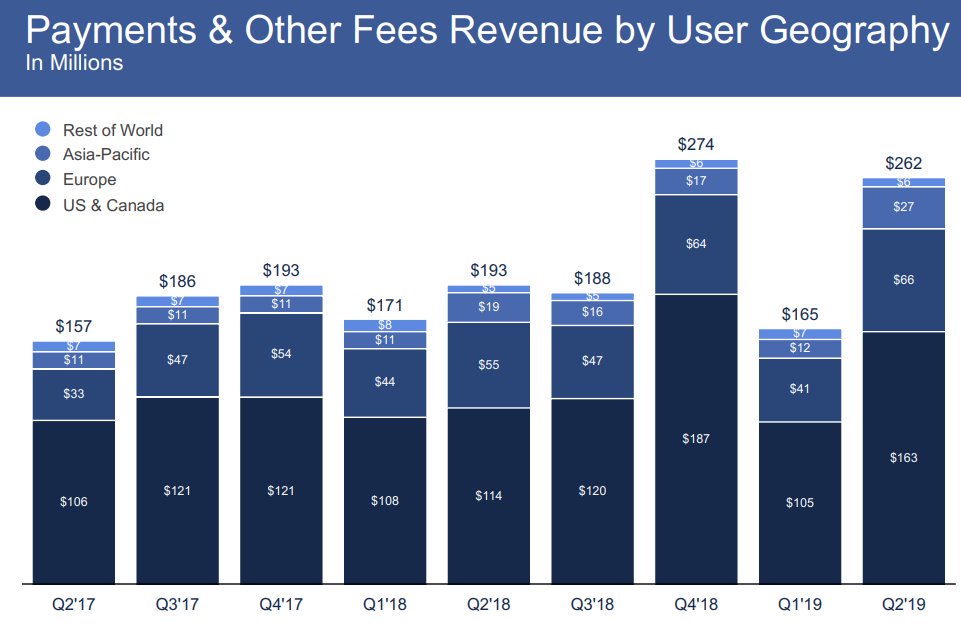

IOW, even w/ rapidly rising costs, numbers just don't look that bad, core platform looks healthy, etc.

Now let's talk about $FB's #optionality...

fool.com/investing/2017…

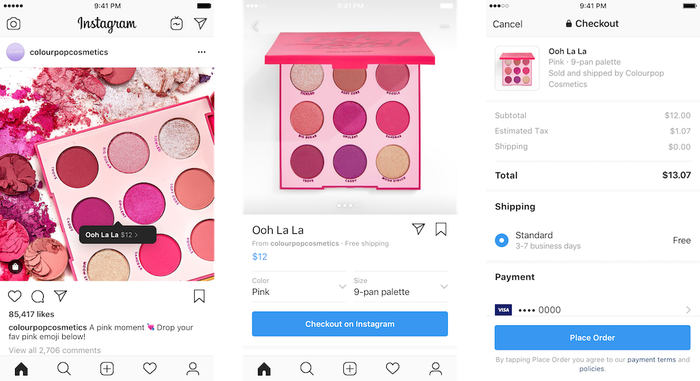

Instagram Checkout, launched in March, might be $10B opportunity according to Deutsche Bank.

Survey: 43% Instagram users likely to use feature, 83% who have used feature likely to do so again.

From db.com/newsroom_news/…

Yes, @Libra_ is off to rocky start. And it might never do diddly squat (technical term). But Libra does not have to replace world's currencies to make impact on $FB's bottom line.

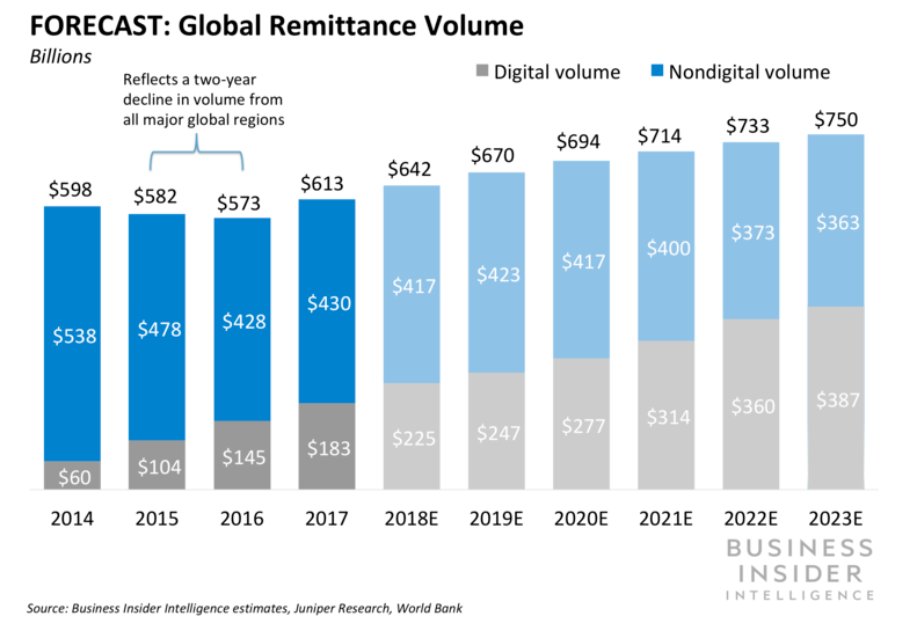

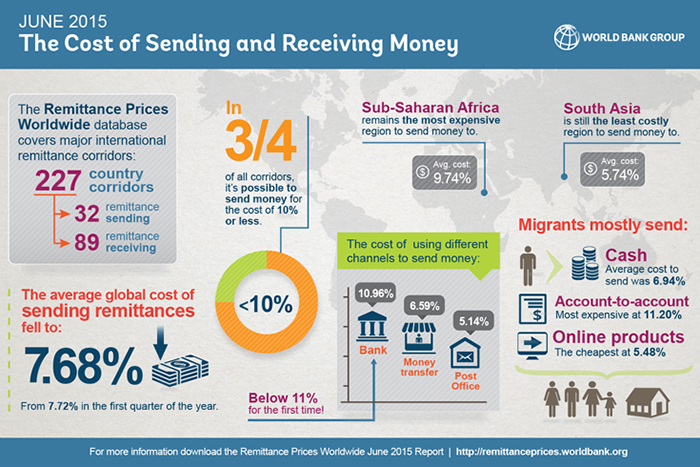

Consider low-hanging fruit such as int'l remittance, w/ $689B being sent from foreigners to home country in 2018 alone. Currently that is costly process. $FB enabling process to be done on Whatsapp? Game changer.

worldbank.org/en/news/press-…

Thus far, admittedly not much to show for the Oculus acquisition ($2.3B deal in 2014), but still early innings.

Global AR/VR market was $11.4B in 2017, projected to reach $571B by 2025, for 63% CAGR.

fool.com/investing/2019…

Could be wrong, but $FB looks like an investment w/

growing revenue

rising costs (has to end at some point, right?)

lots of cash

growing user base w/ extremely powerful network effects

reasonable valuation

optionality in spades, giving it multiple possible futures

Long $FB, about 6% position

I suspended my FB account in 2012/13 and haven't logged on once since.

Recently created Instagram account to follow my son, and I hate the platform. Feel old and out of touch every time I log on.