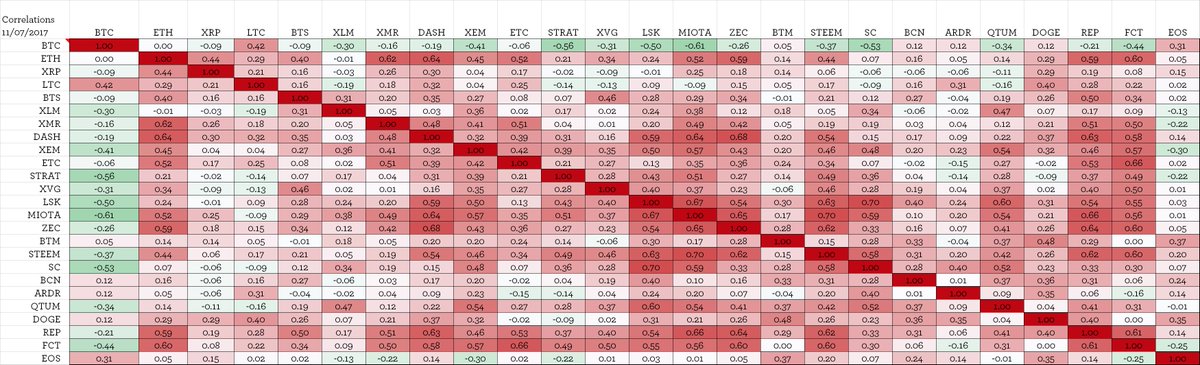

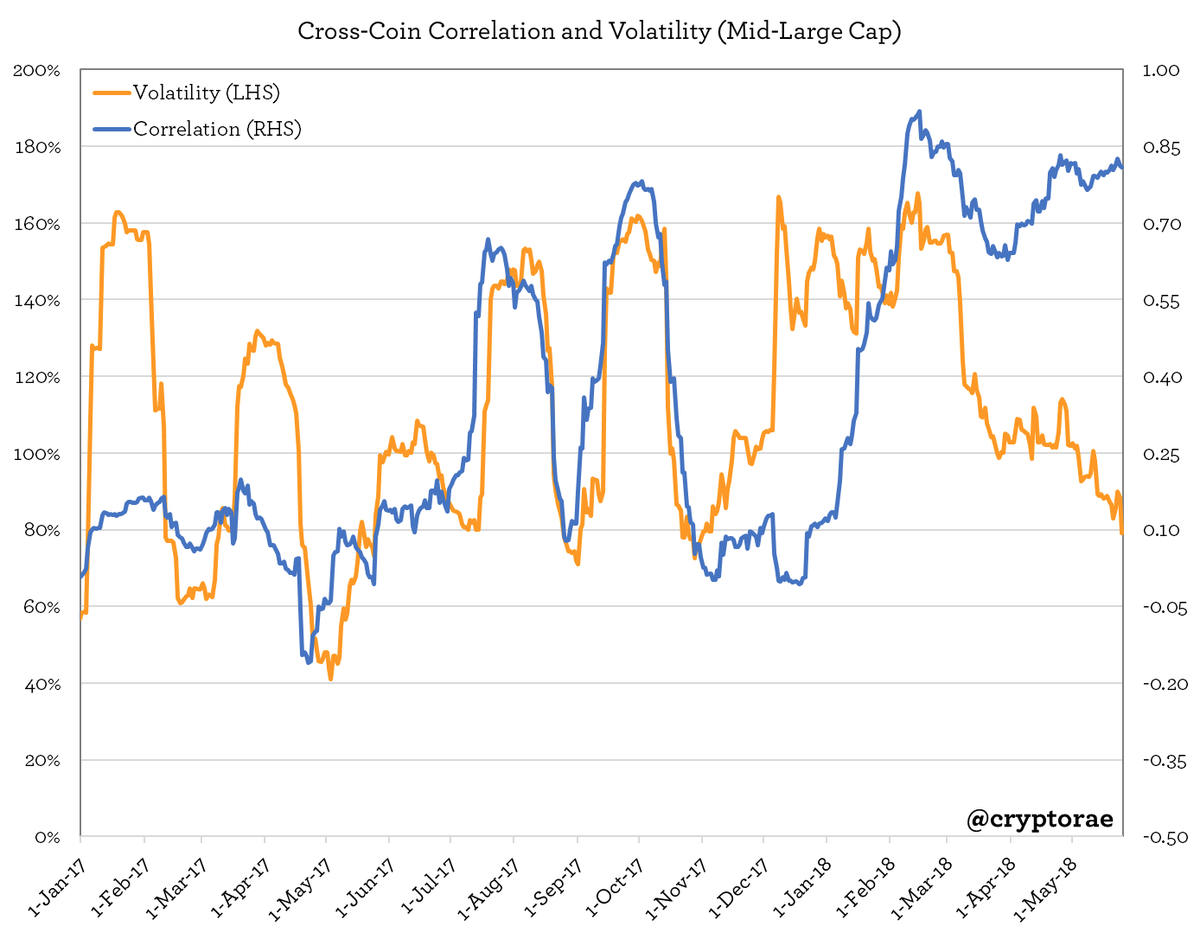

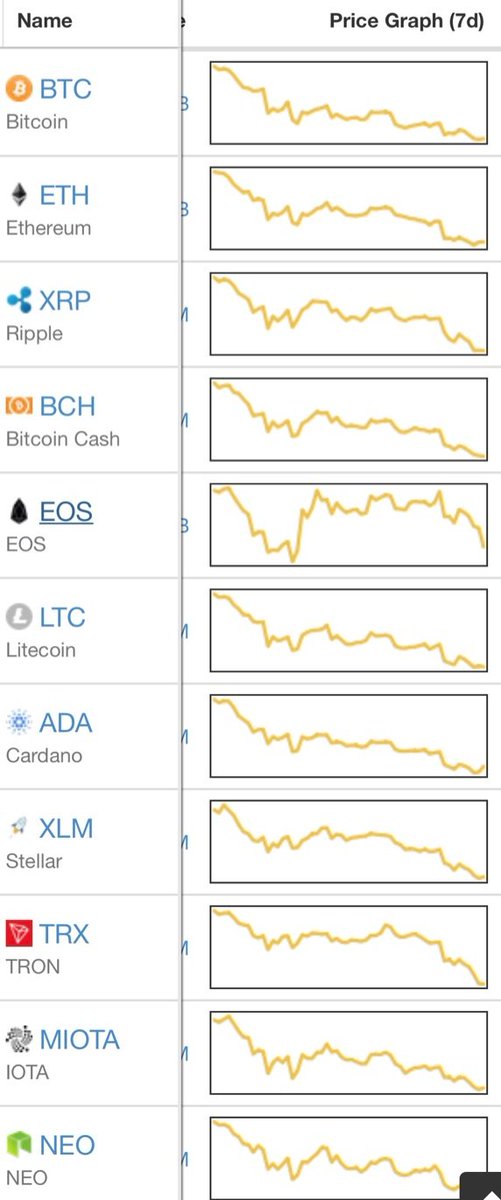

1. "Crypto coins are highly correlated." Kind of true, but look at the market as recently as Nov 2017.. 0 correlation!

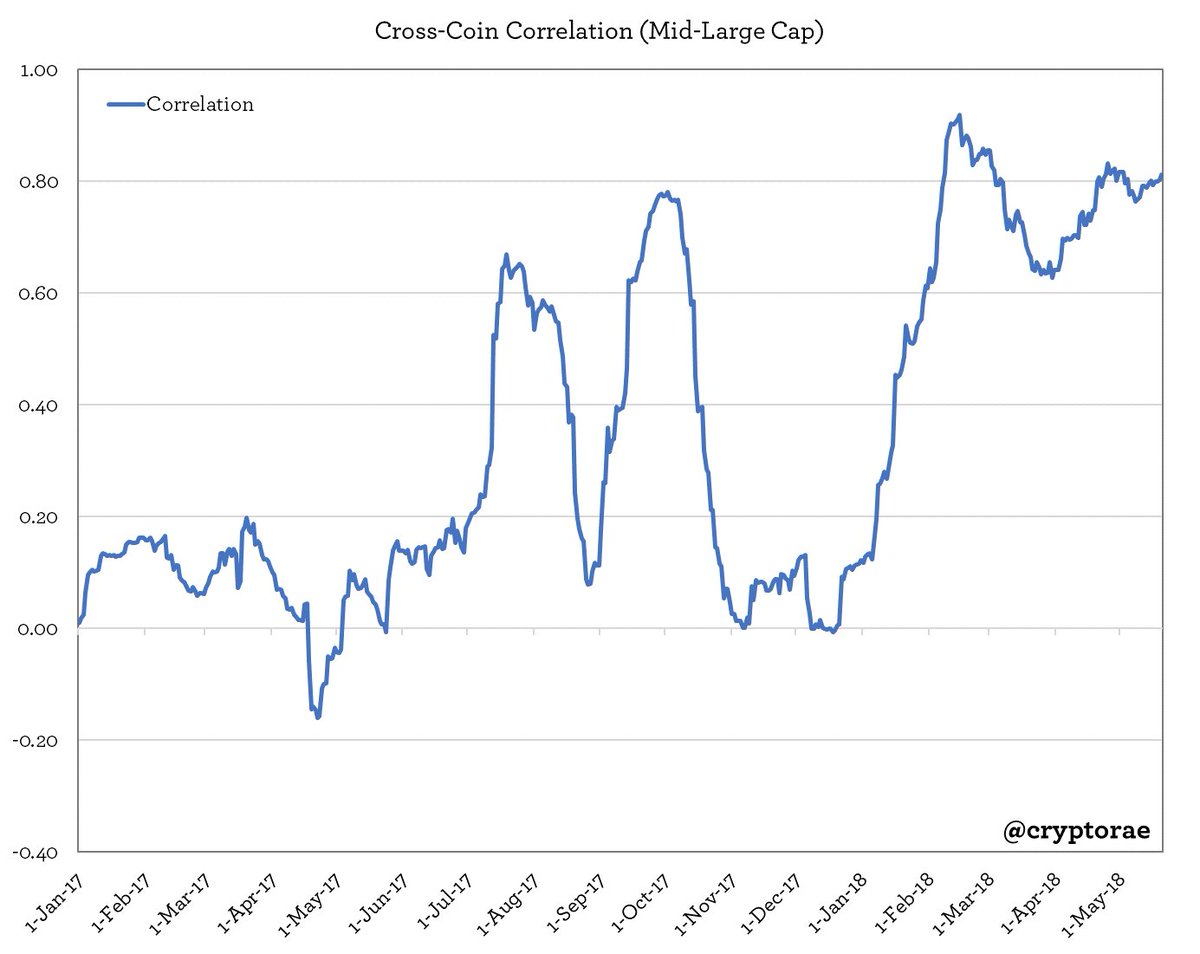

2. Correlations are currently ridiculously high at 0.81 and have been persistently high since early Feb 2018. It seems unhealthy/unsustainable.