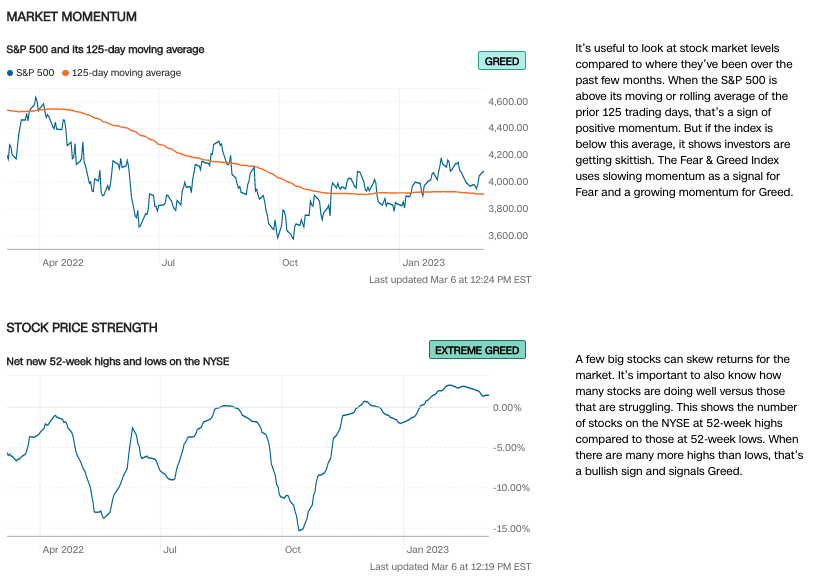

2/🧵 Looking at the latest @CNNBusines “Fear & Greed Index”, the markets are still maintaining their GREED readings on the back of last weeks Thurs - Fri #StockMarket reversal rally that was triggered (all, or in-part) on the back of @federalreserve (non-voting) member Bostic’s… twitter.com/i/web/status/1…

3/🧵 Here are the rest of of the “7 Fear & Greed Indicators” (per @CNNBusiness): 🐂📈 vs. 🐻📉

— Market Momentum (Greed)

— Stock Price Strength (Extreme Greed)

— Stock Price Breadth (Neutral)

— Put/Call Ratio (Greed)

— Market Volatility (Neutral)

— Safe Haven Demand (Greed)

—… twitter.com/i/web/status/1…

— Market Momentum (Greed)

— Stock Price Strength (Extreme Greed)

— Stock Price Breadth (Neutral)

— Put/Call Ratio (Greed)

— Market Volatility (Neutral)

— Safe Haven Demand (Greed)

—… twitter.com/i/web/status/1…

4/🧵 Here is an update on #StockMarket breath, as we did see a pause on selling pressure as market breadth picked up Thursday into Friday’s close… $SPY $SPX

🟣 >20 Day (Current: 38%, Previous: 18%) 📉

🔵 >50 Day (Current: 51%, Previous: 44%) 📉

🟠 >200 Day (Current: 60%,… twitter.com/i/web/status/1…

🟣 >20 Day (Current: 38%, Previous: 18%) 📉

🔵 >50 Day (Current: 51%, Previous: 44%) 📉

🟠 >200 Day (Current: 60%,… twitter.com/i/web/status/1…

5/🧵 Moving over to overall market seasonality for the month of March, after a sizable bounce off from relative support(s) late last week (200 day moving averages, etc.) — as @AlmanacTrader highlights in the below chart 📊, the continuation of the Pre-Presidential Cycle… twitter.com/i/web/status/1…

6/🧵 Next, let's swing on over to the $SPX $SPY Seasonality for the year... 🔮📉

📊h/t @EquityClock #stocks #StockMarket

📊h/t @EquityClock #stocks #StockMarket

8/🧵 S&P 500 Bull 📈 & Bear 📉 seasonality in the 3rd year of a pre-election (Presidential) cycle... 🇺🇸🗓

📊h/t @topdowncharts @Callum_Thomas #stocks #StockMarket #macro #earnings

📊h/t @topdowncharts @Callum_Thomas #stocks #StockMarket #macro #earnings

9/🧵 Here is another take on "Fear & Greed" from @LanceRoberts that takes into account @AAIISentiment, Put/Call Ratio, etc.

Latest reading from simplevisor.com has $SPX $SPY sitting at "neutral" reading ahead of this week's #macro data & @federalreserve J. Powell… twitter.com/i/web/status/1…

Latest reading from simplevisor.com has $SPX $SPY sitting at "neutral" reading ahead of this week's #macro data & @federalreserve J. Powell… twitter.com/i/web/status/1…

10/🧵 Reminder from @carlquintanilla & @jpmorgan ahead of this week that "#earnings slow materially with 99%+ of S&P 500 names now reporting." $SPX $SPY

🗓👀 Looking at the most recent quarter of earnings (Q4/22'), here are some takeaways from #EarningsSeason starting w/ the… twitter.com/i/web/status/1…

🗓👀 Looking at the most recent quarter of earnings (Q4/22'), here are some takeaways from #EarningsSeason starting w/ the… twitter.com/i/web/status/1…

11/🧵 Here's a chart & @Bloomberg @markets article that describes some of the what's happening in #earnings related to "Adjusted EBITDA"...

⚠️ "Corporate America’s Earnings Quality Is the Worst in Three Decades"

⚠️ "S&P 500 operating cash flows trail profits by most on record"… twitter.com/i/web/status/1…

⚠️ "Corporate America’s Earnings Quality Is the Worst in Three Decades"

⚠️ "S&P 500 operating cash flows trail profits by most on record"… twitter.com/i/web/status/1…

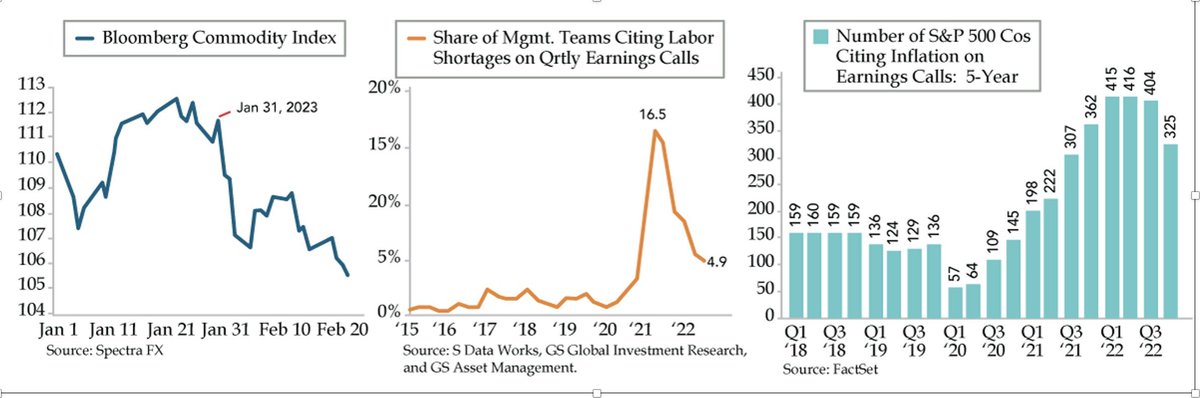

12/🧵 Here is a look-back comparison at some the key "themes" (mentions) on #earnings calls for the most recent qtr (Q4/22') vs. the previous couple years.

Notice that the @Bloomberg #Commodities Index 📉, mentions of labor shortages down📉, & the focus on #inflation pressures… twitter.com/i/web/status/1…

Notice that the @Bloomberg #Commodities Index 📉, mentions of labor shortages down📉, & the focus on #inflation pressures… twitter.com/i/web/status/1…

13/🧵 Per @FactSet, here are the key takeaways from Q4/22' #EarningsSeason...

🟢 "For Q4 2022 (with 99% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue… twitter.com/i/web/status/1…

🟢 "For Q4 2022 (with 99% of S&P 500 companies reporting actual results), 69% of S&P 500 companies have reported a positive EPS surprise and 65% of S&P 500 companies have reported a positive revenue… twitter.com/i/web/status/1…

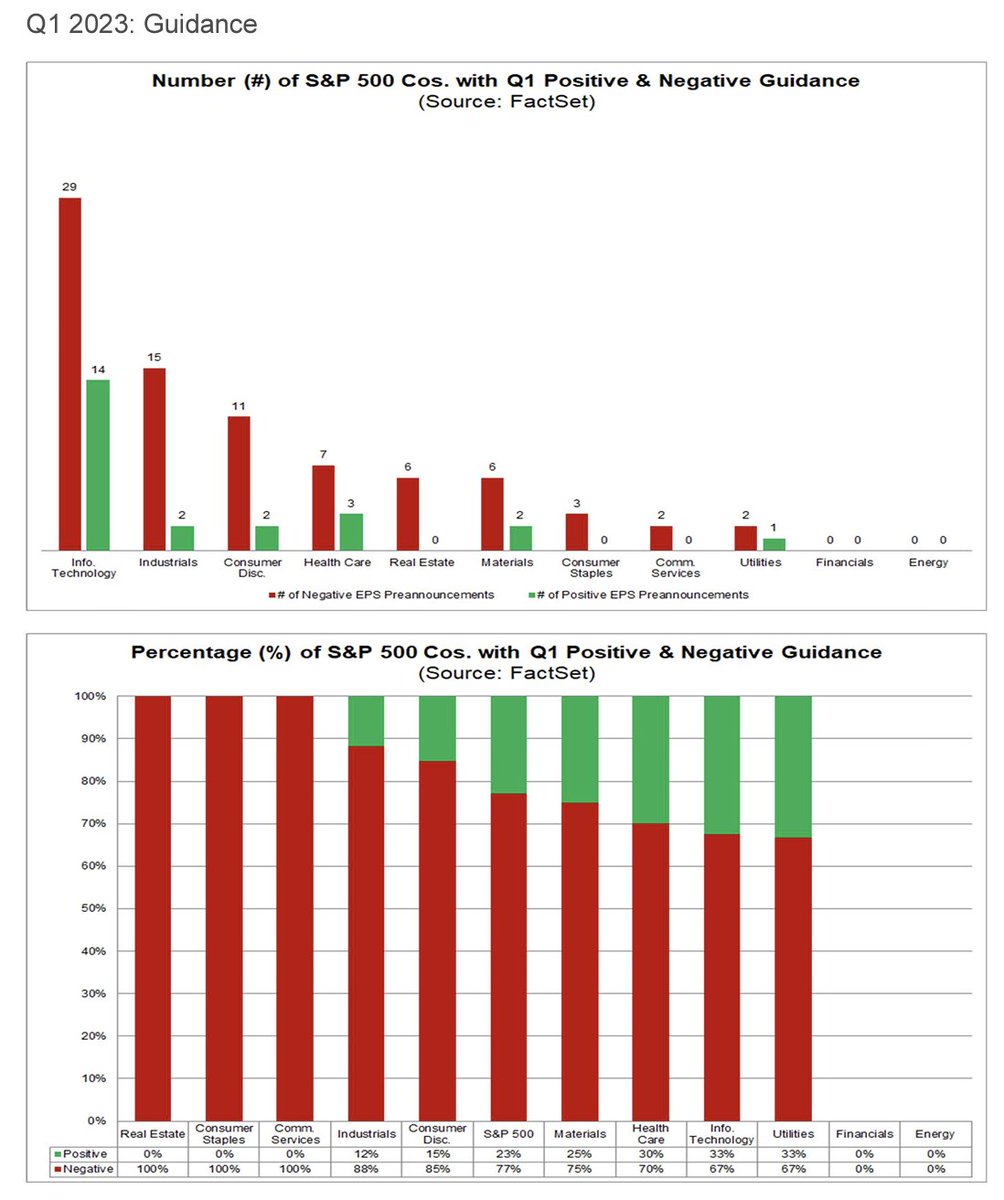

14/🧵 Looking ahead, per the latest @FactSet data, here is the latest #earnings positive/negative guidance for $SPX $SPY (by sector) for Q1/23'...

#Stocks #StockMarket #macro #economy

#Stocks #StockMarket #macro #economy

15/🧵 Staying w/ this thread on earnings (margins) as we look ahead, here are some of the key "focus" 🎯 points for executive teams as we move forward in 23'...

"Trend on corporate earnings calls has been to focus a lot on free cash flow to equity margin, re-shoring, and loss… twitter.com/i/web/status/1…

"Trend on corporate earnings calls has been to focus a lot on free cash flow to equity margin, re-shoring, and loss… twitter.com/i/web/status/1…

16/🧵 Here's a thread from @CameronDawson, discussing some of the expectations around forward #earnings for 23' & potential scenarios for Bears, Bulls, & Just Right (Goldilocks)... 🗓🔮

#Stocks #StockMarket #macro #economy #recession #EarningsSeason $SPY $SPX $DIA $DJIA $QQQ… twitter.com/i/web/status/1…

#Stocks #StockMarket #macro #economy #recession #EarningsSeason $SPY $SPX $DIA $DJIA $QQQ… twitter.com/i/web/status/1…

17/🧵 Keeping some of those potential scenario(s) in-mind from @CameronDawson & her team @NewEdgeWealth, are forward #earnings projections still too lofty? Or, have recent revisions been a counter indicator that could (lead) #stocks #StockMarket higher?

Very interesting chart… twitter.com/i/web/status/1…

Very interesting chart… twitter.com/i/web/status/1…

18/🧵 "With the fourth quarter earnings season mostly complete, we are getting a better look at trailing and forward earnings estimates. According to @FactSet, 94% of S&P 500 companies have reported numbers, with 68% beating estimates. That 'beat rate' was realinvestmentadvice.com/forward-earnin…… twitter.com/i/web/status/1…

18/🧵 "Analysts remain optimistic about earnings even with economic growth weakening as inflation increases, reduced liquidity, and declining profit margins. As shown above, analysts expect the first quarter of 2023 will mark the bottom for the earnings realinvestmentadvice.com/forward-earnin…… twitter.com/i/web/status/1…

19/🧵 "Since 1947, earnings per share have grown at 7.72%, while the economy has expanded by 6.35% annually. That close relationship in growth rates is logical, given the significant role that consumer spending has in the GDP equation. The slight realinvestmentadvice.com/forward-earnin…… twitter.com/i/web/status/1…

• • •

Missing some Tweet in this thread? You can try to

force a refresh