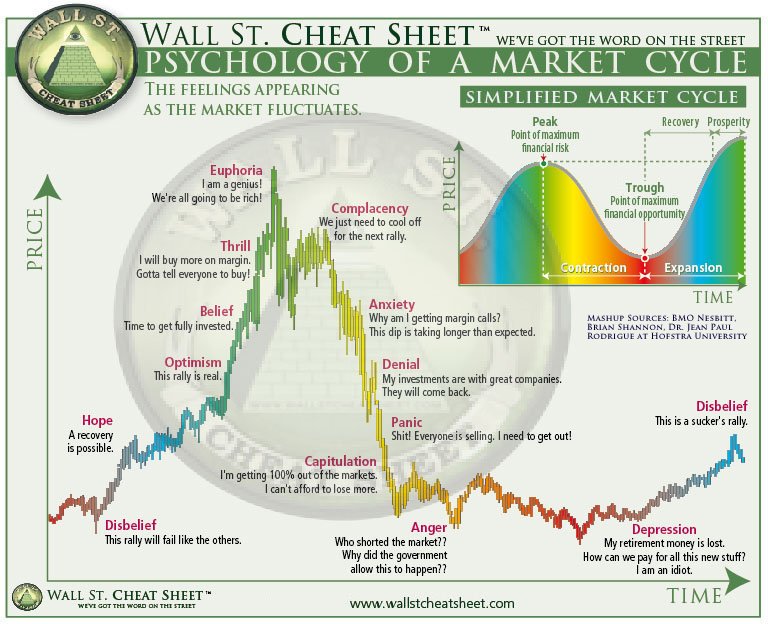

Take the last bear market:

The day we hit bottom, in January 2015

That was Bitcoin's second highest volume trading day, *ever*.

Still to this day!

* End of the last bear market

* End of the accumulation period (the bull market breakout)

* End of the bull market (violation of the parabolic advance)

* End of parabolic mean reversion ($6k capitulation)

We’ve seen a lot of volume recently -- on the very high timeframes, like the monthly chart.

But we haven’t seen it on the daily chart yet.

But until we see it on the daily, I remain skeptical that we’ve bottomed.

And if we haven’t bottomed, then probability is we go lower.

one more bull trap would be … a nearly irresistible opportunity.

But that doesn’t mean it'll happen.

But if it does happen — a little preparation will pay off in a *huge* way.

If we’re lucky enough to go up —

sell spot $BTC into fiat at strategic levels the whole way up to $6k.

If we make it to $6K, * big if * -- by that point, I will have already sold my entire spot BTC portfolio.

Well then…nothing happens.

Then I'll accumulate my portfolio back, in the institutional accumulation zone, over the next bunch of months.

I am perfectly happy to do that.

Because *if* we bull trap even as high as $5k

and *if* most of my orders fill on the way down

my math says I'll come close to doubling my portfolio, in BTC value.

How often do you get a low-risk chance like that?

And they’re right -- if you’re trading price action.

But if you’re actively managing a portfolio of Bitcoin, it absolutely pays to predict price.

The best trade of the secondary bear market *isn’t* leverage longing the generational bottom.

The trend is your friend bruh, and the trend is down.

Or anything near it. Especially the first touch.

I'll start filling shorts as low as $4400, because I don’t know how high it’s going to go.

I’m confident resistance will hold, so I’ll enter short *without* a stop-loss

This is something I very rarely do.

so I’ve set my liquidation price above $6,800

I’ll be shorting **low leverage**

(People who try this high-leverage should expect to get liquidated)

I'll take light profits at $3200, and target $2500-2000.

and it happens slowly, over a period of weeks,

Then I think we’ll see an April-style alt season.

Your alts could move fast, be ready to take profit quickly.

That was the second one, when ETH went to $13 for a split-second.

And in the process of catching them, I inadvertently discovered a trick....

a way of catching flashcrashes that I totally wasn’t expecting to uncover.