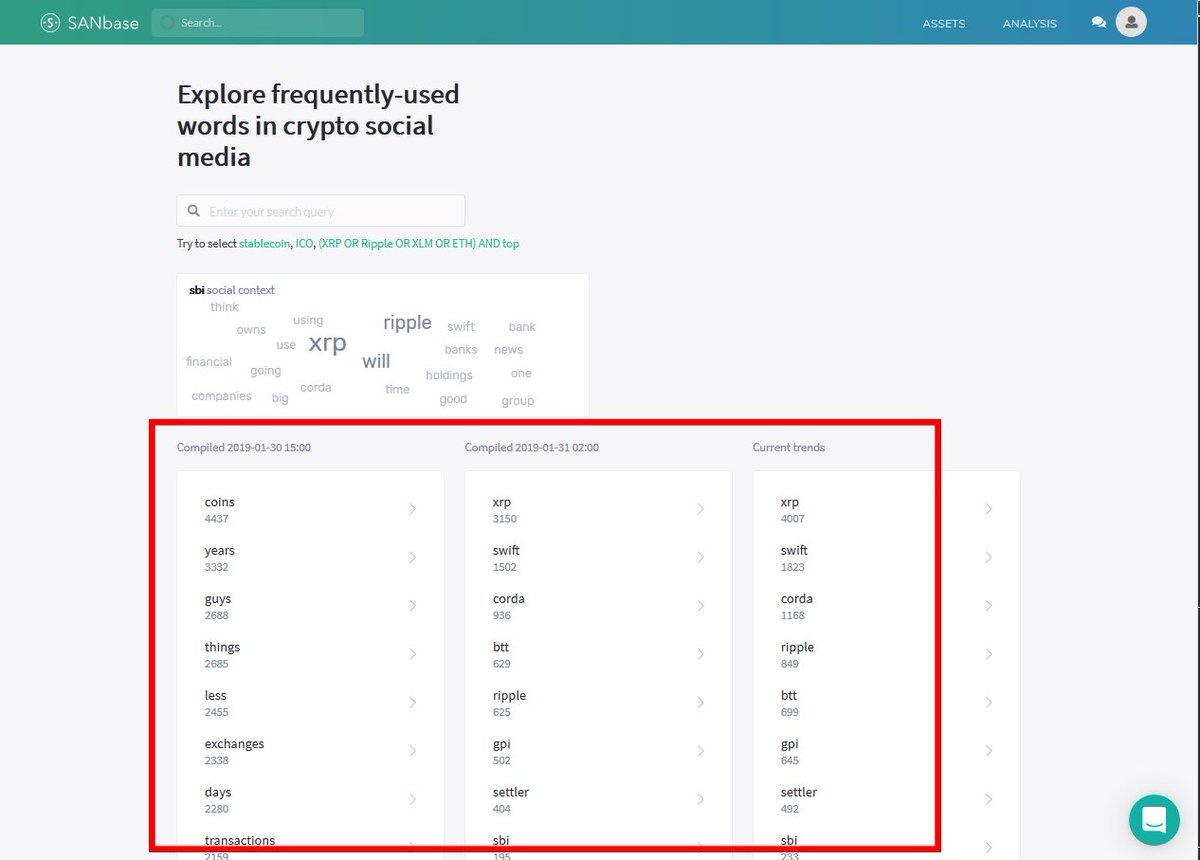

It calculates top 10 words w/ the largest spike in mentions on crypto social media (relative to their past 2-week average) making them biggest *emerging stories* in crypto.

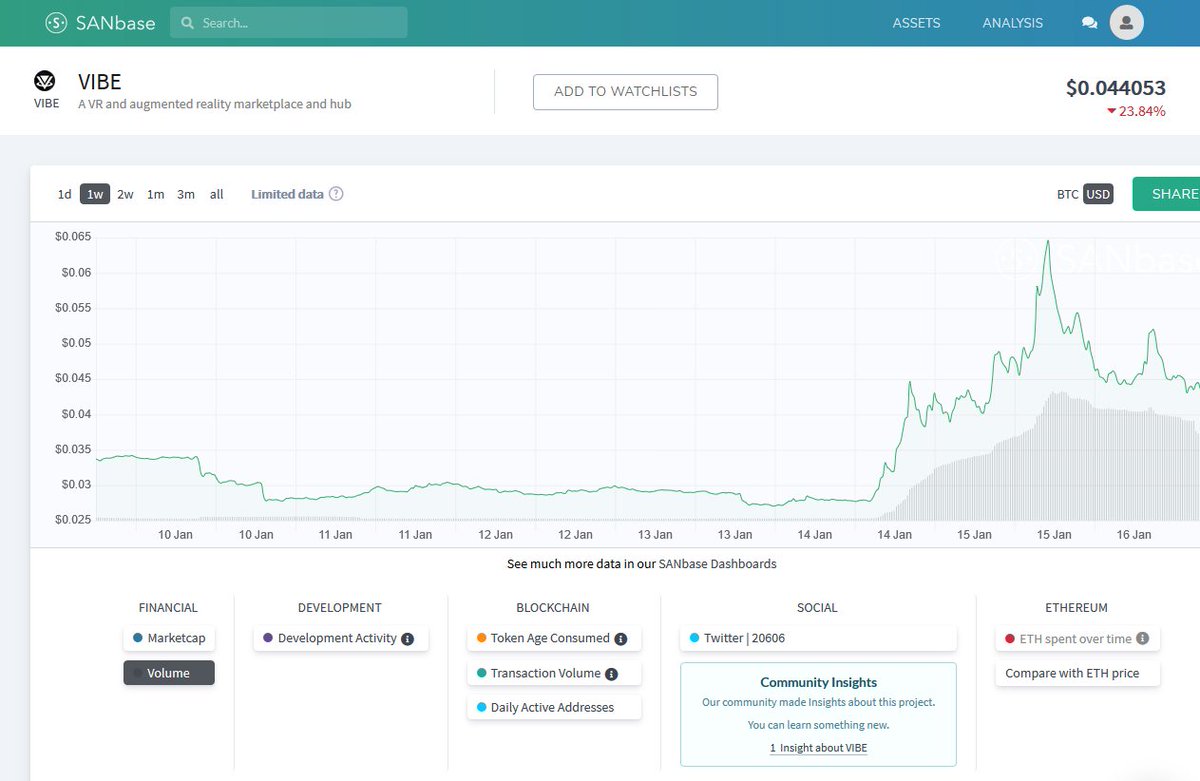

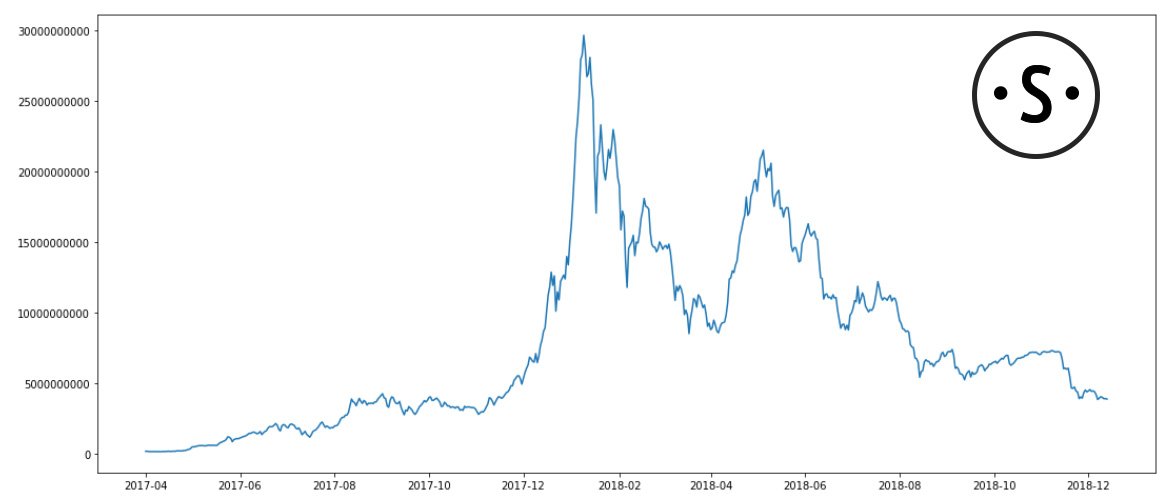

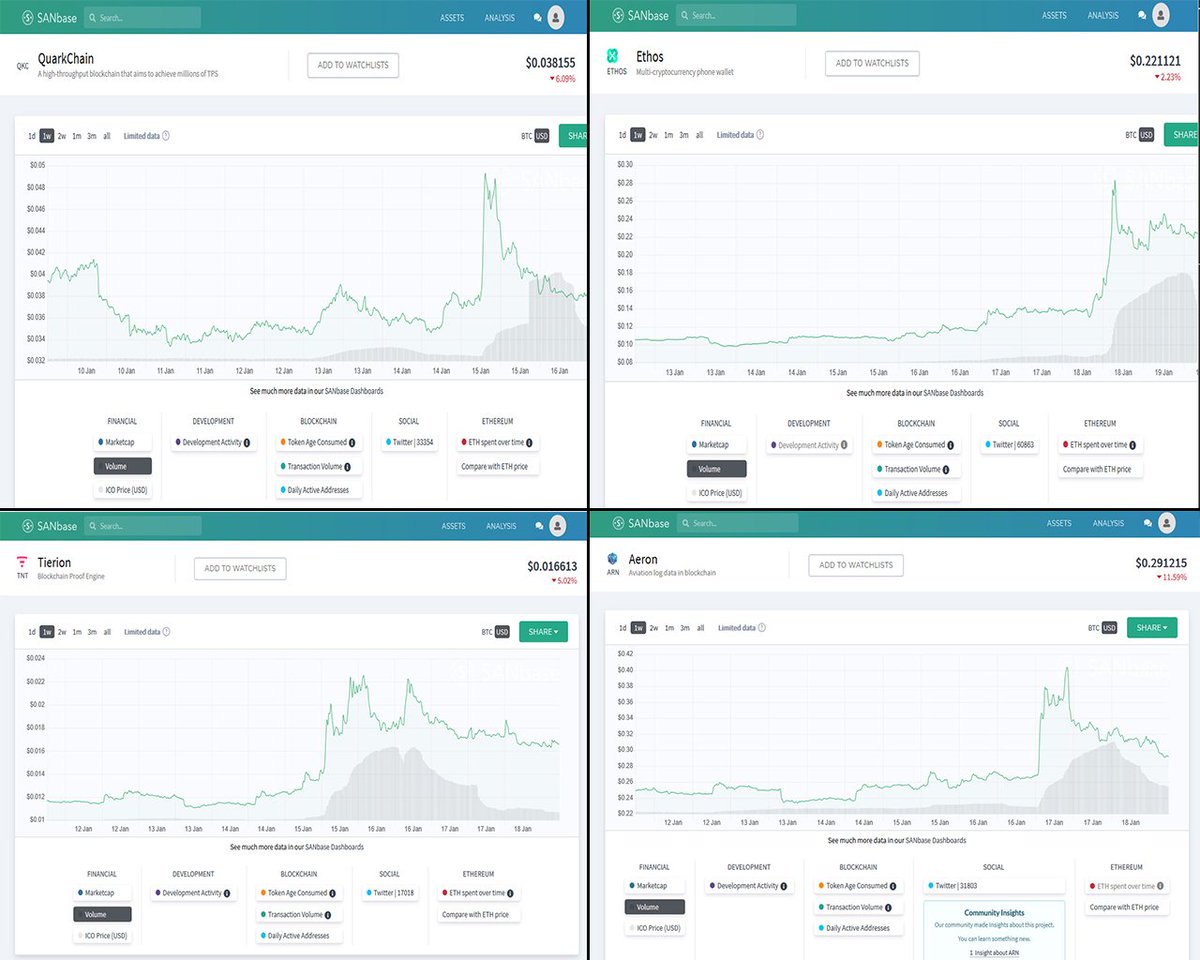

Once we checked the coins on SANbase (app.santiment.net), it was pretty clear why they got the crypto crowd talking:

Random coins were randomly breaking out – and the crowd was loving it.

The big question, of course, was – why?

1. News-driven breakouts

2. Random, unexplained breakouts - some with a common pattern

Let’s quickly go over the first category:

Here’s the top 3 theories that we have:

If smo can confirm this, please let us know. We do have a solid database of exchange wallets, and have so far identified 220+

If that’s the case, what exactly are they up to? And why these coins? At this point, we can mostly speculate.

When considering the size and transaction behavior of these wallets, it'd make sense that they belong to an exchange.

Would be helpful if @binance can shed some light on this.

For those interested, here’s our full analysis of these and other breakout coins of the past 15 days:

santiment.net/blog/breakout-…