councilors signer and bellamy are running late, but the meeting is getting started.

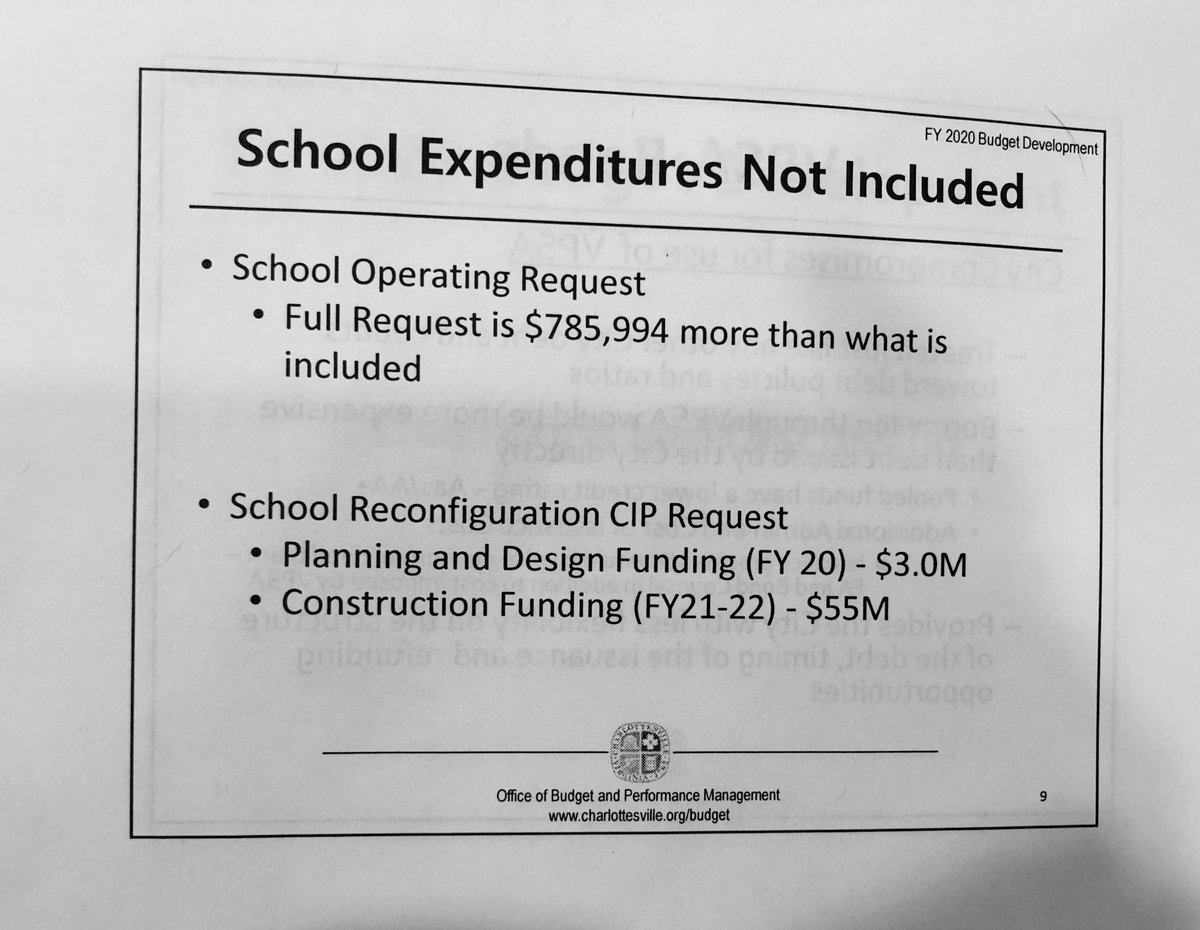

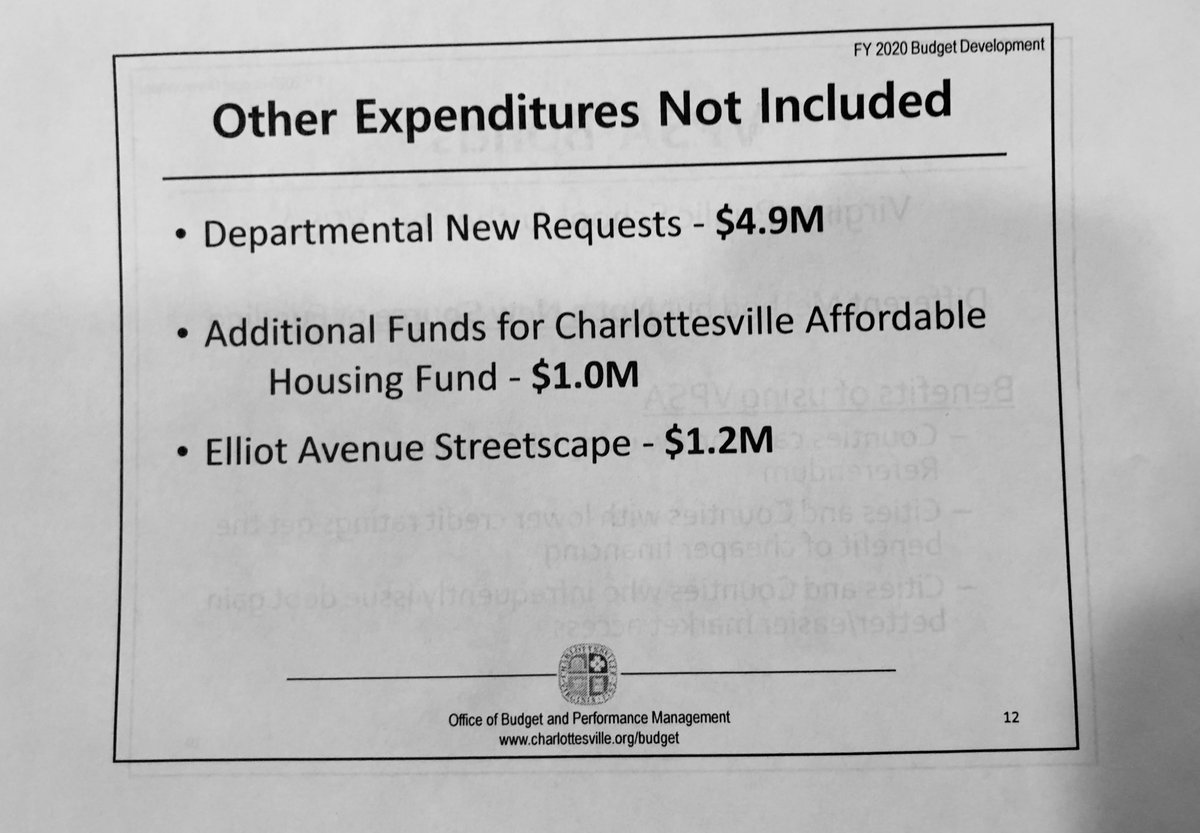

murphy says money could be taken from the CIP, but that would of course take that money from those projects.

(councilor bellamy has arrived... signer is still missing)

(but we’re spending close to a million dollars on raises for cops!)

signer finally showed up.

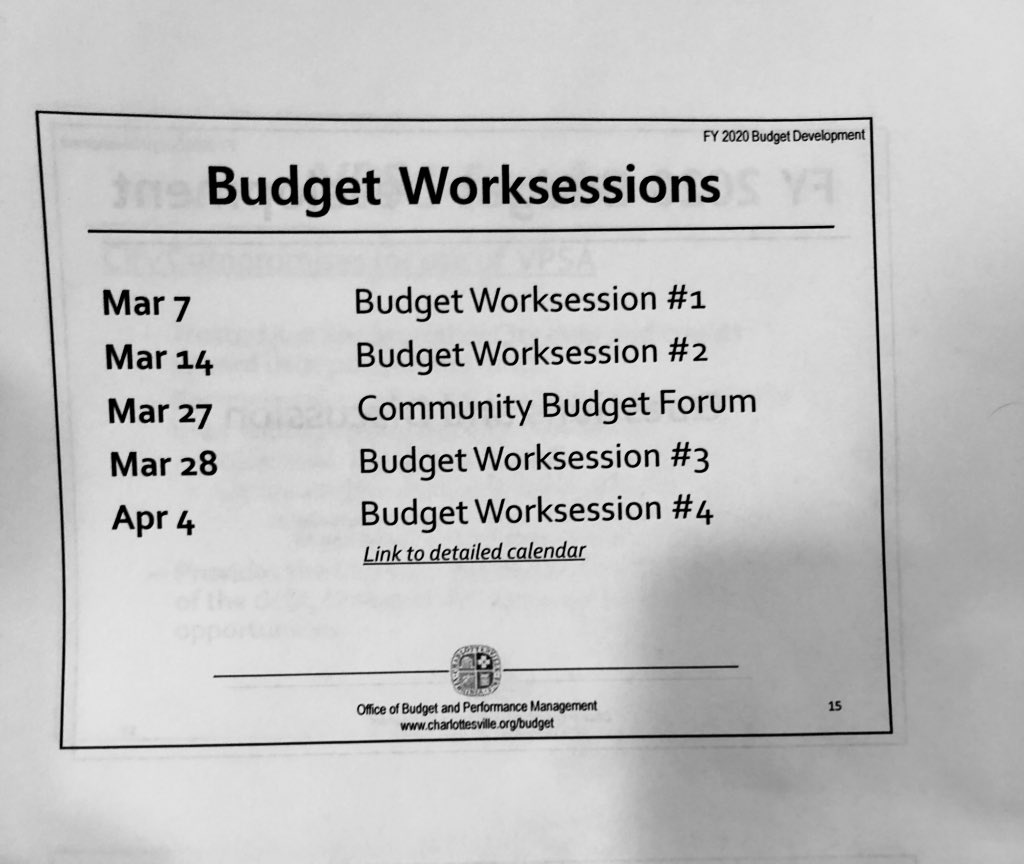

i hate budget season.

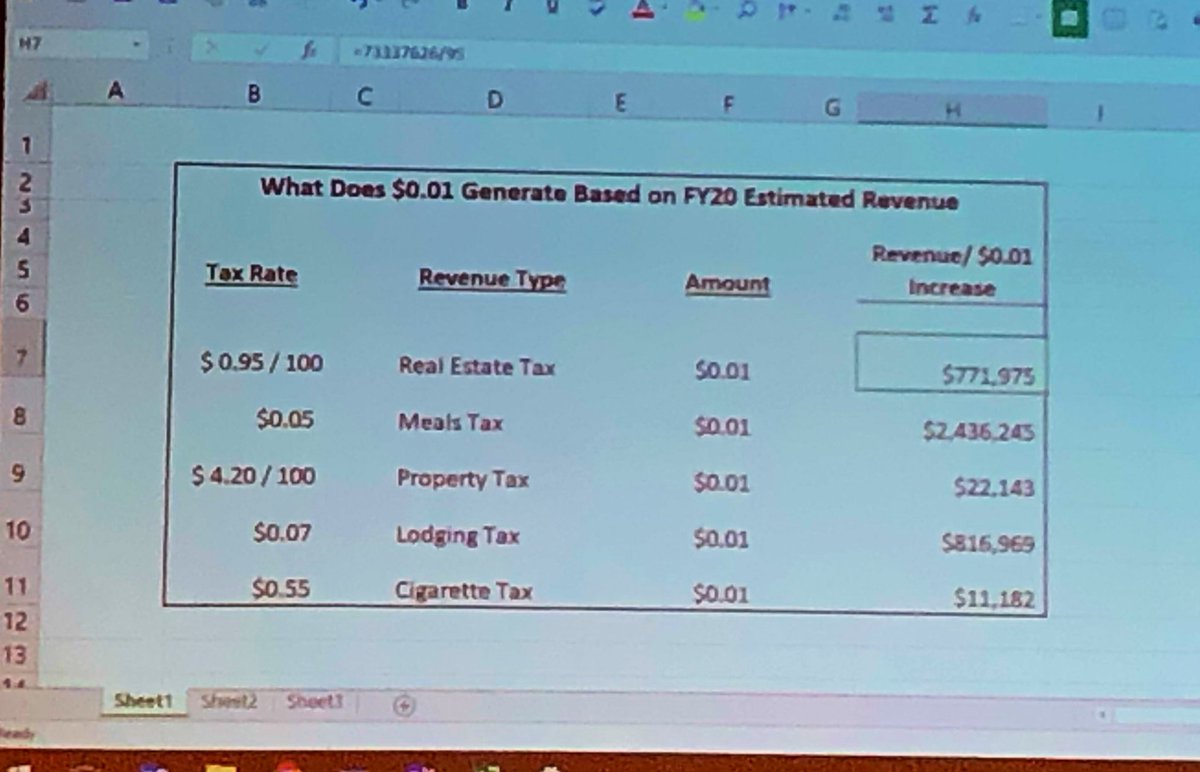

the chart they have up now indicates that would generate $2.4mil in revenue.

nikuyah recalls people being angry about it, kathy says people felt their industry was being “targeted.”

“we need to talk about the community overall,” how the whole community benefits from school improvements & committing to affordable housing. and we need funding to do those things.

nikuyah asks which of these cities we’re most comparable to, but the staffer says that’s the point of the VA first cities data - we’re comparable to all of these localities.

virginiafirstcities.com

ZOju

ZOju