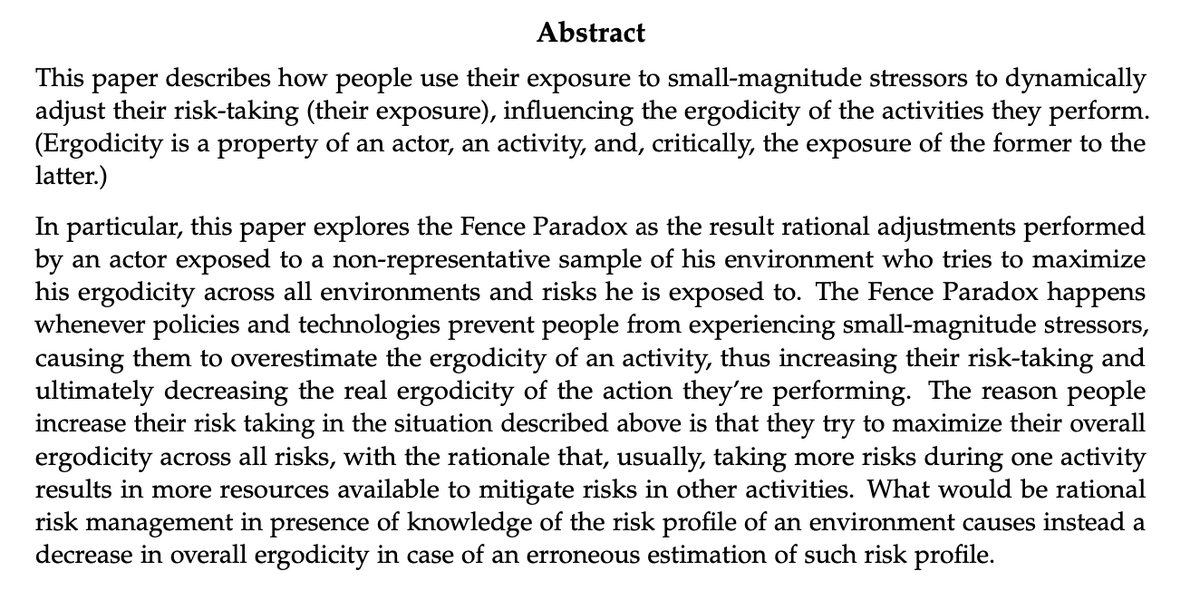

(thread)

in which I explain the link between ergodicity, the Fence Paradox and human approach to risk management.

Also available in paper form at luca-dellanna.com/ergodicity-dyn…

2/ Risk homeostasis (aka Fence Paradox) is the reaction of rationally-maximizing-ergodicity actors reacting to having been exposed to a non-representative subset of the environment.

For a more precise definition of ergodicity, see below

For example, Russian Roulette is a non-ergodic activity for a player (he _will_ eventually "game-over") but not for a company hiring Russian Roulette players.

However, high-magnitude stressors are rare. Therefore, people use low-magnitude ones to estimate the ergodicity of an activity.

On average, after 30 years, a driver experiences few low-speed crashes & estimates driving as low-ergodicity.

On average, after 30 years, a driver would experience no crashes. He would erroneously estimate driving as a high-ergodicity activity and take more risks, exposing himself even more to the rare high-speed crashes.

They end-up being exposed to high-magnitude ones only, but because these are rare, they underestimate their exposure and take more risks.

Driving faster to avoid missing a plane saves me money which I can use to invite a date to dinner, mitigating the risk of being childless

That's why policies & technologies which "protect from small harm" make us take risks ("Fence Paradox")

I do so because, for the human mind, ergodicity is on a spectrum (justification in the next tweet)