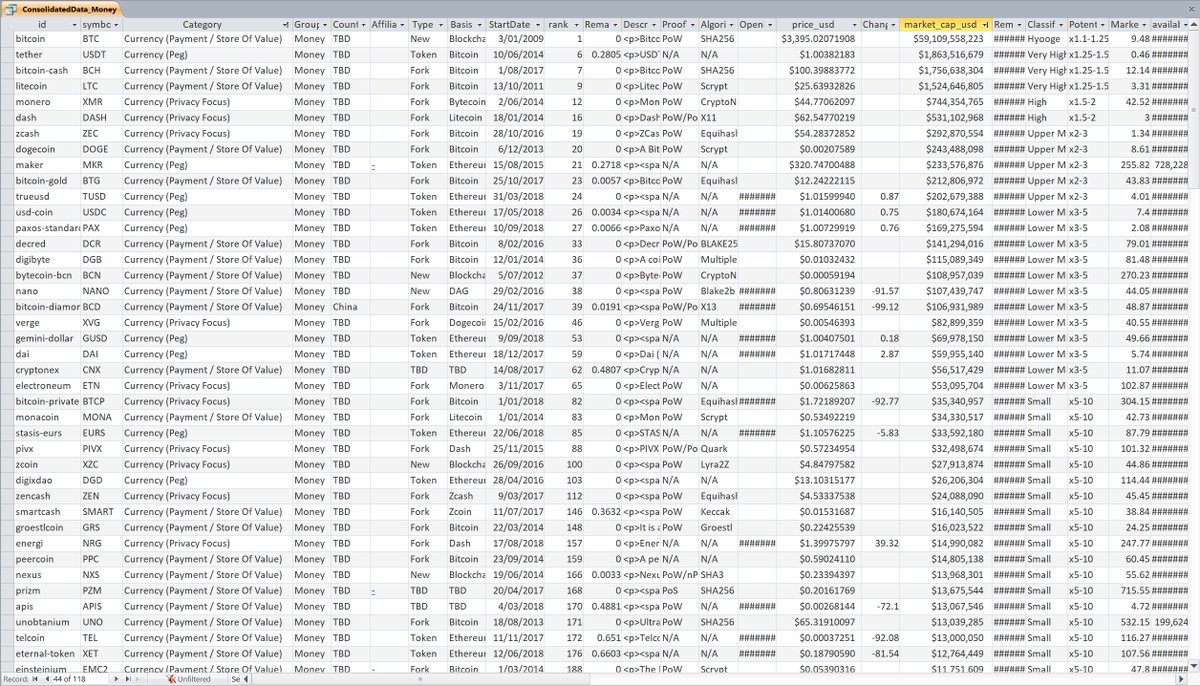

Currency.

1) Business -> success or failure depends on cash flow and generating profits

2) Currency -> success or failure depends on liquidity and adoption.

The alchemy of "cryptoeconomics" (a methodology we once subscribed to).

You can't get past the "currency" problem by introducing a pseudo-ponzi scheme.

Far from it.

The mandate is different from most ecosystem funds. It's not to invest in "ERC20"-like utility tokens on @Algorand, but in profitable businesses which adopt the $ALGO token as their currency.

Currency status.

1) Trust -> PoW & stable monetary policy

2) Scaling -> Lightning Network

3) Applications built on top of its network -> not dApps, but cApps like spot/futures exchanges and custody solutions.

For this, it has been rewarded; crowned King of the cryptoasset market.

1) @UniswapExchange -> decentralised exchange protocol

2) @MakerDAO -> stablecoin protocol locking up over 1% of the supply of $ETH

3) @compoundfinance -> open source lending protocol.

Consider businesses & decentralised protocols built to accept base layer currencies (like $BTC or $ETH).

The very nature of the firm transforms, enhanced by programmatic on-chain dividend redistributions and shareholder governance.

None of this is exciting or revolutionary, and it's not where asymmetric opportunities will be found.

The ideal example is @NexoFinance, a lending platform regularly redistributing dividends to $NEXO holders.

Why?

It's fundamentally backed by future on-chain cash flows of $BTC or $ETH.

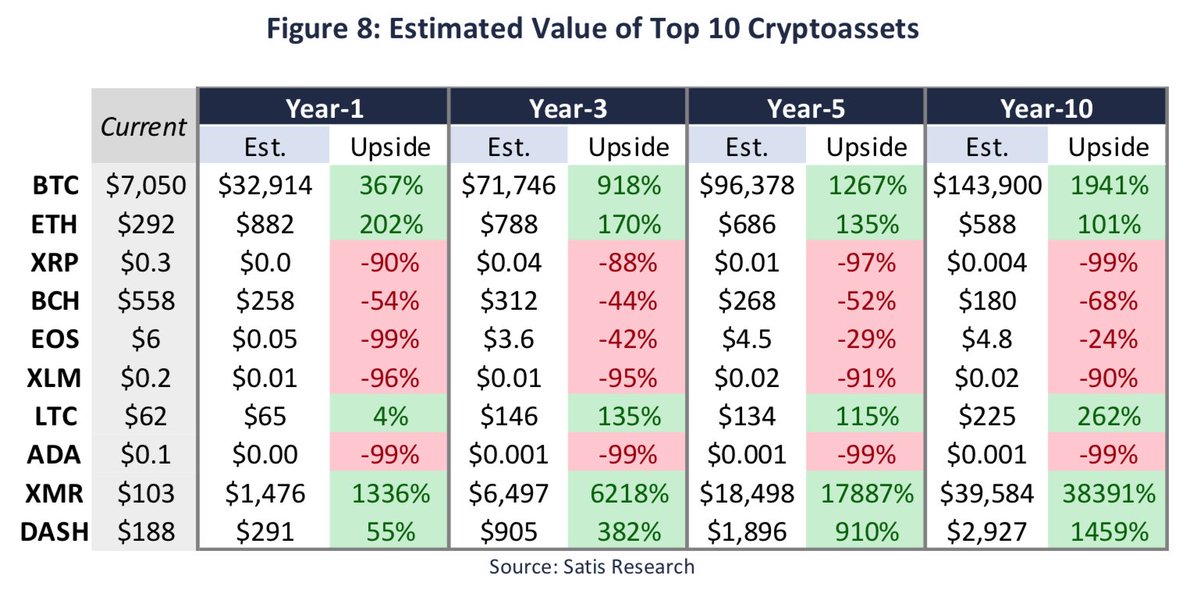

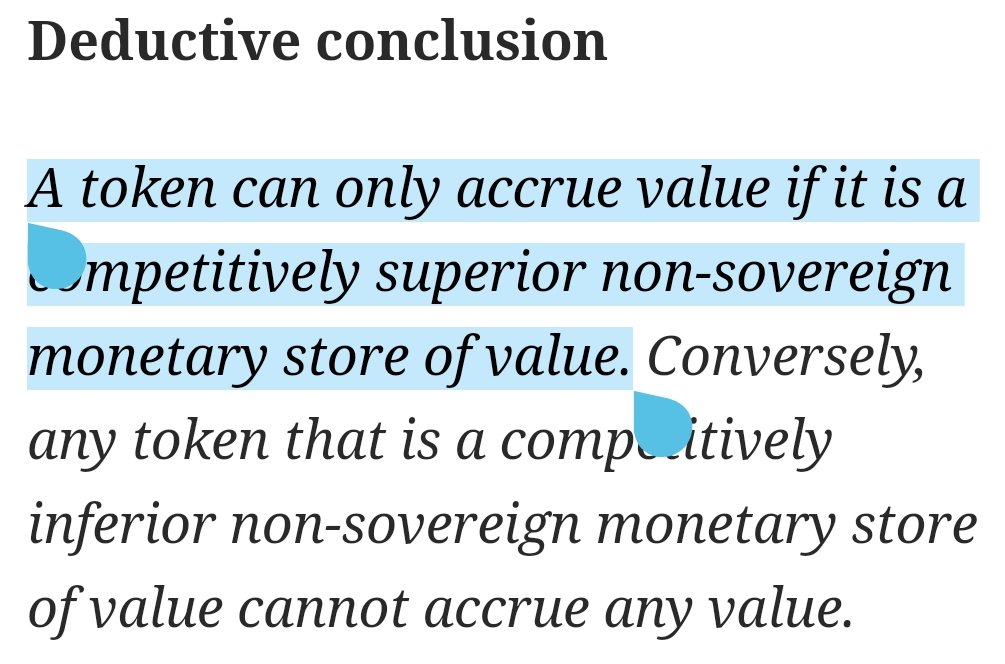

Long term, we believe value will accrue to 2 categories:

1) Currencies -> trust & growth as an SoV or MoE

2) Security tokens -> cryptocurrency accepting businesses / open-source protocols redistributing fees on-chain.

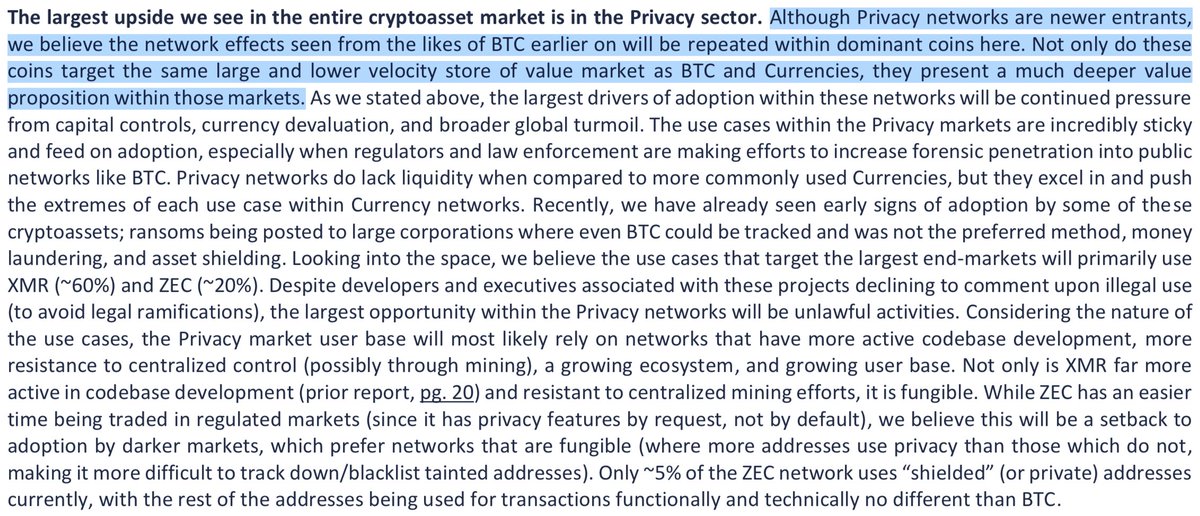

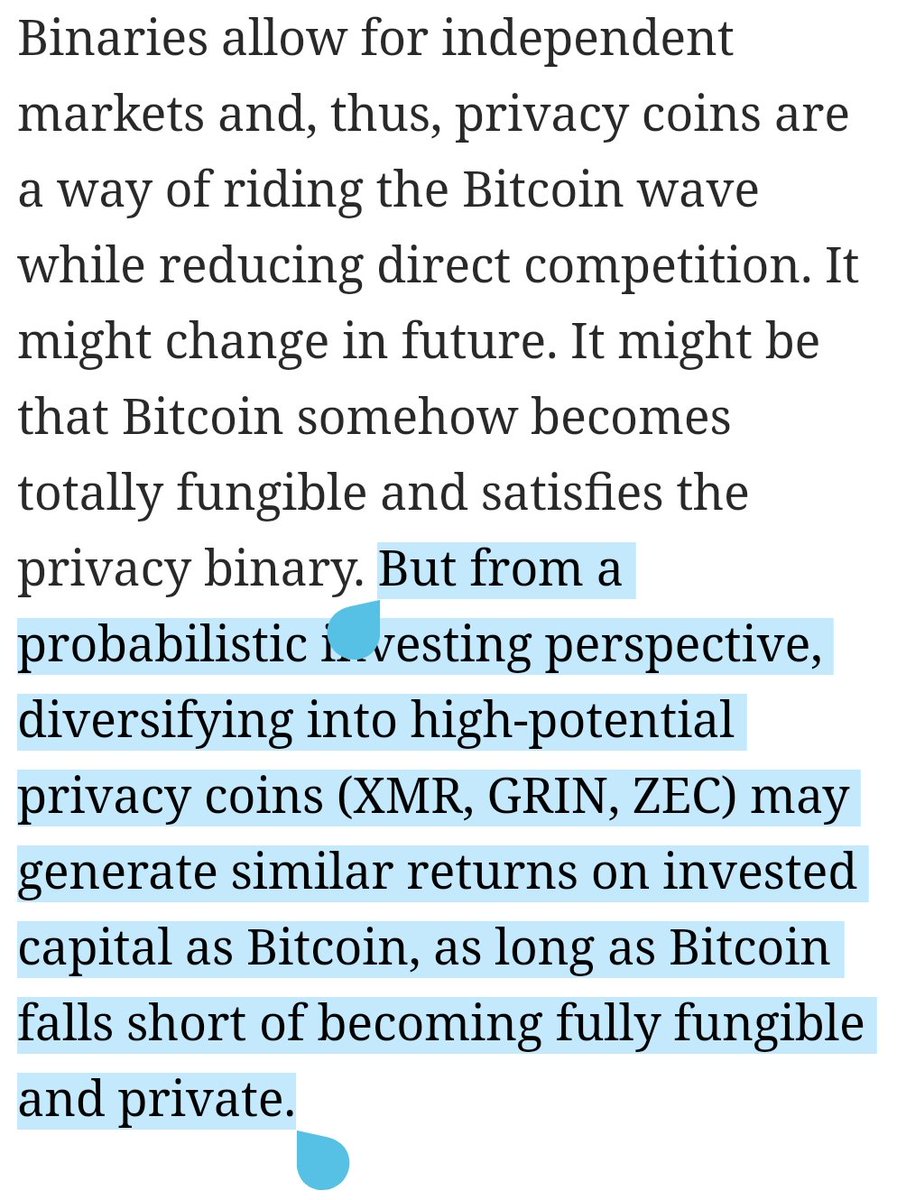

1) Currencies with unique technological propositions and/or aggressive business development. Think $BTC, $ETH, $DCR, $XMR, $ZEC, $XRP, $GRIN, @beamprivacy or $ALGO

2) Security tokens made possible through blockchain, not dressed up startups that couldn't raise VC.

Think of each cryptocurrency as its own economy.

Just like the existing financial system, each economy has its own central bank - a "decentralized" central bank - bound by the mandate of its protocol and social consensus.

The businesses of these borderless economies.

Which economies will grow the largest, and which economies will grow the fastest?