1. 💰 The Moneyness of Credit

2. 🕵️♀️ Inaccuracies in Wall Street Ledger Systems

Will cover what both of those mean here.

Here’s a link to the Credit Bubble Bulletin: creditbubblebulletin.blogspot.com

However, we have “history’s first universally honest ledger.”

Here’s a free copy of the book: mises.org/library/myster…

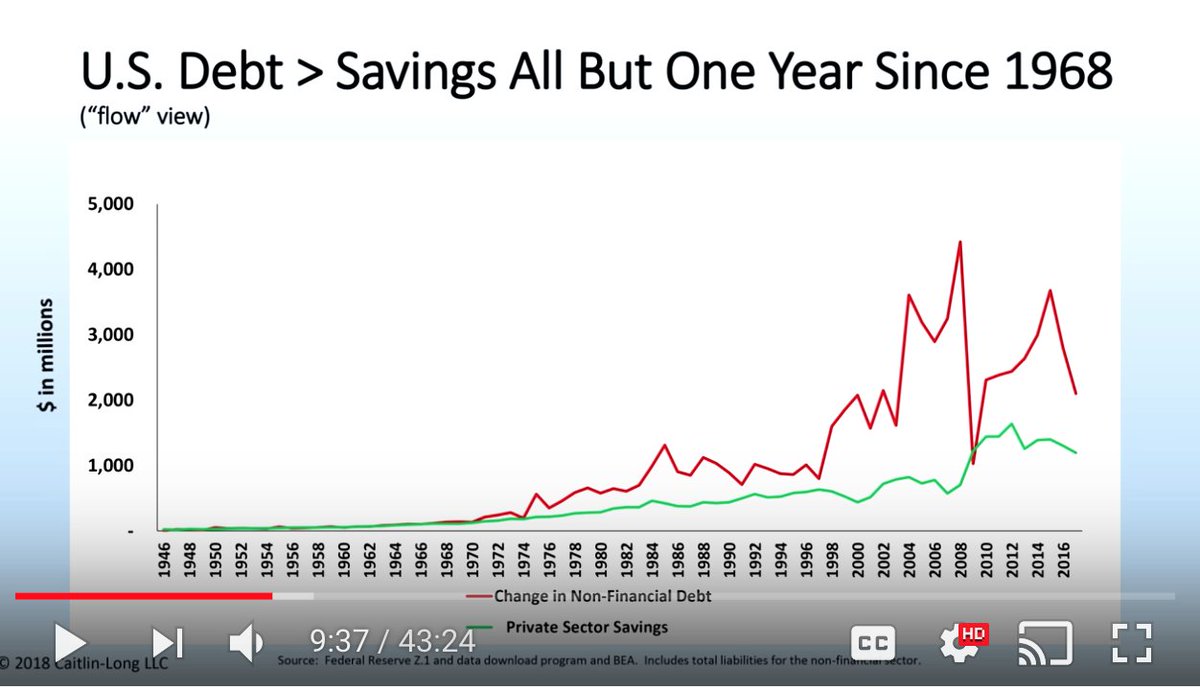

Graph from @CaitlinLong_

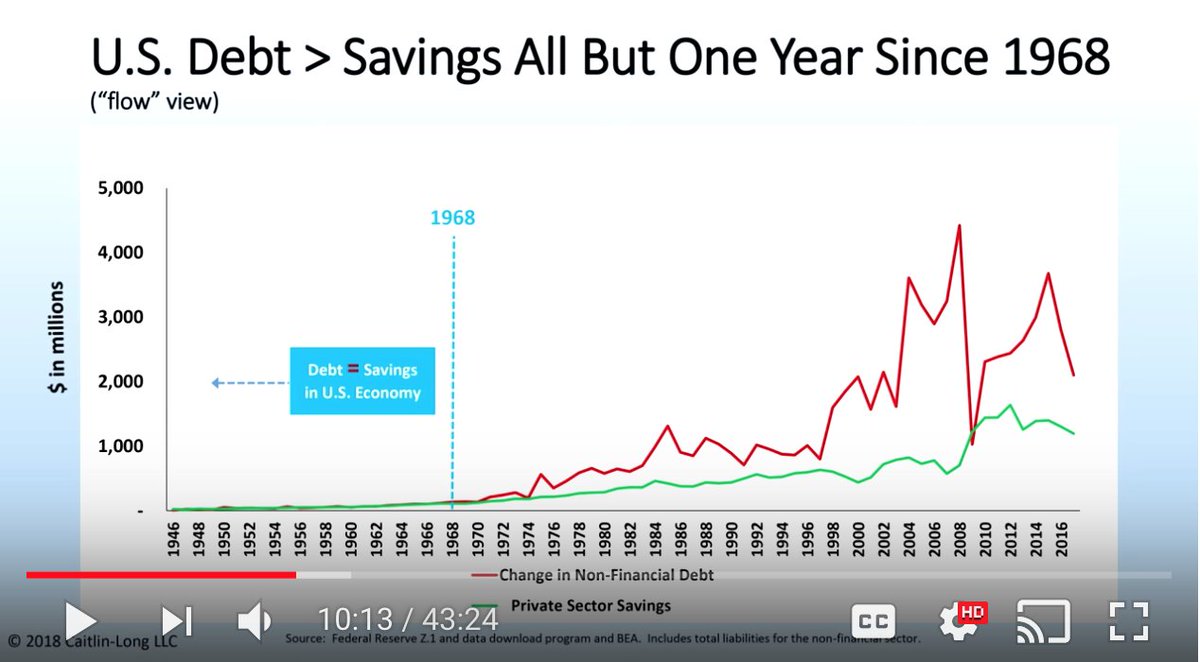

Graph from @CaitlinLong_

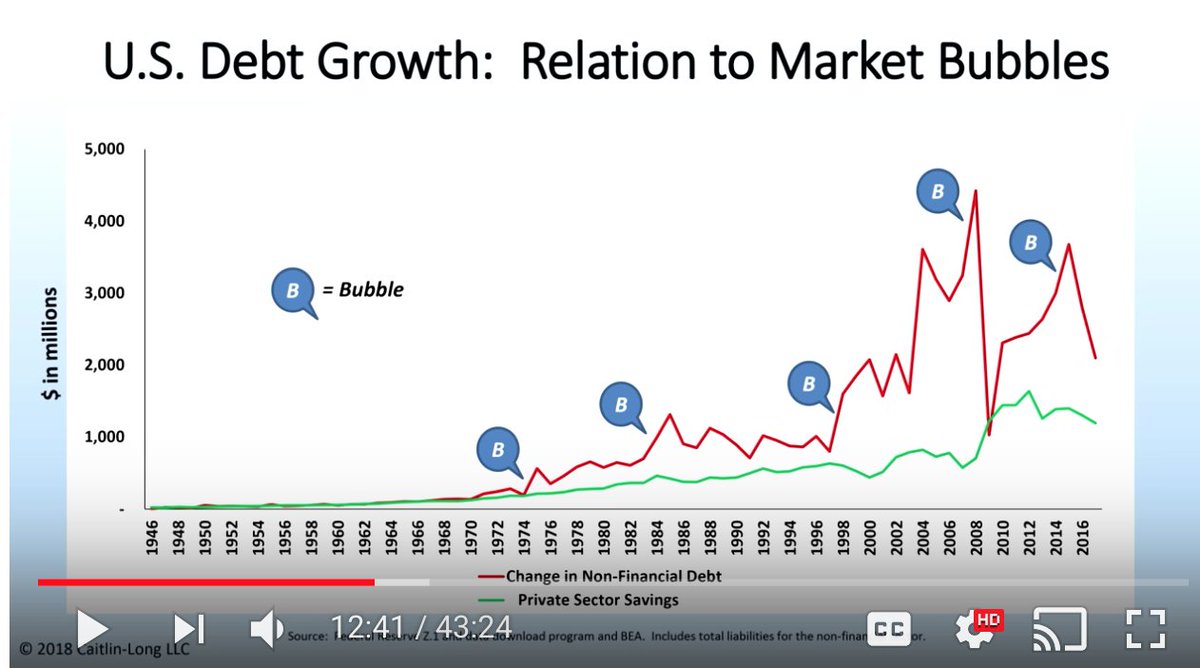

Graph from @CaitlinLong_

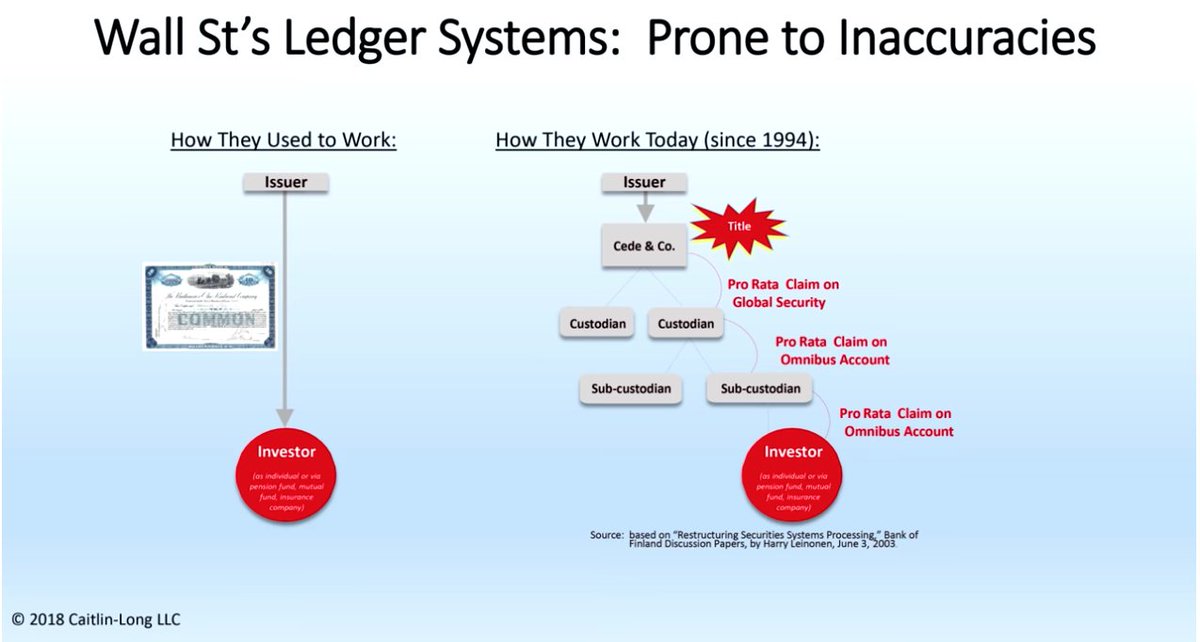

Title of this part is that they are “Prone to Inaccuracies”

In the old days, issuers issued stock certs to investors or through an agent. Simple.

Now, since 1994, you have 5-6 layers in between.

wat?

Graphic from @CaitlinLong_

Wondered abt this when I traded. How accurate is snapshot of stock ownership across market at given time, esp. w/ stock settling taking so long?

This is insane to me. It was insane to P&G too, because they ended up ending the fight for the board seat.

Here’s a link: cii.org/files/09_29_16…

Want to repeat this. Only 👏 1 in 3 👏 parties 👏 who think 👏 they own 👏 a US Treasury 👏 actually do

Great quote at the end:

“I think capital markets won’t be fair unless and until they use honest ledgers”