By @BChappatta ⬇️

It’s virtually impossible for the U.S. to default on its debt, as it controls the dollar, the world’s reserve currency.

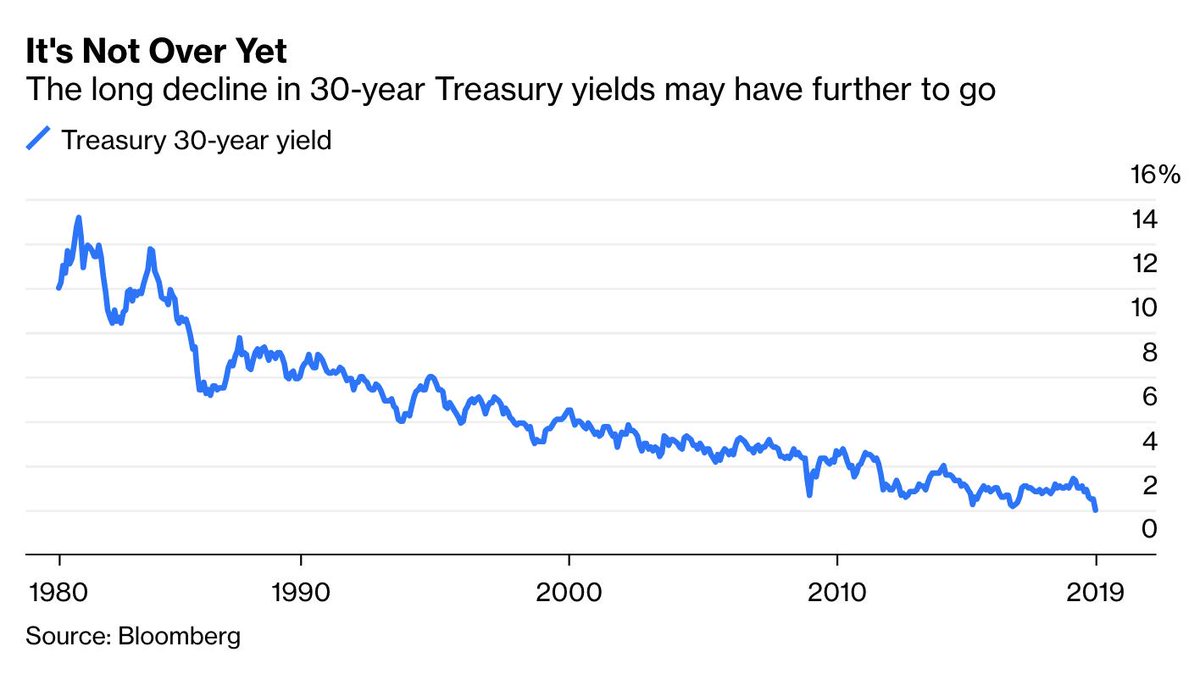

Bonds “rally” when yields fall and prices rise. The 10-year Treasury yield, a global borrowing benchmark, was almost 16% in 1981. In July 2016, it fell as low as 1.32%. bloom.bg/2zYf61s

The S&P 500 Index returned an average of 11.7% a year, albeit with considerably more volatility.

Remember, the *all-time* low is 1.32%. So yes, we are close.

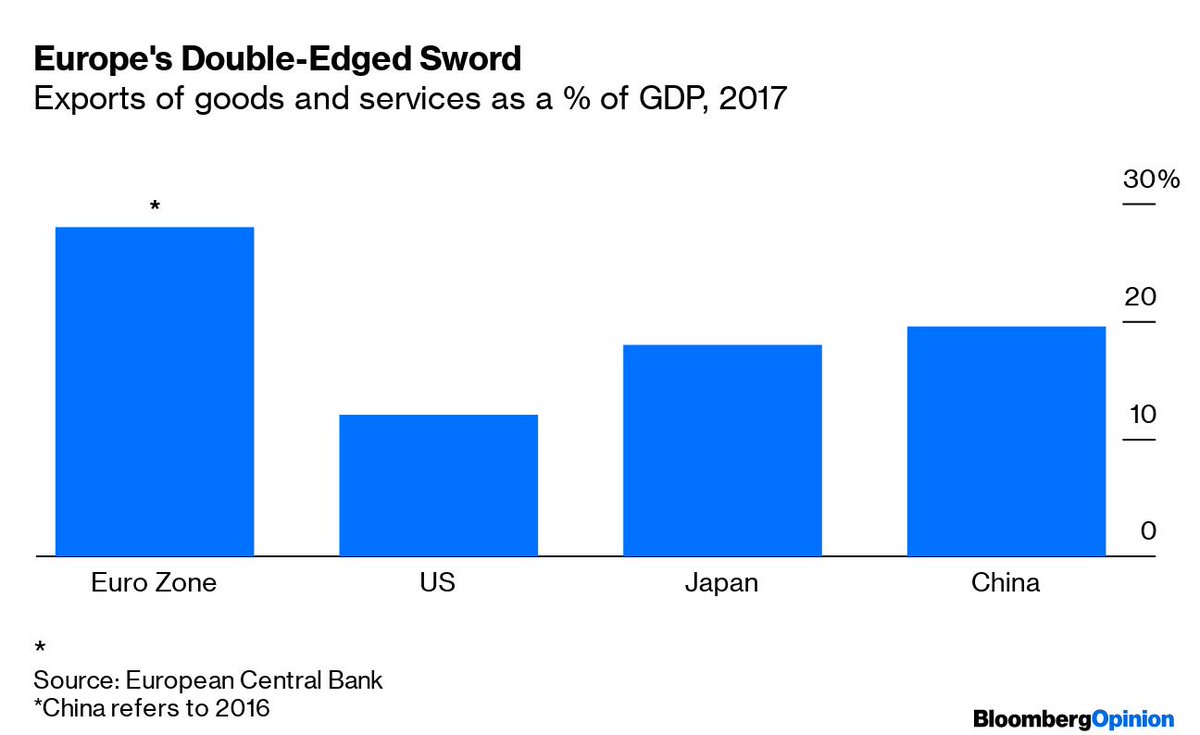

Trade wars threaten global growth. If growth slows, companies are less profitable, and not worth as much. Therefore, stocks decline. When that happens, investors rush to Treasuries.

It has less control over longer-term bonds.

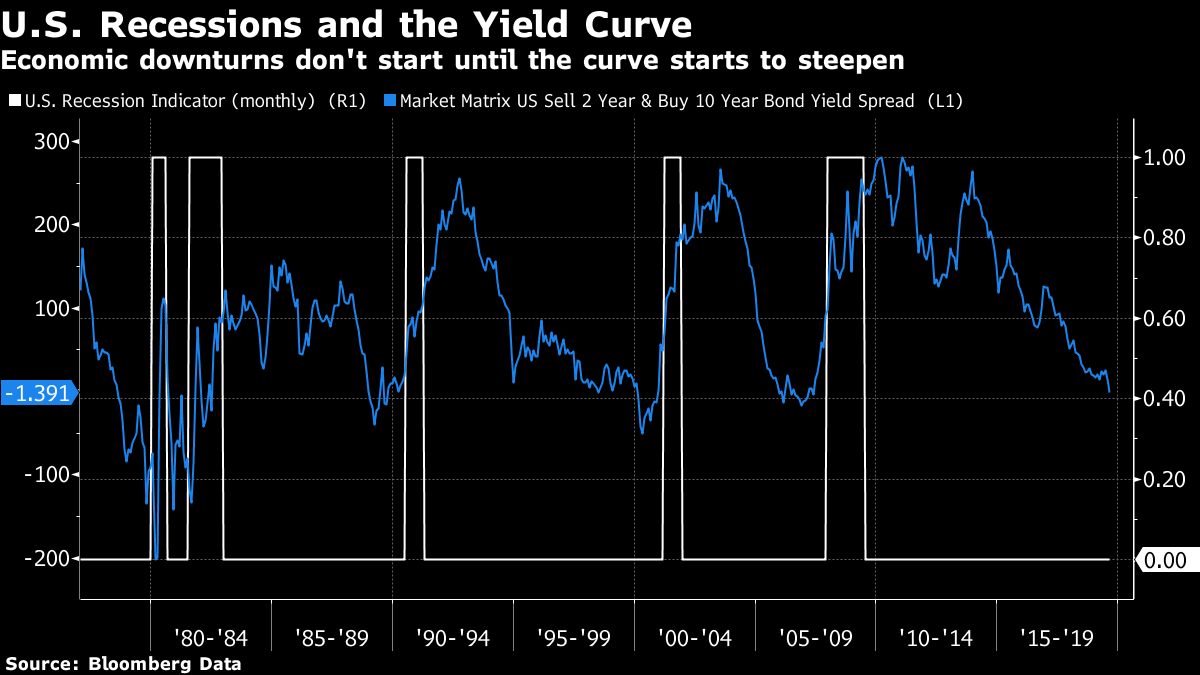

That usually portends recession. At the very least, it’s a sign that the Fed should be lowering rates more quickly.

Similar rates are already below zero elsewhere in the world, like Europe and Japan. bloom.bg/2zYwtiQ

This is a rather uncommon view for fixed-income investors. But it has paid off over 30+ years.

On Thursday, 10-year yields had the biggest intraday increase since November 2016, but few actually stepped up. bloom.bg/2zTUwPQ

That’s good news for borrowers – U.S. investment-grade companies issued a record $74 billion in debt this week – but makes it challenging for savers to earn any steady income on investments. bloom.bg/2zZcqR6

Fiscal spending on infrastructure could be the next frontier. bloom.bg/2LyZzug

Stick with @bopinion columnists as we sort out the answers.