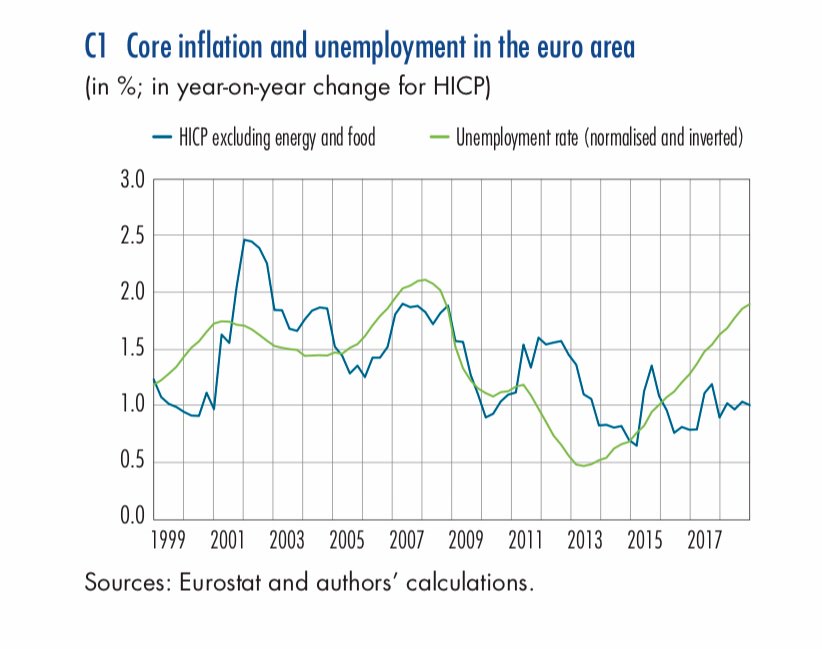

Thread on our #BdfEco piece with @diev_pavel and A. Lalliard

publications.banque-france.fr/en/why-have-st…

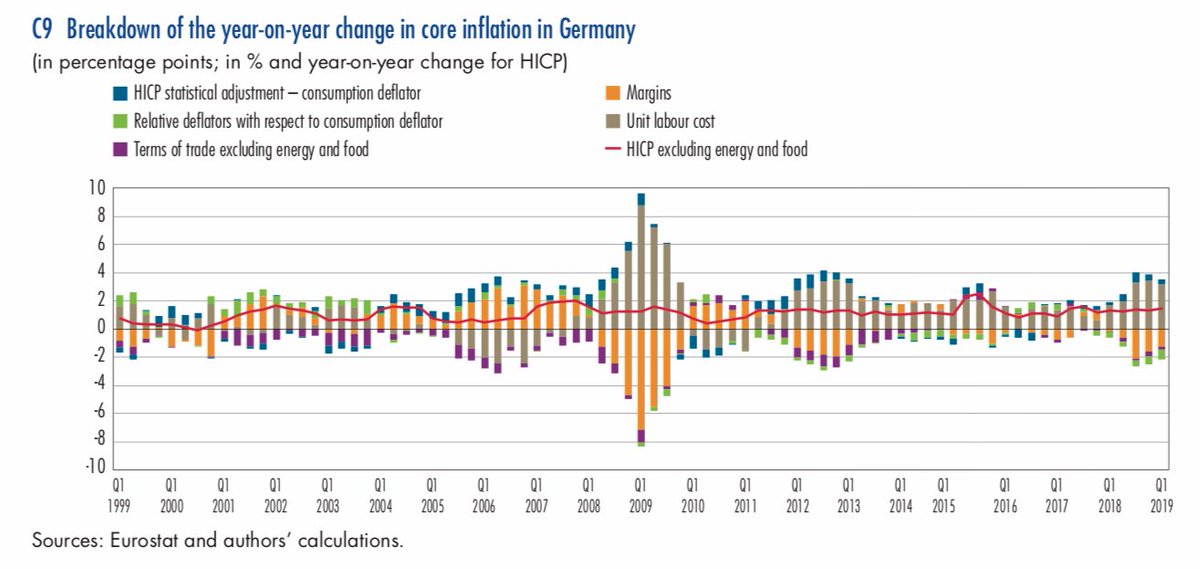

(i) unit labor cost (= wages adjusted for productivity)

(ii) margins

(iii) *core* terms of trade

(iv) and the relative deflator of consumption wrt other demand components

2.6% of unit labor cost vs 1.0% core inflation, a 1.7% difference

1.1pp comes from lower margins

0.4pp comes from core terms of trade

0.2pp comes from the increase in the relative construction investment deflator