Tuesday Top Crypto News.

Everything you need to know in one short thread…

Everything you need to know in one short thread…

According to the Wall Street Journal (#WSJ) Coinbase Global (#COIN) told clients on Monday it’s no longer supporting #Signet, the real-time payments network of failed #SignatureBank.

The #Crypto #Fear and #Greed Index has hit its highest index score this year, reaching levels not seen since #Bitcoin posted its all-time high in November 2021.

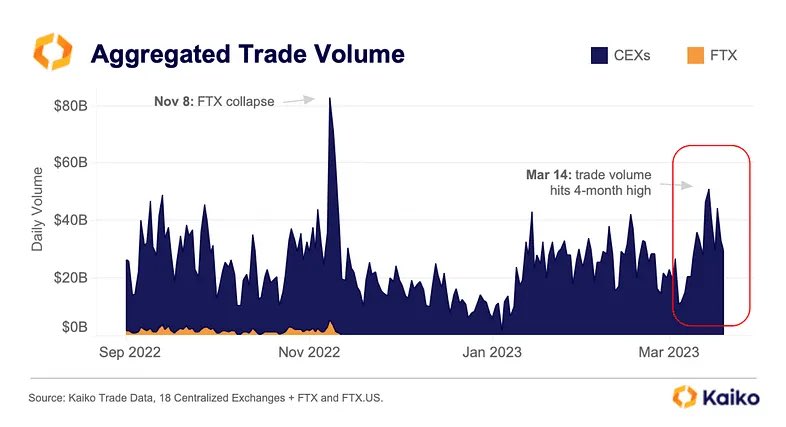

Crypto trade volumes reached their highest level since the #FTX collapse amid last weeks broad market rally. Data from #Kaiko.

Ethereum-based #carbon credits tracker @Carbonable_io has raised $1.2 million in a seed round led by Ethereal Ventures and La Poste Ventures.

Euler Finance the #Ethereum based #protocol is in talks to get back the $196m it lost in a #hack last week. The exploiter said in an on chain message to #Euler…

“We want to make this easy on all those affected. No intention of keeping what is not ours. Setting up secure communication. Let us come to an agreement”

.#Silvergate Capital has received a #NYSE notice of possible delisting.

Mastercard, in partnership with the #Stables platform, will launch a service that will allow retail customers in the Asia-Pacific region to pay with stablecoins wherever #Mastercard is accepted. #FinTech

• • •

Missing some Tweet in this thread? You can try to

force a refresh