Why? Because of antifragility - that which profits from chaos.

$BTC is the world's first asset that benefits from its critics, makes fools of its hijackers & proves naysayers wrong even when they are right.

Each post in this series will feature a new reason why we believe $BTC is the world's first asset with antifragility built into its bones.

From a failed experiment to the "evil spawn", Bitcoin's crises motivate a class of critics to gather at the funeral.

Not to mourn, but to bury.

"We can almost always detect antifragility (and fragility) using a simple test of asymmetry: anything that has more upside than downside from random events (or certain shocks) is anti-fragile; the reverse is fragile".

2018 onwards marks the beginning of the next era: @ErisX_Digital, @Bakkt & @DigitalAssets.

Investors capitulate out of the "better Bitcoins" they bought in hopes of getting rich, and then decide to either:

1) Abandon crypto

2) Rebalance with a heavy $BTC bias, doubling down & looking to the "next cycle".

A 90% drawdown, yet an increase in investor conviction.

Can you think of another asset which behaves this way?

This is antifragility.

1) Monetary history

2) The social, political and economic implications of $BTC

3) The fragilities of the existing financial order.

Not even Gold does this - a large drawdown would inspire panic & undermine its SoV thesis.

1) Double down on anti-crypto resentment ("It's A Scam, P&D, No Fundamentals")

2) Rush back into the asset as price steadily begins to climb ("Oh Man, It's Happening Again…").

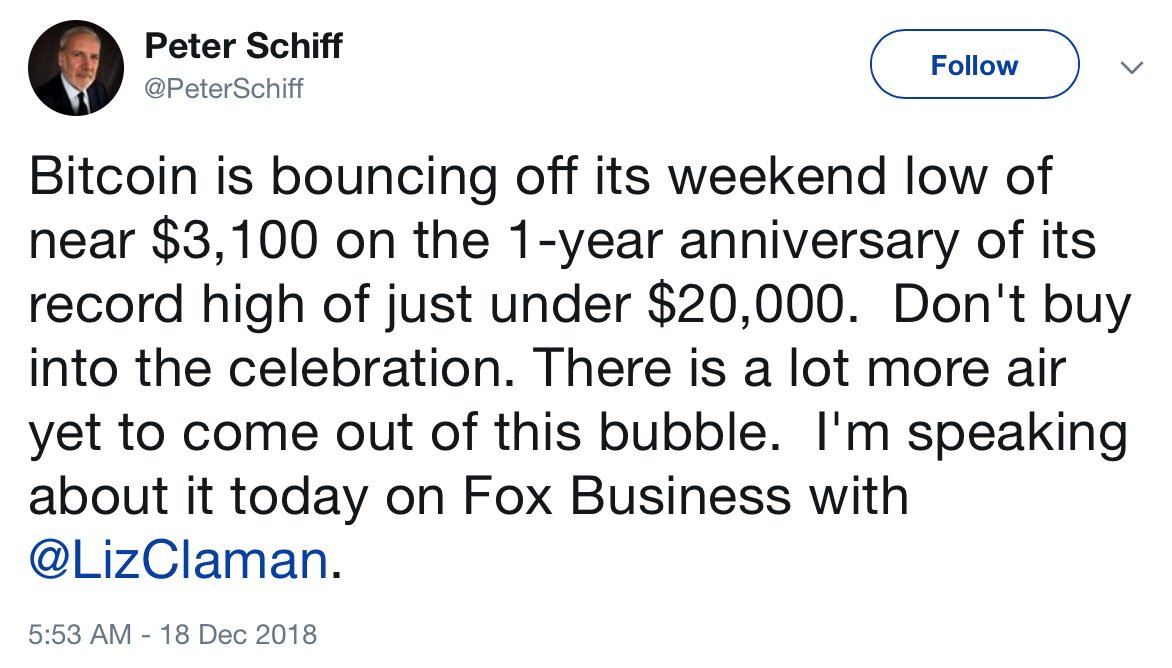

1) Double down, do the unthinkable & Fight Price (@PeterSchiff)

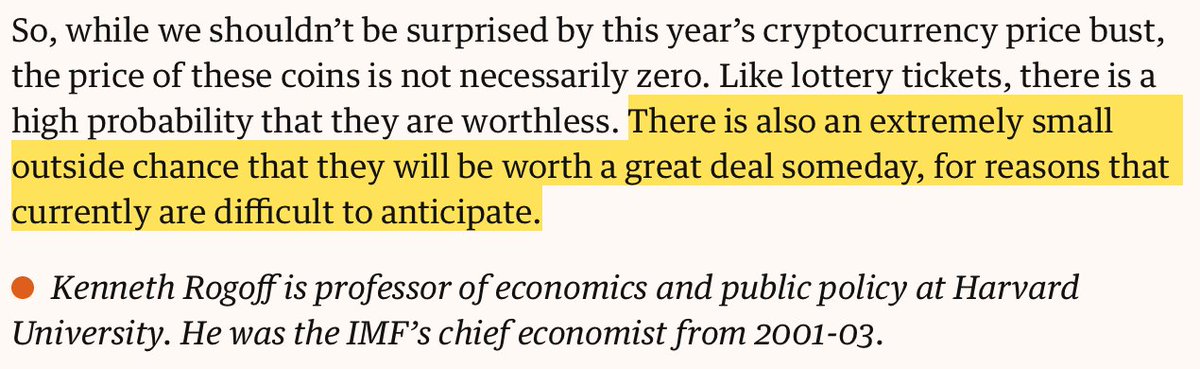

2) Revise their position and concede to an element of the $BTC narrative (@krogoff).

theguardian.com/business/2018/…

Lest you are haunted by the ghosts of your past:

1) Critics have high reputational downside if they're wrong

2) Investors have high financial upside if Bitcoin wins (assuming responsible risk management)

3) Bystanders have high emotional downside in the next cycle ("if only!").

Bitcoin forces your hand: once the volatility clicks, whether today or in 2 years time, you can no longer sit on the fence.

1) How can The Intelligentsia preserve their reputation on a subject by claiming something that previously "died" is once again "dead"?

3) How can investors ignore the unparalleled performance of the asset - which continues to outperform despite violent drawdown?

A positive feedback loop that captures everything in its path.

This is very hard to find in newly emergent assets.

The asset has developed mechanisms to not only survive volatility, but to leverage this seeming disadvantage for its own gain.

Even when "dead", Bitcoin is as alive as it has ever been.

Antifragile.