1. @VitalikButerin on unsolved challenges: "I really honestly think that there are no unsolved research challenges at this point."

"A minimum of two production-ready clients are necessary for launch. I expect the first-mover advantage to be strong."

-@CarlBeek

"If your validator node goes offline for 18 days, and the beacon chain is not finalizing, then your balance will be reduced by "up to 60.8% slash in 18 days".

-@CarlBeek

If a validator behaves provably maliciously, then they are slashed by having their balance reduced. Assuming client software is written well, this should be basically impossible to happen to you. Minimum penalty is 1 ETH, but it goes up linearly.

-@CarlBeek

"One of the beautiful things about PoS is that these attacks can be handled with grace. The community can hard-fork out the malicious actors so they have no more voting power. The malicious actors just burnt a lot of money to temporally halt a network. -@CarlBeek

"The current approach is to fold eth1 into eth2 as an execution environment. In practice, this will mean that we would need to have a hard fork on the eth1 side to rebalance some gas costs...." @VitalikButerin

"But I still think that PoW is not better than PoS from an inequality point of view, because although PoW does distribute coins into "fresh hands", you need so much capital to become a PoW miner that it's a big rich-get-richer mechanic." @VitalikButerin

"Phase 2 is a bit too far out to say, but my hope for phase 1 is Q3/4 of this year." -@CarlBeek

"The closest to a "pause" button is to first exit (which can take as little as half an hour, but may take days/weeks since there's a queuing mechanism) and later re-activate." -@drakefjustin

"The current plan is that eth1 will be folded into eth2 as an execution environment via the stateless client approach, in which case, yes, contracts will keep working as expected." -@VitalikButerin

"2.0 removes the disk I/O bottleneck for consensus participants by heavily leaning towards stateless clients. Finality greatly mitigates the sync latency bottleneck, and the requirement for consensus participants to store historical blocks." @drakefjustin

When the PoW chain starts piggybacking on the PoS chain for security (this could happen during phase 1 or phase 2), it becomes safe to lower the PoW chain reward by maybe ~4x. Further reductions would happen when PoW stops entirely. -@VitalikButerin

"Transfers will probably only go live in Phase 1 at which point exchanges will list ETH2.0. Having exchanges to so will help maintain price-parity between ETH and ETH2.0." -@CarlBeek

The uni-directional Eth1>Eth2 bridge comes with the beacon chain. I'd say it's likely there will be a bi-directional bridge eventually (though unlikely to happen in 2020). Even better than a bi-directional bridge is native integration of Eth1 into Eth2 @drakefjustin

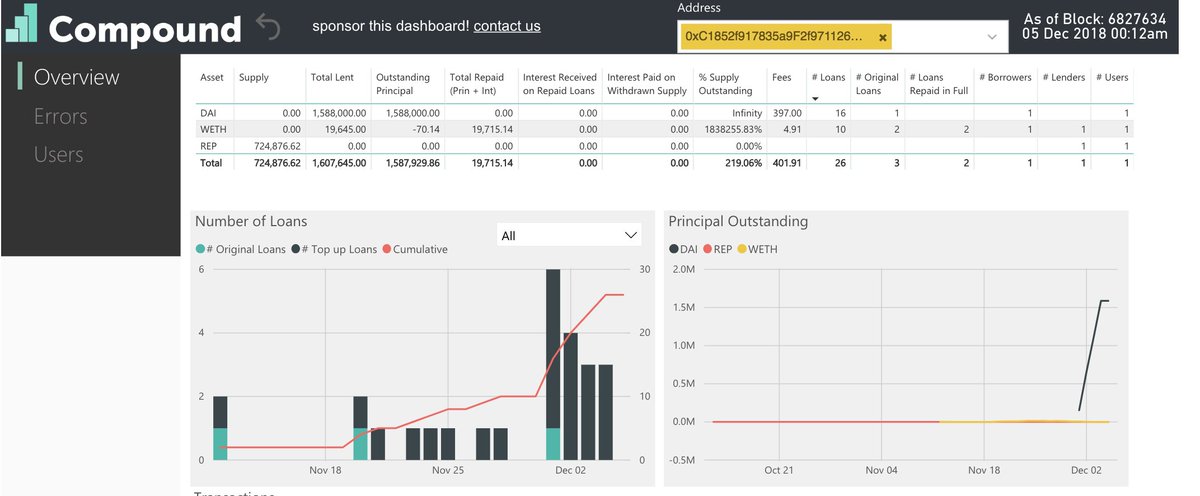

Compound rates for ETH are ~0.02% AFAIK, so very easy to compete with. The "do you take 3% interest staking or 6% lending DAI on Compound" framing is highly misleading, because that 6% is on USD, which is very different to having 3% on ETH. @VitalikButerin

A laptop should be sufficient. We'll know more in a few months when the numbers for block sizes and gas limits of shard blocks get finalized. - @VitalikButerin

Beacon nodes that are not validators are not rewarded in protocol because the protocol can't tell who's a beacon node vs just pretending to be one. Though non-validator nodes may be able to earn money in eth2 through incentivized light client protocols.

"Somewhere between 5000 and 500000 TPS depending on what execution environment and transaction type you're using." -@VitalikButerin

"I don't think EF will have to drive this. Web3/Parity are on it and I believe consider it to be a top priority.

The Shasper (Parity) client is written in substrate to help facilitate this happening." -@dannyryan

"The sharded eth2.0 is expected to handle ~10MB/s of data availability. This is data that is come to consensus upon in shard chains and guaranteed to be available in at least the ~2 week time frame." -@dannyryan