Its why their emphasis is skewed on collecting more data from individuals

Mobile phone

Mpesa

Airtime habits

Data bundle habits

SIM card data etc /2

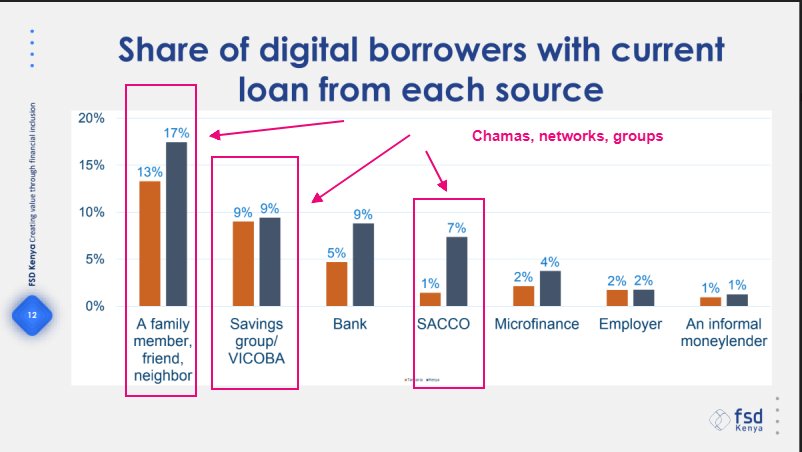

This is V significant for a market like Kenya and arguably East Africa /3

Merry Go round

Savings

Insurance

Investment Club

Traders

Cooperative

Causes /4

Fraud (SIM/Identity)

Default rates

Looking for New Markets (originate new loans)

Competition for digital lending apps by (banks)

Cost of borrowing (price vs risk) How to price accurately /7

Purpose lending (do you know where money is going hint: they dont)

Economic slowdown, less money in people's pocket

Calls for Regulation of digital lender

Too much focus on digital data/online, no clue what is going on offline

Privacy of data /8

Chama identity - you cant steal someone's chama Identity

Lower default because of social pressure from group (these are people you work with or meet everyday) /9

Banks haven’t encroached the chama market

Lending to individuals via chamas reduces risk of default (social pressure, guarantees)

Lend to professional chama groups - boda boda, mama biashara (inventory) /10

Chamas give you a better grasp of offline biashara b/c chamas are last mile

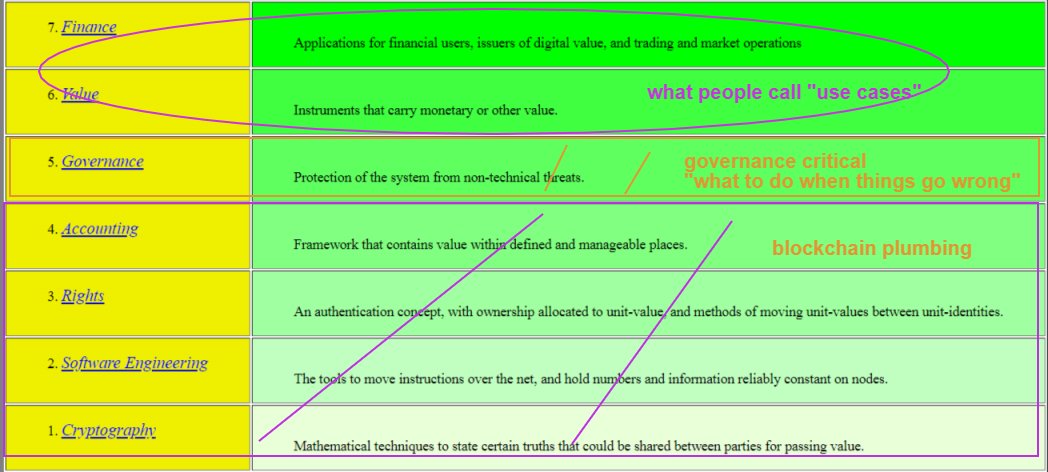

Privacy - group privacy & identity means Chama owns records/data

New products - insure-tech (emergency/burial chamas) /11

eg

Women's Chama group in ruiru accesses group insurance from Britam via group aggregators (ECLOF) /12

Cross chama lending /14

I believe this will unbundle

New data

New markets

and

New digital products/services /n