But stablecoin dominance paints a different story:

4/21

This rise in stablecoin hodlers is attributed to people selling off/unstaking and parking funds in the form of stablecoins.

This dry powder sitting on the sidelines can be redeployed when investor confidence returns. But when is that?

This rise in stablecoin hodlers is attributed to people selling off/unstaking and parking funds in the form of stablecoins.

This dry powder sitting on the sidelines can be redeployed when investor confidence returns. But when is that?

5/21

Liquid-staking derivatives like stETH or mSOL have also gained in popularity and so have yield-bearing token-backed stables like DAI. (Partly attributable to UST's collapse)

Crypto-backed stablecoin dominance:

Liquid-staking derivatives like stETH or mSOL have also gained in popularity and so have yield-bearing token-backed stables like DAI. (Partly attributable to UST's collapse)

Crypto-backed stablecoin dominance:

6/21

After UST's depeg sent stETH to the ground, investor confidence in pegged assets in general took a huge hit.

After UST's depeg sent stETH to the ground, investor confidence in pegged assets in general took a huge hit.

7/21

Y2K (@y2kfinance) might have a solution:

An insurance-like product that lets users hedge/speculate on the depegging of any pegged asset, not limited to stablecoins.

Y2K (@y2kfinance) might have a solution:

An insurance-like product that lets users hedge/speculate on the depegging of any pegged asset, not limited to stablecoins.

8/21

Y2K is a @neworderDAO-incubated project. New Order is a DAO that builds projects from the ground up and offers funding for projects.

These are a few of their portfolio projects:

Y2K is a @neworderDAO-incubated project. New Order is a DAO that builds projects from the ground up and offers funding for projects.

These are a few of their portfolio projects:

9/21

Y2K's primary products consist of:

- Earthquake: (explained in next tweet)

- Wildfire (TBD): A secondary marketplace letting users trade vault tokens before the end of each epoch.

- Tsunami (TBD): Platform specializing in CDO products.

Y2K's primary products consist of:

- Earthquake: (explained in next tweet)

- Wildfire (TBD): A secondary marketplace letting users trade vault tokens before the end of each epoch.

- Tsunami (TBD): Platform specializing in CDO products.

10/21

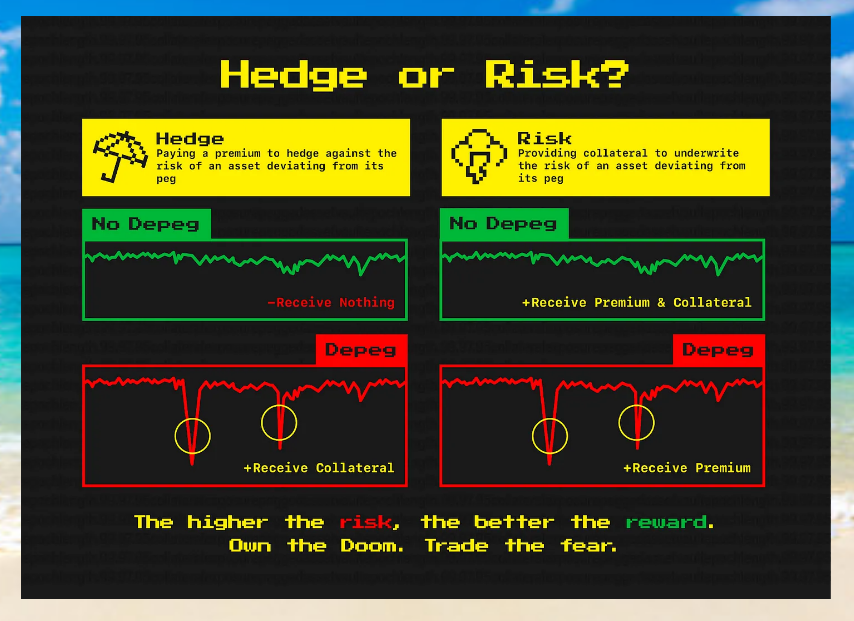

TLDR of how Earthquake works:

- Users can deposit $ETH into the "Hedge vault" or the "Risk vault"

- "Hedge" depositooors bet the asset depegs below a strike price

- "Risk" depositooors bet the asset doesn't reach the strike price

- Premium/collateral payout as follows:

TLDR of how Earthquake works:

- Users can deposit $ETH into the "Hedge vault" or the "Risk vault"

- "Hedge" depositooors bet the asset depegs below a strike price

- "Risk" depositooors bet the asset doesn't reach the strike price

- Premium/collateral payout as follows:

11/21

Upon depositing $ETH into vaults, a corresponding ERC1155 Hedge/Risk vault token is minted.

Each supported asset and listed strike price mints a unique vault token.

Upon depositing $ETH into vaults, a corresponding ERC1155 Hedge/Risk vault token is minted.

Each supported asset and listed strike price mints a unique vault token.

12/21

Y2K has its native $Y2K token with a max supply of 20M.

It's current price / circulating supply sits at $0.61 / 1.2M.

$Y2K is the governance token that will be used to define important parameters of the Y2K ecosystem.

Y2K has its native $Y2K token with a max supply of 20M.

It's current price / circulating supply sits at $0.61 / 1.2M.

$Y2K is the governance token that will be used to define important parameters of the Y2K ecosystem.

14/21

In addition to $Y2K, they have $vlY2K which are essentially LP tokens for providing liquidity to the 80-20 Y2K-wETH Balancer pool.

Lockers can accumulate the following:

- Larger share of governance power

- Protocol revenue share (50% of fees)

In addition to $Y2K, they have $vlY2K which are essentially LP tokens for providing liquidity to the 80-20 Y2K-wETH Balancer pool.

Lockers can accumulate the following:

- Larger share of governance power

- Protocol revenue share (50% of fees)

15/21

These tokens must be locked for either 16 or 32 weeks.

32 week lockers receive 2x more protocol fees and governing power.

Governance power distribution:

Vanilla $Y2K - 1 vote

16-week locked $Y2K - 5 votes

32-week locked $Y2K - 10 votes

These tokens must be locked for either 16 or 32 weeks.

32 week lockers receive 2x more protocol fees and governing power.

Governance power distribution:

Vanilla $Y2K - 1 vote

16-week locked $Y2K - 5 votes

32-week locked $Y2K - 10 votes

16/21

Fee distribution:

5% fee on hedge vault deposits, and risk vault if a depeg occurs

- 70% of the 5% goes to treasury and 30% is redistributed back to lockers.

0.25% fee from premiums & collateral - 70% of it goes to lockers and 30% is redistributed back to the protocol

Fee distribution:

5% fee on hedge vault deposits, and risk vault if a depeg occurs

- 70% of the 5% goes to treasury and 30% is redistributed back to lockers.

0.25% fee from premiums & collateral - 70% of it goes to lockers and 30% is redistributed back to the protocol

17/21

My concern regarding Y2K lies in its token distribution and the $SQUID token jr-looking chart. It seems 94% still sits in the treasury?

My concern regarding Y2K lies in its token distribution and the $SQUID token jr-looking chart. It seems 94% still sits in the treasury?

18/21

My thesis:

As a network effect-reliant project, it needs both hedgooors and riskooors for this "insurance program" to work. Y2K could have the power to reignite investor confidence once its incentives are more attractive.

My thesis:

As a network effect-reliant project, it needs both hedgooors and riskooors for this "insurance program" to work. Y2K could have the power to reignite investor confidence once its incentives are more attractive.

19/21

FWIW tho, $Y2K doesn't seem to be a rug token despite the ol' saying "if utility = governance, run"

FWIW tho, $Y2K doesn't seem to be a rug token despite the ol' saying "if utility = governance, run"

20/21

field-testing @crypthoem's hook. wen dis thread viral?

field-testing @crypthoem's hook. wen dis thread viral?

https://twitter.com/crypthoem/status/1612175412288983040

21/21

I hope you've found this thread helpful.

Follow me @0xsurferboy for more threads on untapped crypto topics 😊

Like ❤/Retweet the first tweet below if you can 🙏

I hope you've found this thread helpful.

Follow me @0xsurferboy for more threads on untapped crypto topics 😊

Like ❤/Retweet the first tweet below if you can 🙏

https://twitter.com/0xsurferboy/status/1612434060856659969

Tagging fellow gigabrains who may be interested 🔥

@DefiIgnas

@rektdiomedes

@thedailydegenhq

@crypto_linn

@0xJamesXXX

@crypto_condom

@DeFiSurfer808

@crypthoem

@defi_mochi

@CryptoShiro_

@DAdvisoor

@TheDeFinvestor

@Slapjakke

@arbitrum

@neworderDAO

@DefiIgnas

@rektdiomedes

@thedailydegenhq

@crypto_linn

@0xJamesXXX

@crypto_condom

@DeFiSurfer808

@crypthoem

@defi_mochi

@CryptoShiro_

@DAdvisoor

@TheDeFinvestor

@Slapjakke

@arbitrum

@neworderDAO

#Y2K #Polygon #Solana #crypto #cryptocurrecy #stablecoin #USDC #USDT #BUSD #binance #FTX #Metamask #Arbitrum #blockchain #Celsius #BlockFi #Genesis #Web3 #Bybit #uniswap #BNB #MATIC #Cardano #altcoins #Defi #Cefi

• • •

Missing some Tweet in this thread? You can try to

force a refresh