The US was the only real VC scene for a long-time. It’s share could only decline. $ in US remains very high

Silicon Valley hitting a peak has been a popular narrative we’ve seen every year @cbinsights

- China is a real powerhouse in tech/VC investing

- Europe and the rest of the USA (not SV + a few other mkts) are a snoozefest in tech/VC investing

Yes - there is more going on there and it's great to see, but let's be real. They are nothing burgers right now

This is a good, noble thing.

But if you issue a study saying "all is good here", that's boring

1. @cbinsights is in NYC

2. Read our newsletter. We poke at SV inane'ness all the time - cbinsights.com/newsletter

3. If tech/investing gets more global, it's great for our business. I hope it does

cbinsights.com/research/repor…

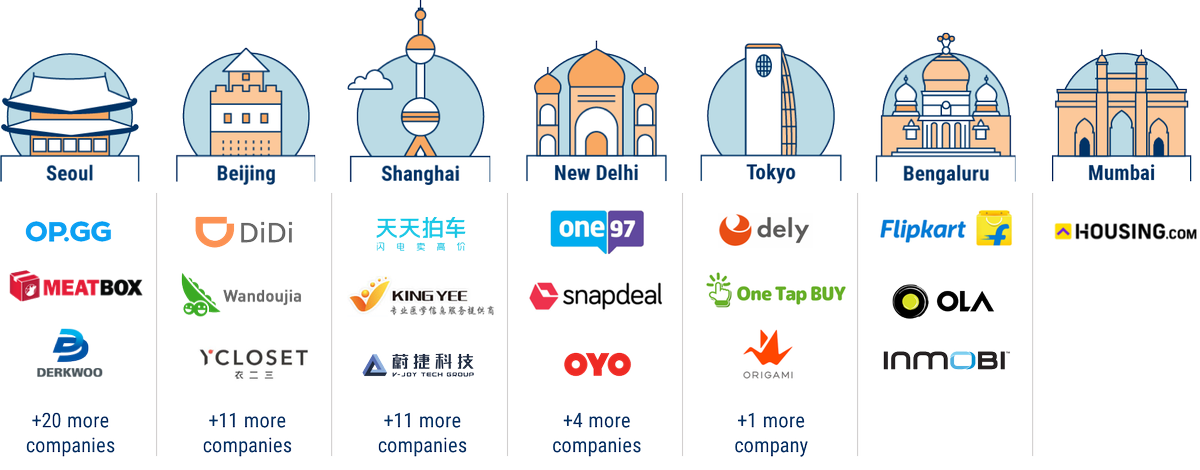

Here's a graphic on where Softbank is investing in Asia. Lots of other great dataviz and data in here

Cuz there is not talent or $$ as they scale. That’s when SV investors come in and also when cos relocate to SV, nyc, etc