@scroll_in published 15 theories about why we are facing a cash crunch now.

So let me float my own theory and examine some of the theories too!

Many factors are attributed for this theory; starting from the scary FDRI bill to Chota Modi Scams to Minimum balance looting..

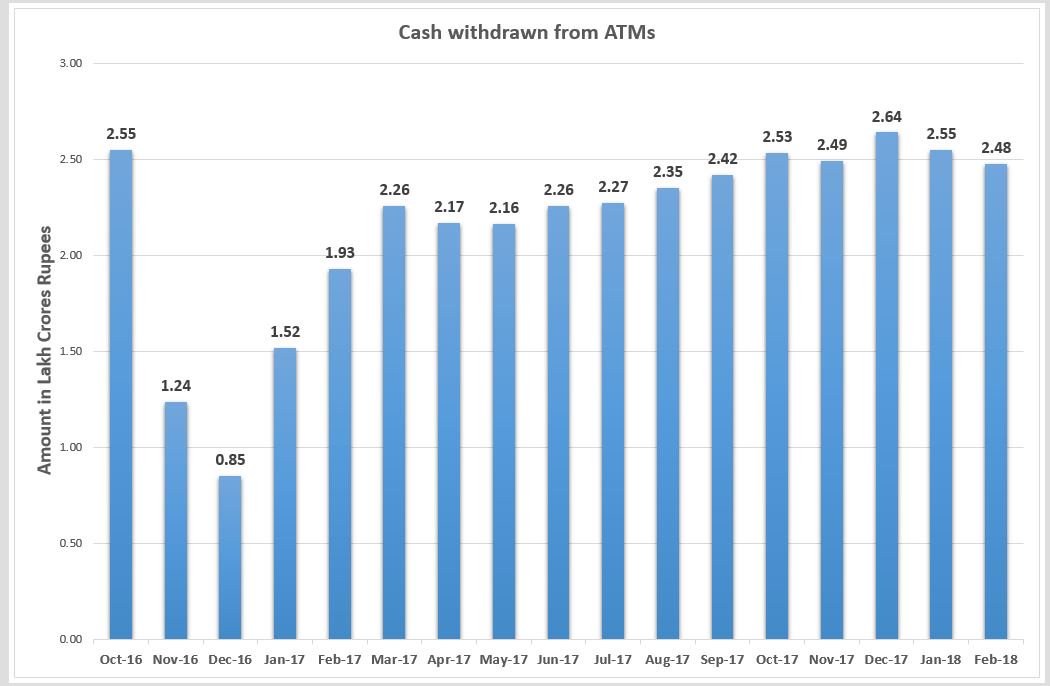

Let's see RBI data on withdrawal of currency through ATMs,, we have published data up to Feb 2018.

Do you see any spur here?

I am not seeing anything abnormal here!

But see graph, more steep withdrawals happened in 4 occasions than this amount in past one year

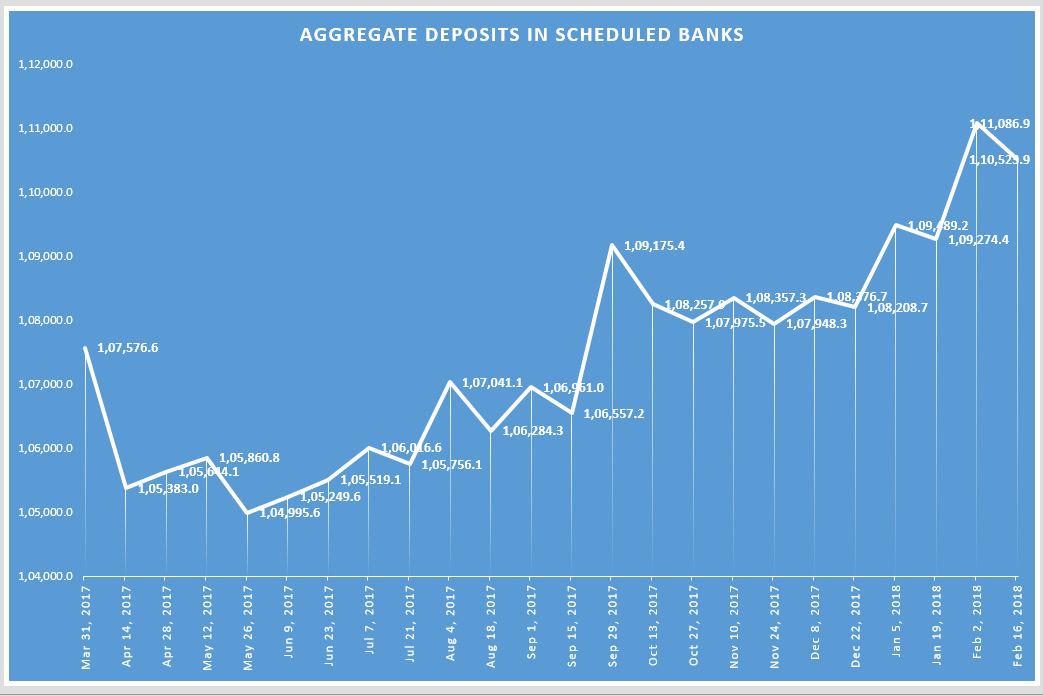

31/03/17 & 14/4/17 - Rs. 2,19,350 crores

12/05/17 & 26/05/17 - Rs. 86,520 crores

04/08/17 & 18/08/17 - Rs. 75,680 crores

29/09/17 & 13/10/17 - Rs. 91,750 crores

Yep, all these figures are bigger than Rs. 56,300 crores. Then why did not ATMs run dry then?

Troll army even accused @INCIndia done a clinically executed plan to dry out ATMs.

So reach your own judgment based on data about the above theories!

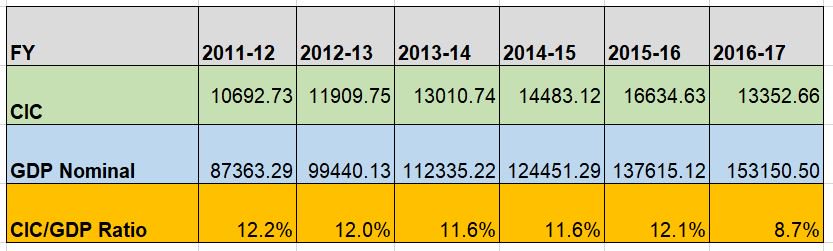

We can see that except 2016-17, average CIC-GDP ratio is 11.9%

We witnessed how it shattered this our economy & GDP growth.

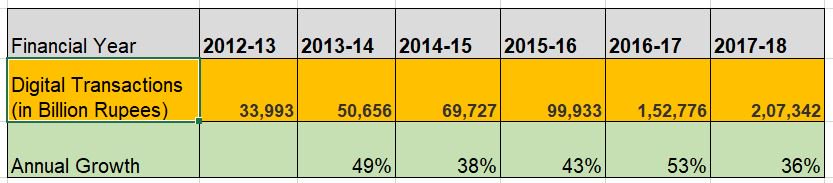

Hence it warrants a closer examination of the digital growth during pre-Demon and post-DeMon periods.

UPI data is not added to this. That will be explained later.

We can see that the digital transaction growth is now shrunk to 36% in last year after reaching a peak of 53% in 2016-17 due to lack of choice during DeMon

Now comes to the point of why I have not taken the much hyped UPI value here.

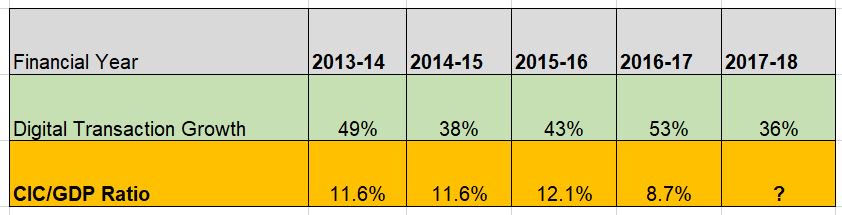

This table needs a closer examination to understand the nuances of the present problem.

Same Government with same digital growth, maintained a CIC-GDP ratio between 11.6%-12.1% before demonetisation.

So total estimated nominal GDP for this year is 169.76 LC

We seen that as digital growth remains almost same in pre & post DeMon periods, to have a smooth economic activity we need around 11.8% average CIC-GDP ratio.

But we are having only ₹18.425 LC as on 06/04/18..

We still need at least ₹1.5 LC now to ease the #CashCrunch

But their hubris did not allow them to accept their monumental blunder.

Secondly, they don't even take stock of their printing capabilities

Then, ₹2000 notes became a pain in their neck.. No change for it & facilitated the more efficient hoarding

But hagiographers still singing praise songs of the DeMon! 🤣

Why the Government now ready to print currency after being obdurate for quite long time.

RBI Annual Report for 2017-18, which will come in next September show only 10.8% CIC-GDP ratio.

As long as Report is not in public domain, it's easy for spin masters to manipulate 😜

Good night!!