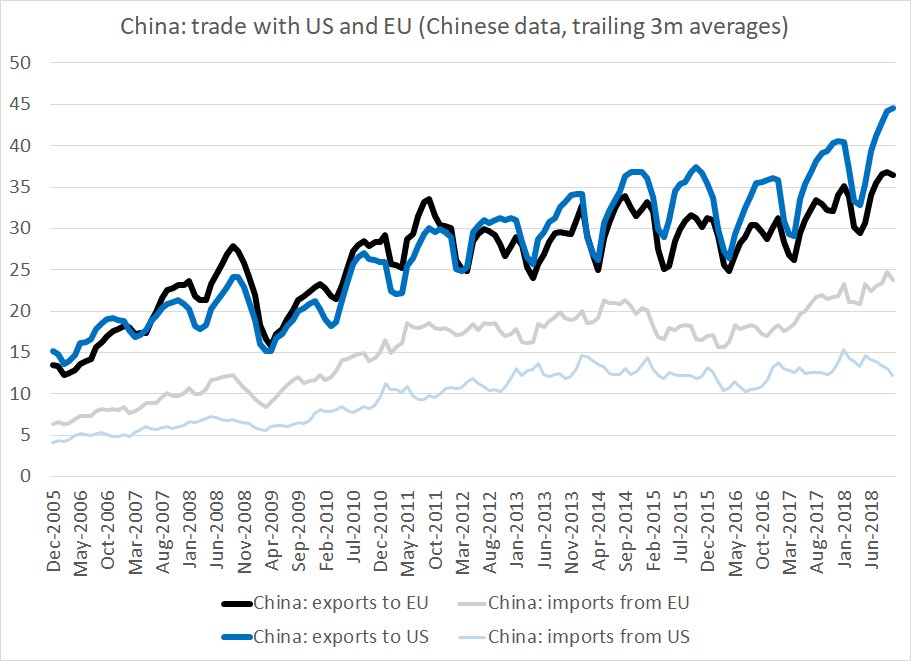

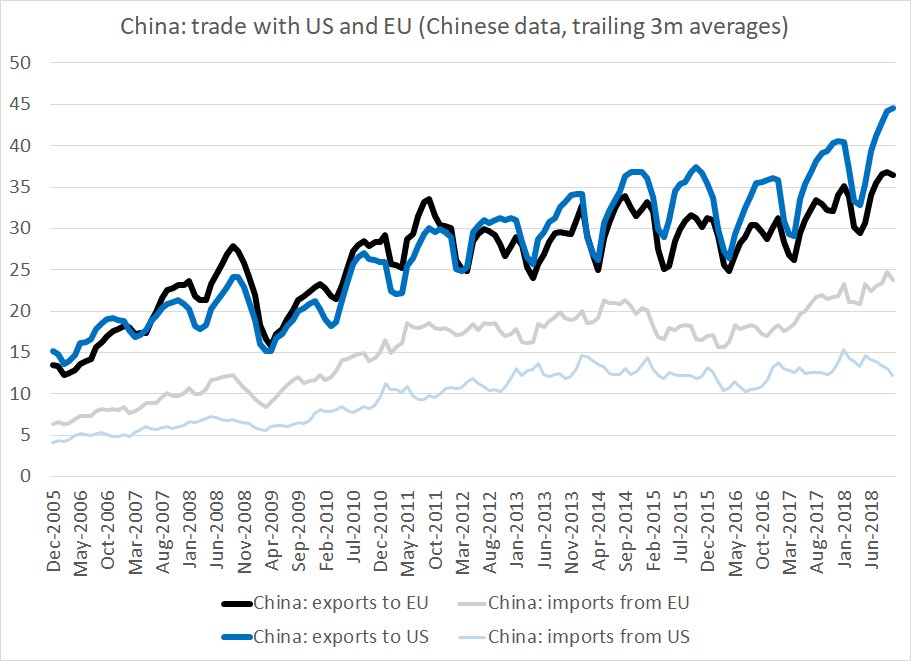

As @gilliantett noted on Friday, Chinese exports to the US (in the Chinese data) have been doing quite well in the last few months.

Running about $5b a month more than this time last year, and $10b more than this time 2y ago

Get real-time email alerts when new unrolls are available from this author!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!