My column today is about why you should go back to not thinking about these weird/scary/exciting metals for another decade. Here's the thread version:

bloomberg.com/amp/opinion/ar…

This is true (cerium, lanthanum and neodymium are somewhere between copper and lead in terms of abundance in the earth's crust) but that's slightly misleading.

Western countries started using much less oil per unit of GDP, and capital flowed into developing new basins like the North Sea.

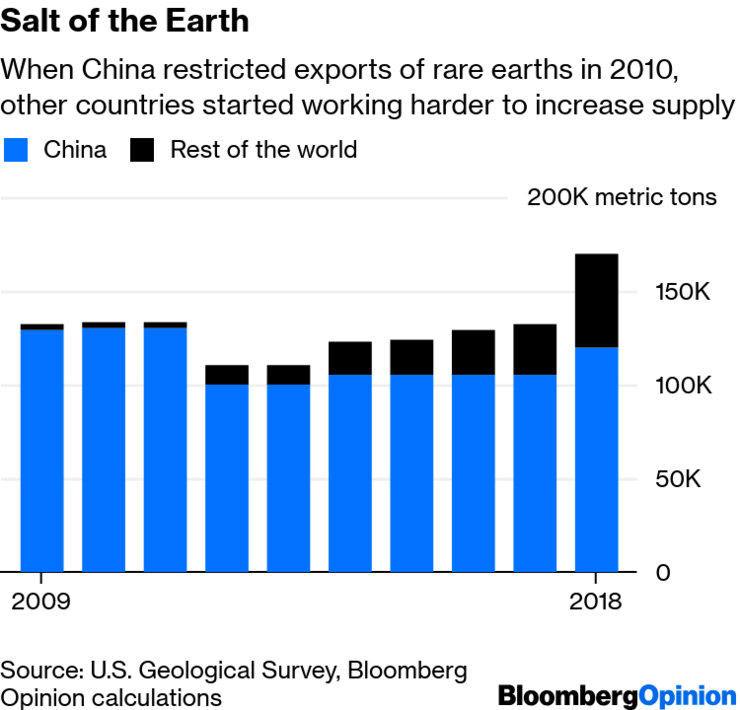

As a result, China's share of supply fell from 97% to 71%.

bloomberg.com/opinion/articl…

I guess Trump could answer Xi's saber-rattling by going on about that.