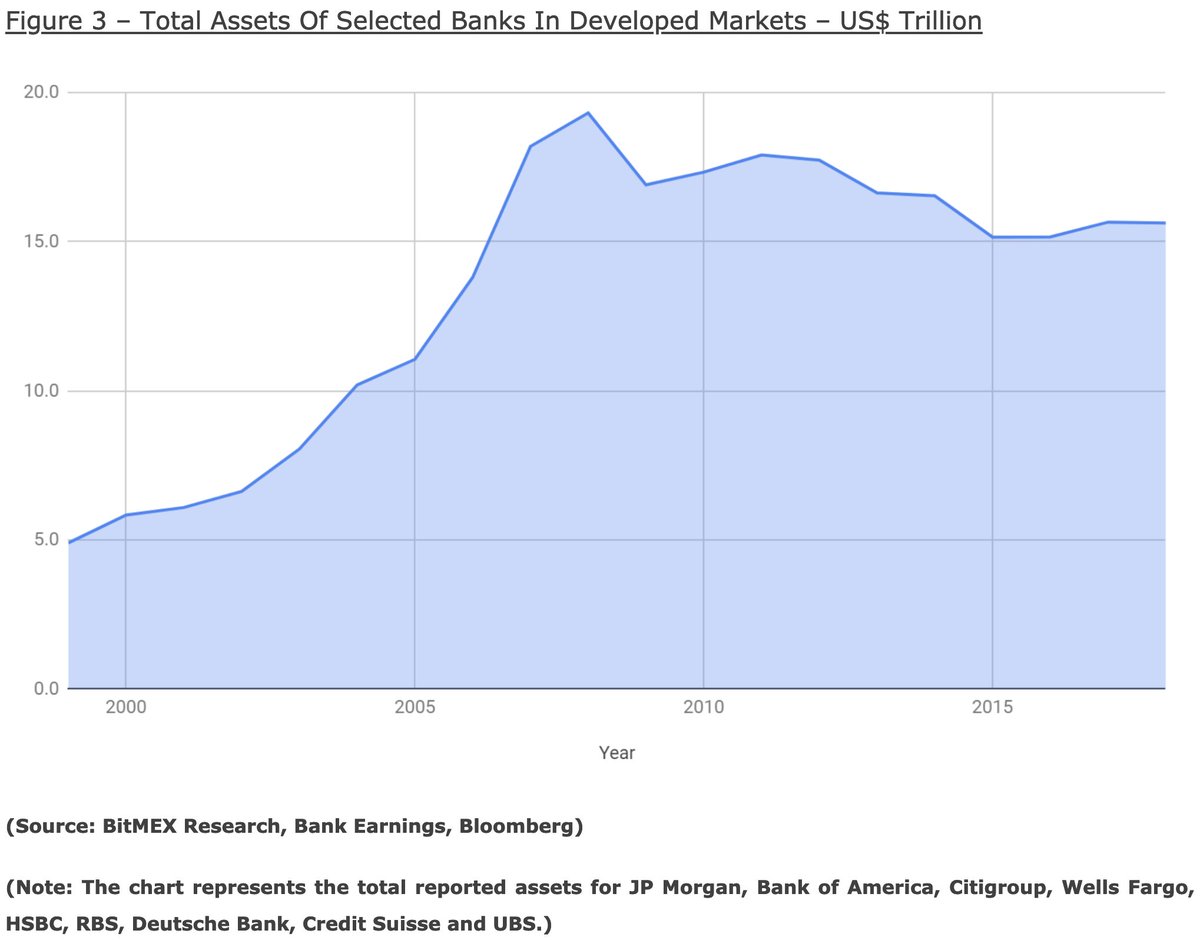

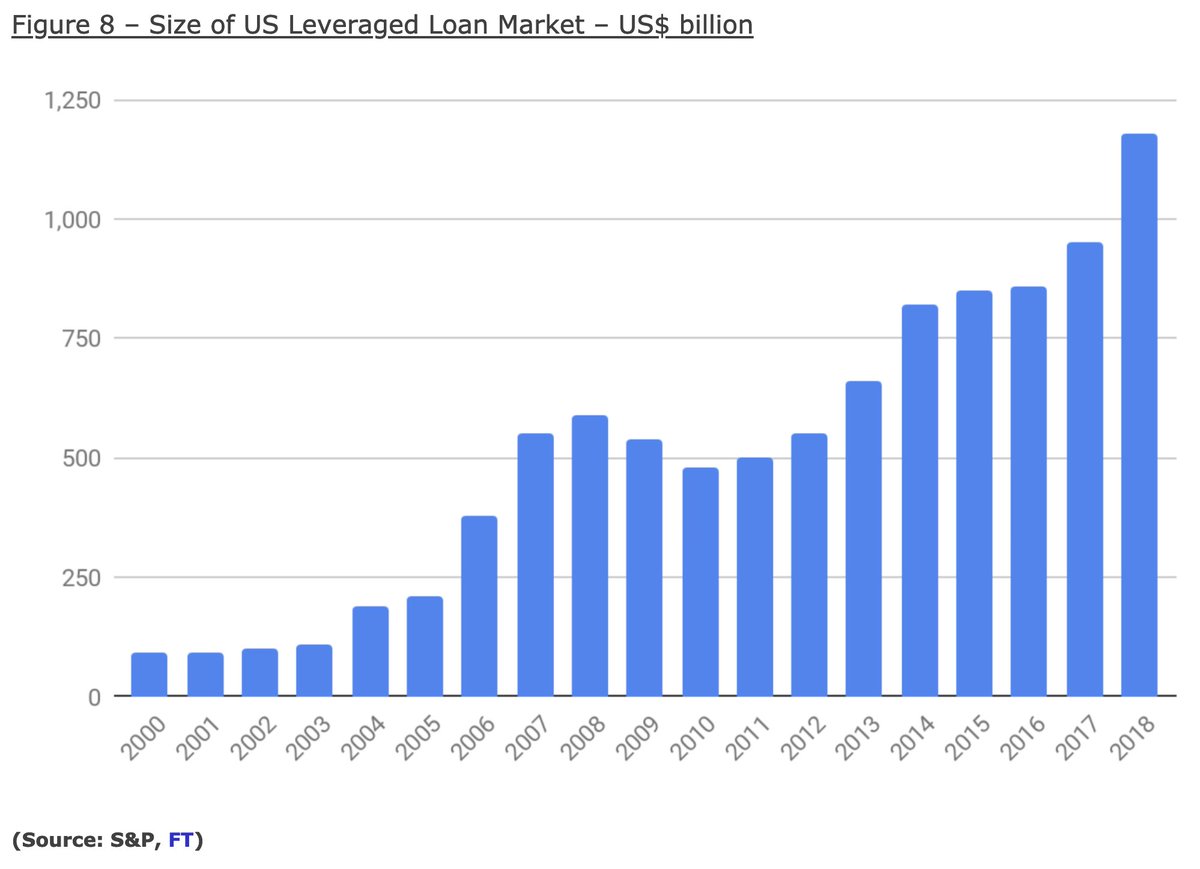

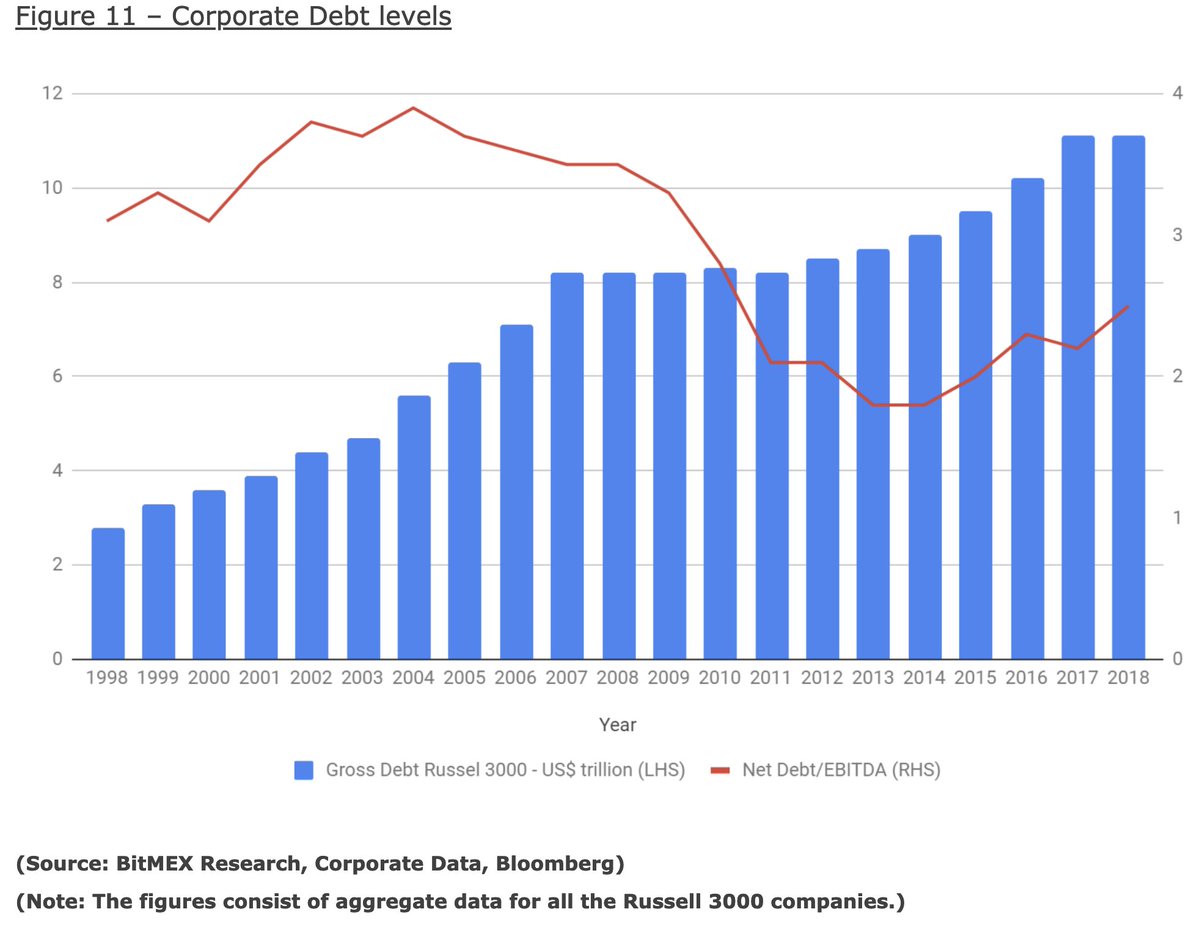

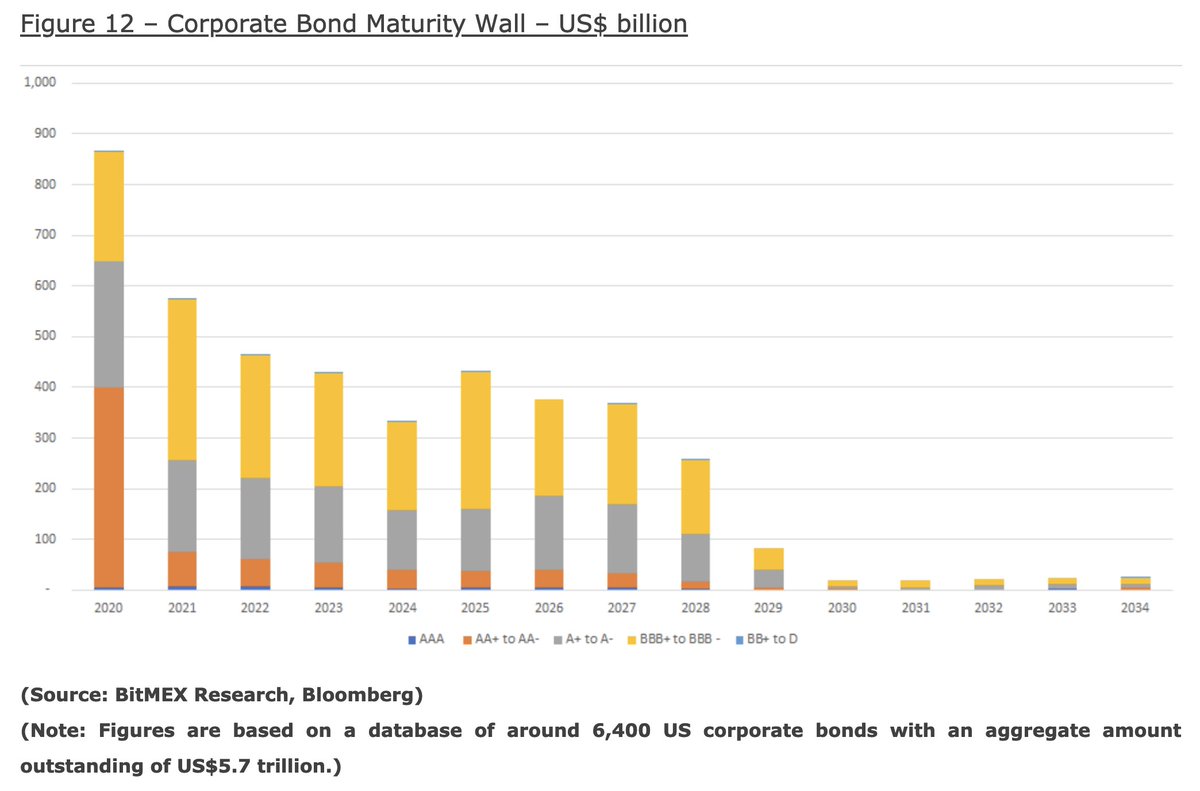

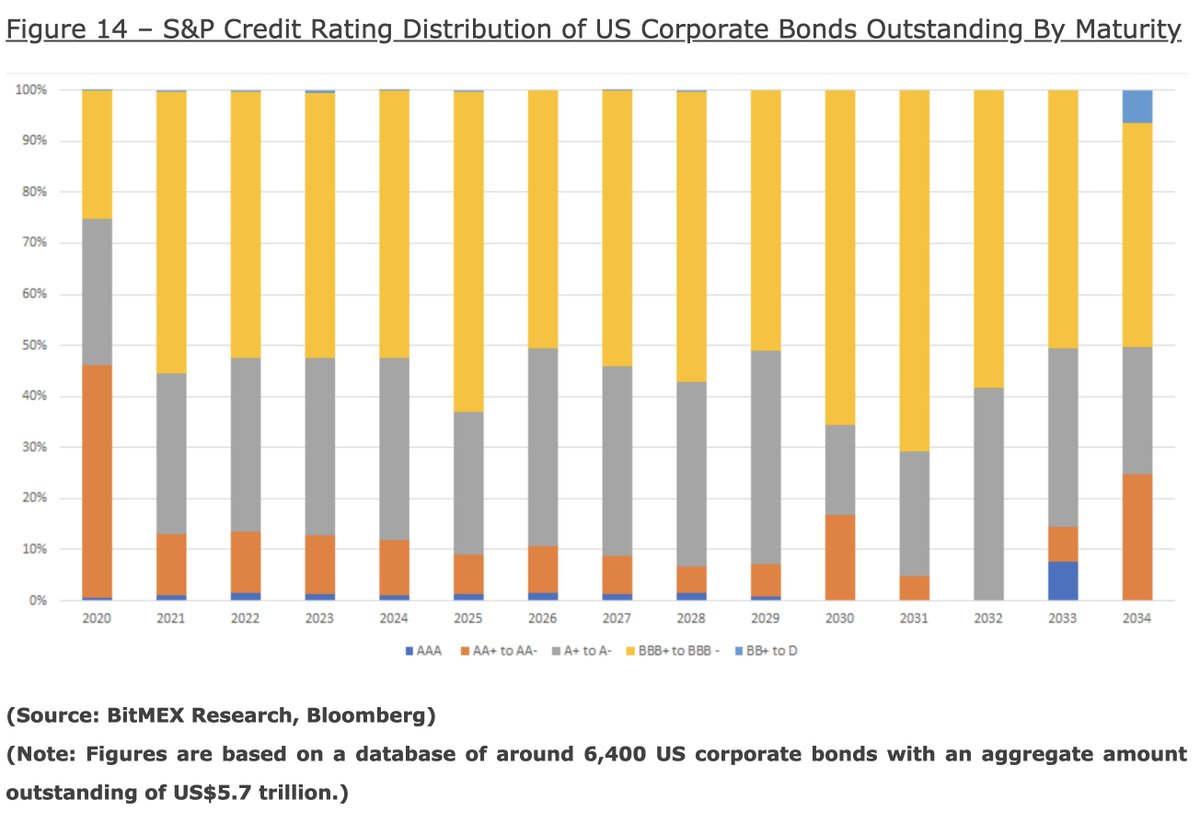

In 2008 risk was elevated by leverage in the banking system & the securitisation of the mortgage market. Today the equivalent risk is in the asset management industry, in particular the corporate debt market

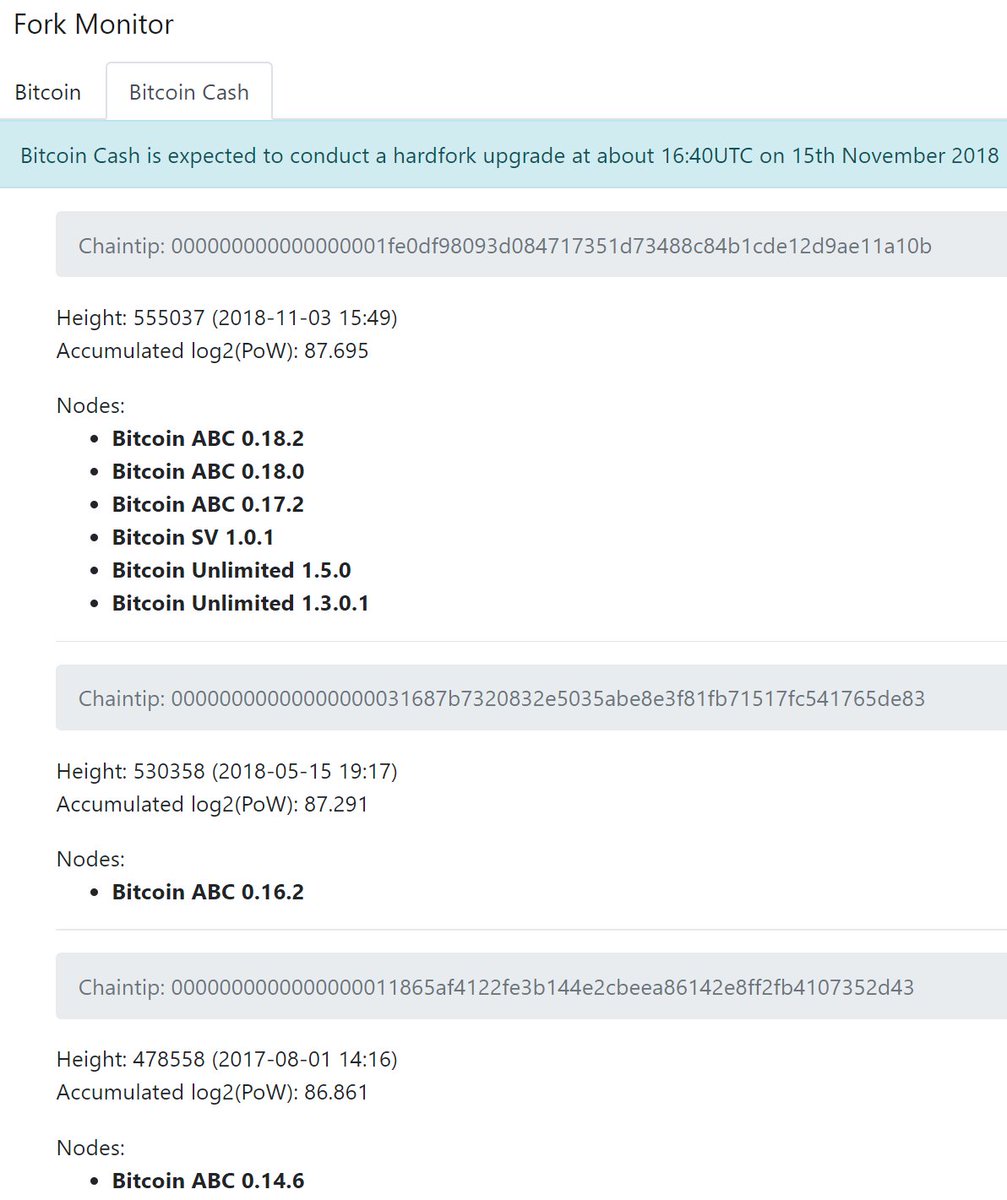

blog.bitmex.com/anatomy-of-the…

* Raghuram Rajan on @Freakonomics - freakonomics.com/podcast/rajan/

* Chris Cole on @MacroVoices - macrovoices.com/podcast-transc…

* "Leverage on the buy side" from @BIS_org - bis.org/publ/work517.p…

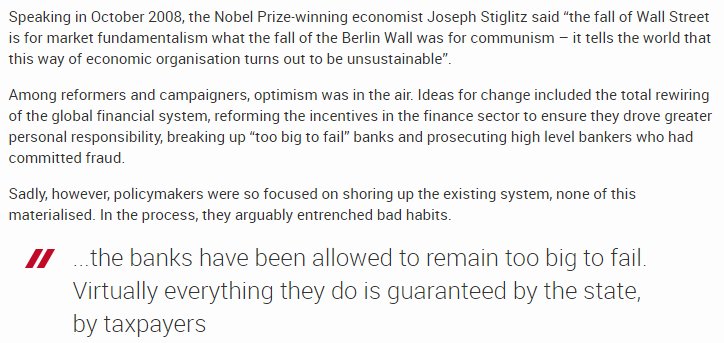

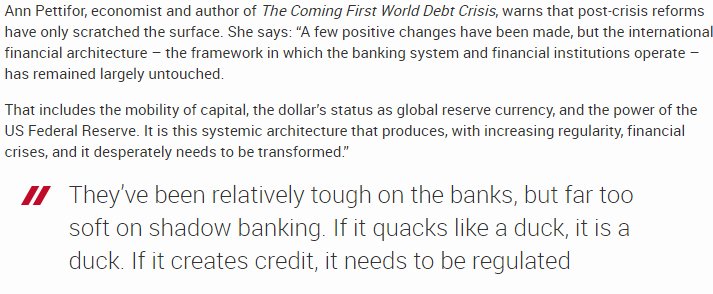

* The Debt Machine from @FT - ft.com/debt-machine