....................................................

1/n

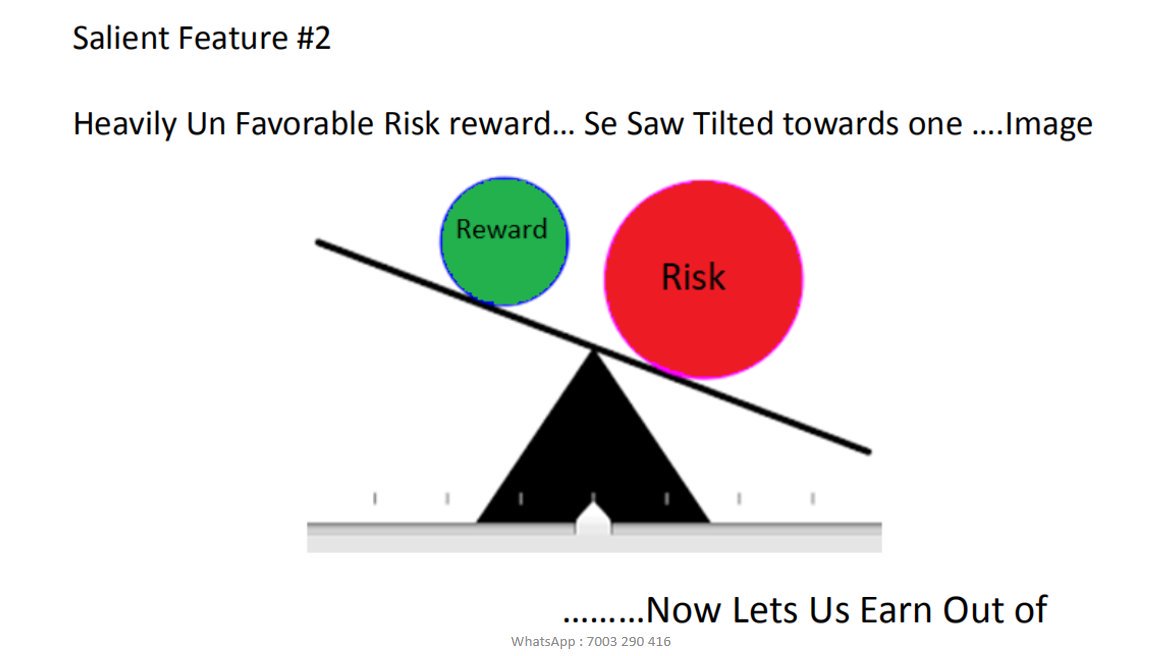

We are going to discuss OI analysis for Trading - Option and Future

There are 4 terms that we need to understand first.

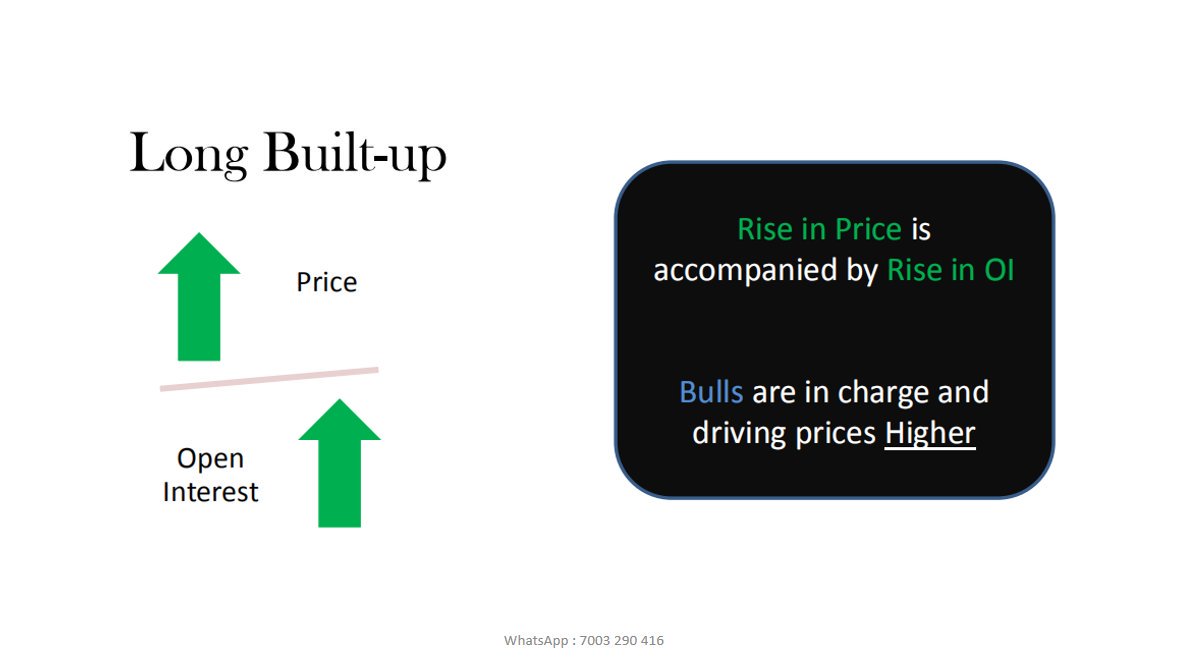

1. Long Build up

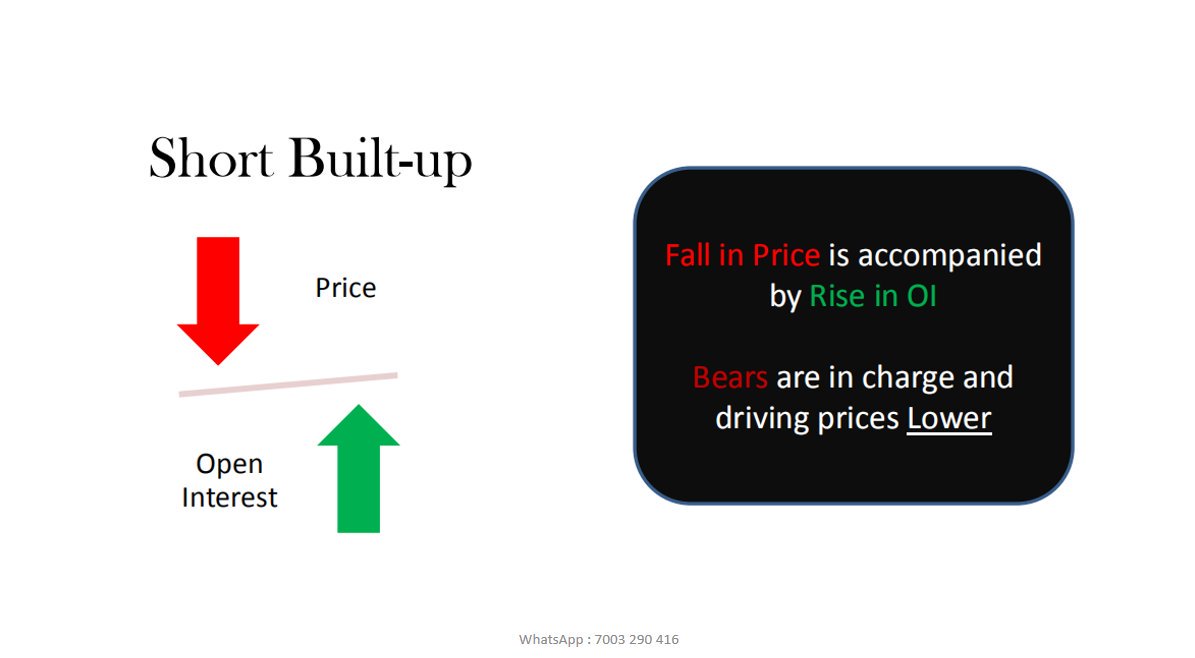

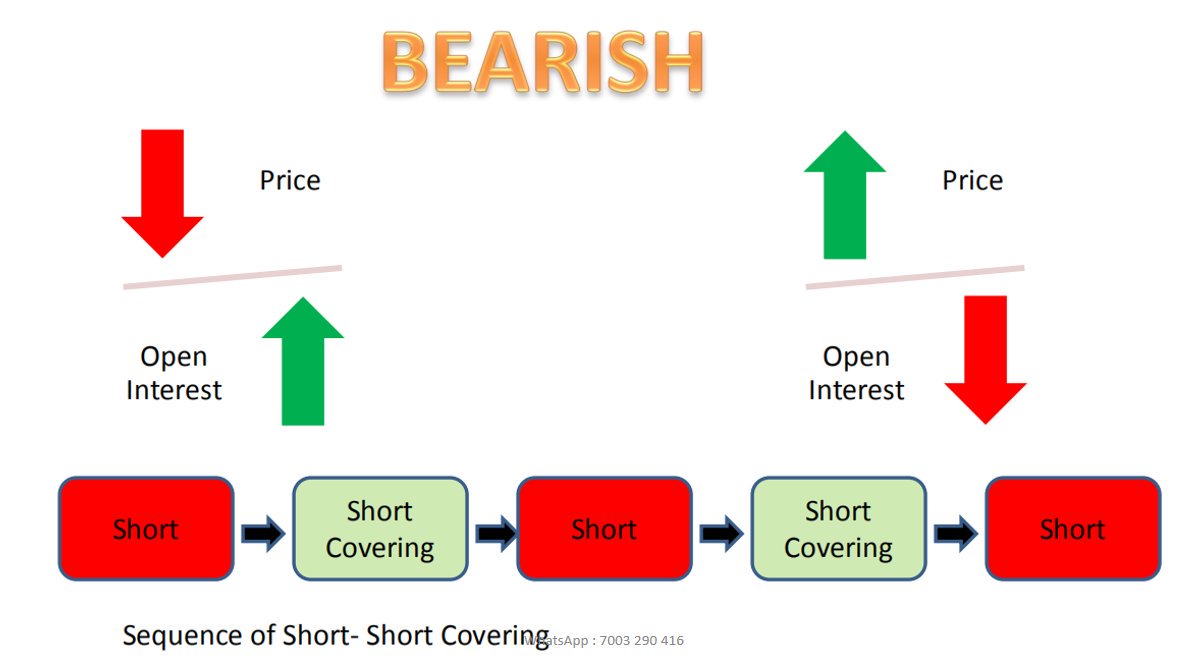

2. Short Build up

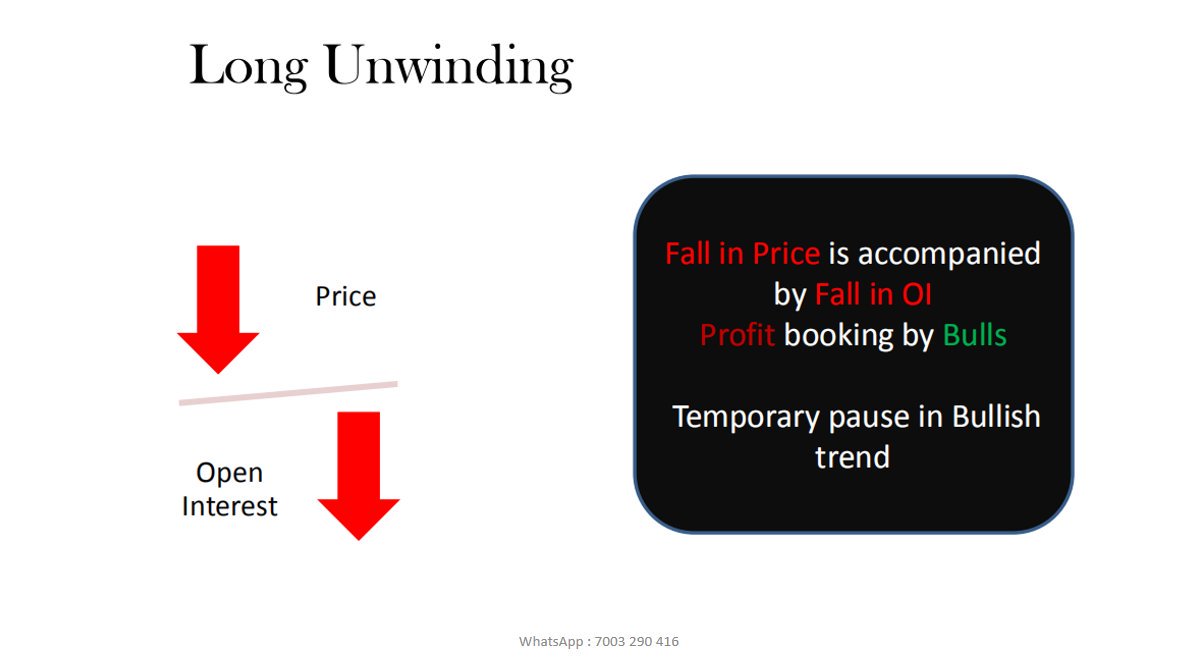

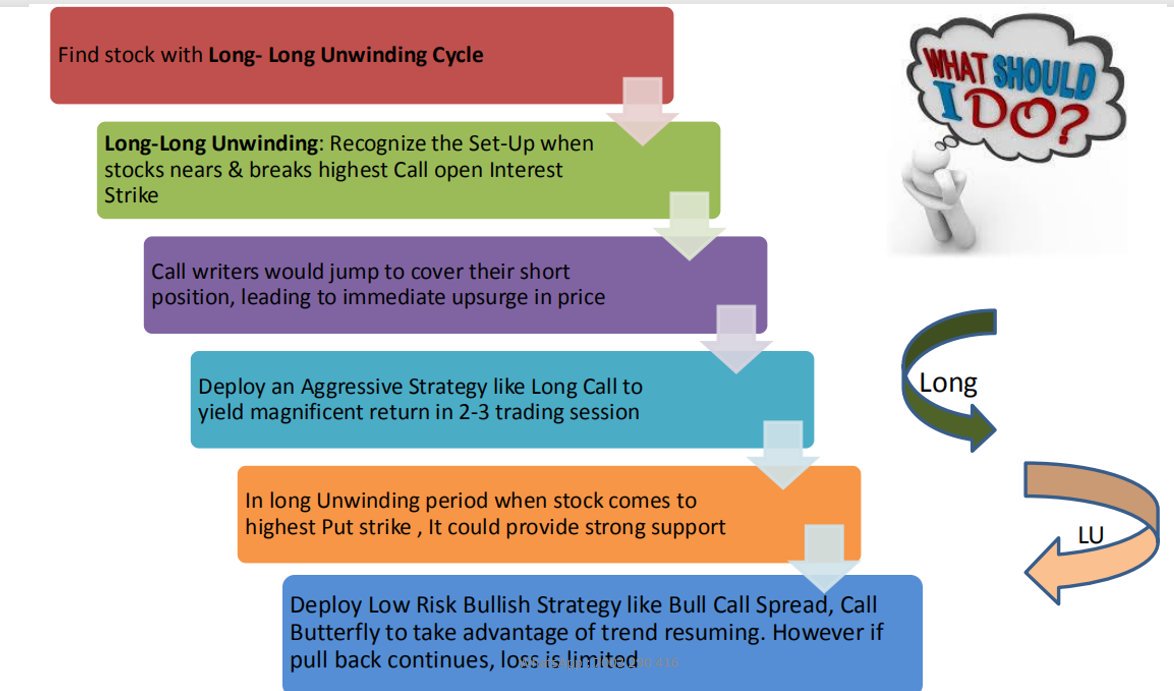

3. Long Unwinding

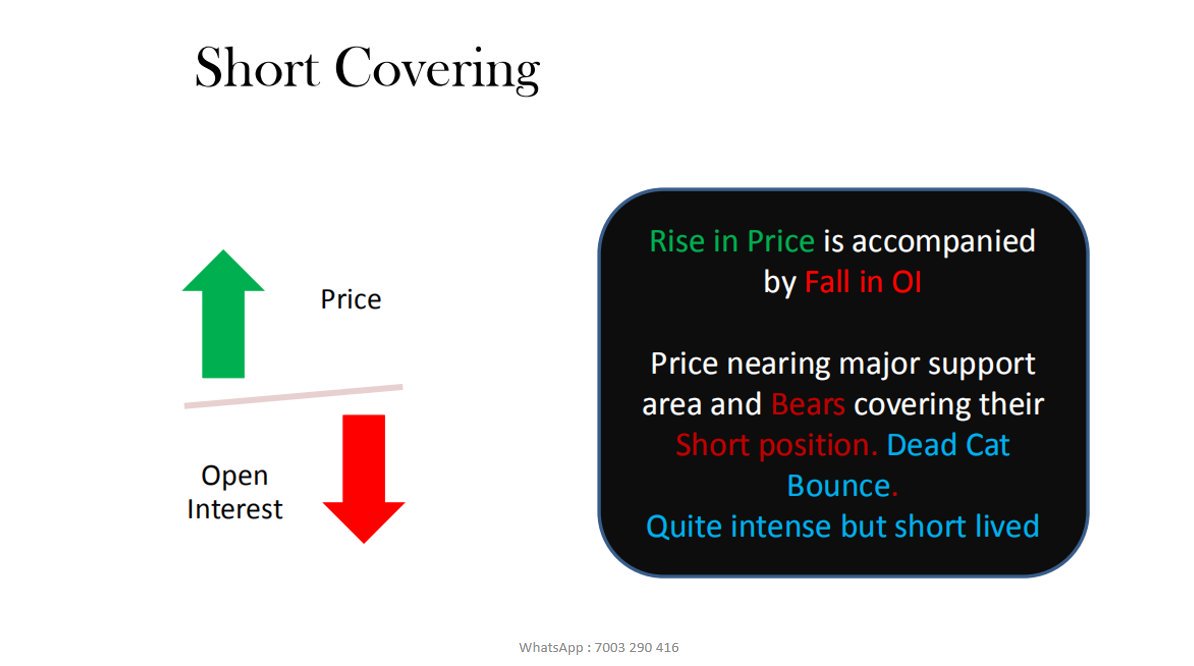

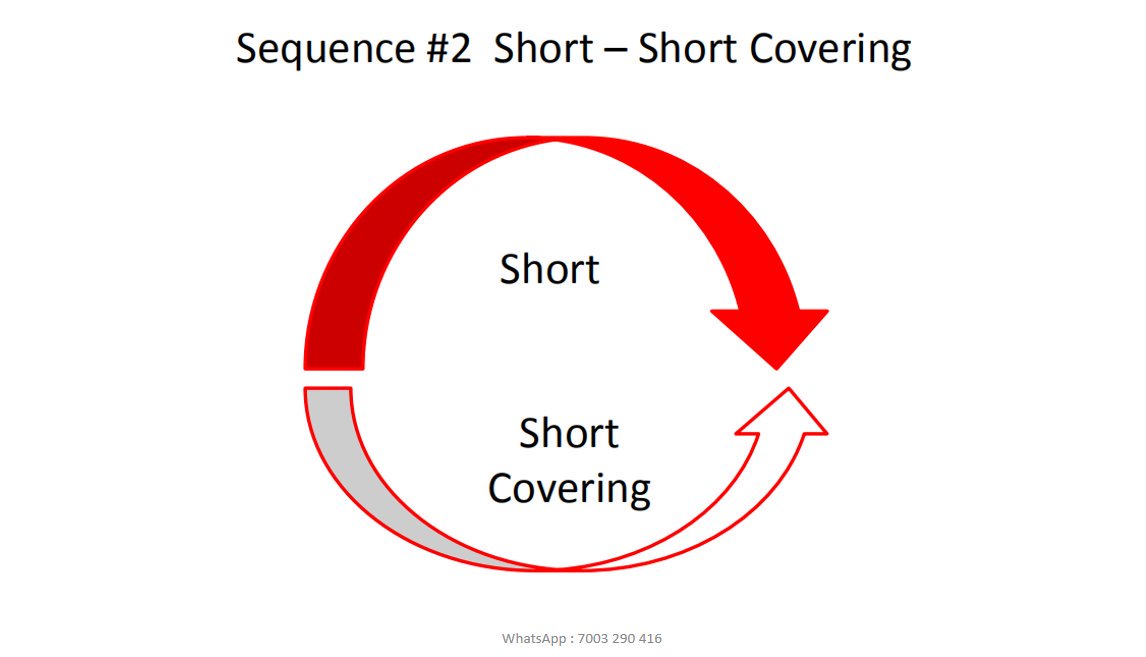

4. Short Cover

We will discuss one by one and understand their use for trading.