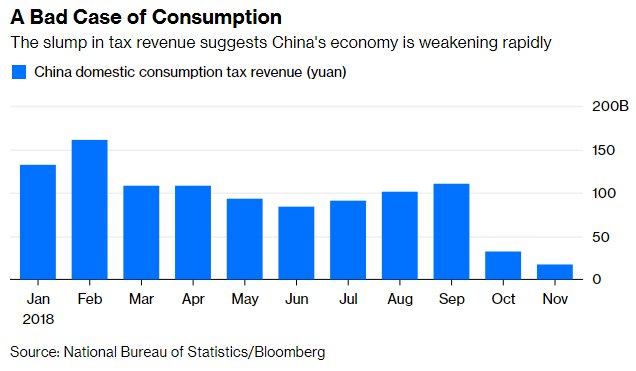

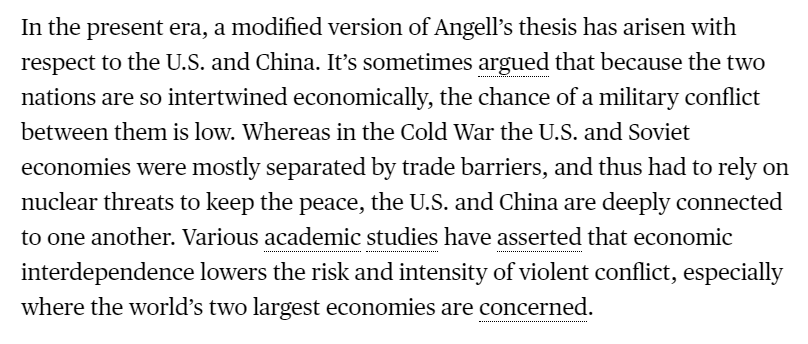

The U.S. and Chinese economies are disentangling.

bloomberg.com/opinion/articl…

(I'm sure @ProfPaulPoast can point me to a more complete literature review.)

bloomberg.com/news/articles/…

reuters.com/article/us-usa…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

China is also divesting from existing investments in the U.S., leading to a net drop in the stock of FDI.

rhg.com/research/chine…

thediplomat.com/2019/06/the-co…

The buffer of interdependence is eroding rapidly.

(end)

bloomberg.com/opinion/articl…