Great read, highly recommended. My highlights:

The belief that in any decision, the right choice is whichever option makes the most money.

This is the default setting that runs much of our world.

It only cares whether there’s “less” or “more.”

And it always wants more.

1. that the point of life is to maximize financial wealth

2. that we’re individuals trapped in an adversarial world

3. that this situation is inevitable and eternal.

It puts a ceiling on what we can be.

Yet even as the seas rise and species die, we continue to prioritize financial maximization.

We struggle to see how any other way of operating is possible.

Other People are the cause of it and they will fix it and they will suffer the consequences if they don’t.

We think we’re separate from it all.

Instead we blame others and pray for a Superman-like solution.

This is the underlying “why” behind many of our choices.

The right-hand turn of modern life.

It means viewing our society as a portfolio to buy, sell, and trade.

It’s like seeing the world through the eyes of a sociopathic oligarch.

Everything has a price.

We refer to this context obliquely as “how things are done” or “how it is.” It’s “what’s normal.”

The choice has already been made for us by someone or something else.

But what about Netflix or HBO shows?

They are made by newer players wanting to establish credibility.

They’re not financially but reputationally maximizing.

Why pay people money when you can create new money and make people borrow it with interest?

So we stopped getting raises.

We started getting credit cards instead.

That’s the Mullet Economy.

As we get more, we want more.

It’s pro-money. It’s just pro-people, too.

Nobody asks what’s supposed to happen after that.

By focusing on financial maximization we’re treating the second rung of Maslow’s hierarchy like it’s the summit.

But we have to keep climbing.

Because money can be exchanged for other things, the growth of money grows everything else.

Money makes the world go around, but only at a fraction of its potential.

GDP sees spending $1,000 on a family vacation and $1,000 on a divorce attorney as the same.

Both are a thousand dollars of GDP.

It’s about how much, not why.

According to our predominant measurement of value, this would be ideal.

If we all lived this way, GDP would skyrocket.

Our choices stopped being about ideals and became about money.

The measured surpassed the not-measured.

The point of money is to create the security to focus on real value in life.

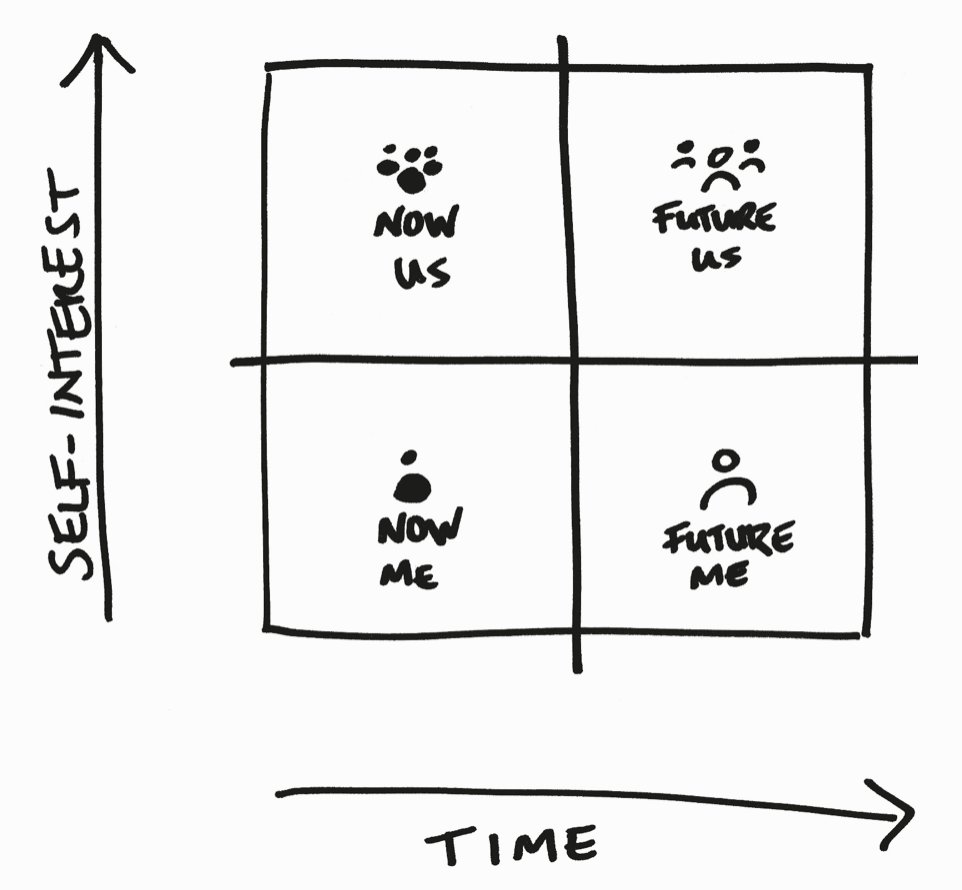

Limiting the dominance of financial maximization doesn’t mean ignoring money, it means putting it into context.

It’s easier to fix somebody else’s problems than your own.