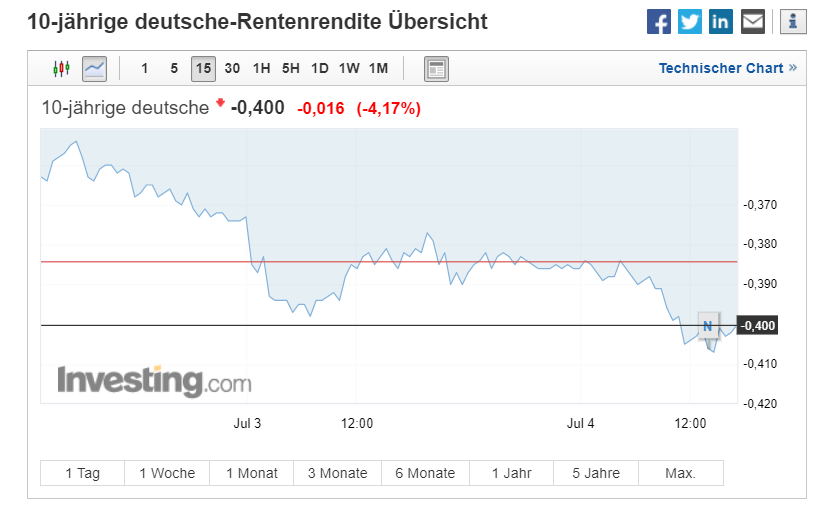

30y Bunds at 0.2%

If we locked in those rates *now*, to invest in infrastructure, we could probably fully liquidate the debt over 30y and still have positive net returns

Lunch anyone? Oh wait #DebtBrake

@ojblanchard1

But at so low rates, even that need not be true anymore. Implement a liquidation along with the investment plan, avoid rollover risk, and still enjoy lunch

Und was Negativzinsen damit zu tun haben (ab 7:10)

daserste.de/information/po…