Here's a thread of (6) charts 📊 that are worth nothing from this last week's @MorganStanley Global Investment Committee (GIC) Weekly Report (01/30/23)... 🧵/👇🏼

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

#macro #economy #earnings #stocks #StockMarket #bonds

morganstanley.com/pub/content/da…

1/🧵 "In the short run, flows, sentiment, positioning & technicals can be powerful drivers, while over the longer term, fundamentals like growth, profitability & productivity are critical, as are earnings surprises." @MorganStanley

#macro #earnings #stocks #StockMarket #bonds

#macro #earnings #stocks #StockMarket #bonds

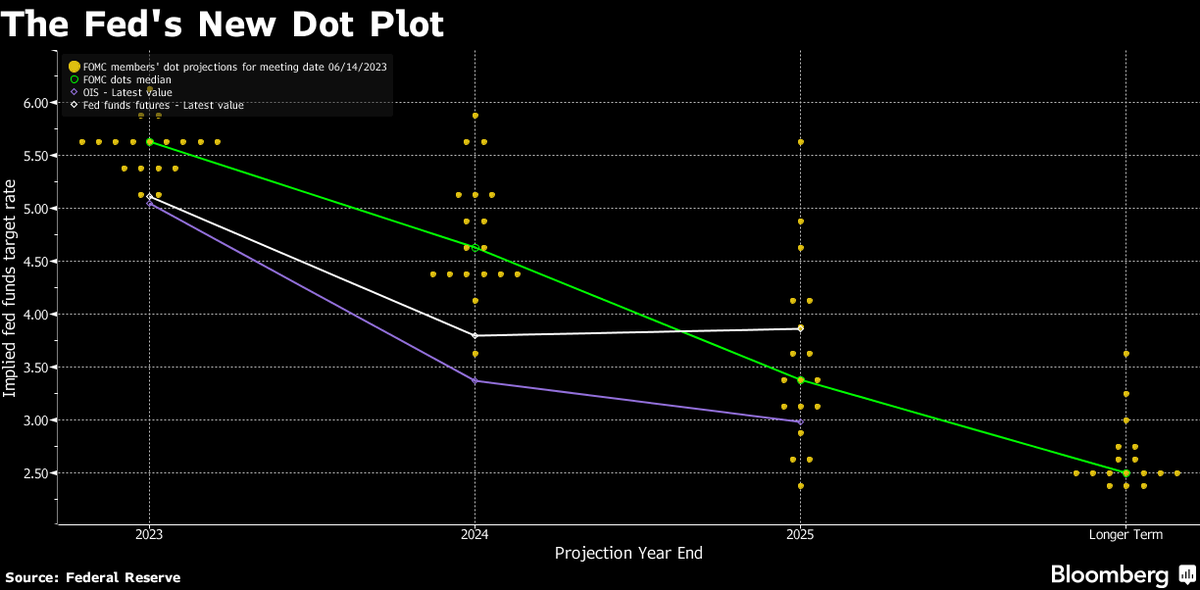

2/🧵 "But sometimes, & for extended periods, markets can settle on one particular thesis, no matter how narrow or implausible." 📊h/t @MorganStanley @GoldmanSachs $MS $GS @Bloomberg

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX

3/🧵 "Such an approach lends itself to dangerous conflation, where coincidence & correlation are mistaken for causality, allowing for the mis-pricing of risk(s)." 📊h/t @MorganStanley $MS @Piper_Sandler

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX $HYG $JNK

#macro #earnings #stocks #StockMarket #bonds $SPY $SPX $HYG $JNK

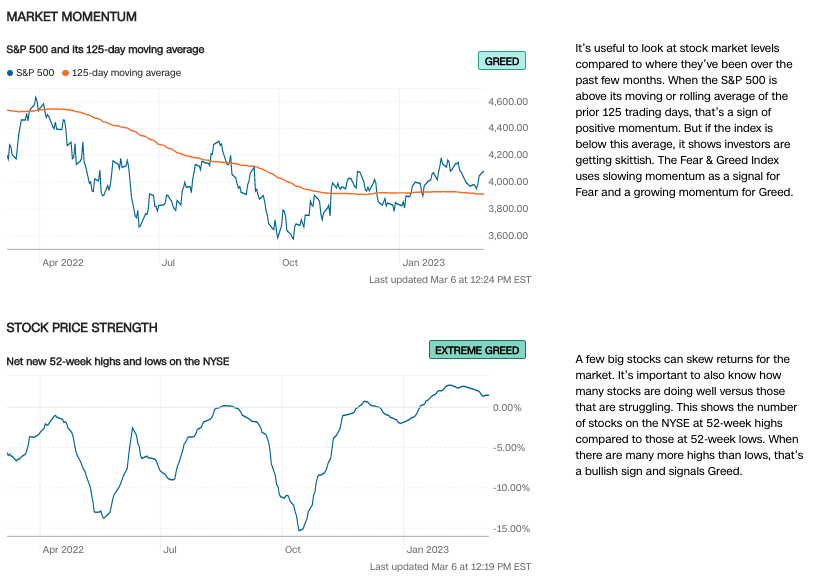

4/🧵 "The S&P 500’s powerful bounce off the October low should not be interpreted as the start of a new bull market, as some pundits have suggested. Economic fundamentals have not troughed, and profit expectations have not rebased to the reality of a slowdown." $SPX $SPY

5/🧵 " Easy financial conditions —not validation of the Goldilocks soft landing scenario— have driven the rally, & we believe some of these temporary factors will reverse, causing a midyear liquidity squeeze. Investors should factor in risks and demand wider premiums."

6/🧵 Leading Indicators (YoY) >>> #recession — Is this time going to be different?

📊h/t @bespokeinvest @MorganStanley $MS

#bonds #stocks #StockMarket #economy #macro

📊h/t @bespokeinvest @MorganStanley $MS

#bonds #stocks #StockMarket #economy #macro

7/🧵 Are the Leading Indicators currently finding their bottom? Or, is there further to fall --> #SPY $SPX forward #earnings declines... 📉⚠️📈

📊h/t @Bloomberg @MorganStanley $MS

#bonds #stocks #StockMarket #economy #macro

📊h/t @Bloomberg @MorganStanley $MS

#bonds #stocks #StockMarket #economy #macro

8/🧵 @Conferenceboard Leading Economic Index (YoY) vs. @ism #manufacturing New Orders vs. @ism PMI — Will the @Conferenceboard lead the @ism #manufacturing lower? 📉⚠️📈

📊h/t @MorganStanley @Bloomberg

#ISM #PPI #macro #economy #stocks #supplychain

📊h/t @MorganStanley @Bloomberg

#ISM #PPI #macro #economy #stocks #supplychain

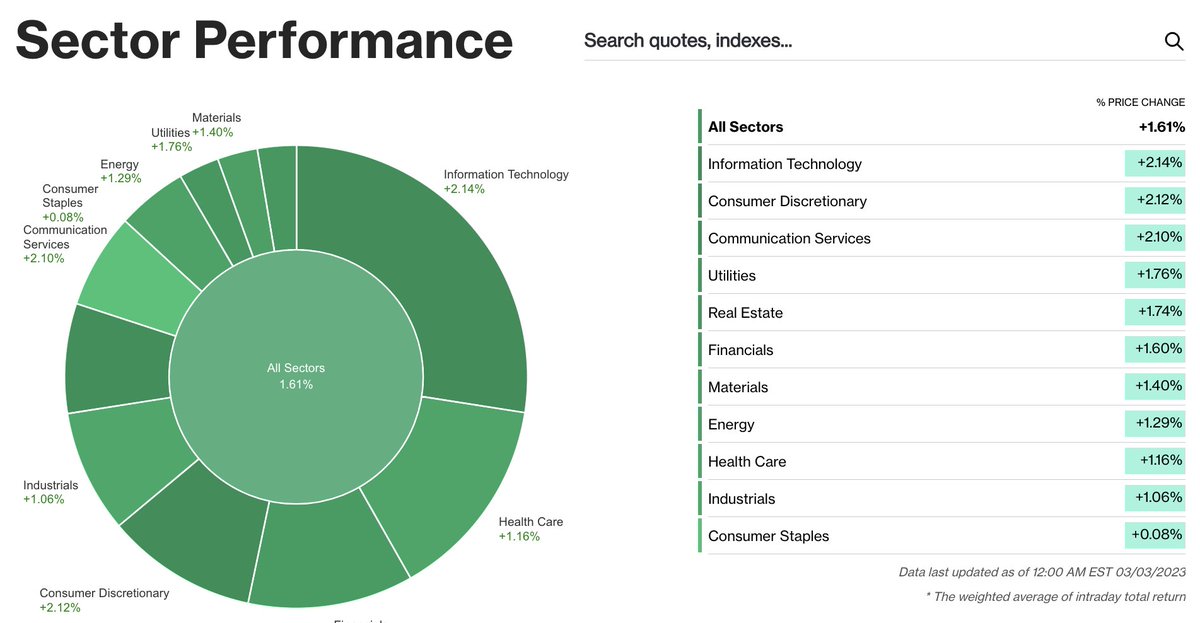

9/📊 @Conferenceboard Leading Economic Index (YoY) vs. Cyclicals to Defensives — Is the market getting ahead of itself w/ the #tech sector leading YTD?

📊h/t @MorganStanley @Bloomberg

#ISM #PPI #macro #economy #stocks #StockMarket #bonds

📊h/t @MorganStanley @Bloomberg

#ISM #PPI #macro #economy #stocks #StockMarket #bonds

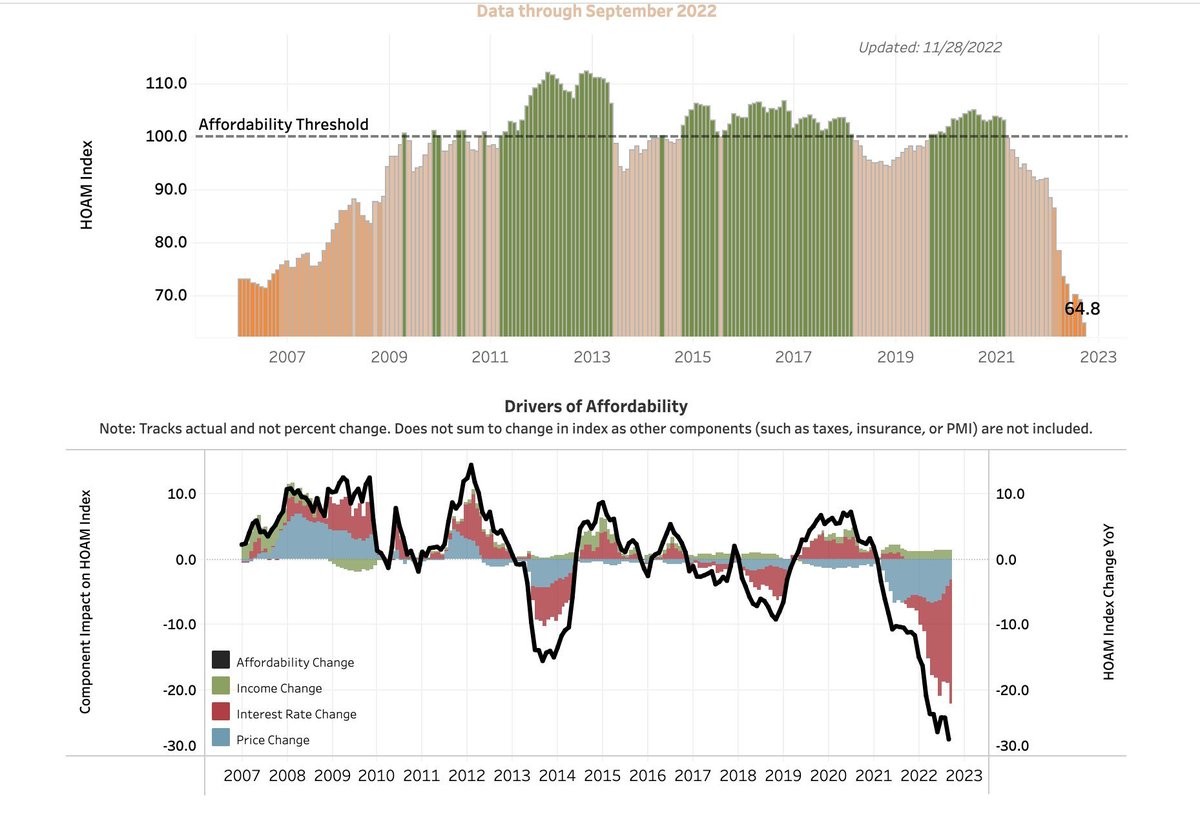

10/🧵" This explosion of liquidity has temporarily offset @federalreserve tightening and helped boost stocks. Looking forward, these easy conditions appear poised to tighten again." @MorganStanley $MS

#stocks #StockMarket #bonds #FederalReserve #DebtCeiling $DXY $SPY $SPX $QQQ

#stocks #StockMarket #bonds #FederalReserve #DebtCeiling $DXY $SPY $SPX $QQQ

11/🧵 "Stay tuned, and avoid 'the chase', especially with extended debt ceiling debate potentially expanding fiscal drainage come summer." @MorganStanley $MS

#stocks #StockMarket #bonds #FederalReserve #DebtCeiling $DXY $SPY $SPX $QQQ

#stocks #StockMarket #bonds #FederalReserve #DebtCeiling $DXY $SPY $SPX $QQQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh