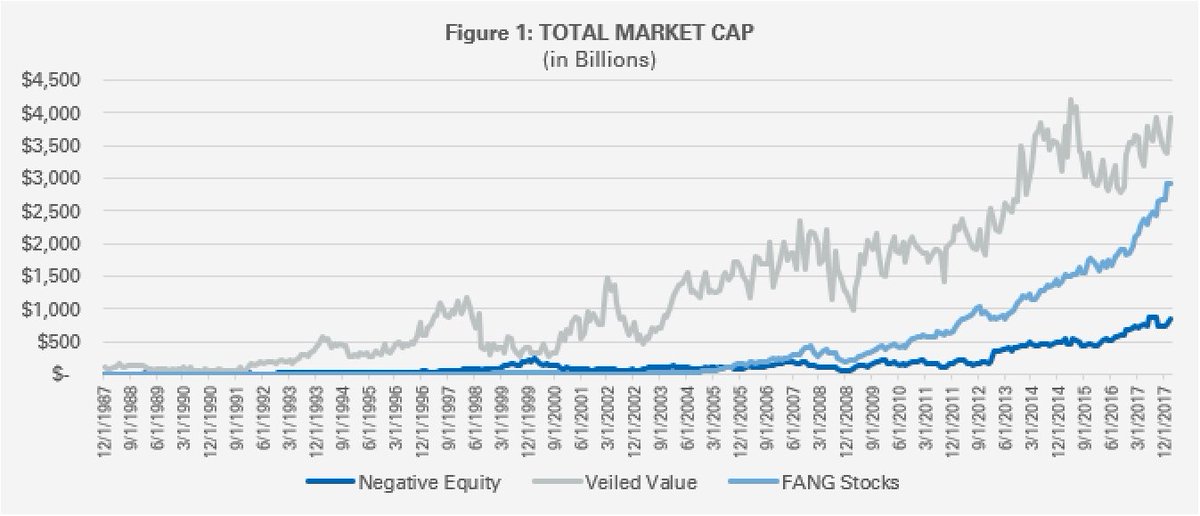

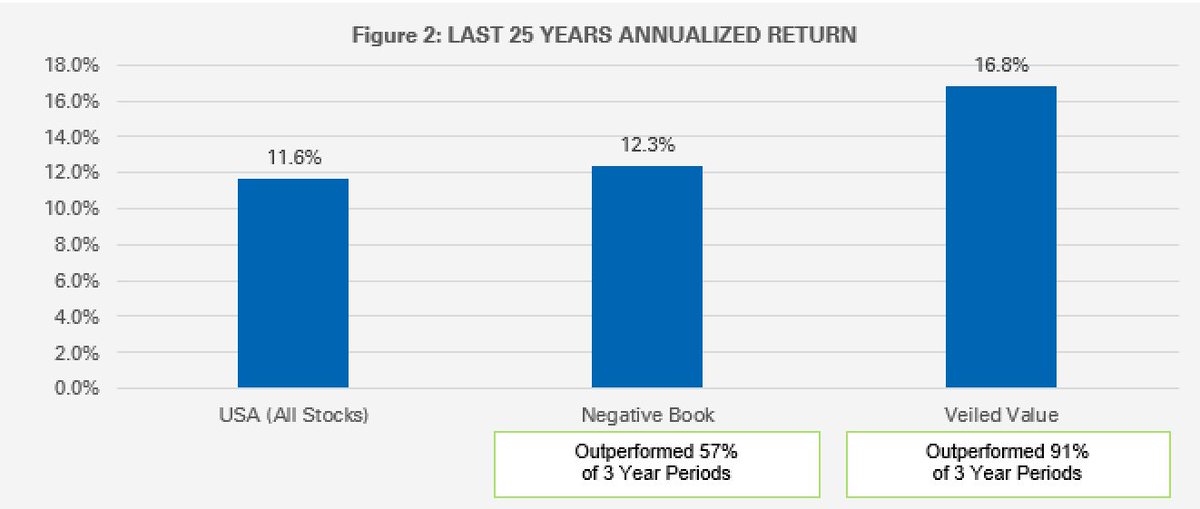

Stocks with negative book values, and “veiled value” stocks, which are in the most expensive third of the market on p/book, but cheapest third on other metrics.

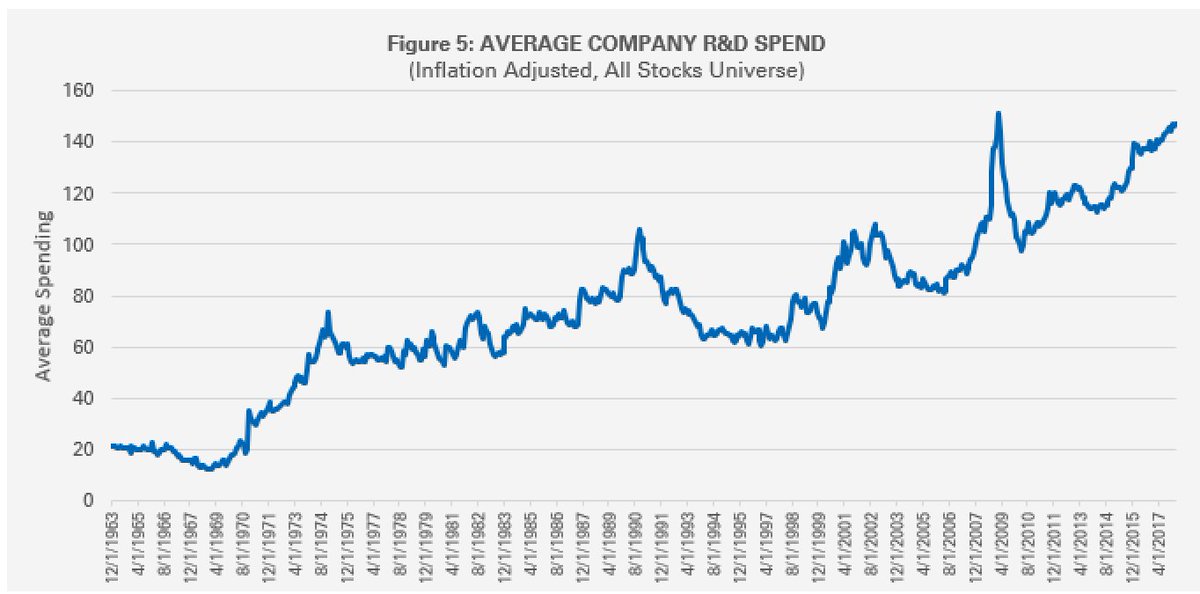

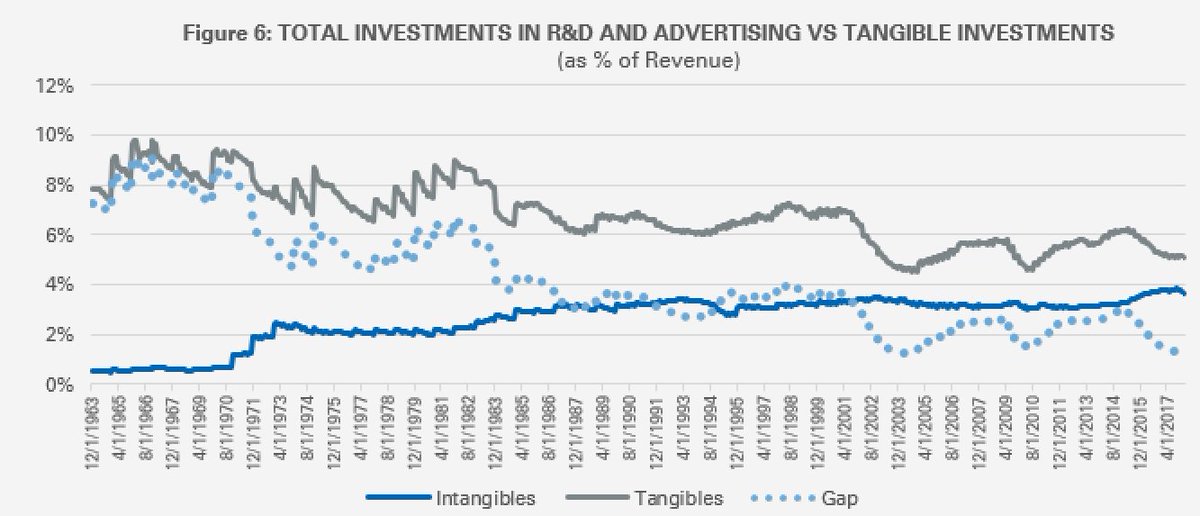

1) Understated intangible assets

2) Understated tong term assets &

3) buybacks and dividends

For example: companies with balance sheets that are nowhere close to reflecting the true value of their real estate owned.

The once CFO of McDonald’s, Harry J. Sonneborn said, “We’re not technically in the food business. We are in the real estate business."

Here are some simple improvements one might make:

1) Create a Research Asset

2) Create a Brand Asset

3) Adjust Real Estate Values to Get Closer to Market Value

4) Adjust for buybacks and dividends (use as part of the ranking)