medium.com/paradigma-capi…

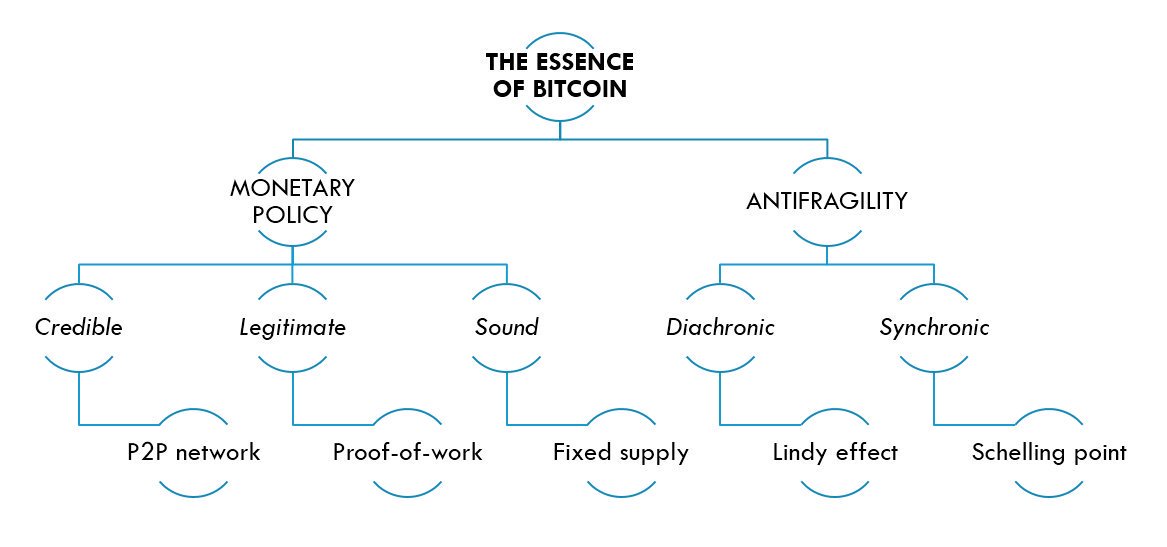

👮 What's the network worth (in cash flows) to maintainers?

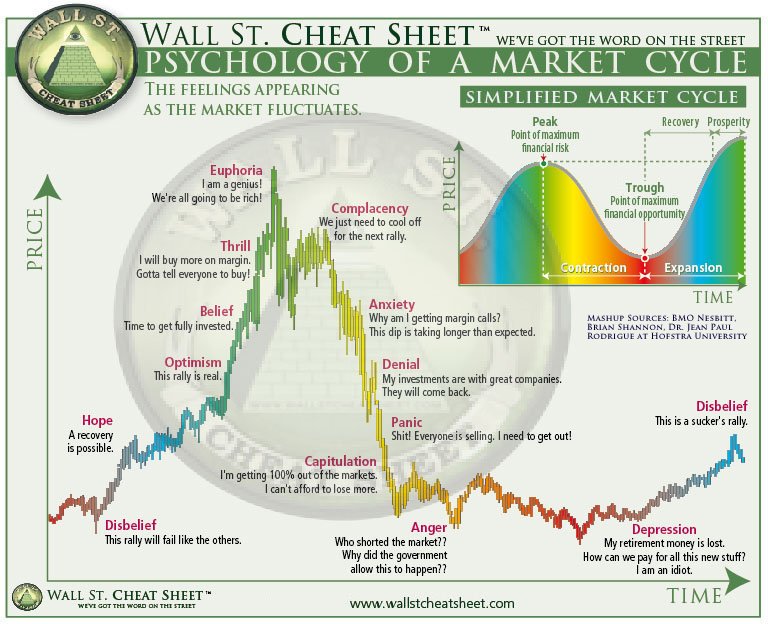

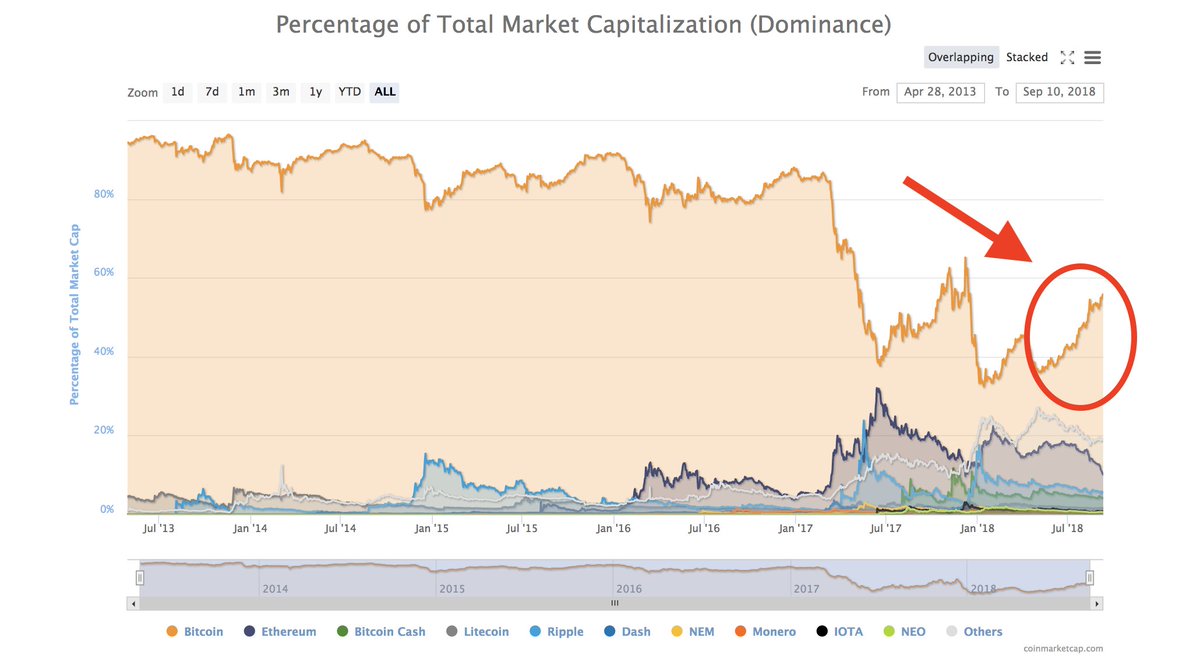

🎉 How euphoric vs. acclimated is the market?

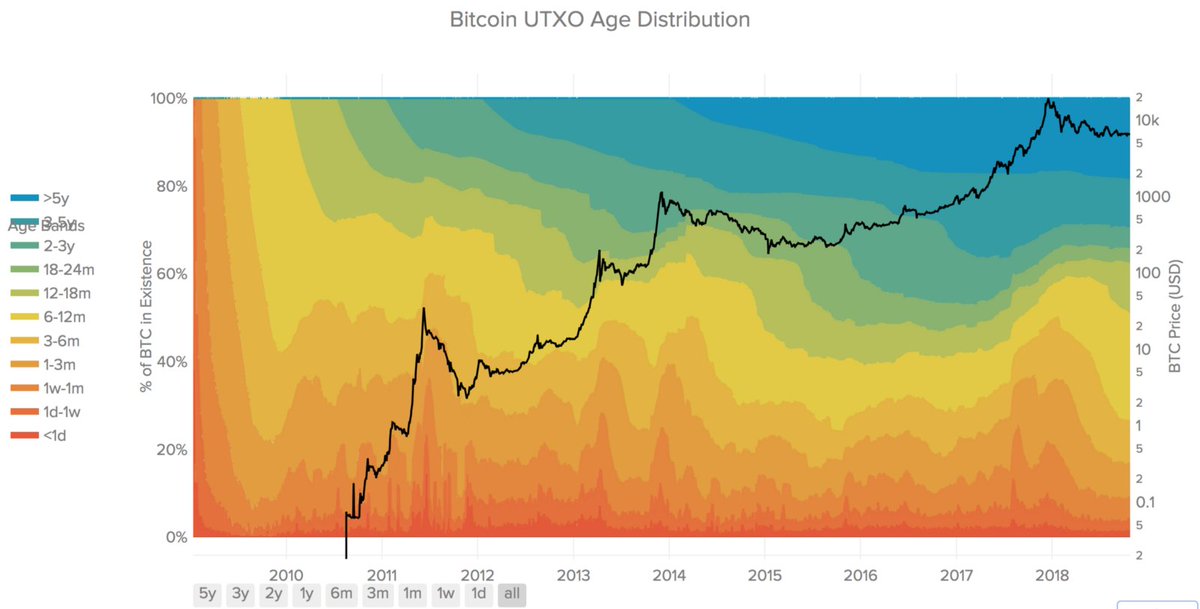

📅 What’s the age profile of bagholders out there (v. roughly)?

🚢 Is the asset under/overvalued re: its usage for value transfers?

"Thermocap" can be a more appropriate measure of wealth in illiquid markets, as argued by @nic__carter. It’s found by pricing outstanding coins based on the value when they were mined...

I like too interpret them as a signal of confidence in the store of value use case for bitcoin.

🐻

🐂

⛄️ Happy crypto-winter, & stay safe out there :) 🧣