Encouraged by an uptrend in $BTC, the meme of "Blockchain-as-a-Service" caught on as companies began deploying PoCs en-masse.

merltech.org/blockchain-for…

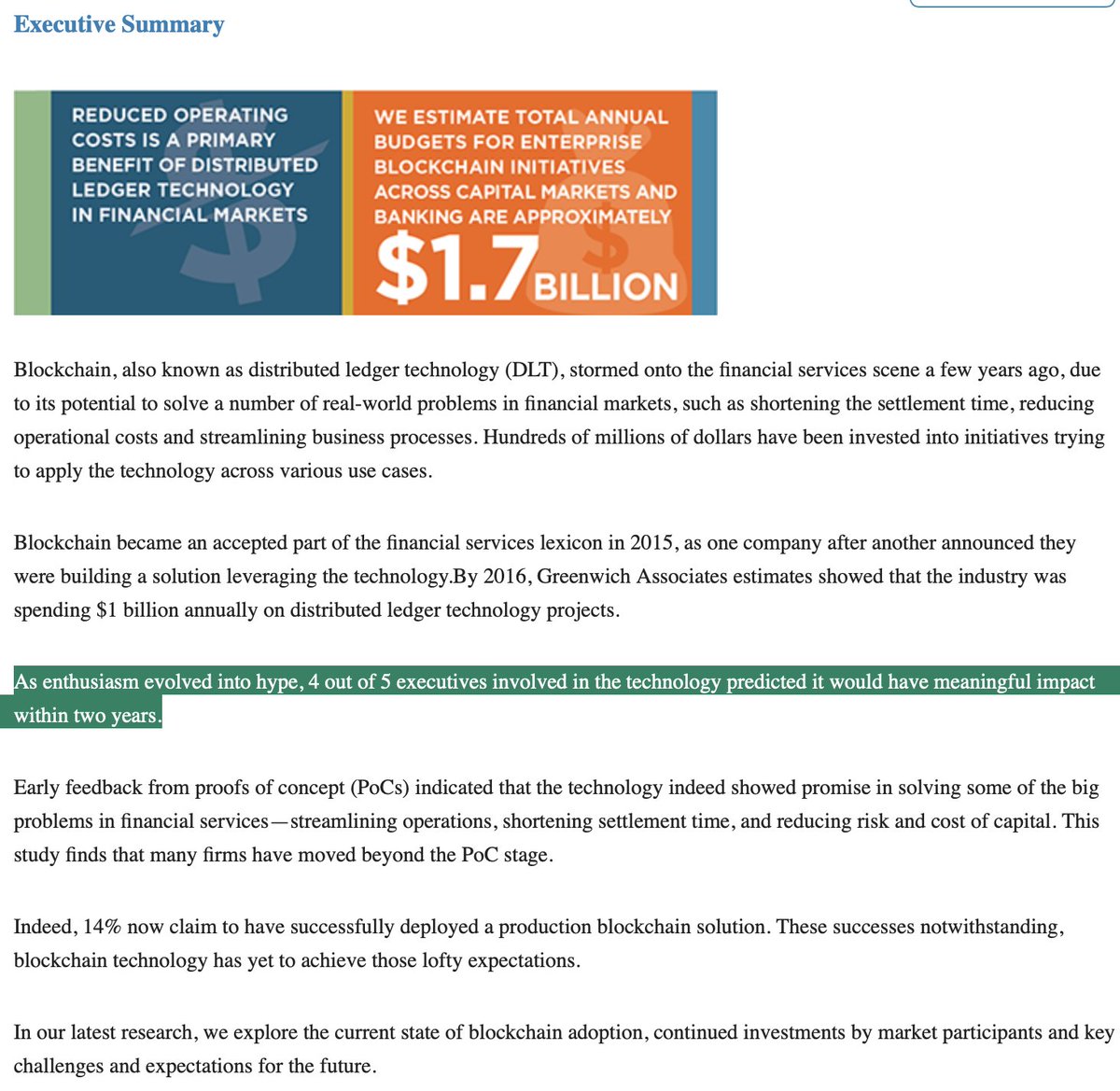

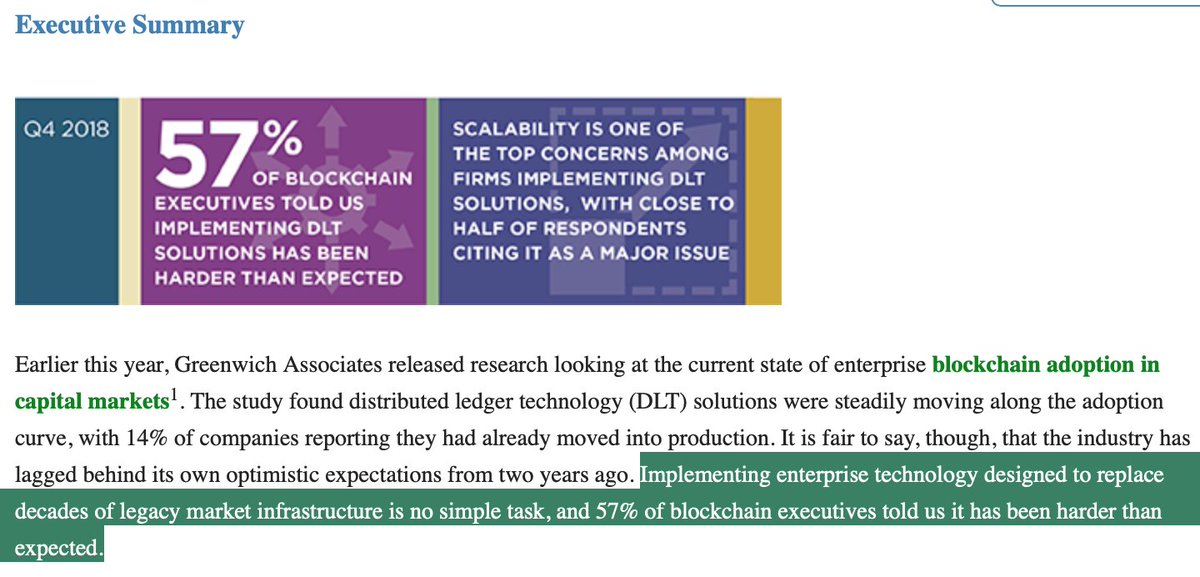

57% of executives now say "implementing DLT solutions has been harder than expected".

greenwich.com/equities/block…

greenwich.com/market-structu…

After 4 years of enterprise consulting, @anguschampion published a piece on his skepticism of private chains, questioning if they "provide a real business benefit at all".

coindesk.com/how-i-lost-my-…

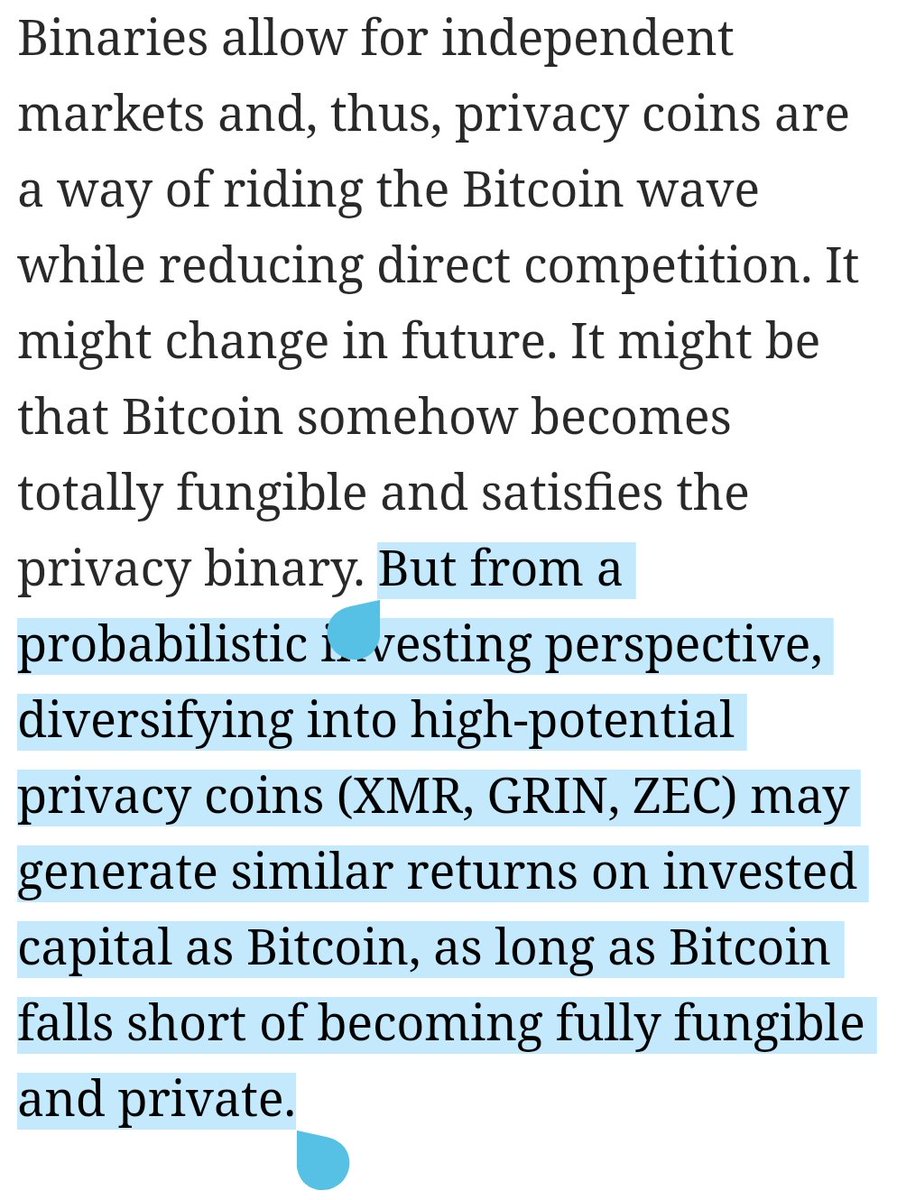

Bitcoin's incredible performance left everyone by the wayside, wishing they could emulate its success.

For the cautious, this meant deconstructing Bitcoin, removing contentious elements - the speculative token - and adopting what remained: the blockchain.

Some raised alarm bells - like @aantonop in 2016 - but the warnings fell on deaf ears.

This is good news.

"Bitcoin And Capital Markets"

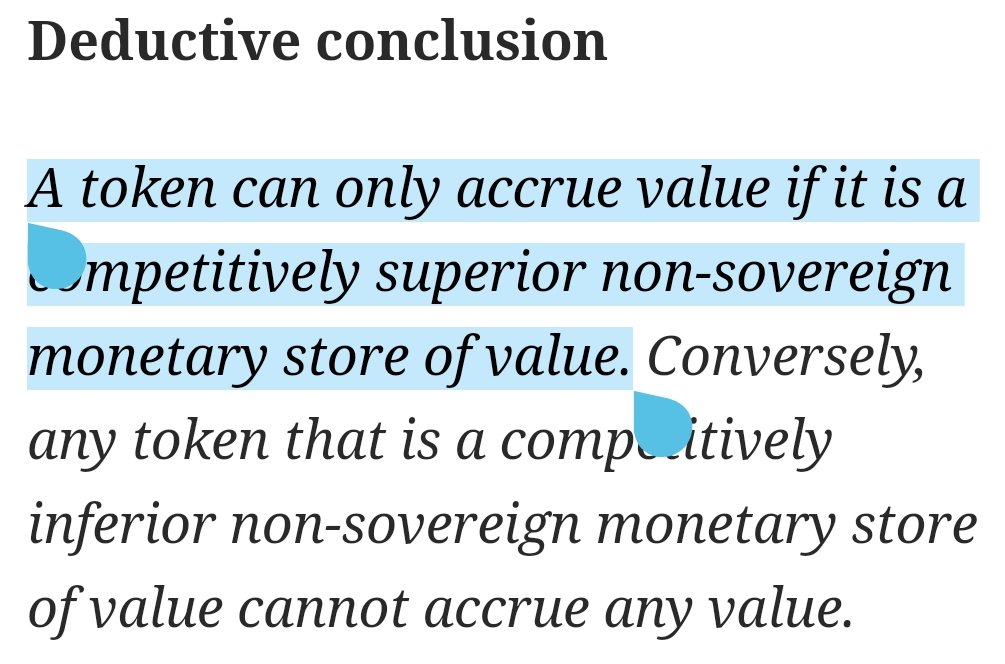

"Blockchain" is just a vehicle to achieve an outcome: trust-minimised, scarce, non-sovereign digital commodities ruled by economic incentives.

2) Derivatives Exchanges -> @Bakkt, @ErisX_Digital, @SeedCX

3) Custody Solutions -> @GoldmanSachs & @BitGo

4) Stock Exchanges -> @sixgroup, @Nasdaq

5) Payments -> @RevolutApp, @Starbucks (through Bakkt), @Square

It is important early institutional adopters commit to the values that drew them in, lest @CaitlinLong_'s warnings of rehypothecation fall on deaf ears.

We're excited to see it mature in the coming years as it draws in the masses to the spell of "digital gold".